The Fate of Polygon (MATIC): Past, Present, Future

At the forefront of Web3 innovation sits Polygon, an Ethereum scaling solution with its native MATIC token empowering frictionless decentralized finance. Join us as we explore Polygon and MATIC’s explosive growth and immense potential through 2030 as a foundational pillar of blockchain’s future.

Polygon has rapidly emerged as a leading platform powering Web3 development — winning major partnerships like Nike along the way. With demand growing for blockchain-based applications, Polygon's native token MATIC seems poised for increased utility and price acceleration.

But speculative mania often overlooks real-world value already taking root. So in this analysis, we'll explore Polygon's capabilities, enabling the next generation of innovation.

What Is Polygon & MATIC?

Originally introduced under the name Matic Network, Polygon was developed as an answer to certain pressing problems of Ethereum, including high transaction costs, limited scalability, and slow processing speeds.

In a scenario where the blockchain landscape was becoming overly saturated and costly, Polygon was envisioned as a more accessible and economical option.

Launched in 2017 by developers from the Ethereum community, Polygon quickly rose to prominence as a Layer 2 scaling solution, functioning in conjunction with the Ethereum blockchain to boost its capabilities.

Polygon relieves Ethereum's main chain congestion through an innovative scaling solution called Plasma. This framework handles transactions "off-chain" then batches results back to Ethereum for final confirmation.

👉 Think of Polygon as an efficient toll-booth verifying passage before vehicles access the main highway. This parallel system prevents clogging while retaining Ethereum's robust decentralized security.

Here is a detailed description of Polygon and its various components:

Polygon's Core Features and Solutions:

- Public Chains:

- Polygon PoS: A sidechain operating as part of the Ethereum ecosystem, providing an EVM-enabled environment with fast transactions and near-zero gas fees. It is live and supports the most widely used Ethereum scaling solutions.

- Polygon zkEVM: Billed as the first zk-Rollup with EVM equivalence, it offers enhanced scalability while maintaining security. It is live and provides fast transactions with minimal gas costs.

- Polygon Miden: An upcoming decentralized zk-Rollup optimized for private data storage and local transaction execution, promising better scalability with privacy features.

- Polygon Avail: A future solution for increasing throughput without compromising decentralization, serving as a base consensus and data availability layer for chains.

- App Specific Chain:

- Polygon CDK (Chain Development Kit): A toolkit for building Ethereum Layer 2 solutions with leading zero-knowledge (ZK) technology, currently live and facilitating the development of app-specific chains.

- Decentralized Identity:

- Polygon ID: A blockchain-native identity system that is live and enables secure and trusted relationships between users and decentralized applications (dApps), based on self-sovereign identity principles.

Polygon places a strong emphasis on developer support and community engagement. It offers a developer hub, extensive documentation, a solution provider network, and a developer-focused Discord channel. The platform encourages community participation through governance, hackathons, and events worldwide. Polygon Village offers support for startups, and there are various guilds for community involvement.

Ecosystem and Resources:

- Polygon’s ecosystem is vast and includes various applications built on the platform, ranging from gaming to DeFi to digital identity.

- Resources such as whitepapers, research articles, and guides on Web3 game development are available for in-depth understanding and knowledge sharing.

Sustainability:

- Polygon is actively engaged in sustainability efforts, aiming to become carbon neutral and eventually climate positive, highlighting its commitment to environmental responsibility.

Use Cases and Applications:

- Users can engage with the Polygon ecosystem in multiple ways: by sending and receiving crypto assets, staking MATIC tokens for rewards, exploring transactions on the Polygon Scan, or testing on the testnet with a faucet.

- The platform supports a range of dApps, offers a bridge for asset transfers, and provides developer tooling for blockchain indexing and token mapping.

In short — Polygon positions itself as a comprehensive solution for scaling and interoperability within the Ethereum blockchain ecosystem, focusing on performance, user experience, and community-driven growth. It offers a variety of tools and services for developers, businesses, and end-users, driving innovation in the Web3 space.

What Is MATIC?

At Polygon's core sits its native MATIC token, enabling frictionless participation across this high-performance landscape. As a processing currency, MATIC settles transactions costs similarly to Ether in Ethereum. But its capabilities scale beyond payments. MATIC also secures Polygon's proof-of-stake governance by incentivizing validators to stake tokens in service of stability.

MATIC further unlocks access to Polygon's thriving decentralized finance ecosystem. As platforms from AAVE to Curve optimize for Polygon's speed and affordability, MATIC facilitates governance decisions, liquidity rewards and frictionless DeFi engagement.

Between scalable payments, staking incentives and DeFi ubiquity, MATIC crystallizes Polygon's full economic potential. Its multifaceted utility positions Polygon for increased relevance as blockchain adoption accelerates.

Here’s an overview of MATIC token’s utility:

Fig. 1. MATIC’s utility.

Advantages & Challenges of Polygon

MATIC's merits are intimately connected to the strengths of the Polygon network. Its primary advantage is its capability for scalability — by offloading transactions from the main Ethereum blockchain, Polygon can facilitate a considerably larger number of transactions at a lower cost. Such scalability renders Polygon, with MATIC at its heart, an appealing option for both developers and end-users.

Another key perk is its potential for interoperability. Polygon strives to forge a multi-chain ecosystem, fostering efficient communication and cooperation among various blockchain systems. This strategic direction places MATIC at the forefront in an era where multiple blockchains will coexist and interoperate fluidly.

However, MATIC and Polygon must contend with their share of obstacles. Security is a prime issue; Though Layer 2 solutions on Ethereum enhance speed and affordability of transactions, they may compromise security to some degree. Ensuring persistent security while achieving scalability remains an ongoing hurdle for Polygon.

An additional point of reflection is Polygon's reliance on Ethereum. While this interdependent bond yields its benefits, any profound alterations or complications arising in Ethereum could have a direct and significant bearing on Polygon and MATIC.

Is Polygon a Good Investment?

Determining if Polygon aligns as an investment requires personal reflection around risks, timelines and portfolio strategy. While price speculation captivates short-term thinkers, evaluate Polygon through a long-term value perspective. Key questions to consider:

- Project Fundamentals: Polygon aims to provide a scalable solution to Ethereum's high fees and slow transaction times. It is a well-established project with various applications and partnerships, which could be a positive indicator for its long-term prospects.

- Market Position: Evaluate where Polygon stands in comparison to other scaling solutions and its adoption rate. A strong market position indicates a robust ecosystem and potential for growth.

- Technology and Development: Research the technological advancements and roadmap of Polygon. The platform's commitment to innovation and solving blockchain issues can impact its future value.

- Tokenomics: Understand the tokenomics of MATIC, including its supply, distribution, demand factors, and how it is used within the ecosystem.

- Regulatory Environment: Keep abreast of the regulatory climate for cryptocurrencies in various countries, as this can significantly affect the market.

- Market Sentiment: The sentiment of the market towards cryptocurrencies, in general, can influence the price of individual coins, including MATIC.

- Risk Assessment: Cryptocurrencies can be highly volatile, and investments can be risky. Assess your willingness to withstand volatility and potential losses.

- Diversification: Consider how Polygon fits within your broader investment portfolio and whether it helps achieve desired diversification.

👉 No single path fits all — shape investments around your time horizon, risk tolerance and wealth plans. In short—DYOR. Luckily, we’re here to help. Read on to evaluate MATIC tokenomics, possible price predictions based on historical performance, and other things that might possibly affect Polygon’s future.

MATIC Tokenomics

Here’s the detailed tokenomics of the MATIC token, inclusive of specific figures and other relevant information as of April 6, 2024:

MATIC Token Price and Market Capitalization:

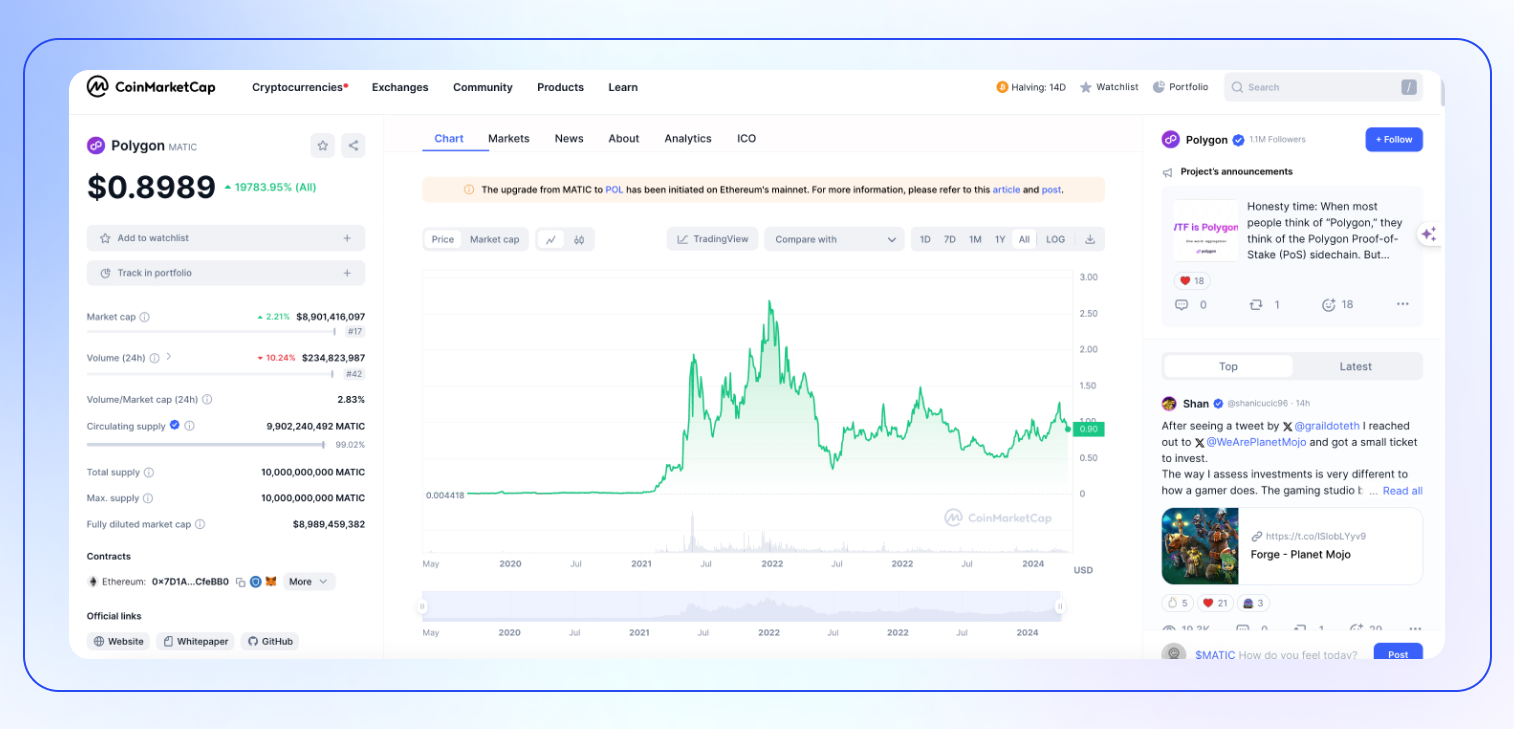

- The price of MATIC is listed as $0.899.

- The market capitalization, a measure of the total value of the circulating supply, is reported as $8,352,241,343.

Circulating Supply: The circulating supply of MATIC is 9,282,943,566 tokens. This number represents the total amount of MATIC that is currently available in the market for trading.

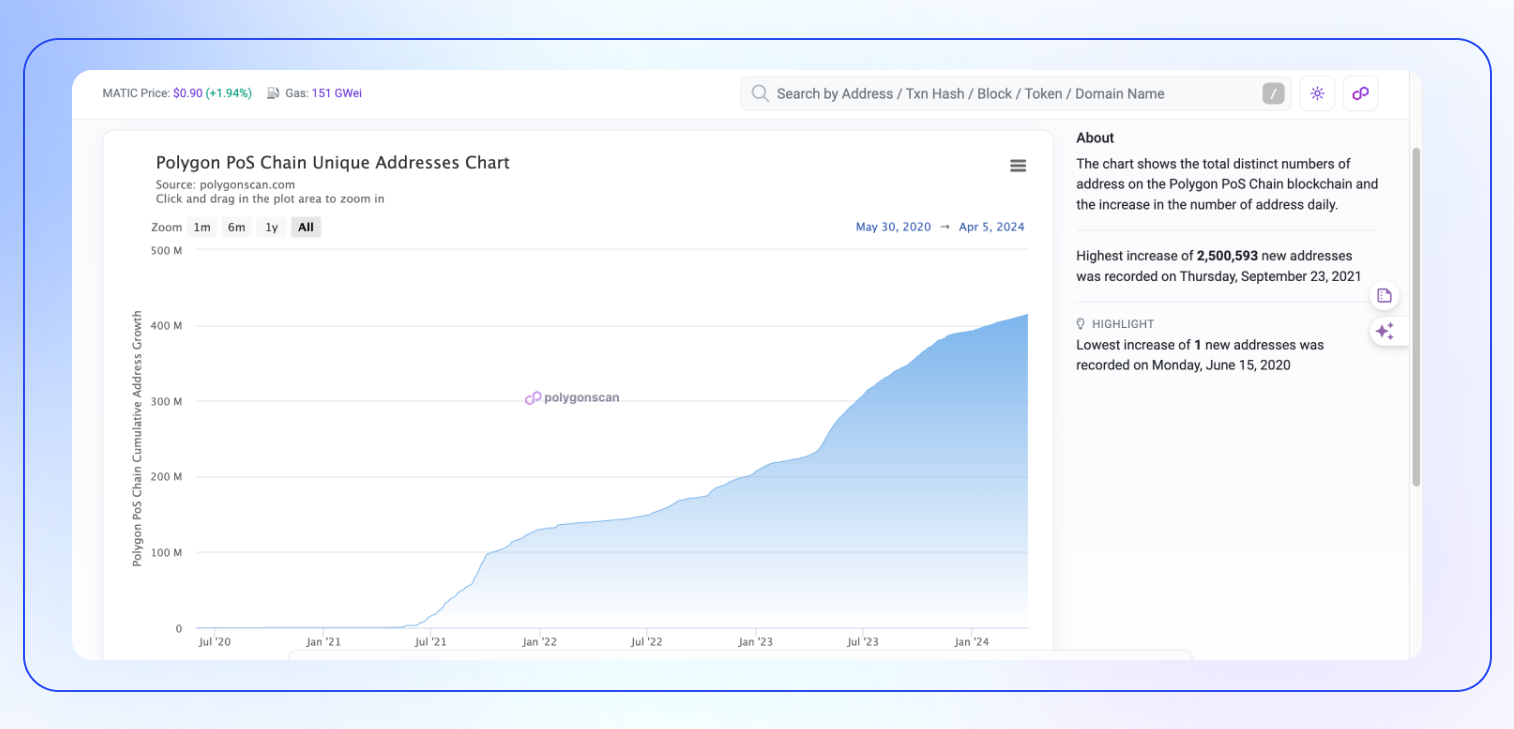

Unique Addresses and Transactions: The following Polygon PoS chain unique address chart (Pic. 2) indicates a number of unique addresses at the time of writing as 414,328,393. While the exact statistics on the number of transactions are 3,830.63 M (52.6 TPS).

MATIC Staking: As mentioned, MATIC holders have the opportunity to stake their tokens to secure the network and earn rewards. Staking involves locking up tokens, which disincentivizes validators from any malicious behavior. The staking mechanism is part of Polygon's proof of stake consensus, contributing to the overall security and consensus of the network.

Availability on Exchanges:

- MATIC is available on a wide range of centralized and decentralized exchanges, which suggests a high level of liquidity and accessibility for users worldwide.

- Decentralized Exchanges (DEXs) listed include Quickswap, Uniswap, DFYN, Bancor, and Sushiswap.

- Centralized Exchanges (CEXs) offering direct deposits/withdrawals to Polygon include prominent names like Coinbase, Binance, AscendEX, OKEx, MeXC, Transak, OKCoin, Bitfinex, Huobi, Digifinex, Crypto.com, Kucoin, Swapzone, Kraken, Gate, Poloniex, WazirX, Probit, CEX, and HitBTC.

Token Address: The contract address for the MATIC token on the Ethereum network is provided as 0x7d1afa7b718fb893db30a3abc0cfc608aacfebb0.

👉 For real-time data and more in-depth information, please refer to Polygon’s official website, Polygonscan, or other financial databases.

MATIC Price History

MATIC’s dramatic price history harbors key insights on Polygon’s market penetration and investor perceptions over time.

In early years post-2019 launch, MATIC found modest traction, trading from $0.0030 to $0.0450 as interest gradually rose. 2020 brought stabilizing gains cementing MATIC’s legitimacy.

Then 2021 became MATIC’s explosive breakthrough to $2.92 — a ascent fueled by Polygon’s recognized scaling potential amidst Web3’s rise. FOMO drove short-term speculators.

2022 sustained lofty highs but expectation comedowns rebalanced MATIC to its fundamental utility value. This pivotal transition tempered volatility back towards sustainable growth.

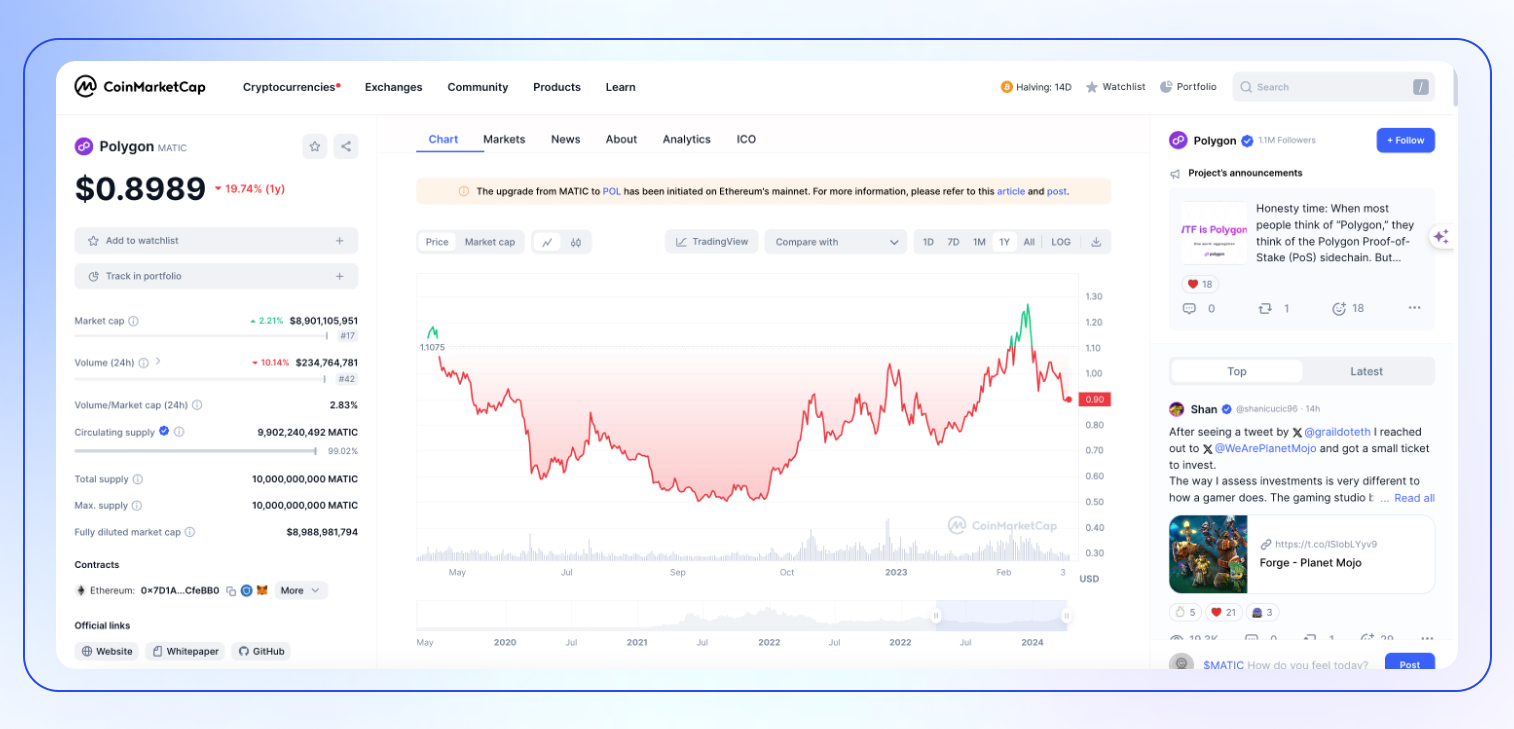

Most recently in 2023 and 2024 (Pic. 4), MATIC discovers stability between $0.50 and $1.50. This new plateau signals MATIC’s entrenched status as critical crypto infrastructure while supporting steady incremental expansion.

MATIC’s turbulent price history reflects evolving perceptions around Polygon’s promise and utility. As investors initially speculated on potential, 2021 saw exuberance overtake rational analysis. This unsustainable peak then corrected towards durable value based on real-world usage and technological merit.

MATIC Price Prediction Near Future

Now, let’s look at the following chart and try to predict where MATIC’s price’s heading.

The above daily chart indicates that the price has been following an uptrend since mid-June, as represented by higher highs and higher lows. The current price is near the upper Bollinger Band, suggesting potential resistance around this area.

- The moving averages (9-day and 26-day) are converging, with the 9-day MA slightly above the 26-day MA, indicating a possible bullish crossover in the short term if the price sustains above these averages.

- The Relative Strength Index (RSI) is at 58.53, which is in the neutral zone but leaning towards the overbought region, indicating that buying pressure has been present but may face a potential pullback if it moves further into the overbought territory.

- The Moving Average Convergence Divergence (MACD) indicator shows the signal line (orange) below the MACD line (blue), which is a bullish sign. However, both lines are close to the zero line, showing that the momentum is not particularly strong.

Based on the current technical analysis, the price of MATIC may continue its uptrend in the near future but may face resistance near the current levels. If it manages to break above the resistance and sustains, the next target could be around the previous highs near $1.20. On the downside, if the price fails to break the resistance and falls below the moving averages, it could head towards the mid-Bollinger Band as the initial support level, which is around $0.90.

Polygon Price Prediction 2025 & 2030: How High Can Matic Go?

Experts have varying opinions on the future price of Polygon MATIC. Generally, there's optimism about its prospects, but the extent of its growth is up for debate:

- Coin Price Forecast is quite bullish on Polygon, suggesting its price could steadily climb and potentially hit $3.82 by 2030 — a consistent upward trajectory over the decade.

- Coinpedia expresses even stronger confidence in MATIC's growth, suggesting the price could escalate to $2.50 in 2024. They speculate a significant crypto market surge around 2025, projecting Polygon's value at $4, and then a remarkable increase to nearly $17 by 2030, indicating a potential market boom.

- Crypto Bulls Club also foresees a positive trend for Polygon's valuation, though they expect some volatility in 2024, with a mid-year peak possibly reaching $2.89. They predict more stability in the following years, with prices potentially surpassing $5 by 2026, assuming Web 3.0 gains significant traction.

- Cryptoticker tops these predictions with very ambitious figures, avoiding specific yearly estimates but suggesting that by 2030, MATIC could range between $5 and $30. Such a surge would require widespread adoption and a significant shift in the crypto landscape. While their analysis concedes that $30 might be overly optimistic, they maintain that $5 is within reach.

Conclusions

Given crypto's inherent volatility, predicting precise price targets years out proves speculative at best and irresponsible at worst. The variables in play seem boundless.

However, Polygon's clear utility bodes well for increasing relevance over 5 to 10 year horizons. As long as innovation on Polygon continues advancing ahead of competing chains, adoption should logically follow.

But rather than anchor to arbitrary price milestones devoid of context, the wiser approach tracks usage growth and technological progress. Because Polygon’s true value reflects the real-world problems it helps solve through a performant, scalable and secure infrastructure for next-generation applications.

And here's a gentle nudge for those interested in trading MATIC — why not give Bitsgap a shot? Bitsgap is a crypto trading platform that aggregates over 15 leading exchanges (each offering MATIC up for grabs) and boasts an array of smart trading instruments and crypto trading bots that could help you capitalize on both short and long-term MATIC price swings. Plus, you can try it out for free with a 7-day trial, so feel free to sign up and explore.

FAQs

Where Can I Find the Price of Polygon MATIC Today?

You can find the current price of Polygon (MATIC) on various financial websites, cryptocurrency information platforms, and exchanges. Here are a few reliable sources to check the latest MATIC price:

- CoinMarketCap: A leading cryptocurrency market data provider that shows real-time prices, market cap, volume, and more.

- CoinGecko: Another popular platform that provides comprehensive cryptocurrency data including current prices, historical charts, and market information.

- Crypto Exchanges & Trading Platforms like Bitsgap: Most crypto exchanges like Binance, Coinbase, Kraken, etc., display the live price of MATIC along with trading options. Bitsgap, on the other hand, aggregates more than 15 top exchanges, so all you have to do is toggle between those to find out the price of whatever crypto asset that caught your eye.

- TradingView: Offers detailed charts and technical analysis tools where you can track the price of MATIC against various fiat currencies or other cryptocurrencies. Bitsgap integrates TradingView charts as well, so you don’t have to toggle between the two platforms.

- Crypto News Websites: Websites like Cointelegraph or Coindesk often provide real-time price updates and market analyses.

Always ensure that the source you are using is updated in real-time and consider checking multiple sources to verify the accuracy of the price.