Your Guide to Understanding Moving Averages in Cryptocurrency

The markets rage, but you glide above the turmoil. The secret? You follow the moving average.

For a crypto trader, moving averages are a must-have tool that can help change the way you trade and put the odds of success in your favor. Let’s see how they work.

The moving average reigns supreme as the world's most popular technical indicator, offering traders invaluable insight into market sentiment. In financial trading, a price is more likely to continue moving in the direction of an established trend. This is where the moving average shines, providing crucial clues about where the price may be heading next.

Join us as we delve into the world of moving averages in cryptocurrency trading, because this exploration may just be the catalyst that transforms your trading approach.

What Is Moving Average Indicator in Cryptocurrency Trading?

The moving average (MA) is a technical indicator that reveals the average price of a specified number of recent candlesticks, offering a streamlined method for identifying trends without being overwhelmed by information.

👉 Suppose a cryptocurrency is trading above its 50-day moving average. This suggests that buyers hold the upper hand over sellers in the market. In this scenario, the moving average highlights the presence of upward momentum and strong buying pressure. Consequently, you can swiftly dismiss the idea of selling the asset and concentrate on purchasing it to capitalize on the prevailing trend.

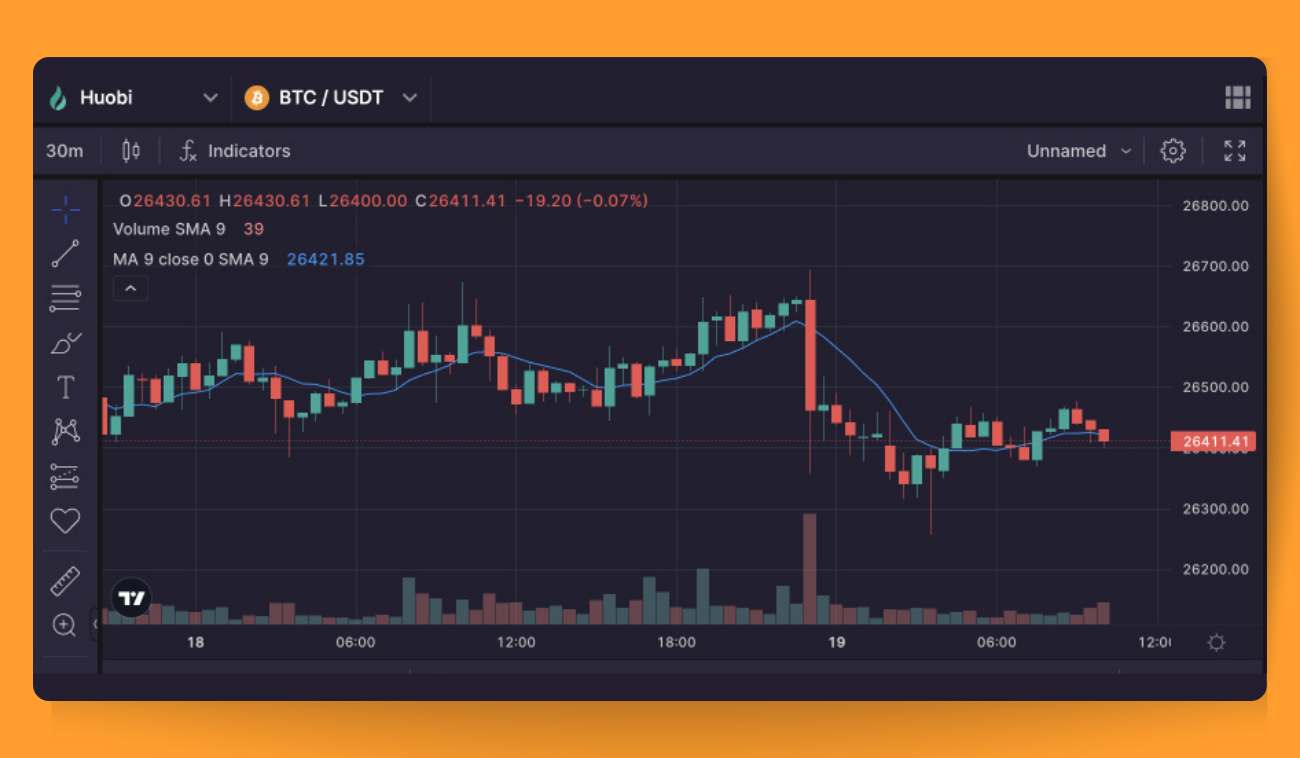

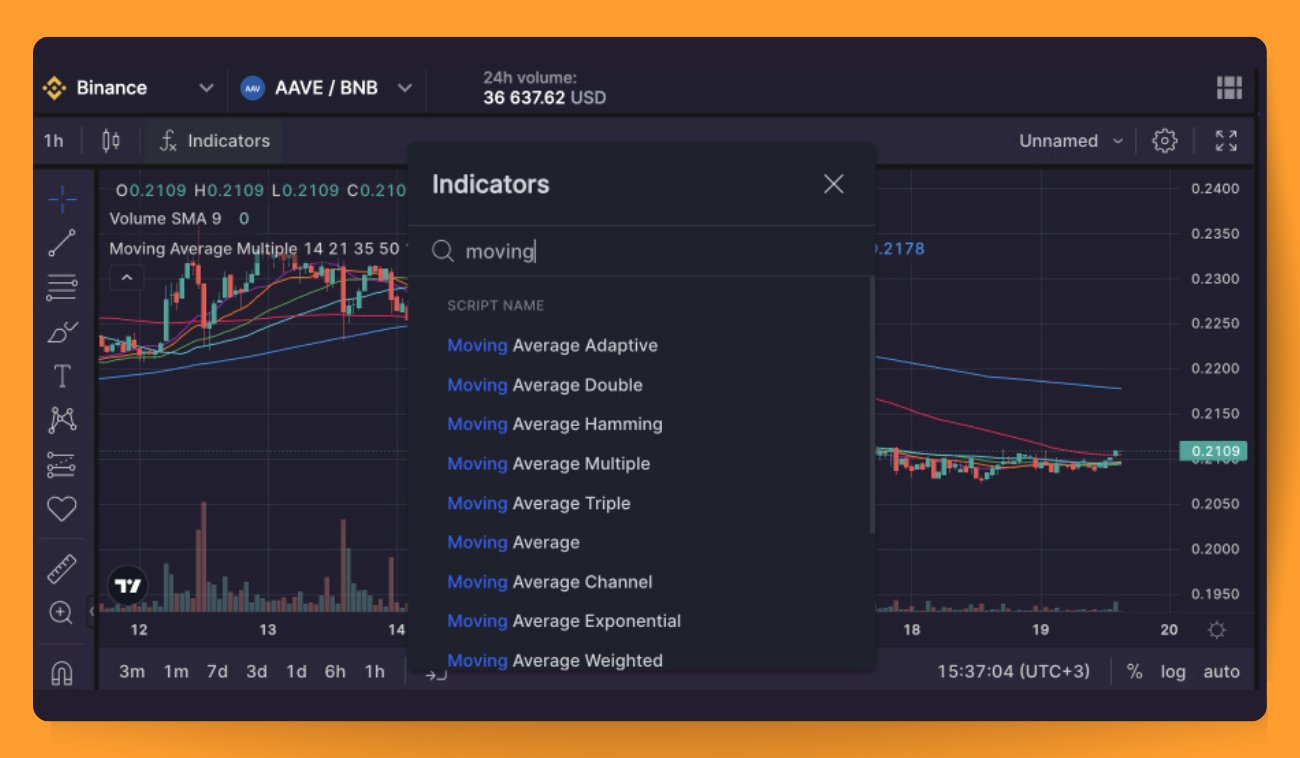

On a price chart, the moving average is represented alongside the price as a dynamic line that shifts its position over time, as demonstrated in the Pic. 1 below:

While moving averages can be an extremely useful tool for crypto traders, they require a solid understanding to be used effectively. It is important to fully grasp how moving averages are calculated and constructed in order to employ them in your trading strategy.

How Does MA in Crypto Work?

Moving Averages streamline price movements and accentuate underlying trends. By ironing out the commotion of daily price shifts, MAs help you concentrate on the bigger picture, leading to well-informed decisions.

Besides pinpointing trends, MAs also prove useful in detecting potential support and resistance levels. As a cryptocurrency's price approaches a moving average, it can serve as a buffer that either bolsters the price (in an upward trend) or deflects further gains (in a downward trend).

You can leverage the moving average in numerous ways, either as a standalone indicator or in tandem with other technical analysis tools. For instance, you might use several moving averages on a single chart for a more vivid trend depiction, or you could pair the moving average indicator with others like Bollinger Bands or the Relative Strength Index (RSI).

Types of Moving Averages & How MA Price Is Calculated

Although the moving average is based on the average price of a recent set of candles, here are additional factors involved in determining its value. Depending on the calculation method, the most efficient moving averages include:

- Simple Moving Average

- Exponential Moving Average

- Weighted Moving Average

We will examine each of these MAs individually.

Simple Moving Average (SMA)

The Simple Moving Average (SMA) is a straightforward indicator that calculates the average price over a specific time period. It does this by summing up the closing prices for the asset over the last 'N' time periods and then dividing that total by "N."

The formula for SMA is:

SMA = (A1 + A2 + ... + An) / n

where:

- An is the price of an asset at period n

- n is the total number of periods

👉 Dubbed "simple" for its unpretentious approach, the SMA treats all data points as equals, whether they're from a few days ago or just yesterday. The 10th closing price in the average carries as much weight as today's closing price. This even-handed treatment of all prices means that the SMA might be a little late to the party when it comes to catching the latest market turns. However, it excels at sifting through short-term noise and unearthing those all-important long-term trend lines.

Exponential Moving Average (EMA)

The Exponential Moving Average (EMA) (Pic. 2) is a variant of the moving average (MA) that assigns greater importance and emphasis to the latest data points. Sometimes referred to as the exponentially weighted moving average, the EMA is more responsive to recent price shifts compared to its counterpart, the Simple Moving Average (SMA). While the SMA applies equal weight to all observations within a given period, the EMA takes a more dynamic approach by prioritizing the newest data points.

Formula for Exponential Moving Average (EMA):

EMA_Today = (Value_Today * (Smoothing / (1 + Days))) + (EMA_Yesterday * (1 - (Smoothing / (1 + Days))))

where:

- EMA = Exponential Moving Average

- Value_Today = Today's price

- Days = Number of days in the time period

- Smoothing = Smoothing factor (usually set to 2)

👉 The 12- and 26-day Exponential Moving Averages (EMAs) frequently steal the spotlight as the most examined short-term averages. These crowd favorites form the backbone of popular indicators such as the Moving Average Convergence Divergence (MACD) and the Percentage Price Oscillator (PPO). Meanwhile, the 50- and 200-day EMAs reign supreme as go-to indicators for long-term trends. Keep an eye out for when a coin's price crosses its 200-day moving average — that's your cue that a reversal might just be in the cards!

Weighted Moving Average (WMA)

The Weighted Moving Average (WMA) (Pic. 2) is designed to keep things sharper by prioritizing recent data over past data. This is achieved by multiplying each bar's price with a unique weighting factor. Thanks to this distinctive calculation, the WMA sticks closer to prices than a corresponding Simple Moving Average.

The weighting factor hinges on the period chosen for the indicator. For instance, here's how a 5-period WMA would be calculated:

WMA = (P1 * 5) + (P2 * 4) + (P3 * 3) + (P4 * 2) + (P5 * 1) / (5 + 4 + 3 + 2 + 1)

where:

P1 = current price,

P2 = price one bar ago, and so on.

👉 Abide by the same guidelines for interpreting WMA as you would for SMA. However, bear in mind that WMA is typically more responsive to price fluctuations. This heightened sensitivity can be both a blessing and a curse. On the positive side, WMA can detect trends earlier than an SMA. Conversely, the WMA is more prone to experience abrupt reversals, or whipsaws, compared to a corresponding SMA.

Common Moving Average Lengths

Here's a list of the most frequently used moving average lengths (Pic. 3):

- 9-day moving average

- 20-day moving average

- 50-day moving average

- 100-day moving average

- 200-day moving average

Moving averages with fewer periods are known as faster MAs, exhibiting a smaller lag factor. Conversely, moving averages with a higher number of periods are called slower MAs, encompassing a more extended time frame, leading to a greater lag factor and increased price fluctuations and noise.

Other Types of Moving Averages

- Moving Average Double (DMEA): A double moving exponential average (DMEA) steps in to combat the lag found in SMAs, which increases with the length of the time period being charted. The DMEA tackles this issue by employing two exponential moving averages (EMAs) and subtracting a smoothed-out EMA. DMEAs are a boon for those focusing on shorter trading periods like day traders and swing traders. By reducing noise and enabling traders to zero in on smaller price fluctuations, as well as being faster with reduced lag, DMEAs possess two essential traits for traders aiming to make trades within short timeframes.

- Moving Average Triple: A triple moving exponential average (TMEA) is akin to a DMEA but levels up by using multiple EMAs instead of just two. This fantastic tool reduces the lag of traditional moving averages, providing even more reliable data for swift trades. TMEA, like all MAs, helps traders spot trends, breakouts, short-term changes or pullbacks, and establish support and resistance levels.

- Moving Average Multiple: The multiple moving average, or Guppy multiple moving average (GMMA), is a powerhouse of a technical indicator designed to foresee breakouts in an asset's price chart. Comprising twelve MAs—six short-term (ST) and six long-term (LT)—this tool is a game-changer. Keep a keen eye on the convergence and divergence of these two MA groups and the spacing between each MA.

How to Read Moving Average Crypto: What Can Cryptocurrency Moving Average Tell You?

Moving averages are a versatile tool that can be employed in many different ways. Some rely on them to spot support and resistance levels, while others use them to determine optimal entry and exit points for long-term positions.

Savvy traders also employ moving averages to generate automated buy and sell signals when the price hits a specific threshold.

👉 The more you understand about these indicators, the better you can integrate them into a comprehensive trading strategy.

However, moving averages should not be used as a stand-alone system but rather as a useful addendum to other technical and fundamental analysis tools. That said, when used properly, moving averages can provide invaluable insights into the market.

One of the most useful techniques is monitoring when a short-term moving average crosses above or below a long-term moving average. For example (Pic. 5):

- Bullish Cross: A 50-day simple moving average crossing above a 200-day SMA signals a bullish trend and buying opportunity for many traders. This indicates buyers are gaining the upper hand, driving the price higher.

- Bearish Cross: The 50-day SMA dropping below the 200-day SMA flashes a warning for traders to sell. This bearish crossover signifies sellers are outnumbering buyers, pushing the price down.

- The Moving Average Convergence Divergence or MACD indicator tracks the relationship between a short-term and long-term moving average. When the MACD turns positive, it means the short-term MA has risen above the long-term MA - signaling upward momentum and a buying opportunity for some traders. When the MACD goes negative, it indicates the short-term MA has dropped below the long-term MA, suggesting downward pressure and a chance to sell.

Though seemingly simple, moving averages can help determine critical entry and exit points, spot reversals, set price targets, and confirm market trends. With the right knowledge and application, MAs transform into a potent yet easy-to-use trading tool.

Crypto Moving Average Example

The dim glow of the monitors lit Jimmy's face as he scrutinized the charts. A flicker on the screen caught his eye — a lesser-known token that had been stealthily gaining momentum. This was the type of quarry Jimmy sought.

He pulled up the token’s chart on Bitsgap and with a practiced eye spotted his favorite tool of the hunt — the 10-day moving average.

A thrill rushed through Jimmy as he saw the price of the token gently rising above the moving average, signaling an uptrend ready to break out. This was the moment he had been preparing for. Without hesitation, he pounced, executing a buy order for this desirable prize.

In the days that followed, the token price surged, as Jimmy had anticipated. His trading thesis, guided by the subtle message of the moving average, proved correct once again. Now comfortably in profit, Jimmy again checked his 10-day MA to plot his next move. Would he hold for bigger gains or sell to lock in his reward? The MA would decide.

Jimmy's story shows how a basic tool, when skillfully applied, can yield an almost unfair advantage. Amateur traders stumble through the dark, but pros like Jimmy know that trend is the trader's only friend, with the MA shedding the light that is obscured to most.

Why Moving Average Method Is Used

The moving average helps pinpoint when to buy or sell by filtering out price noise and revealing the underlying trend. By spotting these trends early, you can buy ahead of market surges and sell before major dips. The moving average also helps determine key support and resistance levels, allowing you to anticipate where the price may reverse direction.

Armed with this advantage, you can deploy an effective trading strategy to maximize profits from short-term market moves.

Scalpers use multiple moving averages with short timeframes to capitalize on quick price changes. Day traders rely on moving averages to get in and out of volatile markets, while swing traders use them to ride short-term uptrends and downtrends.

👉 For example, you may use a 10-day SMA and 30-day SMA. When the 10-day SMA crosses above the 30-day SMA, it signals an upward trend and buying opportunity. If the 10-day SMA crosses below the 30-day SMA, it indicates a downward trend and chance to sell. By analyzing how the short-term moving average interacts with the long-term moving average, you receive an insightful view of momentum and trend changes.

Moving averages boil down price data into an easy-to-use signal to guide trading decisions. Though basic, they continue to stand the test of time because they work.

MA Advantages & Disadvantages for Bitcoin and Cryptocurrency Trading

Cryptocurrency markets are known for wild price swings and volatility. Moving averages can help traders gain clarity in these chaotic conditions by filtering out ordinary fluctuations and smoothing price data into a clear trend signal.

Moving averages give traders the flexibility to choose whatever time period they want, from short-term windows to long-term horizons. Shorter moving averages like 10-day periods react quickly to price changes but also generate more false signals, while longer moving averages like 200-day periods are slower to turn but produce fewer whipsaws. Using multiple moving averages of different lengths allows traders to gauge both immediate market momentum as well as longstanding trends.

Most importantly, moving averages spotlight key support and resistance levels - revealing whether the current price is justified and sustainable based on market conditions. When the price approaches a moving average, it often signals an opportunity to buy at a discount or sell before a possible reversal. Moving averages distill trend information into actionable trading levels.

Despite their widespread use, moving averages aren't without shortcomings.

First of all, moving averages rely solely on past price data. Like any technical analysis tool, they don't account for changes in fundamental factors that may impact a coin's future performance, such as fluctuating demand for the underlying technology or shifts in the project's management structure.

Also, moving averages can span any time period, which can pose challenges as the general trend may differ based on the chosen interval. For example, a 50-day moving average might reveal an uptrend that's actually a countertrend within a downtrend observed in a 200-day moving average.

A long-standing debate surrounds the emphasis placed on the most recent days in a time frame, such as with exponential moving averages. Some believe that current data better represents the asset's direction, while others argue that unequal weighting skews the trend.

Finally, the goal of identifying trends is to predict an asset's future price. However, if a coin isn't trending in any direction, it doesn't provide an opportunity to profit from either buying or short selling.

MA and RSI

The Relative Strength Index (RSI) is a technical momentum indicator that compares recent price gains with losses. Traders and analysts primarily use it to identify potential overbought or oversold market conditions.

👉 However, since overbought and oversold assets might not reverse immediately, it's advantageous to seek confirmation from another trade signal before acting on RSI.

Cue the Moving Average Convergence Divergence (MACD) (Pic. 4), another popular momentum indicator that complements the RSI by calculating momentum differently. It compares the positions of short- and long-term moving averages, allowing traders to monitor the MACD for signs of momentum divergence from price. As the price rises and the RSI maintains overbought readings, the MACD showcases divergence by starting to decline — offering additional confirmation that the market may be overextended and ripe for retracement.

👉 Both the MACD and RSI are contrarian by nature, signaling to buy amidst heavy selling and to sell during significant buying. When they both indicate buying, it's more likely that the security is genuinely oversold. Conversely, if both generate sell signals, the security is probably overbought and headed downward.

To further confirm RSI indications of overbought or oversold markets, moving average crossovers can also come into play.

Pairing RSI with exponential moving averages (EMAs) that respond quickly to recent price changes can be beneficial. Short-term moving average crossovers, like the 5 EMA crossing over the 10 EMA, are ideal for complementing the RSI. A downward crossover of the 5 EMA confirms the RSI's indication of overbought conditions and a potential trend reversal, while an upward crossover suggests that the market might be oversold.

Crypto Moving Average Strategy

Moving averages provide signals for buying and selling an asset based on its relationship to the average price. So the general MA strategy implies buying when the price moves above the moving average, and selling when the price falls below the moving average.

When choosing between SMAs and EMAs, it's uncertain which type and length of moving average will deliver the best results. Since EMAs assign greater weight to more recent market movements, they are more likely to generate earlier trading signals, albeit at the cost of some false signals.

👉 If you seek to outperform the market, then keep in mind that outperforming the market is more challenging than following basic timing strategies. In a bull market, many strategies produce results simply due to the overall positive trend. During more difficult times, numerous strategies fail to prevent losses.

In technical analysis, traders often discuss the (bullish) golden cross and the (bearish) death cross (Pic. 5), which we also mentioned above. Both terms refer to the behavior of moving averages relative to each other. The most common version involves the 50-day and 200-day MAs. When the 50-day MA moves above the 200-day MA, the golden cross signals an upcoming bull market, while the death cross—when the 50-day MA moves below the 200-day MA—typically marks the beginning of a bearish period.

👉 However, since this strategy responds to larger market trends, it may take time to exit and re-enter the market. This can protect from significant losses but may also result in missed opportunities when the market changes course.

Exploring Moving Average (MA) Indicators on Bitsgap:

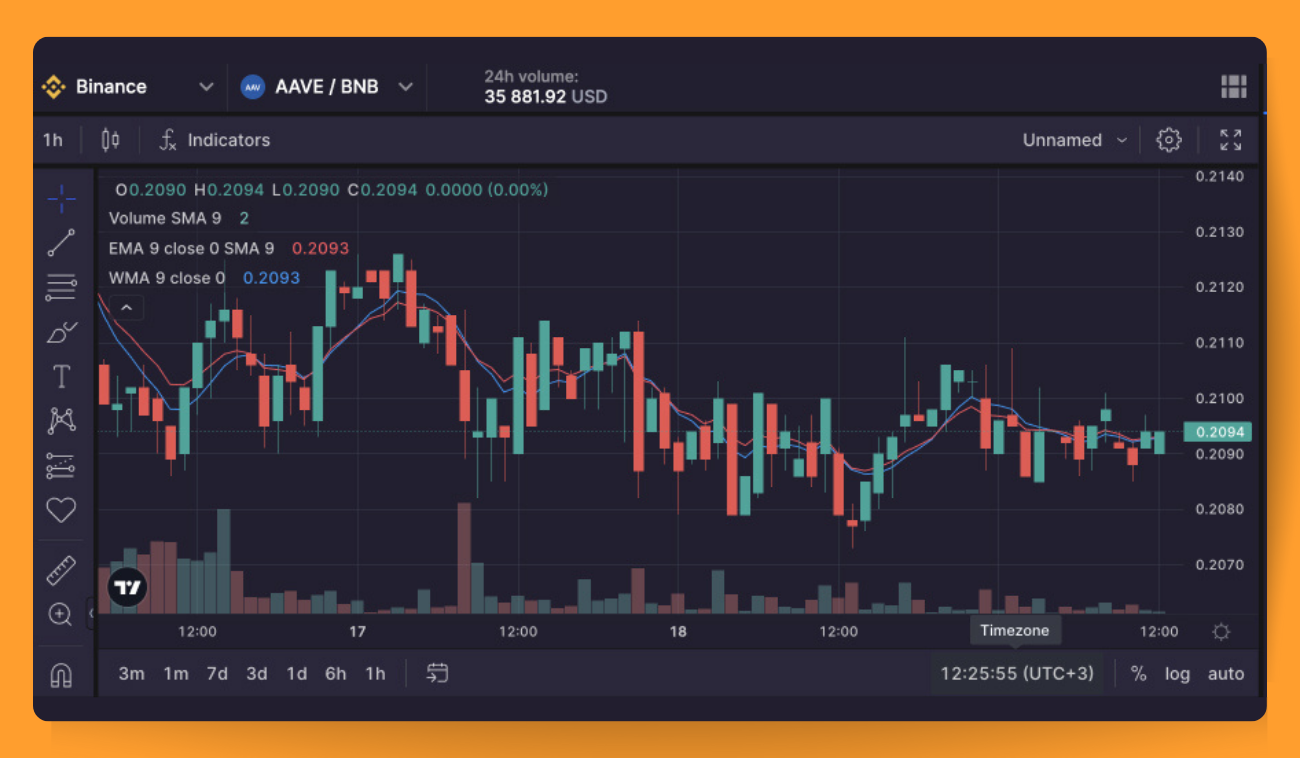

To start using MA indicators on Bitsgap, simply follow these steps with your preferred trading pair.

- Click on "Indicators" (Pic. 6) located at the top of the chart, which will open a new window.

- Use the search bar to find "Moving Average," "Moving Average Double," "Moving Average Hamming," or any other MA indicator you'd like to try out. Remember that some indicators require combining multiple simple moving averages.

- Select the desired indicator, and then close the window by clicking the "x" button. The moving average will now appear on your chart. If you switch to a different timeframe, the indicator will adapt accordingly. You can choose the timeframe at the top left corner of the chart.

Now you're all set to sharpen your trading analysis skills using various MA indicators on Bitsgap! Happy trading!

Bottom Line: The M.A. Magic Trick

Moving averages are fantastic tools, offering a wealth of insights into trends, breakouts, pullbacks, short-term price fluctuations, and more. Plus, with a variety of moving average types and applications, they're the perfect indicators for newcomers to experiment with.

But let's not forget the importance of thorough tech analysis backtesting for all strategies — it's your key to boosting your odds of success!

One of the coolest things about moving averages is that you can visually grasp them in no time. And to make things even easier, you can quickly dive into this on trading platforms like Bitsgap.

So, why not give moving averages a try and see where they take your trading journey?

FAQs

What Is MA Indicator in Crypto?

The Moving Average (MA) is a widely favored indicator across various markets, serving as both a stand-alone trading indicator and a component of other technical analysis tools like Bollinger Bands. As the name suggests, a moving average calculates the average price of an asset over a specific period. This can take the form of a basic moving average, which is a simple arithmetic mean, or an exponential moving average, which allocates greater weight to the most recent prices.

How to Use Moving Average in Crypto?

In a trending market, the MA acts as a dynamic support/resistance level. If the price approaches the moving average and demonstrates a rejection consistent with the trend, it presents an opportunity to open a position immediately. However, in a volatile market, it's challenging to follow the trend since the price lacks a specific direction.

Another technique for chart analysis involves identifying price reversal points using the MA and support/resistance levels. When the gap between the price and the dynamic 20 EMA widens, they tend to move closer due to a "gravitational force" called mean reversion. The likelihood of a mean reversion increases if the price reaches a critical support/resistance level.

Moreover, observing crossovers can reveal a wealth of useful information. When a short-term moving average crosses above the long-term moving average, it signals that short-term traders have become more assertive in the market. Thus, executing a trade following the crossover may yield higher profits.

What Is 200 Day Moving Average Crypto?

The 200-day moving average indicator is useful for assessing longer timeframes, making it an excellent tool for long-term investments.

As the name suggests, the 200-day moving average calculates an asset's average price movements over 200 days. Like all moving averages, it appears as a line on the price chart, rising and falling in sync with average price changes.

The importance of the 200-day moving average varies depending on the type of asset or market a trader is involved in. Day traders might not find the 200-day MA as useful, while long-term traders may not benefit much from an indicator focused on a short timeframe.

However, 200-day MAs offer valuable insights into an asset's performance. A short-term candlestick chart may make an asset's value appear to be plummeting in a bearish turn, but the perspective may change when viewed through the lens of a 200-day MA.

Furthermore, the 200-day moving average serves as a crucial indicator for identifying potential market shifts. By pairing a 200-day MA with a shorter MA, traders can look for instances where the shorter MA bounces off or crosses the 200-day MA, providing valuable insights for their trades.

What Is the Best Moving Average for Cryptocurrency?

One of the best indicators for crypto trading is arguably a combination of indicators, such as MACD.

A moving average crossover (convergence/divergence), or MACD, is an indicator that emerges when a faster moving average (MAs with fewer periods) crosses a slower one (MAs with more periods). MACDs help identify shifts in short-term versus long-term price action. A crossover typically signals an impending trend reversal.

One advantage of this indicator for swing and day traders is the reduced lag factor, thanks to the faster MA in the moving average crossover. This is particularly beneficial for rapid-trading individuals, as swing and day trading are faster-paced styles where lagging indicators can negatively impact trades. Consequently, the moving average crossover indicator is among the best moving averages for day trading.

What Is Moving Average Crypto Strategy?

You can use MAs as part of your crypto strategy in many different ways. Firstly, you can use MAs to identify support and resistance levels. Generally, the longer the timeframe used, the more robust the support or resistance.

Secondly, the slope of a moving average over an extended period can help determine a trend. For example, if a moving average slopes upward, it indicates that the asset is in an uptrend. Conversely, if the moving average slopes downward, it's likely that the asset being analyzed is in a downtrend. But keep in mind that a moving average is a lagging indicator. The slope of a moving average only assists in identifying a trend. A single moving average cannot pinpoint the shift from an uptrend to a downtrend.

Thirdly, moving average crossovers can help identify buying or selling opportunities. To use crossovers, you'll need at least two moving averages on your chart. To prevent overcrowding the chart, most traders opt for just two. One of the moving averages should be longer than the other. With a short-term MA and a long-term MA enabled, monitor the crossovers. Short MA crosses above long MA: bullish trading signal. Short MA falls below long MA: bearish trading signal.

How Does Simple Moving Average (SMA) Work?

A simple moving average is a straightforward method for incorporating MA into your cryptocurrency trading strategy. To calculate it, simply sum up the closing prices for all the days you'd like to include in the average for a specific coin or token. Next, divide this sum by the number of days you plan to plot. This calculation will yield a simple moving average for your chosen time frame.

Moving Average vs Weighted Average

In contrast to a basic moving average, which calculates a baseline by combining all data points, a weighted average enables you to emphasize the most significant factors. This approach allows you to assign greater importance to recent price points. As older cryptocurrency price data may not be as pertinent, focusing more on newer price points can lead to a more accurate outcome when crafting your trend lines.

SMA vs Exponential Moving Average

The exponential moving average (EMA) is a variation of the weighted moving average that emphasizes recent price movements more than a simple moving average, which treats all price actions equally. Since the EMA reacts more quickly to recent price shifts than other indicators, it can be an effective strategy when trading especially volatile assets.