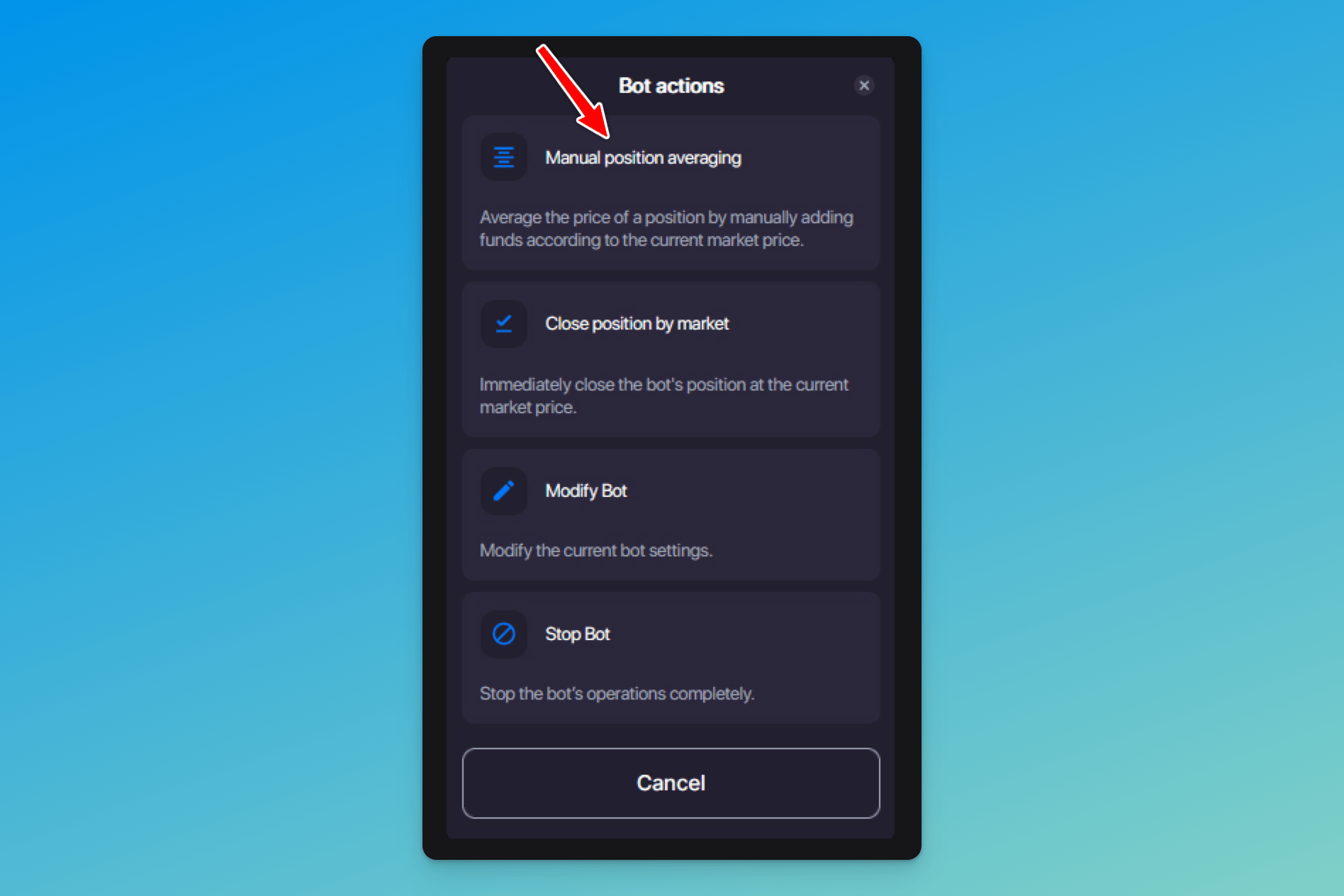

Get Ready to Boost Your DCA Bot With Trailing Take Profit, Manual Averaging, and More

Bitsgap's DCA trading bot has gotten several new features that will make your trading even smoother and, of course, more profitable.

In February, we added a set of cool extra features to the DCA bot’s [Manual adjustment] and [Bot actions] sections that you can use to fully customize your trading strategy.

Learn what features have been added and how you can use them to adjust your strategy for maximum benefit.

The DCA Bot Overview

The Bitsgap DCA Bot is one of a kind automated trading bot — arguably, the best DCA trading tool on the market right now. For a few good reasons — it offers indicator-based trading along with effective risk management tools and has shown superior trading results compared to competitors.

The DCA Bot follows the Dollar Cost Averaging strategy that divides your investment into periodic purchases or sales (depending on your position — long or short). Buying or selling coins in small amounts over time allows the bot to reduce the impact of volatility and get a better average price for an open position.

As mentioned, the Bitsgap DCA bot can enter or exit trades based on your chosen indicators and significantly limit your risks while allowing profits to flow and grow.

We’ve added a set of cool new features to allow you to customize your bot even further. Let’s unpack them.

New DCA Bot Features

Below, you’ll find a detailed description of the new functionality added in the latest platform update.

Trailing Take Profit

Now, when setting up Take Profit (TP), you can also enable the Trailing Take Profit functionality (TTP). With it, the TP price will follow the current price at the distance you define in the settings.

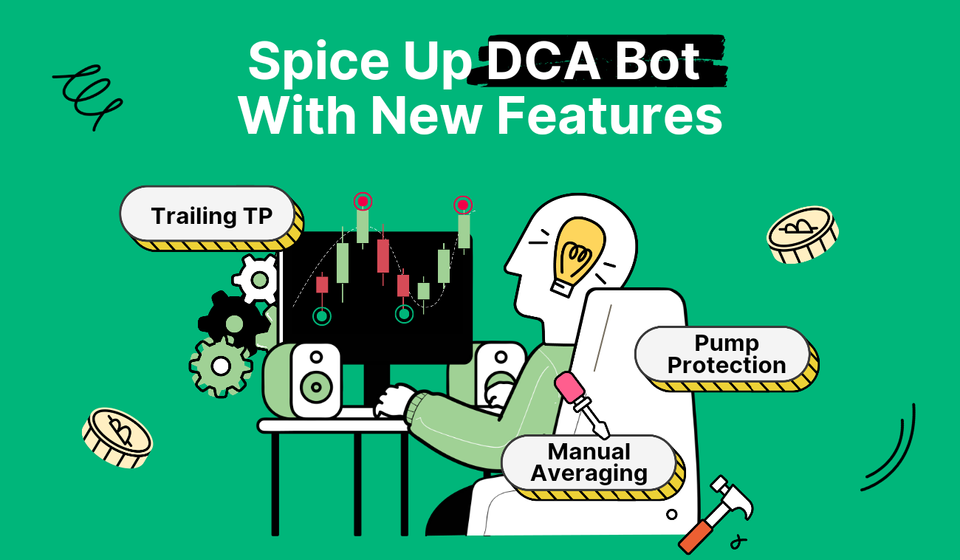

To enable TTP, go to [Manual adjustment] → [Position TP&SL] → [Take Profit] and select [Trailing] (Pic. 1):

Here, you can adjust the following settings:

- Trailing TP Trigger (TTP Trigger) — a level upon which TTP gets activated;

- Price deviation — a percentage deviation from a max (for long) or a min (for short) price reached after TTP activation;

- Percentage of — a reference point for the Trailing TP trigger.

Trailing Take Profit (TTP) is designed to maximize your profits. And here is how it works. First, you set the trigger value (TTP Trigger) and the rebound percentage (Price deviation). Once the price reaches the TTP Trigger, all DCA orders are canceled, and TTP is activated.

During the trailing, the system continuously monitors prices, max/min values, and the difference between the fixed and current prices. If the percentage difference is greater than or equal to what you specified in [Price deviation], the cycle ends, and the position closes with a market order.

Pump / Dump Protection

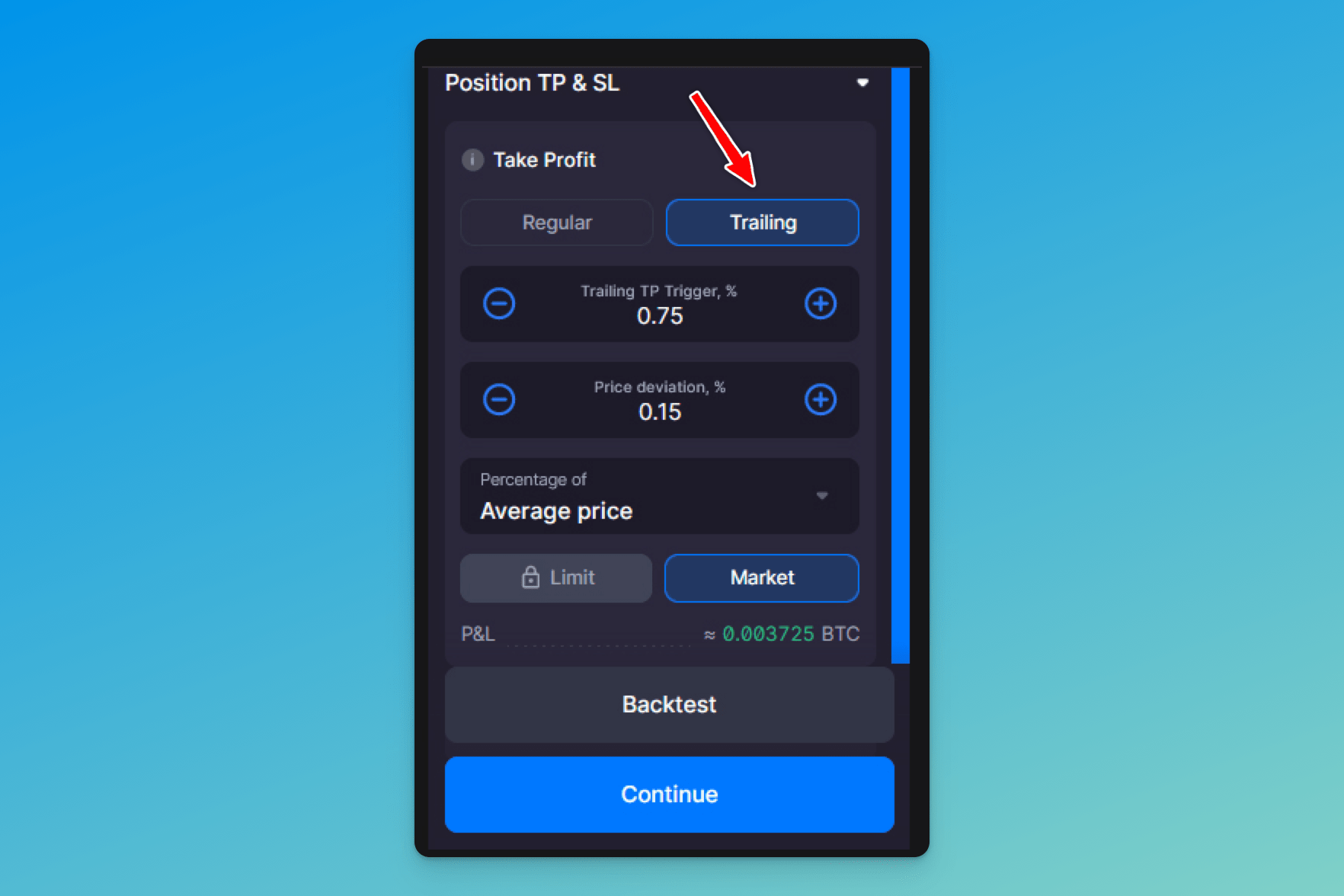

Finally, the Pump and Dump Protection feature is now part of the [Risk Management] tools and is enabled by default. It is a fantastic feature that protects your trading from sharp increases (Pump) or steep falls (Dump) in price.

However, should you wish to disable it, you can do so by heading to the [Risk Management] section and toggling the [Pump / Dump Protection] off (Pic. 2):

Manual Position Averaging

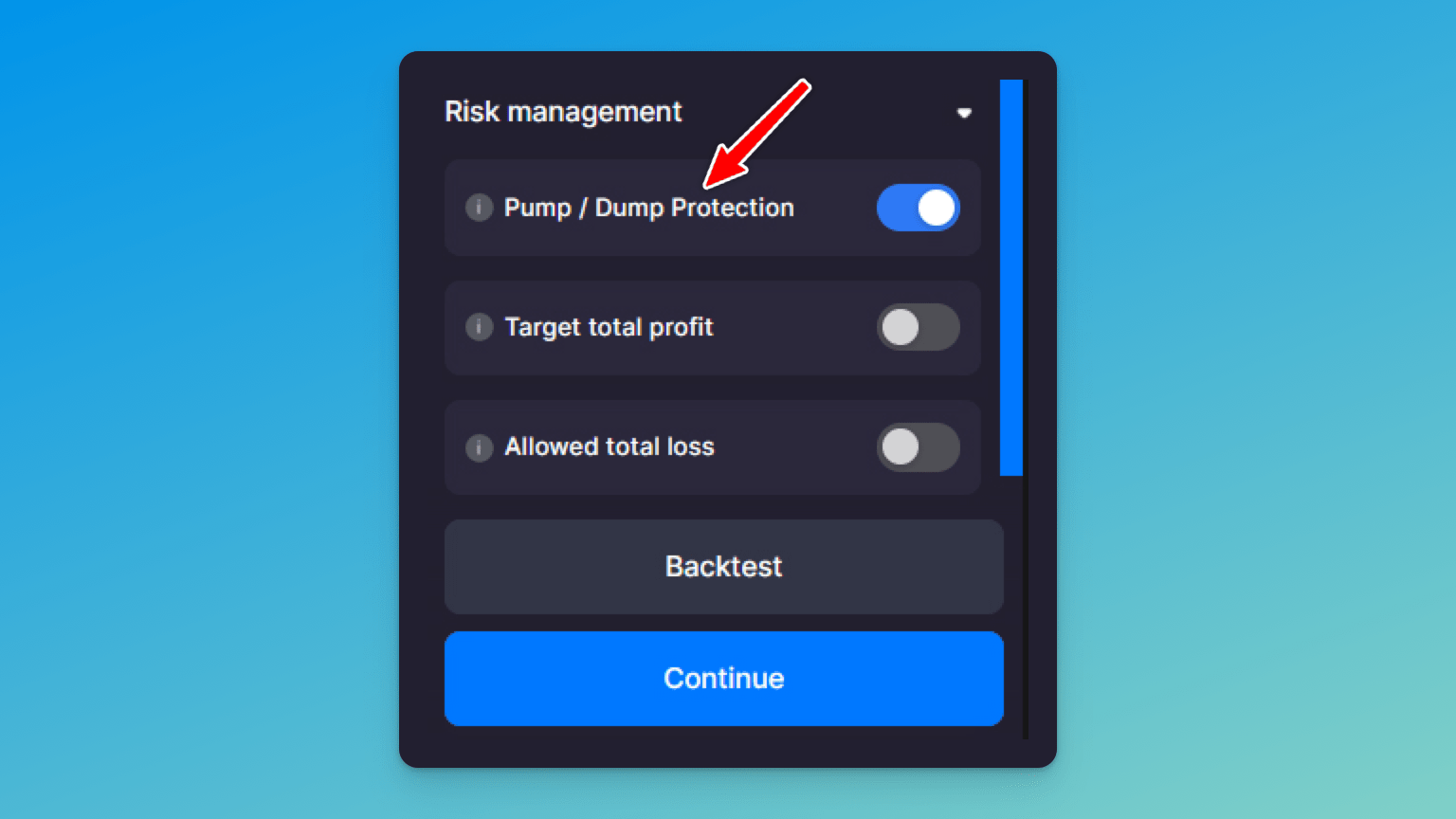

Manual position averaging is the feature that’s now available in the new [Bot actions]. It gives you greater control of your investment by allowing you to add additional funds into the cycle. An extra investment will adjust the current position of your DCA bot and help you take advantage of more profitable opportunities.

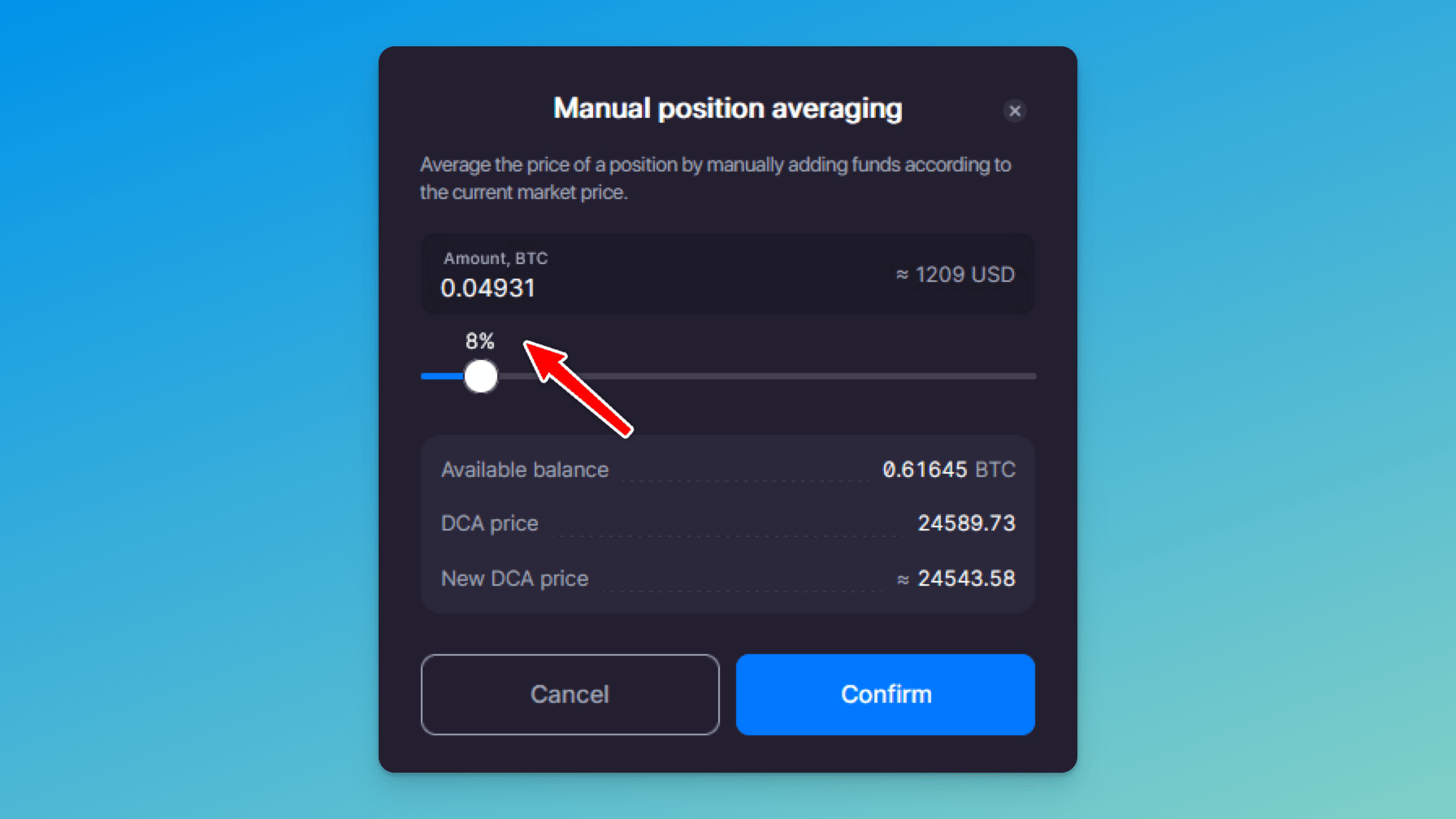

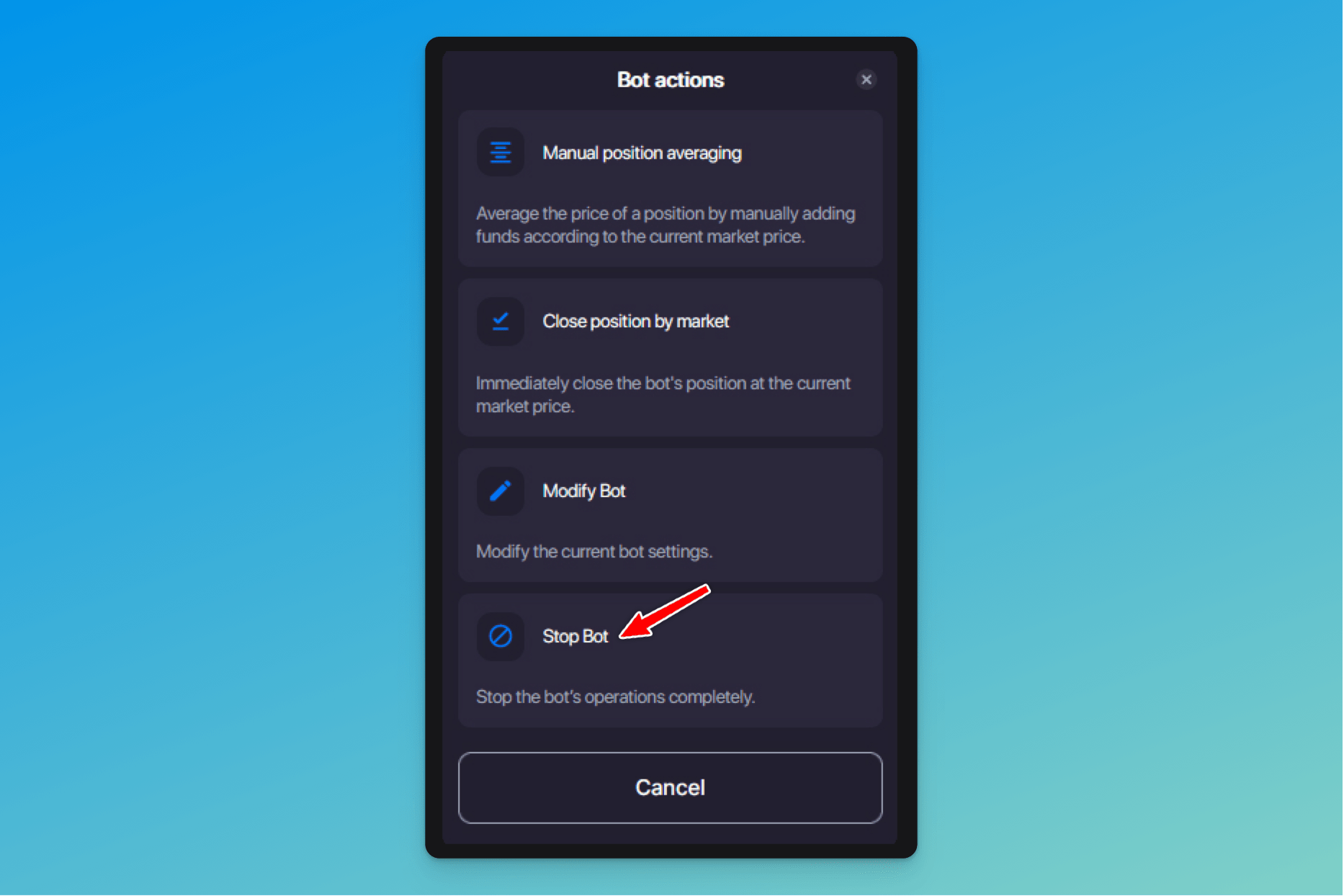

To average your DCA position, select your bot from the list of active bots under the chart, click [Bot actions] on the right-hand side of the interface, and choose [Manual position averaging] (Pic. 3):

Once you click, you’ll see a new window (Pic. 4) where you can specify how much additional funds you want to invest to average your position.

Close Position by Market Price

In the new [Bot actions] section, you can also find the option to [Close position by market] (Pic. 3).

The [Close position by market] option allows you to close the current position of the DCA bot with the sale or purchase of the traded currency at the market price and start a new cycle. For a long bot, the position will close by selling the asset at a market price. For a short bot, it’s the opposite — the position will close by purchasing an asset at a market price.

Stop Bot — Close Bot at Limit Price

If you don’t want to close your bot at a market price, you can do so with a limit order. The [Close bot at limit price] option allows you to close the bot with the sale or purchase of the traded currency by a limit order at a current breakeven price or at a specified price.

To select this option, go to the [Bot actions] menu, choose [Stop Bot] (Pic. 5), and then click on [Sell at limit price] for a long bot or [Buy at limit price] for a short bot.

By the way, closing at a limit price is now available for other bots, too, including GRID and BTD.

Spot Bot Open Orders

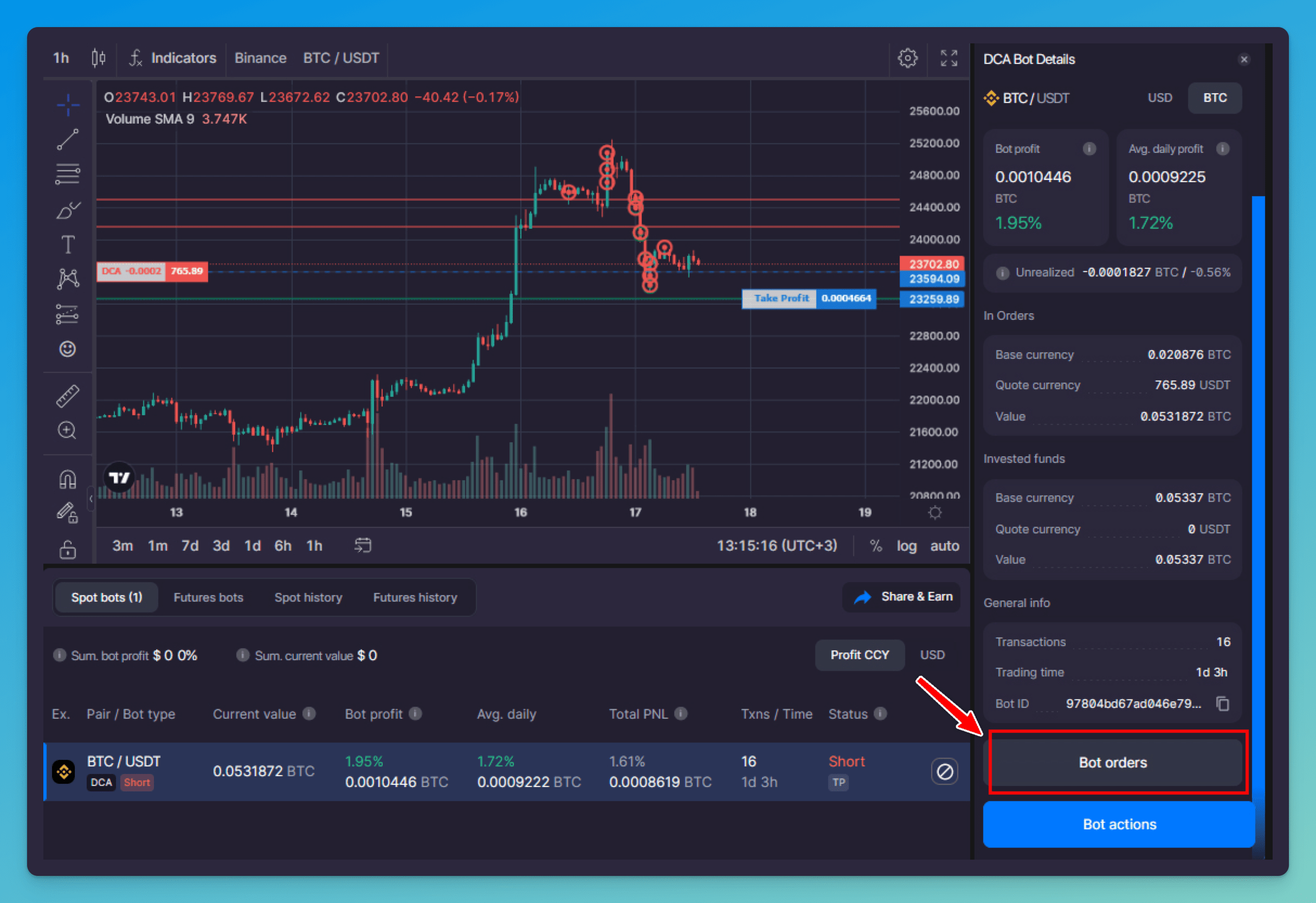

We’ve also added one more tab to the bot details section called [Open orders], where you can check your active orders and restore missing ones if you find any.

To check if you have any orders that need your attention, click on a bot you want to check and then click on [Bot orders] in the window that opens on the right (Pic. 6)

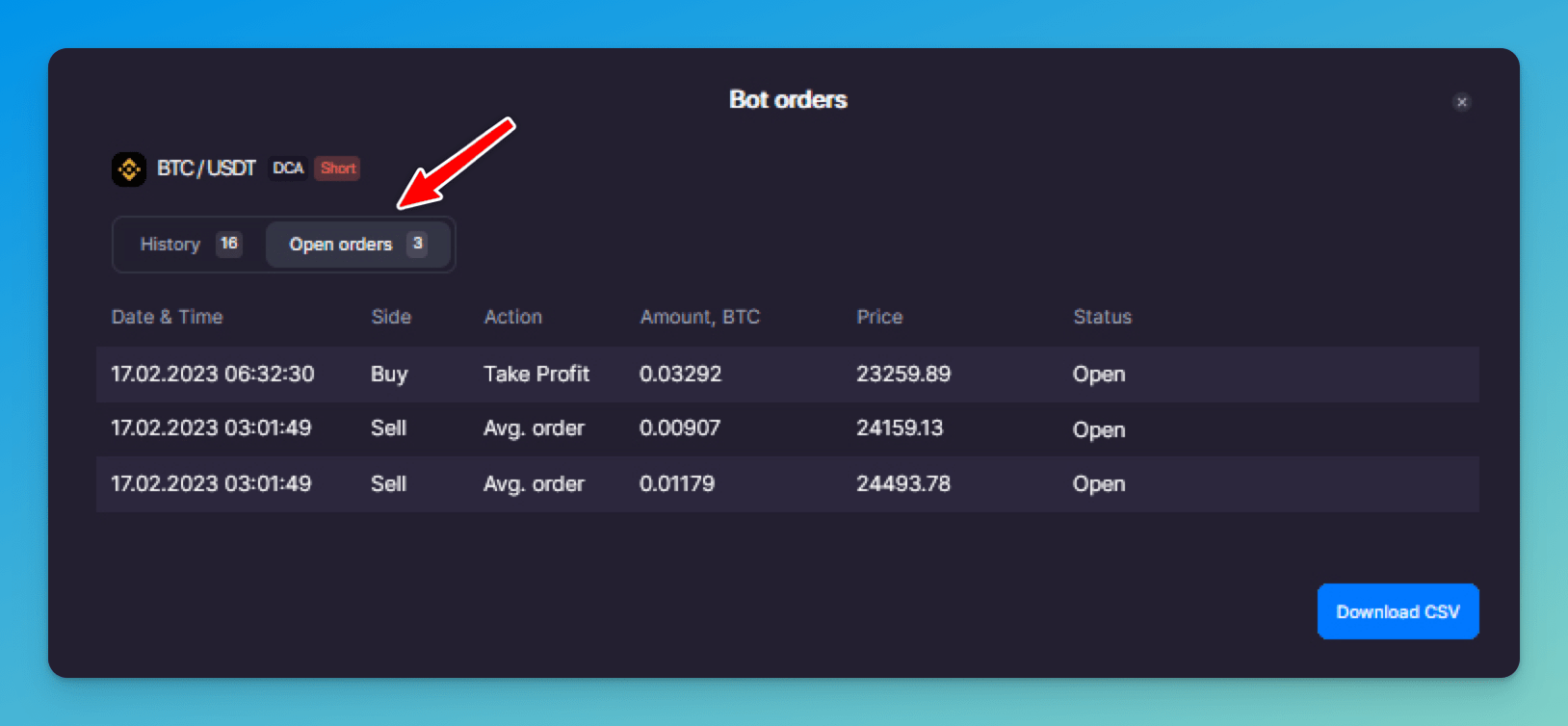

In the window that follows, select the [Open orders] tab (Pic. 7):

Missing orders can happen for several reasons, such as technical issues on the side of the exchange or not enough funds on your balance.

If there are any errors, you’ll see the [Fix all] button to restore the missing order(s).

Active Orders Limit

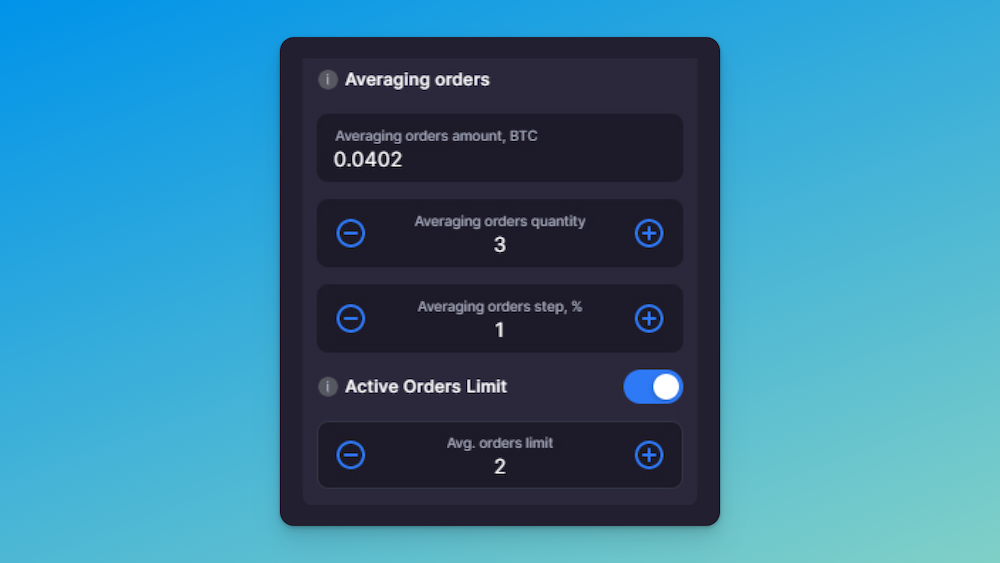

Finally, we’ve introduced [Active Orders Limit], which is a limit on the number of simultaneously placed averaging orders for a new DCA bot.

With this feature, you can choose how many averaging orders the DCA bot will have running at the same time.

[Active Orders Limit] is designed in such a way that it neither places all DCA bot averaging orders at once nor puts them in the order book at the moment the bot is launched. Instead, orders with a lower price will be put in after orders with a higher price have been filled.

This way, funds are not reserved on your available balance for averaging orders that are placed at a lower price, and you can use them for other transactions.

The Active Orders Limit feature is disabled by default, but you can enable it by clicking on [Manual adjustment] → [Bot settings] → [Averaging orders] → [Active Orders Limit] (Pic. 8).

Please note that the feature is available for a new bot only (that is — you can’t activate it or modify the number of simultaneously active averaging orders for an already existing, running DCA bot).

When you set up fewer simultaneously active orders than averaging orders, the orders placed at the lowest prices become inactive and are shown on the chart as grey. You can also check inactive orders in the [Open orders] tab, where they have the [On hold] status.

Bottom Line

The DCA Bot has yet again sustained a significant makeover that brought additional helpful and user-friendly features to its robust functionality.

Ready to check out new features? Then go to the platform now and start trading!