Feature Highlights: How to Smart Trade

In this article, we will outline the fundamentals and will take a look at some examples of how to use Smart Trade effectively for your daily crypto trading.

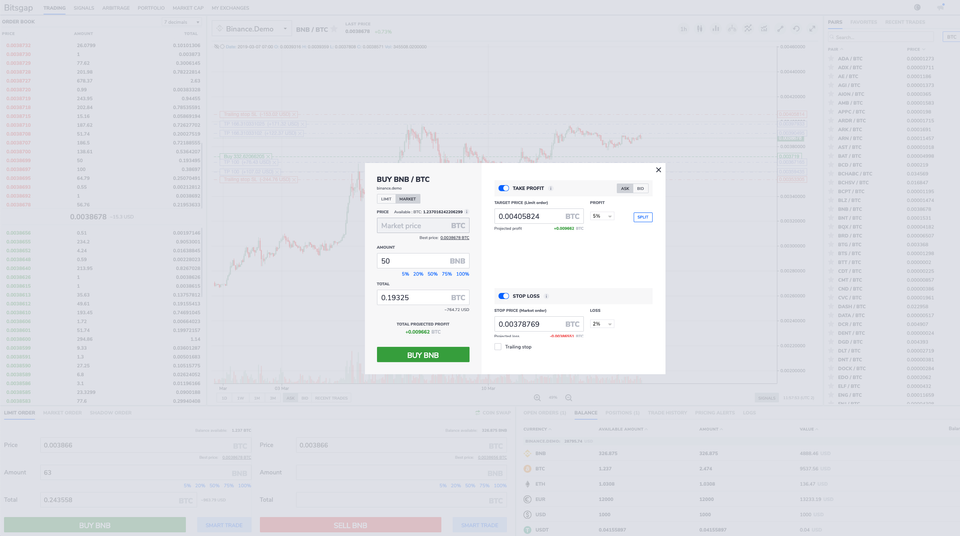

We are always looking for ways to improve our user experience with Bitsgap platform. Today we would like to release a feature highlight for recently implemented Smart Trade order. In this article, we will outline the fundamentals and will take a look at some examples of how to use this feature for your daily crypto trading effectively.

What is Smart Trade order

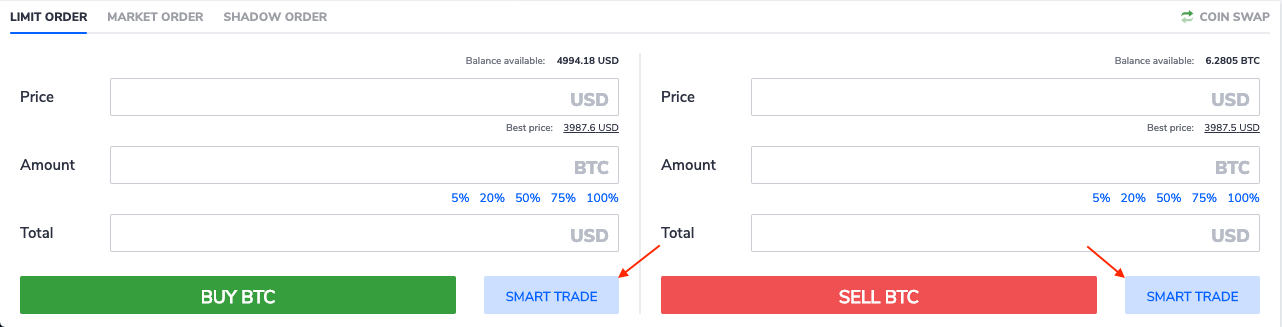

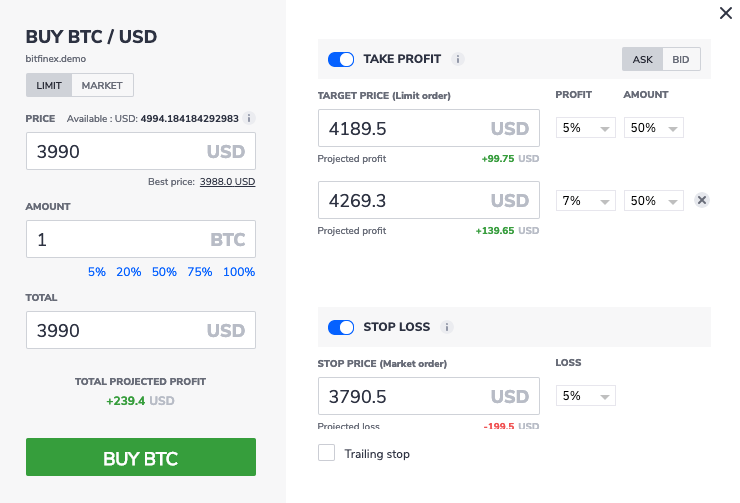

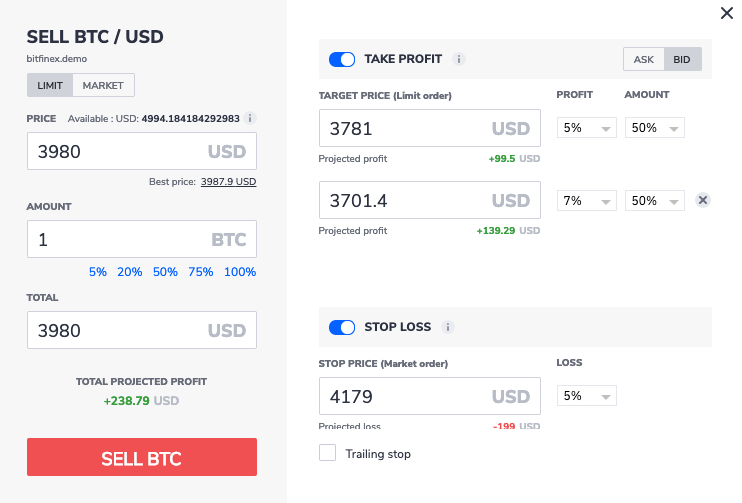

Smart Trade order is a risk management tool which allows you to set take profit and stop loss orders simultaneously. When you configure your Smart Trade order you need to decide the price to open long or short position, take profit levels, and the stop-loss price when you want to protect your funds if the price goes in the opposite direction. The configuration will be different based on whether you want to open a long position (earn on the uptrend) or short position (earn on the downtrend). This advanced order allows you to form your strategy in advance and leave the platform to execute orders for you while you are away.

Take profit: Ask or Bid

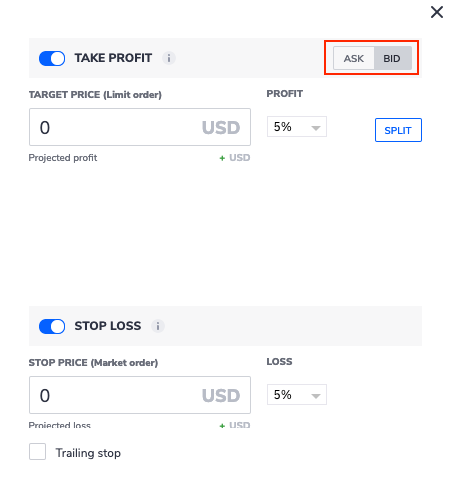

Every trader has different strategies and methods when it comes to closing a trade with profit. We allow taking profit based on the best ask or the best bid price. This is how you determine the presence in the order book, would you like to instantly sell/buy your coins when the price reaches the best bid. Or you want to enter in the order book in advance for better chances to fill your take profit order.

Please note: Regardless of the option selected we always place take profit as a limit order. Let's reveal a couple of scenarios when you want to use the best bid or the best ask as your trigger for take profit order.

Long position strategy

A long position is currency purchase with the expectation that the coin will rise in value. As a trader, you expect to earn from an uptrend movement when the price of the coin goes up.

You want to select Take Profit on Ask when your goal is to appear in the order-book earlier and secure your profit (maker). Buyers will take your deal from the book in order to move the price higher. Bid option for Take Profit you want to use if you are planning to hide your volumes and execute orders instantly when buyers ready to accept your price (taker). This option is great for high volume traders who do not want to directly influence the market order book.

Short position strategy

A short position is currency sell with the expectation that the coin will fall in the value. As a trader, you expect to earn from a downtrend movement when the price of the coin will go down.

You want to select Take Profit on Bid when your goal is to appear in order-book earlier and secure your profit from the difference of selling and repurchasing the same amount of currency back (maker). Sellers will take your deal from the book in order to move the price lower. Ask option for Take Profit you want to use if you are planning to postpone your move and hide your buyer potential. This will allow executing your order instantly as soon as sellers are ready to meet your target price (taker). This option is also great for high volume traders who do not want to directly influence the market order book. But also great for those who is ready for more risk and fill more in the volume.

We hope this highlight will help you with your daily trading. Use Smart Trade, Trade Smart!

Ready to take your trading to the next level?

Sign up for a free Bitsgap account!