Crypto Trading Terminals Breakdown

Trading got you tied up in knots? Cut the confusion and trade smarter with the top crypto trading terminals simplifying your workflow.

Crypto trading terminals are your ace in the hole for scrutinizing, analyzing, and trading cryptocurrencies with unrivaled accuracy. Set out to explore the diverse trading terminals at your disposal and choose the one for your needs.

Packed with advanced features like real-time data, technical analysis, and automated trading, crypto trading terminals give you the power to trade like a pro. They also automate trading strategies, allowing you to execute trades efficiently and avoid mistakes. This summary dives into the top-notch crypto terminals equipped with advanced features aimed to turbocharge your crypto trading and elevate your profits. Without further ado, let’s get started.

What Is a Trading Terminal?

Trading terminals are the ultimate tech-savvy applications engineered to untangle the complicated world of financial instrument trading. Born from the evolution of stock trading from physical exchanges to online platforms, these terminals have revolutionized the trading landscape. Gone are the days of phone calls and newspaper scanning; now, with just a few clicks, traders can execute orders, manage portfolios, and tap into real-time market data. Brokers typically provide these slick terminals to traders to enable effortless, efficient transactions.

Crypto trading terminals, on the other hand, are specialized platforms packed with advanced cryptocurrency trading tools. These terminals can connect to multiple crypto exchanges simultaneously via API, enabling crypto traders to implement sophisticated trading strategies. Professional crypto trading terminals outshine regular exchange trading, offering an arsenal of powerful tools, cutting-edge research data, technical analysis, intricate order types, automated trading, trailing features, and so much more.

Differences between Traditional Trading Terminals and Crypto Trading Terminals

Unlike their traditional counterparts that hinge on brokerages, cryptocurrencies operate through exchanges with notably less rigid oversight.

The rise of Decentralized Finance (DeFi) and Decentralized Exchanges (DEX) platforms adds another intriguing facet to the evolving regulatory scenario.

Furthermore, crypto markets are awake round the clock and exhibit high volatility that starkly contrasts the more steady rhythm of traditional stock markets.

Due to these unique characteristics, trading terminals function distinctly within the two markets. In the world of crypto exchanges, it's not unusual for tokens to be de-listed without warning, or for trading across an entire platform to be put on ice.

Also, let's not forget the feature differences that set these platforms apart. Both traditional and crypto trading terminals come equipped with foundational features such as real-time price data, order execution, portfolio overviews, and funding options. However, crypto trading terminals take it up a notch, adding extra layers of functionality to enhance your trading experience. They often come loaded with wallet functionality, staking, trade signals, and additional security measures.

What Types of Trading Terminals Are There?

Types of trading terminals typically vary based on factors like asset support, operating markets, tool sophistication, and target demographics:

- Stock trading terminals: Built for the stock market buzz. They deliver real-time stock quotes, charting tools, market news feeds, and research. Bloomberg Terminal, E*TRADE Pro, and Interactive Brokers' Trader Workstation are some favorites.

- Forex trading terminals: Tailored for currency trading. They serve up real-time currency quotes, technical analysis tools, and automated trading strategy support. MetaTrader 4 and MetaTrader 5 are leading forex terminals.

- Futures trading terminals: Designed for futures contract trading. They come with advanced order types, charting tools, and real-time news feeds. NinjaTrader is a go-to choice for futures trading.

- Crypto trading terminals: These terminals are your gateway to cryptocurrency trading. They usually support multiple exchanges, provide portfolio tracking, and sometimes even algorithmic trading strategies. Coinigy, Bitsgap, 3Commas, and Quadency are among the popular ones.

- Multi-asset trading terminals: Your one-stop shop for trading multiple asset classes, including stocks, bonds, futures, forex, and sometimes even cryptocurrencies. The Bloomberg Terminal is a leading multi-asset trading terminal.

- Algorithmic trading terminals: Built for automated trading strategy enthusiasts. They typically support backtesting, strategy optimization, and real-time execution. MetaTrader, Bitsgap, NinjaTrader, and TradeStation are top picks.

- Institutional trading terminals: The professional trader's weapon of choice, offering advanced features, extensive market data, and high-speed execution. The Bloomberg Terminal and Interactive Brokers' Trader Workstation are commonly used.

- Retail trading terminals: These user-friendly terminals are perfect for individual investors, offering various analysis, research, and portfolio management tools. Thinkorswim and E*TRADE Pro are popular choices.

It’s worth noting that no two trading terminals are the same. Each has its unique strengths and weaknesses. The best one for you depends on your unique needs and trading style.

What Are the Best Crypto Trading Terminals?

As previously discussed, crypto trading terminals empower traders to manage positions across multiple exchanges from one dynamic interface, offering advanced charting tools, portfolio tracking, and even algorithmic trading strategies. Below are some top-notch picks:

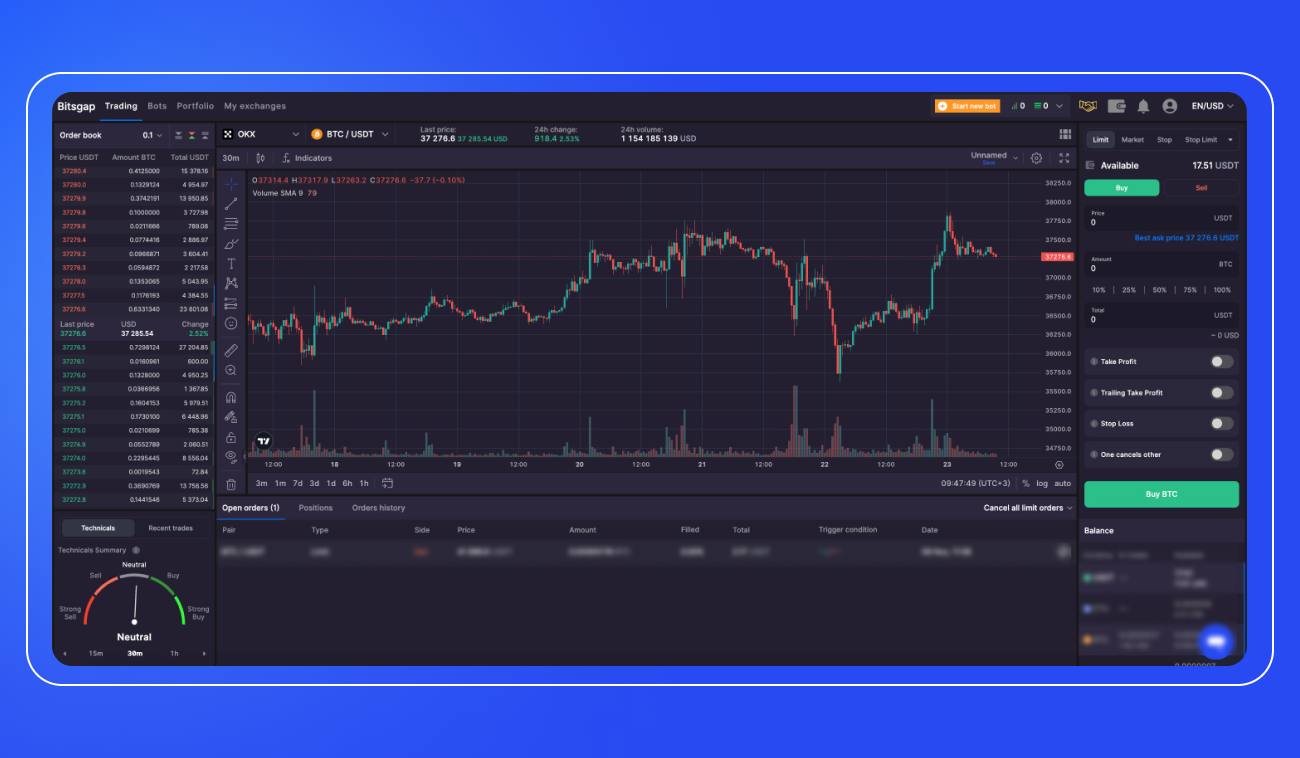

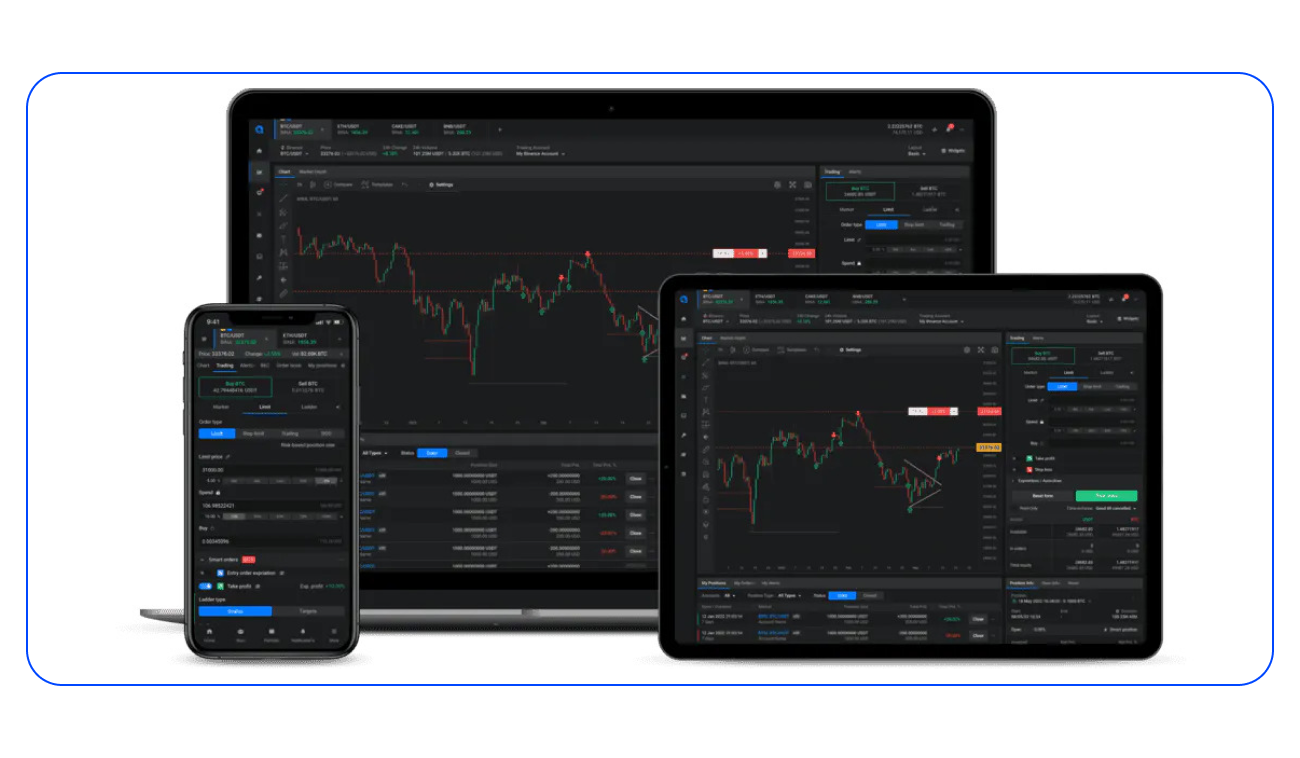

Bitsgap

A frontrunner in cryptocurrency aggregators and advanced trading platforms, Bitsgap connects to as many as 17 exchanges, including Binance Futures. Its advanced suite of cutting-edge tools caters to both manual and automated trading needs. It includes smart trading instruments with advanced order types like TWAP and Scaled, trailing and hedging features, and algorithmic bots like GRID, DCA, Buy the Dip, COMBO futures, and DCA Futures.

By subscribing to Bitsgap today, you'll unlock a 7-day free trial. So, why wait? Jump in, hit subscribe, and dive into an exciting new trading experience yourself!

Coinigy

This platform gives you access to trade on over 46 top crypto exchanges, all from one secure account - that's huge! You get 75+ technical indicators, price/volume alerts, and more. However, some surprisingly basic order types are missing, like trailing stops or take-profit/stop-loss orders. There's no trade automation either, which is a drawback. On the plus side, you get cool features like arbitrage visualization, events calendar, and abundant trading signals. So while the lacking order types and automation are head-scratchers, the massive exchange access and alerts make this a solid choice for many crypto traders.

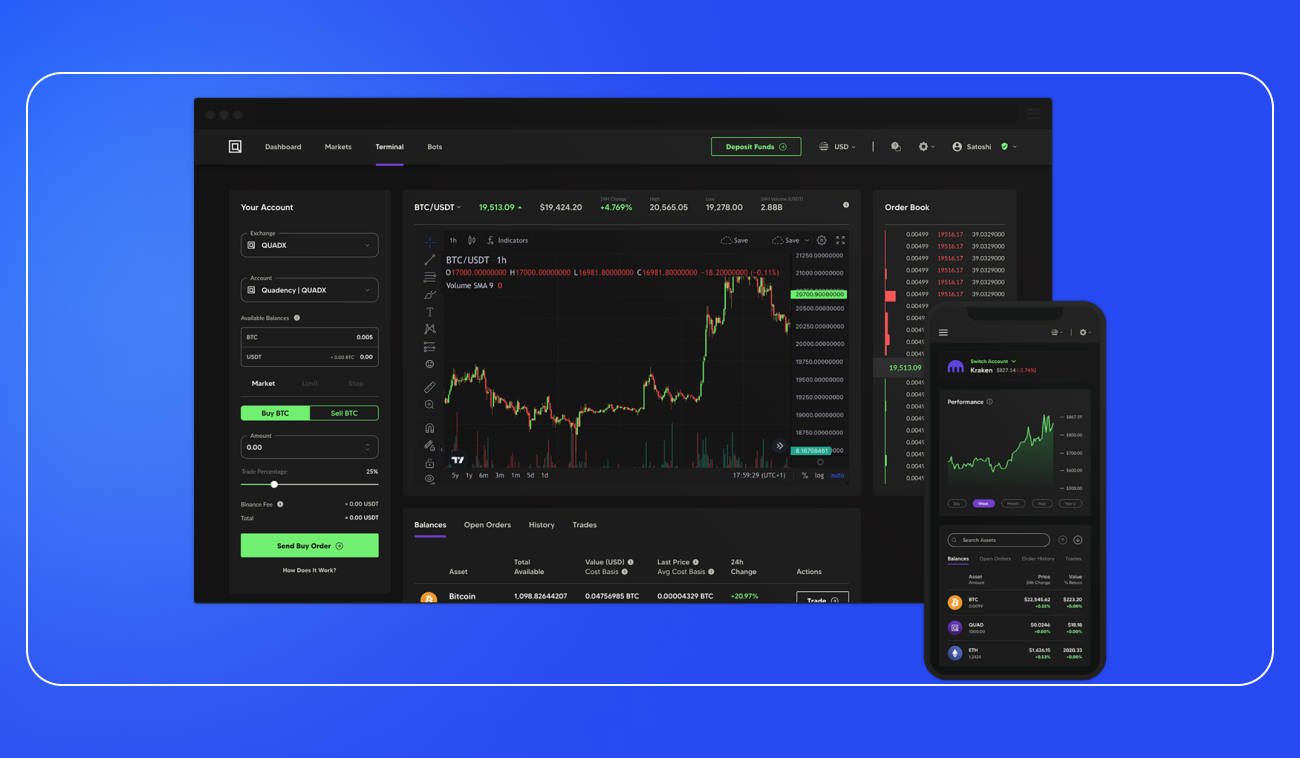

Quadency

This crypto trading terminal provides unified access to 7+ top crypto exchanges, portfolio tracking, and automated trading bots — key features like visualization and automation make Quadency stand out. It packs robust tools like an integrated screener, high-quality streaming data, and advanced charting for powerful crypto analysis. The intuitive interface enables easy order management via market, limit and stop orders. With 10 pre-built strategies, backtesting options, and an AI assistant for custom bots, Quadency offers sophisticated trading capabilities to execute strategies fast and boost profits.

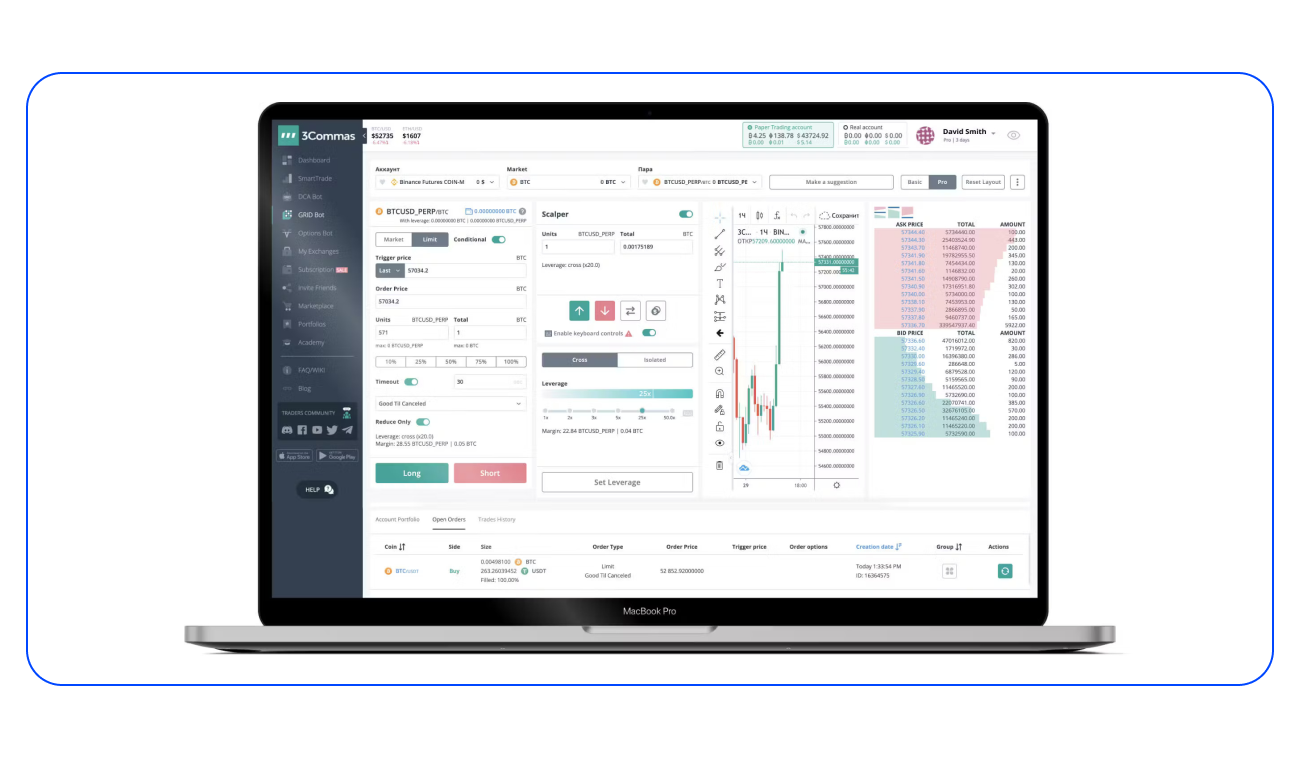

3Commas

Though 3Commas boasts an impressive suite of features like automated bots, portfolio tracking, and multi-exchange support, the platform has faced two concerning security exploits in the past year. Unfortunately, 3Commas' response to these incidents has been less than transparent, making it difficult to fully assess the risks and recommend the platform with complete confidence. While 3Commas offers versatility, its security track record gives pause. Until thorough investigations occur and robust measures are implemented to prevent future exploits, traders may want to exercise caution in using this platform.

Altrady

Altrady is another popular crypto trading terminal that offers powerful tools for portfolio management, market analysis, and scanning to identify profitable coins. It's compatible with 17 top crypto platforms, giving you a robust suite of features, including smart order execution, crypto scanner, watchlists and alerts, in-depth trading analytics, and various bots like signal, DCA, GRID, QFL. However, the Altrady "one-size-fits-all" approach attempts to be a universal terminal when many traders need specialized software tailored to their strategies. For discretionary day traders making many quick transactions, Altrady's functionality has limitations. But for those with medium-term horizons or reliance on systems, Altrady provides a robust toolkit.

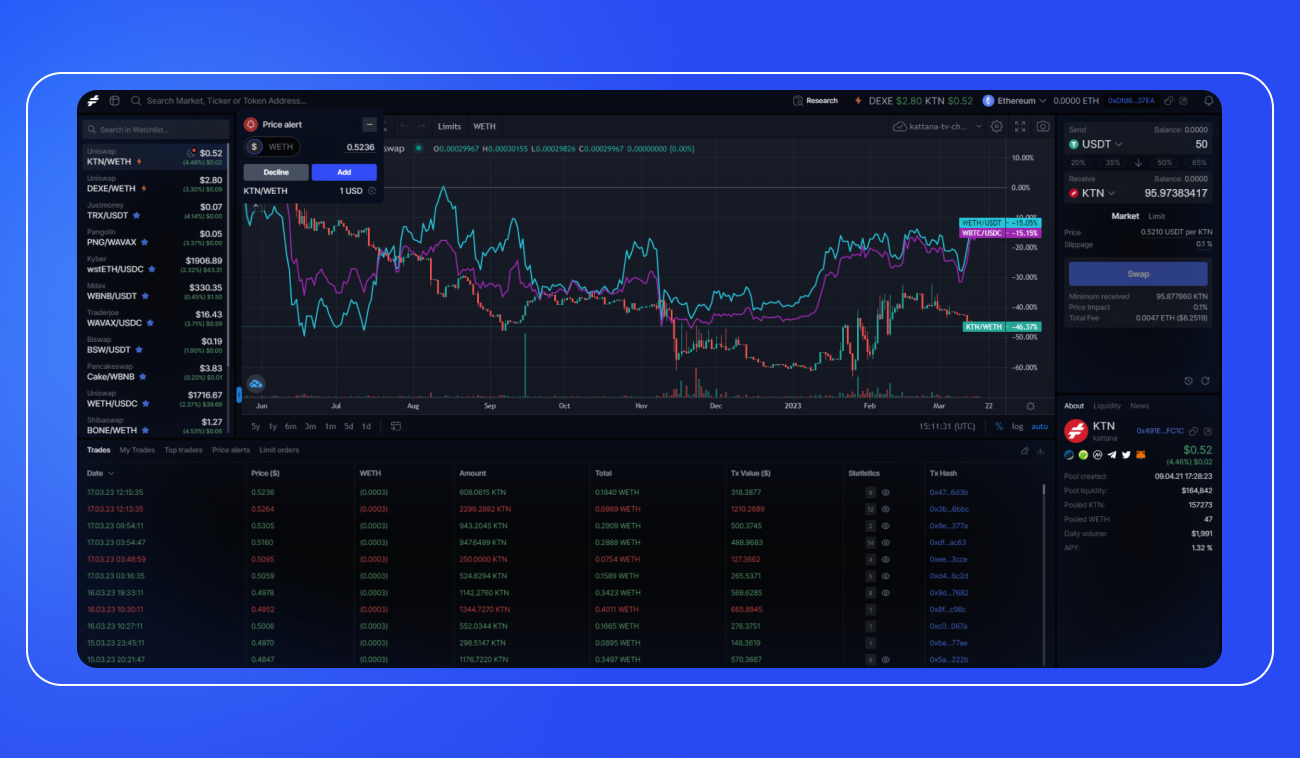

Kattana

Kattana aspires to be the Bloomberg Terminal for decentralized finance (DeFi) - a one-stop hub for DeFi trading tools. It offers charts, 40+ exchange connections, limit orders, news and more. Basic access is free, including trading on 2 charts and limited wallet analysis. But the KTN token unlocks premium features. KTN is an Ethereum-based ERC-20 with fixed supply. It's required to access Kattana's full suite of trading services. As a terminal tailored for traders, demand for KTN will likely grow as crypto markets expand. Kattana grants free access to core functions, while incentivizing KTN holders with advanced features.

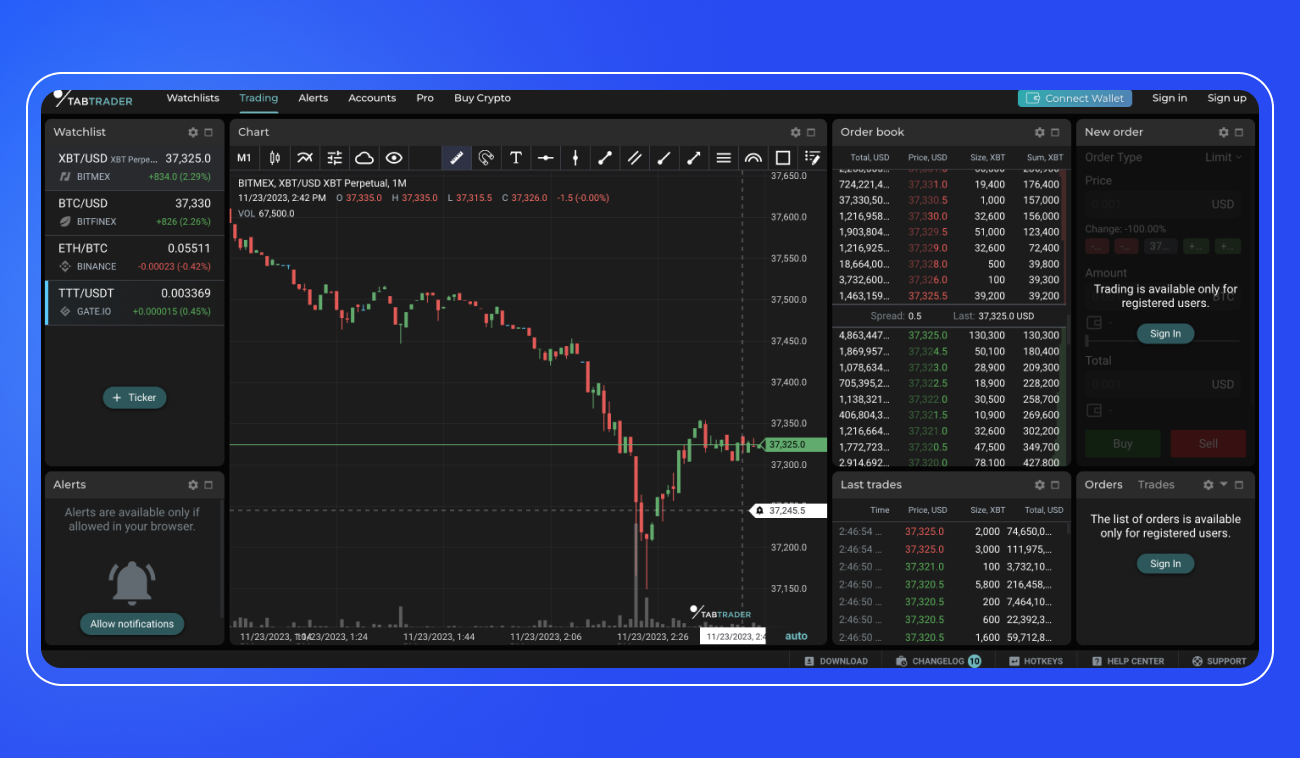

TabTrader

TabTrader is a mobile-first trading terminal with web access supporting 20+ major crypto exchanges. It provides alerts for price movements and market events. TabTrader also includes a non-custodial wallet for easy access to DeFi and decentralized trading. The native TTT token enables purchases in-app and yield farming on DEXs like Orca and Raydium. In the future, TTT may allow governance participation and staking rewards. With exchange connectivity, wallet integration, notifications, and TTT utility, TabTrader aims to be a convenient one-stop app for crypto trading and DeFi engagement on the go.

Bottom Line

Trading terminals, the superheroes of the trading world, have revolutionized the lives of brokers, traders, and investors alike. The future? It's looking brighter than ever! We anticipate an influx of even more potent yet user-friendly terminals, opening the gates of online trading to an ever-growing audience.

Many of the crypto trading terminals we've explored integrate flawlessly with TradingView, a platform celebrated for its advanced charting features and wide-ranging support for cryptocurrencies and exchanges. It's home to a dynamic community of traders sharing ideas and strategies, the perfect playground for the social trader in you.

Do remember, the availability of these platforms can vary by region, and most require a subscription or usage fees.

Here's to happy, successful trading!

FAQs

What Is a Trader Terminal?

Trading platforms, also referred to as trader terminals, are essential software programs for active market participants. These applications enable traders to efficiently execute and manage financial transactions across various asset classes like equities, forex, derivatives, and cryptocurrencies. Robust trader terminals provide users with vital tools to analyze market conditions, identify trading opportunities, execute orders, track positions, and manage risks.

What Is the Best Trade Terminal?

Bitsgap is hands-down the best trading terminal. When it comes to crypto trading, Bitsgap has it all — a vast array of smart trading and automated options, connections to 17 top centralized exchanges, and more. For DeFi, Kattana and TabTrader are the names to remember.