Bitsgap vs. Tiger Brokers: A Comprehensive Comparison for Traders

In this article, we dive deep into a comprehensive comparison between Bitsgap and Tiger.com, two popular trading platforms. Whether you're focused on cryptocurrency automation or multi-asset trading, we break down the latest features to help you make an informed decision.

Welcome to another installment in our Bitsgap Comparison series, where we explore how Bitsgap stacks up against other trading platforms with automation capabilities. In this article, we compare Bitsgap with Tiger Brokers, a versatile trading platform known for its access to global financial markets, including cryptocurrencies. Our goal is to provide a balanced overview of both platforms’ features while highlighting why Bitsgap may offer superior solutions for traders focused on cryptocurrency automation. Ultimately, traders should evaluate these platforms based on their specific needs and preferences.

Key Platform Features: Bitsgap vs. Tiger Brokers

Bitsgap Overview

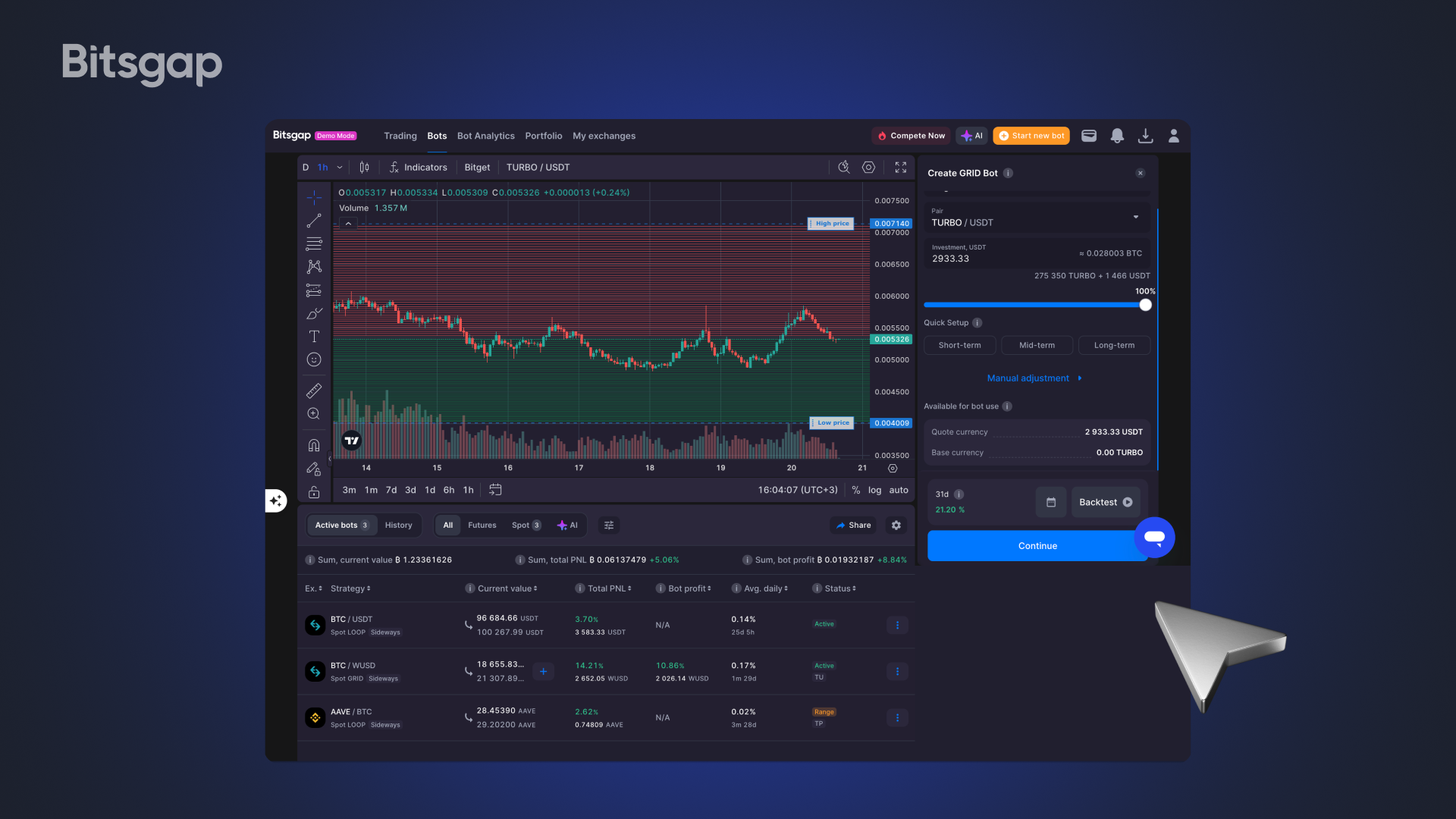

Bitsgap is a dedicated cryptocurrency trading platform designed to simplify and enhance trading across multiple exchanges. It offers a suite of tools, including algorithmic bots, AI-powered trading assistant, a manual trading terminal, and portfolio management. Key features include:

- Trading Bots: GRID, DCA (Dollar-Cost Averaging) bots, and more for automated trading.

- Algorithmic Strategies: Highly customizable strategies with backtesting and optimization.

- Spot and Futures Trading: Support for both spot and futures markets via integrated exchanges.

- Unique Features: AI Assistant for bot recommendations, portfolio tracking, and multi-exchange integration.

Tiger Brokers Overview

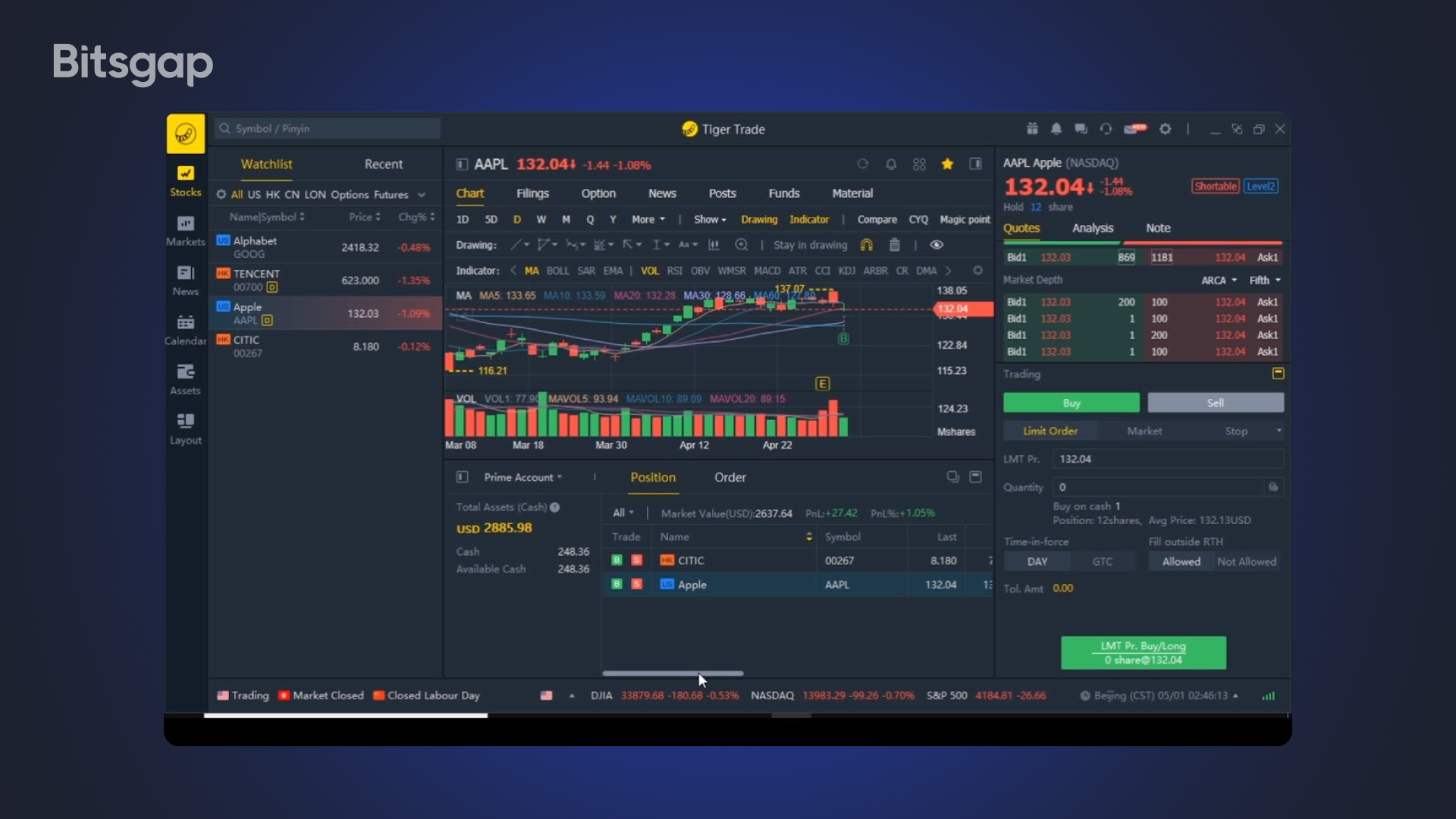

Tiger Brokers is a global online broker providing access to a wide range of financial instruments, including stocks, options, futures, and cryptocurrencies. Its flagship platform, Tiger Trade, is known for its user-friendly interface and analytical tools. Key features include:

- Trading Bots: Limited to third-party integrations like “Tiger Bot” on platforms like Jet-Bot for copy trading.

- Algorithmic Strategies: Supports algorithmic order types via its Open API but lacks built-in trading bots.

- Arbitrage: Not a primary focus, though possible through exchange integrations.

- Spot and Futures Trading: Available for stocks, options, futures, and cryptocurrencies.

- Unique Features: Auto-invest for scheduled investments, TigerAI for market insights, and a community forum for trader discussions.

In the following sections, we’ll dive deeper into these features, comparing automation, exchange support, usability, security, and pricing.

Automated Trading: Bitsgap vs. Tiger Brokers

Bitsgap’s Automation Capabilities

Bitsgap is a leader in automated cryptocurrency trading, offering a variety of trading bots that cater to different strategies:

- GRID Bots: Place buy and sell orders within a price range to profit from market volatility.

- DCA Bots: Automate dollar-cost averaging to reduce risk in fluctuating markets.

- BTD Bot (Buy the Dip): Take advantage of temporary market downturns by automatically executing buy orders when prices fall below certain thresholds.

- LOOP Bot: Trade within a fixed price corridor, earn in two currencies simultaneously, and reinvest profits.

- DCA Futures Bot: Use DCA strategy in the futures market.

- COMBO Bot: A combination of the Grid and DCA bots, providing a hybrid trading strategy.

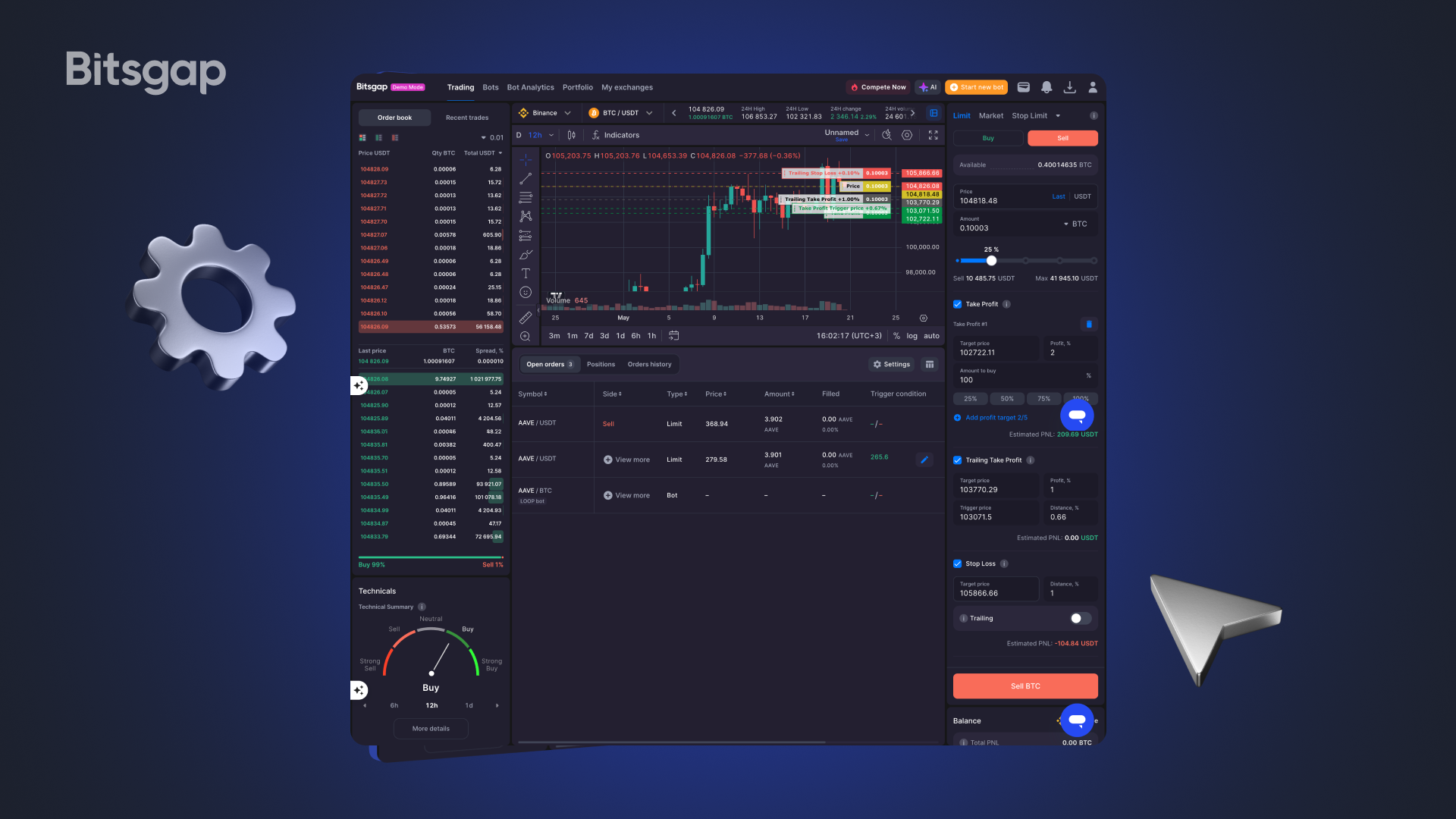

- Customizable Strategies: Traders can adjust parameters like entry/exit points, stop-loss, and take-profit levels.

- Backtesting and Optimization: Test strategies against historical data to refine performance.

- Risk Management: Built-in tools like stop-loss and trailing stop help protect capital.

Bitsgap’s bots are highly effective, with user reviews reporting up to 34% profit in some cases (Bitsgap Review). The platform’s AI Assistant also provides tailored bot recommendations based on investment size and risk tolerance, making it accessible for beginners and powerful for experienced traders.

Tiger Brokers' Automation Capabilities

Tiger Broker’s automation features are less robust for dynamic trading. Its primary automation tool is:

- Auto-invest: Allows users to schedule regular investments in stocks or ETFs, starting at USD 2. This is ideal for dollar-cost averaging but not for active trading strategies.

- TigerAI: An AI-powered assistant that provides 24/7 market insights and analysis but does not execute trades automatically.

- Third-Party Bots: Tiger Broker integrates with platforms like Jet-Bot, where users can access “Tiger Bot” for copy trading. However, this is not a native feature of the Tiger Trade platform.

- Open API: Supports algorithmic order types for quantitative traders, but requires programming knowledge and is not as user-friendly as Bitsgap’s out-of-the-box bots.

Tiger Brokers lacks the flexibility and depth of Bitsgap’s trading bots, making it less suitable for traders seeking automated crypto strategies. Its automation is better suited for long-term, passive investing.

Effectiveness and Risk Management

Bitsgap’s trading bots are designed for efficiency and flexibility, supporting both bullish and bearish markets. The platform’s backtesting feature allows traders to assess bot performance, reducing the risk of untested strategies. Built-in risk management tools, such as stop-loss and trailing stop, further enhance safety.

Tiger Brokers’ Auto-invest feature is low-risk for long-term investors but lacks the dynamic risk management needed for active trading. Its Open API allows custom risk management for advanced users, but this requires technical expertise. Overall, Bitsgap offers superior automation and risk management for crypto traders.

Exchange Support: Bitsgap vs. Tiger Brokers

Bitsgap Exchange Support

Bitsgap supports over 15 major cryptocurrency exchanges, including Binance, Coinbase, Kraken, Huobi, and more. This extensive support allows traders to:

- Manage portfolios across multiple exchanges in one interface.

- Execute arbitrage strategies by leveraging price differences.

- Benefit from high-quality API integrations for fast order execution and deep liquidity.

The platform’s seamless integration ensures minimal latency and reliable order handling, making it ideal for high-frequency trading and arbitrage.

Tiger Brokers Exchange Support

Tiger Brokers integrates with major cryptocurrency exchanges like Binance, OKX, and Bybit. Key points include:

- Segregated Accounts: User funds are stored in separate sub-accounts on these exchanges for security.

- Order Execution: Leverages the liquidity and speed of these exchanges, though specific details on API quality are limited.

- Asset Support: Offers a range of cryptocurrencies, but the focus is broader, including stocks and futures.

Tiger Brokers’ exchange support is robust for a multi-asset broker but narrower than Bitsgap’s crypto-specific focus. Its integration with fewer exchanges may limit arbitrage opportunities compared to Bitsgap.

👉 Bitsgap’s broader exchange support and crypto-specific focus give it an edge for traders prioritizing cryptocurrency trading and arbitrage.

Terminal Interface and Usability: Bitsgap vs. Tiger Brokers

Bitsgap Interface

Bitsgap’s interface is tailored for cryptocurrency trading, offering:

- Manual Trading Terminal: Features advanced charting with over 100 indicators, smart orders (stop-limit, shadow orders), and real-time market data

- Portfolio Management: A unified dashboard to track performance across exchanges.

- Usability: Intuitive design suitable for beginners, with advanced tools for experienced traders.

- Mobile Solution: A mobile app ensures fast operation and device compatibility.

The platform’s clean layout and multi-exchange integration make it easy to navigate, even for those new to crypto trading.

Tiger Brokers Interface

The Tiger Trade app is praised for its user-friendly design and comprehensive features:

- Smart Order Functionality: Supports market, limit, stop, stop-limit, and trigger orders, with advanced charting tools.

- Design: Clean, with real-time quotes, trading history, and financial news streams.

- Suitability: Accessible for beginners, with educational resources and a community forum; advanced enough for professionals with API integration.

- Mobile Solution: Available on iOS, Android, and desktop, with optimized performance for foldable screens and tablets.

Tiger Brokers’ interface is versatile, catering to a wide range of assets, which may add complexity for crypto-only traders.

👉 Both platforms are user-friendly, but Bitsgap’s crypto-focused interface is more streamlined for cryptocurrency traders, while Tiger Trade’s broader scope suits diversified portfolios. Bitsgap’s mobile app is crypto-centric, while Tiger Brokers’ app excels in multi-asset trading.

Security and Data Protection: Bitsgap vs. Tiger Btokers

Bitsgap Security

Bitsgap prioritizes user security with:

- Encryption: 256-bit SSL encryption for data protection.

- Two-Factor Authentication (2FA): Standard on all accounts.

- No Major Breaches: No reported hacks, enhancing trust.

- Risk Prevention: Secure API connections to exchanges ensure safe fund management.

Tiger Brokers Security

Tiger Brokers, as a regulated broker, adheres to stringent security standards:

- Regulatory Compliance: Licensed in Singapore, the US, and other regions, with segregated custodian accounts.

- Certifications: ISO27001 and ISO27701 for information security and privacy.

- 2FA: Standard for all accounts.

- No Major Breaches: No significant security incidents reported.

- Risk Prevention: Regular internal and external audits ensure asset safety.

👉 Both platforms offer robust security, but Tiger Brokers' regulatory oversight and certifications may provide additional reassurance for traders handling multiple asset types. Bitsgap’s crypto-specific security measures are equally reliable for its target audience.

Prices and Tariff Plans: Bitsgap vs. Tiger Brokers

Bitsgap Pricing

Bitsgap operates on a subscription model:

- Free Features: Basic manual trading and portfolio tracking.

- Paid Plans: Access to trading bots, arbitrage tools, and advanced features, with plans typically ranging from $20-$150/month (as of 2025).

- Trial Periods: Offers free trials to test premium features.

- Value: Competitive for automation-focused traders, with costs justified by bot performance.

Tiger Brokers Pricing

Tiger Brokers offers a transparent fee structure:

- Commission-Free Trading: Available for some ETFs and funds.

- Crypto Trading Fees: Vary by exchange (e.g., Binance, OKX), with up to 35% commission reductions for high-volume traders.

- Auto-invest Fees: 1% of trading value (max USD 1) for fractional shares.

- Promotions: Referral programs and cashback rewards reduce costs.

- Value: Competitive for manual traders, especially for multi-asset portfolios.

👉 Bitsgap’s subscription model is ideal for automation enthusiasts, while Tiger Brokers’ low fees appeal to manual traders across multiple markets.

Conclusions and Recommendations

Bitsgap and Tiger Brokers cater to different trading needs. Bitsgap excels in automated cryptocurrency trading, with its advanced trading bots, multi-exchange support, and arbitrage tools, making it the go-to choice for crypto traders seeking efficiency and automation. Its user-friendly interface and robust security measures further enhance its appeal.

Tiger Brokers, through its Tiger Trade app, offers a versatile platform for trading stocks, options, futures, and cryptocurrencies. Its competitive fees, regulatory compliance, and features like Auto-invest and TigerAI make it suitable for diversified investors. However, its lack of built-in trading bots limits its appeal for automated crypto trading.

For traders focused on tiger crypto and automation, Bitsgap is the superior choice due to its comprehensive tools and crypto-specific focus. For those seeking a broader investment platform with access to global markets, Tiger Brokers’ tiger trading capabilities and user-friendly design are compelling. As noted in a tiger trade review, Tiger Brokers' platform is intuitive but lacks the automation depth of competitors like Bitsgap.

Ultimately, your choice depends on whether you prioritize crypto automation (Bitsgap) or multi-asset flexibility (Tiger Brokers). Evaluate your trading goals and asset preferences to make an informed decision.

Why don’t you check it out for yourself and test Bitsgap today? Sign up for a 7-day free trial on the Pro plan or trade in Demo!