Bitsgap vs Quadency Bot Review: Feature Comparison

In this head-to-head comparison, we dive into the core features, strengths, and differences between Bitsgap and Quadency (Quad Terminal). From automation to AI, see which platform delivers the tools and experience modern crypto traders need most.

Welcome to another installment of our Bitsgap Comparisons series, where we put Bitsgap side-by-side with other major players in the automated trading space. Our goal? To break down the differences in capabilities, strategies, and real-world benefits so traders can make informed decisions that best suit their goals.

While we firmly believe Bitsgap stacks up as the stronger choice for most users—thanks to its powerful automation tools, wide exchange integrations, and user-friendly interface—we’re not here to tell you what to pick. We’re here to show you the facts, the features, and how each platform approaches the challenges of modern crypto trading.

In this installment, we’re diving into a comparison between Bitsgap and Quadency, exploring how each platform handles automated trading, portfolio management, and user experience.

Main Platform Capabilities

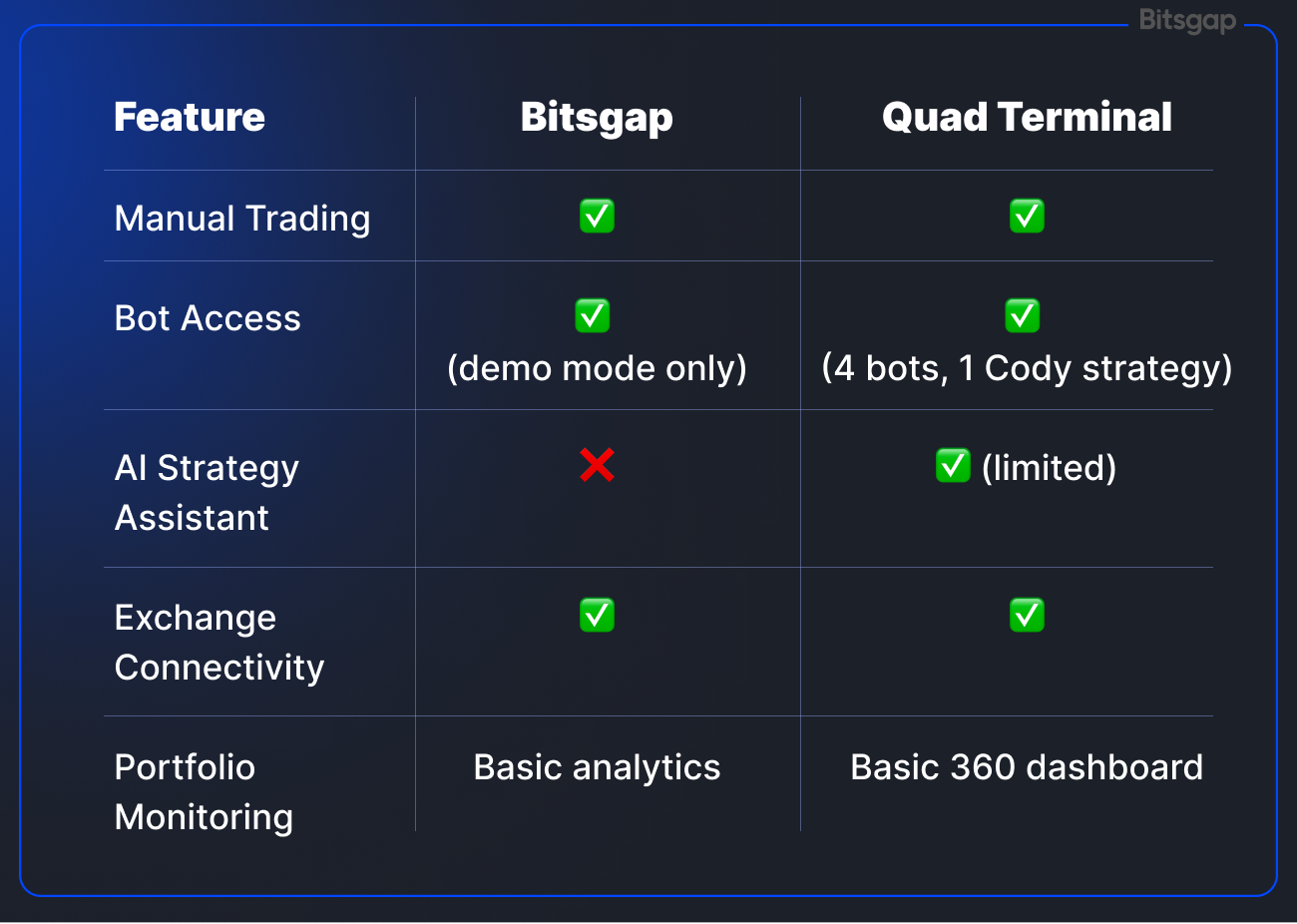

In this section, we’ll take a high-level look at the core functionalities offered by Bitsgap and Quadency—two robust platforms designed for crypto traders who are serious about automation, portfolio management, and maximizing opportunity across exchanges. While we'll explore each feature set in greater detail in later sections, this overview sets the stage for how these platforms approach trading and what tools they put in your hands.

Core Features Overview

Bitsgap is known for its streamlined all-in-one platform that includes advanced automated trading bots, smart algorithmic orders, comprehensive portfolio tracking, and a professional-grade trading terminal. With seamless integration across 15+ leading exchanges and a powerful AI Assistant that curates optimized bot portfolios, Bitsgap is built for both beginners and seasoned traders aiming for precision and performance.

Quadency, rebranded under the Quad Terminal, also positions itself as an all-in-one crypto trading platform, offering multi-exchange connectivity, an impressive suite of automated bots, and its standout feature—Cody, the AI Strategy Assistant. Cody allows users to build strategies using natural language, translating ideas into executable Python-based bots. Quadency also offers portfolio analytics, market overviews, and discounts through its native QUAD token ecosystem.

Key Tools Compared at a Glance

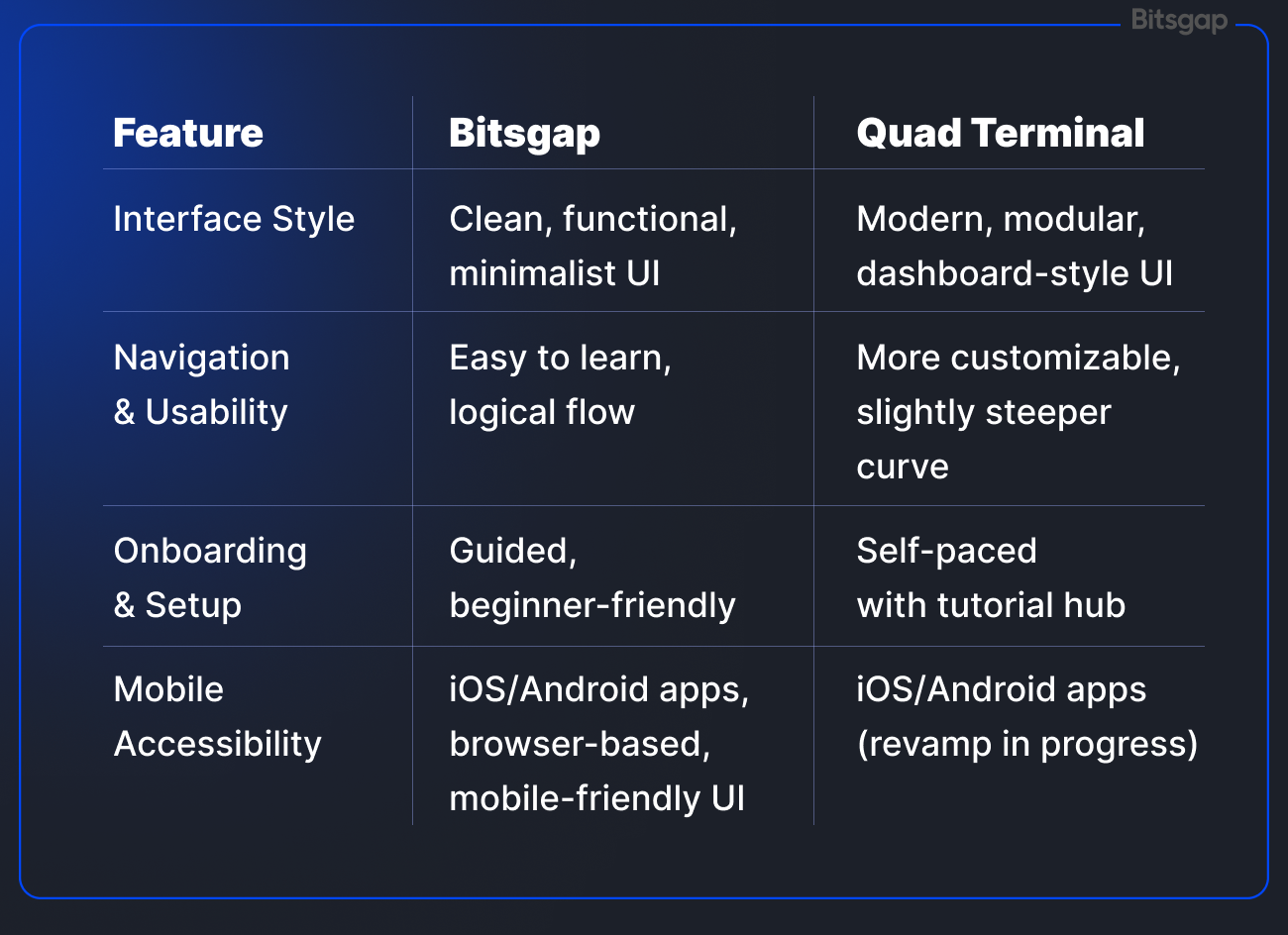

Fig. 1. Comparison of both platforms at a glance.

Ultimately, both platforms aim to simplify and supercharge your trading—Bitsgap through its intuitive AI-powered automation, and Quadency with its blend of AI assistance and customizable scripting flexibility. The difference lies in how each platform delivers these capabilities, and how they balance simplicity, depth, and user empowerment.

In the next sections, we’ll take a deeper dive into each of these categories to see how Bitsgap and Quadency stack up when it comes to bots, smart order systems, portfolio features, and more. Stay tuned.

Automated Trading: Bitsgap vs Quadency Review

Automated trading lies at the heart of both Bitsgap and Quadency, empowering traders to execute strategies around the clock without emotional bias or manual intervention. While both platforms offer a wide array of bot options and customization features, they differ significantly in how they approach automation, risk management, and strategy flexibility.

How Automated Trading Is Implemented

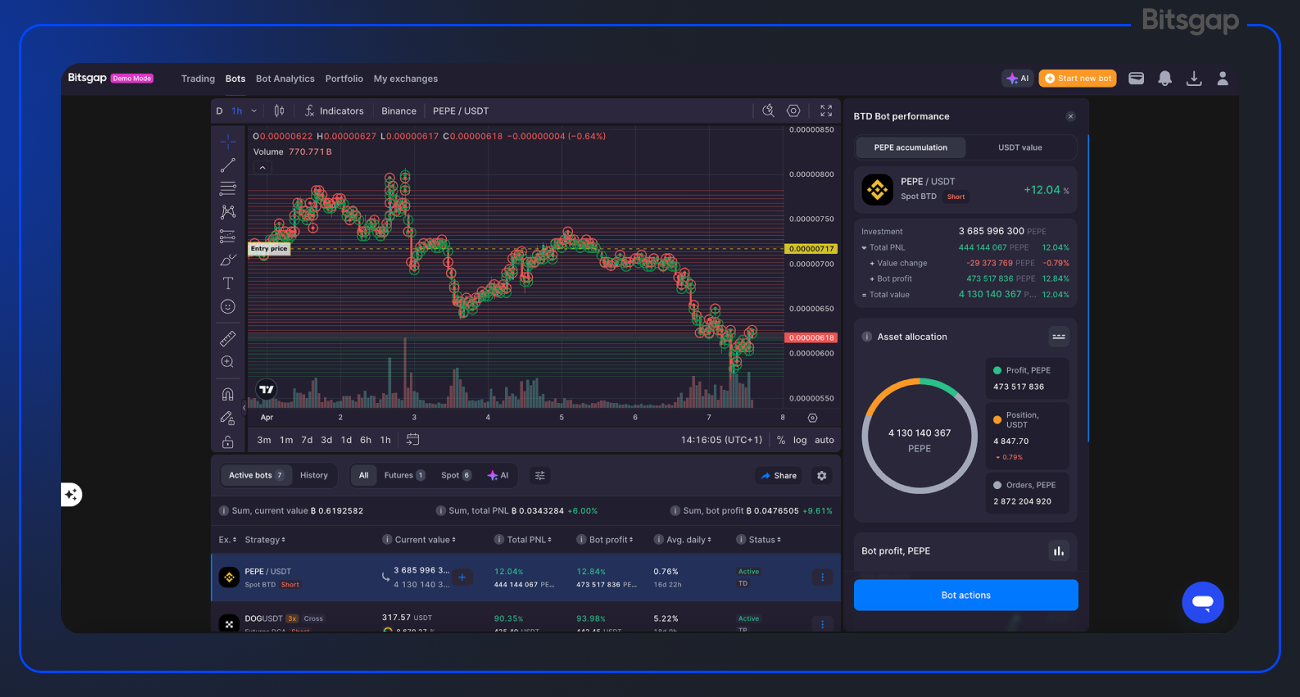

Bitsgap offers a plug-and-play experience where users can deploy powerful trading bots in just a few clicks—backed by AI optimization and pre-tested strategies. Each bot operates with clearly defined roles, and Bitsgap supports both spot and futures trading across 15+ exchanges. Bots are accessible via a unified terminal with rich analytics, making management intuitive and centralized.

Quadency, under its new Quad Terminal branding, delivers a well-rounded suite of automated trading bots designed for every type of crypto trader—from passive investors to hands-on quant strategists. With a blend of pre-built strategies, technical indicator bots, portfolio automation, and full AI-powered customization, Quadency gives users considerable control over how they engage with the market.

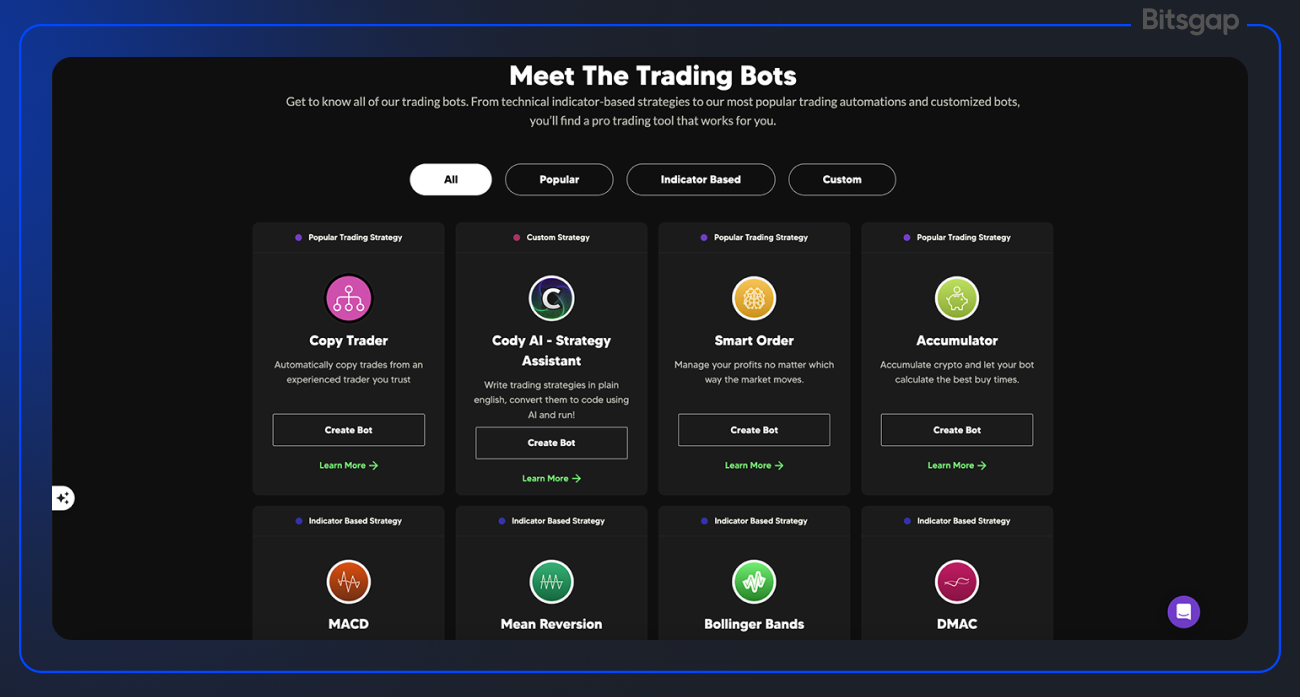

Available Bots

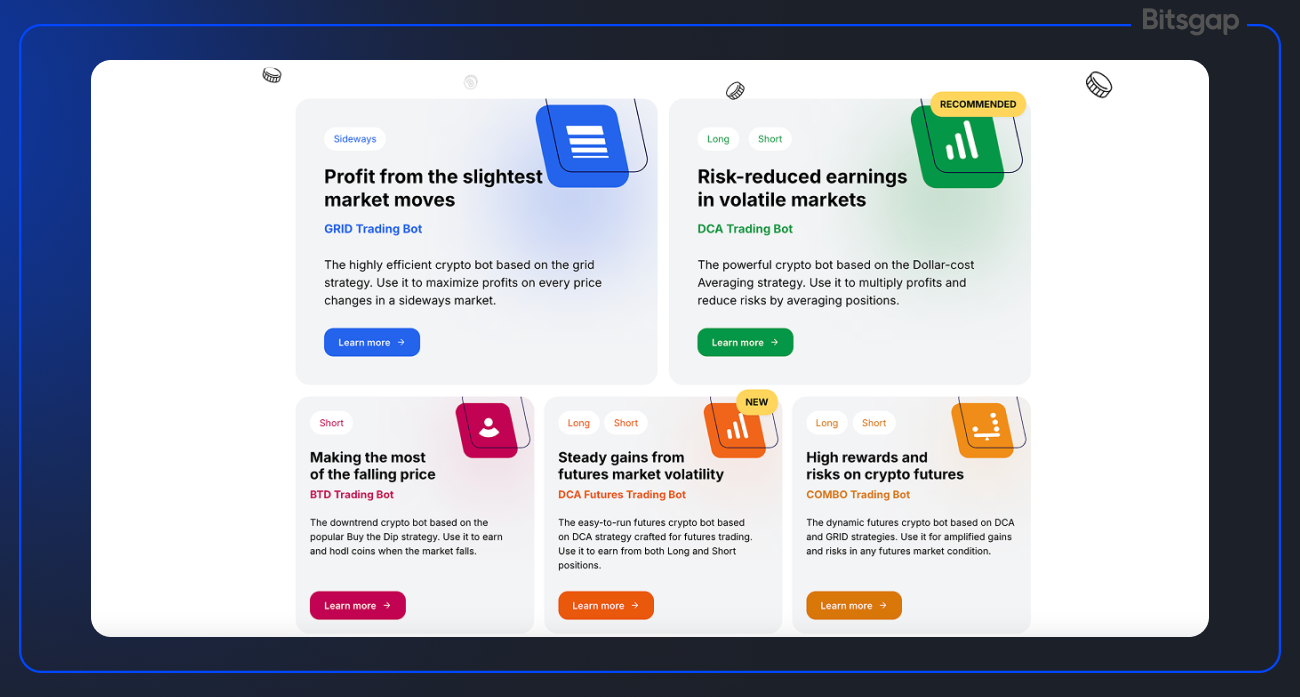

Bitsgap’s Trading Bot Suite Includes:

- GRID Bot – Earn from sideways price action with pump/dump protection

- DCA Bot – Averaging strategy for low-risk entries in volatile markets

- BTD Bot – “Buy the Dip” logic to catch sudden drops

- COMBO Bot – Dual DCA & GRID hybrid for leveraged futures trading

- DCA Futures Bot – Optimized for leveraged futures markets, featuring SL/TP & backtesting

- LOOP Bot – Reinvest profits automatically for compounding growth across base/quote assets

Quadency’s Available Bots Include:

- DCA, Grid, Accumulator, Market Maker bots for standard automation

- Smart Orders Bot for executing advanced multi-leg trades

- Custom AI Bots via Cody that can combine technical indicators, risk rules, and market triggers into complex strategies

- Manual strategy builder for Python-literate users seeking to code their own execution logic

Flexibility & Strategy Customization

Bitsgap provides hundreds of ready-to-use strategies along with the ability to fully customize every bot parameter. Even beginners can quickly configure bot behavior via dropdowns and sliders, while pros can tweak granular settings like order levels, SL/TP thresholds, and DCA multipliers. The AI Assistant can auto-generate portfolio strategies based on your risk appetite.

In contrast, Quadency’s Cody enables deep customization for coders and data-driven traders. It allows users to turn natural language inputs into detailed execution scripts—ideal for those who want full control and transparency of logic. However, it does have a steeper learning curve for non-programmers.

Market Adaptability

Bitsgap bots are designed to adapt to varying market conditions, with dedicated bots for ranging (GRID), trending (DCA), and falling (BTD) environments. Features like trailing orders, pump/dump protection, and price range recalibration ensure bots remain productive even during volatility spikes.

Quadency also offers dynamic strategy behavior via Cody, where you can define market triggers, indicator-based entries, and conditional exits. However, effectiveness largely depends on user-defined parameters and coding proficiency.

Risk Management Features

Both platforms prioritize risk control, but in different ways:

- Bitsgap incorporates robust features like Stop Loss, Take Profit, Trailing Up/Down, Max Drawdown, and real-time PnL tracking across all bots. Futures bots support up to 10x leverage, with built-in SL/TP layers to manage exposure.

- Quadency provides powerful scripting options where users can define detailed risk logic, including capital exposure limits, time-based exits, and multi-indicator confirmations. That said, much of this functionality relies on Cody or manual scripting, making it more advanced-user oriented.

👉 Verdict: Bitsgap simplifies powerful automation with intuitive tools and proven strategies out of the box—ideal for traders who want fast deployment with deep control. Quadency offers more open-ended customization, appealing to technically proficient users who prefer to build and fine-tune everything from scratch.

Exchange support: Bitsgap vs Quad Terminal

Exchange integration is one of the most critical aspects of any crypto trading platform—impacting everything from order execution speed to strategy flexibility and asset coverage. Both Bitsgap and Quad Terminal offer multi-exchange functionality, but their approach, reach, and technical depth differ.

Bitsgap currently supports over 15 major crypto exchanges, making it one of the most broadly integrated platforms in the industry. These include:

- Binance & Binance US

- Bitfinex

- Bitget

- Bybit

- BitMart

- Coinbase

- Crypto.com

- Gate.io

- Gemini

- HitBTC

- HTX (Huobi)

- Kraken

- KuCoin

- OKX

- Poloniex

- WhiteBIT

Quad Terminal also supports a range of top-tier exchanges including:

- Binance

- Coinbase

- KuCoin

- Kraken

- Bitfinex

- Huobi

- Bittrex

- OKX

- Poloniex

- Gemini

- CEX.IO

- HitBTC

- Bybit

- AAX

This gives Quad Terminal users access to thousands of trading pairs and full market visibility, though its list appears slightly more curated and not quite as extensive as Bitsgap’s full lineup.

API Integration & Order Execution

Both platforms rely on secure API key integrations, allowing traders to connect their exchange accounts without exposing withdrawal rights—ensuring safety and compliance.

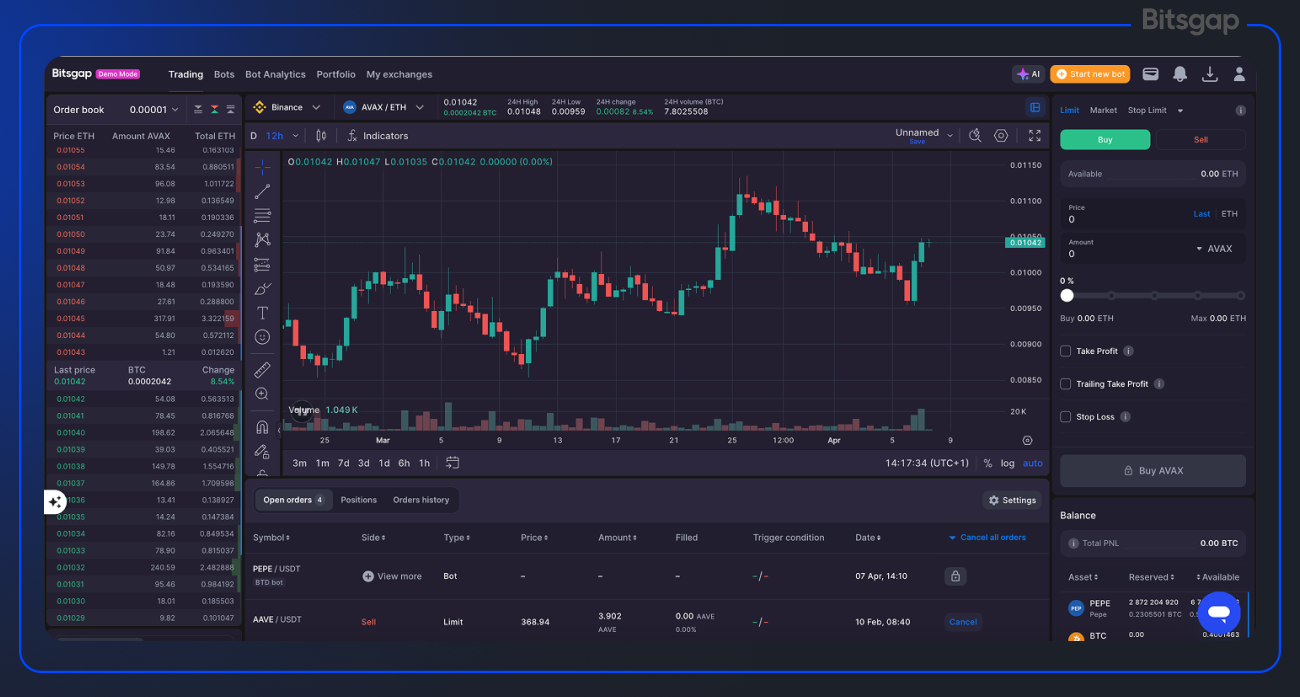

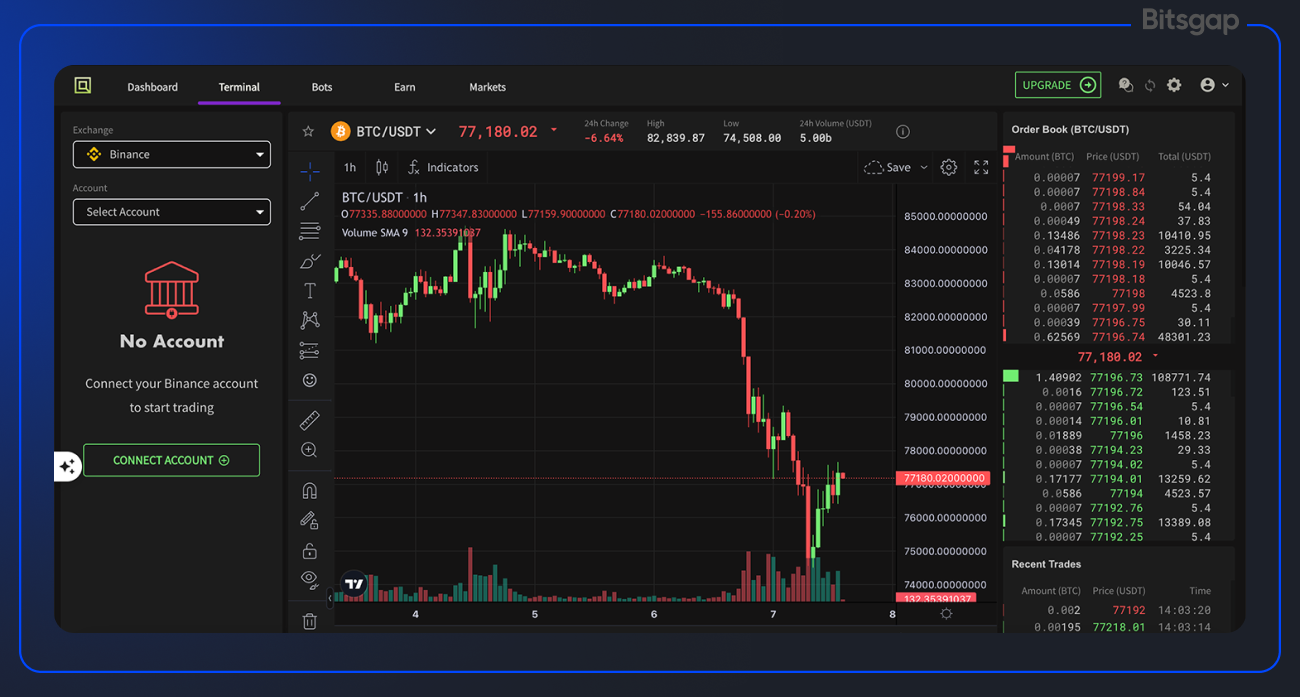

- Bitsgap boasts high-frequency order routing through its unified smart trading terminal. Orders are executed directly through exchange APIs with real-time syncing and status tracking. Bitsgap’s terminal is built for speed and responsiveness, especially important for bots like GRID and DCA Futures.

- Quad Terminal also features multi-exchange trading with smart order routing, bolstered by advanced TradingView charting and automated bot strategies. Execution happens on the exchange side, but Quad emphasizes user-side customization via Cody AI and backtested logic before orders go live

Terminal, Interface and Usability: Bitsgap vs Quad Terminal

A trading platform’s interface is more than just how it looks—it’s how intuitively you can access powerful tools, execute trades quickly, and stay in control of your portfolio. In this section, we compare the design, ease of use, onboarding experience, and device compatibility of Bitsgap and Quad Terminal to see how each caters to different types of users.

Interface Design & Intuitiveness

Bitsgap features a sleek, minimalistic interface optimized for functionality without clutter. The trading terminal offers real-time market data, 100+ indicators via TradingView, and side-by-side views of bots, orders, and portfolio performance. Navigation is straightforward, even with advanced features like TWAP, OCO, and trailing orders. Despite its depth, the platform remains user-friendly, especially for users coming from traditional trading environments.

Quad Terminal, on the other hand, blends a more modern dashboard experience with deep customization. Users are greeted with a modular workspace that prioritizes flexibility—allowing traders to navigate bots, AI (Cody), terminal charts, and portfolio views from a single interface. The platform balances simplicity and control well, especially for those comfortable with multi-window, multi-function dashboards.

Ease of Getting Started

Bitsgap simplifies onboarding with a clean UI and clearly guided steps. New users can connect their exchanges via API, select from pre-built bot strategies, and begin trading in just a few clicks. Tooltips, smart defaults, and an intuitive layout help reduce the learning curve significantly.

Quad Terminal is equally welcoming but leans more into a self-guided learning approach. While setup is beginner-friendly, users may find advanced customization (especially through Cody) requires a bit more exploration.

Mobile Experience & Device Compatibility

Bitsgap is a cloud-hosted platform accessible on any device—desktop, tablet, or mobile—via browser. Its interface is responsive and adapts well to different screen sizes, ensuring seamless access whether you’re monitoring bots or executing smart orders on the go. There’s also a dedicated mobile app (for bot trading) but not the platform's primary access point at this stage.

Quad Terminal also supports web-based access across devices and is actively revamping its mobile app. Mobile compatibility is emphasized in its roadmap, and both iOS and Android versions are available (though features may be limited compared to desktop for now).

Security and Data Protection: Bitsgap vs Quadency Trading Bot

When it comes to crypto trading platforms, security isn’t a feature—it’s a necessity. Users are trusting these platforms with API access to their exchange accounts and sensitive trading data, so it’s crucial to know how each platform protects your assets, account information, and privacy.

Let’s take a look at how Bitsgap and Quad Terminal stack up in terms of security measures, platform safety, and data privacy.

Implemented Security Measures

Bitsgap employs a comprehensive 5-layer security framework:

- Encrypted API Keys with no withdrawal permissions. Bitsgap can't access your funds directly, and any key with withdrawal access is automatically rejected.

- 2048-bit RSA encryption—stronger than what most online banks use—for storing and transmitting sensitive data.

- OAuth integration for supported exchanges like Binance and OKX, ensuring fast and secure API connections without revealing login credentials.

- Two-Factor Authentication (2FA) adds a second layer of protection during login, supported by authentication apps or hardware keys like Yubikey.

- IP Whitelisting, fingerprinting, and anti-countertrade protection safeguard against fraud, phishing, and spoofed activity.

Quad Terminal, likewise, maintains a strong “security-first” architecture:

- API key-based trading ensures that funds never leave the user’s exchange account. API keys are encrypted and stored using multiple layers of 256-bit encryption.

- 2FA is recommended and supported, and users are encouraged to use unique, strong passwords and back up API keys in cold storage.

- Industry-leading protocols like HSTS and TLS are in place to prevent man-in-the-middle attacks.

- Quad Terminal also performs regular penetration testing (OWASP standards) and secures infrastructure via AWS firewalls and rate-limiting to guard against brute-force attacks.

How Safe Are These Platforms?

Both Bitsgap and Quad Terminal emphasize that they do not have access to your funds—they only interact with your exchange through secure API calls with limited permissions.

- Bitsgap has never suffered a major breach in its 7+ years of operation. Their proactive approach, including real-time countertrade protection and OAuth fast-connect, makes it one of the most secure platforms for trading automation.

- Quad Terminal also boasts a clean track record, highlighting its longstanding reputation since 2018 for safe API trading. Their defense-in-depth approach with multi-layer encryption and constant security updates reinforces user confidence.

In both cases, your assets stay on the exchange, and the platform acts purely as a secure interface to automate your trades and manage your portfolio.

Privacy Policy & User Data Protection

- Bitsgap takes a minimalist approach to data collection. They do not require KYC and do not collect sensitive personal information, minimizing any risk of data leakage. All API data is encrypted, and the platform has built-in tools to help prevent phishing and spoofed login attempts.

- Quad Terminal also enforces strict data protection policies. With 256-bit encryption, TLS connections, and internal security audits, they protect all user data and API credentials. Their privacy policy reinforces their commitment not to share or misuse customer information, aligning with global data protection standards.

Fig. 3. Comparison of security features between Bitsgap and Quadency.

👉 Verdict: Both platforms go to great lengths to protect users, but Bitsgap offers an extra edge with its advanced API monitoring, RSA-2048 encryption, and smart integration like OAuth and IP whitelisting. Quad Terminal follows strong modern standards and is equally trustworthy—particularly for users focused on flexibility and advanced use of API-based trading.

In the next section, we’ll cover pricing and plan structure, helping you evaluate what you’re getting for your subscription with each platform.

Pricing and Tariff Plans: Bitsgap vs Quadency Pricing

Choosing the right platform often comes down to value—and that means understanding what you’re getting for the price. In this section, we compare the subscription plans, free feature access, and overall value offered by Bitsgap and Quad Terminal to help you decide which platform gives you more bang for your buck.

Pricing Overview

Bitsgap offers a tiered subscription model with four clear options:

Fig. 4. Bitsgap pricing overview.

All paid plans come with a 7-day free trial of the Pro tier. Bitsgap’s pricing is flexible (monthly/annually) and VAT-exclusive. Even the Free plan allows users to explore key tools in demo mode.

Quad Terminal uses a freemium structure with three plans, priced in QUAD tokens:

Fig. 5. Quodency pricing overview.

A unique benefit with Quad Terminal is the “HODL price lock”: users paying in QUAD tokens get to keep their subscription price even as new features roll out.

Free vs Paid Features

On paid tiers, both platforms unlock full automation features, AI strategy tools, and support for advanced trading types (e.g., futures, trailing orders, rebalancing).

Bitsgap’s strength lies in volume and variety—more bots, deeper AI automation, and futures support. Quad Terminal’s edge is accessibility—you can start using real bots even on the free tier, and build custom AI strategies with Cody.

Best Value for Money?

- Bitsgap is best suited for users who are looking for high-performance, professional-grade automation at scale, with deep AI integrations and robust terminal features. Its pricing is slightly higher, but it justifies the cost with a larger bot allowance, smart orders, advanced analytics, and AI portfolio optimization.

- Quad Terminal offers excellent value for cost-conscious or technically inclined users, especially those who want to experiment with AI-driven strategies like Cody. The ability to access real bots and AI in the free plan is a huge plus, and paying with QUAD tokens keeps the subscription cost locked in over time.

👉 Verdict: Both platforms offer excellent ROI—but the better fit depends on your trading style, scale, and how much hands-on control you want over your strategy.

Conclusions and Recommendations: Bitsgap vs Quadency App

Final verdict with an emphasis on the advantages of Bitsgap.

After exploring everything from automation capabilities and exchange support to security, pricing, and usability, one thing is clear—both Bitsgap and Quadency (Quad Terminal) are strong contenders in the crypto trading automation space. But they take very different approaches.

Quadency shines in flexibility and custom strategy building, especially with its Cody AI assistant, which allows traders to script complex strategies in natural language. Its freemium model and “pay-in-QUAD” perks make it attractive to those who want low-commitment access to sophisticated tools. For users who love to tinker, script, and fine-tune—Quadency is a solid pick.

That said, Bitsgap comes out ahead as the more complete, accessible, and powerful solution for the majority of traders.

Why Bitsgap Wins:

- Battle-tested automation tools like GRID, DCA, BTD, and COMBO bots, optimized for both spot and futures markets

- Plug-and-play simplicity with deep customization options—get started in minutes, scale as you go

- Advanced AI Assistant that not only helps build bots but also recommends diversified AI-generated portfolios

- Top-tier security including encrypted APIs, RSA 2048 encryption, OAuth integrations, and real-time threat detection

- Comprehensive exchange support and smart trading features that work seamlessly across all accounts

- Transparent, flexible pricing that offers more features and bot capacity per dollar

👉 Whether you're just starting your trading journey or you're managing a multi-exchange portfolio, Bitsgap delivers unmatched value and performance in a platform that scales with your needs.

We encourage you to try Bitsgap free for 7 days with full access to our Pro features—no credit card required. Experience firsthand how our automation tools, AI integration, and intuitive interface can upgrade your crypto trading game.