Bitsgap vs GoodCrypto: Which Crypto Trading Platform Is Right For You?

Choosing the wrong crypto trading automation platform could be silently draining your profits every day. Our comprehensive Bitsgap vs GoodCrypto analysis reveals which platform works best when.

Welcome to another installment in our comparative series! Today, we're putting Bitsgap and GoodCrypto head-to-head to see how these popular crypto trading platforms stack up against each other.

As always, our goal is to give you a clear, honest breakdown of both platforms from multiple angles—features, pricing, user experience, and more. While we certainly have a soft spot for Bitsgap (and we'll show you why we think it stands out in several key areas), we firmly believe that the best platform is ultimately the one that works for your specific trading style and needs.

So grab your favorite beverage, get comfortable, and join us as we explore these two powerful crypto trading solutions.

Main Platform Features: Bitsgap vs GoodCrypto Review

Let's delve into the essential tools and features that define both Bitsgap and GoodCrypto platforms. In this section, we'll provide a concise overview of their key offerings, examine their trading automation capabilities, and highlight the unique aspects that differentiate these platforms from one another. This comparative analysis will give you a clear picture of what each platform brings to the table before we explore specific features in greater depth later.

Key Tools Overview

Bitsgap

Bitsgap positions itself as an all-in-one crypto trading platform with a robust set of features developed since 2017. The platform connects to 15+ leading exchanges and offers:

- Trading Bots: Five specialized automated trading bots including GRID, DCA, BTD, LOOP, DCA Futures, and COMBO bots for different market conditions

- Smart Trading Terminal: Advanced order types and algorithmic trading interface

- Portfolio Management: Comprehensive dashboard for tracking performance across exchanges

- AI Assistant: AI-powered bot portfolio creator that promises up to 20% better results than manual trading

- Technical Analysis Tools: Integrated TradingView charts with 100+ indicators

GoodCrypto

GoodCrypto, in operation since 2019, presents itself as a comprehensive crypto trading and portfolio management solution that supports 35+ exchanges across both CEX and DEX ecosystems:

- Trading Tools: Advanced orders including Trailing orders, Stop Loss + Take Profit combos

- Automated Trading: Various bots including Infinity Trailing Bot, DCA Bot, and Grid Bot

- TradingView Integration: Allows triggering any order or bot based on TradingView indicators

- Portfolio Tracking: Real-time monitoring across connected exchanges and blockchain wallets

- DEX Trading: Recently launched goodcryptoX for decentralized exchange trading

Trading Automation Capabilities

Both platforms offer impressive trading automation features, but with different approaches:

Bitsgap focuses on a variety of specialized bots tailored for specific market conditions. For instance, GRID bot helps capitalize on sideways markets, while DCA bot is designed for clear trends. The platform's AI Assistant creates an optimized portfolio of bots, balancing them based on market analysis from seven years of data.

GoodCrypto emphasizes flexibility with its Infinity Trailing Bot that can "ride the trend until its end," as well as integration with TradingView for automated trading based on technical indicators. Their bots can be used across both centralized and decentralized exchanges, with particular attention to DEX trading through their goodcryptoX service.

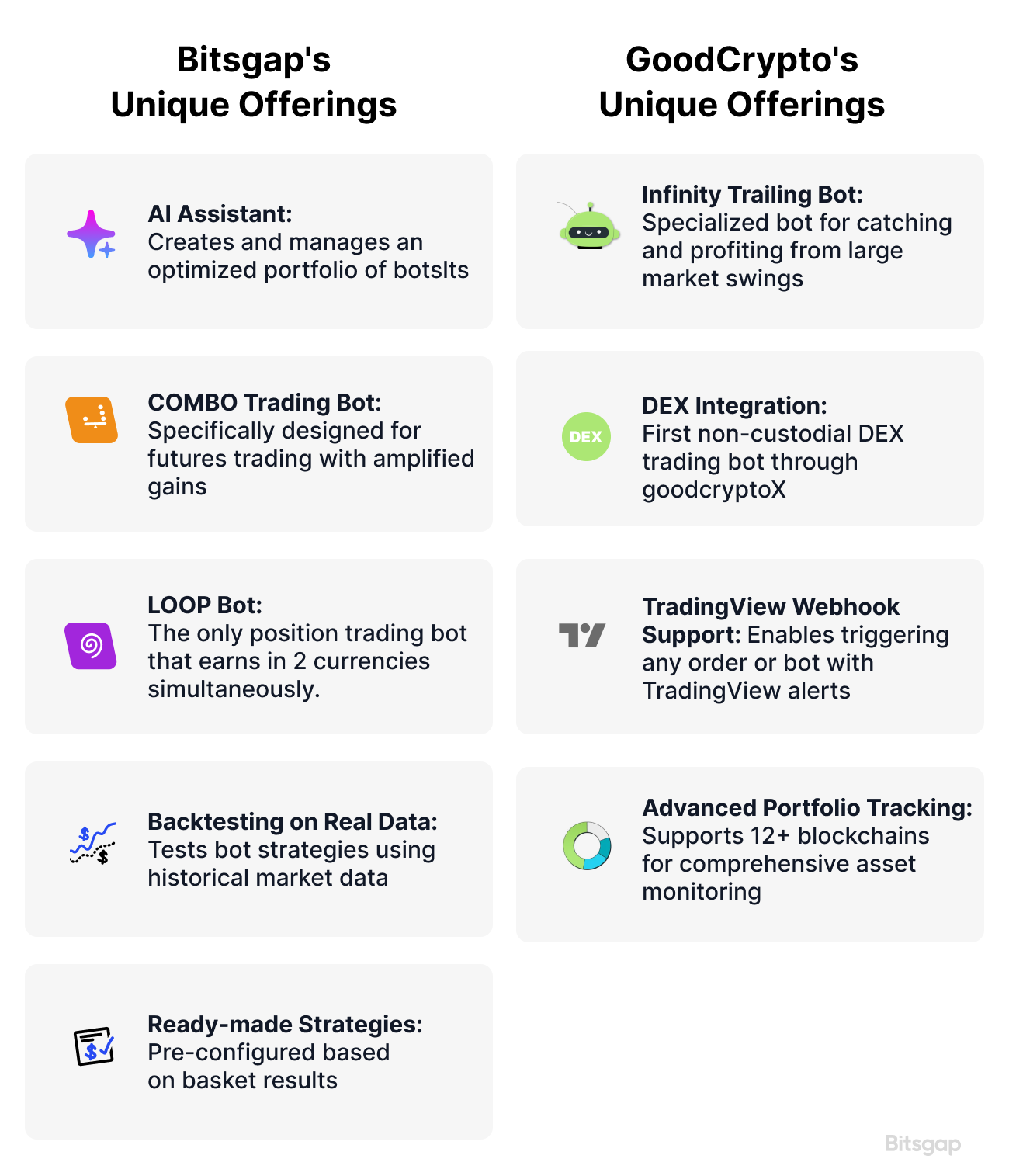

Unique Features and Main Differences

Bitsgap's Unique Offerings

- AI Assistant: Creates and manages an optimized portfolio of bots

- COMBO Trading Bot: Specifically designed for futures trading with amplified gains

- LOOP Bot: The only position trading bot that earns in 2 currencies simultaneously.

- Backtesting on Real Data: Tests bot strategies using historical market data

- Ready-made Strategies: Pre-configured based on basket results

GoodCrypto's Unique Offerings

- Infinity Trailing Bot: Specialized bot for catching and profiting from large market swings

- DEX Integration: First non-custodial DEX trading bot through goodcryptoX

- TradingView Webhook Support: Enables triggering any order or bot with TradingView alerts

- Advanced Portfolio Tracking: Supports 12+ blockchains for comprehensive asset monitoring

Key Differences

- Exchange Coverage: GoodCrypto supports 35+ exchanges compared to Bitsgap's 15+

- DEX Focus: GoodCrypto puts significant emphasis on DEX trading, while Bitsgap is CEX-focused

- Bot Philosophy: Bitsgap focuses on specialized bots for different market conditions, while GoodCrypto emphasizes flexibility and cross-exchange compatibility

- AI Implementation: Bitsgap offers AI portfolio optimization, while GoodCrypto focuses on signal-based automation

Both platforms have evolved significantly since their inception, continuously adding features and refining their offerings to meet the needs of crypto traders ranging from beginners to professionals. In the following sections, we'll explore these features in greater detail to help you determine which platform might be the better fit for your specific trading style and requirements.

Automated Trading: Bitsgap vs GoodCrypto Bot Review

In this section, we'll explore how Bitsgap and GoodCrypto bring automation to your trading strategy, helping you capture opportunities 24/7 without being glued to your screen. We'll compare the various bot types offered by each platform, examine how flexible and customizable these automated solutions really are, assess their effectiveness for different types of traders, and look at the risk management features that help protect your investments from market volatility.

Available Trading Bots

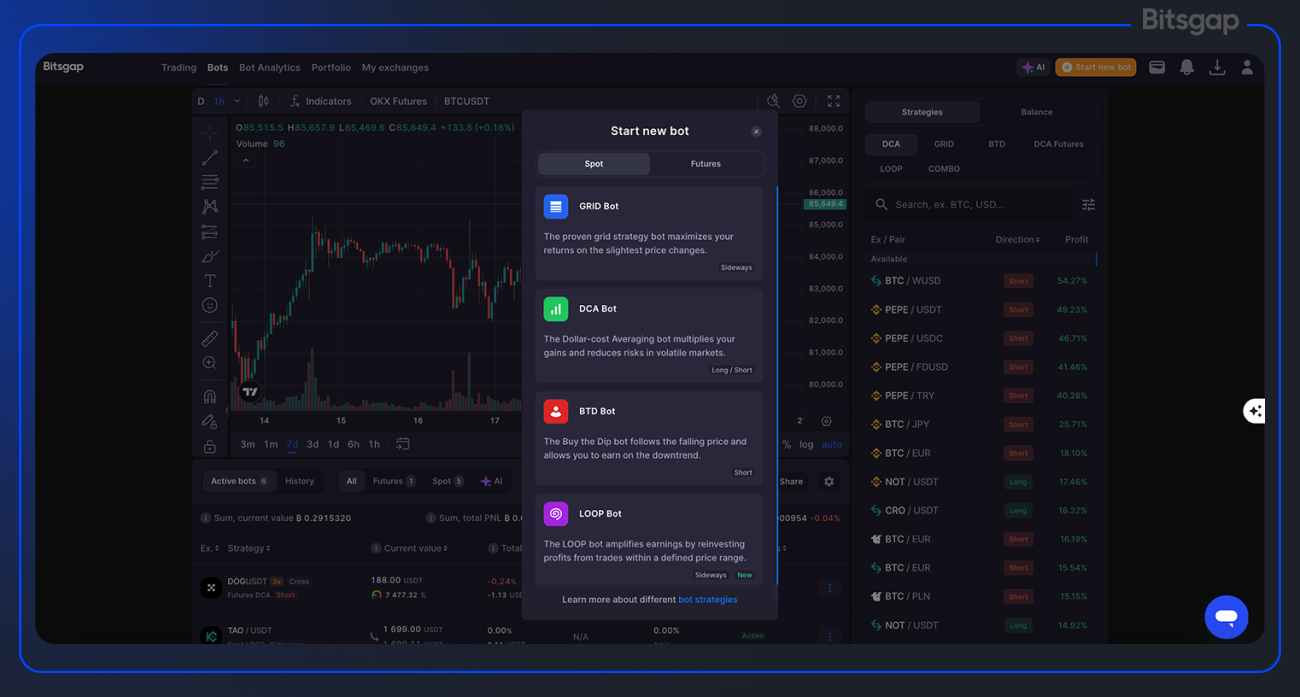

Bitsgap's Trading Bot Arsenal

Bitsgap offers a well-structured suite of specialized trading bots, each designed with a specific market condition and strategy in mind:

- GRID Bot: Perfect for sideways markets, this bot profits from small price fluctuations by automatically buying low and selling high within a defined price range. Since "most markets are moving sideways most of the time," GRID bots are consistently productive.

- DCA Bot (Dollar-Cost Averaging): Designed to reduce risk in volatile markets by averaging positions and gradually building them up. Available in both long and short modes, it's described as a "Swiss Army knife for crypto trading" that can outperform simple buy-and-hold strategies.

- BTD Bot (Buy the Dip): Specially created to capitalize on falling prices, this bot monitors the market for sudden price drops and automatically buys at lower prices—ideal for accumulating assets during downturns.

- DCA Futures Bot: A futures-specific implementation of DCA strategy that lets traders leverage their positions up to 10x, amplifying potential returns while managing risk through dollar-cost averaging.

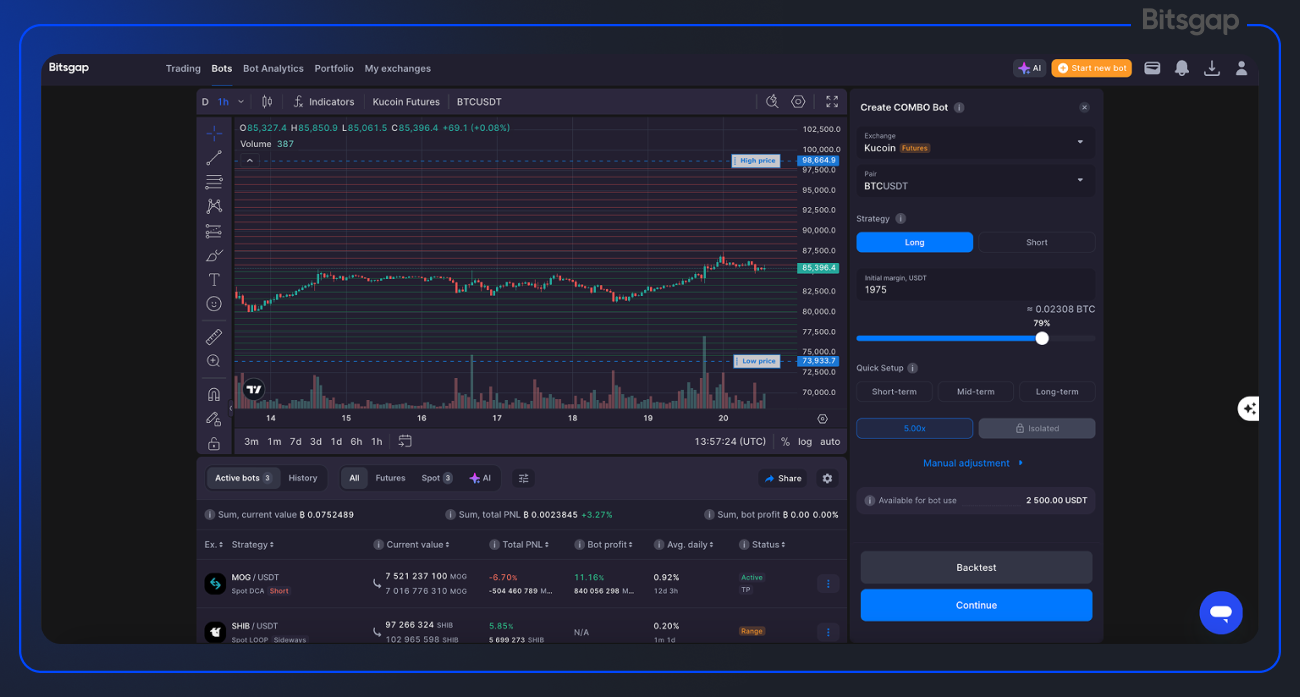

- COMBO Bot: Combines Grid and DCA strategies for futures trading, using DCA for buy orders and Grid techniques for sell orders, offering high risk-reward potential.

- LOOP Bot: A newer addition focused on long-term position trading that earns in both base and quote currencies while automatically reinvesting profits for compound growth.

Bitsgap also offers an AI Assistant that creates and manages an optimized portfolio of bots, monitoring market conditions and automatically balancing your trading strategies.

GoodCrypto's Trading Bot Collection

GoodCrypto takes a different approach with fewer specialized bots but broader integration capabilities:

- Infinity Trailing Bot: Their flagship bot designed to "ride the trend until its end," catching and profiting from large market swings. It comes in two modes: standard and "only exit at profit," the latter being particularly useful for HODLers who want to benefit from volatility.

- Grid Bot: Similar to Bitsgap's offering, this bot profits from small price movements in ranging markets by placing a grid of buy and sell orders.

- DCA Bot: Implements the dollar-cost averaging strategy to reduce risk through systematic investment at regular intervals.

- TradingView Bot: A unique offering that connects TradingView indicators to automated trading strategies, allowing traders to trigger any order or bot based on technical analysis signals without requiring a paid TradingView subscription.

- DEX Gems Sniper Bot: Specifically designed for decentralized exchanges to spot and act on emerging opportunities quickly.

GoodCrypto emphasizes cross-exchange and DEX compatibility, with the recent introduction of goodcryptoX for dedicated decentralized exchange trading.

Algorithm Flexibility and Customization

Bitsgap Customization

Bitsgap prioritizes user-friendly customization with several approaches:

- Ready-made Strategies: For beginners, Bitsgap offers hundreds of pre-made profitable strategies "successfully tested on real data," allowing quick setup without deep technical knowledge.

- Custom Parameters: For more experienced users, each bot allows detailed customization of parameters like trading range, grid steps, investment amount, and take profit/stop loss levels.

- Backtesting: A standout feature is backtesting functionality, which lets users test strategies on historical data before committing real funds.

- Market-Specific Bots: Their approach of having specialized bots for different market conditions (sideways, trending up, trending down) allows traders to match their automation to current market behavior.

The LOOP Bot exemplifies this flexibility, offering traders the choice to profit in either base or quote currency and automatically reinvesting gains for compounding growth.

GoodCrypto Customization

GoodCrypto focuses on versatility and integration:

- TradingView Integration: The platform's standout customization feature is its deep integration with TradingView, allowing traders to trigger any bot or order based on any TradingView indicator or strategy.

- Trailing Parameters: Their Infinity Trailing Bot emphasizes adjustable trailing distances (from 0.5% to 10% or more) to match different volatility levels, with the platform recommending "setting up several Infinity Trailing Bots on the same instrument with different trailing distances" to find the optimal configuration.

- Cross-Exchange Flexibility: With support for 35+ exchanges including DEXs, GoodCrypto emphasizes the ability to implement strategies across different trading venues.

- Signal-Based Automation: Their built-in technical analysis signals (based on 25 popular indicators) can automatically trigger or stop bots, adding another layer of strategy customization.

Effectiveness for Different Trader Categories

For Beginners

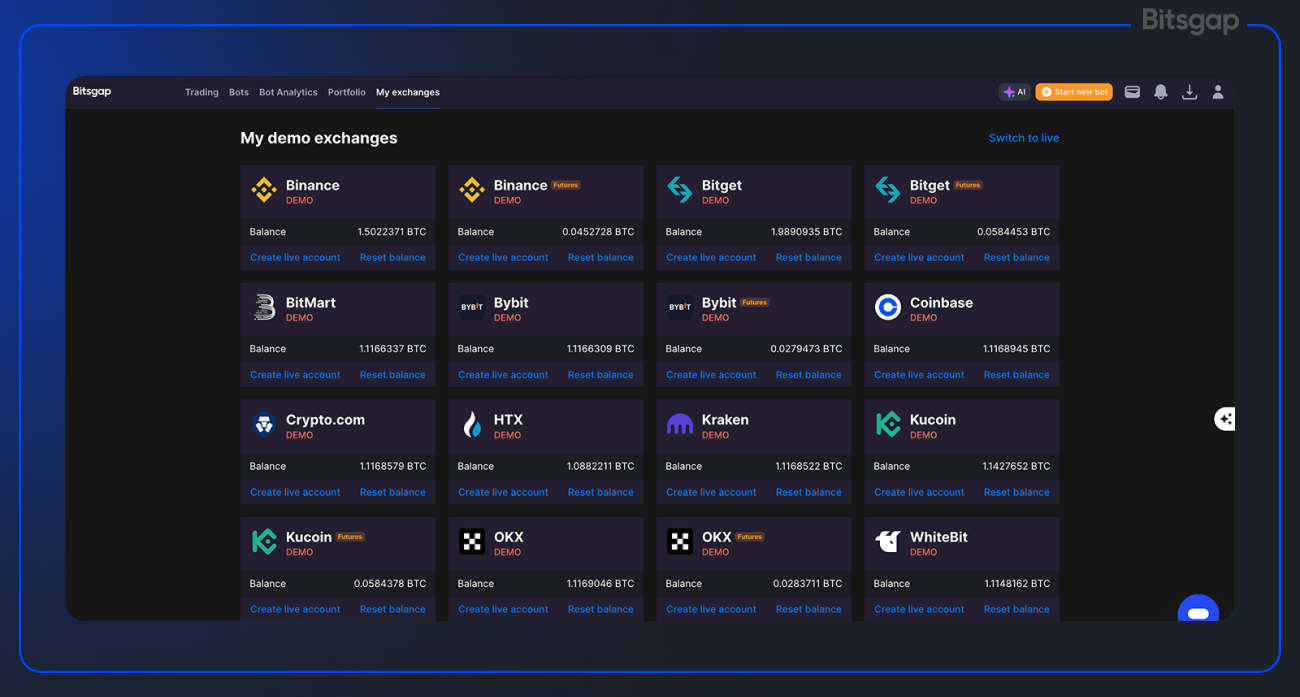

Bitsgap offers a more structured path for newcomers with:

- An intuitive "3-click" bot setup process

- Demo mode for risk-free practice

- AI Assistant to create optimized bot portfolios with minimal input

- Clear bot categorization based on market conditions and complexity level

- Ready-made strategies to get started quickly

GoodCrypto caters to beginners through:

- Built-in technical analysis signals that don't require prior knowledge

- Simple bot setup processes

- Comprehensive educational content

- Free alternatives to paid services like TradingView

For Intermediate Traders

Bitsgap provides:

- Backtesting to refine strategies based on historical performance

- Multiple bot types to switch between as market conditions change

- Real-time analytics to track bot performance

- Futures trading options with managed risk through DCA and COMBO bots

GoodCrypto offers:

- Flexibility to trade across more exchanges (35+ vs Bitsgap's 15+)

- Advanced order types that can be integrated with bots

- Trailing features that adapt to market movements

- DEX trading capabilities alongside centralized exchange options

For Advanced Traders

Bitsgap delivers:

- COMBO and DCA Futures bots with leverage up to 10x

- Portfolio-level bot management through the AI Assistant

- Detailed performance analytics

- Unique LOOP Bot for compounding returns

GoodCrypto provides:

- Webhook integration for custom trigger systems

- API-based automation for more technical users

- DEX trading bots for decentralized finance opportunities

- Cross-exchange arbitrage potential with their broad exchange support

Risk Management and Loss Protection

Bitsgap's Safety Measures

Bitsgap incorporates several risk management features:

- Stop Loss: Available across all bot types to limit potential losses

- Take Profit: Locks in gains at predetermined levels

- Trailing Features: Adjusts positions as the market moves to optimize entry and exit points

- Pump/Dump Protection: Helps prevent bots from buying at local tops or selling at local bottoms

- Backtesting: Tests strategies on historical data to evaluate risk before deployment

- Max/Min Price Settings: Establishes boundaries for bot operation

- Leverage Control: For futures bots, allows setting appropriate leverage levels

Almost all bots highlight these safety mechanisms with detailed risk management parameters, while the AI Assistant aims to optimize portfolio risk through diversification.

GoodCrypto's Protection Mechanisms

GoodCrypto offers its own approach to risk management:

- Stop Loss + Take Profit Combos: Can be attached to any order or bot

- Trailing Stop Loss: Follows price movements to optimize exit points

- "Only Exit at Profit" Mode: For Infinity Trailing Bot, ensures positions aren't closed at a loss

- Custom Alerts: Notifies users of potential market risks

- Technical Analysis Signals: Provides automated guidance on market direction

- Cross-Exchange Diversification: Spreads risk across multiple trading venues

- DEX Integration: Reduces counterparty risk through decentralized trading

GoodCrypto’s documentation emphasizes the importance of choosing appropriate trailing distances based on volatility and using multiple bots with different parameters to find optimal risk-adjusted setups.

Comparing Automation Approaches

What becomes apparent is the differing philosophy between these platforms:

Bitsgap embraces a more structured, specialized approach with distinct bot types for specific market conditions, complemented by AI assistance for portfolio management. Their focus on backtesting and ready-made strategies suggests an emphasis on proven methods and risk management through historical validation.

GoodCrypto takes a more flexible, integration-focused path with fewer specialized bots but broader connectivity (more exchanges, DEX support). Their approach emphasizes adaptability across trading environments and technical analysis-driven automation.

Both platforms recognize the importance of customization and risk management but implement these priorities through different features and user experiences. Your choice between them might depend on whether you prefer Bitsgap's structured specialization or GoodCrypto's flexible integration capabilities.

👉 Verdict: Bitsgap offers the perfect balance of power and simplicity with its specialized trading bots tailored for different market conditions. Moreover, the platform lets you test strategies against historical data before risking real money, while its AI assistant helps optimize your portfolio for better results.

Exchange Support: Bitsgap vs GoodCrypto

When it comes to cryptocurrency trading platforms, the breadth and quality of exchange integrations can make or break your trading experience. After all, what good is a powerful set of tools if they don't connect to where your assets live? In this section, we'll examine how Bitsgap and GoodCrypto stack up in terms of exchange support, comparing their coverage, integration quality, and exclusive exchange partnerships. This information will help you determine which platform better aligns with your preferred trading venues.

Supported Exchanges: Numbers and Quality

Bitsgap's Exchange Ecosystem

Bitsgap offers integration with over 15 leading cryptocurrency exchanges, including major players like:

- Binance

- Binance US

- Bitfinex

- Bitget

- BitMart

- Bybit

- Coinbase

- Crypto.com

- Gate.io

- Gemini

- HitBTC

- HTX (formerly Huobi)

- Kraken

- KuCoin

- OKX

- Poloniex

- WhiteBIT

The platform focuses on quality over quantity, ensuring solid integrations with established exchanges that offer significant liquidity and reliability. These exchanges collectively represent billions in daily trading volume, with Binance alone accounting for approximately $18 billion in 24-hour volume.

GoodCrypto's Expansive Coverage

GoodCrypto takes a more comprehensive approach, supporting a significantly larger number of exchanges—over 35, in fact. Their lineup includes:

- All exchanges supported by Bitsgap

- Plus additional exchanges like:

- dYdX

- Bitstamp

- Phemex

- BitMEX

- And many more

A standout feature of GoodCrypto is their recent expansion into decentralized exchanges (DEXs) through their goodcryptoX product, which appears to be the first non-custodial DEX trading bot. This allows traders to access automated trading on decentralized platforms, a capability not yet offered by Bitsgap.

API Integration and Connection Quality

Bitsgap's Integration Approach

Bitsgap emphasizes reliability and speed in their API integrations:

- Fast Trading Servers: Their documentation specifically mentions that their "servers are located close to popular exchanges to ensure stable and fast order execution."

- Simplified Connection: Users can connect exchanges with just an API key, with no withdrawal permissions required.

- Security Focus: The platform automatically rejects any API keys with withdrawal functions enabled, providing an additional layer of security.

- Complete Trading Suite: Once connected, users gain access to Bitsgap's full range of trading tools including smart orders that may not be available natively on the exchanges themselves.

The platform highlights its processing of over 100 million orders since 2017, suggesting robust and reliable API integration that has stood the test of time.

GoodCrypto's Connection Framework

GoodCrypto takes a slightly different approach to API integration:

- Multiple Account Support: According to their pricing page, different subscription tiers support varying numbers of accounts per exchange (from 1 in the free tier to 50-100 in higher tiers), indicating they can handle multiple accounts on the same exchange.

- Mobile-First Design: With strong emphasis on their mobile app, GoodCrypto appears to optimize their exchange connections for on-the-go trading.

- Webhook Integration: Their TradingView integration suggests sophisticated API capabilities that can process external triggers and convert them into exchange actions.

- DEX Connectivity: Their goodcryptoX feature demonstrates advanced API work integrating with decentralized exchanges, which typically requires different connection methods than centralized exchanges.

GoodCrypto also emphasizes security, noting that "API keys are encrypted the moment you add them to GoodCrypto" and describing security as "the cornerstone of our system's design."

👉 Verdict: In terms of pure numbers, GoodCrypto takes the lead with support for 35+ exchanges compared to Bitsgap's 15+. The most significant difference is GoodCrypto's expansion into decentralized exchanges, offering an entirely new trading ecosystem that Bitsgap currently doesn't cover.

Terminal, Interface and Ease of Use: Bitsgap vs GoodCrypto

In this section, we'll compare how Bitsgap and GoodCrypto have designed their user interfaces, evaluate their accessibility for traders of different experience levels, and assess their performance across different devices. After all, a platform should work seamlessly whether you're at your desk or trading on the go.

Interface Design and Intuitiveness

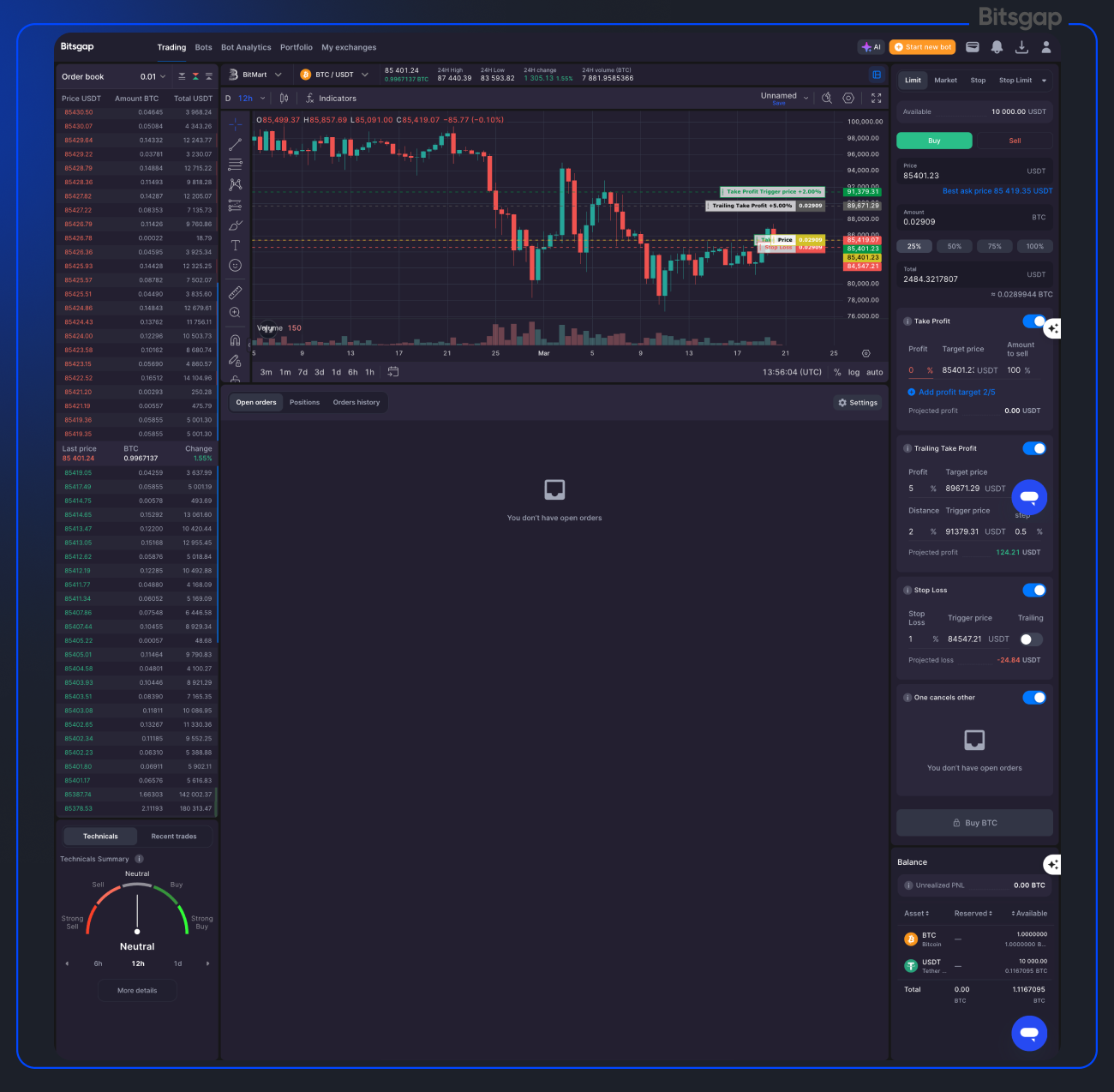

Bitsgap Interface

Bitsgap has designed its interface with an emphasis on clean organization and visual clarity:

- Dashboard-Centric Approach: The platform features a comprehensive dashboard that serves as a command center, giving traders an at-a-glance view of portfolio performance, active bots, and market conditions.

- Contextual Navigation: Tools are organized into logical categories—Trading Terminal, Bots, Portfolio, etc.—making it straightforward to find specific functions.

- Visual Aids: The platform incorporates visual elements to make complex information more digestible, such as clearly demarcated sections for different bot types (GRID, DCA, BTD, etc.) and color-coded performance indicators.

- Minimal Clicks: Bitsgap prioritizes efficiency, hence the interface’s designed to minimize the steps between decision and execution.

GoodCrypto Interface

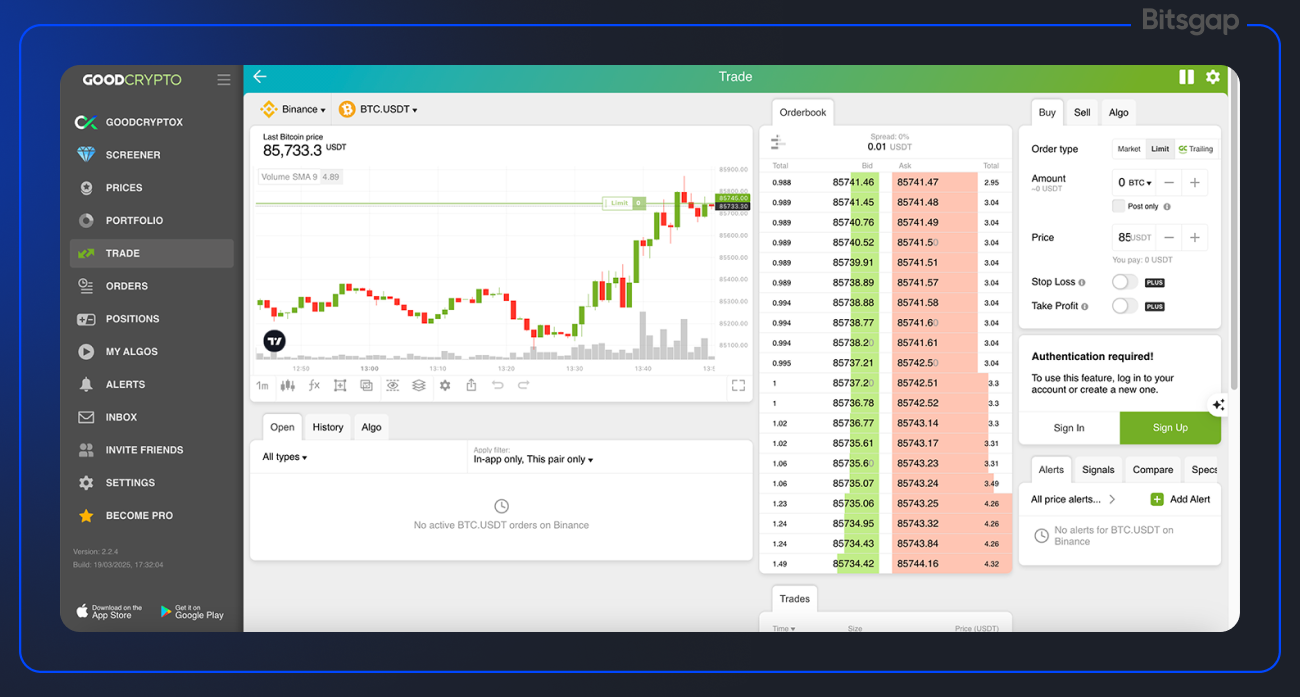

GoodCrypto takes a slightly different approach to its interface:

- Mobile-First Design: The platform appears to have been built with mobile users as a priority, with an interface that translates well between desktop and smartphone experiences.

- Tabbed Organization: GoodCrypto uses a side-panel navigation system hat makes it easy to switch between major functions.

- Integrated Charts: Trading screens prominently feature price charts with technical indicators directly in the workflow, making analysis and execution a seamless process.

- DEX Integration: Their goodcryptoX interface maintains a consistent design language while adding DEX-specific functions like token selection and swap interfaces.

Cross-Platform Experience

Bitsgap Mobile and Web Experience

Bitsgap positions itself as a cloud-based platform that "can be accessed from any device at any time." Their focus appears to be on consistent functionality across devices:

- Cloud Execution: Their orders will execute even if users are offline, suggesting a reliable cloud infrastructure.

- Mobile App: Bitsgap features a mobile app that includes all automations but lacks manual trading features at the moment.

- Responsive Design: Bitsgap’s trading terminal adapts to different screen sizes, though perhaps with a preference for larger displays where more information can be shown simultaneously.

GoodCrypto Mobile and Web Experience

GoodCrypto places significant emphasis on their mobile capabilities:

- Mobile Apps: They offer dedicated apps for both iOS and Android, with a direct APK download option for Android users who prefer to bypass app stores.

- Mobile-Optimized Interface: Their trading screens appear specifically designed for mobile use, with touch-friendly controls and efficient use of limited screen space.

- Mobile-First Design Philosophy: User testimonials specifically praise the mobile experience, with one noting it's "the only app that works on phone and iPad" and another describing it as "super clean, snappy."

- Responsive Web Version: Their web interface maintains consistency with the mobile experience while taking advantage of additional screen space.

GoodCrypto appears to position mobile trading as a core strength, with one reviewer noting it's "very handy app for trading on the go."

Interface Highlights and Unique Features

Bitsgap's Standout Interface Elements

- Trading View Integration: Over 100 indicators and 50 smart drawing tools integrated directly into the platform.

- Real-Time Bot Analytics: Detailed, visually clear monitoring of bot performance.

- Backtesting Visualization: Interactive visual representation of strategy performance on historical data.

- Exchange-Agnostic Algorithmic Orders: Smart orders available consistently across all connected exchanges, even those that don't natively support them.

- AI-Assisted Portfolio Management: Visual interface for AI-recommended bot allocations.

GoodCrypto's Distinctive Interface Features

- DEX Trading Interface: Purpose-built interfaces for decentralized exchange trading through goodcryptoX.

- Security Score Visualization: Their DEX interface includes visual security scores for tokens, helping users quickly assess risk.

- Blockchain Wallet Integration: Direct portfolio tracking of blockchain wallets alongside exchange accounts.

👉 Both platforms have clearly invested significant effort in making advanced trading tools more accessible, but they've approached this challenge from different angles. Your preference might ultimately depend on whether you value Bitsgap's more structured, visually rich desktop experience or GoodCrypto's mobile-first & DEX flexibility.

Security and data protection: Bitsgap vs GoodCrypto

In this section, we'll examine how Bitsgap and GoodCrypto safeguard your assets and sensitive information, analyze their protection mechanisms, and assess whether you can trust these platforms with your cryptocurrency holdings.

API Key Protection and Authentication Methods

Bitsgap's Multi-Layered Security Approach

Bitsgap implements five layers of total security to protect users:

- Encrypted API with No Withdrawal Access: Bitsgap automatically rejects any API key that has withdrawal permissions enabled. This fundamental security measure ensures that even if their system were compromised, attackers couldn't withdraw your funds from exchanges.

- Advanced API Protection:

- 1 Account = 1 API Key Rule: Each API key can only be connected to a single Bitsgap account, preventing compromised keys from being used on multiple accounts.

- Countertrade Protection: Algorithms that detect and block potential countertrade attacks (where attackers manipulate low-volume trading pairs to profit illicitly).

- API Key IP Whitelisting: Trading is restricted to Bitsgap's IP addresses only, blocking activity from unauthorized locations.

- Fingerprinting: Tracking and blocking users attempting malicious activity.

- OAuth Integration: For supported exchanges like Binance, OKX, and KuCoin, Bitsgap offers OAuth authentication, which allows secure authorization without directly sharing API credentials.

- Two-Factor Authentication (2FA): Bitsgap supports 2FA, including hardware security keys like YubiKey, adding an extra verification step beyond passwords.

- 2048-bit RSA Encryption: All data transmitted to Bitsgap's servers is encrypted with bank-grade 2048-bit RSA encryption, with each user account having its own separate encryption key.

GoodCrypto's Security Framework

GoodCrypto also prioritizes security with several robust protection mechanisms:

- On-Device API Key Encryption: API keys are encrypted directly on the user's device using 2048-bit asymmetric encryption before being transmitted.

- Multi-Tiered Server Architecture:

- All connections use SSL encryption

- Backend services are compartmentalized in separately encrypted and firewalled environments

- Keys are stored in a secured, firewalled environment and never returned to the client

- Multi-Layer Account Security:

- User data is encrypted and depersonalized

- Continuous monitoring with unusual behavior detection heuristics

- Active monitoring for suspicious account activity

- External Security Audits: GoodCrypto undergoes regular third-party security audits and maintains a bug bounty program to incentivize white-hat hackers to identify potential vulnerabilities.

- Zero Knowledge Architecture: Their approach to data handling appears designed to minimize the amount of sensitive information they store about users.

Safety of Asset Management

How Bitsgap Protects Your Assets

Bitsgap's approach to asset safety is built around several key principles:

- No Direct Asset Custody: Bitsgap never takes custody of your assets—they remain on your exchanges at all times. As they explicitly state: "One of the key principles of Bitsgap is that you are always in control of your assets and they always remain on the exchange."

- API Key Limitations: By rejecting withdrawal-enabled API keys, Bitsgap structurally prevents the possibility of unauthorized fund transfers.

- Clean Security Record: In its seven years of existence, Bitsgap has never been hacked, nor have there been any serious security breaches.

- Firewall Protection: All sensitive data is stored on secure networks protected by firewalls.

- Minimal Personal Data: Bitsgap doesn't require KYC and collects minimal personal information, reducing the risk associated with data breaches.

How GoodCrypto Secures Your Investments

GoodCrypto takes a slightly different but equally robust approach to asset protection:

- Non-Custodial Design: Like Bitsgap, GoodCrypto doesn't hold your assets—they remain on your connected exchanges or in your personal wallets.

- Encrypted and Firewalled Key Storage: API keys are encrypted and stored in a secure environment that's isolated from other systems.

- Regular Security Audits: Their documentation highlights regular third-party security audits, including cooperation with "leading cyber security experts."

- Depersonalized Data: User data is stored in "encrypted depersonalized databases," minimizing the impact of potential data breaches.

- Bug Bounty Program: Their ongoing bug bounty program encourages security researchers to identify and report vulnerabilities before they can be exploited.

Protection Against Hacks and Unauthorized Access

Bitsgap's Defense Mechanisms

Bitsgap protects against unauthorized access through several sophisticated methods:

- Multi-Factor Authentication: Beyond standard 2FA, Bitsgap supports hardware security keys for an additional layer of protection.

- IP Restriction: By limiting API key access to specific Bitsgap IP addresses, they prevent unauthorized use of your keys from other locations.

- OAuth Implementation: For supported exchanges, OAuth eliminates the need to store API credentials directly, reducing the attack surface.

- Breach Prevention: Their countertrade protection and fingerprinting technologies help identify and block suspicious activities before they result in losses.

- Encryption During Transit and Storage: Data is encrypted both when it's being transmitted and when it's stored, providing protection at all stages.

GoodCrypto's Security Measures

GoodCrypto implements its own set of defenses against potential threats:

- Continuous Monitoring: Their systems actively monitor for unusual behavior and suspicious patterns that might indicate an attack.

- Multi-Layer Security Architecture: The compartmentalized design means a breach in one area doesn't compromise the entire system.

- SSL Encryption: All connections to and from the platform are encrypted to prevent man-in-the-middle attacks.

- White-Hat Hacker Collaboration: By working with security researchers, they proactively identify and address potential vulnerabilities.

- Device-Level Encryption: Encrypting API keys directly on the user's device adds an important security layer that protects credentials before they even reach GoodCrypto's servers.

Comparative Analysis of Security Approaches

While both platforms take security seriously, their approaches reveal some differences in emphasis:

Bitsgap's Security Strengths

- Detailed documentation of their specific security measures

- Clear policy on API key restrictions (1 account = 1 key)

- Emphasis on countertrade protection

- Support for hardware security keys

- OAuth integration for simplified, secure authentication

GoodCrypto's Security Advantages

- On-device encryption before transmission

- Strong emphasis on regular external security audits

- Bug bounty program explicitly mentioned

- Compartmentalized backend architecture

- Focus on depersonalization of user data

Security Summary

Both Bitsgap and GoodCrypto demonstrate serious commitments to security through multiple protection layers, non-custodial approaches to asset management, and robust encryption. The core security architectures of both platforms share important characteristics:

- Neither platform takes custody of your assets

- Both reject withdrawal-enabled API keys

- Both implement strong encryption methods

- Both offer 2FA capabilities

- Both use firewalled environments for sensitive data

For users who follow best practices—using unique passwords, enabling 2FA, and carefully reviewing API permissions—either platform should provide a secure environment for cryptocurrency trading activities.

Pricing and Tariff Plans: Bitsgap & GoodCrypto Bot Review

Making the right choice between trading platforms isn't just about features and security—it's also about getting the best value for your investment. In this section, we'll break down the pricing structures of Bitsgap and GoodCrypto, examine what you can access for free versus what requires a subscription, and analyze which platform offers the most bang for your buck based on different trading needs and budgets. Understanding these cost differences will help you make an informed decision that balances functionality with affordability.

Subscription Costs and Feature Comparison

Bitsgap's Tiered Pricing Structure

Bitsgap offers a straightforward tiered pricing model with four main options:

- Free Plan: Limited functionality for testing the platform

- Unlimited manual trading

- 20 active bots in Demo mode only (no live trading bots)

- Access to smart orders

- Basic Plan: $21/month (when billed annually, $26/month if billed monthly)

- 3 Active Grid bots

- 10 Active DCA bots

- AI Assistant

- Unlimited manual trading

- Unlimited smart orders

- Advanced Plan: $49/month (when billed annually, $62/month if billed monthly)

- 10 Active Grid bots

- 50 Active DCA bots

- Futures bots

- Reinvest bot profit for DCA bots

- Trailing Up & Down for Grid bots

- All Basic plan features

- Pro Plan: $108/month (when billed annually, $135/month if billed monthly)

- 50 Active Grid bots

- 250 Active DCA bots

- Take Profit for Grid bots

- Take Profit for AI-launched bots

- AI Portfolio Mode

- AI improved performance

- All Advanced plan features

All paid plans include cloud trading 24/7/365, support for 15+ exchanges, and both desktop and mobile versions. Bitsgap offers a 7-day free trial of their Pro plan with no credit card required.

GoodCrypto's Multi-Tier Structure

GoodCrypto offers a more granular pricing structure with six tiers, including special options:

- Free Plan: Basic functionality

- 3 synced exchange accounts

- 1 blockchain wallet

- 1 account per exchange

- Limited manual trading features

- No automated trading features

- Plus Plan: $9.99/month

- 5 exchange accounts

- 5 blockchain wallets

- 2 accounts per exchange

- 100 open GC orders

- 10 price alerts

- 1 DCA algo (10 levels)

- 1 Grid algo (25 levels each)

- 1 Infinity Trailing algo

- Trailing orders and TP+SL combos

- Pro Plan: $14.99/month

- 10 exchange accounts

- 10 blockchain wallets

- 10 accounts per exchange

- 500 open GC orders

- 150 price alerts

- 15 DCA algos (15 levels each)

- 10 Grid algos (50 levels each)

- 15 Infinity Trailing algos

- Multiple Take Profits

- TradingView webhooks

- 10% DEX swap fee discount

- Max Plan: $24.99/month

- 50 exchange accounts

- 50 blockchain wallets

- 50 accounts per exchange

- 1000 open GC orders

- 300 price alerts

- 30 DCA algos (30 levels each)

- 20 Grid algos (100 levels each)

- 30 Infinity Trailing algos

- Trailing and Limit TP for DCA

- 15% DEX swap fee discount

- All Pro plan features

- Ultimate Plan: $499 (one-time payment)

- 100 exchange accounts

- 100 blockchain wallets

- 100 accounts per exchange

- 5000 open GC orders

- 1000 price alerts

- 100 DCA algos (250 levels each)

- 100 Grid algos (150 levels each)

- 100 Infinity Trailing algos

- 50% DEX swap fee discount

- Ultimate NFT: 0.33 ETH (one-time payment)

- Same as Ultimate plan with exclusive benefits

GoodCrypto offers 7 days free for Plus plan and 14 days free for Pro and Max plans. They also offer a 50% discount for annual subscriptions.

Free vs. Paid Features

What You Get for Free with Bitsgap

Bitsgap's free tier is primarily designed as a demo environment:

- Manual Trading: Access to the basic trading terminal

- Demo Mode: 20 active bots in demo mode to test strategies without real funds

- Smart Orders: Access to smart order types like stop-limit and OCO

- Technical Analysis Tools: Basic charting and analysis capabilities

- Exchange Connectivity: Connect to supported exchanges (though with limited functionality)

The free tier is essentially a "try before you buy" option rather than a full-featured free version.

What You Get for Free with GoodCrypto

GoodCrypto's free plan offers more functional capabilities:

- Limited Exchange Connections: Connect up to 3 exchange accounts

- Basic Portfolio Tracking: Connect 1 blockchain wallet

- Basic Manual Trading: Access to fundamental trading tools

- Multiple Account Support: 1 account per exchange

- Basic Order Management: Create and manage a limited number of orders

While still limited, GoodCrypto's free tier appears to offer more practical utility for basic trading and portfolio management compared to Bitsgap's demo-focused approach.

Unique Value Propositions of Bitsgap vs GoodCrypto App Review

Bitsgap's Distinctive Value

- AI Portfolio Management: Advanced AI features in the Pro plan that optimize bot deployment

- Bot Quantity: Significantly more bots in higher tiers (250 DCA bots in Pro plan)

- Demo Environment: Robust demo capabilities for testing strategies

- Pre-made Strategies: Ready-to-use bot configurations based on tested approaches

GoodCrypto's Distinctive Value

- Lifetime Options: One-time payment options for unlimited usage

- DEX Integration: Native DEX trading capabilities with fee discounts

- Cross-Exchange Scale: Support for up to 100 exchange accounts

- Multiple Account Management: Up to 100 accounts per exchange

- Blockchain Integration: Support for up to 100 blockchain wallets

Cost-to-Feature Ratio Analysis

When we compare the cost per feature between the platforms:

- Bot Allowances:

- Bitsgap Pro: $108/month for 300 total bots = $0.36 per bot

- GoodCrypto Max: $24.99/month for 80 total algos = $0.31 per algo

- Exchange Connections:

- Bitsgap: All plans connect to 15+ exchanges but with varying bot allowances

- GoodCrypto Max: $24.99/month for 50 exchange accounts = $0.50 per exchange

- Advanced Features:

- Bitsgap emphasizes AI portfolio management and bot optimization

- GoodCrypto emphasizes cross-exchange strategy implementation and DEX integration

Overall Value Assessment

When considering all factors—price points, feature sets, exchange support, and unique capabilities—GoodCrypto’s lower subscription costs coupled with broader exchange support and comparable feature sets make it the more cost-effective choice.

However, Bitsgap may offer better value for traders who:

- Need a large number of DCA and Grid bots (250+ in the Pro plan)

- Prioritize AI-driven portfolio management

- Prefer deeper specialization in bot strategies over broader exchange connectivity

Conclusions and Recommendations: Bitsgap and GoodCrypto Review

After diving deep into the capabilities, interfaces, security measures, and pricing structures of both Bitsgap and GoodCrypto, we've developed a comprehensive understanding of what these leading crypto trading automation platforms offer. While both platforms deliver impressive functionality for cryptocurrency traders seeking to automate their strategies and optimize their returns, Bitsgap stands out in several key areas that make it particularly compelling for serious traders.

One of the most impressive aspects of Bitsgap is its thoughtfully designed user interface. The platform strikes an excellent balance between power and accessibility, making sophisticated trading strategies approachable even for those relatively new to cryptocurrency markets. The dashboard-centric design gives traders immediate visibility into performance metrics, while the intuitive bot setup process—often requiring just three clicks—eliminates unnecessary complexity. This polished user experience reflects Bitsgap's focus on making advanced trading tools accessible to traders of all experience levels.

When it comes to trading bots, Bitsgap particularly excels with its specialized bot types tailored to specific market conditions. The GRID and LOOP Bots efficiently capture profits in sideways markets, the DCA Bot reduces risk in volatile conditions and works well both on uptrends and downtrends, and the BTD Bot helps traders capitalize on market dips. This specialization allows traders to deploy the right tool for each market scenario, rather than trying to force a one-size-fits-all approach. The platform's COMBO and DCA Futures bots further extend these capabilities to the high-leverage world of futures trading, potentially multiplying returns for risk-tolerant traders.

Another standout advantage of Bitsgap is its AI Assistant, which can create an optimized portfolio of bots tailored to current market conditions. This AI-driven approach takes the guesswork out of bot selection and parameter setting, leveraging data analysis to identify the most promising opportunities. For traders who want to harness automation but lack the time or expertise to fine-tune strategies themselves, this feature provides substantial value that isn't matched by GoodCrypto's offerings.

The security architecture of Bitsgap is particularly impressive. Their "five layers of total security" approach includes encrypted API connections with no withdrawal permissions, advanced API protection mechanisms like countertrade prevention and IP whitelisting, OAuth integration for supported exchanges, 2048-bit RSA encryption (stronger than many banking applications), and two-factor authentication. Throughout seven years of operation, Bitsgap has maintained a spotless security record with no hacks or breaches—a remarkable achievement in the volatile crypto space.

While GoodCrypto offers broader exchange support with 35+ connections and appealing DEX integration, many traders will find that Bitsgap's more focused approach delivers better performance where it matters most. Bitsgap's emphasis on execution speed and reliability on major exchanges often translates to better fills and more consistent performance, especially for high-frequency strategies like grid trading.

If you're considering a crypto trading automation platform, we’d strongly recommend taking Bitsgap for a spin. Click the link below to sign up for a 7-day free trial on the Pro plan with no credit card required. The trial gives you access to 50 Grid bots, 250 DCA bots, the AI Assistant with portfolio mode, futures trading capabilities, and all the advanced features that make Bitsgap stand out in the market. Whether you're looking to capture profits in sideways markets with Grid trading, reduce risk with Dollar Cost Averaging, or leverage AI to optimize your trading, Bitsgap's Pro plan offers the comprehensive toolkit you need to elevate your crypto trading to the next level.