Bitsgap vs CryptoTradeMate

In this head-to-head comparison, we break down Bitsgap and CryptoTradeMate across trading bots, pricing, automation, and ease of use—so you can pick the platform that truly levels up your crypto game. Discover why traders prefer Bitsgap.

Welcome to another installment of our Bitsgap Comparisons series, where we take a close, honest look at how Bitsgap stacks up against other trading platforms in the crypto space. Our goal? To highlight what makes Bitsgap a standout solution for modern traders—while still giving you the facts so you can decide what works best for your needs.

In this article, we’ll dive into a head-to-head comparison between Bitsgap and CryptoTradeMate, evaluating both platforms across key areas such as:

- Automation tools and trading strategies

- Exchange connectivity and supported integrations

- Security features and account protection

- Pricing and value for money

- Overall user experience and functionality

Whether you're a seasoned trader or just starting your crypto journey, understanding the strengths and limitations of each platform is essential. So let’s get into it—Bitsgap vs CryptoTradeMate: which one earns your trust and trading volume?

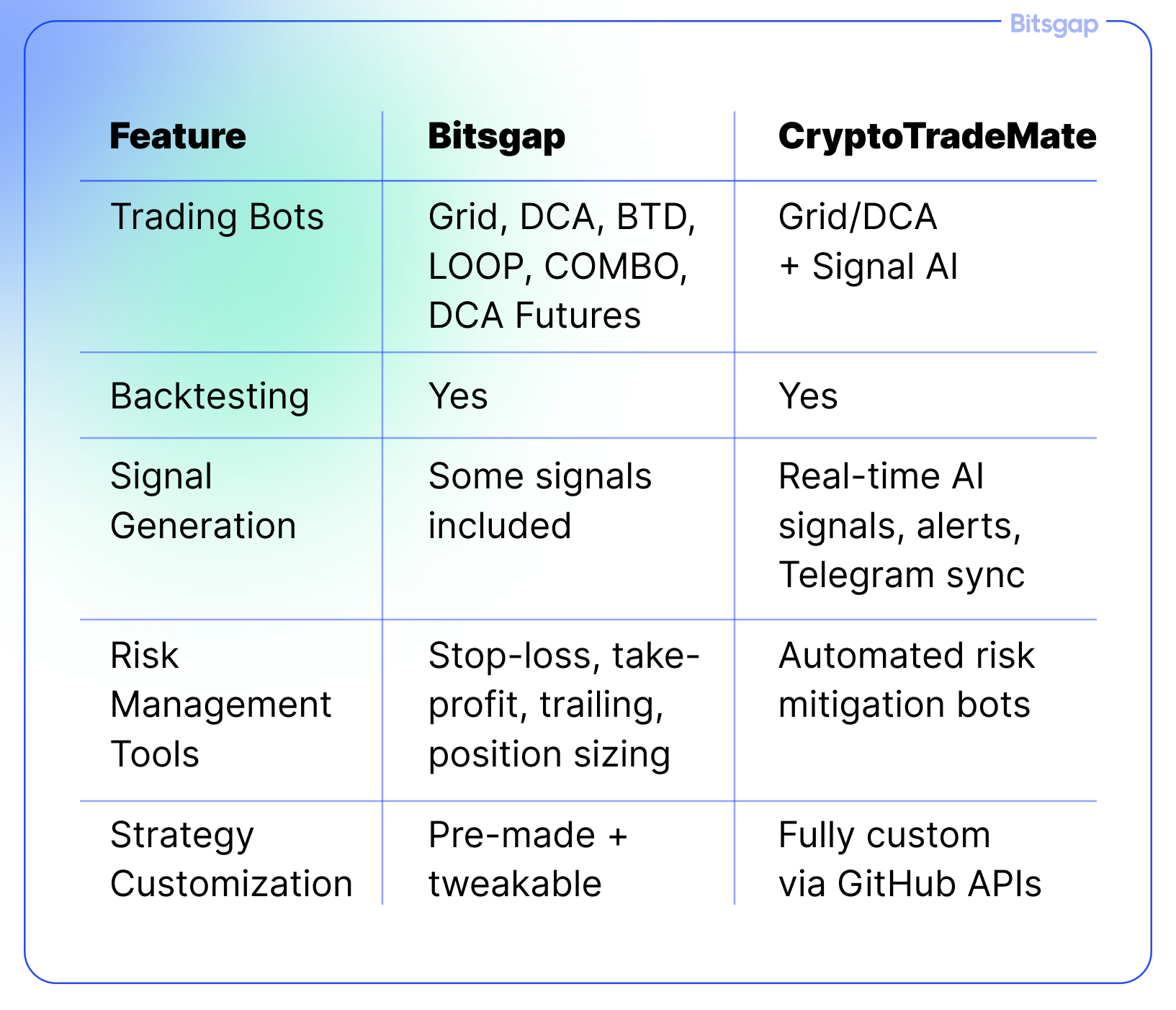

Main platform features: Bitsgap vs CryptoTradeMate

Both Bitsgap and CryptoTradeMate offer advanced trading platforms tailored for crypto traders, but they differ in design philosophy, target audience, and the depth of tools provided.

Bitsgap: All-in-One Crypto Trading Suite

Bitsgap positions itself as a complete trading automation and portfolio management platform, renowned for its robust bots and seamless exchange integration. It is ideal for users looking for a reliable, security-first, user-friendly system that supports both beginners and pros.

Core Features:

- 6 Advanced Trading Bots: GRID, DCA, DCA Futures, Buy-the-Dip (BTD), LOOP, and COMBO bots for diverse strategies.

- Smart Trading Terminal: Unified dashboard supporting 15+ major crypto exchanges like Binance, KuCoin, Coinbase, OKX, Kraken, and more.

- Portfolio & Risk Management: Full performance analytics, trailing stop loss, take profit, and API-based security.

- Backtesting & Pre-Built Strategies: Traders can simulate bots on historical data and launch in 3 clicks.

- Demo Mode & 7-Day Free Trial: Fully functional trial with no credit card required.

- High-End Security: 2048-bit encryption, counter-trade protection, API whitelisting, and no withdrawal rights on API keys.

CryptoTradeMate: AI-Powered & Open-Source Ecosystem

CryptoTradeMate (CTM8) stands out as a developer-friendly, AI-first trading platform, offering an open-source stack and token-based economy. Its modular design favors flexibility and customization, especially appealing to tech-savvy users and collaborative communities.

Core Features:

- AI Signal Bots & Automated Strategies: Bots based on Scalping, Trend Following, Risk Management, and real-time analytics.

- Open-Source Architecture: Enables users to build, test, and deploy custom strategies via GitHub.

- Backtesting & Market Screener: Includes indicators like RSI, MACD, Bollinger Bands, with full strategy optimization tools.

- Sentiment Tools: Fear & Greed Index to assess market mood.

- Portfolio Monitoring: Tracks balances across exchanges and supports stop-loss, take-profit orders.

- Staking, Token Utility & Governance: Holding CTM8 unlocks premium tools, discounts, and governance votes.

- Exchange Support: Compatible with Binance, KuCoin, Coinbase, OKX, and more.

Automation & Algorithmic Trading

Target Audience & Use Cases

- Bitsgap: Ideal for retail traders, advanced hobbyists, and small-scale portfolio managers looking for polished, out-of-the-box solutions. Simplicity, performance, and security are its strengths.

- CryptoTradeMate: Best suited for developers, open-source contributors, and power users who want to experiment, automate, or run decentralized signal-sharing setups. Appeals to those looking for flexibility and token-driven incentives.

👉 In summary, Bitsgap emphasizes a clean, intuitive experience backed by enterprise-grade security, whereas CryptoTradeMate offers a decentralized, highly customizable toolkit focused on AI and community contribution.

Automated Trading: Bitsgap vs CryptoTradeMate

Automated trading is at the heart of modern crypto strategies—removing emotion, optimizing timing, and enabling 24/7 execution. In this section, we compare how Bitsgap and CryptoTradeMate equip users with algorithmic tools to trade smarter, faster, and safer.

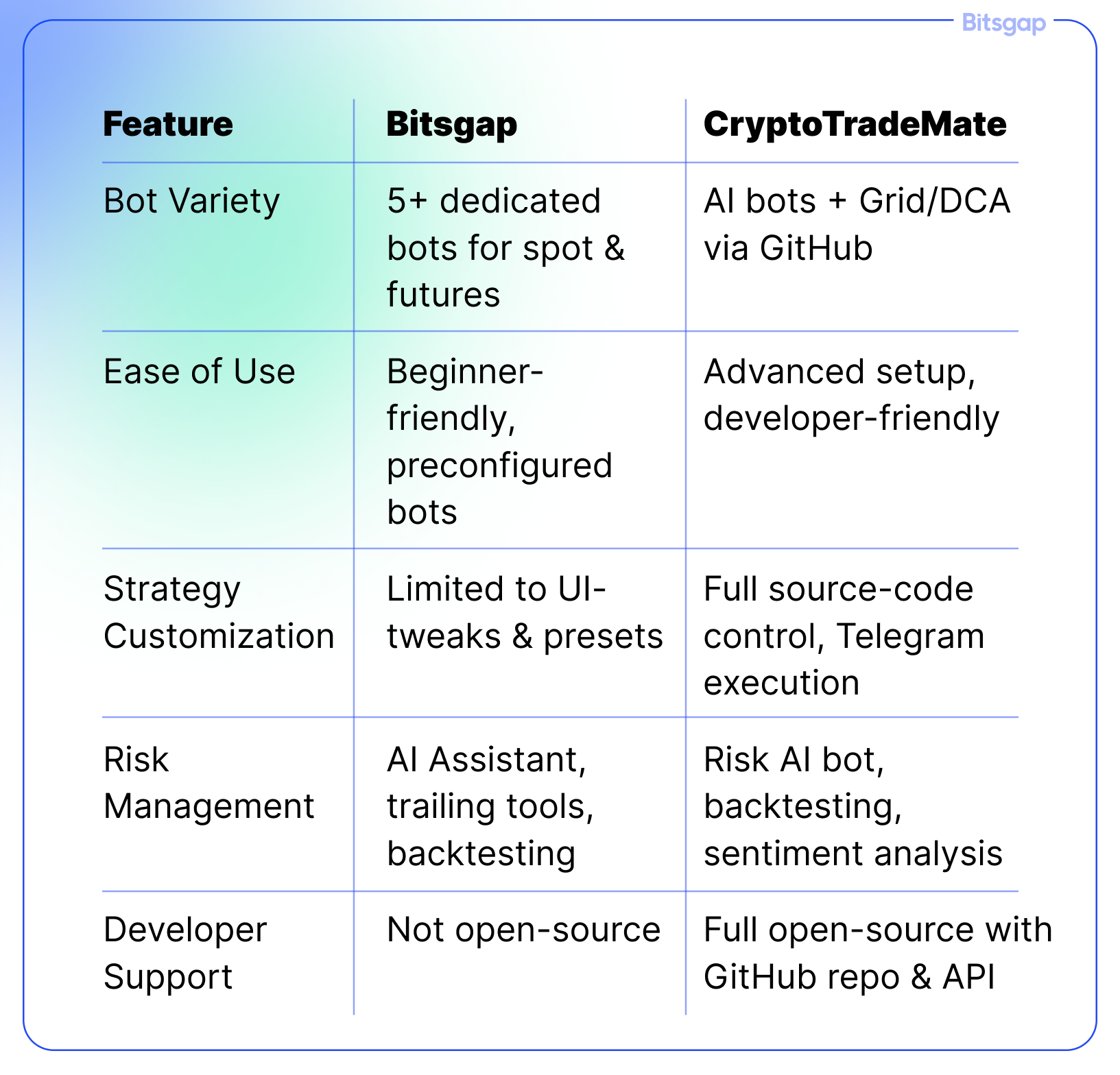

Types of Trading Bots

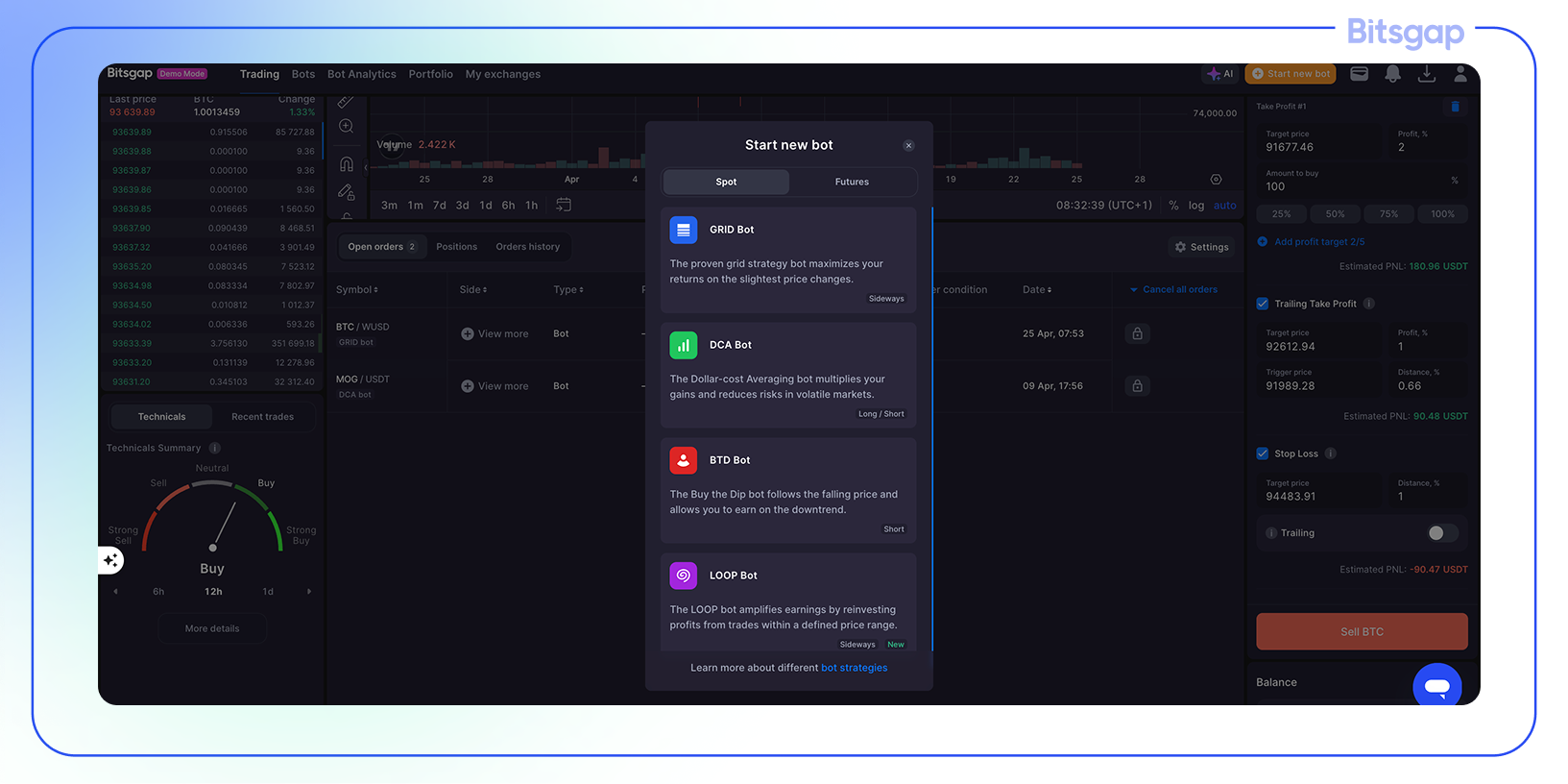

Now let’s look at the types of bots available on both platforms:

Bitsgap

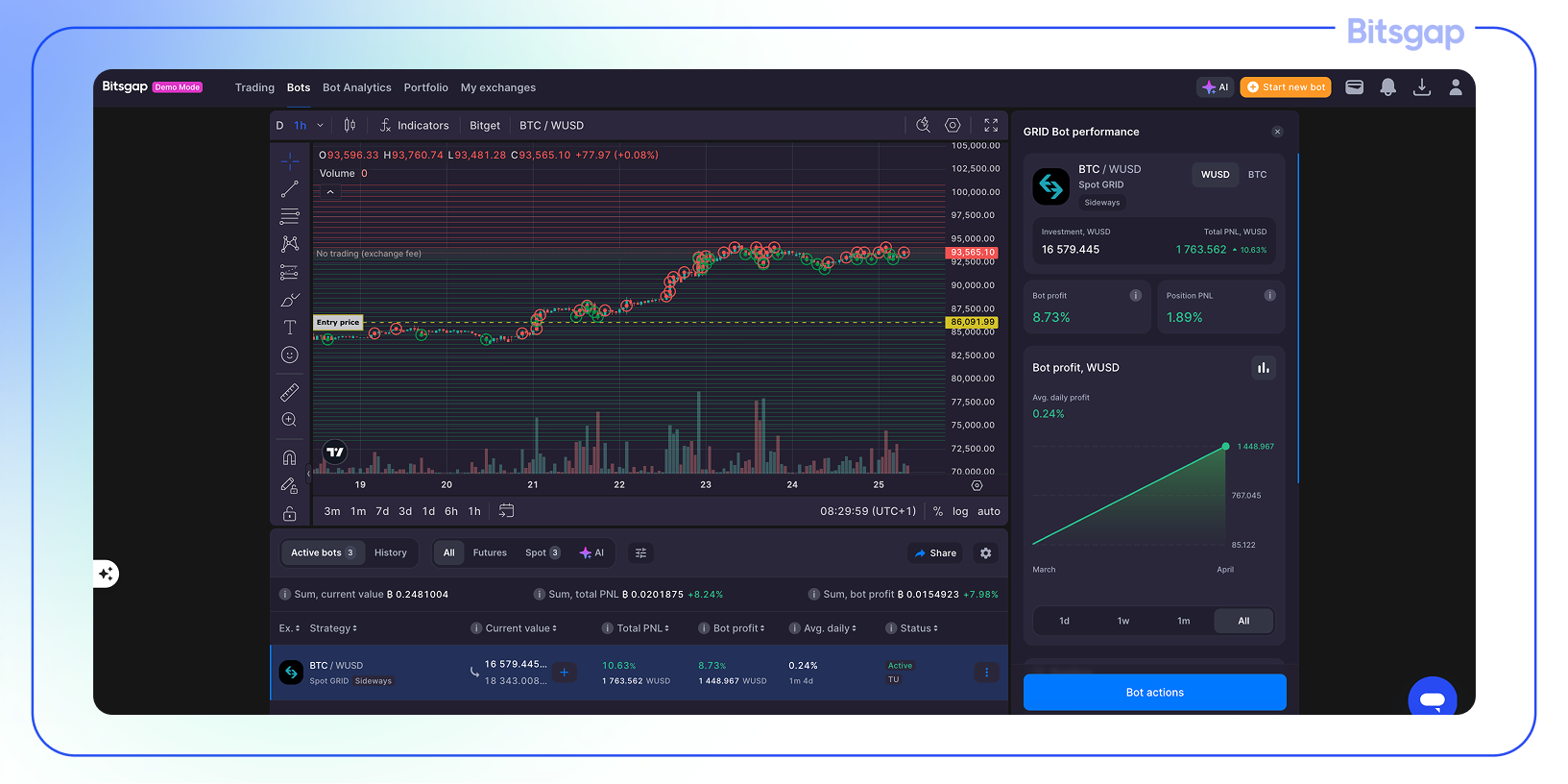

Bitsgap offers six distinct bots, each optimized for a particular market condition:

- GRID Bot: Best for sideways markets; executes trades within fixed price ranges.

- DCA Bot: Applies Dollar-Cost Averaging for long or short positions in volatile markets.

- BTD Bot: “Buy the Dip” logic designed to accumulate assets during downturns.

- LOOP Bot: Unique position trading bot that earns in two currencies and reinvests profits.

- COMBO Bot: Fuses GRID and DCA logic for high-reward futures trading.

- DCA Futures Bot: Targets leverage-enhanced gains on futures pairs.

Additionally, Bitsgap’s AI Assistant can launch a portfolio of bots based on user risk profiles and market conditions, offering smart balancing and stop-loss/take-profit automation across multiple bots.

CryptoTradeMate

CryptoTradeMate features a flexible set of AI-powered bots:

- Scalping AI: Targets micro-gains through high-frequency trades.

- Trend Following AI: Captures broader price movements by following prevailing trends.

- Risk Management AI: Automates stop-losses and take-profits to safeguard positions.

- Grid and DCA Bots: Included in the open-source GitHub bot, usable via Telegram and webUI.

These bots are backed by real-time data, machine learning algorithms, and are integrated across Binance, KuCoin, OKX, and others.

Customization and Strategy Flexibility

Bitsgap

While Bitsgap emphasizes ease of use with pre-built strategies and backtesting, its customization is somewhat guided. You can adjust bot parameters and test setups against historical data, but full code-level customization isn’t supported out-of-the-box.

The AI Assistant provides a simplified setup where users can select investment amounts and let the platform curate a diversified bot portfolio—ideal for users prioritizing convenience.

CryptoTradeMate

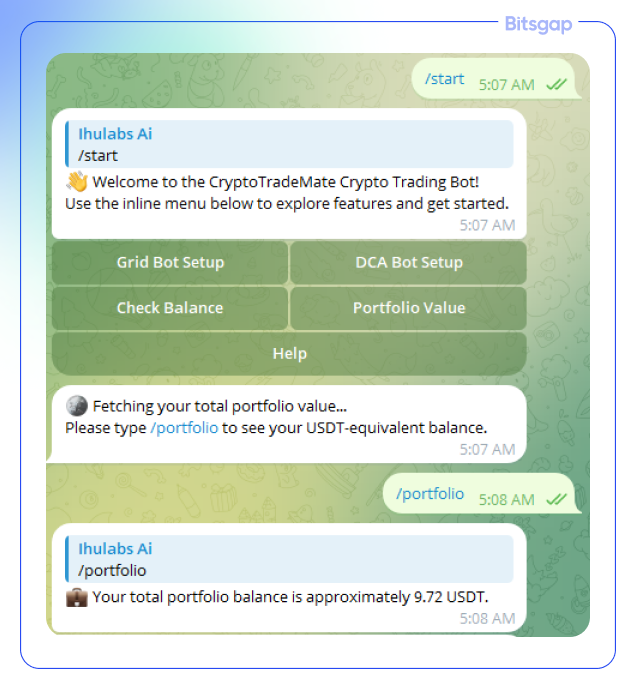

CryptoTradeMate is developer-first and fully open-source. Users can build, fork, or completely rewrite bot logic from its GitHub repository. Its Telegram integration makes real-time strategy deployment and bot interaction seamless.

For advanced users, the platform offers API access, allowing full algorithmic control and strategy automation. The Pro and Developer tiers include access to signal generation APIs and higher rate limits for high-frequency use cases.

Automation Philosophy: Presets vs DIY

- Bitsgap leans toward preset strategies and plug-and-play convenience. It's designed for both beginners and pros, with minimal configuration needed to launch high-performing bots.

- CryptoTradeMate is geared toward manual configuration and developer experimentation. It's best for users wanting to tweak or build strategies from scratch with full access to code and parameters.

Risk Management Tools

Both platforms are equipped with robust safety nets:

Bitsgap

- Integrated Take Profit / Stop Loss / Trailing Features

- Smart Balancing and Portfolio Lock-in via AI Assistant

- API-based security (read-only, no withdrawal rights)

- Backtesting tools to validate risk before live deployment

CryptoTradeMate

- Risk Management AI Bot handles real-time portfolio protection.

- Backtesting and Drawdown Analysis enable strategic planning.

- Sentiment tools like the Fear & Greed Index guide discretionary inputs.

- Position sizing and stop-loss automation come standard.

Summary: Which Automation Approach Wins?

👉 If you want fast deployment and plug-and-play power—Bitsgap is your go-to. But if you're seeking open-source control and deep customizability—CryptoTradeMate might be your ideal playground.

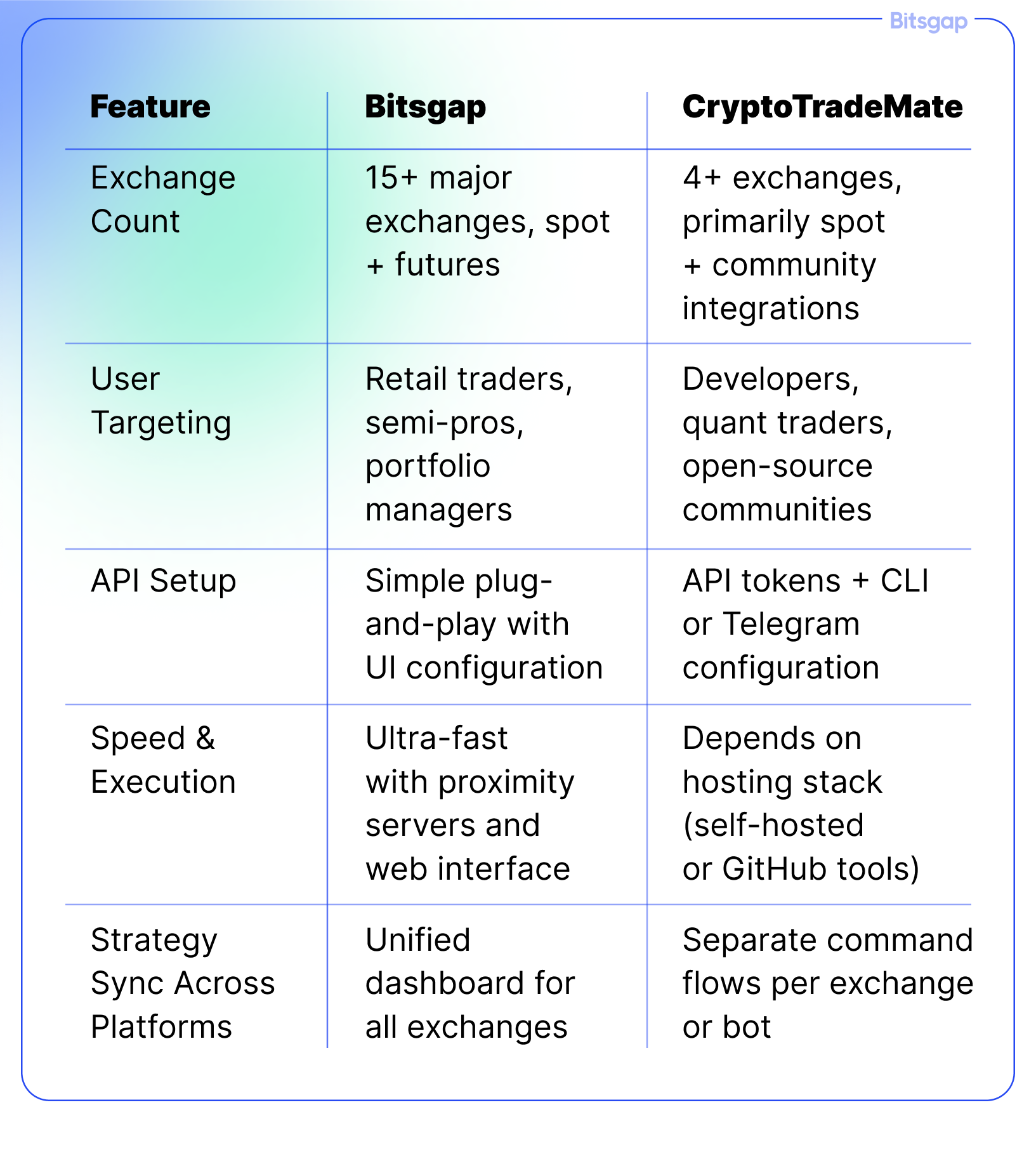

Exchange Support: Bitsgap vs CryptoTradeMate

When it comes to automated trading, exchange support is more than just a checklist item—it's the core infrastructure that determines reach, speed, and strategy flexibility. This section compares the number and quality of exchanges supported by Bitsgap and CryptoTradeMate, along with insights into their API integrations and execution performance.

Number & Range of Supported Exchanges

Bitsgap

Bitsgap supports a broad and diverse range of 15+ major crypto exchanges, giving traders access to both high-liquidity and niche trading environments.

Supported Exchanges Include:

- Top-tier: Binance, Coinbase, Kraken, OKX, KuCoin

- Other majors: Bitfinex, Gate.io, Crypto.com, Gemini, HTX, Bitget

- Alt-heavy platforms: Poloniex, WhiteBIT, BitMart, HitBTC

This coverage enables users to trade over thousands of pairs across both spot and futures markets, significantly expanding their strategy canvas. For instance, KuCoin alone offers over 3,200 trading pairs accessible via Bitsgap.

CryptoTradeMate

CryptoTradeMate supports a smaller, but well-targeted set of exchanges primarily optimized for automation and open-source interaction:

Supported Exchanges Include:

- Binance

- KuCoin

- OKX

- Coinbase (via GitHub-based bot)

These platforms cover the vast majority of trading volume for retail users and are accessible via API integration, providing 24/7 automated execution and performance monitoring.

API Integration & Execution Speed

Bitsgap

Bitsgap has refined API connectivity for speed, stability, and security:

- High-frequency trade execution with close-to-exchange server placement.

- Read-only API keys with no withdrawal rights—enhancing security.

- Exchange switching and bot management are real-time and seamless.

- All trades, bots, and smart orders run through a single centralized dashboard, making multi-exchange execution more manageable.

CryptoTradeMate

CryptoTradeMate’s API system is developer-focused:

- Built using CCXT in the backend for reliable exchange integration.

- Full Telegram interface for API-triggered trading (e.g., deploying bots or checking balances).

- Open-source environment allows custom command sets and manual strategy routing.

- While robust, performance speed depends on implementation and host setup (e.g., self-hosted on cloud or local server).

Differences in Exchange Approach

Centralized Convenience or Developer Control?

- If you're looking for maximum exchange coverage, instant execution, and easy multi-exchange management, Bitsgap provides a polished solution ready for action out of the box.

- If your preference is open-source flexibility, and you don’t mind rolling up your sleeves to control every layer of your strategy—including which exchange handles what—then CryptoTradeMate is your playground.

👉 Both platforms offer robust exchange integration, but Bitsgap shines in scope and speed, while CryptoTradeMate champions customizability and decentralized deployment.

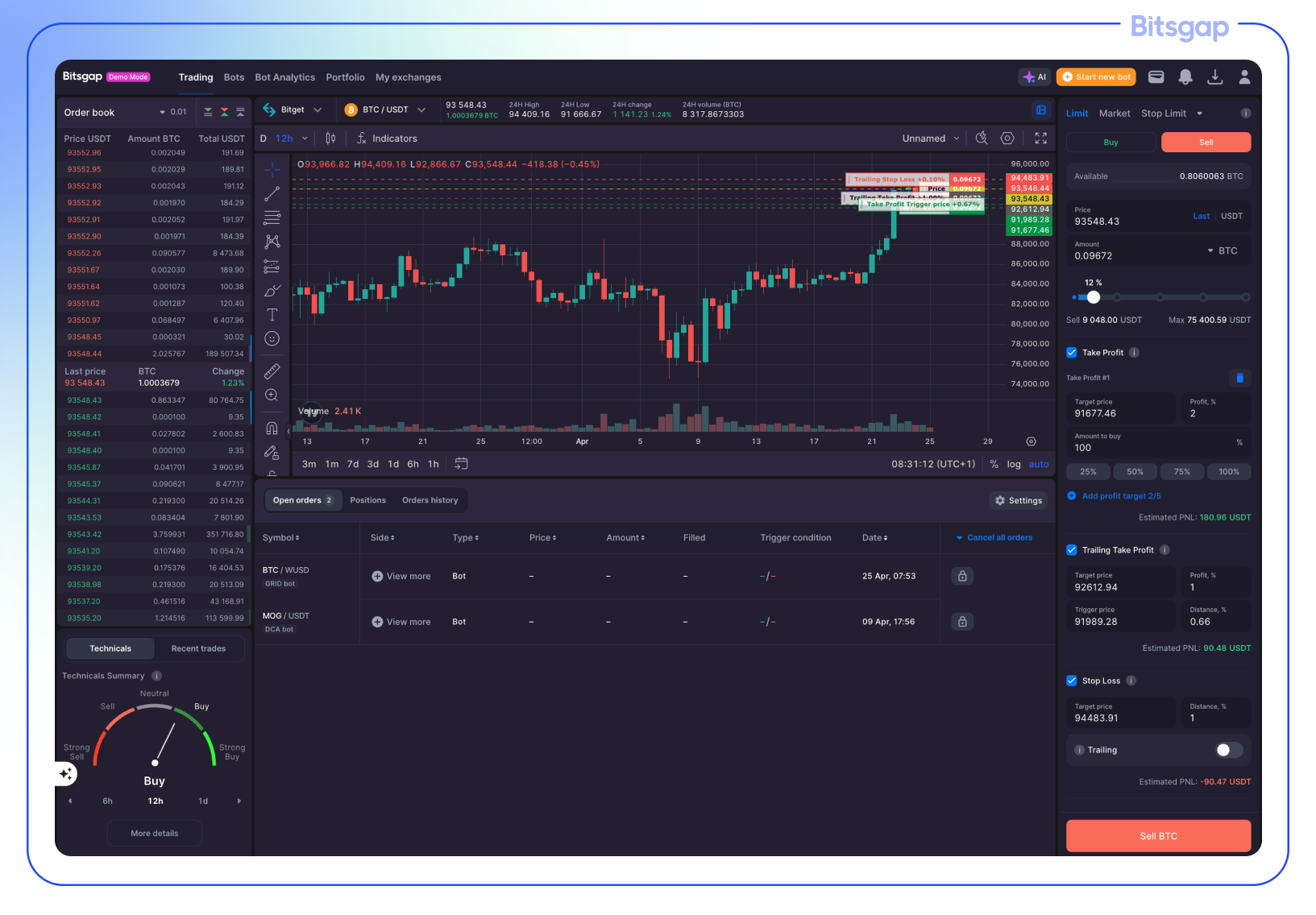

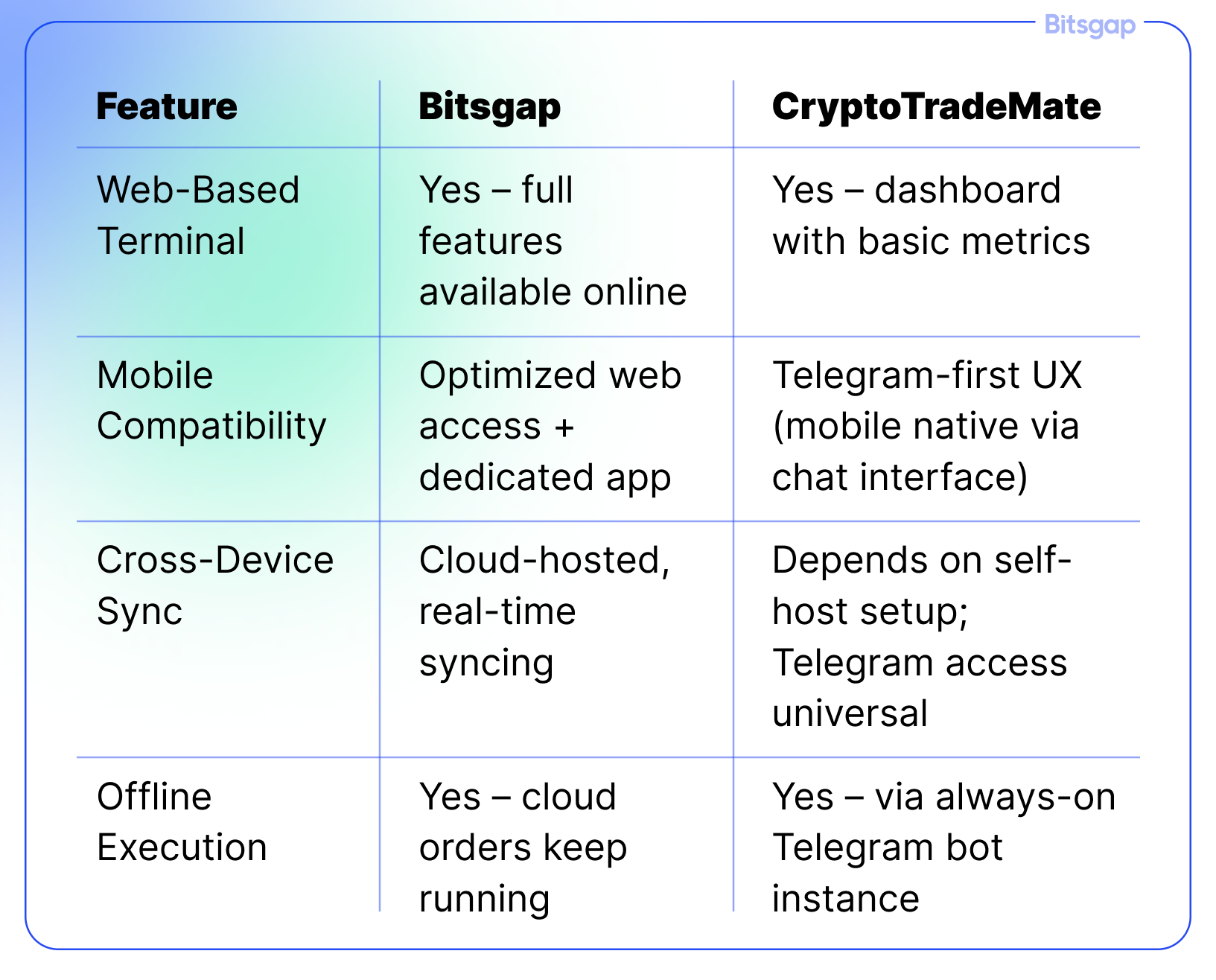

Terminal, Interface & Ease of Use

A powerful trading engine is only as effective as the interface that delivers it. Whether you're executing complex trades or automating a portfolio, a smooth, intuitive experience makes all the difference. Here's how Bitsgap and CryptoTradeMate compare in terms of their interface, smart trading features, and overall accessibility for traders at all levels.

Trading Terminals: Precision vs. Personalization

Bitsgap: Advanced Yet Accessible

Bitsgap’s trading terminal is polished, professional, and highly versatile. Designed to centralize trading across 15+ exchanges, it includes:

- Smart Order Types: Market, Limit, Stop-Limit, TWAP, Scaled, OCO, and Trailing Orders.

- Manual Smart Trading Tools: Take-Profit, Stop-Loss, and real-time portfolio tracking across all accounts.

- 100+ Indicators via TradingView integration for in-depth technical analysis.

- Cloud-based execution: Your orders stay active even if you're offline.

Whether you’re placing precision entries with limit orders or trailing your profits during volatility, Bitsgap’s terminal supports multi-layered strategies in one unified interface.

CryptoTradeMate: Modular and Telegram-Driven

CryptoTradeMate takes a more decentralized and lightweight approach to its terminal:

- Web dashboard offers access to real-time AI signals, performance metrics, and customizable analytics.

- Telegram Bot Terminal: A command-driven interface lets you deploy Grid or DCA strategies, view balances, and manage trades through simple messages.

- Inline menus and command shortcuts make it easy to interact, but this format suits users comfortable with CLI-style input.

For users comfortable with Telegram or looking to self-host their terminal, CryptoTradeMate’s minimal UI could be a strong advantage.

Beginner Friendliness and Learning Curve

Bitsgap

Bitsgap is clearly optimized for accessibility:

- All-in-one dashboard for bots, analytics, and terminal functions.

- Preset strategies with visual bot setup make it friendly for beginners.

- Free 7-day PRO trial and demo mode ensure a risk-free start.

- Onboarding tutorials, support articles, and tooltips make navigation simple.

The intuitive drag-and-drop layout, interactive charts, and dropdown-driven logic significantly reduce the intimidation factor.

CryptoTradeMate

While CryptoTradeMate offers strong guidance for technically inclined users, beginners may face a steeper learning curve:

- Open-source GitHub setup, CLI instructions, and Telegram commands are best suited for developers or advanced traders.

- Documentation is available but assumes comfort with scripting or system-level installs.

- Dashboard UI offers clean metrics, but lacks the visual depth of a modern graphical interface.

That said, its community-driven model provides active support via GitHub and Telegram, and devs can unlock Pro features through contributions.

Mobile & Desktop Accessibility

👉 Bitsgap provides a more refined, plug-and-play experience across desktop and mobile, while CryptoTradeMate’s Telegram interface ensures control from any device, albeit in a more technical format.

Final Thoughts

- Bitsgap shines in visual clarity, onboarding flow, and advanced manual trading features. It's ideal for users who want a sleek, all-in-one experience without coding.

- CryptoTradeMate stands out for devs, tinkerers, and bot-builders who prefer open systems, Telegram flexibility, and low-overhead setups.

Both platforms are effective in their own right—Bitsgap offers comfort and control, while CryptoTradeMate offers customization and command.

Security and data protection: Bitsgap vs CryptoTradeMate

When selecting a crypto trading platform, security is paramount. Both Bitsgap and CryptoTradeMate implement measures to protect user data and funds, though their approaches differ. Here's a comparative overview:

API Key Management & Encryption

Bitsgap:

- Encrypted API Keys: Utilizes 2048-bit RSA encryption, surpassing the security standards of many online banking systems.

- Withdrawal Restrictions: API keys are configured to disallow withdrawals, limiting potential misuse.

- IP Whitelisting: Allows users to restrict API access to specific IP addresses.

- Duplicate Key Prevention: Ensures each API key is unique to a single account, preventing unauthorized reuse.

- OAuth Integration: Supports OAuth for secure authentication with exchanges like Binance and OKX.

CryptoTradeMate:

- Secure API Storage: Emphasizes the secure storage of API keys, though specific encryption standards are not detailed.

- User-Controlled Permissions: Encourages users to set API permissions that limit access, enhancing security.

Data Protection & Risk Mitigation

Bitsgap:

- No Custodial Access: Does not store user funds; all assets remain on the user's exchange accounts.

- Countertrade Protection: Employs algorithms to detect and prevent unauthorized trading activities.

- Regular Security Audits: Conducts internal audits to identify and address potential vulnerabilities.

CryptoTradeMate:

- Open-Source Transparency: Being open-source allows for community scrutiny, potentially identifying and addressing security issues.

- User Responsibility: Places the onus on users to implement best security practices, such as secure API management and system configurations.

👉 Bitsgap offers a robust, enterprise-level security framework suitable for users seeking a managed environment with stringent protections. Conversely, CryptoTradeMate provides flexibility and transparency, appealing to technically adept users comfortable with configuring and managing their own security protocols.

Prices and Tariff Plans: Bitsgap vs CryptoTradeMate

When evaluating crypto trading platforms, understanding their pricing structures and the value they offer is crucial. Here's a comparative analysis of Bitsgap and CryptoTradeMate, focusing on their subscription models, features available in free and paid plans, and the overall value proposition for traders.

Subscription Models: Bitsgap vs. CryptoTradeMate

Bitsgap

Bitsgap operates on a tiered subscription model with three primary plans:

- Basic: $23/month

- 2 active GRID bots

- 10 active DCA bots

- Unlimited smart orders

- Access to 15+ exchanges

- Demo practice mode

- Backtesting tools

- Advanced: $55/month

- 25 active GRID bots

- 250 active DCA bots

- Futures bots

- Trailing features

- Take Profit for bots

- Pro: $119/month

- All features from Advanced

- AI optimization tools

- Priority support

All plans come with a 7-day free trial of the Pro plan, allowing users to test premium features before committing.

CryptoTradeMate

CryptoTradeMate offers a more flexible pricing structure, including a free open-source option and several paid plans:

- Free (Open-Source): $0

- Limited access to market screener & signal bots

- Basic portfolio tracking

- Community trading signals

- Basic Plan: $9.99/month

- Full access to market screener

- AI trading signals

- Standard backtesting

- Pro Plan: $49.99/month

- All Basic features

- Automated trading bots

- Advanced analytics

- Premium signal alerts

- Developer API Access: $99.99/month

- API for automated strategies

- Access to signal generation API

- Extended API rate limits

Additionally, holding the platform's native token, $CTM8, can provide up to a 50% discount on Pro plans.

Free Plan Features

Bitsgap

The free plan offers:

- Unlimited manual trading

- 20 active bots for demo trading

- Support for over 15 exchanges

However, access to automated bots and advanced features is restricted.

CryptoTradeMate

The open-source free version provides:

- Limited access to market screener & signal bots

- Basic portfolio tracking

- Community trading signals

This plan is ideal for developers and traders comfortable with self-hosting and customization.

Value Proposition of Paid Plans

Bitsgap

Bitsgap's paid plans are tailored for traders seeking a comprehensive, user-friendly platform with robust automation features. The Advanced and Pro plans offer extensive bot capabilities, advanced trading tools, and integration with multiple exchanges, justifying the higher subscription costs for active traders.

CryptoTradeMate

CryptoTradeMate's paid plans cater to traders interested in AI-driven strategies and automation. The Pro plan, in particular, offers advanced analytics and premium signal alerts, providing significant value for its price point. The availability of discounts through $CTM8 holdings further enhances its affordability.

Conclusion & Final Verdict: Why Bitsgap Has the Edge

When comparing Bitsgap and CryptoTradeMate, it becomes clear that both platforms cater to different types of crypto traders—but Bitsgap stands out for its professional polish, comprehensive features, and ease of use.

- All-in-One Powerhouse: Bitsgap integrates smart trading tools, advanced bots, and multi-exchange management into a single, seamless interface.

- Enterprise-Grade Security: With 2048-bit encryption, no-withdrawal API keys, and secure cloud-based execution, Bitsgap sets the standard for platform security.

- Advanced Yet User-Friendly: Whether you're a novice or a seasoned trader, Bitsgap’s clean UI, smart presets, and backtesting make automation accessible to everyone.

- Superior Exchange Coverage: With support for 15+ top-tier exchanges, Bitsgap allows traders to diversify, arbitrage, and manage portfolios without switching platforms.

- Pro Tools for Real Traders: Take advantage of tools like trailing orders, Take Profit / Stop Loss, and AI-driven optimization—features often missing or limited on other platforms.

While CryptoTradeMate is a solid choice for developers and users seeking open-source customization and AI-powered experimentation, its technical orientation and limited exchange integration make it better suited for a niche audience.

If you're looking for a secure, professional, and full-featured crypto trading platform, it's time to test Bitsgap for yourself.

Sign up now and enjoy 7 days of the Pro plan—completely free.No credit card. No commitment. Just powerful bots, smart analytics, and a better way to trade.