Bitsgap vs Cryptohopper: Ultimate Comparison Guide

Choosing the wrong crypto trading bot could cost you thousands in missed opportunities and poor execution. Our comprehensive Bitsgap vs Cryptohopper comparison reveals which platform delivers superior automation, better security, and higher potential returns for serious crypto traders.

Welcome to the second installment of our Bitsgap Comparison Series, where we analyze how Bitsgap stacks up against other major automated cryptocurrency trading platforms. In our first installment, we compared Bitsgap vs. 3Commas, breaking down their features, usability, and advantages. Now, in this edition, we turn our focus to another popular competitor: Cryptohopper.

Both Bitsgap and Cryptohopper offer robust tools to help traders automate their crypto trading strategies, minimize risks, and maximize profitability. However, their approaches, features, and usability differ. This comparison will help you understand the strengths and weaknesses of each platform, guiding you toward the best choice based on your needs and trading style.

While both platforms offer grid trading, portfolio management, and advanced automation, we’ll highlight why Bitsgap remains the top choice for traders seeking a secure, efficient, and user-friendly experience.

Without further ado, let’s get started.

Platforms Overview: Cryptohopper & Bitsgap Review at a Glance

Bitsgap positions itself as an all-in-one crypto trading platform that streamlines portfolio management across multiple exchanges. Founded in 2017, Bitsgap has quickly established itself with over 650,000 traders using its services and more than 4.7 million bots launched. The platform excels at providing a unified trading experience by connecting 15+ leading cryptocurrency exchanges through a single dashboard, allowing users to seamlessly manage trading activities.

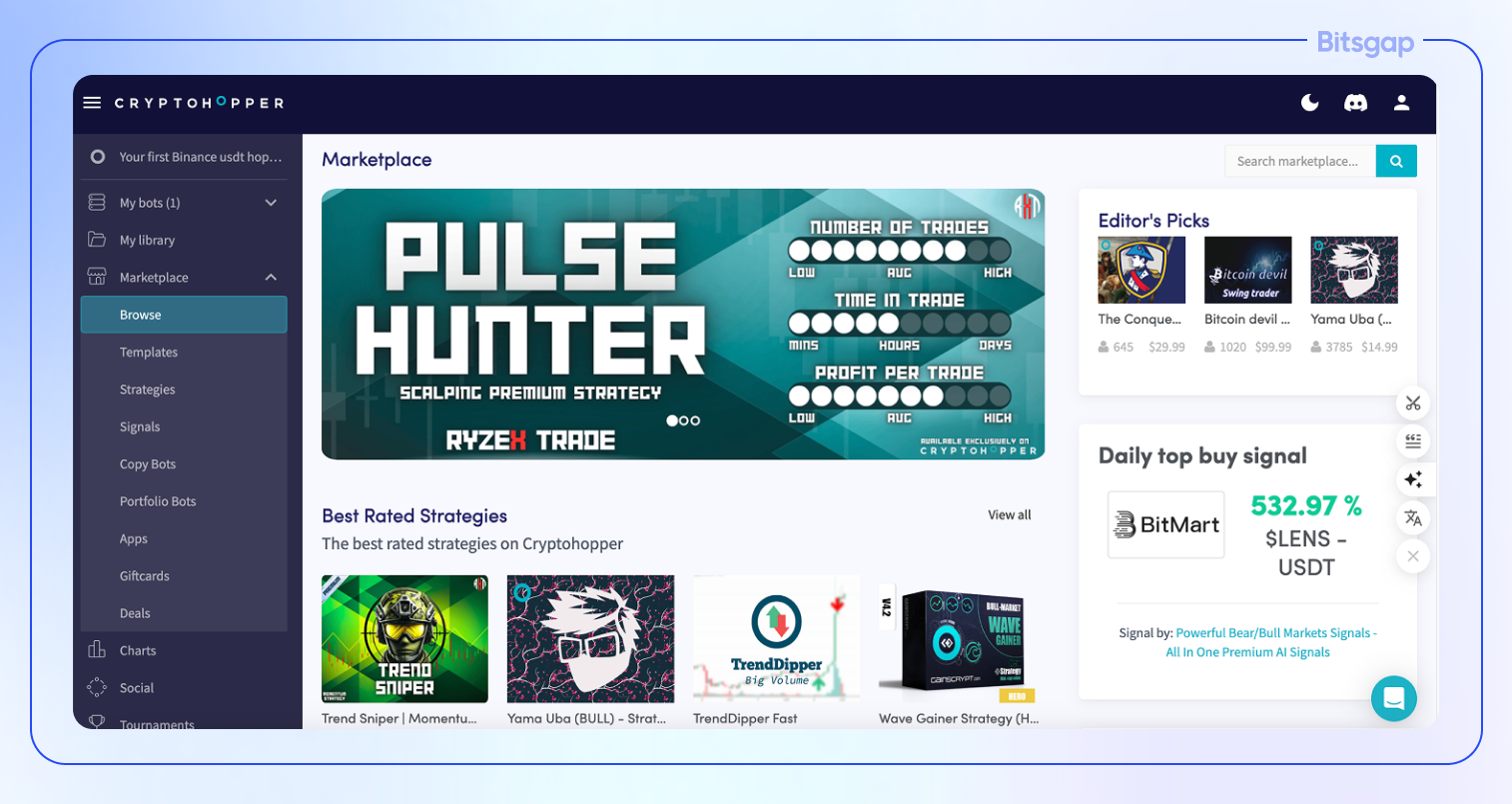

Cryptohopper markets itself as "the world's most customizable crypto trading bot," focusing on removing emotions from trading decisions while offering highly adaptable automation tools. The platform emphasizes its ability to serve traders across all skill levels, from beginners to algorithmic trading experts. Cryptohopper's core function is to enable users to automate their trading strategies with extensive customization options while providing a social trading environment where users can learn from and copy successful traders.

Key Platform Features

In this section, we’ll break down the core features of both platforms, highlighting their similarities, differences, and unique offerings.

Core Functions of Bitsgap and Cryptohopper

Both Bitsgap and Cryptohopper are designed to automate crypto trading, offering users various tools to simplify and enhance their trading experience. Their primary functions include:

- Automated Trading Bots—Allow traders to execute strategies without manual intervention.

- Smart Trading Tools—Features like Stop-Loss, Take-Profit, and Trailing Orders for risk management.

- Multi-Exchange Integration—Support for multiple crypto exchanges through secure API connections.

- Portfolio Management—Real-time tracking and management of crypto assets.

- Backtesting & Strategy Optimization—The ability to test and refine trading strategies using historical data.

While both platforms offer these fundamental capabilities, they differ in execution, customization, and advanced functionalities.

Key Tools Available on Both Platforms

Trading Bots

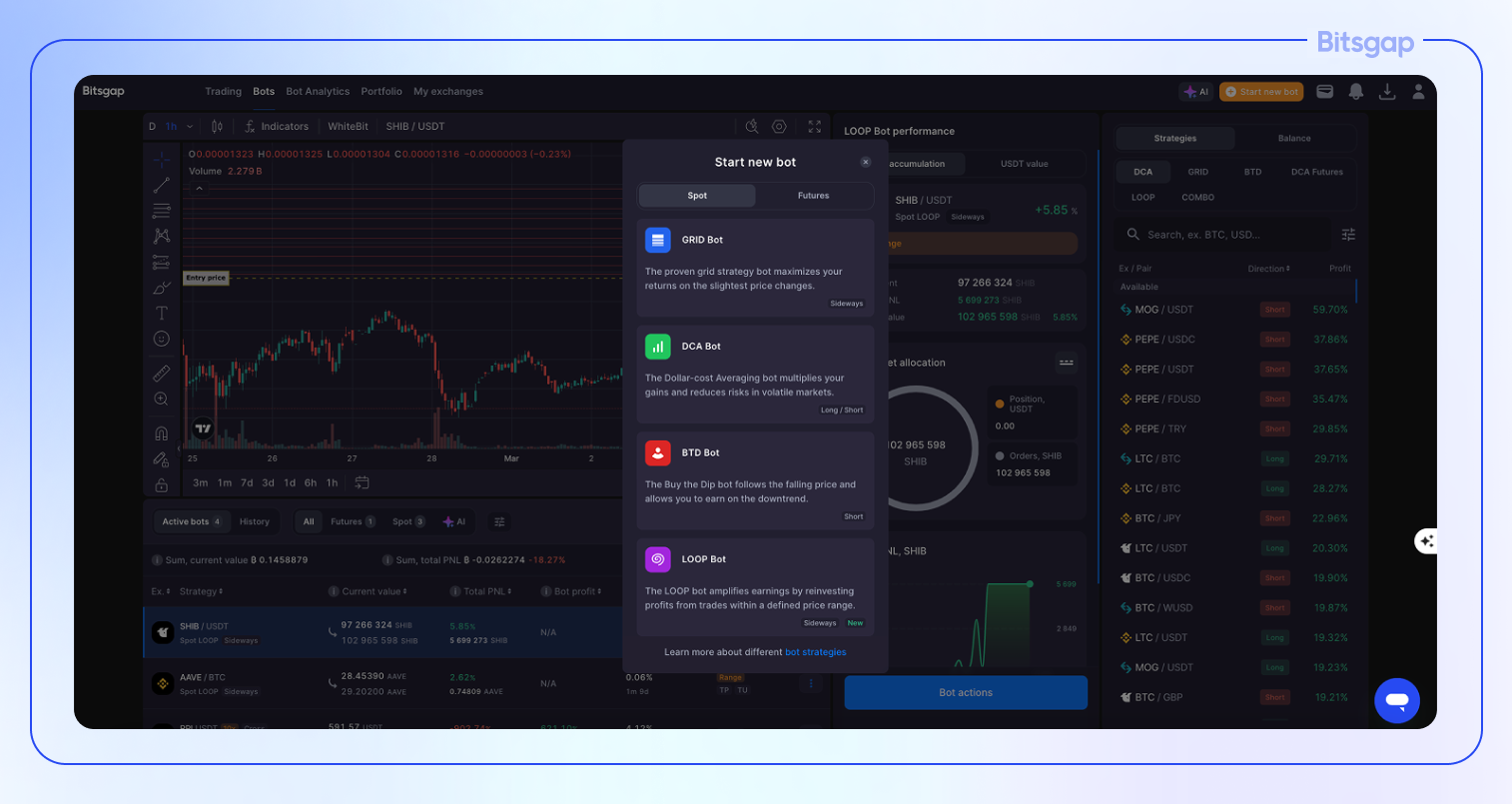

- Bitsgap: Provides a variety of automated bots, including GRID, DCA, BTD, LOOP, COMBO, and DCA Futures bots, catering to different market conditions and risk levels.

- Cryptohopper: Offers DCA, Arbitrage, Market-Making bots, along with AI-based automation for strategy selection.

Smart Trading Terminal

- Bitsgap: Features an advanced trading terminal where users can place algorithmic orders such as OCO, TWAP, Stop-Limit, and Scaled orders, enhancing precision.

- Cryptohopper: Provides a trading terminal with trailing stop-loss and short-selling options, allowing traders to react to market changes dynamically.

AI & Strategy Automation

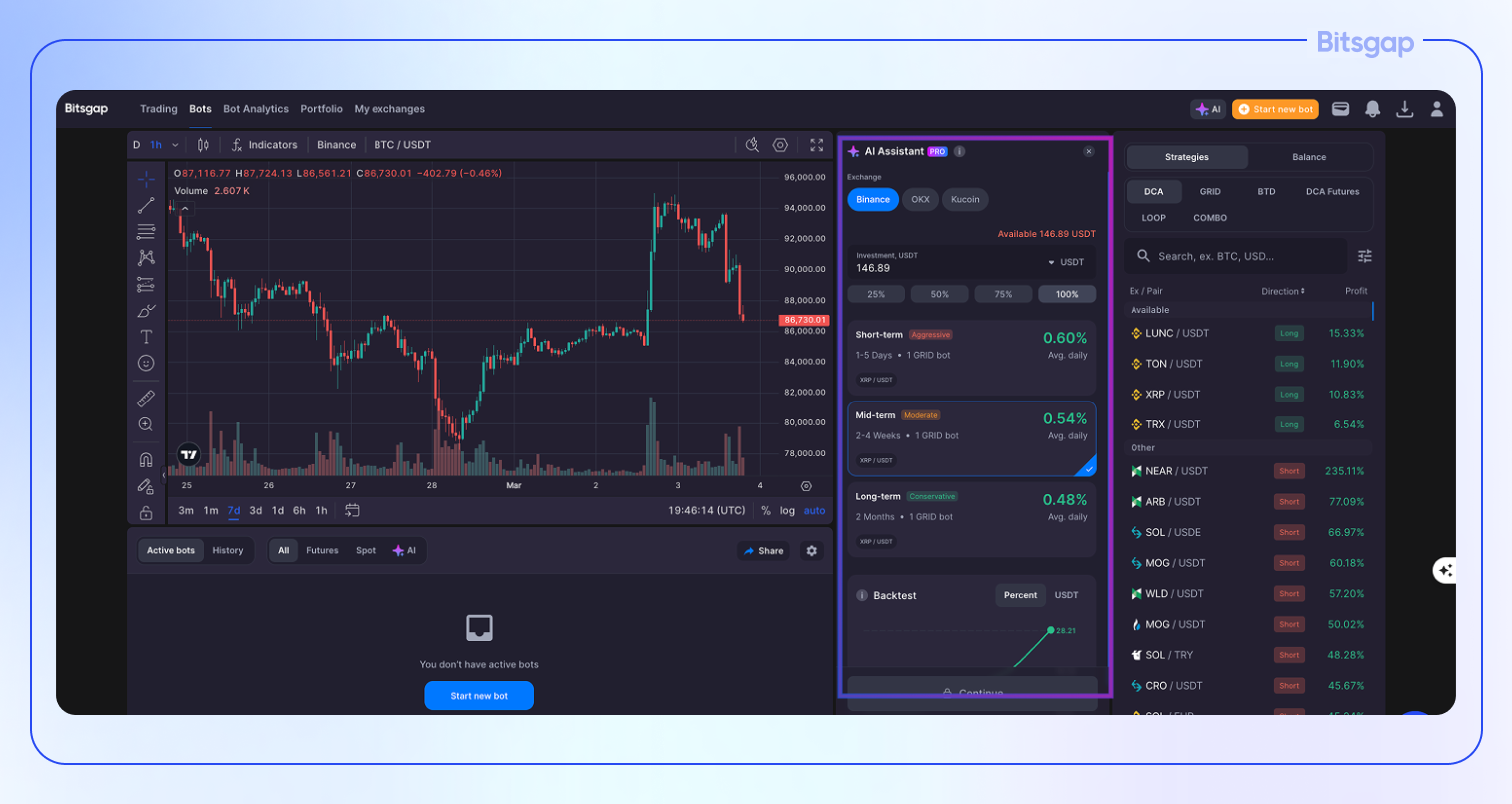

- Bitsgap: AI Assistant automatically builds and manages a portfolio of trading bots, optimizing for profitability.

- Cryptohopper: Uses AI-powered Algorithm Intelligence (AI) to analyze multiple strategies and select the best-performing one based on market conditions.

Backtesting & Strategy Marketplace

- Bitsgap: Offers pre-made strategies based on historical performance, with built-in backtesting for refining strategies.

- Cryptohopper: Features a strategy marketplace where users can buy and sell trading strategies, as well as a signals marketplace for copying expert traders.

Differences in Functionality & Unique Features

Bitsgap’s Unique Features

✅ AI Assistant—Automatically creates and manages a portfolio of bots for optimized trading.

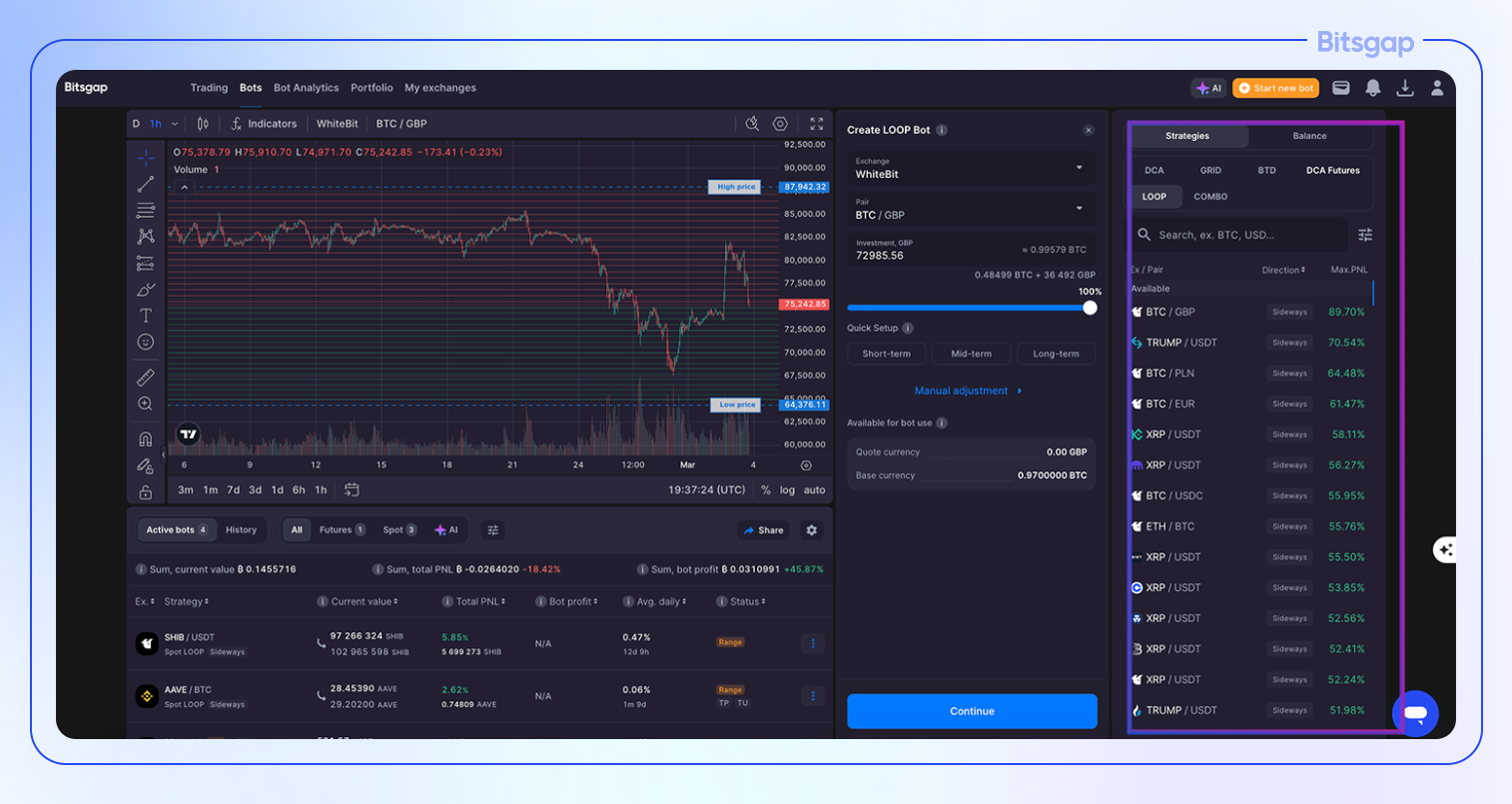

✅ Smart Algorithmic Orders—Supports TWAP, OCO, and Scaled Orders, providing more precise trade execution.✅ Unique Trading Bots—For instance, LOOP bot is an original position trading bot that earns in both currencies unlike anything else present on the market.

✅ Geared for an Easy Start—From a dedicated Strategies Widget that suggests optimized backtested strategies ranked by profitability to Quick Start options when setting up bots.

✅ Seamless Multi-Exchange Trading—Connects to 15+ major exchanges with a unified dashboard for portfolio management.

✅ Cloud-Based Execution—Ensures bots run 24/7, even if the user is offline.

Cryptohopper’s Unique Features

✅ Social Trading & Marketplaces—Allows users to copy expert traders, subscribe to trading signals, and purchase pre-configured strategies.

✅ AI Strategy Optimisation—The Algorithm Intelligence feature rates and ranks various strategies, selecting the best one dynamically.

✅ Arbitrage Trading—Enables exchange arbitrage, allowing traders to profit from price differences across platforms.

Automated Trading: Bitsgap vs Cryptohopper

Both Bitsgap and Cryptohopper offer powerful trading bots designed to optimize profits, reduce risks, and adapt to different market conditions. However, the types of bots, customization options, and risk management features vary between the two platforms.

In this section, we’ll compare the automated trading capabilities of Bitsgap and Cryptohopper, covering the available trading bots, their flexibility, effectiveness in different market conditions, and the risk management tools each platform provides.

Types of Trading Bots on Bitsgap and Cryptohopper

Bitsgap Trading Bots

Bitsgap provides a diverse selection of automated trading bots tailored to different market conditions:

- GRID Bot—Profits from small price movements in sideways markets.

- DCA (Dollar-Cost Averaging) Bot—Reduces risk by averaging entry prices over time.

- DCA Futures Bot—Designed for futures trading, allowing profits from both long and short positions.

- BTD (Buy the Dip) Bot—Accumulates crypto during downtrends, maximizing gains during recovery.

- LOOP Bot—Earns in both currencies, reinvests profits, and works best long-term.

- COMBO Bot—A hybrid GRID + DCA strategy for high-risk, high-reward futures trading.

- AI Assistant—Automatically creates and manages a portfolio of bots based on market analysis, a user’s budget, and risk preferences

Cryptohopper Trading Bots

Cryptohopper also provides several automated trading solutions, including:

- DCA Bot—Similar to Bitsgap’s DCA bot, averaging out entry prices to minimize losses.

- Market-Making Bot—Provides liquidity by placing buy and sell orders within a price range.

- Arbitrage Bot—Exploits price differences between exchanges for risk-free profits.

- Algorithm Intelligence (AI) Bot—Uses AI to analyze and optimize trading strategies.

- Copy Bot—Allows users to copy the trades of professional traders in the Cryptohopper marketplace.

Effectiveness of Bots in Different Market Conditions

Bitsgap

- Sideways Markets—The GRID Bot is highly effective in ranging markets, capturing profits from frequent price fluctuations.

- Clear Trends—The DCA Bot and DCA Futures Bot help mitigate risk in uncertain conditions while maximizing returns on clear trends.

- Bear Markets—The BTD Bot is built specifically for buying undervalued assets during downtrends.

- Long Term Trading—The LOOP bot is excellent at compounding wealth in both base and quote currencies long-term.

- High-Risk Trading—The COMBO Bot is optimized for futures trading, offering amplified gains (but also higher risks).

Cryptohopper

- Trending Markets—The AI Bot dynamically adjusts strategies based on market trends, making it effective in both bull and bear markets.

- Arbitrage Opportunities—The Arbitrage Bot is useful when price discrepancies exist across different exchanges.

- Long-Term Investors—The DCA Bot helps long-term traders accumulate assets gradually, reducing exposure to market volatility.

- Short-Term Trading—The Market-Making Bot is designed for high-frequency trading, ensuring liquidity in low-volatility conditions.

Risk Management Features on Each Platform

Bitsgap

✅ Stop-Loss & Take-Profit—Ensures traders lock in gains and limit losses automatically.

✅ Trailing Features—Trailing Stop-Loss and Trailing Take-Profit help secure profits in volatile markets.

Cryptohopper

✅ Trailing Stop-Loss & Trailing Buy—Helps traders capture profits while minimizing downside risk.

✅ AI-Based Risk Adjustment—The Algorithm Intelligence Bot dynamically adjusts risk exposure based on market conditions.

✅ Social Trading Risk—Copy Bot users must carefully evaluate professional traders, as blindly following signals can increase risk.

✅ Exchange Arbitrage Risks—While arbitrage bots can generate profits, exchange order delays and fees can reduce effectiveness.

As you can see, both Bitsgap and Cryptohopper provide powerful automated trading solutions, but they cater to different types of traders:

- Bitsgap is ideal for traders looking for a structured, AI-enhanced approach, with robust risk management, multi-exchange support, and diverse trading bots.

- Cryptohopper is better suited for users who prefer social trading, AI-based strategy selection, and marketplace-driven automation.

Exchange Support: Bitsgap vs Cryptohopper

Choosing a crypto trading platform isn’t just about the features—it’s also about which exchanges are supported. The ability to connect multiple exchanges in one place allows traders to diversify portfolios, optimize liquidity, and maximize trading opportunities. Both Bitsgap and Cryptohopper provide multi-exchange support, but their integration capabilities and the number of supported exchanges differ.

Comparison of Available Cryptocurrency Exchanges

Both Bitsgap and Cryptohopper support a wide range of crypto exchanges, allowing users to trade across multiple platforms from a single interface.

Bitsgap Supported Exchanges

Bitsgap provides access to 15+ major crypto exchanges, including:

- Binance, Binance US, Bitfinex, Bitget, Bybit, BitMart, Coinbase, Crypto.com, Gate.io, Gemini, HitBTC, HTX, Kraken, KuCoin, OKX, Poloniex, and WhiteBIT.

With high trading volumes and deep liquidity, Bitsgap ensures traders have access to a diverse range of trading pairs, with some exchanges offering over 3,000+ pairs.

Cryptohopper Supported Exchanges

Cryptohopper also integrates with multiple exchanges, including:

- Coinbase Advanced, KuCoin, Crypto.com, OKX, BingX, Bitvavo, Binance, Binance US, Kraken, BitMart, HTX, ProBit Global, Bitfinex, Poloniex, HitBTC, and EXMO.

While Cryptohopper supports a similar number of exchanges, its focus on social trading and AI-driven strategies means that traders rely on marketplace signals rather than direct liquidity optimization.

Trading Terminal, Interface and Usability: Bitsgap vs Cryptohopper

A well-designed interface is crucial for both beginner and advanced traders, ensuring smooth navigation, efficient trade execution, and seamless portfolio management. Bitsgap and Cryptohopper offer intuitive trading terminals that allow users to monitor the market, execute trades, and automate strategies with ease.

Visual Overview of the Interface

Bitsgap’s Interface

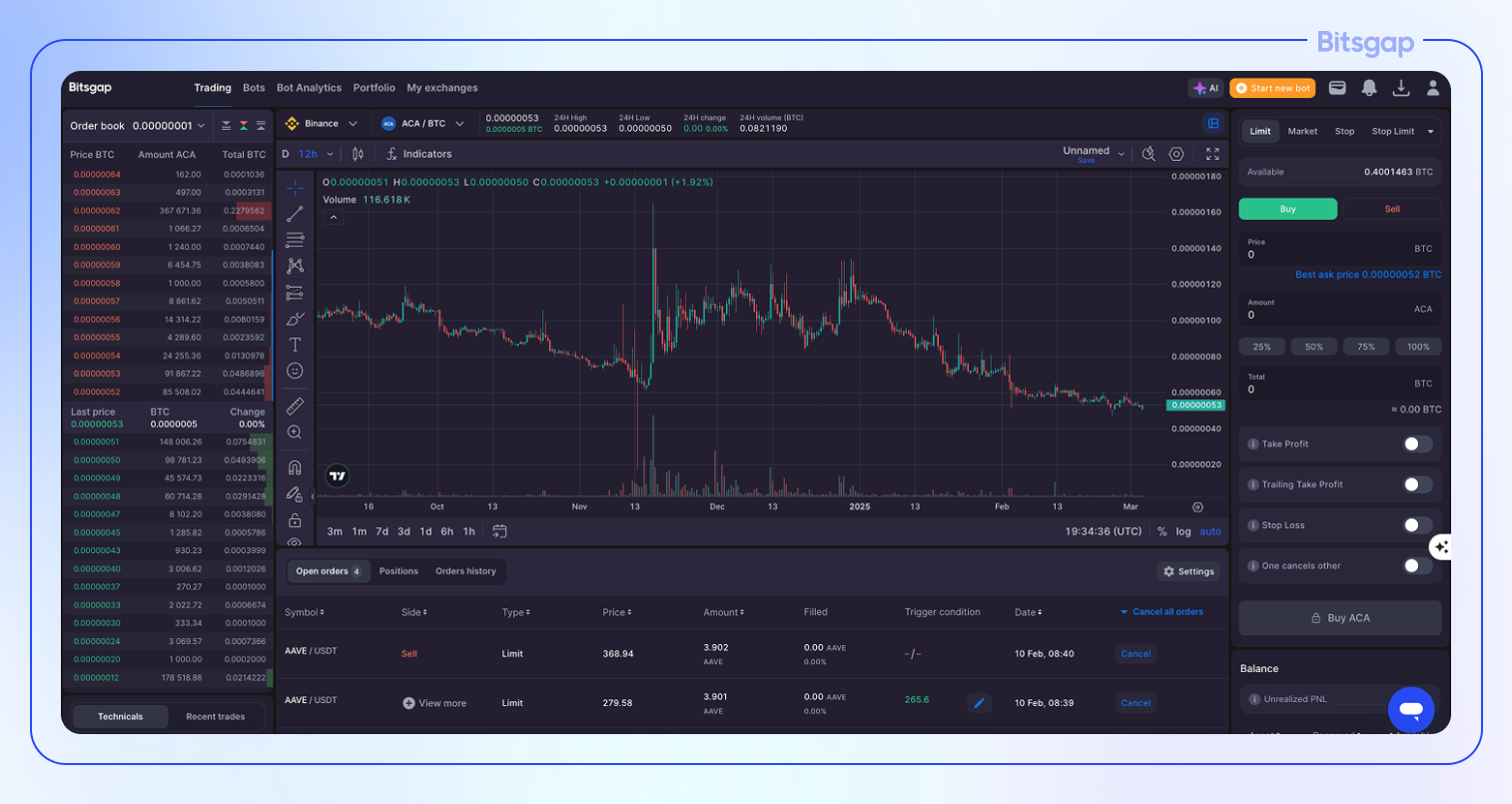

Bitsgap’s cloud-hosted trading platform is designed for efficiency and ease of use, offering a clean, modern interface that integrates multiple trading tools into a single dashboard. Key highlights of the interface include:

- Multi-Exchange Dashboard—Connects to 15+ crypto exchanges, allowing users to monitor and manage all accounts from one place.

- Smart Trading Panel—Displays real-time market data, with quick access to trading bots, order types, and trading indicators.

- Customizable Charting Tools—Features 100+ indicators and 50+ smart drawing tools, powered by TradingView for in-depth market analysis.

- Bot Analytics—A superior performance & actionable analytics dashboard that tracks bot profit, total PNL, average daily bot profit, among other things.

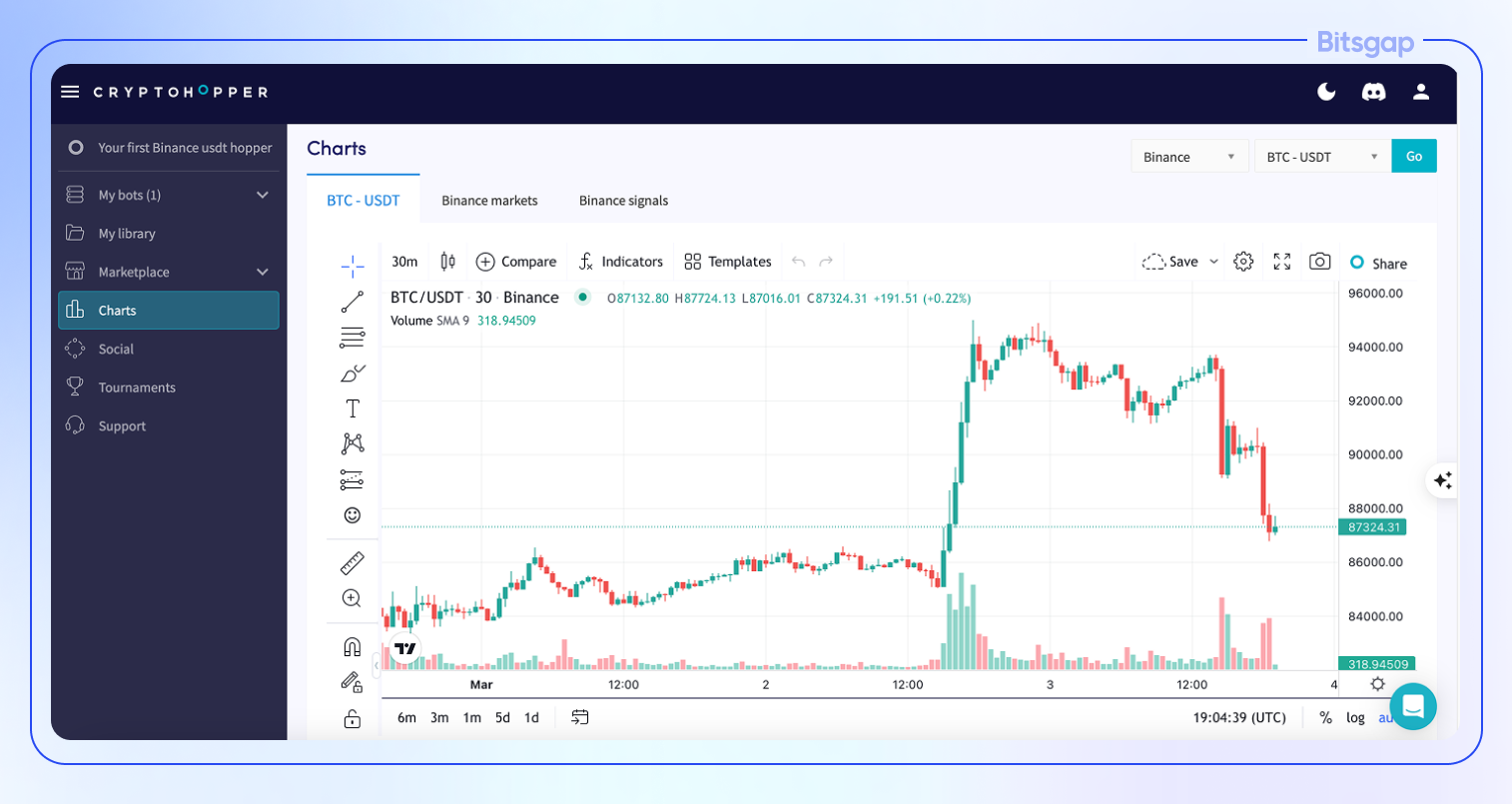

Cryptohopper’s Interface

Cryptohopper’s trading terminal focuses on a visually interactive experience, catering to both manual and automated traders. Notable features include:

- Drag-and-Drop Order Book—Traders can visually adjust orders by dragging them within the order book, making trade execution more interactive.

- Strategy Marketplace Integration—Users can buy, sell, and implement trading strategies directly from the interface.

- Performance Tracking Dashboard—Automatically tracks profits, losses, and open positions for easier portfolio management.

Trading Terminal Features

Bitsgap’s Trading Terminal

Bitsgap provides an advanced trading terminal with smart algorithmic orders and automated risk management tools. Key features include:

- Smart Orders—Supports OCO (One Cancels the Other), TWAP (Time-Weighted Average Price), Scaled Orders, and Stop-Limit Orders, even if the exchange itself doesn’t natively offer them.

- Automated Trading Execution—Orders are processed even when the user is offline, thanks to cloud-based infrastructure.

- Risk Management Tools—Includes Stop-Loss, Take-Profit, and Trailing Stop to help traders protect their investments.

Cryptohopper’s Trading Terminal

Cryptohopper’s trading terminal is designed for convenience and automation, integrating manual trading, bot execution, and social trading tools. Features include:

- Trailing Orders—Users can attach Trailing Stop-Loss and Take-Profit directly to their buy orders, ensuring automatic profit capture.

- Integrated Social Trading—Allows traders to subscribe to signals, copy professional traders, or purchase strategy templates.

- Portfolio Tracking—Eliminates the need for external portfolio trackers by automatically monitoring position performance.

Security and Data Protection: Bitsgap vs Cryptohopper

Security is one of the most critical aspects of any automated crypto trading platform. Given the risks associated with online trading, ensuring that personal data, API keys, and funds remain secure is a top priority for both Bitsgap and Cryptohopper.

In this section, we’ll examine the security mechanisms employed by both platforms, compare their data protection levels, and assess how safe it is to trust them with your assets.

Security Mechanisms: API Keys, Two-Factor Authentication, and More

Bitsgap’s Security Features

Bitsgap prioritizes user protection with multi-layered security protocols to safeguard funds and personal data:

- Encrypted API Keys—Bitsgap connects to exchanges via API keys with trade-only permissions, ensuring that funds cannot be withdrawn from user accounts.

- Advanced API Protection—Features like IP whitelisting, countertrade protection, and fingerprinting prevent unauthorized access and fraudulent trading activity.

- OAuth Integration—Secure authentication with Binance, OKX, and KuCoin prevents third-party access to API credentials.

- 2048-bit RSA Encryption—Data is encrypted using a high-security RSA 2048-bit standard, making it more secure than most online banking systems.

- Two-Factor Authentication (2FA)—Users can enable 2FA for login and sensitive actions, adding an extra layer of security.

Cryptohopper’s Security Features

Cryptohopper also incorporates several protective measures to keep user accounts secure:

- API-Based Trading—Like Bitsgap, Cryptohopper does not have withdrawal access to user funds but can execute trades via API keys.

- Two-Factor Authentication (2FA)—Encourages users to enable 2FA for account logins and critical security actions.

- OAuth Integration—Secure authentication with some exchanges.

- Advanced API Protection—Supports other protective measurements like IP whitelisting.

- Security Monitoring & Incident Response—After a security breach in January 2024, Cryptohopper implemented stricter monitoring to detect unusual login patterns.

- Phishing Awareness Measures—The platform educates users about phishing attacks and urges them to verify links before entering credentials.

While both platforms prioritize security, Bitsgap offers stronger API protection, more advanced encryption, and additional safeguards like countertrade protection and fingerprinting.

How Safe Is It to Trust These Platforms with Your Assets?

Both Bitsgap and Cryptohopper operate on a non-custodial model, meaning neither platform holds or stores user funds—they only execute trades via API connections. This greatly reduces the risk of funds being stolen directly from the platform.

However, Cryptohopper’s recent security breach in January 2024 raises concerns about potential vulnerabilities. While no funds were lost, user data such as names, usernames, and login timestamps were compromised, emphasizing the importance of strong password management and 2FA activation.

On the other hand, Bitsgap has never experienced a significant security breach, and its 2048-bit encryption, IP whitelisting, and countertrade protection provide an additional layer of safety.

Pricing and Tariff Plans: Bitsgap vs. Cryptohopper

When choosing an automated crypto trading platform, pricing is a crucial factor. Traders need to consider what features are included at each price point, whether a free plan is available, and which service provides the best value for money. Both Bitsgap and Cryptohopper offer subscription-based pricing models, with multiple tiers catering to different levels of traders, from beginners to professionals.

In this section, we’ll compare the subscription costs, analyze the features available in free and paid plans, and evaluate which platform offers the best value.

Comparison of Subscription Costs: Bitsgap vs Cryptohopper

Both platforms offer tiered pricing structures, allowing users to choose a plan that best fits their trading needs.

Bitsgap Pricing Plans

Bitsgap offers four pricing tiers, with a 7-day free trial available on the PRO plan:

- Free Plan—$0/month

- Basic Plan—$21/month (if billed annually) or $26/month on a monthly plan

- Advanced Plan—$49/month (annually) or $62/month on a monthly plan

- Pro Plan—$108/month (annually) or $135/month on a monthly plan

Cryptohopper Pricing Plans

Cryptohopper also provides four subscription tiers, with a 3-day free trial on the Explorer plan:

- Pioneer Plan (Free)—$0/month

- Explorer Plan—$24.16/month (if billed annually)

- Adventurer Plan—$57.50/month (if billed annually)

- Hero Plan—$107.50/month (if billed annually)

While both platforms offer free plans, Bitsgap’s paid plans start slightly cheaper than Cryptohopper’s, especially for advanced trading features.

What Features Are Available in the Free Versions?

Bitsgap Free Plan

Bitsgap’s free plan includes:

✅ Unlimited manual trading

✅ 20 active bots in Demo mode

✅ Smart orders for spot trading

✅ Access to 15+ supported exchanges

✅ Cloud-based trading with 24/7 execution

Cryptohopper Free Plan (Pioneer)

Cryptohopper’s Pioneer plan offers:

✅ Manual trading

✅ Limited portfolio management tools

✅ Access to marketplace strategies (but no automated trading bots)

While both free versions allow manual trading, Bitsgap provides a Demo mode with active bots, making it better for users who want to test automation before subscribing.

What Features Are Included in the Paid Plans?

Bitsgap Paid Plans

As users upgrade to higher-tier plans, they gain access to:

- More active trading bots (Basic: 3 GRID / 10 DCA, Pro: 50 GRID / 250 DCA)

- AI Assistant for automated bot portfolio management

- Futures trading bots (Advanced & Pro plans)

- Take Profit for AI-launched bots (Pro plan)

- Trailing Up & Down for GRID bots

- Reinvest bot profits

Cryptohopper Paid Plans

Cryptohopper’s paid plans focus on:

- More active bots (Explorer: 1, Hero: 75)

- Market-making and arbitrage bots (Adventurer & Hero)

- Strategy designer & AI strategy optimization

- Access to trading signals & copy trading

- Shorting & dollar-cost averaging (DCA) strategies

Overall, Bitsgap’s paid plans focus on smart trading tools and AI automation, whereas Cryptohopper emphasizes copy trading, arbitrage, and social trading features.

Which Service Offers the Best Value for Money?

For beginners, Bitsgap’s free plan offers more functionality than Cryptohopper’s. For advanced traders, Bitsgap’s Pro plan provides significantly more bots and AI-driven automation at a lower price than Cryptohopper’s Hero plan.

Final Verdict:

✅ Best for AI automation & smart orders → Bitsgap

✅ Best for social trading & arbitrage → Cryptohopper

Ultimately, the best choice depends on your trading style, but Bitsgap offers greater value in terms of automation and advanced trading features.

Conclusions and Recommendations on Cryptohopper vs Bitsgap

Bitsgap is best suited for traders who prioritize automation, advanced trading strategies, and portfolio management with actionable analytics. With its AI Assistant, smart algorithmic orders, and deep risk management features, it is particularly beneficial for those who seek precision and efficiency in their trading activities. The platform’s seamless API integration, 2048-bit encryption, and security measures, including countertrade protection and IP whitelisting, ensure that users can trade with confidence. Bitsgap’s smart strategy suggestions and AI portfolio management further simplify automated trading by optimizing bot portfolios, making it an excellent choice for both experienced traders and beginners looking for a structured approach to crypto trading.

On the other hand, Cryptohopper is ideal for traders who are more inclined toward social trading, copy trading, and marketplace-driven strategies. The platform allows users to follow experienced traders, subscribe to trading signals, and leverage AI-powered strategy selection. Those who prefer a more hands-off approach or want to learn from seasoned professionals may find Cryptohopper’s marketplace and strategy-sharing features highly valuable.

In the final analysis, Bitsgap stands out as the superior choice for traders seeking a comprehensive, secure, and high-performance automated trading platform. Its AI Assistant, diverse range of trading bots, advanced smart orders, and unmatched security protocols make it a powerhouse for cryptocurrency trading. Unlike Cryptohopper, which relies heavily on social trading, Bitsgap provides a more robust, self-sufficient system that adapts to market conditions in real time. With no major security breaches, a proven track record of innovation, and an intuitive interface designed for both beginners and professionals, Bitsgap remains the best choice for traders looking to maximize profitability while maintaining full control over their strategies. Why not test it today?