Bitsgap vs Coinrule: Which Automated Trading Platform Offers Better Value?

This comprehensive analysis reveals why serious traders overwhelmingly choose Bitsgap's robust terminal and advanced bot strategies over Coinrule's simpler approach, delivering the sophisticated automation capabilities essential for maximizing profits in crypto markets.

Welcome to the fourth installment in our comprehensive Bitsgap comparison series, where we evaluate leading cryptocurrency automation platforms side by side. After examining Bitsgap against 3Commas, Cryptohopper, and TradeSanta in our previous articles, today we turn our attention to Coinrule—another popular solution in the automated trading space.

Both Bitsgap and Coinrule aim to solve trading challenges, but they approach automated trading with different philosophies and feature sets.

In this detailed comparison, we'll analyze both platforms' key features, user experience, strategy effectiveness, security measures, and pricing structures. While our analysis reveals Bitsgap as the more robust and versatile solution with superior trading options, we present the evidence transparently so you can determine which platform aligns better with your trading goals and experience level.

Key Platform Features

In this section, we'll examine the core capabilities that define both Bitsgap and Coinrule, exploring how each platform approaches automated cryptocurrency trading. We'll compare their essential tools, trading mechanisms, and unique strengths to help you understand which platform might better serve your trading requirements and preferences.

An Overview of Bitsgap and Coinrule

Since 2017, Bitsgap has grown into a comprehensive crypto trading platform, becoming a leader in trading automation. The numbers are impressive: 650,000+ traders, $9.46 billion managed, and 4.7 million automated systems created, producing $148 million in yearly profits.

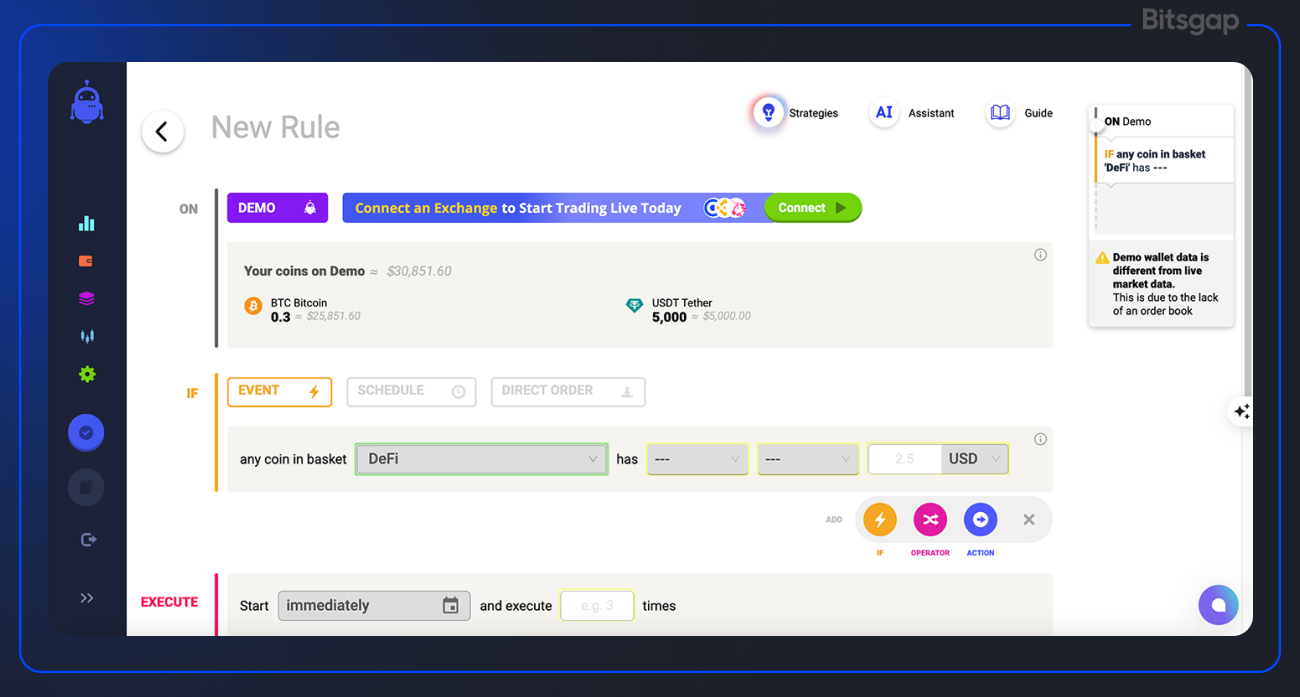

Coinrule offers user-friendly automated trading without requiring technical skills. Created by three entrepreneurs, it works for both beginners and experienced traders. The platform uses simple "If-This-Then-That" logic, making automated trading accessible to everyone.

Key Tools Overview: Bitsgap vs Coinrule

Let’s look at a few key tools each one offers:

Bitsgap Tools

- Multi-Exchange Integration: Connects with 15+ leading cryptocurrency exchanges through a single interface

- Advanced Trading Bots: Offers six specialized bot types (GRID, DCA & DCA Futures, BTD, COMBO, and LOOP)

- Smart Trading Terminal: Provides a unified trading dashboard across all connected exchanges

- Portfolio Management: Tools for tracking and optimizing holdings across exchanges

- Technical Analysis Widget: Built-in charting and analysis capabilities

- Backtesting: Ability to test strategies against historical data

- Pre-made Strategies: Ready-to-deploy trading approaches

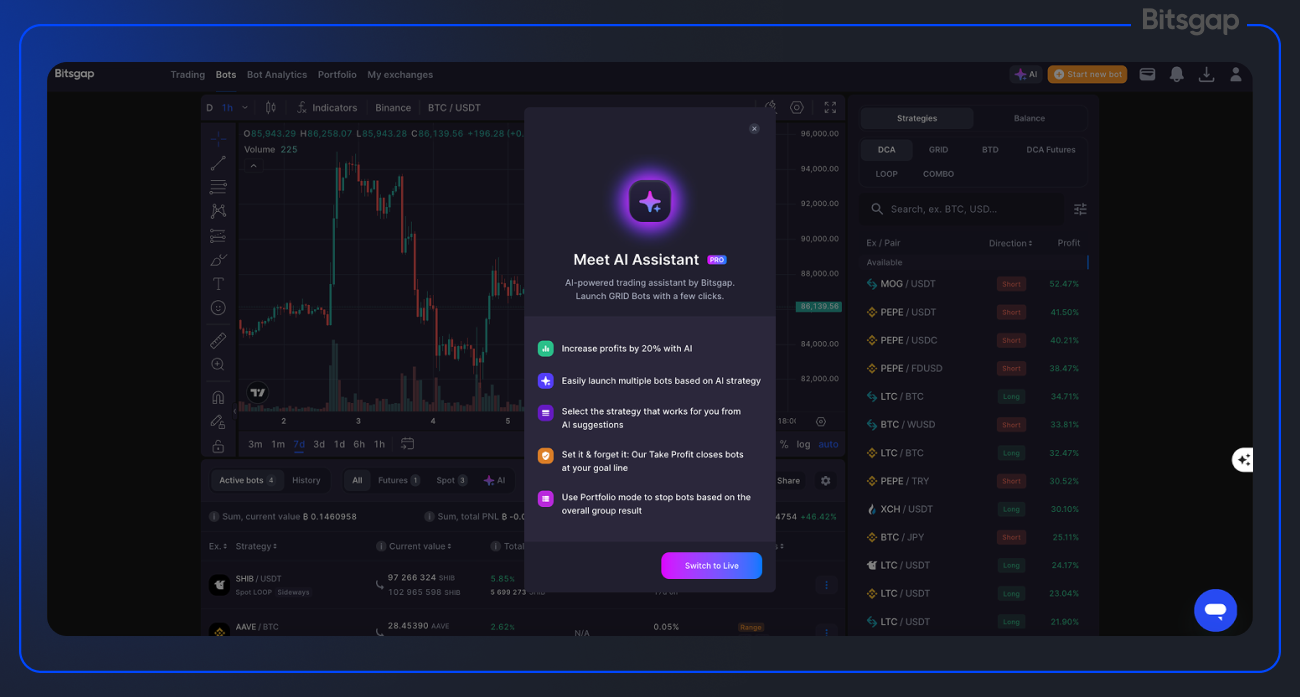

- AI Assistant: Suggests an optimal portfolio of bots based on users’ risk preferences, available balance, and exchange connections.

Coinrule Tools

- No-Code Strategy Builder: Visual rule builder using IFTTT logic

- Exchange Integration: Supports major platforms including Binance, Coinbase Pro, and Kraken

- Template Library: 250+ pre-built rules and strategies

- Any Coin Scanner: Feature to track and trade any coin available on connected exchanges

- TradingView & Custom Scripts: Support for external trading strategies

- CoinruleGPT: AI-powered tool for strategy optimization

Main Trading Functions

Bitsgap Trading Functions

Bitsgap centers its trading capabilities around specialized bots targeting different market conditions:

- GRID Trading Bot: Designed to profit from sideways markets by automatically buying low and selling high within a defined price range

- DCA (Dollar Cost Averaging) Bot: Reduces risks through systematic purchasing or selling and works best on clear trends.

- BTD (Buy The Dip) Bot: Capitalizes on falling prices by executing strategic purchases during downtrends

- COMBO Bot: High-reward, high-risk trading on crypto futures markets

- LOOP Bot: Recently added unique position trading bot for long-term trading

The platform also offers algorithmic orders and smart trading features through its terminal, allowing for advanced order types and execution strategies beyond the automated bots.

Coinrule Trading Functions

Coinrule's approach to trading revolves around its rule-based system:

- Custom Rule Creation: Users define conditions and resulting actions using the platform's IFTTT interface

- Strategy Marketplace: Curated platform where users can purchase pre-built strategies from other traders

- CoinruleGPT: AI assistant that helps optimize trading strategies by analyzing and improving rule logic

Unique Features and Strengths

Bitsgap's Unique Strengths

- Comprehensive Ecosystem: Offers a full suite of tools beyond just bots, creating an all-in-one trading platform

- Proven Track Record: Operating since 2017 with substantial user base and documented trading volume

- Bot Specialization: Each bot type is designed for specific market conditions, allowing traders to adapt to changing markets

- High Connection Coverage: Integration with 15+ exchanges provides exceptional flexibility

- AI Assistant: Suggests a portfolio of bots based on users’ risk preferences and funds.

- Security Focus: Emphasizes security with no withdrawal access, encryption, and various protective measures

Coinrule's Unique Strengths

- Accessibility: Simple interface designed for non-technical users

- Strategy Marketplace: Community-driven marketplace for sharing and purchasing strategies

- AI Integration: CoinruleGPT for AI-powered strategy optimization

- Traditional Market Support: Beyond crypto, supports stocks and ETFs through Alpaca integration

- Visual Rule Building: Intuitive visual interface for creating and modifying trading strategies

Both platforms offer powerful automation tools, but with distinct approaches. Bitsgap provides a more comprehensive trading ecosystem with specialized bots for different market conditions, while Coinrule excels in accessibility through its intuitive rule builder. The choice between them will largely depend on a trader's specific needs, experience level, and trading preferences.

Automated Trading: Coinrule Trading Bot vs Bitsgap Trading Bot

Both platforms offer a range of trading bots, risk management tools, and customization options to help traders navigate the volatile crypto market efficiently. In this comparison, we’ll explore:

- The types of trading bots and automated strategies available on each platform.

- The flexibility and customization options for algorithmic trading.

- How these platforms handle different market scenarios.

- The risk management features each platform provides to safeguard users’ investments.

Types of Trading Bots and Automated Strategies

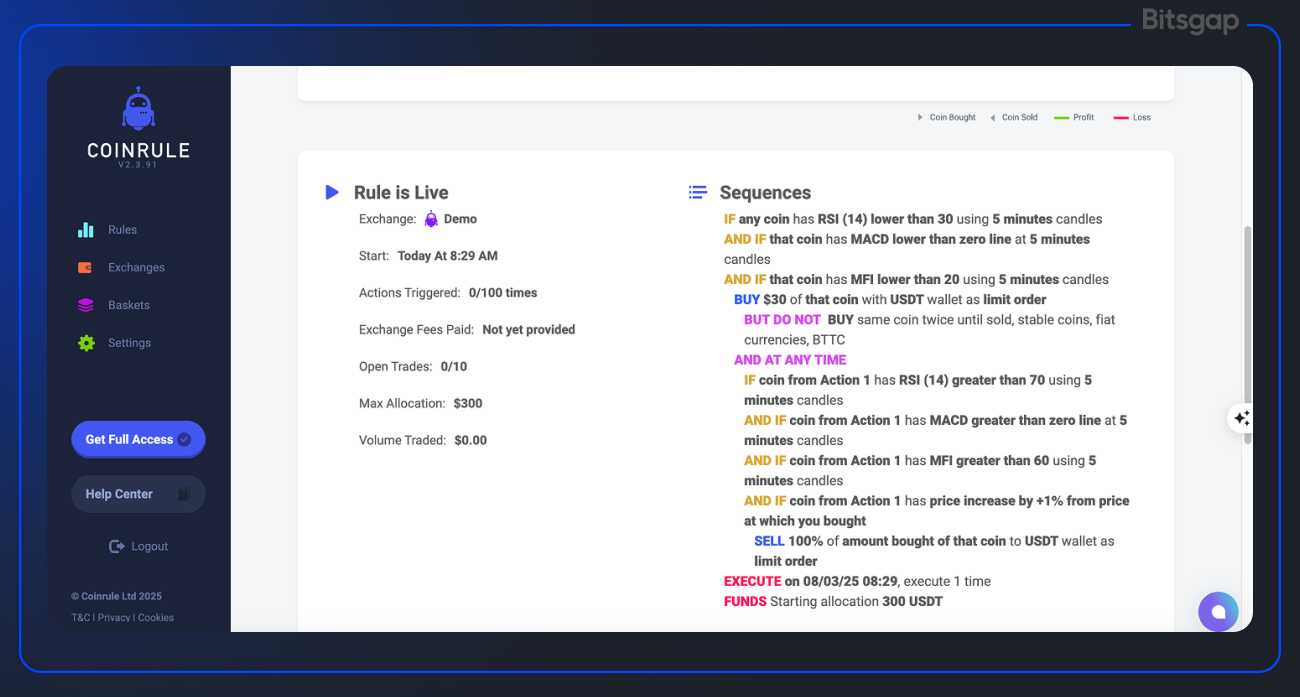

Coinrule Trading Bot Review

Coinrule provides a rule-based approach to automated trading. Users can create trading strategies using IFTTT-style logic (If This, Then That) without needing coding skills. The platform offers:

- Pre-built template strategies for different market conditions.

- Custom rule creation for advanced traders.

- Strategy Marketplace where users can purchase proven strategies from other traders.

- 'Any Coin' Market Scanner, which tracks multiple cryptocurrencies for opportunities.

- TradingView integration, allowing traders to automate signals from external indicators.

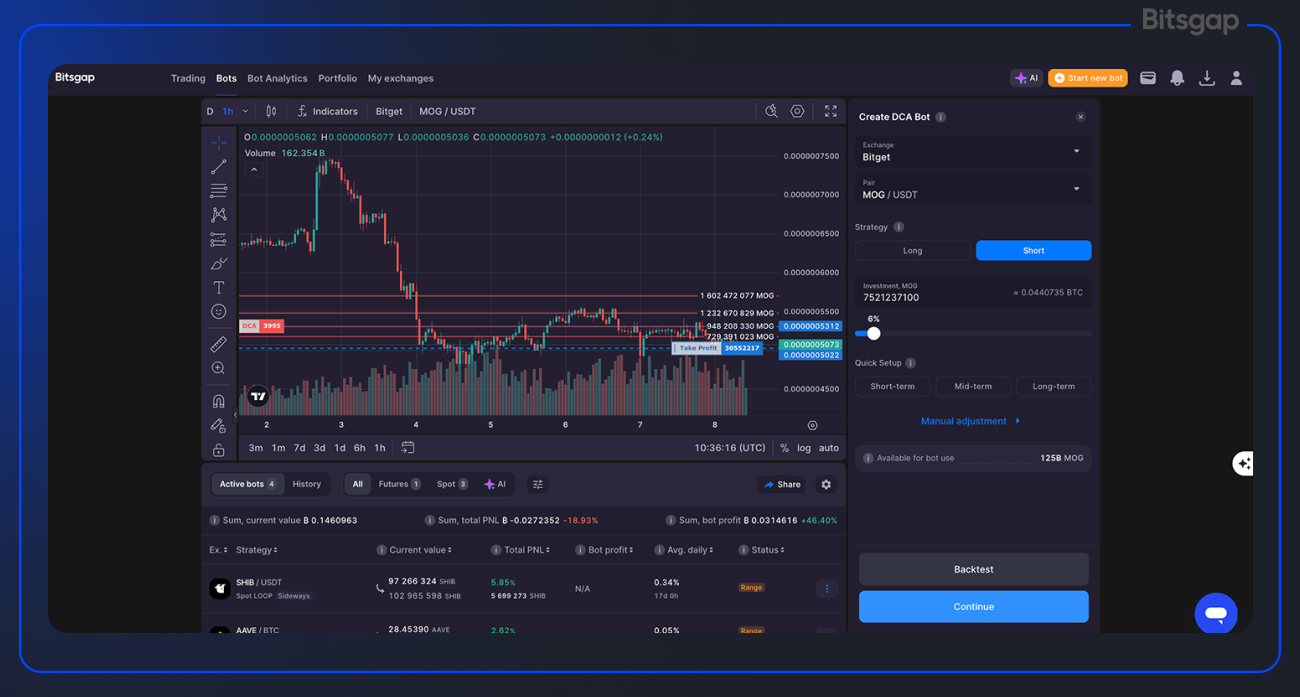

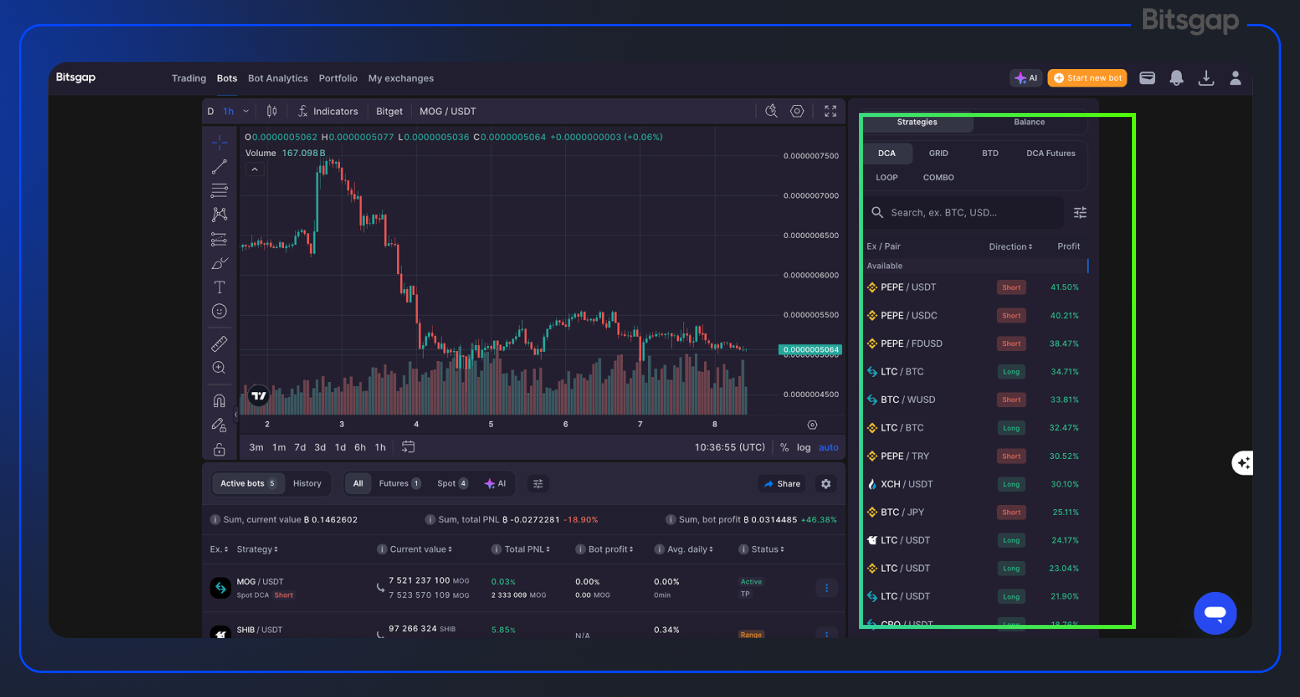

Bitsgap Trading Bot Review

Bitsgap offers a more diverse range of automated trading bots tailored for different market conditions. These include:

- GRID Trading Bot—Profits from sideways market movements.

- DCA (Dollar-Cost Averaging) Bot—Reduces risk by averaging buy/sell prices over time.

- BTD (Buy the Dip) Bot—Accumulates crypto during market downturns.

- COMBO Bot—Merges strategies for high-risk, high-reward futures trading.

- LOOP Bot—Specialized position trading bot that earns in 2 currencies, reinvests profits, and is designed for long-term trading.

- DCA Futures Bot—Designed for futures trading with leverage.

👉 Verdict: Coinrule is ideal for traders who prefer a very simple, rule-based, no-code approach, while Bitsgap provides specialized bots for different strategies, including futures trading (that cater to both beginners and professional traders).

Algorithm Customization Options and Flexibility of Settings

Coinrule:

- Allows users to customize strategies using pre-set templates or fully custom rules.

- Offers TradingView integration for advanced users to trigger trades based on external indicators.

- "Any Coin" Market Scanner enables traders to automate trades across multiple assets.

- CoinruleGPT helps users optimize their trading strategies with AI-powered analysis.

- Strategy Marketplace for accessing community-developed trading strategies.

Bitsgap:

- Provides pre-configured bots with customizable parameters (e.g., grid spacing, DCA levels, leverage settings).

- Offers backtesting on historical data to refine strategies.

- Has advanced automation settings like trailing stop, take profit, and stop loss.

- Allows manual adjustments to bots even after they've been deployed.

- Provides AI Assistance for custom intelligent portfolio building based on a user’s risk tolerance and available funds.

- Integrates with 15+ exchanges, providing exceptional flexibility in trading across platforms.

👉 Verdict: Bitsgap offers greater flexibility and customization in bot settings with broader exchange integration, while Coinrule provides a simpler approach that is easier for beginners.

Handling Different Market Scenarios

Coinrule:

- Offers pre-built strategies tailored for different market conditions (trend-following, scalping, mean reversion, etc.).

- Users can adjust rules to automate buy/sell actions based on price movements, indicators, or market trends.

- Demo trading allows traders to test strategies before going live.

- Focused on spot trading, with limited futures trading capabilities.

Bitsgap:

- Bots like GRID and LOOP excel in sideways and volatile markets.

- DCA works best on clear down or upward trends.

- BTD Bot takes advantage of market dips

- Smart balancing feature in the AI Assistant helps adjust bot strategies based on market conditions.

- Futures trading support in both COMBO and DCA Futures, allowing leveraged positions.

- Demo trading and a 7-day free trial on the PRO plan allows to test nearly all Bitsgap’s functionality absolutely free of charge.

👉 Verdict: Bitsgap provides a wider range of bots to handle diverse market conditions, including futures trading. Coinrule, while limited to spot trading, offers structured strategies suitable for different market trends.

Risk Management Features on Each Platform: Coinrule Bot vs Bitsgap Bot

Coinrule:

- Stop-loss and take-profit settings to limit exposure.

- Paper trading (demo mode) enables users to test strategies without real funds.

- AI-powered strategy optimization with CoinruleGPT.

Bitsgap:

- Stop-loss, take-profit, and trailing stop built into all bot strategies.

- Leverage settings for futures trading (higher risk, but offers greater control).

- Backtesting helps optimize risk-adjusted strategies before deploying them live.

- Real-time bot analytics provide performance insights to make adjustments.

- Enhanced security with no withdrawal access, 2048-bit encryption, and a spotless security record since 2017.

👉 Verdict: Both platforms offer risk management tools, but Bitsgap provides more real-time analytics, backtesting, trailing features, along with stronger security measures. Coinrule's risk management is very basic, with a focus on structured rule-based trading.

Here’s a structured table for easy reference of things discussed above:

Fig. 1. Comparison of trading bots on Bitsgap and Coinrule.

Which one should you choose?

- Choose Coinrule if you prefer a basic and no-fuss approach. It's ideal for beginners who want to automate trading with pre-defined strategies in spot markets.

- Choose Bitsgap if you want a wider variety of trading bots, futures trading support, and more customization options for optimizing automated strategies. It's ideal for both beginners and pro traders looking for higher flexibility and real-time analytics.

Both platforms offer free trials, so users can test them before committing to a subscription. Bitsgap provides a 7-day PRO plan trial, a free plan, and a demo mode, while Coinrule offers a free tier and demo to get started.

Exchange Support: Bitsgap vs Coinrule Review

When choosing an automated trading platform, the number and quality of supported exchanges play a crucial role. A wider exchange selection means better liquidity, more trading opportunities, and greater flexibility for executing strategies.

Below, we compare both platforms’ exchange support to help you determine which platform best suits your trading needs.

Fig. 2. Exchange support on Bitsgap and Coinrule.

👉 Verdict: Bitsgap supports more exchanges, making it a better option for users who need broader market access and liquidity optimization. Coinrule’s integration with Alpaca offers an advantage for traders interested in stocks and ETFs alongside crypto trading.

Terminal, Interface and Usability: Bitsgap vs Coinrule

When choosing an automated trading platform, the user interface (UI) and overall usability play a crucial role in efficiency and convenience. Both Bitsgap and Coinrule offer powerful trading terminals, but they differ in visual design, accessibility, and ease of use for traders with varying levels of experience. In this comparison, we’ll analyze:

- Visual and functional differences in the interfaces

- How beginner-friendly and advanced trader-friendly each platform is

- Availability of mobile solutions and ease of setup

Visual and Functional Differences in the Interfaces

Let’s focus on visual distinctions first.

Bitsgap

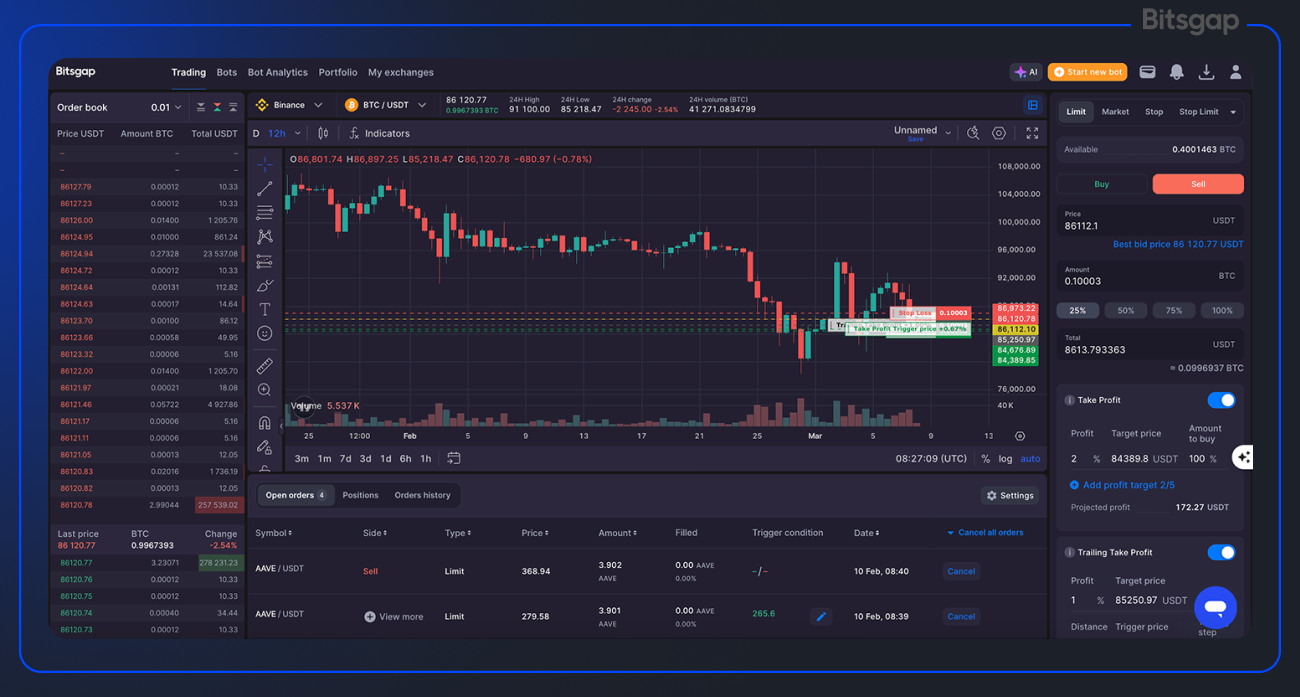

Bitsgap’s trading terminal is designed for active traders who need a comprehensive dashboard with real-time market data, advanced charting tools, and detailed order management.

Key UI Features:

- Integrated TradingView charts with 100+ indicators and 50+ drawing tools for technical analysis.

- Smart trading orders such as Stop Loss, Take Profit, Trailing, and OCO (One Cancels the Other).

- Multi-exchange access from a single interface, allowing seamless execution across 15+ supported exchanges.

- Real-time order book and trading history for precise market tracking.

🟢 Best for: Both beginners and advanced traders who want full control over order execution.

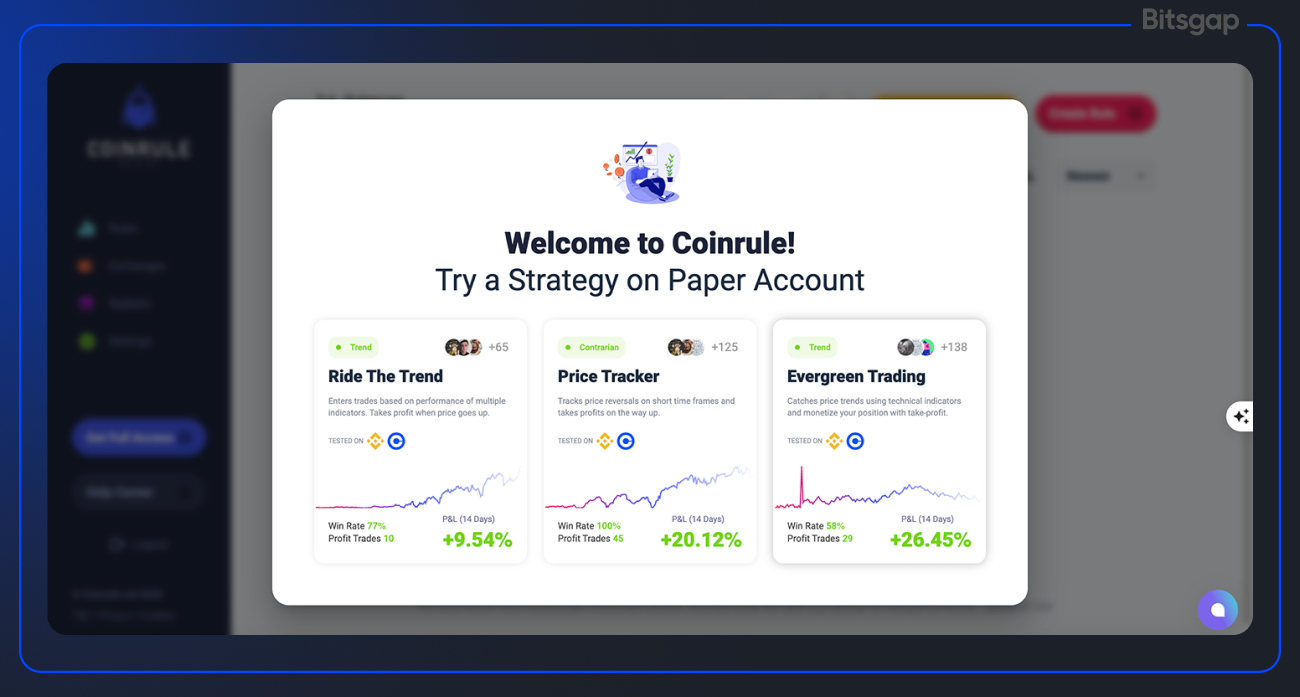

Coinrule

Coinrule’s interface follows a simplified, rule-based approach, making it ideal for beginners and traders looking for simple automation without manual intervention.

Key UI Features:

- No-code, rule-based strategy builder using IFTTT (If This, Then That) logic.

- Pre-built strategy templates with backtested performance metrics.

- Visual rule editor for creating custom trading strategies without coding.

- Live trading dashboard showing rule execution, conditions met, and trade history.

🟢 Best for: Beginners and traders who prefer automation over manual trading.

👉 Verdict:

- Bitsgap provides a professional-grade trading terminal with manual execution tools.

- Coinrule focuses on automation, offering a simplified, strategy-driven UI.

How Convenient Is It for Beginners and Experienced Traders?

A great trading platform should cater to both beginners looking for an easy entry into automated trading and experienced traders who need advanced tools for strategy optimization. Below, we analyze how Bitsgap and Coinrule accommodate traders of different experience levels.

Bitsgap

✅ For Beginners:

- Offers pre-configured trading bots (GRID, DCA, LOOP, BTD) that simplify trading strategies.

- Offers AI Assistant for a hands-off portfolio-building approach.

- Offers strategy suggestions ranked by historical profitability for an easy start.

- Demo mode allows risk-free testing before live trading.

- Intuitive trading terminal, but the number of features can be overwhelming for new traders.

✅ For Experienced Traders:

- Provides full charting tools, advanced order types, and real-time analytics.

- Supports leverage and futures trading, making it suitable for high-risk strategies.

- Backtesting and real-time bot performance tracking improve strategy refinement.

Coinrule

✅ For Beginners:

- Pre-built trading templates help users start quickly.

- Paper trading mode allows users to test strategies without real funds.

✅ For Experienced Traders:

- Supports TradingView integration for external signal automation.

- Offers custom rule creation with indicators like RSI, MACD, and Moving Averages.

- CoinruleGPT helps optimize trading strategies using AI insights.

Here’s a comparative table for ease of reference:

Fig. 3. Usability & accessibility of both platforms.

Security and Data Protection: Bitsgap vs Coinrule

Both Bitsgap and Coinrule have implemented comprehensive security architectures to protect user data and funds, though they approach this crucial aspect with different emphases and technical implementations.

Implemented Security Measures: API Keys, Two-Factor Authentication, Encryption

Bitsgap’s Security Features

Bitsgap employs a multi-layered security system to protect user data and prevent unauthorized access:

- Encrypted API Keys

- Bitsgap does not store user funds and connects only via encrypted API keys.

- No withdrawal permissions are allowed, ensuring that funds cannot be moved from exchange accounts.

- Advanced API Protection

- 1 Account = 1 API Key Rule: Prevents stolen API keys from being used on multiple accounts.

- Countertrade Protection: Detects and blocks suspicious trading activities (e.g., price manipulation).

- API Key IP Whitelisting: Restricts API access to specific IP addresses, blocking unauthorized logins.

- OAuth Secure Authentication

- Used for Binance, OKX, and KuCoin, ensuring safer API connections without exposing sensitive credentials.

- 2048-bit RSA Encryption

- Stronger than online banking encryption, making it virtually impossible to crack.

- Two-Factor Authentication (2FA)

- Users must enable Google Authenticator or SMS-based 2FA for additional security.

Coinrule’s Security Features

Coinrule also prioritizes security and implements strict data protection measures:

- Encrypted API Keys

- Uses AES-256 encryption to store API keys securely.

- Each user has a private encryption key, stored separately for added security.

- Data Encryption in Transit

- TLS 1.2+ encryption ensures all communication between web apps, databases, and backend servers remains secure.

- Cloudflare CDN Protection

- Defends against DDoS attacks, preventing unauthorized access via traffic filtering and rate limiting.

- Two-Factor Authentication (2FA)

- Mandatory 2FA for account logins, reducing the risk of unauthorized access.

- Developer Access Restrictions

- No single developer has access to both API key databases and encryption storage, preventing internal leaks.

- Recaptcha & Rate Limiting

- Prevents brute force attacks by limiting login attempts and using Recaptcha v3 for authentication requests.

Comparison of Bitsgap and Coinrule Cybersecurity Levels

Here’s how platforms ensure the security of users’ funds:

Fig. 4. Security features on both platforms.

And yet another table comparing the security features of both platforms:

Fig. 5. Comparison of security features.

👉 Verdict: Both platforms encrypt API keys and do not store user funds, preventing unauthorized withdrawals. However, Bitsgap offers more advanced API key security (OAuth, IP whitelisting, and countertrade protection), making it more secure for active trading.

Prices and tariff plans: Bitsgap vs Coinrule

Bitsgap and Coinrule offer various subscription plans, ranging from free plans with limitations to premium packages with advanced trading tools. In this article, we’ll compare:

- Subscription plans and available features for both platforms.

- What is included in the free versions and their limitations.

- Which platform offers the best value for money based on features and pricing.

Comparison of Subscriptions and Available Features

Let’s start with the available pricing plans on both platforms:

Bitsgap Pricing Plans

Bitsgap offers four plans:

Fig. 6. Bitsgap plans.

Coinrule Pricing Plans

Coinrule also provides four plans:

Fig. 7. Coinrule plans.

What is Available in the Free Versions and Their Limitations?

Now, let’s analyse what’s in store in the free versions of both platforms:

Bitsgap Free Plan

✅ Includes:

- Unlimited manual trading.

- 20 active demo bots for testing strategies.

- Access to all supported exchanges.

❌ Limitations:

- No live automated bots (Grid or DCA).

- No futures trading or AI-powered features.

- No access to trailing and advanced order types.

Coinrule Free Plan (Starter)

✅ Includes:

- 2 live rules for automated trading.

- 2 demo rules for testing.

- 10 pre-built strategy templates.

- 1 exchange connection.

❌ Limitations:

- Max trading volume capped at $3K/month.

- Only 3 conditions per rule.

- No access to advanced indicators or TradingView integration.

👉 Verdict:

- Bitsgap’s free plan is better for manual traders but lacks automated bots.

- Coinrule’s free plan allows automated trading but with limited rules and trading volume.

Which Service Offers the Best Value for Money?

Fig. 8. Comparison of plans and value for the money.

👉 Verdict:

- For Automated Trading: Coinrule’s Investor plan ($29.99/mo) offers more rule-based automation than Bitsgap’s Basic plan.

- For Active Traders: Bitsgap’s Advanced plan ($62/mo) provides more bots, futures trading, and AI-driven features.

- For High-Volume Traders: Bitsgap is the better choice as it has no trading volume limits.

Conclusions and Recommendations: Why Bitsgap Stands Out as Ultimate Coinrule Alternative

After a detailed comparison between Bitsgap and Coinrule, it is clear that Bitsgap offers a more advanced, feature-rich, and flexible trading environment, making it the superior choice for traders who want powerful automation, advanced security, and seamless market execution.

Why Choose Bitsgap? The Key Advantages

✅ 1. More Advanced Trading Bots and AI Features

- Supports multiple strategies including GRID, DCA, BTD, LOOP, DCA Futures, and COMBO bots, giving traders more control over market conditions.

- AI-powered automation enhances performance with AI Portfolio Mode and AI Assistant.

- Trailing features for bots, ensuring optimized profit capture.

✅ 2. Unlimited Trading Volume and Exchange Support

- 15+ supported exchanges, including Binance, Coinbase, Kraken, KuCoin, OKX, and more.

- No volume trading limits on paid plans, unlike Coinrule, which caps trading volume based on subscription.

✅ 3. Best-in-Class Security and API Protection

- 2048-bit RSA encryption (stronger than banking security).

- OAuth authentication for safer API connections with exchanges like Binance and OKX.

- Countertrade protection to prevent market manipulation.

- IP whitelisting for API keys, adding an extra layer of security.

✅ 4. More Competitive Pricing and Features Per Plan

- Basic plan ($26/mo) includes 3 Grid bots, 10 DCA bots, and AI assistance, offering more automation than Coinrule’s Investor plan ($29.99/mo).

- Advanced and Pro plans provide more bots, AI features, and futures trading, making Bitsgap a better value for active traders.

✅ 5. Seamless User Experience with Smart Trading Terminal

- Full TradingView integration with 100+ indicators for technical analysis.

- Smart orders, including OCO, Trailing Stop, and Take Profit, allowing for more flexible trade execution.

- Cloud-based platform ensures bots continue running 24/7 without requiring users to stay online.

Ready to take your trading to the next level? Bitsgap offers a 7-day free trial on the PRO plan, giving you access to all premium features, including:

✅ AI-powered trading bots

✅ Unlimited manual trading & smart orders

✅ Futures trading bots

✅ Advanced security features

No credit card required. Just sign up and start optimizing your trades today!