Bitsgap vs Banana Gun Bot Review & Comparison

From rapid token sniping to multi-exchange automation, we pit Bitsgap against Banana Gun to see which crypto trading bot stands out. The verdict? One platform clearly leads in tools, security, and long-term value.

Welcome back to yet another installment in our Bitsgap vs Banana Gun series where we compare Bitsgap against competitors highlighting why Bitsgap stands out across features, pricing, and overall value for the money. However, ultimately of course you decide for yourself, we just describe the feature set against the pricing. In this installment, we'll compare Bitsgap and Banana Gun.

Let's dive into the specifics of each platform and see how they stack up against each other...

Main Platform Features: A High-Level Overview

In this section, we provide a high-level comparison of the main features offered by Bitsgap and Banana Gun. We'll explore their core functionalities, the trading tools they provide—including bots and algorithmic strategies—and highlight the unique aspects that set each platform apart. Detailed analyses of these features will follow in subsequent sections.

Core Functionalities of Bitsgap & Banana Gun Crypto

Bitsgap: Bitsgap is an all-in-one crypto trading platform that integrates with over 15 major exchanges, including Binance, Coinbase, and Kraken. It offers a unified interface for managing trades, portfolios, and automated strategies. Key components include a sophisticated trading terminal, portfolio tracking, and a suite of automated trading bots.

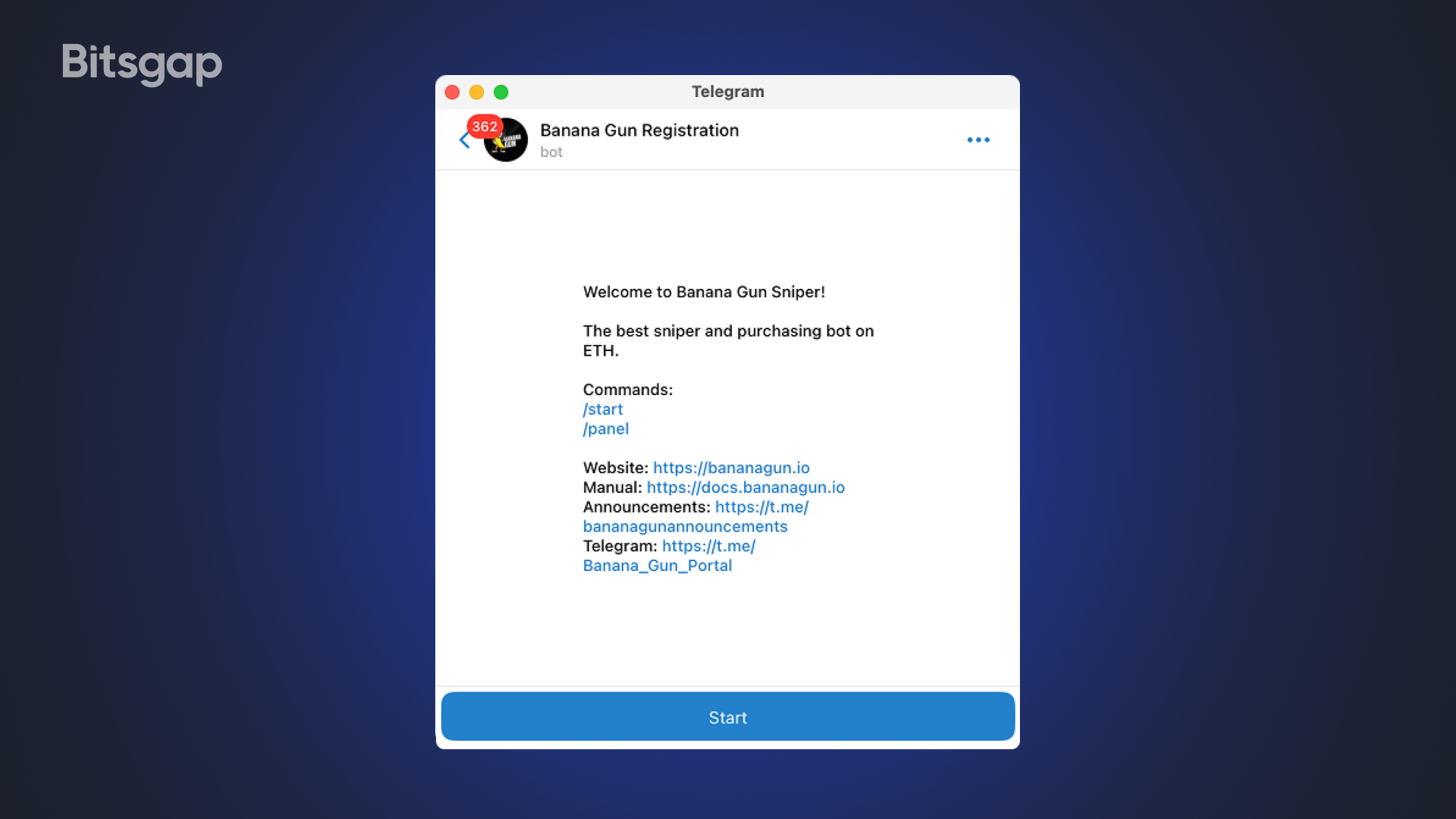

Banana Gun: Banana Gun operates as a Telegram-based trading bot designed for rapid, on-chain trading across Ethereum, Solana, and other blockchains. It specializes in token sniping—automatically detecting and purchasing newly listed tokens within seconds of deployment. The platform also supports manual trading through Telegram, offering a hybrid approach for users.

Trading Tools & Automation

Bitsgap

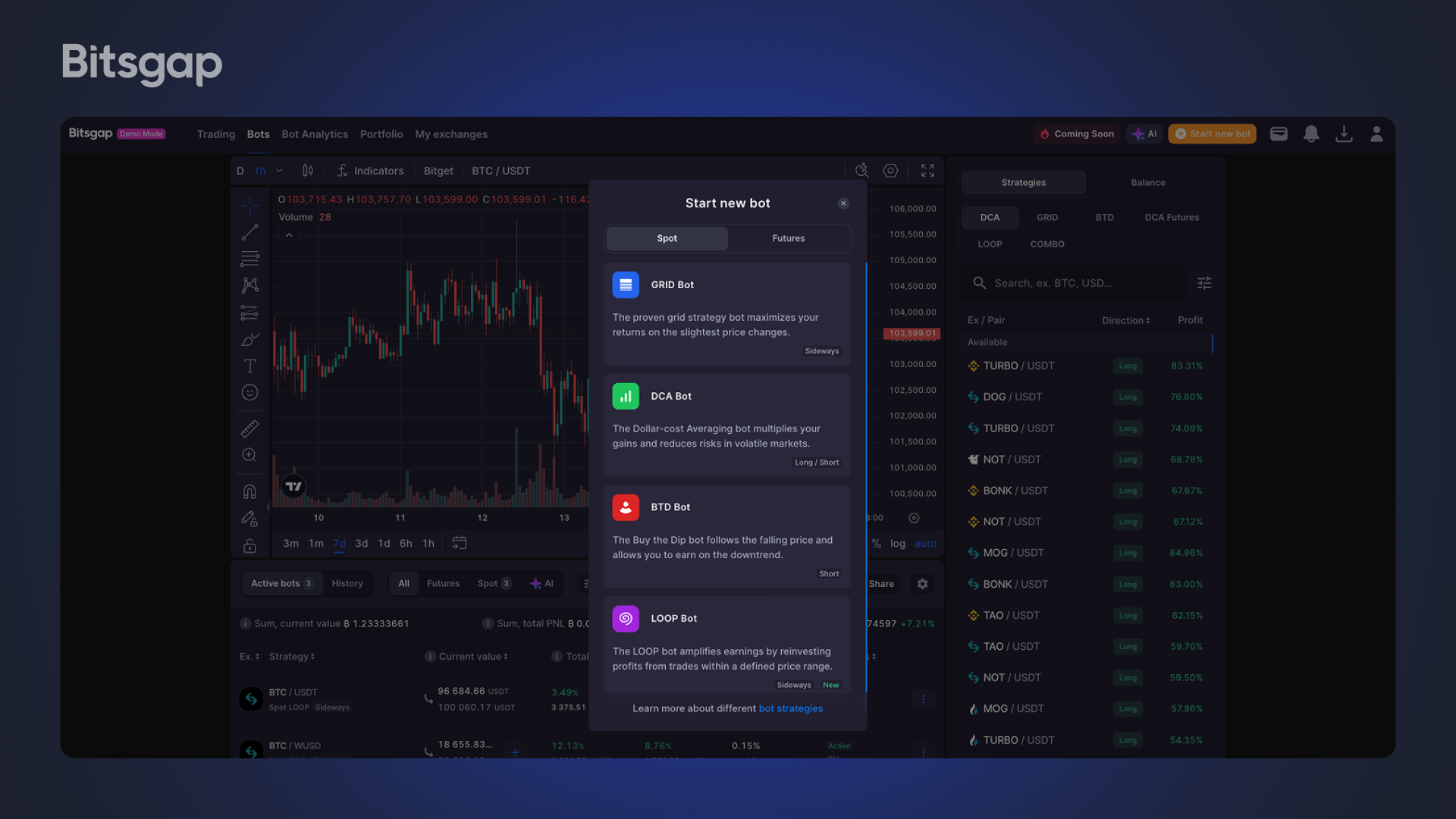

Bitsgap provides a range of automated trading bots tailored to different market conditions:

- GRID Bot: Ideal for sideways markets, placing multiple buy and sell orders to profit from small price fluctuations.

- DCA Bot: Employs Dollar Cost Averaging to reduce risk in volatile markets by strategically averaging positions.

- BTD Bot: Specialized for downtrends, following the "Buy the Dip" strategy to accumulate assets during price drops.

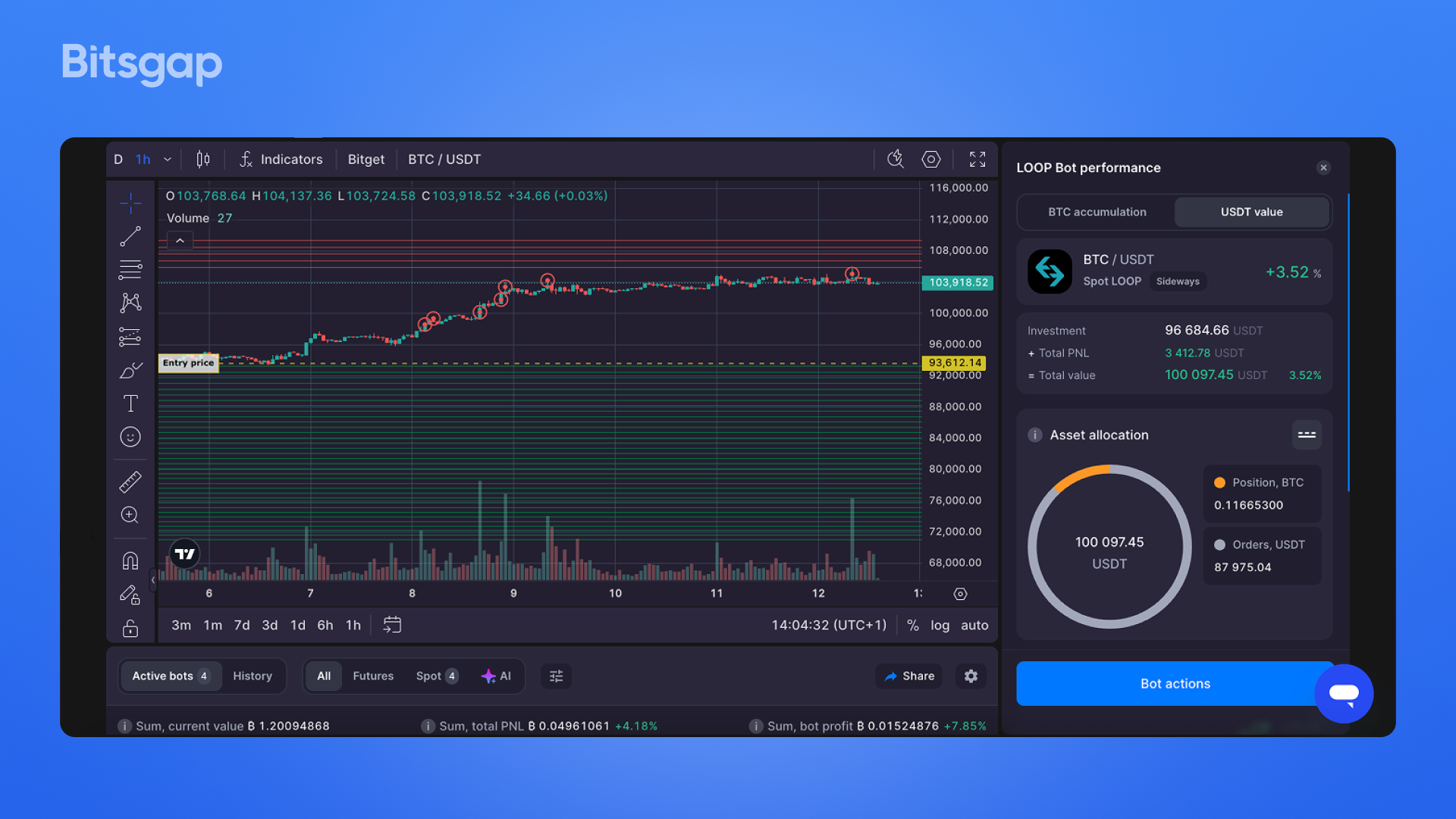

- LOOP Bot: A unique position trading bot that reinvests earnings back into the market, aiming for long-term portfolio growth.

- COMBO & DCA Futures: Futures bots for trading crypto futures with up to x10 leverage.

These bots can be customized and deployed across multiple exchanges, allowing for diversified and automated trading strategies.

Banana Gun

Banana Gun's primary feature is its automated sniping capability, which enables users to enter new markets before broader retail interest pushes prices upward. The bot scans the blockchain in real-time and executes buy orders based on preset parameters. Additional features include:

- Manual Trade Execution: Users can execute trades directly through Telegram, connecting their wallets and managing transactions with ease.

- Multi-Chain Compatibility: Supports trading on Ethereum, Solana, and plans to expand to other blockchains.

- Security Features: Incorporates MEV resistance, reorg protection, and honeypot detection to safeguard users from common on-chain trading risks.

Unique Features & Key Differences

Bitsgap

- Multi-Exchange Integration: Allows users to manage and automate trades across multiple centralized exchanges from a single platform.

- Advanced Trading Terminal: Offers over 100 indicators, 50 drawing tools, and smart trading orders.

Banana Gun

- Telegram-Based Interface: Enables users to trade directly within Telegram, offering a seamless and accessible trading experience.

- Rapid Token Sniping: Designed to automatically detect and purchase newly listed tokens within seconds, giving users a competitive edge.

- Revenue Sharing: 40% of the bot’s revenue is distributed to $BANANA token holders, providing an incentive for long-term engagement.

👉 Summary: While Bitsgap offers a comprehensive suite for multi-exchange trading and automation, Banana Gun focuses on rapid, on-chain trading through a user-friendly Telegram interface. In the following sections, we'll delve deeper into each platform's features to help you determine which aligns best with your trading strategy.

Automated Trading: Bitsgap vs. Banana Gun Bot Crypto

In this section, we delve deeper into the automation capabilities of Bitsgap and Banana Gun. We'll examine how each platform implements algorithmic trading, the flexibility they offer in strategy customization, their efficiency across various market conditions, and the risk management features they provide.

Algorithmic Trading Implementation

Bitsgap

Bitsgap offers a suite of AI-powered trading bots designed for both spot and futures markets. These bots include:

- GRID Bot: Capitalizes on sideways markets by placing buy and sell orders at set intervals.

- DCA Bot: Implements Dollar Cost Averaging to mitigate volatility risks.

- BTD Bot: Executes "Buy the Dip" strategies during market downturns.

- LOOP Bot: Reinvests profits automatically to compound returns over time.

- COMBO Bot & DCA Futures Bot: Work on crypto futures with up to 10x leverage.

Banana Gun

Banana Gun functions as a Telegram-based trading bot, specializing in rapid, on-chain trading across Ethereum, Solana, and other blockchains. Its primary feature is automated token sniping, which detects and purchases newly listed tokens within seconds of deployment. Additionally, it supports manual trading through Telegram, offering a hybrid approach for users.

Strategy Customization & Flexibility

Bitsgap: Bitsgap provides extensive customization options for its trading bots. Users can adjust parameters such as order size, grid levels, and stop-loss/take-profit settings. The platform's AI Assistant offers optimized bot portfolios based on user-defined criteria, enhancing strategy personalization.

Banana Gun: Banana Gun allows users to set specific parameters for token sniping, including gas fees, slippage tolerance, and transaction limits. While it doesn't offer the same depth of customization as Bitsgap, its focus on speed and simplicity caters to users seeking quick entry into new token markets.

Performance Across Market Conditions

Bitsgap: Bitsgap's diverse bot offerings enable it to perform effectively across various market conditions:

- Trending Markets: DCA and BTD bots help in accumulating positions during uptrends or downtrends.

- Sideways Markets: GRID and LOOP bots capitalize on price fluctuations within a range.

The platform's recent performance update reported over $16.4 million in profits generated by its bots over a three-month period, highlighting their effectiveness.

Banana Gun: Banana Gun excels in volatile, fast-moving markets, particularly during new token launches. Its rapid execution capabilities allow users to enter positions before broader market participation, potentially leading to significant gains. However, its performance may be less optimal in stable or sideways markets where rapid price movements are less common.

Risk Management & Market Adaptation

Bitsgap: Bitsgap incorporates several risk management features:

- Stop-Loss/Take-Profit Orders: Automatically secure profits or limit losses.

- Trailing Features: Adjust stop-loss and take-profit levels as the market moves.

- Backtesting: Evaluate strategies against historical data before deployment.

These tools enable users to adapt their strategies to changing market conditions effectively.

Banana Gun: Banana Gun emphasizes security in its operations:

- MEV Resistance: Protects against front-running attacks.

- Reorg Protection: Safeguards against blockchain reorganizations.

- Honeypot Detection: Identifies and avoids malicious contracts.

These features are crucial for users engaging in on-chain trading, where smart contract risks are prevalent.

👉 Summary: Bitsgap offers a comprehensive suite of automated trading tools suitable for various market conditions and trading strategies, with robust risk management features. Banana Gun, on the other hand, provides a specialized tool for rapid, on-chain trading, focusing on speed and security during new token launches. The choice between the two depends on the user's trading objectives and preferred market engagement.

Exchange Support: Bitsgap vs. Banana Gun Trading Bot

In this section, we examine the exchange support offered by Bitsgap and Banana Gun. We'll explore the list of supported exchanges, API integration capabilities, order execution speed, and the differences in the number and quality of integrated crypto exchanges.

Supported Exchanges

Bitsgap

Bitsgap supports over 15+ major centralized cryptocurrency exchanges, providing users with a broad range of trading options. Some of the prominent exchanges include:

- Binance

- Coinbase Advanced

- Kraken

- KuCoin

- OKX

- Bitfinex

- Bitget

- Gate.io

- Gemini

- Poloniex

- WhiteBIT

This extensive support allows users to manage and automate trades across multiple platforms from a single interface.

Banana Gun

Banana Gun focuses on decentralized exchanges (DEXs) across various blockchain networks. It supports a wide array of DEXs, including:

- Ethereum: Uniswap v2/v3, Sushiswap v2/v3, Pancakeswap v2/v3, Shibaswap v2, Saitaswap v2, EtherVista

- Solana: Raydium AMM, Raydium CP, Raydium CLMM, Pump.fun, Orca, Meteora Dynamic, Meteora DLMM, Fluxbeam, Moonshot, PumpSwap, Boopfun

- BNB Chain: Pancakeswap v2/v3, Four.meme

- Sonic: Shadow Stable/Volatile & v3, WAGMI, SwapX v2/v3, Dyorswap v2, Sushi v2/v3, Spookyswap v2/v3, Sonicswap v2, Metropolis v2, Equalizer Stable/Volatile, Memebox

- Base: Uniswap v2/v3, Sushiswap v2/v3, Baseswap v2/v3, Aerodrome, Pancakeswap v2/v3

- Unichain: Uniswap v2/v3, Dyorswap v2

This extensive DEX support enables Banana Gun users to engage in on-chain trading across multiple blockchain ecosystems.

API Integration & Order Execution Speed

Bitsgap

Bitsgap connects to centralized exchanges through API keys, allowing for seamless integration and real-time data synchronization. This setup enables users to execute trades, manage portfolios, and deploy automated strategies efficiently. The platform's infrastructure ensures low-latency order execution, which is crucial for high-frequency trading and arbitrage opportunities.

Banana Gun

Banana Gun operates through a Telegram-based interface, interacting directly with smart contracts on supported DEXs. This direct interaction allows for rapid trade execution, often within seconds of token deployment. The platform's architecture is optimized for speed, making it particularly effective for token sniping and other time-sensitive trading strategies.

Differences in Exchange Integration

Bitsgap

- Number of Exchanges: Supports over 15 centralized exchanges.

- Exchange Types: Primarily centralized exchanges (CEXs).

- Trading Pairs: Access to a vast array of trading pairs across supported exchanges.

- Use Case: Ideal for users seeking to manage and automate trades across multiple CEXs from a single platform.

Banana Gun

- Number of Exchanges: Supports numerous decentralized exchanges across multiple blockchain networks.

- Exchange Types: Exclusively decentralized exchanges (DEXs).

- Trading Pairs: Focuses on newly launched tokens and niche markets.

- Use Case: Best suited for users interested in on-chain trading and rapid entry into new token markets.

👉 Summary: Bitsgap offers extensive support for centralized exchanges, providing users with a comprehensive platform for managing and automating trades across multiple CEXs. In contrast, Banana Gun specializes in decentralized exchange support, enabling rapid, on-chain trading across various blockchain ecosystems. The choice between the two platforms depends on the user's trading preferences and the types of exchanges they wish to engage with.

Terminal, Interface, and Usability: Bitsgap vs. Banana Gun

In this section, we compare the user interfaces and usability of Bitsgap and Banana Gun, focusing on their trading terminals, visual design, beginner-friendliness, and accessibility across devices.

Trading Terminal & Smart Order Features

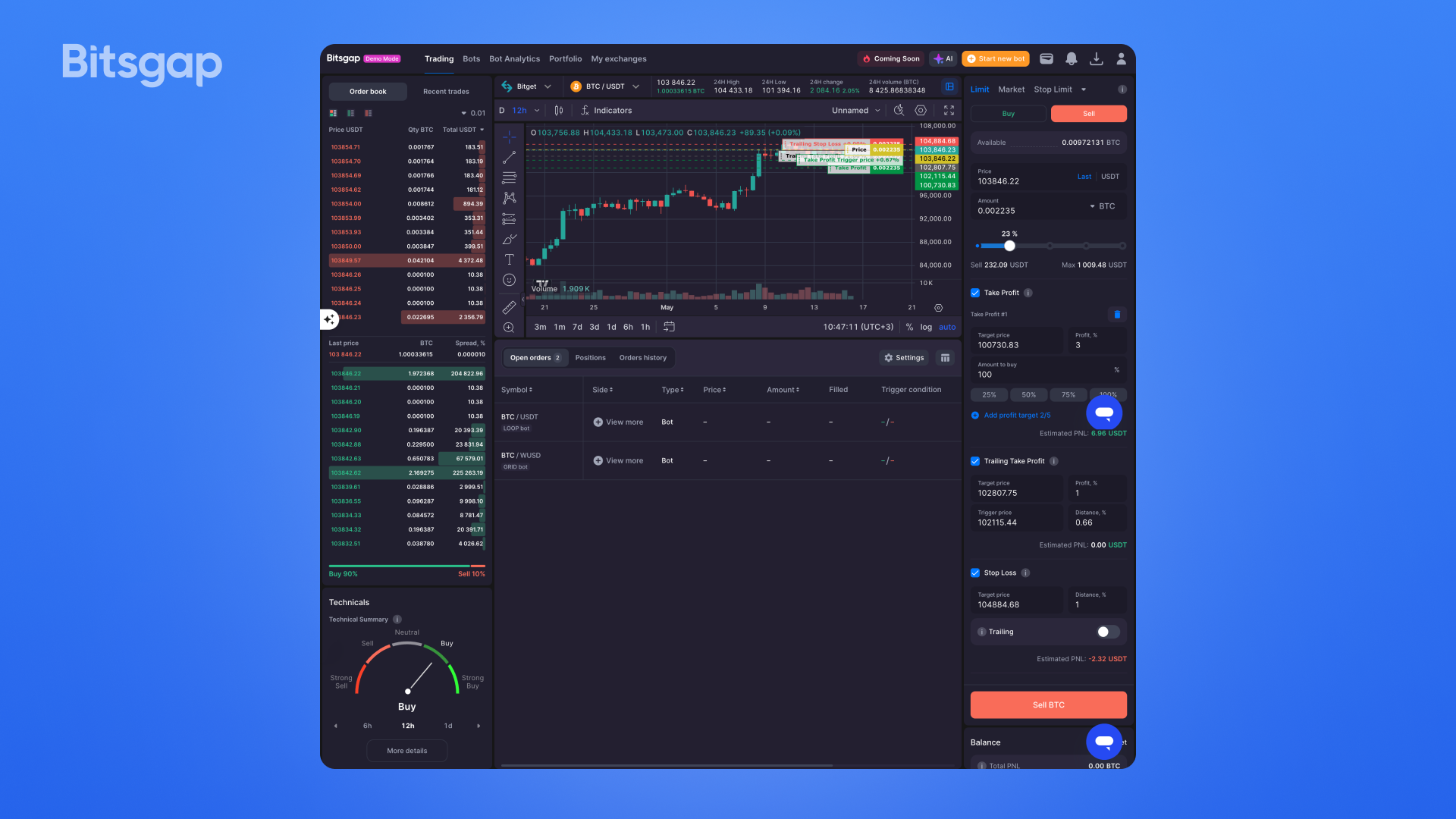

Bitsgap: Bitsgap offers a comprehensive web-based trading terminal that integrates with over 15 major exchanges. The terminal supports advanced order types, including OCO (One Cancels the Other), TWAP (Time-Weighted Average Price), stop-limit, and scaled orders, enhancing precision in trading strategies. Additionally, Bitsgap provides smart trading features such as stop-loss, take-profit, and trailing orders, even if these options aren't natively supported by the connected exchanges.

Banana Gun: Banana Gun operates primarily through a Telegram-based interface, allowing users to execute trades directly within the messaging app. The bot specializes in rapid token sniping and supports features like auto-sniping, limit orders, and copy trading. While it doesn't offer a traditional trading terminal, its streamlined commands enable quick trade execution.

Visual Design & Usability

Bitsgap: Bitsgap's interface is designed for both beginners and experienced traders. It features a clean layout with customizable widgets, real-time charts powered by TradingView, and intuitive navigation. The platform's recent updates have enhanced the user experience by improving sorting options and adding advanced settings for positions, orders, and history widgets.

Banana Gun: Banana Gun's Telegram interface is minimalist, focusing on speed and simplicity. Users interact with the bot through straightforward commands, making it accessible for quick trades. While it lacks the visual complexity of traditional trading platforms, its design caters to users seeking rapid, on-the-go trading solutions.

Beginner-Friendliness

Bitsgap: Bitsgap provides a user-friendly experience with a 7-day free trial on its PRO plan, allowing new users to explore its features without immediate commitment. The platform's intuitive design, combined with educational resources and responsive customer support, makes it approachable for beginners.

Banana Gun: Banana Gun is designed for ease of use, especially for those familiar with Telegram. Its straightforward command structure and quick setup process make it accessible to newcomers. However, the lack of a graphical interface may present a learning curve for users accustomed to traditional trading platforms.

Mobile Accessibility

Bitsgap: Bitsgap’s mobile app is available on both iOS and Android platforms. The app mirrors the desktop experience, offering features like automated trading bots, portfolio tracking, and demo modes. This advancement allows users to manage their trades and monitor the market on the go.

Banana Gun: Banana Gun's operation through Telegram inherently provides mobile accessibility, as Telegram is widely available on smartphones. This setup enables users to execute trades and monitor the market directly from their mobile devices without the need for additional applications.

👉 Summary: Bitsgap offers a feature-rich trading terminal with advanced order types and a user-friendly interface suitable for both beginners and experienced traders. Its recent mobile app launch enhances its accessibility. Conversely, Banana Gun provides a streamlined, command-based trading experience through Telegram, prioritizing speed and simplicity, which may appeal to users seeking quick, on-the-go trading solutions.

Security and Data Protection: Bitsgap vs. Banana Gun

In this section, we examine the security measures and data protection protocols implemented by Bitsgap and Banana Gun. We'll explore their approaches to safeguarding user data and assets, including API key management, two-factor authentication, encryption standards, and overall platform reliability.

API Key Management & Encryption

Bitsgap: Bitsgap employs a multi-layered security approach to protect user data and funds:

- Encrypted API Keys: Bitsgap connects to exchanges using encrypted API keys with trade-only permissions, ensuring that funds cannot be withdrawn. Any API key that allows withdrawals is automatically rejected.

- RSA 2048-bit Encryption: All user data is encrypted using bank-grade RSA 2048-bit encryption, making it virtually impossible to hack.

- OAuth Secure Connection: Bitsgap integrates OAuth authentication for exchanges like Binance and OKX, ensuring secure API key transmission.

- API Key IP Whitelisting: Users can restrict API usage to trusted IP addresses, preventing unauthorized access.

Banana Gun Banana Gun focuses on securing on-chain trading activities:

- MEV-Resistant Swaps: Protects against front-running attacks by miners.

- Anti-Rug System: An 85% effective system to detect and prevent rug pulls.

- Reorg Protection: Safeguards against blockchain reorganizations.

- Honeypot Detection: Identifies and avoids malicious contracts.

Two-Factor Authentication (2FA)

Bitsgap: Bitsgap strongly recommends enabling two-factor authentication (2FA) for both the platform and the associated email address. They support hardware security keys/FIDO2 as a 2FA method, adding an extra layer of protection against unauthorized logins.

Banana Gun: Banana Gun has implemented two-factor authentication (2FA) for all transfers, enhancing account security. This measure was introduced following a security incident to prevent unauthorized access and transactions.

Protection of User Assets

Bitsgap: Bitsgap ensures that user funds remain on the connected exchanges, adding an extra layer of security. By not holding user funds directly, Bitsgap reduces the risk of centralized breaches.

Banana Gun: Banana Gun operates through Telegram and interacts directly with smart contracts on supported decentralized exchanges (DEXs). Users are advised to enable two-factor authentication on their Telegram accounts and use secure wallets to protect their assets.

Summary

Both Bitsgap and Banana Gun prioritize the security of their users through various measures:

- Bitsgap: Offers a robust security framework with encrypted API keys, RSA 2048-bit encryption, OAuth secure connections, and two-factor authentication.

- Banana Gun: Focuses on on-chain security with features like MEV-resistant swaps, anti-rug systems, reorg protection, honeypot detection, and two-factor authentication for transfers.

Users should consider their trading preferences and security requirements when choosing between these platforms.

Pricing and Tariff Plans: Bitsgap vs. Banana Gun Price

In this section, we compare the pricing structures of Bitsgap and Banana Gun, focusing on subscription costs, available features in free and paid tiers, and overall value for money.

Bitsgap Pricing Plans

Bitsgap offers three subscription tiers, each designed to cater to different trading needs:

- Basic Plan: Priced at $23/month, this plan includes 2 active GRID bots, 10 active DCA bots, and unlimited smart orders.

- Advanced Plan: At $55/month, users gain access to 5 active GRID bots, 50 active DCA bots, futures bots, trailing up & down features, and unlimited smart orders.

- Pro Plan: For $119/month, this plan offers 25 active GRID bots, 250 active DCA bots, take profit features, futures bots, trailing bots, and unlimited smart orders.

All plans come with a 7-day free trial on the Pro plan, allowing users to explore the platform's full capabilities before committing.

Banana Gun Pricing Model

Banana Gun adopts a different approach by offering its Telegram-based trading bot completely free of subscription fees. Instead, users pay a small tip for each transaction executed through the bot.

This pay-per-use model ensures that users only incur costs when they actively trade, making it a cost-effective solution for those who prefer flexibility over fixed monthly fees.

Fig. A comparative table of Bitsgap and Banana Gun pricing models

Free vs. Paid Features Comparison

Bitsgap:

- Free Trial: 7-day access to the Pro plan features.

- Paid Features: Access to varying numbers of active bots, advanced trading tools, and smart order functionalities depending on the chosen plan.

Banana Gun:

- Free Access: Full access to the trading bot's features without any subscription.

- Transaction Tips: Users pay a small tip per transaction, aligning costs with usage.

Value for Money

Bitsgap offers a comprehensive suite of tools suitable for traders who require advanced features and are comfortable with a monthly subscription. The tiered plans allow users to select a package that aligns with their trading volume and complexity needs.

Banana Gun, with its no-subscription model, provides an economical alternative for traders who prefer a pay-as-you-go approach. This model is particularly advantageous for those who trade less frequently or are exploring automated trading without a significant upfront investment.

Conclusions and Recommendations: Bitsgap vs. Banana Gun

After a comprehensive comparison of Bitsgap and Banana Gun, it's evident that each platform serves distinct trading needs within the cryptocurrency ecosystem. However, when evaluating overall functionality, security, and value for money, Bitsgap emerges as the more robust and versatile trading solution.

Why Bitsgap Stands Out

- Comprehensive Trading Tools: Bitsgap offers a suite of advanced trading bots, including GRID, DCA, and futures bots, catering to various market conditions. Its platform supports over 25 major centralized exchanges, providing users with extensive market access.

- User-Friendly Interface: With a clean, intuitive design, Bitsgap is accessible to both beginners and experienced traders. Features like a demo mode and AI-assisted strategy recommendations enhance the user experience.

- Robust Security Measures: Bitsgap employs bank-grade encryption, two-factor authentication, and ensures that API keys have trade-only permissions, safeguarding user assets effectively.

- Flexible Pricing Plans: Offering tiered subscription models starting from $23/month, Bitsgap provides options suitable for various trading volumes and strategies. A 7-day free trial allows users to explore its features before committing.

On the other hand, the Banana Gun crypto trading bot operates through Telegram, focusing on rapid, on-chain trading across Ethereum and Solana networks. Its primary strength lies in automated token sniping, allowing users to engage with new token launches swiftly. While it excels in this niche, its functionality is limited compared to comprehensive platforms like Bitsgap.

So, if you’re aiming for a holistic trading experience across multiple exchanges and strategies, opt for Bitsgap. 7-day free trial on Pro is on us!