Bitsgap vs. Altrady: Which Crypto Trading Platform is Right for You?

In the battle of trading automation titans, one platform is leaving the competition behind with AI-powered strategies that practically print returns.

Welcome to another installment in our comparison series, where we assess how Bitsgap stacks up against other leading crypto trading platforms. Today, we’re diving into Bitsgap vs. Altrady, two powerful tools designed to automate trading and enhance portfolio management.

In this article, we’ll explore their functionality, ease of use, flexibility, exchange support, and security, helping traders determine which platform aligns best with their trading style—whether it's active strategy management or comprehensive automation through advanced bots.

While both tools have their strengths, Bitsgap’s superior automation capabilities, intuitive interface, and diverse bot strategies make it the go-to choice for traders looking to maximize profits with minimal effort. But in the end, the decision is yours—let’s break it down.

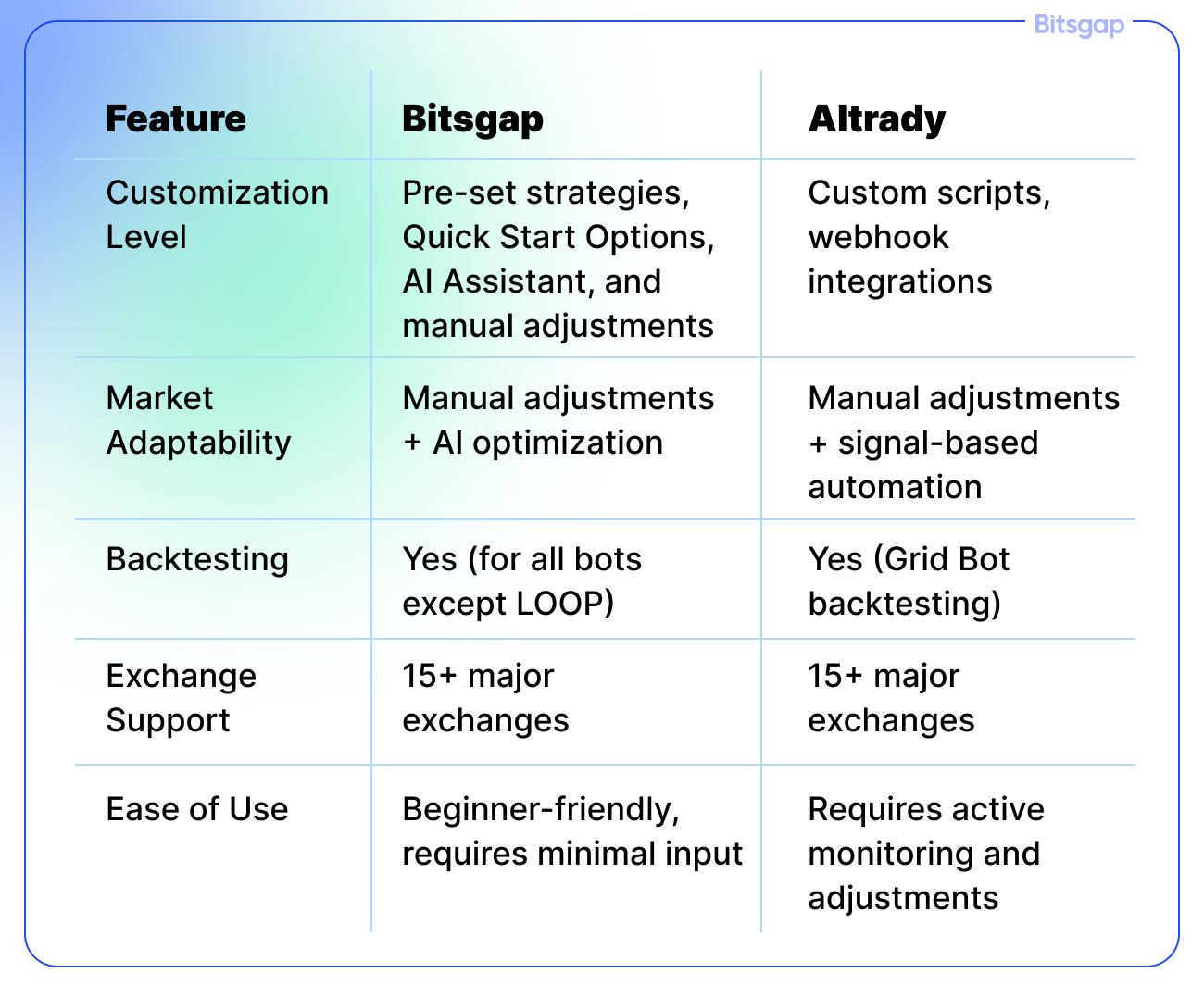

Key Platform Features: Bitsgap vs Altrady Crypto

Both Bitsgap and Altrady are comprehensive crypto trading platforms that allow users to manage multiple exchange accounts from a single interface, but they have different strengths and approaches to crypto trading.

Key Tools of Bitsgap and Altrady

Bitsgap: Automation and Efficiency

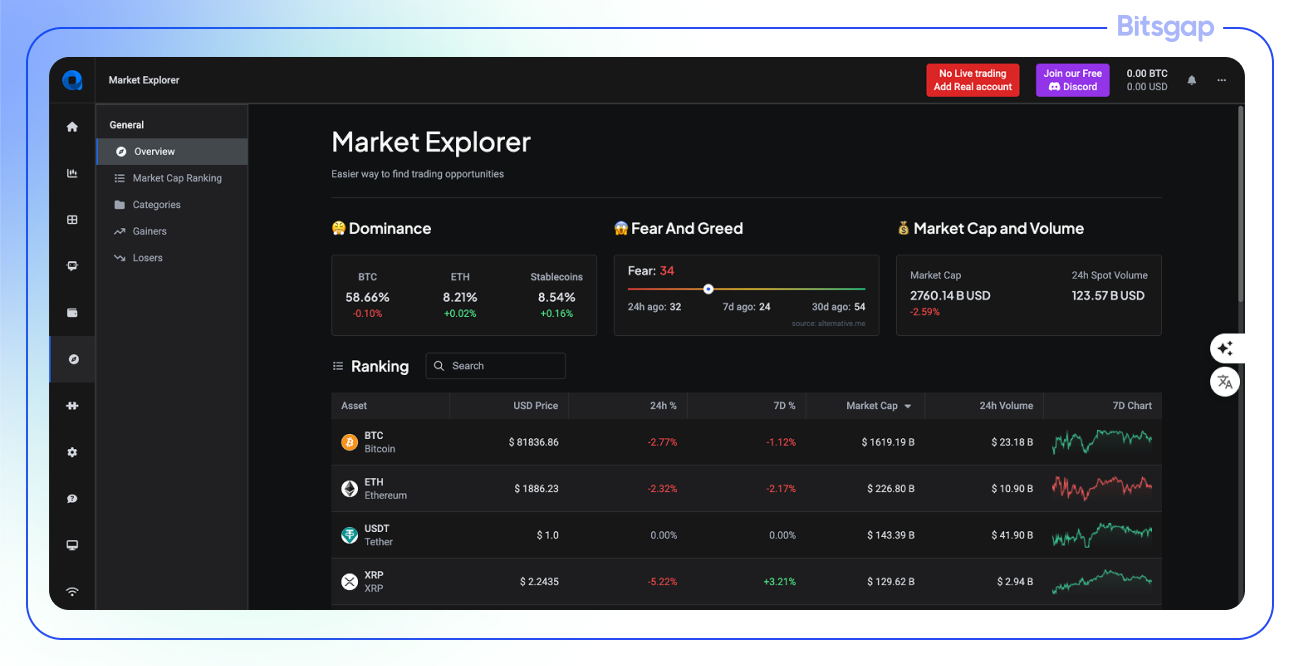

Bitsgap is a powerful trading platform that enables traders to execute strategies both manually and automatically. It integrates with 15+ major exchanges and offers a suite of trading bots and other powerful trading tools to optimize different market conditions.

- Trading Bots:

- GRID Bot: Profits from sideways markets by setting buy and sell orders in a grid pattern.

- DCA Bot: Uses Dollar-Cost Averaging (DCA) for both spot and futures markets to reduce risk in volatile markets.

- BTD Bot: Executes trades based on the Buy the Dip strategy.

- COMBO Bot: Combines DCA and GRID strategies for high-risk, high-reward futures trading.

- AI Assistant: Automatically generates a balanced portfolio of bots, optimizing risk and profitability.

- Smart Trading Terminal:

- Supports limit, market, stop-limit, OCO, TWAP, and scaled orders.

- Take Profit & Stop Loss: Ensures risk management and profit protection.

- Trailing Orders: Adjusts automatically based on market movements.

- Portfolio Management:

- Links multiple exchanges into one interface.

- Provides real-time market data and analytics.

Altrady: Advanced Market Analysis & Manual Trading

Altrady is designed for traders who prefer manual control with enhanced market insights. It features:

- Smart Trading Tools:

- Multi-entry orders: Place up to 10 entry and exit orders at once.

- Trailing Stop & Take Profit: Protects profits and adjusts to market trends.

- Ladder Orders: Automates scaling in and out of positions.

- Risk Management Tools: Includes PnL tracking, stop-loss cooldowns, and position sizing calculators.

- Automated Trading Bots:

- Grid Bot: Similar to Bitsgap’s, it profits from market fluctuations.

- Signal Bot: Allows integration with TradingView for custom webhook signals.

- Provider Alerts: Automates trades based on signals from trusted market providers.

- Market Analysis & Alerts:

- Crypto Base Scanner: Identifies profitable market opportunities.

- Trend Line Alerts: Notifies traders about breakouts and key market movements.

- Chart Replay & Watchlists: Allows backtesting of strategies.

- Multi-Exchange Integration:

- Trade on 15+ exchanges from a single dashboard.

- Unified Portfolio Management: Reduces risk through diversified exchange connections.

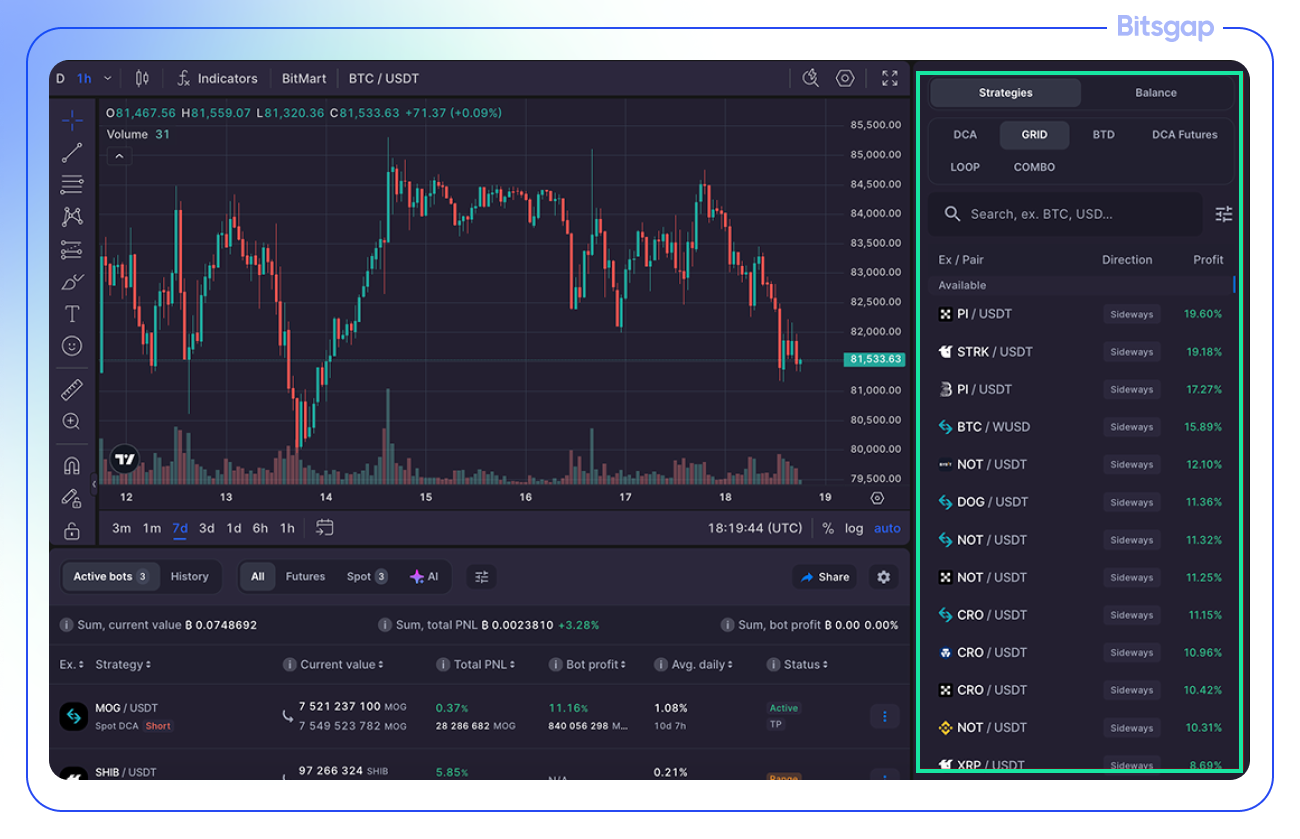

Differences in Approaches: Automation vs. Analytical Trading

Fig. 1. Differences in approaches between Altrady and Bitsgap.

Unique Features of Each Platform

What Makes Bitsgap Unique?

✅ AI-Powered Trading: The AI Assistant automatically builds optimized bot portfolios.

✅ Advanced Bot Strategies: Offers DCA, GRID, BTD, LOOP, and COMBO Bots, covering spot and futures trading.

✅ Fully Automated Trading: Designed for traders who want minimal manual intervention.

What Makes Altrady Unique?

✅ Comprehensive Market Analytics: Features Crypto Base Scanner, Chart Replay, and Signal Bots.

✅ Customizable Trading Terminal: Users can fully personalize their workspace with widgets.

Automated Trading: Bitsgap vs Altrady Trading Bots

Both Bitsgap and Altrady offer automated trading capabilities through specialized bots, but their approaches, variety, and focus differ significantly.

Bitsgap Trading Bots

Bitsgap provides a comprehensive ecosystem of specialized bots, each designed for specific market conditions:

- GRID Trading Bot

- Designed for sideways markets

- Profits from small price movements within a predefined range

- Perfect for beginners

- Includes stop loss, take profit, and trailing features

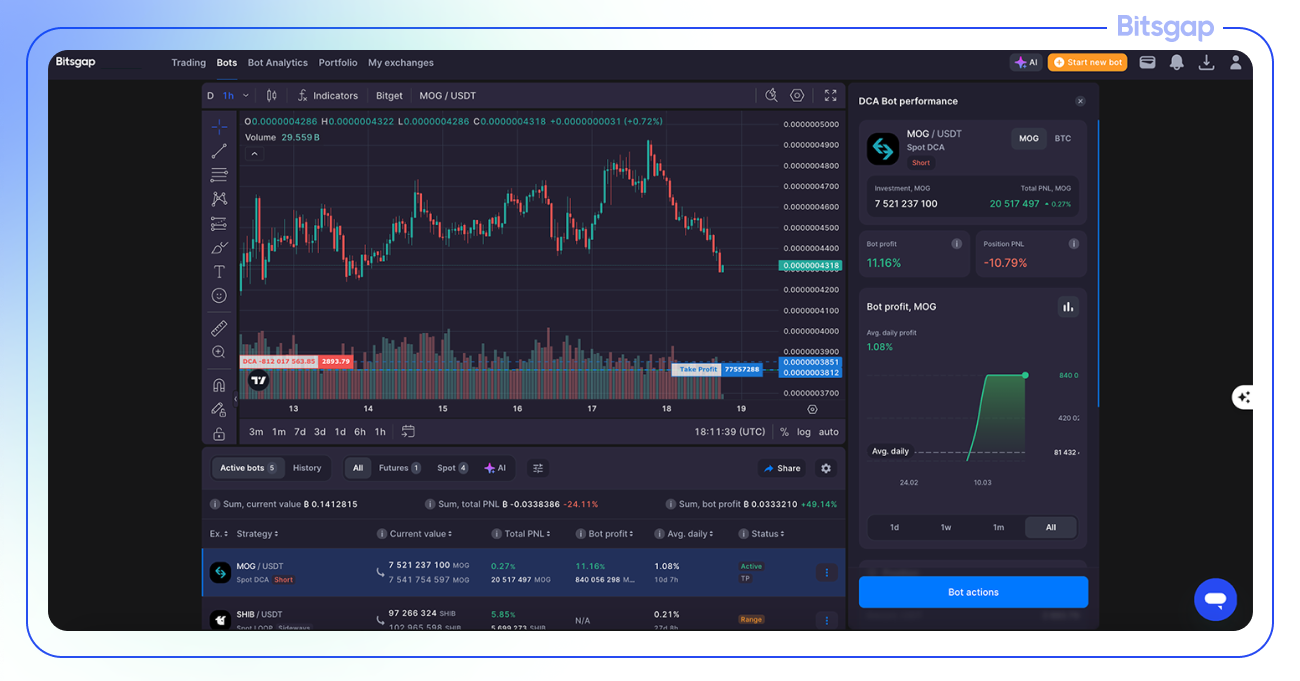

- DCA (Dollar-Cost Averaging) Bot

- Works in both long and short directions

- Reduces risk in volatile markets by averaging positions

- Suitable for upward and downward trending markets

- BTD (Buy the Dip) Bot

- Specialized for downtrend markets

- Helps accumulate coins during market downturns

- Includes stop loss and take profit features

- DCA Futures Bot

- Specifically designed for futures trading

- Supports both long and short positions

- Leverages DCA strategy for futures markets

- COMBO Bot

- Combines DCA and GRID strategies

- Designed for futures markets with high rewards and risks

- Supports leveraged trading

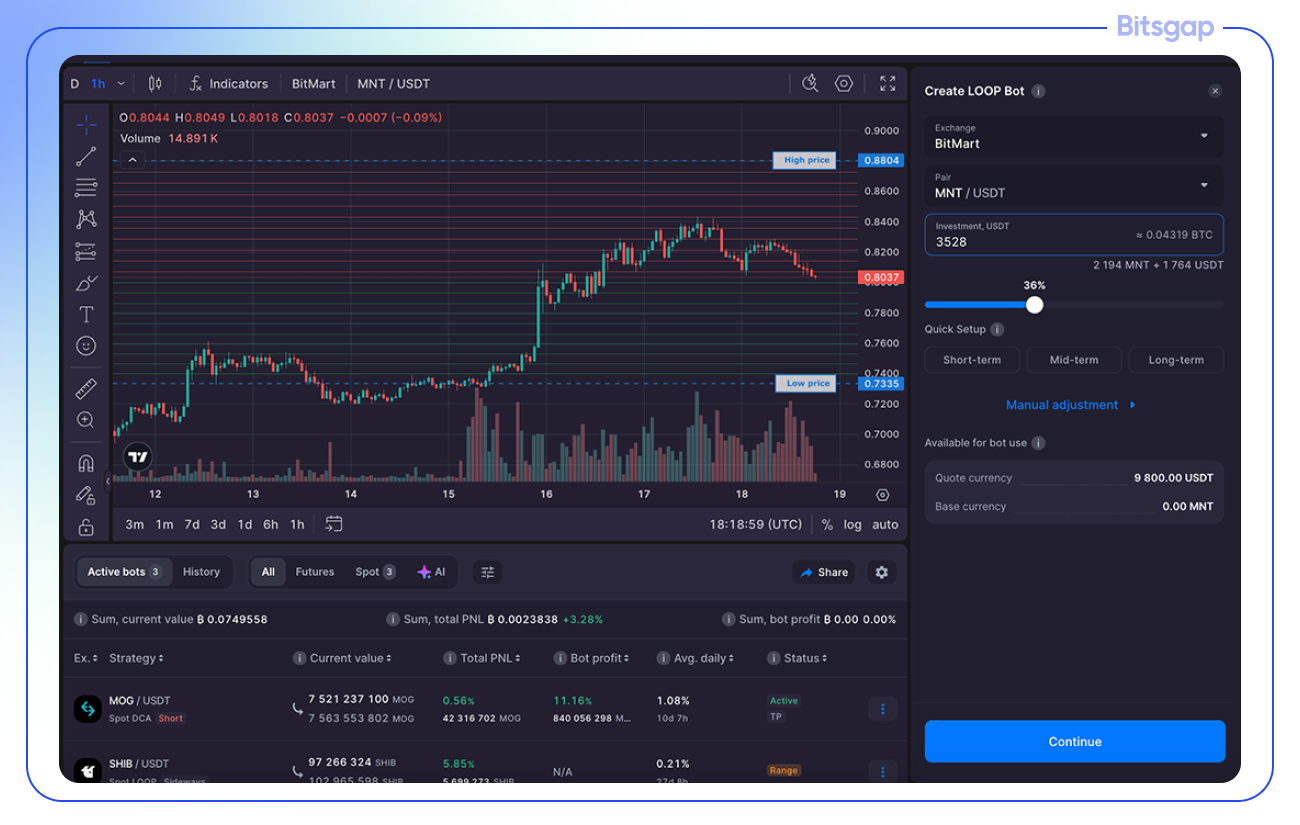

- LOOP Bot

- Unique position trading bot

- Earns in 2 currencies simultaneously

- Reinvests profits automatically

- Works best within a fixed price corridor

- Designed for long-term trading

- AI Assistant

- Creates and manages a portfolio of bots

- Monitors market correlations for optimal diversification

- Boosts profits by up to 20% compared to manual trading

- Based on 7 years of market analysis

Altrady Trading Bots

Altrady offers fewer trading bots:

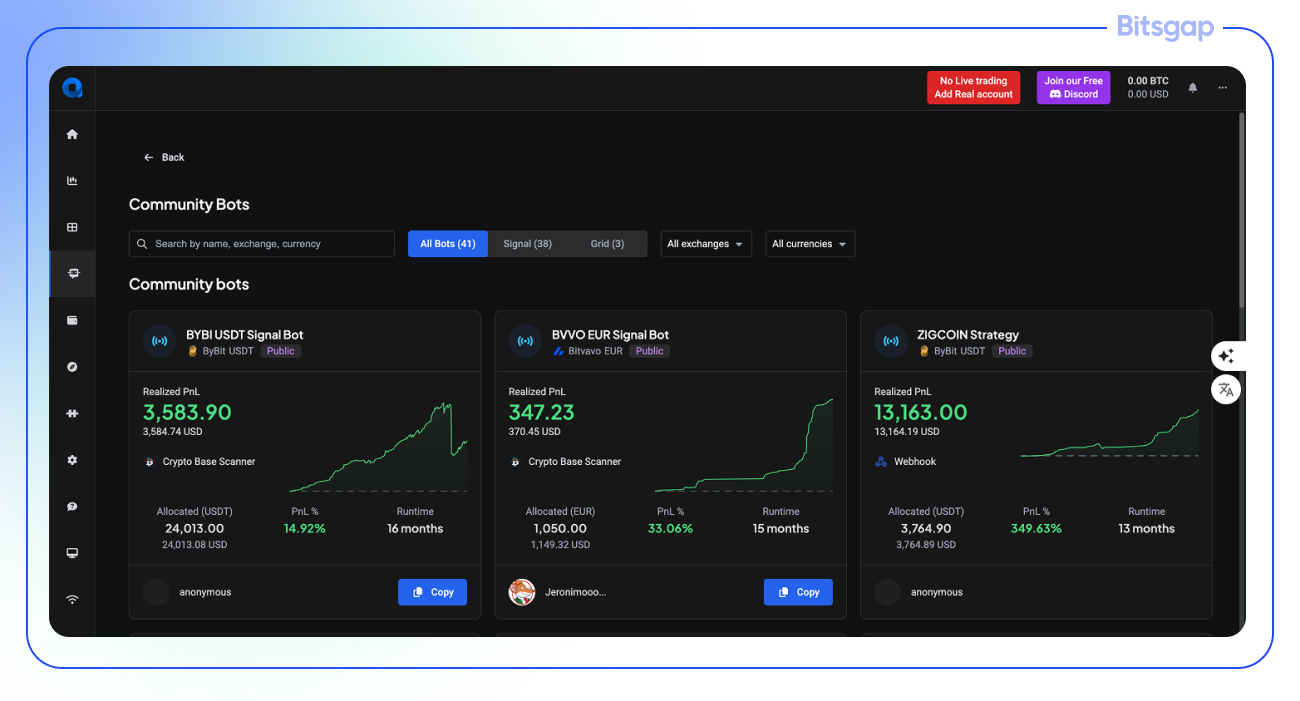

- Signal Bot

- Works with selected signal providers (like Crypto Base Scanner, The Better Traders, Fox Signals)

- Automatically executes trades based on signals

- Includes analytics to track performance

- Can use DCA orders for position management

- Webhook Bot

- Integrates with TradingView or custom algorithms

- Allows for custom signal creation

- Supports dynamic trading actions (Open, Close, Reverse)

- Highly customizable for experienced traders

- Grid Bot

- Works in sideways markets

- Features "trailing up and down" to follow price movements

- Includes analytics to monitor ongoing performance

Customization and Strategy Adaptation

Bitsgap Strategy Customization

- Pre-made Strategies: Offers ready-made strategies based on backtested results

- Backtesting: Allows testing bot strategies on historical data before deployment

- Parameter Adjustment: Users can adjust parameters like grid levels, grid steps, stop-loss & take-profit levels, exit/entry points, price range, etc.

- Instant Launch: Emphasizes ease of setup with "3-click" launch process

- Bot Selection by Market Condition: Different bots for different market types (sideways, trending up/down)

- Real-time Bot Analytics: Provides detailed statistics on bot performance

- Pre-configured Backtested Strategy Suggestions: Suggests optimized strategies ranked by profitability for an easy start.

- Demo Mode: Risk-free testing environment before using real funds

- Backtesting: Backtesting for all bots except LOOP.

Altrady Strategy Customization

- Webhook Builder: Allows creation of custom signals with more control over strategy logic

- Grid Bot Backtest Tool: Tests grid settings on historical data to optimize parameters

- Dynamic Trading Actions: Supports complex actions beyond simple buy/sell orders

- Signal Provider Selection: Choice of vetted signal providers with proven track records

- Bot Analytics: Performance tracking with market-specific insights

- Custom Position Parameters: Ability to specify entry price, DCA orders, take profit levels, and stop-loss in signal bots

Flexibility and Risk Management

Bitsgap Flexibility and Risk Management

- Multi-Bot Types: Different bot types for various market conditions provides flexibility

- Indicator-Based Trading: Uses technical indicators for DCA trading

- Stop-Loss Protection: Included in most bot types

- Take Profit Settings: Automatic profit-taking at predetermined levels

- Trailing Features: Dynamic adjustment of orders as market moves

- Pump & Dump Protection: Guards against market manipulation

- Leverage Control: Options for leveraged trading in futures bots (up to x10 allowed)

- AI Portfolio Balancing: AI Assistant monitors correlations between markets for diversification

- Backtesting: Testing on historical data allowed for all bots but LOOP

- Onboarding Support: Help Desk materials, 24/7 support, and live chat for urgent issues available

Altrady Flexibility and Risk Management

- Custom Webhook Integration: Highly flexible signal creation through webhooks

- Grid Bot Trailing: "Trailing up and down" feature adapts to changing market conditions

- Analytics-Driven Adjustments: Performance analytics to guide strategy refinement

- Signal Bot DCA Management: Adjustable DCA settings based on historical performance data

- Backtest-Informed Strategy: Grid bot backtesting helps optimize settings before deployment

- Onboarding Support: Educational resources and support for strategy refinement

- 30-Day Money-Back Guarantee: Risk-free trial period for testing bot effectiveness

- Action-Specific Parameters: Each trading action (Open, Close, Reverse) can have different parameters

Key Differences in Automated Trading Approaches

- AI Implementation

- Bitsgap emphasizes its AI Assistant for portfolio management

- Altrady focuses on signal-based automation and custom webhook integration

- Market Direction Adaptation

- Bitsgap has dedicated bots for different market directions (sideways, up, down)

- Altrady adapts through signal providers

- Futures Trading

- Bitsgap offers manual futures trading and specialized futures trading bots (DCA Futures, COMBO)

- Altrady supports futures trading (manual trading & Signal Bot)

- Ease of Setup vs. Customization

- Bitsgap emphasizes "3-click" setup and beginner-friendly options

- Altrady seems to be catered toward more experienced traders

👉 Verdict: Both platforms offer robust automated trading solutions with strong risk management features, but they cater to somewhat different trader profiles. Bitsgap may appeal more to traders seeking specialized, purpose-built bots for specific market conditions, while Altrady might be preferred by those wanting deeper customization and integration capabilities with external systems like TradingView.

Exchange Support: Bitsgap vs Altrady

Both Bitsgap and Altrady offer multi-exchange functionality, allowing traders to manage their cryptocurrency trading across various platforms through a single interface. This integration is critical for traders who want to access different markets or diversify their trading across multiple exchanges without juggling multiple accounts and interfaces.

Comparison of Supported Cryptocurrency Exchanges

Bitsgap:

- Supports 15+ major cryptocurrency exchanges

- Includes Binance, Binance US, Bitfinex, Bitget, BitMart, Bybit, Coinbase, Crypto.com, Gate.io, Gemini, HitBTC, HTX, Kraken, Kucoin, OKX, Poloniex, and WhiteBit

Altrady:

- Also supports 15+ cryptocurrency exchanges

- Includes Woo, Poloniex, OKX, MEXC, KuCoin, Kraken, HTX, HitBTC, Gate.io, Crypto.com, Coinbase, Bybit, Bitvavo, BingX, and Binance

Unique Exchanges

Bitsgap Exclusive:

- Binance US

- Bitfinex

- Bitget

- BitMart

- WhiteBit

Altrady Exclusive:

- Woo

- MEXC

- Bitvavo

- BingX

Additional Exchange-Related Features

Bitsgap:

- Provides detailed trading volume data for each exchange

- Lists the number of trading pairs available on each exchange

- Highlights portfolio rebalancing and diversification across exchanges

- Offers a unified dashboard to view all exchange accounts

Altrady:

- Features a powerful portfolio asset manager

- Allows segregation of client portfolios across multiple exchanges

- Enables tracking portfolio value over time with detailed charts

- Provides filtering capabilities for asset data across exchanges

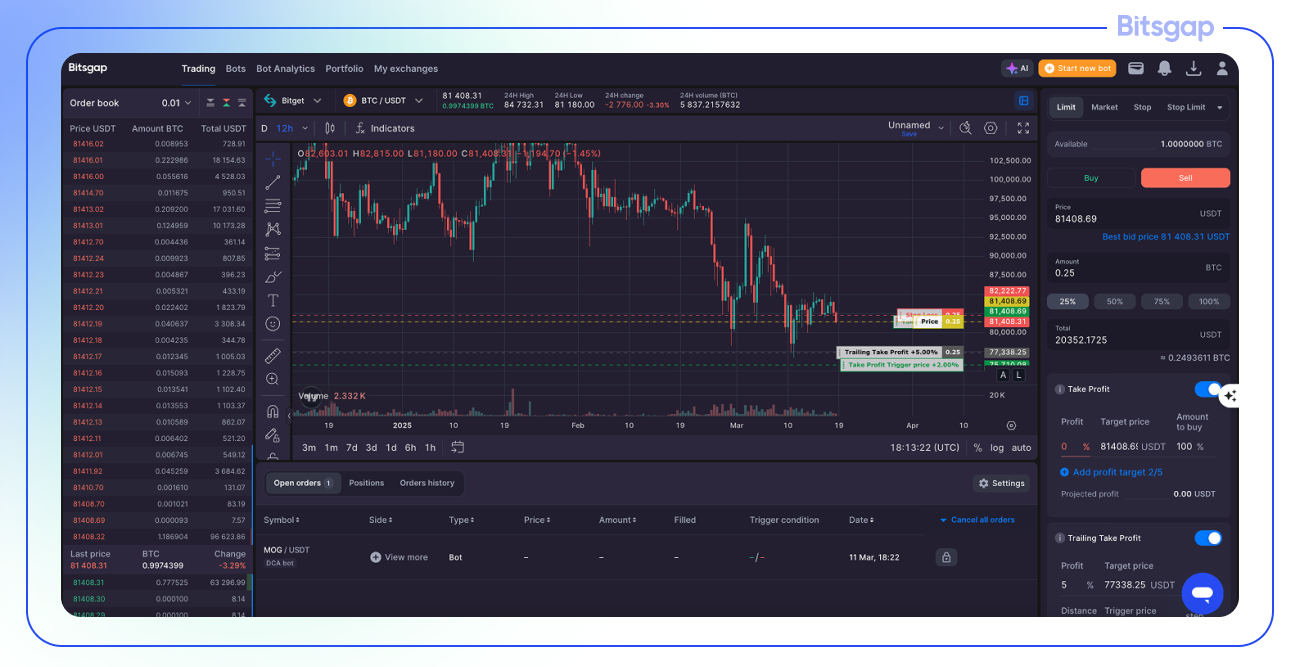

Terminal, Interface, and Usability: Bitsgap vs. Altrady

Both Bitsgap and Altrady offer sophisticated trading terminals designed to enhance the crypto trading experience, but they implement different approaches to user interface and functionality.

Visual Comparison of Interfaces

Bitsgap Interface

Bitsgap's interface emphasizes simplicity and accessibility:

- Clean, minimalist design with a focus on essential trading functions

- Centralized dashboard showcasing all connected exchanges in one view

- Order execution panel with clearly labeled smart order options

- TradingView integration with over 100 indicators and 50 drawing tools

- Simple three-step process (Sign Up → Connect → Start Trading) highlighted in the interface

- Algorithmic orders prominently displayed (Limit, TWAP, Scaled, Market, Stop Limit, Stop)

- Dedicated mobile app + web app designed to work across multiple device types

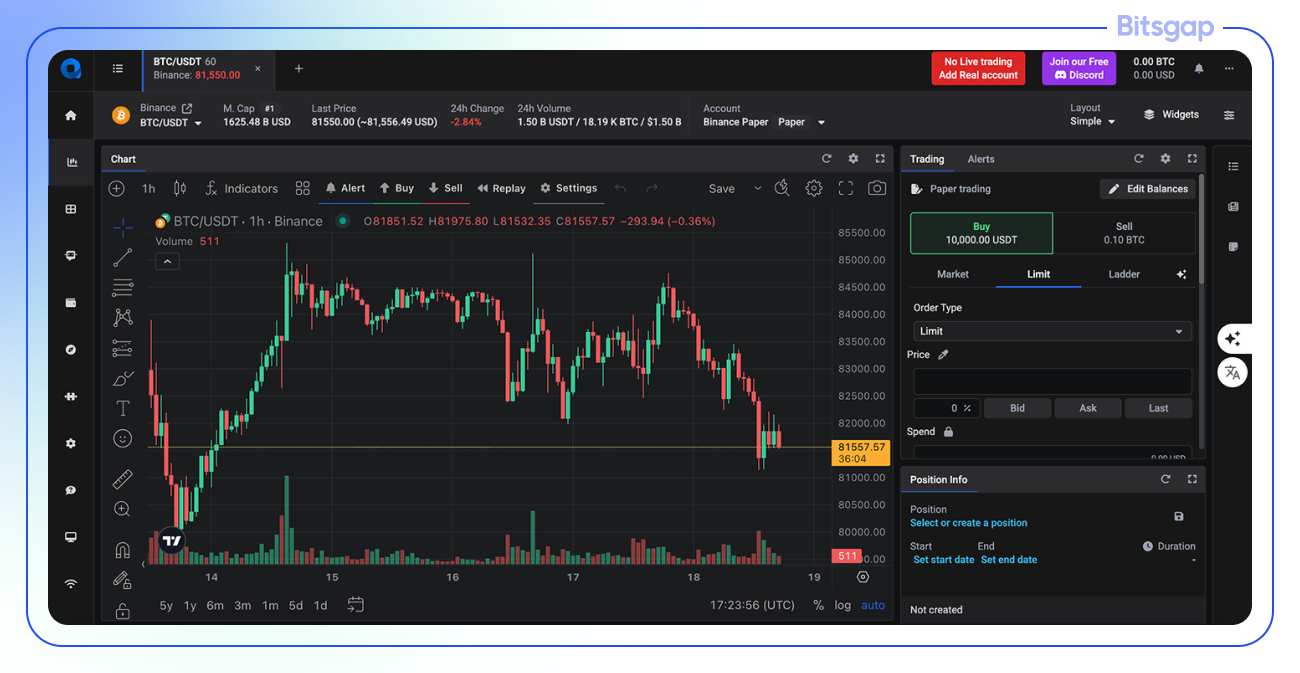

Altrady Interface

Altrady's interface offers more comprehensive customization and detailed trading tools:

- Fully customizable trading terminal allowing users to create personalized layouts

- Widget-based system for viewing multiple markets or timeframes simultaneously

- Advanced order types with visual representation (ladder orders, trailing entries)

- Visual trade feedback directly on charts showing entry/exit points

- Position information widget displaying real-time profit/loss calculations

- Tabbed market navigation for quick switching between important markets

- Chart replay function integrated into the interface for strategy testing

- Dedicated mobile app for iOS and Android

Beginner vs Professional Usability

For Beginners

Bitsgap Advantages for Beginners:

- "Instant launch with 3 clicks" feature for trading bots

- Simple bot selection process categorized by market conditions

- Demo mode for risk-free practice, 7 free trial on PRO plan

- Ready-made strategies for quick implementation

- "No fiddly settings" approach

- AI Assistant to create automated bot portfolios without requiring technical knowledge

- 24/7 customer support for assistance

Altrady Advantages for Beginners:

- Free paper trading plan "forever" for unlimited risk-free practice

- 1-1 onboarding call to get up to speed with the app

- Continuing education through Altrady Academy courses and webinars

- 24/7 customer support for assistance

For Professionals

Bitsgap Advantages for Professionals:

- Advanced bot ecosystem with specialized tools for different market conditions

- Extensive customization options for manually adjusting bot strategies

- Real-time bot analytics for performance optimization

- Backtesting capabilities on actual historical data

- Smart order types in trading terminal

- Advanced security features

- Trailing features

Altrady Advantages for Professionals:

- Highly customizable trading terminal layout

- Advanced order types like ladder orders with price and size scaling

- Fibonacci and linear scale options for order placement

- Trailing entry and trailing take profit for precision trading

- Stop loss with cooldown to avoid stop hunts

- Chart replay for strategy testing and improvement

- Trend line alerts for technical breakout trading

- Position management with detailed metrics including fees paid

Both platforms prioritize user-friendly interfaces but with different approaches to complexity and customization. Bitsgap appears to target both beginners and professionals with an emphasis on simplicity and automation, while Altrady provides more detailed trading tools and customization options that may appeal more to advanced traders who want granular control over their trading environment.

Security and Data Protection: Altrady vs Bitsgap

Both Bitsgap and Altrady prioritize security as a cornerstone of their platforms, implementing multiple layers of protection to safeguard users' cryptocurrency assets and personal data. As third-party trading tools that connect to exchanges via API keys, their security measures are crucial for gaining and maintaining user trust.

Security Measures Implemented in Bitsgap & Altrady Bots

Bitsgap Security Framework

Bitsgap has implemented a comprehensive five-layer security system:

- Encrypted API with No Withdrawal Access

- API keys with withdrawal permissions are automatically rejected

- Only requires trade history, balance view, and trading permissions

- No KYC or personal data collection, minimizing data exposure risk

- Advanced API Protection

- "1 Account = 1 API Key" rule prevents API key reuse across accounts

- Countertrade protection to prevent market manipulation through unpopular trading pairs

- Detection and blocking of suspicious trading patterns

- API Key IP whitelisting to restrict access to Bitsgap's servers only

- OAuth Integration

- Partnership with major exchanges (Binance, OKX, Kucoin) for OAuth authentication

- One-click setup with no setup errors

- API keys are only transmitted between the exchange and Bitsgap in encrypted form

- 2048-bit RSA Encryption

- Industry-leading encryption standard (claimed to take ~300 trillion years to crack)

- Each user account encrypted with its own separate RSA-2048 key

- All information delivered to servers encrypted and protected by firewalls

- Two-Factor Authentication

- Optional but recommended additional security layer

- Support for hardware security keys like Yubikey

- Prevents unauthorized account access

Altrady Security Framework

Altrady emphasizes a multi-layered security approach:

- Secure Login System

- Strong, unique password requirements

- Login notifications for new location access

- IP tracking for suspicious login attempts

- Two-Factor Authentication (2FA)

- Backup codes provided for account recovery

- Identity verification process for 2FA reset

- Regular 2FA prompts for users who haven't enabled it

- Five Word Passkey System

- Unique encryption key for API keys stored locally on the user's computer

- Required for adding, editing, or deleting API keys

- Required when using a new device for the first time

- Creates a barrier even if login credentials are compromised

- API Key Encryption

- API keys encrypted on the client side using the five word passkey

- Encrypted keys stored on Altrady servers

- Only decryptable using the user's personal five word passkey

- IP Whitelisting

- Recommends binding IP addresses to API keys

- Provides Altrady server IPs for whitelisting on exchanges

- Notes that IP whitelisted API keys don't expire (unlike non-whitelisted ones)

Safety Assessment for Cryptocurrency Asset Management

Bitsgap Safety Evaluation

Strengths:

- Seven-year track record with no reported hacks or security breaches

- Multiple layers of encryption and protection

- No withdrawal access by design

- Minimal data collection reduces exposure risk

- OAuth partnerships with major exchanges

- Countertrade protection against market manipulation

- 2048-bit RSA encryption (industry-leading standard)

Considerations:

- Cloud-based platform with keys stored on servers (though encrypted)

- Requires trust in Bitsgap's security implementations

- Users must follow security best practices when creating API keys

Altrady Safety Evaluation

Strengths:

- Client-side encryption of API keys

- Five word passkey that never leaves the user's device

- Device-level authorization for new logins

- Detailed documentation on security best practices

- No reported security incidents mentioned in documentation

- Multi-level authentication process

Considerations:

- Requires users to securely store their five word passkey

- Recovery process if passkey is lost could be challenging

- Users must follow recommended security practices

Comparative Safety Analysis

Both platforms implement robust security measures that follow industry best practices for cryptocurrency trading tools:

- API Key Protection: Both platforms emphasize trading-only API permissions and implement encryption. Bitsgap uses 2048-bit RSA encryption for all data, while Altrady uses a unique five word passkey system for client-side encryption.

- Authentication Layers: Both offer multi-factor authentication, with Bitsgap supporting hardware security keys and Altrady implementing a five word passkey system as an additional layer.

- IP Whitelisting: Both platforms recommend and support IP whitelisting of API keys to restrict access to their servers only.

- Protection Against Attacks: Bitsgap explicitly mentions countertrade protection and fingerprinting to prevent exploitation, while Altrady focuses on device-level authorization and login notifications.

- Track Record: Bitsgap explicitly mentions having no security breaches in seven years of operation. Altrady doesn't specifically mention its security track record.

Pricing and Tariff Plans: Bitsgap vs Altrady Pricing

When choosing a crypto trading platform, pricing and available features play a crucial role. Bitsgap and Altrady both offer multiple subscription tiers, providing different levels of access to trading tools, bots, and market analysis features. Let’s compare their subscription costs, free vs. paid plans, and overall value for money.

Subscription Costs and Available Features

Fig. 2. Subscription costs: Bitsgap vs Altrady Bot review.

🔍 Verdict: Bitsgap offers better automation with AI-powered bots across all plans, while Altrady focuses more on alerts, market scanners, and manual trading tools.

Free vs. Paid Plans: What Do You Get?

Bitsgap Free Plan

✅ Unlimited manual trading

✅ 20 active bots in demo mode

✅ Smart orders & trading terminal

Altrady Free Trial (14 Days)

❌ No permanent free plan

✅ Access to all features during trial

✅ Downgraded to Basic Paper Trading after trial

🔍 Verdict: Bitsgap offers a permanent free plan with demo trading, whereas Altrady only provides a free trial, after which users must pay to continue.

Where Do Users Get More for Their Money?

- For automated trading and AI-powered bots, Bitsgap is the better choice, offering more active bots and AI features at a competitive price.

- For active traders who rely on alerts, scanners, and manual trading tools, Altrady provides more market analysis features but at a higher cost per bot.

- Bitsgap provides a free plan, while Altrady requires a paid subscription after the trial period.

Final Verdict: If you prioritize automation, AI trading, and value for money, Bitsgap offers more advanced features at lower prices. However, if you need market analysis tools and manual trading enhancements, Altrady may be a better fit. 🚀

Conclusions and Recommendations: Bitsgap vs Altrady Review

After an extensive comparison of Bitsgap and Altrady across multiple dimensions—from automated trading capabilities to security measures, from exchange support to interface design—a clear picture emerges of two competent platforms with distinct strengths, but with Bitsgap establishing itself as the more compelling solution for traders focused on automation and algorithmic trading.

Why Bitsgap Stands Out

Bitsgap has developed a remarkably comprehensive ecosystem of specialized trading bots designed to thrive in various market conditions. The platform's commitment to automated trading is evident in its rich offering of GRID, DCA, BTD, LOOP, COMBO, and DCA Futures bots, each meticulously crafted for specific market scenarios. What truly distinguishes Bitsgap's approach, however, is the integration of artificial intelligence through its AI Assistant, which brings portfolio-level thinking to bot deployment and management.

This AI-driven approach represents the next evolution in crypto trading—moving beyond single-strategy automation to intelligent portfolio construction and management. The AI Assistant analyzes market correlations, balances risk across different trading pairs, and optimizes bot deployment based on seven years of market data analysis. This level of sophistication simply isn't available on competing platforms, including Altrady.

While Altrady offers solid trading tools and some automation capabilities, its bot ecosystem is more limited in both variety and quantity. Bitsgap's Advanced plan provides access to 50 DCA bots and 10 Grid bots, far exceeding Altrady's offering of just 5 bots at a comparable price point. For serious algorithmic traders, this difference in scale can significantly impact portfolio diversification and risk management.

Security Without Compromise

Both platforms prioritize security—as they should—but Bitsgap's implementation of 2048-bit RSA encryption (with a crack time of around 300 trillion years) demonstrates a commitment to enterprise-grade protection. The platform's five-layer security system, including encrypted APIs, advanced API protection mechanisms, OAuth integration with major exchanges, and comprehensive two-factor authentication options, creates a secure environment for managing trading operations without compromising on functionality.

Bitsgap's seven-year track record without security breaches speaks to the effectiveness of these measures. For traders concerned about entrusting their API keys to third-party platforms, this clean security history provides meaningful reassurance.

The Trading Experience

Bitsgap's interface strikes an elegant balance between simplicity and functionality. While Altrady offers more customization options for its trading terminal, Bitsgap's focused design prioritizes efficiency and ease of use without sacrificing essential features. The platform's "three-click" approach to bot deployment makes algorithmic trading accessible even to novices, while still providing the depth and analytical tools that experienced traders demand.

The integration of TradingView charts with over 100 indicators and 50 drawing tools ensures that technical analysis capabilities remain robust, while the cloud-based infrastructure guarantees 24/7 operation regardless of the trader's personal internet connection or hardware status.

A Compelling Value Proposition

When evaluating the overall value proposition, Bitsgap emerges as the superior choice for traders focused on automation. Its tiered pricing structure rewards commitment with substantial discounts for annual billing, and the features included even at the Basic tier ($21/month with annual billing) provide meaningful automation capabilities.

For traders seeking maximum algorithmic firepower, the Pro plan at $108/month (annual billing) delivers an unmatched suite of tools, including 50 Grid bots, 250 DCA bots, AI Portfolio Mode, and take profit automation. While this represents a premium price point, the potential for these tools to generate consistent returns makes it an investment rather than merely an expense.

Try Before You Commit

Perhaps the most compelling aspect of Bitsgap's offering is the opportunity to experience its premium features without financial commitment. The platform offers a full 7-day trial of its PRO plan without requiring a credit card, allowing traders to explore the complete suite of automation tools and evaluate the interface before making any payment.

This risk-free trial period provides the perfect opportunity to see firsthand how Bitsgap's advanced automation tools could transform your trading approach. In a market where timing and strategy are everything, having a week to explore these capabilities represents a significant advantage.

Take advantage of Bitsgap's 7-day free trial to experience these capabilities for yourself. With no credit card required and access to the complete Pro plan feature set, you have nothing to lose and potentially significant trading advantages to gain.