Zilliqa (ZIL) Bucks All Market Trends, or Does It?

Zilliqa? Unpack the full story — from its tech-savvy foundations to controversy, from market analysis to bold predictions.

Zilliqa burst onto the crypto scene with a bang in 2017, promising to revolutionize blockchain scalability through an innovative sharded architecture allowing unprecedented transaction speeds. After its token's meteoric 1,300% surge during 2018's mania, this one-time darling saw its price crater.

Yet the underlying technology continued gaining traction, attracting dApps hungry for higher throughput. Now with the winds of a nascent bull market again filling its sails, Zilliqa aims to realize its lofty vision — if it can navigate allegations of misconduct rocking its C-suite.

This piece will dissect ZIL’s rollercoaster price action, both the groundbreaking tech propelling its ascendant platform and the controversy surrounding its executive leadership.

What Is Zilliqa (ZIL)?

Zilliqa is a robust blockchain platform designed to scale securely in an open, permission-less distributed network. The core feature that sets Zilliqa apart from other blockchain platforms is its implementation of sharding.

👉 By pioneering sharded blockchain infrastructure, Zilliqa aspires to establish the premiere ecosystem where developers can construct decentralized applications (dApps) necessitating vastly higher transaction speeds and throughput than feasible on conventional chains.

Ziliqa’s History & Development Timeline

Zilliqa emerged in 2017 when a team of academics, scientists, and developers from National University Singapore banded together to tackle blockchain's scaling dilemma. With Prateek Saxena, co-author of an influential sharding study, among the founding cohort, research-driven innovation anchored Zilliqa's mission from inception. This rigorous scientific footing enabled the burgeoning platform to architect a sharded architecture where transaction loads distribute across a decentralized network in parallel — unlocking a new class of high-performance dApps, too intensive for the limits of traditional architectures.

Here’s Ziliqa’s brief development timeline overview:

- 2017: Zilliqa started as a project developed by researchers from the National University of Singapore led by Xinshu Dong. Its novel protocol aimed to address the limitations of scalability and security in earlier blockchain systems.

- January 2018: Zilliqa conducted its initial coin offering (ICO), which was notably successful, raising a significant amount of capital that helped fund the development of its unique sharded architecture.

- June 2019: Zilliqa launched its mainnet, moving from an Ethereum-based ERC-20 token to its native token, ZIL. This launch marked a significant milestone as it introduced sharding in practice.

- 2020 and Beyond: Post-mainnet, Zilliqa has focused on expanding its ecosystem, including launching decentralized finance (DeFi) applications, non-fungible tokens (NFTs), and developing partnerships across various industries.

Detailed Analysis of Zilliqa & its native token ZIL

ZIL is the native cryptocurrency of the Zilliqa blockchain. It serves several key functions within the platform:

- Transaction Fees and Gas: ZIL is used to pay for transactions and computational services on the Zilliqa network. These fees are notably lower compared to other major blockchains like Ethereum, making Zilliqa an economically attractive option for developers and users.

- Staking: Users can stake their ZIL tokens to participate in the network consensus and earn rewards. Staking is described as eco-friendly, aligning with growing concerns about the environmental impact of blockchain technologies.

- Governance: Holding ZIL potentially allows users to participate in governance decisions, influencing the future development of the network.

- Utility in dApps: ZIL is used within various dApps for different purposes, such as purchasing services or goods, participating in DeFi applications, or trading NFTs.

Services Offered by Zilliqa

Zilliqa offers a range of services focused on enhancing the scalability and security of blockchain applications:

- Sharding: Zilliqa was one of the first blockchains to implement sharding, a technology that breaks the network into smaller pieces or "shards" to process transactions in parallel, significantly increasing throughput.

- Scilla Language: Zilliqa introduces its own secure programming language, Scilla (Smart Contract Intermediate-Level Language), designed to avoid security issues and enable formal verification of contracts.

- dApps Development: The platform supports the creation of various decentralized applications, from gaming and financial services to NFT marketplaces and community projects.

- DeFi Products: Zilliqa facilitates access to decentralized financial products and services, offering alternatives to traditional financial systems with a focus on transparency and security.

Zilliqa Ecosystem

- Development and Community Engagement: Zilliqa actively supports developers through resources like the Scilla Cookbook, developer portals, and funding opportunities, fostering a vibrant community around its technology.

- Ecosystem: The Zilliqa blockchain platform currently lists 125 projects, spanning a variety of sectors, including decentralized finance (DeFi), non-fungible tokens (NFTs), gaming, education, and more. For instance, Ezil and Comining are providing mining pool services specifically for ZIL, and Staking Rewards and Everstake platforms enable users to stake their ZIL tokens, contributing to network security and earning rewards.

- Partners and Projects: The ecosystem includes a variety of partners and projects, ranging from startups to global enterprises, which build and deploy on Zilliqa. This diversity showcases Zilliqa's capability to support a wide range of applications and innovations.

- NFTs and the Creator Economy: Zilliqa emphasizes its role in supporting the creator economy through NFTs, providing tools and platforms for creators to monetize digital assets in new and innovative ways.

Zilliqa Ecosystem in Numbers

Below is a detailed picture of the Zilliqa ecosystem's scale, activity, and key metrics

Token Metrics

- ZRC-2 Tokens and Prices: Ziliqa’s ecosystem stats list ZRC-2 tokens (Zilliqa's equivalent of ERC-20 tokens), each with its price. These token prices reflect the diverse range of assets available within the Zilliqa ecosystem, from stablecoins like XSGD and zUSDT to utility tokens like gZIL and more speculative assets.

Network Performance and Statistics

- Daily Transactions: The network handles a substantial volume of daily transactions, indicative of active usage and engagement.

- Cumulative Value of Transactions on Chain: 63,956,174, which demonstrates a significant throughput of transactions since inception.

- Number of Nodes: 2,400 nodes are part of the network, ensuring decentralized security and network integrity.

Staking and Financial Statistics

- Total Value Locked (TVL) in Staking: $179.41 million, highlighting strong community trust and financial commitment to the network's security and operations.

- Percentage of Circulating Supply Staked: 28.43%, a healthy proportion that indicates active participant engagement and investment in the network's future.

- Annual Percentage Rate (APR) for Staking: 10.26%, offering a lucrative return for stakeholders compared to traditional financial instruments.

User Engagement

- Total Number of Addresses: 4,755,519, reflecting broad adoption and a wide user base.

Overall, the Zilliqa blockchain exhibits a dynamic and thriving ecosystem as evidenced by its robust transactional activity, diverse range of tokens, substantial engagement in staking, and a broad user base. These numbers indicate not only active current use but also substantial potential for future growth and development.

ZIL News

Zilliqa has been actively advancing in several strategic areas, particularly in Web3 gaming, DeFi developments, and infrastructure enhancements. Here’s a comprehensive summary of the latest news and developments within the Zilliqa ecosystem:

Advancements in Web3 Gaming and Fan Loyalty Programs

- Skill2Earn Model: Zilliqa is pioneering a Skill2Earn approach in Web3 gaming, focusing on rewarding players based on their skills rather than just participation. This model aims to address the sustainability issues seen in previous Play2Earn models.

- The Winners Circle: This is a new fan loyalty program developed in partnership with Racing League. It utilizes Zilliqa's blockchain technology to offer innovative and unprecedented rewards for sports fans, including prize draws and exclusive experiences.

Token Offerings and Financial Instruments

- $FPS Token Launch: The token for the Web3War game saw a significant response from investors, highlighting the strong market interest in Zilliqa’s gaming projects.

- $SEED Token: Announced by Kalijo, this digital reserve asset is designed to integrate DeFi yields from other EVM-compatible networks, enhancing the financial layer of Zilliqa.

Infrastructure and Platform Development

- Zilliqa 2.0: There are ongoing preparations for the launch of Zilliqa 2.0, which promises to redefine the network's capabilities and introduce cutting-edge protocol improvements.

- Scilla Plugin Update: The Scilla plugin for Hardhat was updated to version 3.8.0, indicating continuous improvements and support for developers building on Zilliqa.

- ZilBridge: After an extended downtime, ZilBridge is back online, restoring full functionality and ensuring continuity in cross-chain operations.

Ecosystem Expansion: Various new applications and services continue to join the Zilliqa ecosystem, showcasing its growing appeal across different sectors, including gaming, DeFi, and NFTs.

External Collaborations and Partnerships: Partnerships with entities like Racing League and initiatives like The Winners Circle and Skill2Earn are strategic moves to expand Zilliqa's influence in non-traditional blockchain sectors such as sports and entertainment.

👉For the latest news on Ziliqa, refer directly to project’s blog or, otherwise, browse through news media outlets like Coindesk and Decrypt.

Zilliqa’s Controversy

However, allegations exist shrouding Zilliqa’s executive team in controversy that warrant examination. Specifically, certain questionable business practices underpinning the blockchain project have sparked criticism and skepticism.

Here is a summary of that controversy:

- Questionable Practices: The leadership of Zilliqa, including Max Kantelia, Juzar Motiwalla, Prateek Saxena, and Matt Dyer, is accused of engaging in deceptive practices detrimental to investors.

- SEC Investigations and Legal Actions:

- In 2019, the SEC investigated Zilliqa Research Pte. Ltd. and Max Kantelia, finding misleading statements that led to the artificial inflation of the ZIL token's price. This resulted in a classic 'pump-and-dump' scheme where the inflated prices allowed insiders to sell at a profit, harming investors when the price subsequently fell.

- In 2022, another lawsuit was filed by the SEC against Max Kantelia and Zilliqa Research Pte. Ltd. for allegedly conducting an unregistered ICO for the ZIL token, raising over $22 million from investors under false pretenses, in violation of U.S. securities laws.

- Continued Dubious Activities:

- By 2024, the article claims Zilliqa's leadership was still engaging in suspect activities, including using new individuals to initiate IDOs, possibly to evade legal scrutiny and continue pump-and-dump schemes with the FPS token launch.

- Some sources indicate Valentin Cobelea as a key figure in operations, potentially diverting attention from the core leadership's actions.

- Ownership and Influence:

- The company Roll1ng Thund3rz (UEN: 202237402E), reportedly controlled by Zilliqa, is discussed with a shareholding structure indicating Zilliqa's 76% stake, while individuals like Matt Dyer and Valentin Cobelea hold smaller percentages.

- Some believe that Max Kantelia and Juzar Motiwalla, through their holdings, exert significant influence over the company, raising concerns about the true independence of this subsidiary from Zilliqa.

Surely, the above paints a damning picture of Zilliqa’s core team. CEO Max Kantelia, CTO Juzar Motiwalla, Chief Scientific Advisor Prateek Saxena, and Product Lead Matt Dyer stand accused of orchestrating alleged pump-and-dump schemes, running an unregistered ICO prompting SEC enforcement, and other deceptive practices harming investors. There might be also circumstantial evidence as to Zilliqa enlisting new actors to spearhead subsequent offerings — potentially to distance past indiscretions from current funding rounds.

👉 These controversies underscore the imperative of judicious due diligence for any exploring investments related to Zilliqa or any other project for that matter. For an industry still lacking comprehensive regulatory guardrails, the onus remains on participants to scrutinize projects for signs of misconduct while exercising caution amid the crypto wild west's inherent risks.

Zilliqa Forecast: ZIL Price & Zilliqa Price Prediction 2030

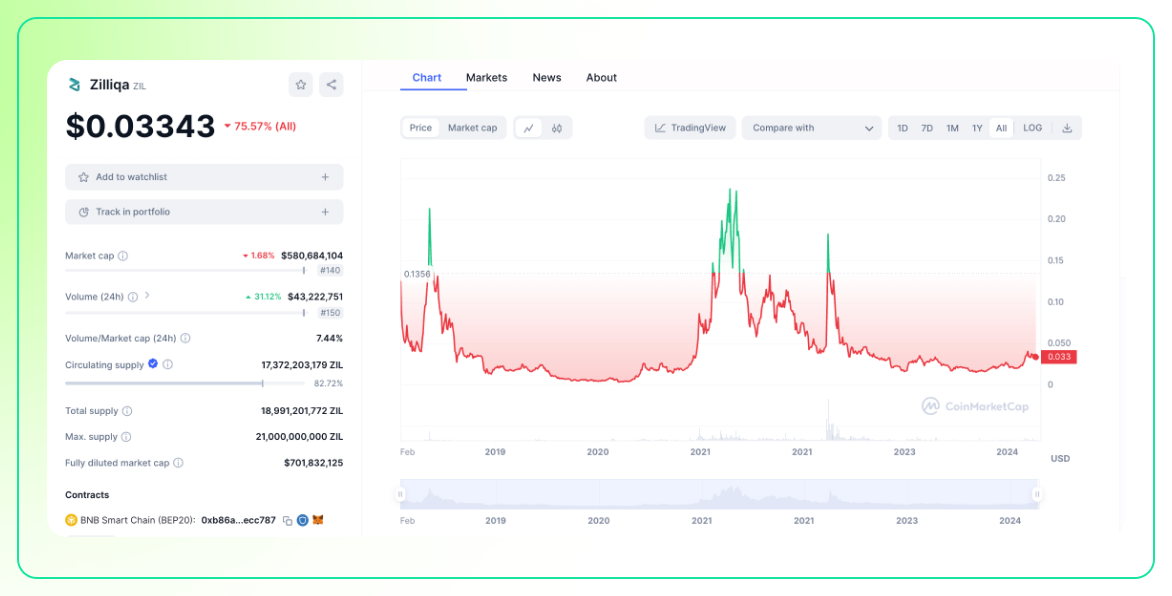

As can be seen from the above chart (Pic. 2), Zilliqa’s price chronology bisects into four eras:

- From launch through 2017, prices flatlined, pinned between $0.003 and $0.01 as the nascent, research-driven blockchain found its footing.

- 2018’s crypto mania propelled ZIL into a parabolic rally topping out around $0.1356 that May, a 1,300%+ explosion indicating the platform’s potential.

- After retracing off all-time highs, a period of consolidation between $0.005 and $0.02 persisted until 2021’s bull market stoked twin rallies in March and May nearing previous peaks around $0.15 and $0.23 respectively.

- However, both 2021 spikes reversed downwards back to lower levels around $0.03, the range where ZIL has since oscillated.

Overall, the price of ZIL has experienced periods of volatility with occasional spikes, but has generally remained at a lower price range throughout its history.

ZIL Crypto Price Now: Short-Term

Now, let’s examine how ZIL is doing now (at the time of writing — April 12, 2024) and where the price is heading short-term.

On the daily chart, we can see that the price has been in a consolidation phase after a strong uptrend:

- The Moving Average (MA 9 close) line is flat, indicating that there is no clear short-term trend.

- The Bollinger Bands (BB 20 2) are relatively tight, which often precedes a period of increased volatility.

- The Relative Strength Index (RSI 14 SMA) is around 48, which is neutral territory.

- The Moving Average Convergence Divergence (MACD 12 26 close 9) is also flat with the histogram bars decreasing in height, indicating a potential reduction in momentum.

The hourly chart shows a more granular view, with the price consistently trading below the MA 9 close, suggesting a short-term downtrend. The Bollinger Bands are beginning to expand, indicating an increase in volatility. The RSI is slightly below 50, which is slightly bearish, and the MACD line is below the signal line and with increasing negative histogram bars.

Unfortunately, forecasting where the price might head is challenging due to the mixed signals in both charts:

- The consolidation pattern on the daily chart suggests that there could be a potential breakout in either direction. You should keep an eye on the Bollinger Bands and watch for a sustained move outside of the bands which could indicate the direction of the next trend.

- On the hourly chart, the current bearish signals suggest a potential move lower unless the price can break and hold above the MA 9 close line.

As always, use additional indicators, price action analysis, and consider market news and sentiment when making trading decisions.

ZIL Crypto Price Prediction: Long-Term

Currently, ZIL's market capitalization hovers around $583 million with a circulating token supply of over 17 billion.

Despite swirling controversies and the crypto market's fickle sentiment, ZIL's long-term prognosis remains bullish. Predictive models forecast ZIL potentially ascending to $0.054 by 2025. More optimistic projections from Conwire eye an eventual price point around $0.18 within the same timeframe.

So while volatility persists as the norm rather than the exception for crypto assets, Zilliqa appears positioned to continue advancing both its blockchain infrastructure and token value over the coming years if the team executes on its technical roadmap.

Conclusion

Despite the lingering allegations miring its key executives, Zilliqa’s core innovation remains undimmed — a high-throughput blockchain architecture scaling into a congested future.

For traders looking to capitalize on $ZIL’s next potential price wave as this technology matures, platforms like Bitsgap provide access to Zilliqa tokens across 15+ exchanges. Beyond mere trading, Bitsgap empowers you to automate your ZIL investing strategies through bots harnessing advanced, emotionless algorithms designed to maximize returns in all market conditions. First seven days are free, so why not give it a go?