Your Guide to the Bitcoin Mempool: Where Your Transactions Wait Their Turn

While other traders are scratching their heads wondering why their trades aren't going through, you could be the one who knows exactly when to strike by mastering the secret of the mempool.

Ever wondered what happens to your Bitcoin transaction in those nerve-wracking minutes (or sometimes hours) before it gets confirmed? Welcome to the Bitcoin mempool—essentially a digital waiting room where your transaction hangs out with thousands of others before making it onto the blockchain. Think of it as an airport's departure lounge, but for Bitcoin transactions waiting to take off.

If you've ever sent Bitcoin, you've interacted with the mempool, whether you knew it or not. It's where your transaction sits while miners decide which ones to process first, and it's the reason why sometimes you'll pay higher fees to "skip the line." During busy periods, understanding how the mempool works can be the difference between your transaction zipping through quickly or getting stuck in crypto traffic.

In this guide, we'll walk you through:

- The mempool explained in plain English—what it is and why you should care

- How your transactions flow through the system, from send to confirmation

- The features that determine whether your transaction gets picked first

- Real-time tools to help you check mempool conditions

- What's coming next in mempool development

- Answers to your burning mempool questions

- Where to learn more if you want to dive deeper

Ready to master the mempool? Let's begin.

What Is the Bitcoin Mempool?

In this section, we will explore the Bitcoin mempool, its purpose, and how it fits into the broader Bitcoin network.

Definition: A Temporary Storage Area for Unconfirmed Transactions

The Bitcoin mempool (short for "memory pool") is a temporary storage area where unconfirmed Bitcoin transactions reside before they are added to a block. Whenever you send a Bitcoin transaction, it doesn't go directly into the blockchain. Instead, it is first broadcast to the network and held in the mempool of Bitcoin nodes until a miner selects it for inclusion in a block.

Think of the mempool as a waiting room for transactions—some transactions get prioritized and processed quickly, while others may experience delays depending on network congestion and transaction fees.

How it functions within the Bitcoin network

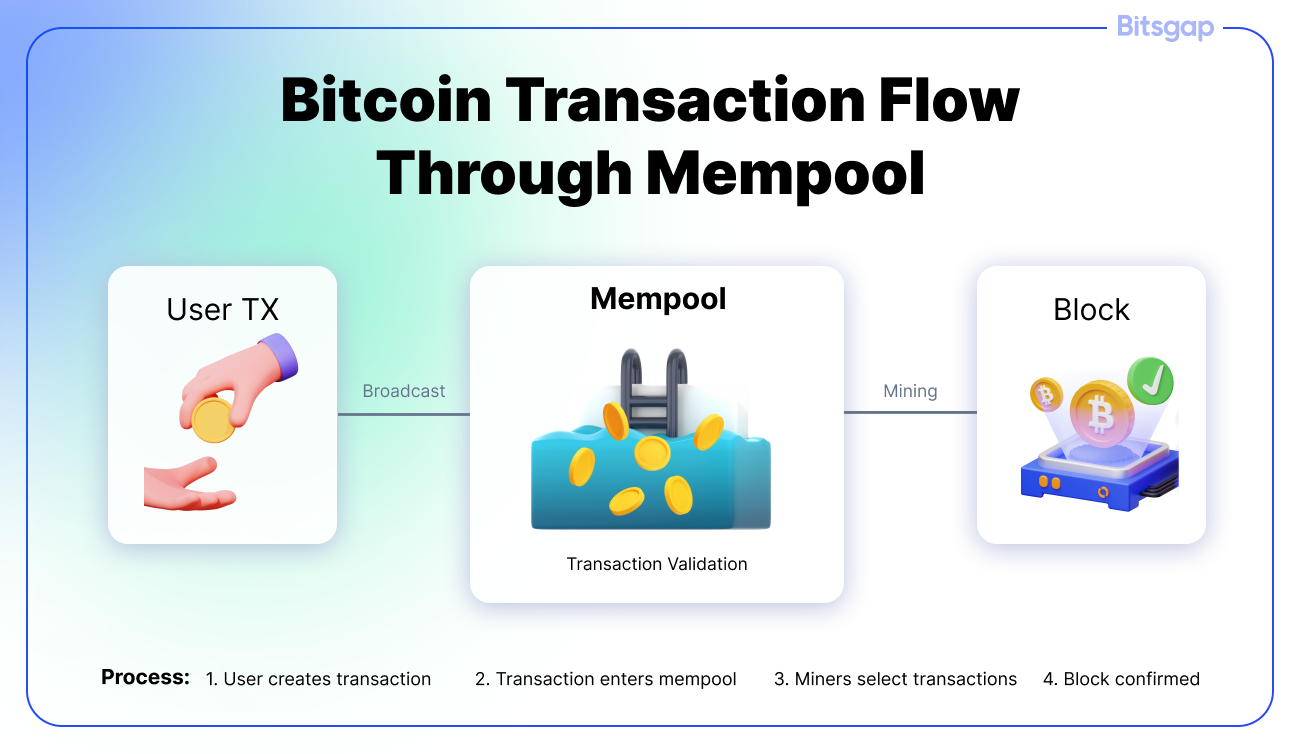

The mempool acts as a buffer between transaction broadcasts and block confirmations. Here’s a simplified breakdown of how it functions:

- A user creates and signs a Bitcoin transaction.

- The transaction is broadcast to the Bitcoin network.

- Every Bitcoin node that receives the transaction validates it and stores it in its own mempool.

- Miners scan the mempool and select transactions to include in the next block (usually prioritizing those with higher fees).

- Once a transaction is confirmed in a block, it is removed from the mempool.

Role of Full Nodes in Maintaining the Mempool

Bitcoin full nodes play a critical role in maintaining the integrity of the mempool. Each full node keeps a local version of the mempool, meaning there is no single, universal mempool—each node’s mempool may slightly differ based on transaction propagation speed and local policies.

Full nodes perform the following functions related to the mempool:

- Validating Transactions: Nodes check if transactions are valid (e.g., ensuring sufficient funds and proper signatures).

- Relaying Transactions: Nodes share new transactions with other nodes, helping them propagate across the network.

- Managing Mempool Size: If a mempool reaches its size limit, lower-fee transactions may be dropped to make room for higher-priority ones.

👉 Bitcoin's full nodes are like the bouncers of this digital waiting room. Each runs its own version of the mempool—that's right, there isn't just one big mempool, but many working together. These nodes check if your transaction plays by the rules (got enough funds? signature legit?), share new transactions with other nodes, and keep the mempool tidy by dropping lower-fee transactions when space gets tight.

By maintaining the mempool, full nodes help ensure that Bitcoin transactions are processed efficiently and securely, even before they are confirmed on the blockchain.

How the Mempool Works

Now that we understand what the Bitcoin mempool is, let’s dive into how it operates. This section will cover the transaction life cycle, how transactions enter and exit the mempool, and how miners prioritize transactions based on fees.

Transaction Life Cycle: From Broadcast to Confirmation

A Bitcoin transaction goes through several stages before it is fully confirmed on the blockchain:

- Broadcast: The sender creates a transaction and broadcasts it to the Bitcoin network.

- Validation: Bitcoin nodes verify the transaction’s validity (e.g., checking signatures, confirming UTXOs).

- Mempool Entry: If valid, the transaction is stored in the mempool of Bitcoin nodes.

- Mining Selection: Miners scan the mempool and pick transactions (typically prioritizing those with higher fees).

- Block Inclusion: The transaction is included in a new block and added to the blockchain.

- Final Confirmation: Once the block is mined, the transaction is removed from the mempool, and the recipient can consider the funds received.

How Transactions Enter and Exit the Mempool

- Entering the Mempool:

- When a transaction is first broadcast, it is received by nodes, validated, and stored in their mempool if accepted.

- If a transaction has an extremely low fee or is invalid, nodes may reject it.

- Exiting the Mempool:

- A transaction leaves the mempool when it is successfully mined into a block.

- If a transaction remains in the mempool for too long (due to low fees), it may be dropped by nodes when the mempool reaches capacity.

- Users can speed up stuck transactions using Replace-By-Fee (RBF) or Child-Pays-For-Parent (CPFP) techniques.

Fee Prioritization: How Miners Choose Transactions

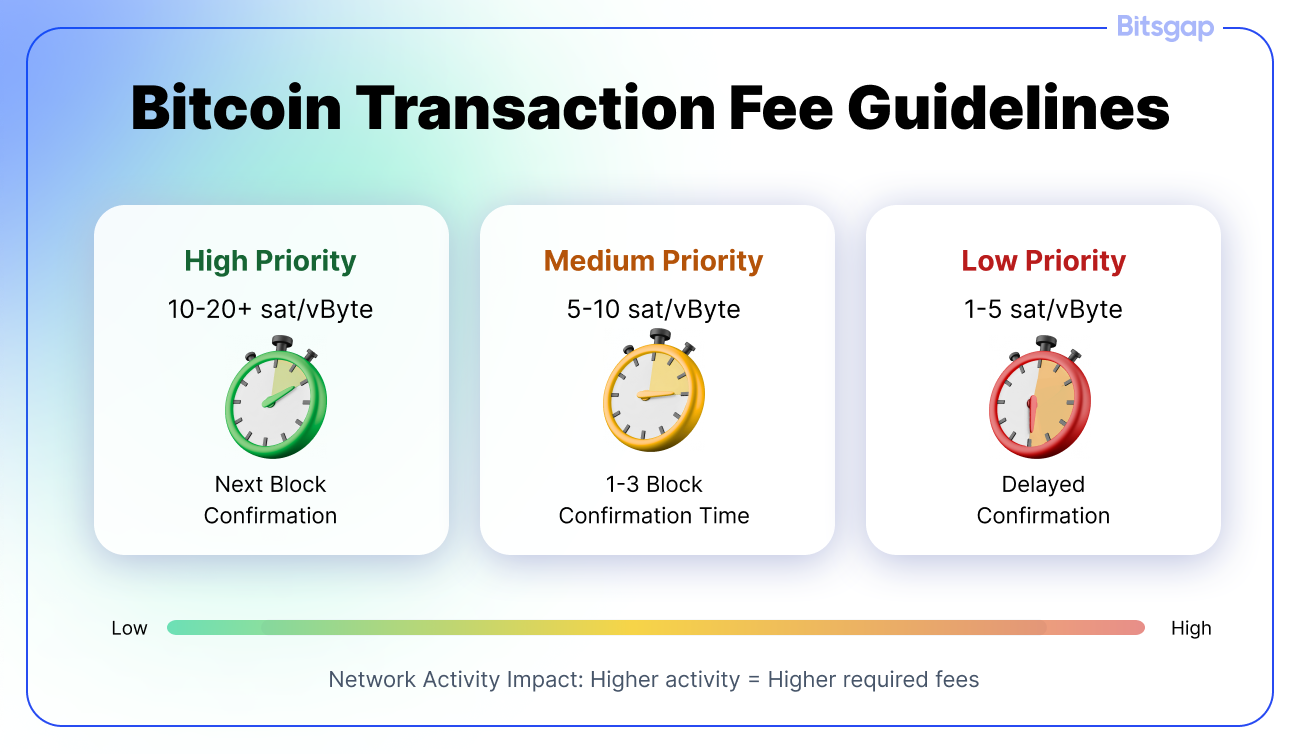

Since Bitcoin blocks have a limited size (typically ~1–4 MB, depending on SegWit adoption), miners must prioritize transactions to maximize their earnings. They do this by selecting transactions with the highest fee per byte (satoshis per vByte).

Factors influencing miner selection:

- Transaction Fee Rate: Higher fees mean faster inclusion in a block.

- Transaction Size: Larger transactions take up more space and require higher fees to remain competitive.

- Network Congestion: During peak activity, fees rise as users compete for limited block space.

- Transaction Type: SegWit transactions take up less block space and may be more fee-efficient.

To ensure timely confirmation, users can check the mempool status using fee estimation tools and set competitive fees accordingly.

Mempool Congestion and Its Effects

Bitcoin’s mempool is a dynamic environment where unconfirmed transactions wait to be added to a block. However, during periods of high network activity, the mempool can become congested, leading to delays and increased transaction fees. In this section, we will explore the causes of mempool congestion, its impact on fees and confirmation times, and what happens when transactions get dropped due to excessive congestion.

Causes of Mempool Congestion

Mempool congestion occurs when the number of unconfirmed transactions exceeds the available space in upcoming blocks. This can happen due to several factors:

1. High Transaction Demand

- Spikes in Bitcoin activity—such as during bull markets, major news events, or network disruptions—can lead to a surge in transactions being broadcast.

- When the number of new transactions outpaces the rate at which they are confirmed, the mempool starts to fill up.

2. Limited Block Space

- Bitcoin blocks have a size limit ranging from ~1 MB to 4 MB (depending on SegWit adoption), which restricts how many transactions can fit into each block.

- Since blocks are mined roughly every 10 minutes, only a limited number of transactions can be confirmed in a given timeframe.

- If too many transactions are competing for block space, lower-fee transactions may remain in the mempool longer.

3. Low-Fee Transactions Accumulating

- Users who set low transaction fees may find their transactions stuck in the mempool, especially during busy periods.

- If the mempool is full, miners prioritize higher-fee transactions, pushing lower-fee transactions further down the queue.

4. Network Congestion Events

- Events such as NFT minting on Bitcoin (Ordinals), increased trading volume, or high on-chain activity can flood the mempool with transactions.

- Some users and services may broadcast thousands of transactions at once, causing a backlog.

Impact on Transaction Fees and Confirmation Times

Mempool congestion directly affects transaction fees and confirmation times, making Bitcoin transactions more expensive and unpredictable.

1. Rising Transaction Fees

- Miners prioritize transactions with the highest fee per byte (sats/vByte) because they aim to maximize their rewards.

- When congestion is high, users must increase their fees to outbid others and get their transactions included in the next block.

- Fee estimation tools help users determine the optimal fee for faster confirmation.

2. Longer Confirmation Times

- Transactions with low fees may take hours or even days to confirm during congestion.

- Some transactions remain in the mempool for extended periods, creating uncertainty for senders and recipients.

- Users can track mempool size and estimated confirmation times using block explorers and mempool monitoring tools.

3. Increased Risk of Transactions Being Dropped

- Each Bitcoin node has a mempool size limit (often set to 300 MB by default).

- When the mempool reaches its capacity, nodes start dropping the lowest-fee transactions to make room for higher-fee ones.

- If a transaction is dropped, it is no longer being relayed across the network, and the sender may need to rebroadcast it with a higher fee.

👉 Think of the mempool like a busy airport during holiday season—when too many transactions try to take off at once, things get crowded. During these rush hours, you'll either need to pay more for a "priority boarding pass" (higher fees) or settle in for a longer wait. And just like some standby passengers might never make their flight, transactions with too-low fees might get dropped when space runs out.

How Transactions Get Dropped if the Mempool Reaches Capacity

When Bitcoin’s mempool becomes overloaded, transactions that do not meet a node’s minimum fee threshold may be removed from the mempool. Here’s how it happens:

- Nodes Automatically Drop Low-Fee Transactions

- Full nodes have a default mempool size limit (typically 300 MB).

- If this limit is exceeded, the node will start removing the lowest-fee transactions first.

- These dropped transactions can still exist in other nodes’ mempools, but they are at risk of disappearing from the network.

- Dropped Transactions Become “Stuck”

- If a transaction is removed from most nodes’ mempools, it may no longer be relayed across the network.

- This can make it difficult for the transaction to be confirmed unless it is rebroadcasted.

- Solutions for Stuck Transactions

- Replace-By-Fee (RBF): If the transaction was sent with RBF enabled, the sender can increase the fee and rebroadcast it for faster inclusion.

- Child-Pays-For-Parent (CPFP): A recipient can create a new transaction with a higher fee that incentivizes miners to confirm the original stuck transaction.

- Rebroadcasting: If a transaction is dropped, users can manually rebroadcast it with a higher fee to get it back into the mempool.

We’ll talk more about the “solutions” in the next section.

👉 Congestion directly hits your wallet and patience: more people competing for limited block space means higher fees to get ahead of the queue, and longer waits if you're not willing to pay up. Want to make sure your transaction doesn't get stuck? Keep an eye on mempool conditions before you hit send, pay competitive fees when it matters, and keep some rescue tools (like RBF) ready just in case.

Optimizing Transactions for the Mempool

The Bitcoin mempool is constantly changing, and transaction delays or high fees can be frustrating for users. However, by understanding how to monitor the mempool and optimize transaction fees, you can ensure your Bitcoin transactions are confirmed efficiently. This section covers how to check mempool activity, set appropriate fees, and use advanced techniques like Replace-By-Fee (RBF) and Child-Pays-For-Parent (CPFP) to speed up stuck transactions.

How to Check Mempool Size and Activity

Before sending a Bitcoin transaction, it’s useful to check the current state of the mempool to determine how congested the network is.

Key Metrics to Monitor:

- Mempool Size: The number of unconfirmed transactions waiting to be processed.

- Transaction Count: The total number of transactions in the mempool.

- Fee Levels: The average and recommended fees for fast confirmation.

- Block Space Availability: How many transactions are likely to fit in the next block.

Where to Check Mempool Activity?

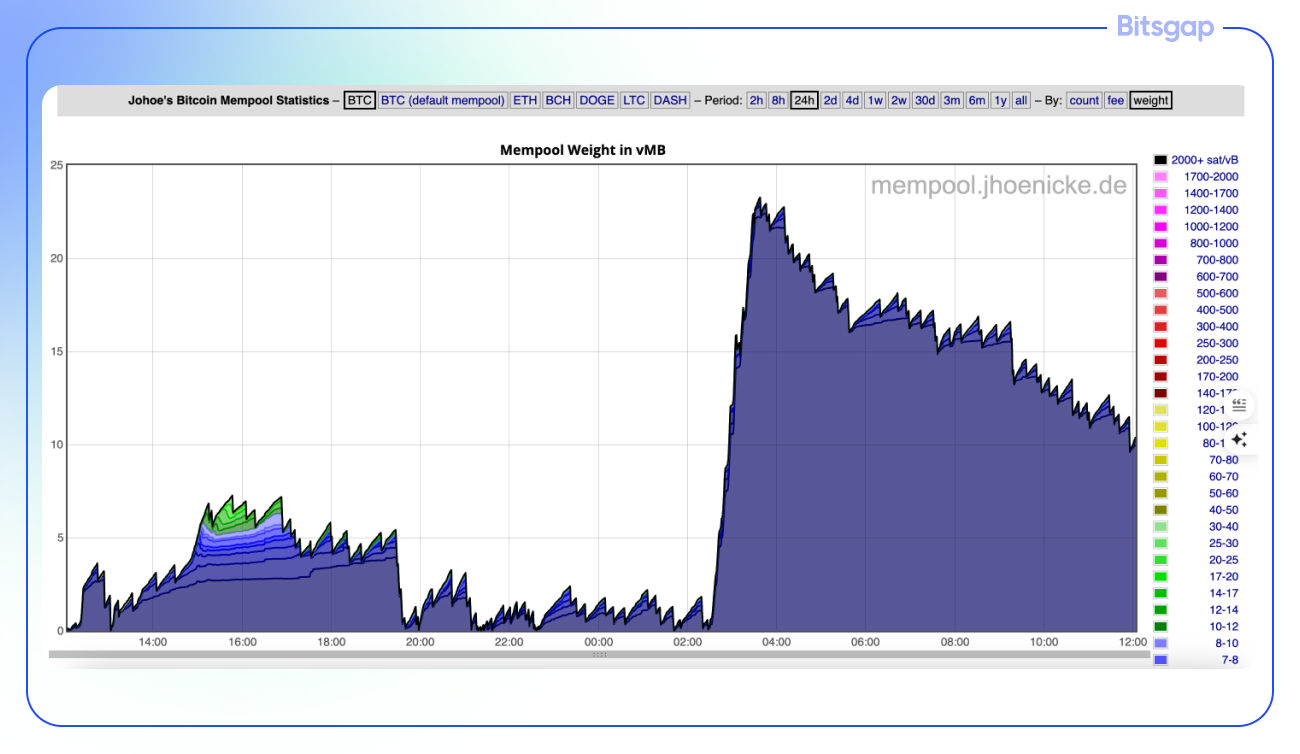

Several websites provide real-time insights into the Bitcoin mempool:

- Mempool.space – A detailed visual representation of mempool status, block confirmations, and fee recommendations.

- Johoe’s Bitcoin Mempool Statistics – Historical mempool size charts and fee distribution analysis.

- Block Explorers (e.g., Blockchain.com, Blockstream.info) – Show mempool transaction data and network congestion.

By checking these tools, you can decide whether to send a transaction immediately or wait for lower network activity to reduce fees.

Setting Appropriate Transaction Fees for Faster Confirmation

Bitcoin miners prioritize transactions with higher fees, so setting an appropriate fee is crucial for fast confirmation.

Fee Estimation Guidelines:

- High Priority (Next Block Confirmation): Set a higher fee (e.g., 10-20+ sat/vByte) to ensure your transaction is mined quickly.

- Medium Priority (1-3 Block Confirmation Time) – Use a moderate fee (e.g., 5-10 sat/vByte) if you can wait a bit longer.

- Low Priority (Delayed Confirmation) – If you’re not in a rush, a lower fee (e.g., 1-5 sat/vByte) may eventually get confirmed when network activity decreases.

How to Determine the Right Fee?

- Use fee estimation tools (see the next section) to check current recommended fees.

- If the mempool is congested, increase your fee to avoid long delays.

- If the mempool is empty, you can use a lower fee to save on costs.

Using Replace-By-Fee (RBF) and Child-Pays-For-Parent (CPFP) Techniques

If your transaction is stuck in the mempool due to low fees, you can use advanced techniques to speed it up:

1. Replace-By-Fee (RBF)

- What is RBF?

Replace-By-Fee (RBF) is a Bitcoin feature that allows you to increase the transaction fee after it has already been broadcast. If your transaction is taking too long because of a low fee, you can create a new version of the same transaction with a higher fee, and miners will prioritize the updated version.

- How to Use RBF:

- When sending a Bitcoin transaction, check if your wallet supports RBF and enable the option before broadcasting the transaction. Many modern wallets, such as Electrum, Bitcoin Core, and BlueWallet, offer this feature.

- If your transaction gets stuck, simply resend it with a higher fee. The new transaction will replace the original one in the mempool, increasing the chances of faster confirmation.

- Miners will prefer the higher-fee version and confirm it instead of the original low-fee transaction.

- When to Use RBF:

- If you mistakenly set a low transaction fee and want to speed up confirmation.

- When the mempool suddenly becomes congested, causing delays for your transaction.

- If your wallet supports RBF and you want more flexibility in managing fees.

2. Child-Pays-For-Parent (CPFP)

- What is CPFP?

Child-Pays-For-Parent (CPFP) is a technique that helps speed up stuck transactions by creating a new transaction (child) with a higher fee, incentivizing miners to confirm both the original transaction (parent) and the new one together. This is particularly useful when you receive Bitcoin but the sender used a low fee, causing the transaction to get stuck in the mempool.

- How to Use CPFP:

- If you have received an unconfirmed Bitcoin transaction with a low fee, create a new transaction spending those unconfirmed funds.

- Set a higher fee for the new transaction (child transaction) to make it attractive for miners.

- Since miners want to collect the higher fee from the child transaction, they will confirm both transactions together, clearing the stuck parent transaction from the mempool.

- When to Use CPFP:

- When you receive a stuck Bitcoin transaction with a low fee and need it confirmed quickly.

- If you need to spend unconfirmed funds, but the original transaction is still waiting for confirmation.

- When using a wallet that does not support RBF, making CPFP the only option to speed up the transaction.

The best method to use depends on your role in the transaction. If you are the sender and your wallet supports Replace-By-Fee (RBF), you can simply resend the transaction with a higher fee, giving you direct control over how quickly it gets confirmed. On the other hand, if you are the recipient of a stuck transaction and cannot modify the sender’s fee, Child-Pays-For-Parent (CPFP) allows you to create a new transaction with a higher fee, incentivizing miners to process both transactions together.

Both RBF and CPFP are effective tools for ensuring that your Bitcoin transactions don’t remain stuck in the mempool indefinitely

Tools to Monitor the Mempool

Keeping an eye on the mempool helps you make informed decisions about transaction fees and timing. Here are some of the best tools available:

Blockchain Explorers with Mempool Analytics

Apart from those already mentioned above like mempool.space or Blockchain.com Explorer, consider the following:

- BTCScan.org: Provides transaction tracking, mempool data, and estimated confirmation times.

- Bitaps Mempool: A mempool visualization tool showing fee rankings and pending transactions.

- Walletexplorer.com: Offers insights into mempool activities and wallet-based transaction tracking.

- OKLink Bitcoin Explorer: Displays mempool transactions, block confirmations, and historical fee trends.

Fee Estimation Tools for Optimal Transaction Fees

These tools help you determine the best fee for timely transaction confirmations:

- BitcoinFees.net: A simple tool showing recommended fees based on network congestion.

- Johoe’s Bitcoin Mempool Statistics: Offers historical mempool size trends and fee distribution charts.

- BTC Fee Estimator (Bitcoiner.live): Provides real-time fee rates for different confirmation time preferences.

- WhatTheFee.io: Estimates the best fee based on current network conditions and past transaction data.

- Earn.com Bitcoin Fee Estimator: Suggests optimal fees based on mempool activity and priority levels.

- TX Street: A visual representation of Bitcoin and Ethereum mempool congestion, helping users understand network delays.

- Blocknative Gas Estimator: Primarily for Ethereum but also useful for Bitcoin fee trends.

Wallets with Built-in Fee Estimators

Many Bitcoin wallets automatically suggest optimal fees based on real-time mempool data:

- Electrum: Allows manual and dynamic fee selection.

- BlueWallet: Offers real-time fee estimates for different priority levels.

- Ledger Live: Provides fee recommendations based on network congestion.

- Samourai Wallet: Includes advanced fee estimation and transaction acceleration options.

- Wasabi Wallet: Suggests optimal fees for privacy-focused transactions.

By using these tools, you can avoid overpaying for transactions when network activity is low and adjust fees accordingly when congestion is high.

Future Developments and Scaling Solutions

As Bitcoin adoption grows, so does the demand for block space, leading to mempool congestion and higher transaction fees. To address these challenges, several scaling solutions have been implemented or are being developed to improve Bitcoin’s transaction efficiency. In this section, we’ll explore Segregated Witness (SegWit) and its impact on mempool efficiency, as well as Layer 2 solutions like the Lightning Network and their role in reducing congestion.

SegWit and Its Impact on Mempool Efficiency

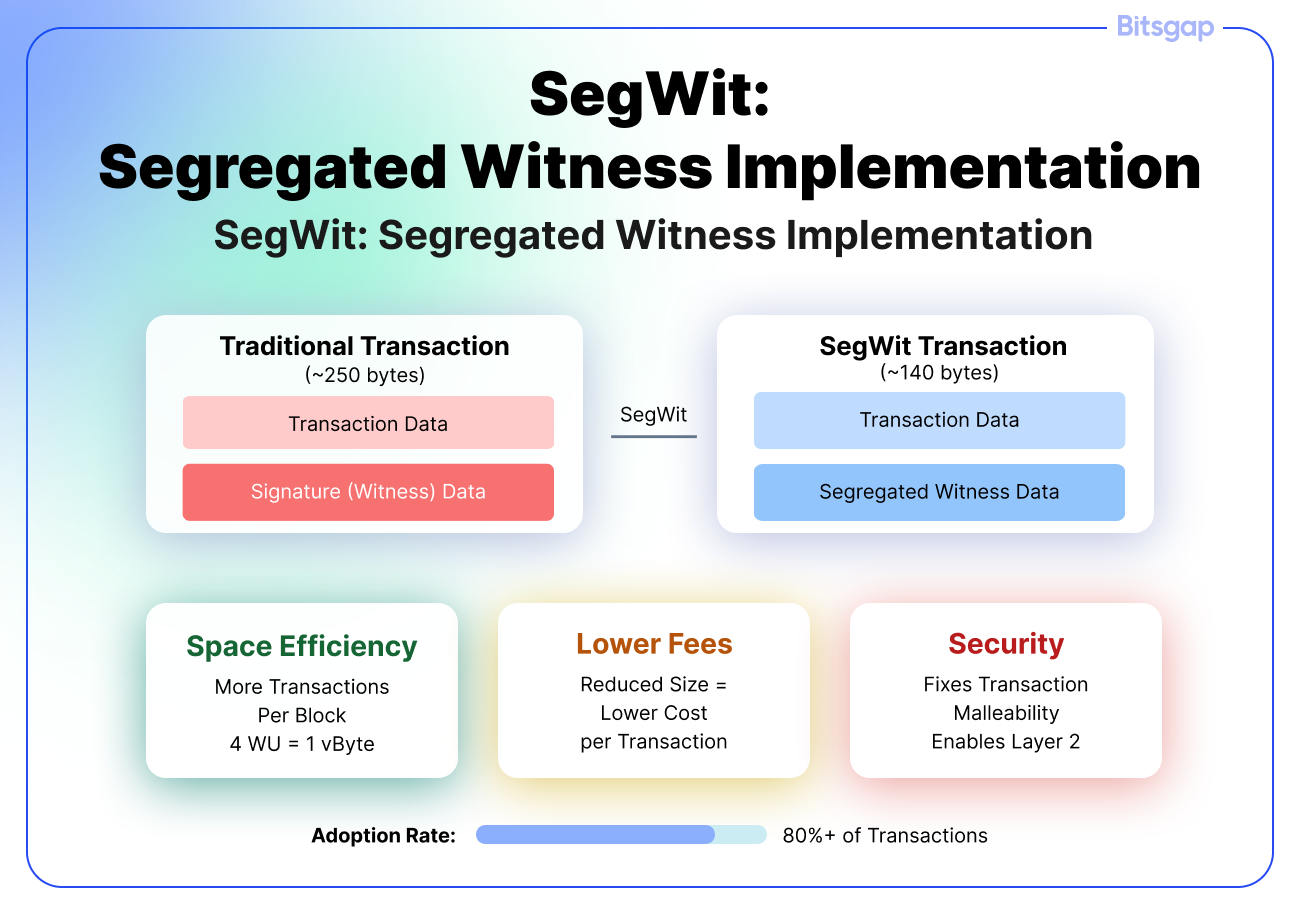

Segregated Witness (SegWit) is a Bitcoin protocol upgrade introduced in 2017 (BIP141) to improve the efficiency, security, and scalability of Bitcoin transactions.

How SegWit Works

- SegWit separates the witness data (signature information) from the main transaction data, reducing the transaction’s effective size.

- This allows more transactions to fit within a single block, increasing Bitcoin’s transaction throughput.

- SegWit transactions use a different weight calculation, where 1 vByte (virtual byte) = 4 weight units (WU), making them more space-efficient.

👉 Think of SegWit like smart luggage packing – it separates your transaction's signature (like your extra shoes) from the main data (your essential items). By reorganizing this data differently, your transaction takes up less space in the Bitcoin block. It's like turning your bulky suitcase into a compact carry-on.

Impact on Mempool Efficiency

✅ Reduces Transaction Size:

- A standard Bitcoin transaction is ~250 bytes, while a SegWit transaction can be ~140 bytes (depending on inputs/outputs).

- Smaller transactions mean more transactions fit into each block, reducing mempool congestion.

✅ Lowers Transaction Fees:

- Since miners prioritize transactions based on size, using SegWit reduces the fee per transaction.

- Users can send Bitcoin with lower fees compared to non-SegWit transactions.

✅ Prevents Malleability Attacks:

- SegWit fixes the transaction malleability issue, making it easier to build Layer 2 solutions like the Lightning Network.

Adoption of SegWit

- Major wallets and exchanges now support SegWit, and its adoption rate is above 80% of Bitcoin transactions.

- Users can maximize efficiency by using SegWit-compatible wallets and addresses (e.g., native SegWit bech32 addresses starting with bc1).

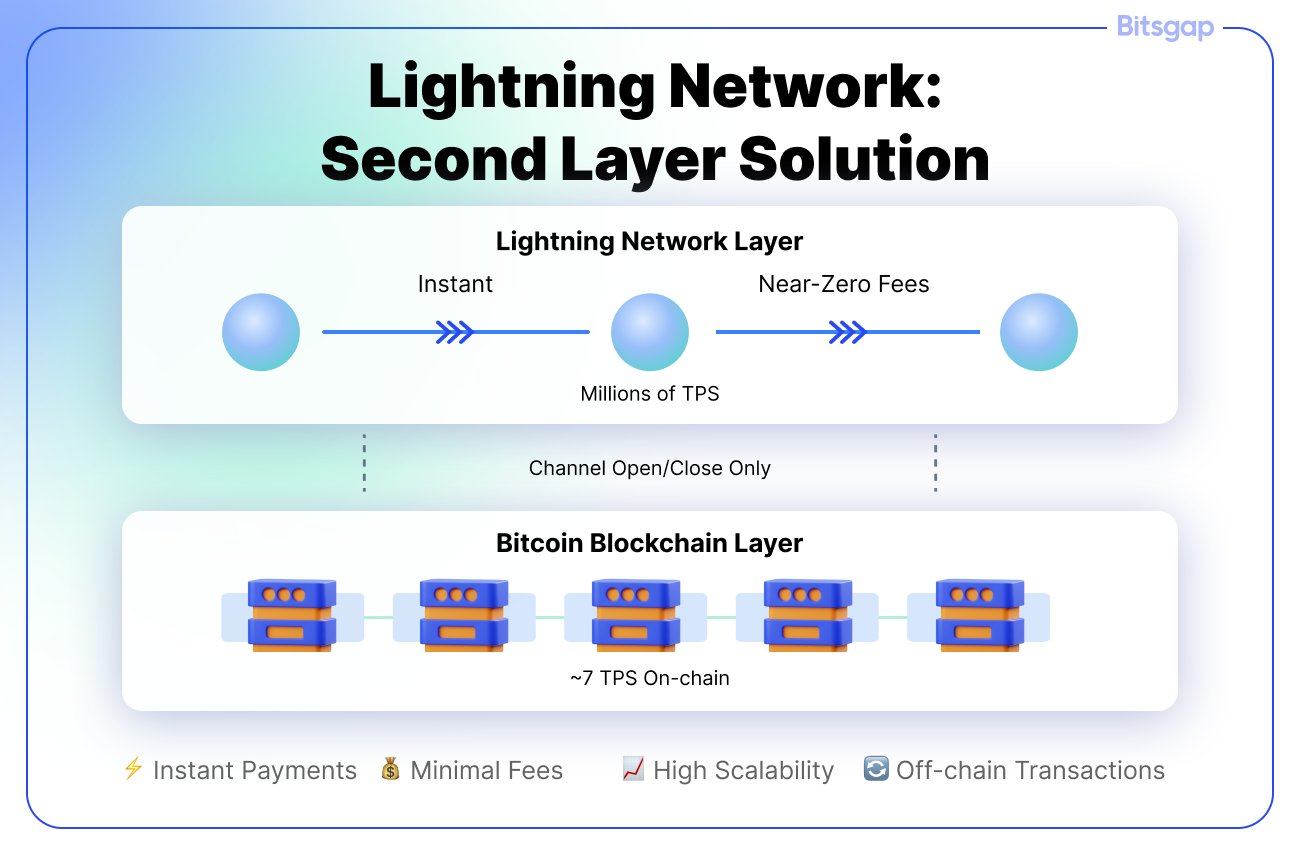

Layer 2 Solutions: Lightning Network and Its Role in Reducing Congestion

While SegWit improves on-chain efficiency, it doesn’t entirely solve Bitcoin’s scalability limitations. To further reduce congestion, Layer 2 solutions like the Lightning Network provide an off-chain way to process transactions faster and cheaper.

What is the Lightning Network?

The Lightning Network is a second-layer protocol built on top of Bitcoin that enables instant, low-cost transactions by using payment channels instead of recording every transaction on the blockchain.

👉 Instead of recording every coffee purchase on Bitcoin's main blockchain (imagine filing paperwork for every item you buy!), the Lightning Network lets you open a tab of sorts. You only need to hit the main blockchain when you're opening or closing these payment channels – everything in between happens at lightning speed (yes, that's where the name comes from!).

How the Lightning Network Reduces Mempool Congestion

✅ Off-Chain Transactions:

- Transactions occur off-chain between users and only need to be settled on-chain when channels open or close.

- This significantly reduces the number of transactions competing for block space.

✅ Instant Payments with Near-Zero Fees:

- Lightning transactions settle almost instantly, unlike on-chain Bitcoin transactions that require block confirmations.

- Fees are minimal (often fractions of a cent) compared to on-chain fees, making micropayments feasible.

✅ Scalability for Bitcoin:

- The Lightning Network can handle millions of transactions per second, compared to Bitcoin’s on-chain limit of ~7 transactions per second (TPS).

- By shifting small, frequent payments off-chain, it eases pressure on the mempool.

Adoption and Growth of the Lightning Network

- Exchanges and Wallets: Many exchanges (e.g., Binance, Kraken) and wallets (e.g., Phoenix, Muun, Breez) now support Lightning transactions.

- Merchants and Services: Businesses are adopting Lightning for fast, low-cost Bitcoin payments.

- Network Capacity: The total Bitcoin locked in the Lightning Network continues to grow, increasing its usability.

Challenges and Considerations

- Liquidity Issues: Users need funded channels to transact efficiently.

- Channel Management: Opening and closing channels still require on-chain transactions, affecting fee costs.

- Adoption Growth: Wider adoption is needed for mainstream usability.

👉 Learn more about the Lightning Network here: What Is the Lightning Network for Bitcoin, How it Works, and Why It Matters?

Conclusion: How Mempool Knowledge Can Improve Your Trading Strategy

Understanding Bitcoin’s mempool can give you a competitive edge in trading, helping you time your transactions more effectively and reduce costs. Since the mempool shows real-time network congestion and fee trends, you can use this data to optimize when you deposit or withdraw funds, ensuring faster transactions at lower fees. When the mempool is congested, delays can occur, which is crucial if you're making time-sensitive trades or reacting to market movements. By monitoring mempool conditions, you can anticipate slowdowns, adjust your withdrawal timing, and avoid unexpected fees that could impact your profitability.

If you want to automate your trading and access multiple markets efficiently, Bitsgap is the perfect solution.

Bitsgap is a crypto trading platform and aggregator that connects you to 15+ major exchanges, allowing you to trade across different markets. With advanced automation tools, including GRID, DCA (Dollar-Cost Averaging), LOOP, smart orders, and AI Assistant, you can maximize your profits and minimize risks.

By combining mempool insights with automated trading strategies, you’ll be able to stay ahead of market fluctuations and execute trades with greater precision.

FAQs

What Is Bitcoin Mempool?

The Bitcoin mempool is a temporary storage area where unconfirmed transactions wait before being included in a block. When a user sends a transaction, it is first validated by Bitcoin nodes and stored in their mempools until miners select it for confirmation. Transactions with higher fees are prioritized, while lower-fee transactions may experience delays. The mempool size fluctuates based on network activity and congestion levels. Once a transaction is confirmed in a block, it is removed from the mempool.

What Is Fractal Bitcoin Mempool?

Fractal Bitcoin mempool refers to the complex and dynamic patterns observed in how transactions accumulate, get prioritized, and clear over time. Due to fluctuating network activity, the mempool often exhibits fractal-like behavior, where congestion and fee structures form repeating patterns at different scales. These patterns help analysts understand transaction backlogs and predict fee market trends. The term is sometimes used to describe visualizations of mempool dynamics. Studying these trends can help users optimize fee selection and transaction timing.

What Is El Salvador Bitcoin Mempool?

El Salvador's Bitcoin mempool refers to the unconfirmed Bitcoin transactions within the country’s Bitcoin infrastructure, particularly following its adoption of Bitcoin as legal tender in 2021. With state-backed wallets like Chivo and growing Bitcoin usage, the country’s network activity sometimes influences global mempool congestion. Increased Bitcoin payments and Lightning Network adoption in El Salvador help reduce on-chain congestion. However, like any mempool, it follows the same principles of transaction validation and prioritization based on fees. There is no separate "El Salvador mempool," but its Bitcoin usage contributes to the overall network’s transaction flow.

Where To Find Bitcoin Mempool Chart?

Bitcoin mempool charts are available on various blockchain explorers and analytics platforms. Websites like Mempool.space, Johoe’s Bitcoin Mempool Statistics, and Blockstream.info provide visual representations of mempool size, transaction backlog, and fee estimates. These charts help users monitor congestion and determine the best transaction fees. Some platforms also offer historical data to analyze trends over time. Checking a mempool chart before sending a transaction can help avoid delays and high fees.

What Is Bitcoin Mempool Size?

The Bitcoin mempool size refers to the total number of unconfirmed transactions waiting for inclusion in a block. It is typically measured in megabytes (MB) or the number of transactions stored across full nodes. When network activity is high, the mempool size grows, leading to higher fees and longer confirmation times. If the mempool exceeds a node’s memory limit, low-fee transactions may get dropped. Monitoring mempool size helps users choose optimal transaction fees and avoid delays.