Understanding the Crypto Alt Season

The next altcoin season is poised to ignite the crypto market, promising to turn savvy investors' portfolios into goldmines. As Bitcoin's dominance wanes, a new era of blockchain innovation is dawning—are you ready to ride the wave?

Market behavior often exhibits distinct patterns and cycles. One such phenomenon that has captured the attention of traders and investors alike is the "Alt Season"—a period when alternative cryptocurrencies, or "altcoins," outperform Bitcoin and experience significant price surges.

The concept of market cycles and seasonality is not unique to crypto; it's a well-established principle in traditional financial markets. However, in volatile crypto space, these cycles can be more pronounced and occur with greater frequency.

But is the Alt Season a reliable indicator of market trends, or is it merely overhyped speculation? In this article, we’ll try to answer this and other questions:

- The nature and characteristics of Alt Seasons

- The importance of recognizing market cycles in cryptocurrency trading

- Alt Season indicators and how to interpret them

- Predictions and speculations about the next potential Alt Season

Without further ado, let’s get started.

What Is Crypto Alt Season?

Crypto Alt Season, short for "Alternative Cryptocurrency Season," refers to a period in the cryptocurrency market when alternative cryptocurrencies (altcoins) significantly outperform Bitcoin in terms of price appreciation. During an Alt Season:

- Many altcoins experience rapid price increases.

- The market share of altcoins grows relative to Bitcoin.

- Trading volume for altcoins typically increases.

- Investor attention shifts from Bitcoin to various altcoin projects.

An Alt Season can last anywhere from a few weeks to several months. It's often characterized by increased risk appetite among investors, who are willing to allocate more capital to smaller, potentially higher-risk crypto projects in search of higher returns.

Is Crypto Season the Same As Crypto Alt Season?

While related, Crypto Season and Crypto Alt Season are not exactly the same:

- Crypto Season:

- Refers to a broader bullish period in the entire cryptocurrency market.

- Typically includes price appreciation for both Bitcoin and altcoins.

- Can be longer in duration, sometimes lasting for many months or even a year or more.

- Often starts with a Bitcoin rally, followed by increased interest in the broader crypto market.

- Crypto Alt Season:

- Specifically focuses on the outperformance of altcoins compared to Bitcoin.

- Can occur within a broader Crypto Season but is more narrowly defined.

- Generally shorter in duration than a full Crypto Season.

- May happen towards the latter part of a broader Crypto Season, as investors seek higher returns in smaller cap coins.

Key Differences:

- Scope: Crypto Season encompasses the entire market, while Alt Season focuses on altcoins.

- Duration: Crypto Seasons are generally longer than Alt Seasons.

- Market Dynamics: In a Crypto Season, Bitcoin often leads the rally, while in an Alt Season, altcoins outperform Bitcoin.

It's important to note that these terms are not officially defined and can be subject to different interpretations within the cryptocurrency community. However, understanding the distinction can help investors and traders better analyze market trends and potential opportunities in different segments of the crypto market.

What Is Alt Season Indicator?

The Alt Season Indicator is a tool used by cryptocurrency traders and investors to gauge whether the market is entering or currently in an "Alt Season" — a period when altcoins are outperforming Bitcoin. While there isn't a single, universally accepted Alt Season Indicator, several metrics and tools are commonly used to assess the likelihood of an Alt Season. Here are some key aspects of Alt Season Indicators:

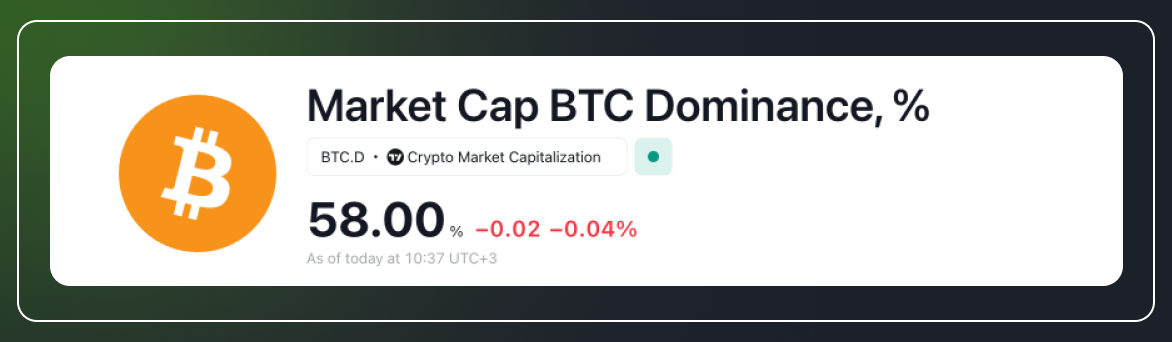

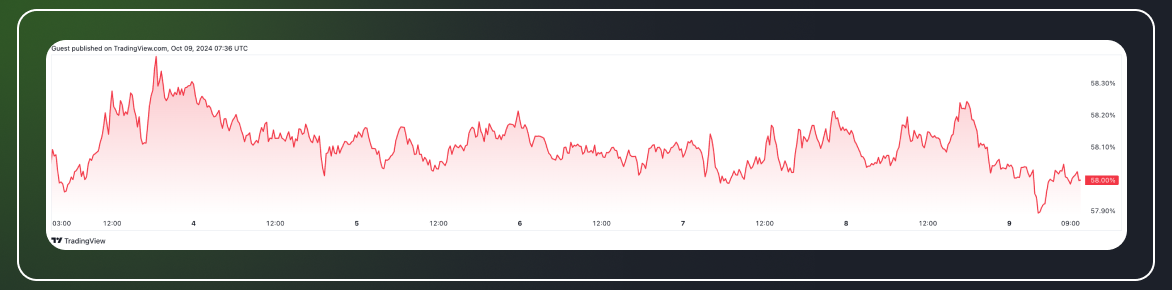

Bitcoin Dominance

One of the most widely used indicators is Bitcoin Dominance, which measures Bitcoin's market capitalization as a percentage of the total cryptocurrency market cap.

- Calculation: (Bitcoin Market Cap / Total Crypto Market Cap) * 100

- Interpretation: A declining Bitcoin Dominance often signals a potential Alt Season, as it indicates that capital is flowing from Bitcoin into altcoins.

- Threshold: Some traders consider Bitcoin Dominance below 50% as a potential indicator of an Alt Season.

Altcoin Market Cap Ratio

This indicator compares the total market capitalization of altcoins to Bitcoin's market cap.

- Calculation: Total Altcoin Market Cap / Bitcoin Market Cap

- Interpretation: An increasing ratio suggests growing strength in the altcoin market relative to Bitcoin.

Top 10 Altcoins Performance

This indicator tracks the performance of the top 10 altcoins by market cap (excluding Bitcoin) compared to Bitcoin over a specific period.

- Calculation: Average percentage gain of top 10 altcoins vs. Bitcoin's percentage gain

- Interpretation: When a majority of top altcoins consistently outperform Bitcoin, it may indicate an Alt Season.

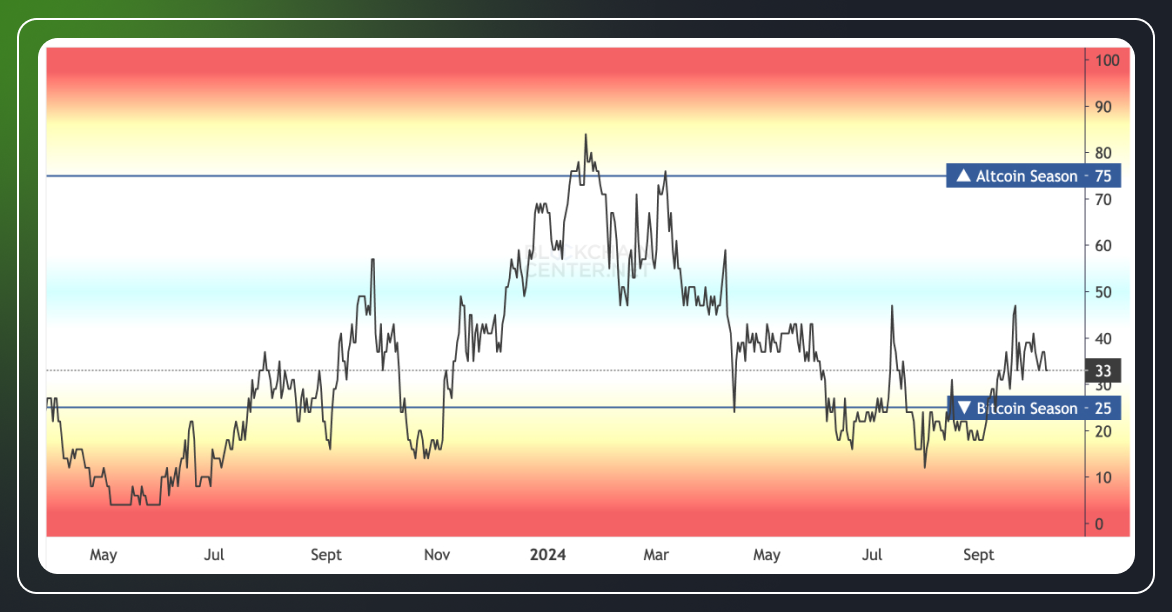

Alt Season Index

Some crypto data platforms offer a proprietary Alt Season Index, which combines various metrics to provide a single score indicating the likelihood of an Alt Season.

- Scale: Often presented as a percentage or a 0-100 score

- Interpretation: Higher scores (e.g., above 75%) suggest a higher probability of an ongoing Alt Season

Trading Volume Ratios

This indicator compares the trading volumes of altcoins to Bitcoin's trading volume.

- Calculation: Total Altcoin Trading Volume / Bitcoin Trading Volume

- Interpretation: An increase in this ratio may indicate growing interest in altcoins, potentially signaling an Alt Season.

Important Considerations:

- No single indicator is foolproof. Traders often use a combination of indicators for a more comprehensive analysis.

- Market conditions can change rapidly, and past patterns don't guarantee future results.

- Different traders may use different thresholds or interpretations of these indicators.

- The crypto market's evolving nature means that indicators may need to be adjusted over time to remain relevant.

Understanding and effectively using Alt Season Indicators can help traders and investors make more informed decisions about allocating their resources between Bitcoin and altcoins. However, it's crucial to combine these indicators with broader market analysis and risk management strategies.

Fig. 1. How to Identify an Alt Season: Summary Table

Alt Seasons: Historical Perspective, Current Situation, and Future Predictions

Previous Altcoin Seasons

In crypto, two periods stand out as particularly significant for altcoins. These "alt seasons" saw unprecedented growth and interest in cryptocurrencies beyond Bitcoin, reshaping the landscape of digital assets.

The 2017-2018 Alt Season

Duration: December 2017 to January 2018

Context:

- Bitcoin (BTC) experienced its most remarkable bull run to date, reaching nearly $20,000 in December 2017.

- This surge in Bitcoin's price and public interest created a ripple effect throughout the crypto market.

Key Developments:

- Proliferation of New Coins: The success of Bitcoin catalyzed the launch of numerous new cryptocurrencies.

- Investor Frenzy: Buoyed by Bitcoin's success, investors eagerly sought the "next Bitcoin," pouring capital into various altcoins.

- ICO Boom: This period saw a surge in Initial Coin Offerings (ICOs), with many projects raising millions in a matter of hours or days.

- Market Expansion: The total cryptocurrency market cap reached unprecedented levels, briefly surpassing $800 billion in January 2018.

Notable Altcoins: Ethereum (ETH), Ripple (XRP), and Litecoin (LTC) saw significant price increases during this period.

The 2020-2021 Alt Season

Duration: December 2020 to April 2021

Context:

- Bitcoin broke its previous all-time high, surpassing $60,000 in March 2021.

- The COVID-19 pandemic had accelerated digital adoption and increased interest in alternative investments.

Key Developments:

- DeFi Explosion: Decentralized Finance (DeFi) projects gained massive traction, with many tokens seeing exponential growth.

- NFT Boom: Non-Fungible Tokens (NFTs) entered the mainstream, driving interest in blockchain-based digital assets.

- Institutional Adoption: Major companies and institutional investors began adding cryptocurrencies to their balance sheets.

- Technological Advancements: Many altcoins introduced innovative features, scaling solutions, and use cases.

Notable Altcoins: Ethereum (ETH) reached new highs, while projects like Binance Coin (BNB), Cardano (ADA), and Polkadot (DOT) saw remarkable growth.

Comparative Analysis: Both alt seasons shared some common characteristics:

- They were preceded by significant Bitcoin price rallies.

- New projects and tokens gained rapid popularity and valuation.

- Retail investor participation increased dramatically.

- The overall cryptocurrency market capitalization reached new heights.

However, the 2020-2021 alt season was marked by greater institutional involvement and a broader range of technological innovations, particularly in DeFi and NFTs.

Is It Alt Season?

Based on the indicators discussed above, it's not currently an altcoin season. The Altcoin Season Index at 33 and Bitcoin's market dominance at 58% both suggest that Bitcoin is still the dominant force in the crypto market at this time.

When Is Alt Season?

Based on the information we could gather from various experts, we can analyze the predictions for the next altcoin season as follows:

- Arthur Hayes' Prediction: According to Hayes, the altcoin season will begin after Bitcoin (BTC) surpasses $70,000 and Ethereum (ETH) exceeds $4,000. He doesn't provide a specific date, but ties it to these price milestones.

- Technical Analysis:

- The altcoin market cap is showing signs of recovery, with a potential bullish five-wave pattern targeting $1.61 trillion.

- Excluding Ethereum, other altcoins are showing even more bullish signals.

- Bitcoin's dominance rate (BTCD) is showing topping signals, suggesting a potential shift towards altcoins.

- Timeframe Indications:

- The analysis suggests a strong possibility of an altcoin season in Q4 2024.

- This aligns with the period after the U.S. presidential elections in November 2024.

- Extremely bullish macro factors:

- High correlation between digital assets and equities (at a 2-year high)

- Equities and gold at all-time highs

- Treasury yields falling

- U.S. Dollar trending lower

- Fed signaling rate cuts

- Mildly bearish broader crypto-specific factors:

- Increased dispersion in token performance (some altcoins showing significant gains)

- Lack of significant news or initiatives from major conferences

- Exchange volumes remain low compared to previous significant rallies

- Much of the buying interest is futures-based rather than spot-based, indicating speculation rather than new money entering the market

Based on the combined information, the next altcoin season is most likely to occur in Q4 2024 or early 2025. This timing is supported by:

- The expectation that Bitcoin will reach key price levels ($70,000-$100,000) by late 2024–early 2025.

- Technical indicators suggesting a potential shift from Bitcoin dominance to altcoin growth.

- The alignment with major economic events like the U.S. presidential elections and potential changes in fiscal policy.

- The absence of substantial new investment and the current dependence on leveraged speculation indicate an altcoin season is unlikely in the immediate future. However, the November elections could potentially act as a catalyst for such a market shift.

What Are Next Altseason Coins?

It’s always good to start any season prepared, so here’s some of the most promising altcoins to consider based on their technology, market position, and growth potential:

- Polygon (MATIC): An Ethereum scaling solution with a focus on infrastructure development.

- Ripple (XRP): Known for its efficient payment system, with potential upside as the SEC case nears conclusion.

- Polkadot (DOT): Enables cross-chain communication and supports the development of decentralized apps.

- Chainlink (LINK): A decentralized oracle network connecting off-chain data with on-chain smart contracts.

- Uniswap (UNI): A leading decentralized exchange on the Ethereum network.

- Binance Coin (BNB): The native token of the Binance ecosystem, with regular token burns reducing supply.

- Cosmos (ATOM): Aims to solve interoperability issues between blockchains.

- Avalanche (AVAX): A layer-one blockchain offering high scalability and fast transaction speeds.

- Injective (INJ): A layer-one blockchain focused on decentralized finance applications.

- The Graph (GRT): Provides indexing for blockchain data across multiple networks.

- VeChain (VET): An enterprise-grade smart contract platform with real-world applications.

Key Factors to Consider

- Technology: Look for coins with innovative solutions to existing blockchain challenges.

- Adoption: Consider projects with growing partnerships and real-world use cases.

- Market Position: Established coins with room for growth may offer a balance of stability and potential returns.

- Tokenomics: Understanding supply dynamics can help predict potential price movements.

While these altcoins show promise, it's crucial to conduct thorough research before investing. The cryptocurrency market is highly volatile, and past performance doesn't guarantee future results. Always invest responsibly and within your risk tolerance.

How to Win in Next Alt Season?

Capitalizing on the next altcoin season requires a strategic approach. Here's how to maximize potential gains:

- Research and Diversification: Thoroughly research potential investments, analyzing both fundamentals and technical aspects to identify promising altcoins. Diversify your holdings across different projects to mitigate risk and maximize potential returns. Don't put all your eggs in one basket.

- Strategic Timing: Utilize technical analysis tools like support/resistance levels and RSI to pinpoint optimal entry and exit points. Monitor market sentiment and price trends to make informed decisions. A clear entry and exit strategy is crucial for managing risk and maximizing profits during volatile periods.

- Presale Opportunities: Consider participating in presales for new altcoins. This provides early access to potentially high-growth projects at discounted prices. Research upcoming ICOs and presale cryptos, focusing on innovative projects with strong potential. Investing early can yield substantial returns as the project develops.

Conclusion

In summary, an altcoin season, marked by significant price increases in non-Bitcoin cryptocurrencies, may be on the horizon. Many analysts predict a potential surge in late 2024 or early 2025, aligning with possible economic shifts. This potential surge could be driven by investors seeking higher returns in smaller-cap cryptocurrencies, technological advancements in altcoin projects, increased blockchain adoption, and the transition of projects from speculative ventures to real-world applications. Promising altcoins to watch include Polygon, XRP, Polkadot, Chainlink, Uniswap, Binance Coin, Cosmos, Avalanche, Injective, The Graph, and VeChain. Each project presents unique opportunities, but thorough research is crucial.

For those looking to capitalize on the trading opportunities presented by the upcoming altcoin season, welcome to Bitsgap. As a comprehensive cryptocurrency trading platform and aggregator, Bitsgap connects to more than 15 crypto exchanges, providing traders with a powerful suite of tools:

- Advanced automations for efficient trading

- Smart orders to optimize entry and exit points

- Portfolio management with actionable analytics

- AI assistance to help inform trading decisions

Bitsgap's all-in-one platform allows traders to navigate the complex world of cryptocurrency trading with greater ease and precision, potentially maximizing opportunities during the altcoin season.

Why not sign up now and get your 7-day free trial on the PRO plan?

Remember, while the potential for significant gains exists during an altcoin season, the cryptocurrency market remains highly volatile. Always invest responsibly, never invest more than you can afford to lose.