Top 5 Cryptocurrency Trading Styles

Get set to find your perfect match in the exciting jigsaw of risk and time management. Join us on this exciting dating spree with some trading styles.

Unearth the top five trading styles in the crypto universe! Go ahead, pick one that feels like 'the one', or play the field and try them all.

Ah, the wild world of cryptocurrency trading — where volatility reigns supreme and faint-hearted stock traders fear to tread. But let's shatter that myth, shall we? Crypto trading isn't the monstrous maze it's made out to be. In fact, it's no more daunting than navigating the traditional stock market. With the right strategy and a keen sense of the market, you can churn out consistent returns.

As for trading styles, some traders are all about those small, steady gains over time, while others are the hibernating bears, locking away assets and dreaming of a big, fat profit payday. Whichever style tickles your fancy, understanding the crypto market and deciphering crypto charts is a non-negotiable. So, let's cut to the chase. It's time to plunge headfirst into the roller-coaster ride of crypto trading styles and help you find the one that makes your heart race and your portfolio smile.

Types of Cryptocurrency Trading

Let's talk about the big picture first. Cryptocurrency trading strategies can be broadly divided into two main categories, based on the duration of your trade:

- The crypto marathoners: long-term trading

These traders are in for the long haul, holding onto their assets for months on end. Unfazed by the daily drama of crypto price fluctuations, they keep their eyes on the prize, banking on a lucrative future return.

- The crypto sprinters: short-term trading

This strategy is all about quick moves. Traders buy and sell within short timeframes, aiming to dodge major dents during downward trends. But there's a catch — they might miss out on the slow and steady growth that long-term trading can offer.

Now that we've got that sorted, let's delve into the different trading styles that sprout from these two main strategies. Ready to explore? Let's go!

5 Different Cryptocurrency Trading Styles

HODLing

Welcome to the world of 'Hold On For Dear Life (HODL)' trading, where the game is all about playing it cool and playing it long. Traders who adopt the HODL style purchase an asset and hold onto it for months, come rain or shine in market fluctuations. They're not just in it for a quick buck; they're dreaming big, eyeing a substantial price gain in the long run. In essence, HODLers are the embodiment of 'Go big or go home.'

The beauty of HODLing is that it doesn't demand constant surveillance of crypto charts. An occasional check-in is all it takes. Instead, HODLers lean on fundamental analysis, evaluating the inherent value of an asset and scrutinizing factors that could sway its future price. This includes market trends, the team steering the crypto project, reputation, market capitalization, and more.

The timeline for this strategy? Well, that's as unpredictable as a plot twist in a thriller. It hinges on the level of profit you're aiming for. But remember, greed is not your friend and panicking at bearish trends is a no-go. Knowing when to cash out is just as crucial as holding on.

Intrigued by the strategy? Check out our comprehensive guide on HODLing.

Scalping

Scalping is a high-octane day trading style where every minute counts. Scalpers are the sprinters of crypto trading, swiftly selling off assets for petite profits before prices plummet. They're not aiming for the jackpot, but rather, they're content with a steady stream of small wins.

This trading style doesn't ride the wave of substantial price movements or downturns. Instead, it's all about placing many small bets on minor price fluctuations. To do this, scalpers often capitalize on market inefficiencies such as bid-ask spreads (the gap between the lowest asking price and highest bid price) and liquidity gaps. But beware of the trading fees - if they're too high, your profits might evaporate.

Scalping tends to thrive in liquid markets, where predictability is higher and closing positions is smoother. But this is no place for rookies — successful scalping demands a deep grasp of market dynamics and price action, not to mention significant time spent glued to the screen, ready to pounce on the slightest movement.

So, if you have a knack for making split-second decisions under pressure and can dedicate a good chunk of your day to crypto trading, you might just have what it takes to be a scalper.

Feeling a thrill at the thought of scalping? Dive into our detailed guide on this strategy.

Day Trading

Let's set the record straight first. Unlike its traditional stock market cousins, the cryptocurrency market doesn't punch a time card. No opening bell, no closing bell — it's a 24/7 show.

So, what's this thing called day trading in the crypto world?

Well, day trading in cryptocurrency is all about making moves during the market's most active hours. Think of it as a short-term strategy, where you wrap up trading positions in anything from a brisk 30 minutes to a few leisurely hours (sleeping on open positions is a no-no here). It's a bit like scalping, but with a more relaxed pace and a bit more breathing room to close your position.

But here's the kicker: the crypto universe is as volatile as a soap opera plotline. Prices can swing in your favor or betray you at any given moment. This means you'll need to commit a good chunk of your time to day trading, and setting stop loss and take profit limits on your orders wouldn't hurt either.

If you're the type who's always got their finger on the pulse of crypto trends and has a sharp eye for crypto price charts, you might just find that day trading crypto assets can be more than a hobby. It could be your bread and butter.

Have questions about day trading? Peruse this piece at your leisure.

Swing Trading

Let's talk about a little secret in the crypto community. Many believe that crypto prices bob up and down in a rhythmic dance, tracing a curve. Enter swing trading — the art of spotting this dance and using it to rack up some tidy profits. It's a short-term strategy where traders hold their positions for a few days to a couple of weeks.

In terms of long positions, swing trading is all about hopping on at the valley of the curve, riding the price wave up to the peak, and then gracefully bowing out with a profit. For short positions, you'll be doing this dance in reverse.

As a swing trader, sudden market fluctuations shouldn't send you into a tailspin, as long as you've identified a pattern by examining the support and resistance levels. To make the most out of swing trading, you'll need to harness both technical indicators and fundamental analysis to accurately forecast your moves.

For crypto trading newcomers, swing trading could be a good starting point. It gives you a bit more time to make trading decisions compared to the frenzied pace of day trading or scalping, where decisions need to be made faster.

Position Trading

Picture this: A trading cycle that stretches over a year, even several years. Welcome to position trading, the marathon of the trading world. If you can keep a cool head amidst the buzz around crypto trends and aren't glued to crypto price charts, this might be your sweet spot.

With position trading, it's all about having faith in your cryptocurrency holdings. That said, don't put on blinders. Dive deep into the nitty-gritty of your chosen crypto asset. Analyze its fundamentals, pore over expert opinions, get to know the team behind the project. Once you're confident in the crypto venture, lock in your position. Then, kick back and wait for the ripe moment to harvest your profits.

As a position trader, you should be able to tune out the white noise of public opinion, as long as you've done your homework. Those position traders who placed their bets on bitcoin amidst various clamors of recessions, numerous exchange fallouts, and you-name-what perturbations, are now reaping sweet rewards, thanks to their unwavering belief in bitcoin's future.

Automated trading

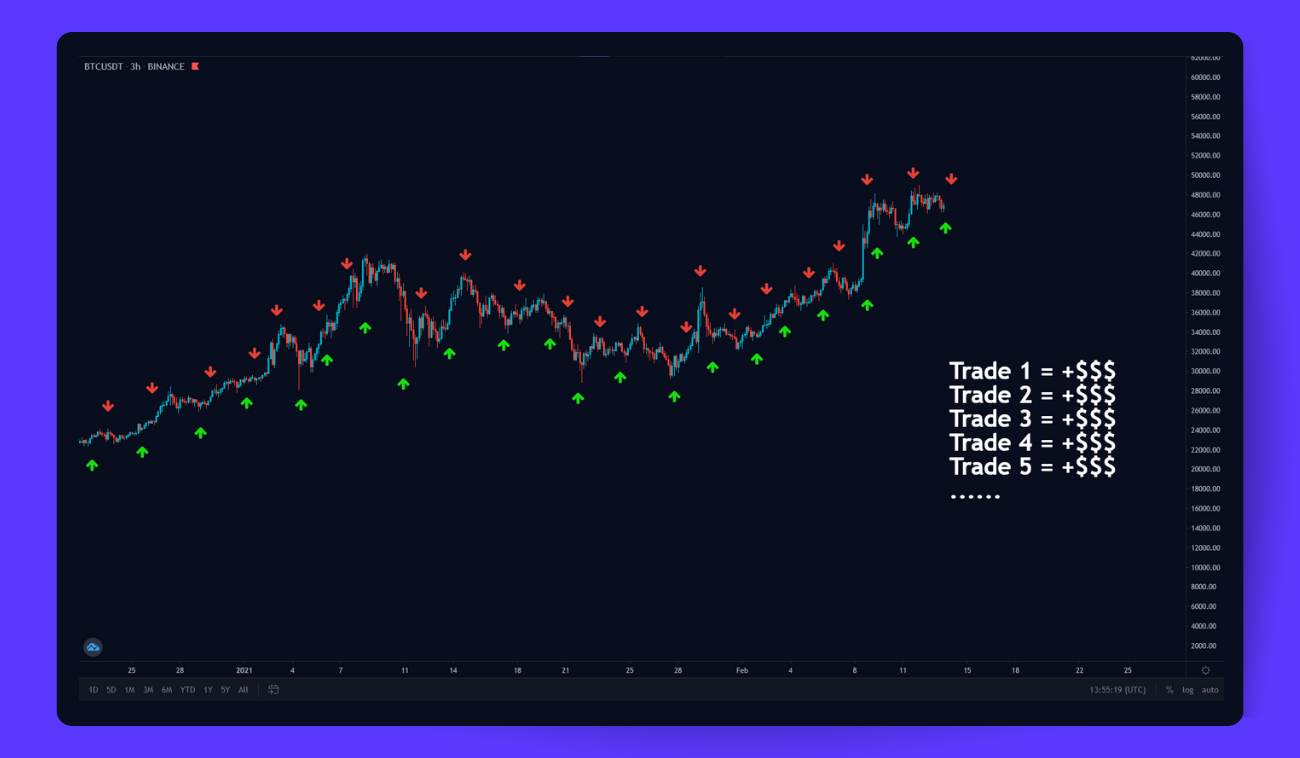

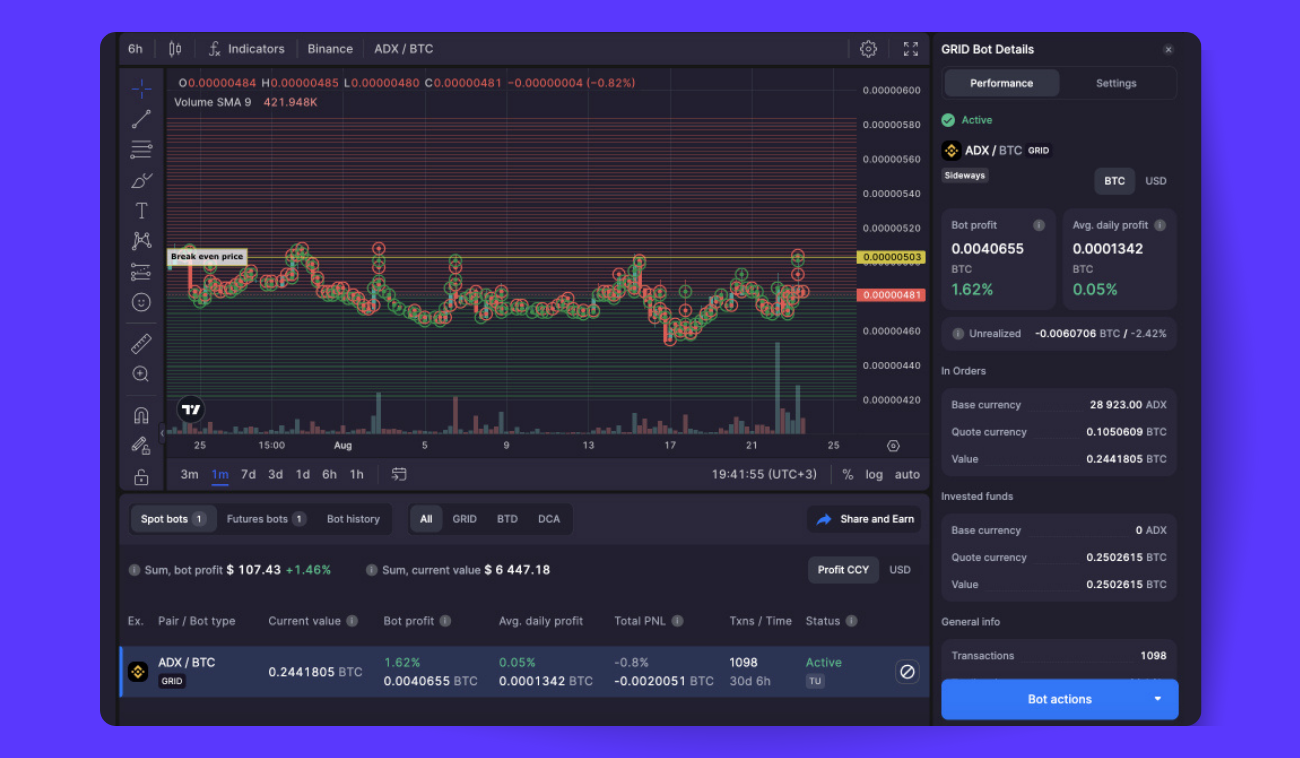

Imagine a system where trading rules are pre-set and, once activated, trades are executed automatically by a computer. This isn't science fiction — this is automated trading systems. These algorithmic trading systems are said to be responsible for an estimated 70% to 80% of trades on crypto exchanges. So, how about joining that 80% and reaping the benefits with the rest of the pros?

The advantages are aplenty. An automated trading system keeps emotions at bay, ensuring you stick to your trading plan. It allows you to backtest your automated strategy against extensive historical data, giving you confidence in your trading approach based on past performance. And if the backtest doesn't yield satisfactory results? Simply tweak your strategy and settings for better outcomes. What's more, as computers instantly respond to market changes, automated systems execute orders as soon as the criteria are met. This means you won't miss out on a promising opportunity or fail to exit a position when things go south because you're asleep or away from the computer. Your laptop has got your back.

Sure, there might be a few hiccups like system failures, but with careful selection, thorough understanding, and proper programming of the automated system, success is within reach.

If you're ready to automate your trading style, consider our trading platform, Bitsgap. As one of the largest crypto aggregators online, Bitsgap connects to more than 17 top exchanges (and counting), allowing you to trade on all your linked exchanges from a single interface. It offers charting instruments, smart trading options, hedging and trailing, as well as automated trading bots to maximize returns.

Whether your strategy is DCA, GRID, BTD, or your style is swing, day, or scalping, you can pre-set and customize your bot settings for seamless, round-the-clock operation.

But don't just take our word for it — give it a go yourself!

Bottom Line: How to Pick the Right Trading Style?

Alright, folks, here's the deal — when it comes to trading styles, there's no one-size-fits-all snazzy suit or little black dress. It's all about what fits your financial goals like a glove and how much time you can spend in the thrilling crypto trading arena.

Got a strategy? Perfect! Give it a whirl with Bitsgap's demo trading. Once you're feeling brave and confident, it's time to gamble some real cash. Just remember to start small and let your positions grow as you rack up successful trades.

And listen, don't be that rookie who's trying on different trading styles like hats at a millinery. Stick to a strategy, even if it's not making you a crypto mogul overnight (just make sure you're not bleeding money, okay?).

Success in crypto trading is about separating the wheat from the chaff — distinguishing between the blaring market noise and real, actionable trends. Learn the ropes of different order types like stop loss and take profits to keep your profits high and losses low.

Remember, that trading strategy isn't a life sentence. Once you've got a good handle on the game and a few trading victories under your belt, feel free to play around. Mix it up with different strategies, like combining automation with manual swing trading.

So, in a nutshell, crypto trading doesn't come with a manual. It's all about finding what works for you and sticking to it. Happy trading!

FAQs

What Are Some Popular Bitcoin Trading Techniques?

Alright, here's the lowdown: we've already chatted about the usual suspects — HODLing, day trading, swing trading, scalping, and automated trading. But wait, there's more! Enter arbitrage and trend Trading, the unsung heroes of bitcoin trading strategies.

Arbitrage is like being that sneaky shopper who spots a bargain on one website and sells it on another for a tidy profit. You buy bitcoin low on one exchange and sell high on another. This opportunity exists thanks to price discrepancies across different exchanges.

Then there's trend trading. It's like being a meteorologist, but instead of predicting weather patterns, you're predicting market trends. You analyze these trends and decide when to buy or sell. To help with this, trend traders use various technical indicators — the crypto equivalent of a weather radar.

But remember, folks, all these trading techniques are a mixed bag of risks and rewards. Always do your homework and consider your risk appetite before jumping into the bitcoin or any other cryptocurrency pool. Trade smart!

What Are Some Popular Ethereum Trading Strategies?

First off, we have the 'Hodl' strategy, the sassy cousin of 'Hold'. This is for all you patient souls who buy Ethereum and then clutch it tightly, riding through the market's wild ups and downs, all with an unwavering belief that its price will soar to the moon someday.

Then, we're back to the usual band of misfits — day trading, arbitrage, swing trading, scalping, trend trading, and our dear friend, automated trading. All the fun and games of bitcoin trading, but with a different leading character.

And finally, for those who fancy themselves as the Sherlock Holmes of trading, there's the fundamental analysis approach. In this method, traders don their detective hats and delve into the nitty-gritty of Ethereum's underlying technology, updates, developments, and overall market trends to make long-term investment decisions.

Remember, every trading strategy comes with its own thrilling twists and turns. Choose wisely, and may the Ethereum odds be ever in your favor!

What Are Some Popular Altcoin Trading Strategies?

Altcoins are all those cryptocurrencies that aren't bitcoin, but they're still vying for a piece of the crypto pie. Much like their big siblings, bitcoin and ether, they share many trading strategies, but with a twist!

Whether you're a swing trader, a day trader, or a holder, it's not enough to just pick a strategy and roll with it. You need to understand the ins and outs of the coin's fundamentals and the tech magic that powers the project.

And don't put all your eggs in one altcoin basket! Spread that risk around like butter on toast. Diversifying your holdings across several altcoins can be a lifesaver when one of them decides to take a nosedive.

So, in altcoin trading, make sure you've got your safety gear on. Remember, knowledge is power and diversification is your safety net!

What’s the Difference between Position Trading and Holding?

Position trading and HOLDling are like the tortoise and the hare of trading, each with their own pace, style, and philosophy.

Position Trading is the strategy of choice for the seasoned trading wizards. Position traders are like the master chess players of the trading world, using a blend of technical analysis, fundamental analysis, and macroeconomic trends to plot their moves. They're in it for the long haul, holding onto positions for weeks, months, or even years. They have their game plan chalked out, including specific entry and exit points for their trades. They keep a close eye on the ever-changing market landscape and tweak their strategies accordingly.

Now, HODLers are the Zen masters of trading. They buy and then hold onto their crypto for dear life, weathering the storm of short-term price swings. They have an unwavering faith in the long-term value of their crypto. Instead of trading actively, they sit tight through the market's highs and lows, expecting their holdings to appreciate over time. It's less about quick gains and more about belief in the asset's future potential.

So, in a nutshell, while both strategies involve playing the long game, position trading is a more active, analytical approach, with traders timing their market entry and exit based on various factors. In contrast, hodling is a more laid-back affair, where the trader simply buys and holds, typically driven by a belief in the asset's long-term potential.