The Proposed US Bitcoin Strategic Reserve: The What, Why, and How.

The US has long relied on strategic reserves of gold and oil. Now, Bitcoin is entering the conversation. Could this digital currency become a key component of America's financial arsenal?

The concept of strategic reserves has long been fundamental to U.S. national security and economic policy. From the vast gold vaults of Fort Knox to the massive petroleum stockpiles across the Gulf Coast, these reserves serve as crucial buffers against economic shocks and geopolitical uncertainties. Now, the nation is contemplating a new kind of strategic reserve: Bitcoin.

The journey of Bitcoin from digital curiosity to potential national asset reads like a Silicon Valley fairy tale. What began as theoretical musings in "The Bitcoin Standard" (2018) has evolved into serious policy discussions and concrete action by corporations like MicroStrategy and nations like El Salvador.

The momentum reached new heights when President-elect Trump endorsed the "BITCOIN Act" at the Bitcoin 2024 conference, essentially promising to add cryptocurrency to America's financial arsenal. Following his electoral victory, the Trump administration revealed plans to allocate a portion of Treasury reserves to Bitcoin, aiming to diversify the nation's portfolio and capitalize on the potential of digital assets. The announcement, combined with the administration's enthusiastic embrace of all things crypto, sent Bitcoin's price soaring faster than a SpaceX rocket.

In this article, we’ll unpack exactly what a Bitcoin Strategic Reserve is, dissect Trump's grand pronouncements, and explore the "why" behind it all. Looming large is the question: Did Trump's January crypto order usher in the era of the Bitcoin reserve, or was it a false dawn?

What Is the Bitcoin Strategic Reserve?

The concept of a Bitcoin Strategic Reserve mirrors the idea of national gold reserves. It involves a government holding a significant amount of Bitcoin as part of its treasury assets. While no nation has yet fully implemented a dedicated "Bitcoin Strategic Reserve," the US is exploring the possibility of creating one. This reserve would be a store of Bitcoin held by the US Treasury, intended to serve various strategic purposes, such as hedging against inflation, diversifying the nation's assets, and potentially even contributing to debt reduction. The idea draws inspiration from smaller countries like El Salvador, which adopted Bitcoin as legal tender, and from corporations like MicroStrategy and Tesla, which added Bitcoin to their balance sheets.

What Is the Proposed US Bitcoin Strategic Reserve?

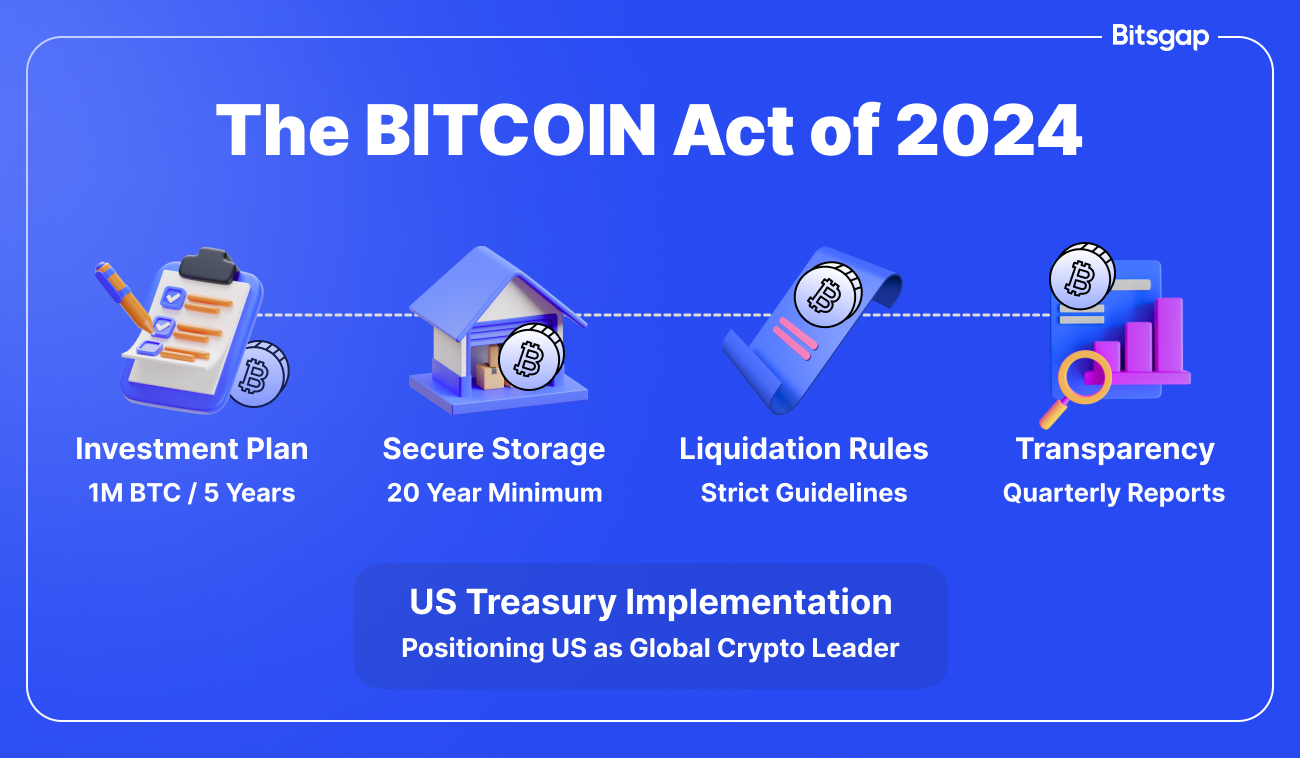

The proposed US Bitcoin Strategic Reserve is an initiative to allocate a portion of the US Treasury's assets to Bitcoin. This proposal, gaining traction due to the BITCOIN Act of 2024, aka Bitcoin Bill, introduced by Senator Cynthia Lummis, outlines a plan for the Treasury to acquire 1 million BTC over five years, at a rate of 200,000 BTC per year. This represents an investment of roughly $76 billion. The Bitcoin would be stored in secure, Treasury-managed digital vaults for at least 20 years, with robust custodial measures and transparency through blockchain-based monitoring and independent audits. The proposal also includes strict liquidation guidelines to minimize market disruption. The 2024 Nashville announcement by the Trump administration indicated an initial allocation of 2% of Treasury reserves to Bitcoin, phased in over 24 months.

The Purpose of a Bitcoin Reserve: Why Bother?

Proponents argue that holding a significant amount of Bitcoin could offer several potential advantages:

- Hedge against inflation and dollar instability: Bitcoin, with its fixed supply, is seen by some as a hedge against inflation and a potential safeguard against the devaluation of the U.S. dollar. This argument rests on the belief that Bitcoin's value will continue to appreciate over the long term.

- Reduce national debt: Some believe that a substantial increase in Bitcoin's value could allow the U.S. to sell its Bitcoin holdings and reduce its national debt. Senator Lummis's proposal, for instance, suggests that such a reserve could potentially cut the U.S. debt in half over 20 years.

- Geopolitical leverage: A large Bitcoin reserve could provide the U.S. with more leverage in international affairs, particularly against countries like China and Russia. This leverage could potentially stem from influencing the Bitcoin market or using Bitcoin in international transactions outside the traditional dollar-based system.

- Dominate the Bitcoin market: Former President Trump suggested that a Bitcoin reserve would help the U.S. dominate the global Bitcoin market, potentially countering the influence of other nations.

However, critics argue that Bitcoin's volatility and lack of intrinsic value make it unsuitable as a strategic reserve asset. They also raise concerns about the security risks associated with holding large amounts of cryptocurrency and the potential for market manipulation.

How Would a US Bitcoin Strategic Reserve Work?

The practical implementation of a U.S. Bitcoin Strategic Reserve remains a subject of debate. While former President Trump ordered the creation of a digital asset working group to explore this concept, the specifics are still unclear. Here are some key considerations:

- Acquisition: The initial stockpile could be derived from Bitcoin seized by law enforcement, which currently stands at around 200,000 Bitcoins. Further acquisition could involve purchasing Bitcoin on the open market, although this raises concerns about market impact and cost.

- Funding: Funding mechanisms are also under discussion. Lummis's bill proposes using profits from Federal Reserve banks' deposits and gold holdings to finance the purchases.

- Management: The Treasury Department would likely be responsible for managing the reserve. This would involve securing the Bitcoin holdings, potentially through a combination of cold storage and other security measures. Managing the volatility of Bitcoin would also be a crucial aspect.

- Legal framework: A clear legal framework would be needed to govern the acquisition, management, and potential use of the Bitcoin reserve. This framework would need to address issues such as ownership, security, and the authority to buy and sell Bitcoin.

Bitcoin Reserve in Action: Real-World Implications

The practical implications of an SBR are far-reaching and touch upon several key areas:

- Impact on the dollar: While the initial impact might be minimal, a large SBR could eventually contribute to the "de-dollarization" of the global economy. This could diminish the U.S.'s ability to exert influence through financial sanctions but could also protect the U.S. from the risks associated with a dollar-centric system.

- Relationship to gold reserves: Initially, Bitcoin would likely complement, rather than replace, existing gold reserves. However, the long-term role of gold in a digital economy remains a subject of discussion.

- Managing volatility: The U.S. Treasury would need to develop strategies to manage the inherent volatility of Bitcoin. This could involve hedging strategies, diversification, and potentially setting limits on the amount of Bitcoin that can be bought or sold at any given time.

- Impact on sanctions: While Bitcoin's traceability could aid in enforcing sanctions, its decentralized nature could also make it more difficult to control financial flows. This could necessitate new approaches to sanctions enforcement in a world with significant Bitcoin adoption.

- Security and accountability: Storing a large amount of Bitcoin presents significant security challenges. Robust security measures, including cold storage and multi-signature wallets, would be essential. The transparency of the blockchain could, however, enhance accountability by allowing public audits of the reserve.

The debate is likely to continue as the implications of this novel concept are further explored.

The Bitcoin-Friendly States of America

A growing number of U.S. states are exploring the creation of state-level Bitcoin reserves, signaling a significant shift towards embracing cryptocurrency as a strategic asset. While the federal government debates the specifics of a national digital asset stockpile, these states are taking proactive steps to integrate Bitcoin into their financial strategies.

Eleven states are leading this charge, with most proposing to allocate up to 10% of specific state funds to Bitcoin. Pennsylvania, for example, is considering investing a portion of its substantial general fund, investment fund, and $7 billion rainy day fund into Bitcoin. Other states, like Wyoming, are taking a more cautious approach, proposing a 3% allocation of public funds to Bitcoin.

Here's a look at some of the states making strides in this area:

- Pennsylvania: Proposed the Pennsylvania Bitcoin Strategic Reserve Act, potentially allocating up to 10% of several state funds to Bitcoin.

- Florida: With support from key political figures, Florida is expected to join the Bitcoin reserve race later in 2025.

- Texas: Introduced Senate Bill 778 to create a dedicated Bitcoin reserve separate from the state’s general revenue fund, allowing for donations from residents.

- Ohio: Introduced the Ohio Bitcoin Reserve Act to establish a state Bitcoin fund, granting the State Treasurer authority to purchase Bitcoin.

- North Dakota: Proposed a resolution to allocate state funds to digital assets, potentially including Bitcoin.

- New Hampshire: Introduced a bill allowing the state treasury to invest in Bitcoin and potentially engage in lending or staking.

- Oklahoma: Introduced the Strategic Bitcoin Reserve Act, focusing on Bitcoin and other high-market-cap digital assets.

- Massachusetts: Proposed allocating up to 10% of the state’s rainy-day fund to Bitcoin or other digital assets.

- Wyoming: Filed a bill to create a Bitcoin reserve, proposing a 3% allocation of public funds.

- Utah: Proposed allocating 10% of state funds to Bitcoin and some stablecoins, with provisions for staking and lending.

- Arizona: Approved the Arizona Strategic Bitcoin Reserve Act (SB1025), allowing up to 10% of public funds to be invested in Bitcoin.

These states are not only exploring the acquisition of Bitcoin but also considering strategies for managing these reserves, including lending, staking, and ensuring secure self-custody. This movement reflects a growing recognition of Bitcoin's potential as a store of value and a hedge against inflation.

Trump's Crypto Order: Did it Deliver on the Bitcoin Promise?

President Trump's executive order on digital assets, while welcomed by the crypto industry for its focus on regulatory clarity and user protections, has created ambiguity regarding the promised "strategic national bitcoin stockpile." The order calls for the exploration of a "potential creation and maintenance of a national digital asset stockpile," leaving room for interpretation on several key points.

The order's language raises questions about:

- "Potential" Stockpile: The use of the word "potential" suggests that the creation of a stockpile isn't guaranteed.

- "Digital Assets": The broad term "digital assets" doesn't specify Bitcoin, leaving open the possibility of including other cryptocurrencies.

- Source of Assets: The order suggests the stockpile could be derived from existing government crypto holdings seized in enforcement actions, rather than through direct market purchases like the Strategic Petroleum Reserve.

Experts have offered differing interpretations. Galaxy Digital's Head of Research, Alex Thorn, suggests "stockpile" might simply refer to holding existing seized assets rather than acquiring new ones.

While the executive order has spurred positive developments, such as the SEC's reversal of a restrictive accounting rule (SAB 121) that hampered banks from acting as Bitcoin custodians, the future of a national Bitcoin strategic reserve remains uncertain. Prediction markets reflect this uncertainty, with the odds of a reserve being established this year dropping following the order's release. The order prioritizes establishing processes and teams to improve crypto policy, but the realization of a dedicated Bitcoin stockpile requires further action and clarification.

Conclusion

The concept of a Bitcoin reserve, whether at the state or federal level, represents a significant step toward recognizing cryptocurrency's role in the future of finance. While several states are forging ahead with plans to establish their own Bitcoin reserves, the ambiguity surrounding President Trump's executive order leaves questions about the fulfillment of his campaign promise for a national Bitcoin stockpile. The order's focus on regulatory clarity and user protections is a positive development for the crypto industry, but the realization of a dedicated national Bitcoin reserve remains uncertain, hinging on further action and clarification.

Regardless of the federal government's ultimate decision, the increasing interest in Bitcoin underscores the growing mainstream acceptance of cryptocurrency. With Bitcoin on everyone's lips, and even President Trump issuing his own Trump token, now is an opportune time to explore the crypto market. Platforms like ours offer a comprehensive suite of tools, including automations, smart orders, and AI assistance, helping you turn even the smallest crypto stash into your own ‘strategic bitcoin reserve’. Why not give it a try? 7 days are free.