The Bitcoin Time Bomb: Understanding Bitcoin Halving 2024

The code is set, the countdown begun — Bitcoin's next halving looms on the horizon like a time bomb primed to detonate in 2024. Will this reduce miner profits or rocket Bitcoin to new highs? Read on to explore projections and possibilities around the seismic supply shock ahead.

The Bitcoin halving is an event that occurs roughly every four years where the bitcoin reward for mining new blocks gets cut in half. These periodic Bitcoin halvings aim to control inflation by decreasing the bitcoin supply over time. While previous halvings have typically corresponded with bitcoin price increases, the magnitude of those gains seems to have diminished.

As we approach the next Bitcoin halving expected in 2024, there are open questions around how much of a price impact it will have. This article will examine the potential effects of the upcoming Bitcoin halving, both positive and negative. Now, let’s get into it.

What Is Bitcoin Halving?

The Bitcoin halving is a programmed event where the reward miners receive for processing transactions and adding new blocks is cut in half. This halving occurs approximately every 4 years, or after 210,000 blocks are mined at the current 10 minute per block rate.

By reducing the generation rate of new bitcoins, the halving aims to control overall supply and ensure bitcoin remains finite, capped at 21 million total coins. Reducing the incoming supply as demand grows can increase bitcoin's value over time based on basic supply-demand principles.

The controlled supply shortage created by the halving matches bitcoin's image as a scarce digital asset, like gold. This predictable tapering of inflation makes bitcoin appealing as a hedge against currency devaluation.

The halving is a key part of Bitcoin's code that shapes its identity as a deflationary currency whose value can rise over time. It helps cement bitcoin's reputation as "digital gold."

How Does Bitcoin Halving Work?

The Bitcoin halving is automatically triggered on a fixed schedule dictated by the Bitcoin protocol. Specifically, the event is set to occur after 210,000 new blocks have been mined on the blockchain since the previous halving. This threshold is hardcoded into Bitcoin's underlying code and cannot be altered without forking Bitcoin to create an entirely new cryptocurrency.

The automated, set schedule for halvings means they will predictably occur without any external influence or control. This hands-off, algorithmic approach gives the halving an air of monetary policy independence, reinforcing bitcoin's image as an apolitical, mathematically-assured digital store of value.

Historical Perspective on BTC Halvings

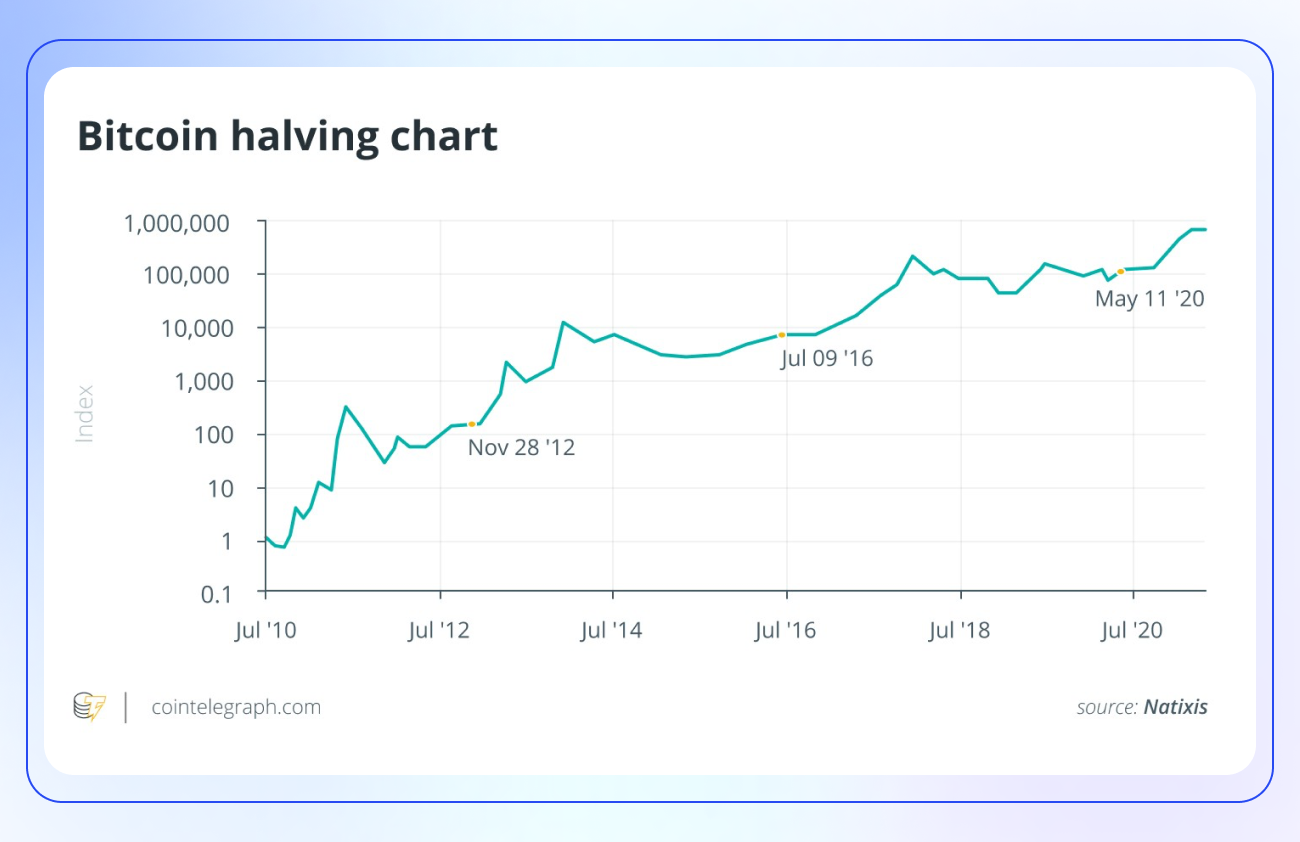

Since Bitcoin's launch in 2009, there have been three halving events so far. The first happened on November 28, 2012, cutting the block reward from 50 to 25 bitcoins. Following this initial halving, bitcoin's price saw a notable increase, setting a precedent for post-halving price surges. The second halving occurred on July 9, 2016, dropping the reward to 12.5 bitcoins. Again, bitcoin's price spiked significantly in the subsequent year. Most recently on May 11, 2020, the third halving took place, reducing the reward to 6.25 bitcoins where it currently stands.

In the periods around each halving, speculation builds, media coverage intensifies, and price volatility escalates in anticipation of and reaction to the reduced supply rate. The halvings spark hype cycles that ultimately thrust Bitcoin further into the zeitgeist. The cyclical halving events have become milestones that focus the crypto community's attention while impacting price and fundamentals.

Bitcoin Halving Dates: When Is Bitcoin Halving 2024?

With the next halving anticipated in mid-to-late April 2024, Bitcoin halving countdown excitement is building as the event nears. While the precise date is unknown, the somewhat predictable schedule aims to avoid shocking the network. However, trading frenzy still surrounds halvings, as evidenced by bitcoin's current price spike approaching its all-time high.

However, investors should be cautious — scarcity can increase prices but reduced mining could cause prices to plateau. The key is not monitoring overall network growth. As long as Bitcoin's adoption expands, its potential as a global store of value rises.

Ultimately, halvings reinforce Bitcoin's narrative while adoption remains the force propelling its ascendance. Investors should see halvings as waypoints on the road to maturation rather than ends in themselves.

What to Expect After Bitcoin Halving

The hype surrounding the BTC halving along with developments like ordinal inscriptions and ETF approvals have already buoyed bitcoin's price in anticipation. Still, broader economic conditions and market dynamics will ultimately determine the post-halving outcome.

While anticipation may lift prices pre-halving, reduced mining incentives could later limit upside. ETFs may improve access but don't guarantee adoption. Inscriptions provide transparency yet success depends on utilization. Overall, projections based solely on the halving have limitations.

This is not to dismiss the halving's significance, but to recognize it does not happen in isolation.

Here's an analysis of the key points and their likely implications post-halving:

Supply Impact:

- Halving Event: The Bitcoin block reward for miners will decrease from 6.25 to 3.125 BTC, effectively reducing the rate at which new bitcoins are generated and introduced into the system.

- Implications: This reduction in supply often creates a bullish sentiment as it could lead to scarcity, potentially driving up the price if demand remains constant or increases.

Miner Positioning:

- Preparation: Miners have been preparing for reduced revenue by raising funds and selling reserves to buffer against the anticipated decrease in block rewards.

- Implications: This suggests that miners are taking proactive steps to sustain their operations post-halving. However, if the price of bitcoin does not increase to counterbalance the reduced block rewards, some miners may become unprofitable, possibly leading to a consolidation in the mining industry.

Sustained Onchain Activity Growth:

- Ordinal Inscriptions and NFTs: The introduction of NFT-like collectibles inscribed on the Bitcoin blockchain has generated significant transaction fees for miners.

- Implications: The growth in onchain activity, particularly through new use cases like ordinal inscriptions, could partially offset the revenue miners lose from the block reward halving by providing an alternative revenue stream through transaction fees.

Bitcoin ETFs' Market Impact:

- ETF Adoption: The approval and adoption of Bitcoin ETFs is providing a new source of steady demand for bitcoin.

- Implications: The increased demand from institutional and retail investors via ETFs could absorb sell pressure from miners, potentially leading to a more stable or increased bitcoin price post-halving.

Macro and Market Structure:

- Historical Context: Previous halvings coincided with major macroeconomic events that influenced bitcoin's price, such as the European debt crisis, the ICO boom, and the COVID-19 pandemic.

- Future Outlook: While historical trends suggest a price increase post-halving, it's important to note that these increases are not guaranteed and may also be influenced by broader macroeconomic factors.

Challenges and Innovations:

- Miner Revenue and Expenses: The increased hash rate and mining difficulty imply higher expenses for miners, creating a challenging environment post-halving.

- Network Security: A significant portion of miner revenue may need to come from transaction fees in the future to continue incentivizing miners to secure the network.

Bitcoin has shown resilience and evolution that point to potential prosperity even after the next halving. Its adaptability along with expanding on-chain activity indicate Bitcoin may continue thriving in a reduced issuance environment. However, the precise price and security consequences of the 2024 halving remain uncertain. The effects will likely hinge on an intersection of supply and demand shifts, miner strategies, increases in market maturity, and broader economic conditions.

With over a century remaining until the final Bitcoin halving expected around 2140, there is still a long road ahead. This last halving will mark the mining of the 21 millionth bitcoin and the full depletion of the original issuance schedule. At that point, Bitcoin's incentive structure will completely transition from block rewards to transaction fees.

The network's future beyond 2140 remains highly speculative, contingent on many variables. Bitcoin's price, security model, and global financial role by that distant date will hinge on technological progress, adoption rates, regulatory reactions, macroeconomic trends, and more.

And While You Wait …

As you anticipate the upcoming halving event, consider leveraging bitcoin's volatility to your advantage through a crypto trading and aggregation platform like Bitsgap. With connectivity to over 15 exchanges from a single interface, Bitsgap offers a suite of tools, including automation and intelligent trading features. For example, during a clear uptrend, you might use a Bitsgap DCA (Dollar-Cost Averaging) bot. In periods of sideways movement, you could take advantage of short-term price variations with a GRID bot. Furthermore, you have the opportunity to increase potential returns using leverage with Bitsgap's COMBO and DCA futures bots in the futures markets. In essence, for automated and savvy trading solutions, Bitsgap is a platform worth considering, especially when the first 7 days are free.

Conclusion

Bitcoin has shown resilience and evolution that point to potential prosperity even after the next halving. Its adaptability along with expanding on-chain activity indicate Bitcoin may continue thriving in a reduced issuance environment. However, the precise price and security consequences of the 2024 halving remain uncertain.

The effects will likely hinge on an intersection of supply and demand shifts, miner strategies, increases in market maturity, and broader economic conditions. Despite bitcoin's demonstrated ability to navigate prior halvings, projections around the next event still contain contingencies and unknowns.

While the halving spotlights Bitcoin's provable digital scarcity, ensuring this scarcity translates to a stronger store of value depends on technological progress and real-world integration keeping pace with each supply shock. Bitcoin's future relies on both robust code and growing adoption propelling it forward through the halvings and beyond.