Stellar (XLM): Past, Present, Future

Once an obscure cryptocurrency, Stellar Lumens (XLM) has rapidly grown into one of the top digital assets — but will its meteoritic rise continue?

As a leader in blockchain payments technology, Stellar could become the currency of choice for fast, low-cost, cross-border transactions. But will it?

Bitcoin has long set the pace in the world of digital payments, so it wasn't surprising when new tech-savvy projects popped up aiming to speed up transactions and make sending digital cash super quick. Stellar Lumens is one such standout project that's been making waves since it hit the scene, offering what many see as a promising way to handle cryptocurrency payments. Stellar isn't just about speed; it's been on the forefront of developing some seriously advanced payment tech and has teamed up with some big names, not just in the crypto world but in the traditional finance sector too. In this article, we're going to take a closer look at Stellar Lumens: what it's all about, the potential of its currency (XLM), what the future might hold, price predictions, and the hurdles it might encounter along the way. So, let's jump right in and explore.

What Is Stellar?

At its core, Stellar is an open-source decentralized network aimed at facilitating swift, secure, and cost-effective international payment solutions.

Launched in 2014 along with its overseeing foundation, Stellar operates on its native token, Stellar Lumens (XLM), which enables almost real-time transactions across different currencies and streamlines cross-border payments.

👉 What's cool about Stellar is that it's not just playing the big leagues with the likes of Ripple, its main rival. Instead, Stellar has its eyes on the everyday person, aiming to connect individuals just as smoothly as it does big businesses and payment networks all around the world.

The network's vision is to become the ultimate remittance protocol that transcends borders and limitations, offering a versatile platform for the creation, sending, and trading of various monetary representations, including fiat currencies like the US dollar, Euro, and Bitcoin, among others.

Stellar is reimagining money with a fully interoperable financial ecosystem catering to all participants from one unified platform. It provides extensive SDKs and APIs for easy integration.

Additionally, Stellar facilitates straightforward ICO launches compared to other blockchains. Projects like Mobius, SureRemit, and Smartlands have already leveraged Stellar for token creation.

What Makes Stellar Unique?

At a first look, it might seem that Stellar offers similar services to what you get from classic banks, but there are distinctive features that set Stellar apart.

Stellar's network operates on a decentralized blockchain, making transaction speeds much quicker and fees significantly lower than traditional banking. Transactions on Stellar are lightning-fast, completing within 2-5 seconds, and the fees are so low they're practically negligible — just $0.00006 per swap. That's a stark contrast to the hefty charges you might pay for an international bank transfer.

Stellar doesn't only differ from traditional banking; it also stands out among other crypto projects. Many cryptocurrencies cater to businesses, but Stellar is all about empowering individuals and building an inclusive digital economy. It's a tool for social impact, aiming to tackle poverty and unlock individual potential.

Stellar's infrastructure consists of many servers spread worldwide, each running Stellar Core software. These servers each hold a blockchain copy and work together to stay in sync.

Stellar takes a unique approach to reaching consensus, not using Proof-of-Work or Proof-of-Stake. Instead, it uses the Stellar Consensus Protocol (SCP), which is a way to agree on transactions without a closed, central system.

Stellar’s SCP is a type of federated Byzantine agreement system. It's designed to allow decentralized networks to quickly and efficiently agree on outcomes. This ensures everyone on the Stellar network has the same view of transaction history.

A Byzantine agreement system is robust even against nodes that may intentionally provide false information. For example, if a user tries to spend the same token twice with different recipients, a Byzantine agreement system prevents this by using a quorum — a majority that must agree on a transaction before it's considered final.

In Stellar's system, nodes wait for a majority of their trusted peers to agree on a transaction before they consider it settled. This Federated Byzantine Agreement (FBA) ensures the network remains secure, open, and democratic, avoiding the limitations of centralized intermediaries.

How Stellar Works

Stellar simplifies the way you send money around the world, making it faster and more transparent than traditional systems. Think of it as a high-tech version of services like PayPal.

Here's how it works:

- To get going, you’ll have to set up an account, which is basically creating a wallet address. This comes with two key parts: a public key, which you can give out to people, and a private key, which you keep to yourself to keep everything secure. Your public key is like a digital signature; it's a secure way to make sure that any transactions you do on the network are safe and sound.

- Then, you add money to the Stellar network, similar to how you'd load funds into a digital wallet. On Stellar, these funds go to something called an Anchor, which is just a fancy term for a service that converts your regular money (like dollars or euros) into a form that the Stellar network can use.

👉 Now, let's say you want to send $1000 to a friend across the ocean. With Stellar, you deposit your dollars with an Anchor, and you get a digital version of your dollars on the Stellar network.

- Ready to send it to your friend? Just a few clicks and Stellar automatically does the currency conversion for you, hunting down the cheapest way to turn your digital dollars into euros. Then, just like that, the euros pop up in your friend's account, ready to be taken out as cold, hard cash.

The best part? This whole thing happens in the blink of an eye, and it's all done behind the scenes. Stellar's goal is to make sending money as easy and hassle-free as sending a text message, and it really is that simple.

XLM Token (Stellar Lumens)

Lumens, also known by their ticker symbol XLM, are the native digital currency of the Stellar network.

Unlike other blockchain tokens that are mined or periodically doled out by the system, lumens were all made at once — a whopping 100 billion when the Stellar network sparked to life.

For the initial five years or so of Stellar's operation, the lumen supply experienced a designed annual increase of 1%. But then, the Stellar community put their heads together and voted in October 2019 to stop this annual increase. Subsequently, in November 2019, the total number of lumens was reduced.

The current supply stands at approximately 50 billion lumens, and there are no plans to create additional lumens. Of this trove, 20 billion lumens are out there, circulating and being traded, while the Stellar Development Foundation is hanging onto the other 30 billion. They're not just sitting on them — they're using them to fuel Stellar's growth and bring more people into the fold.

Lumens fulfill a dual role in the Stellar ecosystem:

- First, they help protect the network from spam by being used to pay for transaction fees and by enforcing minimum account balances. This minimum balance is required to deter the creation of junk accounts filled with spam transactions. Currently, each transaction incurs a nominal fee of 0.00001 XLM.

- Second, Lumens act as an intermediary for transactions involving different currencies, assisting in trades that might not be immediately possible due to low direct market liquidity.

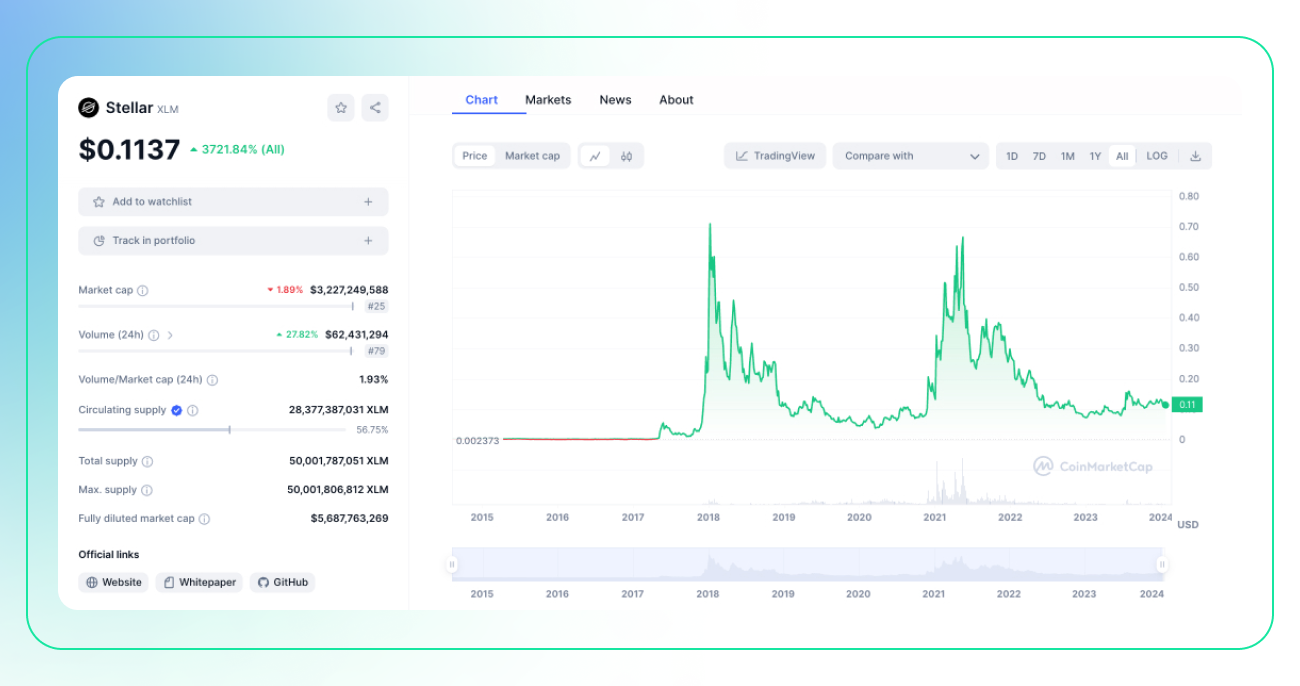

Lumens initially traded without significant fluctuations following their listing in 2014 and continued in a tight range for three years, oscillating between $0.001 and $0.006. It wasn't until the bullish cryptocurrency market of 2017 that Lumens gained significant value. Let’s outline what has happened with XLM since then (Pic. 1):

- In 2017, Stellar Lumens got caught up in the crypto craze, with its value skyrocketing from the humble sub-cent region to an eye-watering peak near 93 cents.

- The upward momentum continued into early 2018, with XLM hitting its all-time high price. However, like many cryptos, XLM then faced a downturn for the rest of 2018 during the "crypto winter."

- 2019 was mostly a bearish year for XLM, with the price trending down or moving sideways. An important event was the Stellar Development Foundation burning half the total supply of XLM tokens.

- After starting 2020 at low prices, XLM saw some recovery and upward price movement later in the year during another crypto bull market.

- 2021 was a volatile year for XLM with rapid price surges and corrections, but it didn't reach its 2017/2018 highs.

- In 2022, XLM faced challenges and bearish trends, impacted by broader crypto market sentiment and macroeconomic factors.

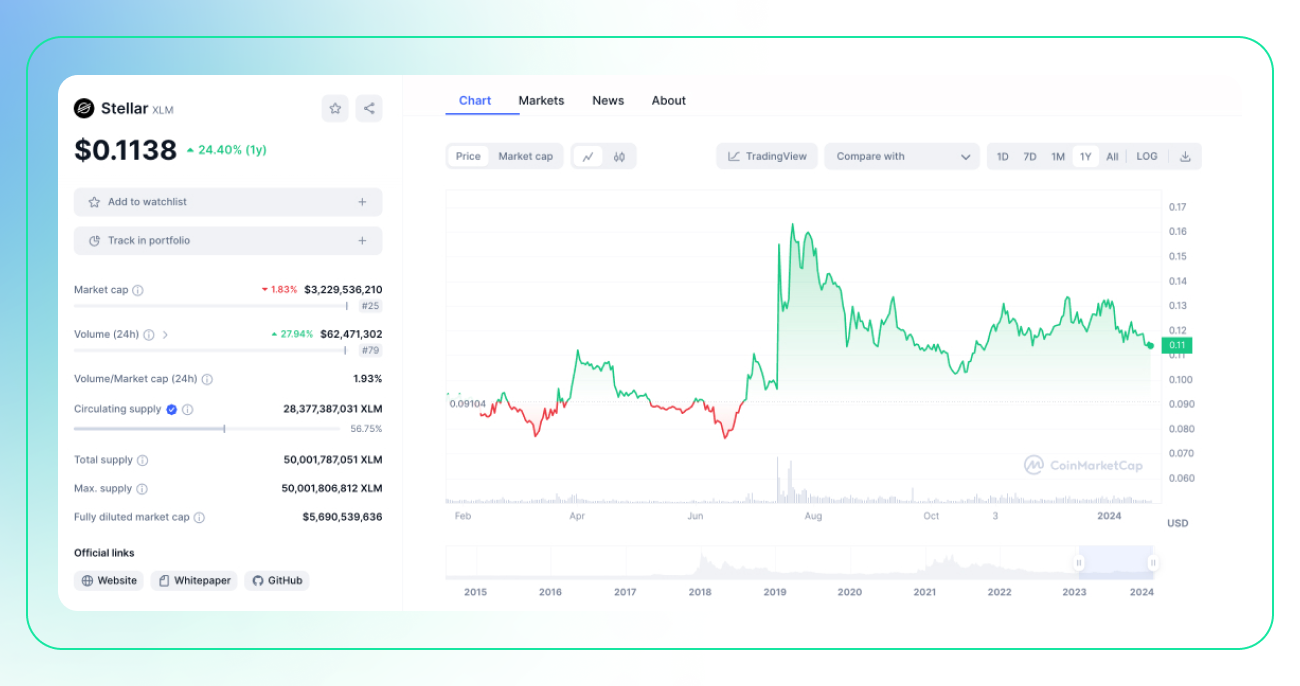

- 2023 (Pic. 2) saw the crypto market still recovering from various shocks and regulations. XLM briefly hit $0.16 before stabilizing around $0.11 by the start of 2024.

XLM Potential: Future of Stellar Lumens

When it comes to Stellar's company prospects, things are looking up. A big part of this optimism comes from their all-star team, including tech veterans like Jed McCaleb and Joyce Kim.

McCaleb has a track record of founding successful tech ventures, including Ripple and the file-sharing service eDonkey, as well as the infamous Mt. Gox Bitcoin exchange. After leaving Ripple due to a clash of visions, he started Stellar. The company's top brass includes President, CEO, and Executive Director Denelle Dixon, who brought her experience from Mozilla, where she was the COO, and legal expertise from Yahoo, backed by her law degree from the University of California.

Stellar's diverse team spans the globe and includes a mix of techies, engineers, and visionaries, all united in their mission to build a financial system that works for everyone. Although Stellar has hubs in San Francisco and New York City, its team members work from all over the world.

Another big plus for Stellar is their partnerships with big names like IBM and Circle, as well as ties to government institutions such as the National Bank of Ukraine and the U.S. Government Money Fund. They've also teamed up with a bunch of money transfer services, like Tempo in France and Remitr in the Americas. Stellar keeps its community in the loop with regular updates about what they're working on. A peek into Stellar's GitHub page shows lots of coding and development activities, proving they're in it for the long haul.

So, if you're wondering whether to invest in Stellar, the current mood is to either buy more or hold onto what you've got. With its price looking attractive right now, it might be a good time to get in and see what the future holds.

Does XLM Have a Future: XLM Stellar Price Prediction

Are you holding onto XLM and hoping to strike it rich quickly? You might be wondering if XLM could hit $1, maybe even shoot up to $50, or what it could be worth by 2030. Well, the truth is, predicting the future prices of cryptocurrencies is really tricky since we don't have a magic crystal ball.

Even so, anyone with a bit of technical analysis know-how can take a peek at XLM's current trends. It's been hovering between $0.11 and $0.12 for some time. If we want to see the price go up, XLM needs to break out of this pattern that it's been stuck in since the fall. This would be a sign that things might be turning around, which could mean the price might start climbing.

But if it doesn't break out, the price could actually fall further. That said, the crypto market has been pretty upbeat lately, especially past ETF approval, so many people think prices will rise for XLM and other digital coins.

Remember, though, crypto prices can swing wildly and unpredictably. So while it's fun to dream about the possibilities, make sure you do your research and think carefully before you decide to buy or sell. It's always best to play it safe!

Where to Trade XLM?

XLM is available to trade on a bunch of exchange platforms, including big ones like Coinbase and Binance, as well as smaller local exchanges that let you trade in your own currency if you're in certain parts of the world. Plus, there's this cool tool called Bitsgap that brings all these exchanges together in one spot. Bitsgap also offers sophisticated smart trading tools and bots designed to operate effectively in all market scenarios. And guess what? If you sign up now, you get to try it out for free for a whole week. So, why not give it a whirl today?

FAQs

What’s the Future of XLM?

The future outlook for Stellar Lumens (XLM) will depend on several key factors. Continued advancement of the Stellar network's core technology and expanding adoption are critical for XLM's success. If Stellar can further secure partnerships and extend use cases, especially for cross-border payments and asset tokenization, it may drive increased demand for XLM. The evolving regulatory environment for cryptocurrencies can either assist mainstream adoption or impede XLM's progress depending on policy directions. Broader market sentiment also impacts XLM, with bullish trends lifting prices and bearish markets depressing them. Stellar competes with other payment-focused cryptos, so remaining innovative and competitive is essential. Upgrades from the Stellar Development Foundation that enhance scalability, security, or functionality may positively influence XLM. Additionally, a robust developer community driving innovation and cementing Stellar's credibility could increase XLM utilization. While unpredictable, these factors shape the landscape in which XLM operates and will likely impact its future direction.

Where Can I Find Stellar Forecast?

If you're on the hunt for projections about Stellar Lumens (XLM), there's a variety of platforms you can check out: look into cryptocurrency analytics platforms such as CoinMarketCap, CoinGecko, and TradingView; peruse financial news giants like Forbes and Bloomberg; dive into specialized crypto news portals including Cointelegraph, CryptoSlate, and CoinDesk; sift through research papers and whitepapers for in-depth insights; or, if you're up for it, use tools provided by platforms like TradingView to perform your own technical analysis.