Risk Management in Crypto Trading: Balance Risk & Reward Like a Pro

The crypto seas storm wildly, but you can weather the tempest. An armory of risk management weapons awaits, promising to transform peril into profit!

Despite the unpredictability inherent in the crypto market, there is an arsenal of strategies to navigate these choppy waters effectively. Stay with us as we delve deeper into risk management and turn uncertainties into opportunities.

The crypto market, susceptible to dramatic price oscillations, can sometimes feel like a rollercoaster ride. As with any investment, there's always the possibility of your capital taking a hit, regardless of how foolproof the venture may appear. In this context, risk management emerges as an essential ally on your path to investment success.

Join us as we explore various methods to navigate and mitigate risks in crypto.

What Is Risk Management Crypto?

Trading in the crypto world will inevitably expose you to adverse scenarios. These might take the form of trades not progressing as planned, unexpected price surges, errors, and a slew of other undesirable occurrences.

👉 Risk is an integral part of trading; it's a reality every crypto trader must embrace.

Ignoring sound risk management practices can significantly impact your trading balance, and you may even lose your entire capital.

Risk management strategies outline your approach to handling risks in trading. They serve as your safety net against the potential downsides of your trades and help you maintain control over your losses. These guidelines not only safeguard you but can also assist in achieving your desired outcomes when the appropriate crypto trading strategies are properly implemented.

Risk Calculation: How to Calculate Risk Management Crypto

Trading crypto holds rewards beyond imagination, but only for those who respect its ruthless nature. So we must sharpen our skills to master risk, not vainly try eliminating it. Our journey begins by learning to calculate crypto's risks, translating market mysteries into navigable numbers.

Risk-to-Reward Ratio in Crypto Trading

When weighing any investment opportunity, it's wise to balance risk and reward. An invaluable tool that helps us thoughtfully assess this trade-off is the risk/reward ratio.

The risk/reward ratio compares the potential profit of a trade to its potential loss. In other words, it quantifies the reward you might receive for the risk you undertake.

For instance, an investment with a risk/reward ratio of 1:2 implies that you stand to earn two dollars for every dollar you risk, assuming the trade swings in your favor. This ratio is critical to cryptocurrency trading, whether for daily trades or long-term investing, aka "hodling."

To calculate the risk/reward ratio, assume Polka Dot’s (DOT) current price is $5. A crypto trader may decide to enter a long position (buy) with these parameters:

- Entry price: $5

The price at which they buy DOT. - Stop-loss: $4

If the price of DOT falls to the stop-loss point, the system would sell the purchased DOT to prevent further losses. In essence, they're risking $1 per DOT bought at $5. - Take profit: $7

If the price of DOT increases, the take-profit price is where they would sell the DOT at a profit of $2 per DOT.

While there are several online calculators that can help you compute the risk/reward ratio, here’s how to calculate it manually:

Risk-reward ratio = (Entry point - Stop point) / (Profit target - Entry point)

- Initial risk is $1 per DOT (the difference between the entry price of $5 and the stop-loss price of $4).

- The take-profit level offers a reward of $2 per DOT, resulting in a risk-reward ratio of 1:2 ($1 risk divided by $2 reward).

Though not a flawless tool, these estimates help thoughtfully evaluate if an investment aligns with our risk tolerance and goals. Of course, in the ever-changing crypto market, you must continue adjusting your course. The risk/reward ratio provides an initial bearing, but as volatility stirs, you should reassess with fresh data and discernment. Other navigational aids like trading strategies, analysis, and vigilance can and should complement the ratio.

Asset Allocation

Excel is a widely recognized tool that has found its place in both professional and everyday life. There's no need for you to be an Excel expert to perform basic risk management operations. All you need is a basic understanding of how to create a simple table that lets you experiment with asset allocations, cryptocurrency conversion calculations, and so forth.

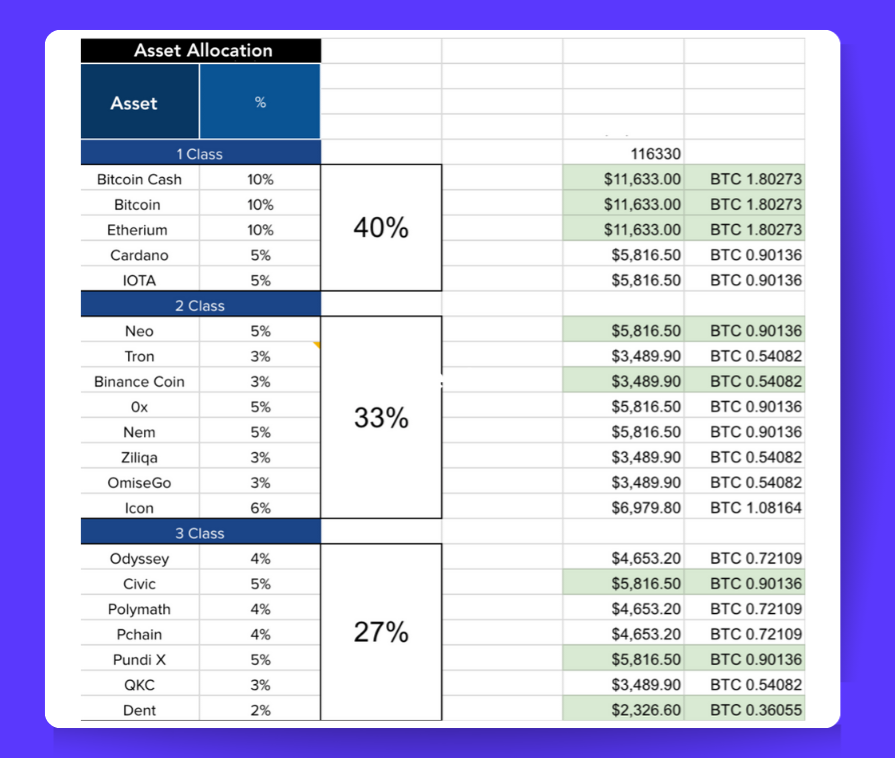

Here's how you can create a proportionate asset allocation based on your available balance (refer to Pic. 1 for clarity).

On the left, you'll see a table with selected coins, categorized into "Class 1", "Class 2", and "Class 3". The classification concept is purely a product of your imagination. Note that the investment allocation ranges from 2% to 10%. Essentially, this indicates the percentage of your total balance that you're willing to risk on a particular asset. The table is fully customizable to sort, classify, and organize diversification in any way you wish. This is what we call a strategic plan.

Once you've established your plan, execute your trades based on your asset allocation using Bitsgap's "Portfolio" feature, which allows you to monitor the dynamics of your portfolio. In this context, your focus should be on "ROI". The total ROI reflects the cumulative return on your investments since you began trading via Bitsgap.

Crypto Risk Management Strategies

Remember, no investment is worth risking what you can't afford to lose, a principle that holds true across all markets, and more intensely with cryptocurrencies, known for their potential for dramatic losses within hours. But that’s common sense, isn’t it?

So keep perspective. Never wager more coins than you can spare, as crypto's volatility shows no mercy. Before casting off, consider carefully if the journey ahead aligns with your risk appetite.

With some battle-tested risk management strategies in your tactical arsenal, you can sail these waters while keeping risk an ally.

Stop Loss Strategies for Crypto

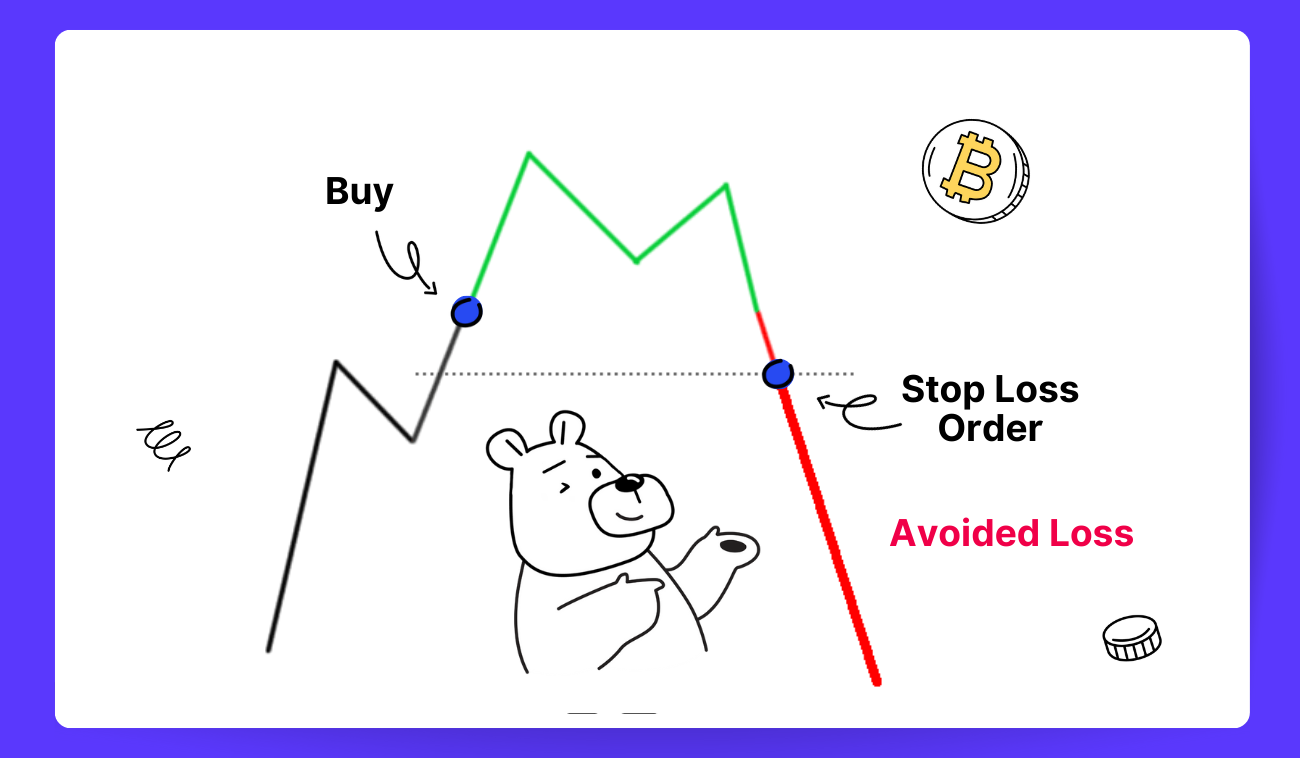

Upon reviewing your trading journal, you may discover that a majority of your substantial losses occurred because you neglected to establish a stop loss (Pic. 2). Some traders tend to cling to losing trades for an extended period, consistently shifting the stop-loss further from the initially defined risk level. This stems from the psychological difficulty of admitting one's forecast about the market direction was wrong.

Trading needs to be logical and emotion-free. Stick to your trading plan and use risk management tools properly.

There are various methods to set stop-losses:

- Percentage stop: This method uses a pre-defined percentage of the trader’s account. For instance, a trader might risk 2% of the account on a trade. The percentage risk varies among traders. However, setting the stop-loss based on the percentage can force the trader to set the stop at an arbitrary price level, which might not take into account the market conditions.

- Volatility stop: This method uses the market's volatility to set stop-loss levels. Tools such as Bollinger Bands or the Average True Range (ATR) indicator can be used to gauge volatility. This approach gives traders some leeway for possible fluctuations unless they exit the game too early.

- Chart stop: This method uses technical analysis, like support and resistance levels, to set stop-losses. If these levels break, it may indicate that market forces are pushing the market in a particular direction.

- Time stop: This method sets a predetermined time to exit a trade. For example, an intraday trader might close all positions at the end of the trading day. This method ensures that your capital isn’t tied up in trades that aren’t moving.

Remember, the stop-loss should be set according to market conditions or your system's rules, not based on how much you're willing to lose. This approach will provide a more realistic risk management strategy.

Position Sizing for Digital Currencies

Position sizing refers to the volume of cryptocurrency you decide to either buy (long) or sell (short). Your decision hinges on the maximum financial loss you're prepared to bear if the trade doesn't go as planned, commonly referred to as "max risk."

Newbies in cryptocurrency trading are usually advised to limit their max risk to between 1% and 2% of their total portfolio for short-term trades. For trades intended to last longer, the max risk can be increased to 5%.

To illustrate, assume you own a cryptocurrency account worth $5,000 and you're interested in buying a token priced at $20 per token.

You decide to cap your max risk at 2% of your total account value, which equates to $100. Following your analysis, you determine that if the token's price dips to $15, you should set a stop loss (which means you should exit the trade).

If you enter the trade by buying the token at $20 and you're planning to exit at $15 (your stop loss price), this represents a potential loss of $5 per token (i.e., $20 - $15).

You then divide your max risk ($100) by the potential loss per token ($5). This gives you 20 tokens ($100 / $5 = 20). So, you decide to buy 20 tokens for this trade.

If the price of the token does indeed fall to your stop loss price of $15, you'll sell your 20 tokens. The loss of $5 per token multiplied by 20 tokens equals a total loss of $100, which is exactly 2% of your total account value, in line with your max risk policy.

Scaling

Unless you are extremely certain about the price at which you want to enter a trade, it is generally advisable to split your entry and exit orders into two or more transactions around your desired entry/exit zone.

Building on the previous example about position sizing, suppose you're interested in buying a token at $20, but according to your analysis, the price could drop to as low as $16 before the market sentiment fully swings to bullish.

To minimize the risk of setting your entry price too low (which could result in missing the trade entirely) or too high (which could prevent you from securing the best price and thus reduce potential returns), you might consider dividing your entry and exit orders among different price levels.

Instead of purchasing 20 tokens all at once at $20, you might opt to buy five tokens at $20, five tokens at $18, and 10 more at $16.

This strategy allows you to partially engage in the trade if the token price doesn't fall below the $20 mark. Moreover, if the price does decrease to $16, you will have averaged down your entry price to $17.5.

If you set your stop loss at $15, the loss per token would be $2.5 ($17.5 - $15). And since you have 20 tokens, your total maximum risk (if all tokens hit the stop loss price) would be $50 (20 tokens * $2.5 loss per token).

These examples are basic, but comprehending and applying these principles are often enough to prevent major setbacks when starting on your trading journey.

Diversification in Digital Assets

Even though it's clear that most cryptocurrencies closely follow bitcoin's price movements, making asset allocation diversification difficult, there are still ways to diversify your trading strategies. You can combine passive and active portfolio management tools. Margin funding, which generates interest income by lending capital to leveraged traders, is one example of a passive strategy.

The key is to use a mix of approaches so you're not overly exposed to any single strategy or market behavior. Diversification among trading methods can provide some protection, even when the assets themselves are highly correlated.

Emotional Control

Many traders often overlook the crucial role that emotional stability plays in the trading process. A significant field of study known as "Behavioural Finance" delves into the psychological influences and implications involved in active portfolio management and trading. Your emotional state can profoundly influence the trading choices you make.

There's a saying that goes, "The tone of your morning sets the course of your day." Therefore, it's crucial to prevent external stressors like unresolved conflicts or impending exam stress from disrupting your mental calmness. When your emotional equilibrium is off-kilter, it can rapidly erode your concentration, a vital element in decision-making for trading and investing. There are many strategies you can adopt to temporarily disengage from real-life distractions or issues.

While meditation might be a viable solution for some, it may not work for everyone. Regardless, the objective is to utilize all accessible psychological tools to enhance your focus and quiet your mind when you feel your thoughts are chaotic, and your brain is in overdrive. If not, your risk management strategy could be jeopardized.

Trading Journal

Maintaining a record of your trades is vital. This practice enables you to identify your trading strengths and shortcomings. Understanding which trades yield the highest profits or losses allows you to delve into the reasons behind them. As you engage in this introspective process, you will uncover intriguing patterns in your trading habits.

For example, you might discover that you excel at trading altcoins rather than bitcoin. Or perhaps you find that your performance dips on Fridays and Saturdays, possibly due to distractions from family engagements. Maybe your less than optimal performance is a result of juggling too many trading strategies, instead of focusing on one or two that you're proficient in.

Remember, every trader is unique, and honing your trading skills requires rigorous work on your strengths and weaknesses. It's always good practice to amplify what drives your profitability.

Education

It may sound clichéd, but education and practice really can improve your trading skills. The market is always evolving, so a strategy that works today could become obsolete tomorrow.

To keep up with the market, you need to continually learn new strategies and tools, like automated trading systems such as Bitsgap. You also need to define and adhere to solid risk management principles. Practicing different strategies is crucial too.

For example, Bitsgap's Demo mode allows you to execute trades without putting real money at risk. If you haven't tried dip buying, DCA, futures, or other approaches, Demo mode is a great way to build those skills in a risk-free environment.

The bottom line is that successful trading requires an ongoing commitment to learning and skill development so you can adapt as market conditions change. With the right education and practice, you can become a better trader over time.

Bitsgap’s Risk Management Tools

Did you know that on Bitsgap, you could turn every ordinary order into a smart one?

Your order comes fully loaded with an arsenal of risk management features to augment any trading strategy. Whether deploying a limit, market or scaled order, you can outfit it with additional safeguards like Take Profit, Trailing Take Profit, Stop Loss, Trailing Stop Loss, or One Cancels the Other (Pic. 3).

For example, Bitsgap’s Stop Market order packs a powerful punch with its trailing feature that dynamically adjusts your open order, reacting in real-time to the market's price gyrations. This clever feature is a trader's best friend, automatically adapting your stop order to price swings based on a percentage you specify, freeing you from the tedious task of manually tweaking your order every day.

Once unleashed, the trailing feature springs into action anytime the price moves by the percentage step you set. With every market fluctuation, it stealthily creeps behind the price, updating your stop order's trigger point. The smallest step is 0.2%, allowing precise tracking of even subtle price moves.

Here's a practical demonstration of how this function operates in live trading:

- Assume the ETH price is 2k and you plan to set a Stop order to acquire the coin at 3k with a price step of 5%.

- The moment the price decreases by 5% (i.e., to 1.9k), your Stop order will adjust to 2.85k (by 5%).

- Should the price continue to descend, the order will adjust when the price deviation reaches another 5%.

- As illustrated, the trailing function gets activated every 5% and adjusts the open order by 5%, either down or up, from its prior position.

Another interesting feature is Trailing Take Profit, which you can incorporate into your smart order along with Take Profit. This dynamic duo allows you to methodically exit your position in phases, incrementally selling portions at the Take Profit target while the trailing feature reserves remaining coins, poised to seize additional gains.

As the asset price ascends, the trailing feature ratchets your take profit higher, chasing the rising price while locking in parts of the profit. When the uptrend ultimately reverses, the trailing feature springs the trap, liquidating the remaining position to bank the maximum returns. This coordinated attack of staggered profit-taking and automated trailing maximizes your potential earnings by capitalizing on both the climb and the inevitable pullback.

The profit-boosting modifications don't stop there. You can outfit Bitsgap's army of crypto bots with the same arsenal of hedging tools and profit-taking features. Whether commanding a phalanx of DCA bots across spot and futures, constructing a GRID bot matrix, deploying BTD shock troops or a COMBO bot barrage, every bot becomes a profit-maximizing, risk-minimizing engine of gains.

Ready to dive in and start trading safely? Welcome to Bitsgap!

Bottom Line

In conclusion, risk management is a critical component of successful trading, and it's imperative for both novice and seasoned traders to take it seriously. The disparity between thriving traders and those who struggle is often not the complexity of their trading strategies, but their adherence to simple, consistent risk management protocols and trading plans.

It's essential to set realistic expectations to effectively manage risks. Pursuing exorbitant profits, such as 40% monthly returns, may lead you to overtrade or excessively leverage, thus elevating the risk of substantial losses. By setting achievable goals, you are better equipped to manage trading emotions like greed, fear, and hope, fostering a more disciplined and successful trading approach.

FAQ

Why Is Risk Management Important?

Risk management is critical when trading cryptocurrency. While exciting, the volatility and uncertainty of the crypto market can also lead to financial stress. Traders may encounter bad actors or market events that spur rash trading decisions, amplifying risk exposure.

Responsible trading means maintaining better control over your trades and overall strategy. Effective risk management helps shield you from market turmoil sparked by unexpected developments. It enables you to trade with greater care and discipline, rather than reacting impulsively.

Why Do You Need Risk Management?

Risk management is critical for traders to avoid major losses that could deplete their capital. This is particularly true in the volatile cryptocurrency market where price changes can be extreme. Without risk management, you have no protection against substantial risks.

Effective risk management enables you to define limits on potential losses. This helps guarantee that one poorly performing trade does not lead to a devastating loss of capital. Risk management gives you the control you need to survive the turbulent swings of the crypto markets.

What Are Risk Management Tools?

Cryptocurrency traders have various software tools and strategies available to help manage the risks inherent in this volatile market. Using these can help limit losses, guide informed decisions, and ultimately achieve your crypto investing goals. Some examples include:

- Position sizing to determine appropriate trade quantities based on risk tolerance.

- Stop-loss orders to automatically sell if a crypto hits a predefined low price, capping losses.

- Take-profit orders to lock in gains at a set high price.

- Diversification across assets to limit exposure to any single cryptocurrency.

- Hedging with offsetting positions to mitigate risks.

- Automated trading bots to execute programmed strategies.

- Portfolio trackers for performance metrics, allocation, and risk analysis.

- Risk assessment software for insights on volatility, liquidity, etc.

- Margin funding to generate interest income instead of direct crypto exposure.

- Hardware wallets for secure offline storage, avoiding exchange hacks.

While helpful for mitigating risks, these tools can't eliminate risk completely. It's essential to research each one thoroughly to understand how to use them effectively as part of a prudent risk management approach.

How to Properly Implement Risk Management?

- Have a Solid Trading Plan: Your trading plan should include your risk tolerance, profit goals, methodologies, and the types of cryptocurrencies you’re interested in trading. It should also specify when to enter and exit trades.

- Only Invest What You Can Afford to Lose: The crypto market is highly volatile, so you should only trade with money you can afford to lose.

- Size Your Positions: Don’t risk all your capital on a single trade. Successful traders often risk a fixed percentage of their capital per trade.

- Limit the Use of Leverage: Leverage can magnify your profits but also your losses. Use it cautiously.

- Always Calculate Your Risk-to-Reward Ratio: This ratio helps you understand the potential risk versus the potential return of a trade. Aim for trades with a high probability of success.

- Use Stop Loss Orders: These orders can limit losses if the market moves against you.