Orbs Analysis: Orbs Project & ORBS Price

Positioned as a modular middleware layer amplifying existing infrastructure, Orbs tackles systemic bottlenecks while enabling developers to focus innovation atop robust, future-proof foundations. Let’s see what else Orbs brings to the table.

This article inaugurates a series exploring innovative blockchain tokens and coins with significant potential. We will conduct in-depth analyses on projects aiming to impact the cryptoverse across domains like Web 3.0, DeFi, NFTs and GameFi.

To kick things off, we will examine Orbs — an open, decentralized public blockchain infrastructure executed by a secure network of permissionless validators using proof-of-stake consensus. Orbs operates as a separate decentralized execution layer between existing L1/L2 solutions and the application layer, enhancing EVM and non-EVM smart contracts without migrating liquidity. This "decentralized backend" unlocks new possibilities.

Here, we will provide a comprehensive overview of Orbs including its ecosystem, tokenomics, price history and future outlook. Without further ado, let’s get started.

What Is Orbs Crypto?

Pic. 1. Orbs.

Orbs is a "Layer-3" public blockchain infrastructure project designed to operate atop existing Layer-1 (L1) and Layer-2 (L2) blockchain solutions. It utilizes a Proof-of-Stake (PoS) consensus mechanism and is run by a network of permissionless validators known as Guardians.

Key Characteristics of Orbs:

- Decentralized Execution Layer: Orbs functions as a separate decentralized execution layer that sits between the foundational blockchain layers (L1/L2) and the application layer. This positioning allows Orbs to enhance the capabilities of existing smart contracts without necessitating the transfer of liquidity to a new chain.

- Enhancement of Smart Contracts: The platform is specifically designed to support and improve the functionality of both Ethereum Virtual Machine (EVM) and non-EVM smart contracts. This makes it suitable for a wide range of applications in Web 3.0, decentralized finance (DeFi), non-fungible tokens (NFTs), and GameFi sectors.

- Decentralized Backend Services: Recognizing the limitations and centralized dependencies of current smart contracts, Orbs provides decentralized backend services that can be executed by its network. This helps in removing centralized points of failure and enhancing the security and reliability of decentralized applications (dApps).

- Support for Complex Operations: As a Layer-3 solution, Orbs is tasked with handling complex logic and scripts that are not feasible on L1 and L2 solutions alone. This capability allows it to offer additional services and functionalities to DeFi applications, furthering their decentralization and capabilities.

- Integration and Protocols: Orbs powers several protocols such as dLIMIT, dTWAP, and Liquidity Hub, which contribute to its utility and effectiveness in the blockchain ecosystem.

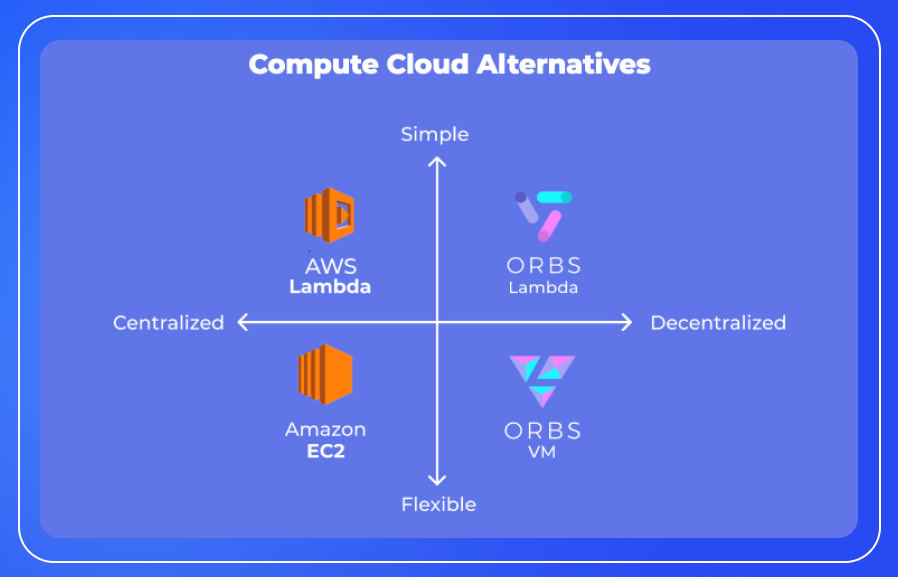

Orbs VM and Orbs Lambda

Orbs blockchain infrastructure has two core components: Orbs VM and Orbs Lambda. These components are designed to offer decentralized alternatives to popular centralized cloud services by Amazon Web Services (AWS), specifically targeting serverless and virtual machine services. Here’s a breakdown of their key features and functionalities.

Orbs Lambda is a decentralized, event-driven, serverless computing solution. It is conceptually similar to AWS Lambda but is decentralized:

- Functionality: Users can write cloud functions in standard JavaScript, using common Node.js libraries like node-fetch. These functions can be triggered by new blocks or on-chain events from L1 or L2 blockchains.

- Execution: Deployed functions are executed across multiple decentralized validator nodes, ensuring robustness and reducing reliance on centralized infrastructures.

Orbs VM is a decentralized virtual machine that operates similarly to a Docker-based virtual machine. Again, it is akin to AWS EC2 but decentralized:

- Flexibility: Users can implement custom services within a Docker container using any programming language, such as Go, C++, Rust, JavaScript, Java, or Python.

- Deployment and Operation: Once deployed, the service runs continuously as an always-on service across multiple independent decentralized validator nodes.

Both Orbs Lambda and Orbs VM enhance the decentralized execution capabilities beyond what the Ethereum Virtual Machine (EVM) initially offered. The EVM, being the first decentralized execution platform that was Turing-complete, faced limitations due to security considerations within its tightly secured sandbox. Both aim to make decentralized computing more accessible to developers by allowing the use of mainstream programming languages and frameworks without needing blockchain-specific knowledge.

Strategic Positioning:

- Market Segmentation: The Orbs network segments the decentralized compute cloud market similarly to how AWS segments its services. Orbs Lambda is for simplicity and serverless needs, while Orbs VM offers greater flexibility for more complex and continuous services.

- Aspiration: Orbs aspires to be a leading decentralized compute cloud platform, providing robust and versatile infrastructure solutions to enhance and decentralize applications across various industries.

Orbs Ecosystem & Tokenomics

Orbs tokenomics is centered around several key mechanisms designed to promote network security, participation, and scalability. Here are its main elements:

- Proof of Stake (PoS) Architecture: Orbs operates on a PoS model, which involves validators (Guardians) who are chosen based on the amount of ORBS tokens staked by themselves and delegated by other token holders.

- Guardian Role: Guardians play a crucial role in maintaining the security and operation of the network. They are responsible for running validator nodes, participating in consensus, and managing reward distribution. Their influence in the network is proportional to the stake delegated to them.

- Staking and Delegation: Token holders can delegate their ORBS tokens to Guardians. This delegated stake increases the security of the network and the influence of the Guardian in network decisions such as consensus and governance.

- Reward Distribution: Rewards are distributed to Guardians and their delegators based on the stake and the duration it is held. A new reward distribution mechanism introduced in Orbs V2.5 automates this process at the protocol level, making it more scalable and gas-efficient.

- Rewards and Fees: The system sets a maximum annual reward of 12% of the total delegated stake, with ⅓ guaranteed to the Guardians (up to 4% annual reward maximum) and the remaining ⅔ to the delegators (up to 8% annual reward maximum). This balance aims to provide attractive returns while maintaining sustainable token inflation.

- Election Committees: The introduction of a two-tier committee system in V2—General and Certified committees—caters to different stakeholder needs and compliance requirements. Guardians are incentivized to qualify for both committees to maximize their rewards and influence.

- Validator Nodes Streamlining: Updates in the V2.5 include enhancements to the operation of network validator nodes by Guardians, focusing on efficiency and cost reduction.

- Hybrid Blockchain Model: Utilizing both Orbs and Ethereum networks, Orbs benefits from the robustness of Ethereum’s Proof-of-Work system while operating its own PoS logic. This dual-layer architecture enhances security and provides a decentralized audit mechanism.

- Governance and Community Involvement: The Orbs network emphasizes community participation in governance. Guardians, as key stakeholders, have a say in network decisions, including reward distribution settings which they can adjust to suit the needs of their delegators.

This tokenomics structure is designed to encourage participation, enhance security, and ensure the scalability of the Orbs network, aligning the interests of various stakeholders through mechanisms that incentivize active and long-term engagement in the network.

Orbs Ecosystem

The Orbs ecosystem is a multifaceted blockchain infrastructure aimed at enhancing the functionality and interoperability of existing blockchain layers. It supports a wide array of tools and protocols designed to improve the utility of decentralized applications, foster community governance, and promote transparency and efficiency across the blockchain space.

Protocols and Services Powered by Orbs:

- dTWAP Protocol: A decentralized protocol for time-weighted average pricing, useful for financial applications requiring fair market price calculations over time.

- dLIMIT Protocol: A decentralized protocol aimed at providing limit order functionalities within the blockchain ecosystem.

- Liquidity Hub: Enhances liquidity management across different protocols and platforms.

- Notification Protocol: Allows decentralized and automated notifications.

- TON Access and TON Vote: Tools for governance and access within the Orbs network.

Community and Governance:

- Governance: Community governance features that allow stakeholders to participate in decision-making through tools like TON Vote.

- Hexa Foundation: Supports community projects and ecosystem development.

Development and Analytics Tools:

- Developers: Resources like documentation, community dashboard, OIP-6 Migrator, and migration contracts to support developers.

- Analytics: Tools like Orbs Universe Analytics and Network Status Page provide insights into network performance and metrics.

Applications and Use Cases:

- DeFi Applications: Orbs supports various decentralized finance (DeFi) applications and platforms like DeFi.org Accelerator Program, KogeFarm, and TonSwap.

- Exchanges: Lists exchanges like ZKE Exchange, ANTirex, and Ultorex that support ORBS tokens.

Supported Chains and Tools:

- Arbitrum: Orbs supports interoperability with other chains like Arbitrum for enhanced scalability and reduced fees.

- Explorers and Oracles: Tools like TONscan for exploring blockchain data and integrating with oracles for real-world data fetching.

Social Impact and NFTs:

- The ecosystem also shows a commitment to social impact projects and supports non-fungible tokens (NFTs), indicating a broad scope of application and community engagement.

Orbs in Numbers

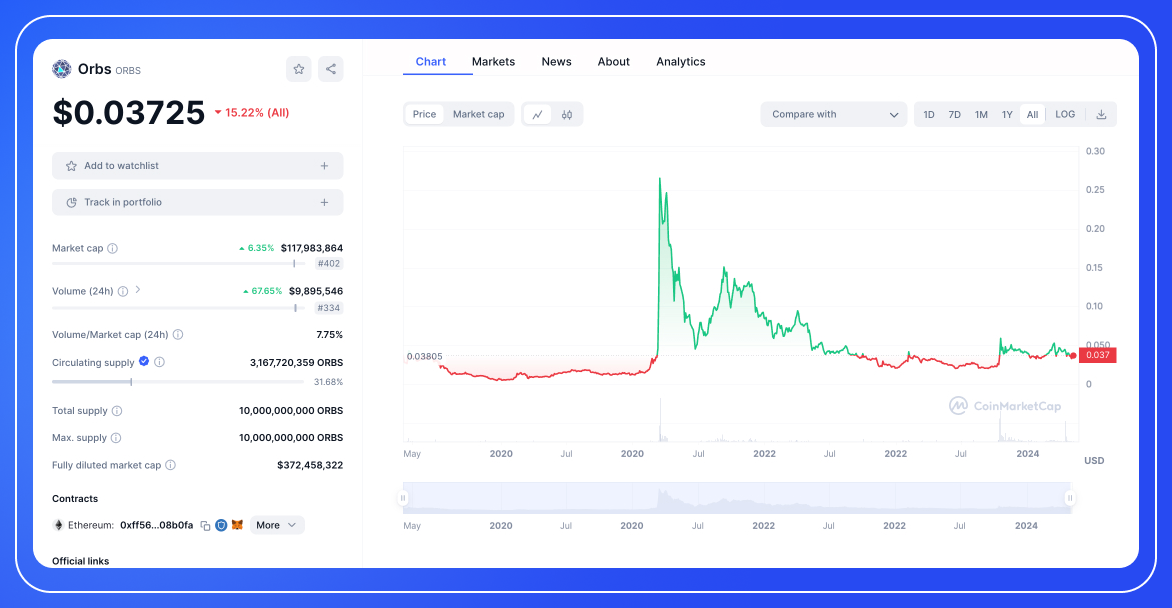

According to the latest CoinMarketCap data, here’s a summary of the key metrics for Orbs (ORBS):

- Price: The current price of ORBS is approximately $0.03725

- Market Cap: The market cap is currently $117,983,864, indicating the total market value of the circulating supply of ORBS.

- 24h Trading Volume: The trading volume over the last 24 hours is around $9.9 million.

- Circulating Supply: There are 3,167,720,359 ORBS currently in circulation.

- Total Supply: The total supply of ORBS is 10,000,000,000.

- Max Supply: The maximum supply of ORBS, which is the total amount of ORBS that will ever exist, is also 10,000,000,000.

- Price Performance Metrics:

- 24h Low/High: ORBS traded as low as $0.03493 and as high as $0.03725 within the past 24 hours.

- All-time High: The all-time high price of ORBS was $0.3626 on March 16, 2021.

- All-time Low: The all-time low price of ORBS was $0.004628 on December 18, 2019.

ORBS Price Analysis

ORBS began trading in the cryptocurrency market around May 2019 with its price initially hovering below $0.01. Since its inception, the price action has experienced significant volatility with a few notable trends.

The first notable movement occurred around April 2021, where ORBS saw a dramatic spike in price, jumping from around $0.05 to a peak of over $0.36 - marking a significant surge within a short period. However, this peak was short-lived as the price declined sharply afterwards, returning to the $0.05–$0.10 range by mid-2021.

Looking at the last year, from the second chart (Pic.), ORBS has shown a gradual increase in price from mid-2023 until around October 2023, where it peaked again at around $0.055. After this peak, the price went through a correction phase, gradually going down and stabilizing around the $0.03—$0.04 range for the next few months. As of the last data point on the chart, ORBS price has slightly declined to around $0.03725, currently down 15.22% from its previous levels and maintaining a market capitalization just shy of $120 million.

In summary, while ORBS has seen significant price swings since inception with short periods of sharp increases, its price action over the past year has generally followed a stabilization pattern with occasional, less drastic peaks and troughs compared to earlier in its trading history.

Price of ORBS Today, Tomorrow, and Beyond

Based on the daily chart, ORBS appears to be in a downtrend as shown by the descending Bollinger Bands (BB) and the price trading below the moving average (MA). However, there has been a slight upward movement recently with the price crossing over the MA, which could indicate a potential reversal or short-term bullish movement. The RSI is currently at 47.73, suggesting that the market is neither overbought nor oversold. The MACD is below the signal line but is starting to curve upwards, indicating weakening bearish momentum.

On the hourly chart, ORBS shows a short-term bullish trend with the price trading above the MA and an upward movement in the Bollinger Bands. The RSI is at 71.39, which is close to the overbought territory, suggesting that there might be a short-term pullback or consolidation. The MACD is above the signal line and is trending upwards, indicating increasing bullish momentum.

Short-term prediction: The price might continue to show bullish behavior in the short term, possibly testing the upper Bollinger Band on the hourly chart. However, traders should be cautious due to the RSI nearing overbought levels, which could lead to a short-term retracement or consolidation.

Long-term prediction: Since the daily chart still exhibits a downtrend, the current bullish movement could be short-lived. The long-term price direction will depend on whether the price can sustain its movement above the MA and if the MACD can cross above the signal line with conviction. If these conditions are met, there could be a bullish reversal; if not, the downtrend may continue. It is important to monitor key resistance and support levels and watch for confirmatory signals before making any long-term predictions.

Trading & Storing ORBS

ORBS tokens are listed on leading platforms like Binance, OKX, KuCoin, Gate.io and Bitget, among many others.

By connecting your accounts to Bitsgap, you can buy, sell and manage ORBS across multiple exchanges in one unified interface. Our all-in-one cryptocurrency management takes the complexity out of tracking holdings and transactions across separate providers.

Bitsgap also enables you to execute advanced trading strategies across your portfolio including automated bots and smart orders. These effective tools maximize profits while minimizing effort and risk.

ORBS tokens can be securely stored in top cryptocurrency wallets including Trust Wallet, MetaMask, Binance Chain Wallet, Backpack and Phantom among others.

These popular options allow you to easily track, receive and send ORBS while maintaining full control of your private keys. Compatibility with both hot and cold storage provides flexibility to manage your holdings based on your security preferences.

Conclusion

In summary, Orbs stakes a unique position as a trailblazing Layer-3 infrastructure project augmenting existing blockchain architectures. This critical middleware unlocks advanced decentralization capabilities for applications leveraging smart contract and blockchain technologies.

By empowering developers through flexible and accessible tools that amplify security and efficiency, Orbs progress aligns with the ethos of autonomy and trust that defines blockchain innovation.

As a pioneering supporter of the smart contract ecosystem, Orbs remains committed to pushing the boundaries of decentralized infrastructure. The platform reduces reliance on centralized systems to allow unencumbered growth across Web 3.0, DeFi, NFT and GameFi verticals.

Backed by a strong technical foundation and community support, Orbs serves as scaffolding for the next generation of decentralized apps by elevating security, scalability and practical functionality.

FAQs

Orbs vs Orb: What’s the Difference?

Orbs and Orb are related to different projects in the crypto space. Orbs operates as a public blockchain infrastructure, serving as an intermediary layer that enhances blockchain network scalability by bridging L1/L2 solutions with the application layer. The Orbs token (ORBS), an ERC20 token, facilitates interactions within the Orbs network. On the other hand, Orbcity is a Web3 city and land Metaverse built on the Polygon network, marking its debut as the first official metaverse land project under the LANDFI initiative. It uniquely combines non-fungible token (NFT) gaming with decentralized finance (DeFi) platforms, providing a dynamic environment for users interested in NFT collection and/or farming