Ondo Coin Review & Analysis

Imagine accessing the stability of US Treasury bills and the flexibility of blockchain, all within a single platform. That's the vision Ondo Finance is bringing to life, offering tokenized real-world assets and innovative DeFi solutions designed for institutional-grade investors.

Ondo Finance is pioneering a bridge between traditional finance and the decentralized world of blockchain. By leveraging cutting-edge technology, Ondo Finance offers institutional-grade financial products, including fixed-yield loans, tokenized US dollar-denominated assets, and a versatile cross-chain bridge. Their innovative approach has garnered attention for its potential to revolutionize how investors access and trade real-world assets like US Treasury bills and money market funds. With partnerships spanning industry giants like Coinbase, BlackRock, and Morgan Stanley, Ondo Finance is rapidly carving its niche in the burgeoning DeFi landscape.

This article delves into a comprehensive review and analysis of Ondo Finance, examining both its fundamental strengths and technical capabilities to help you make a well-informed investment decision.

What Is Ondo Finance?

Ondo Finance is a blockchain-based financial platform that aims to bridge the gap between traditional finance and decentralized finance (DeFi) by offering institutional-grade investment products and services on-chain. They achieve this through a two-pronged approach:

- Tokenized Financial Products:

- Focus on High-Quality Assets: Ondo manages tokenized funds that invest in highly liquid, multi-billion dollar exchange-traded funds (ETFs) composed of traditional assets like U.S. Treasuries and money market funds.

- Flagship Products:

- USDY (US Dollar Yield): A tokenized cash equivalent offering a competitive yield (currently 5.30% APY) generated from the underlying U.S. Treasury holdings. It's designed as an alternative to stablecoins, allowing holders to earn the yield instead of issuers.

- OUSG (US Treasuries): A similar product to USDY but specifically designed for qualified purchasers, offering exposure to short-term U.S. Treasuries with instant minting and redemption features.

- Emphasis on Security and Regulation: Ondo prioritizes security and regulatory compliance by:

- Holding assets with qualified third-party custodians like Morgan Stanley and BlackRock.

- Utilizing daily accounting services from NAV Consulting and undergoing annual audits.

- Implementing robust security measures and ensuring all smart contracts are audited and certified.

- Decentralized Finance Protocol (Flux Protocol): Flux is a decentralized lending protocol designed to handle the transfer restrictions often associated with permissioned tokens, enabling a wider range of traditional assets to be utilized within DeFi.

Key Features of Ondo Finance:

- Institutional-Grade Approach: Ondo brings traditional finance's rigor and standards to the DeFi space, focusing on quality assets, regulated service providers, security audits, and experienced leadership with backgrounds in institutions like Goldman Sachs, Bridgewater, and MakerDAO.

- Focus on Liquidity: Recognizing the importance of liquidity in financial markets, Ondo partners with various players like centralized exchanges (Bybit), OTC desks (Wintermute), and DeFi protocols (Uniswap) to ensure seamless capital flow and provide 24/7 liquidity for their tokenized products.

- Interoperability and Blockchain Agnosticism: Ondo prioritizes interoperability by supporting multiple Layer 1 and Layer 2 blockchains, including Ethereum, Solana, Mantle, and Polygon. They utilize their Ondo Bridge, powered by Axelar technology, to facilitate seamless token bridging across these chains.

👉 Overall, Ondo Finance aims to bridge the gap between traditional and decentralized finance by offering a secure, regulated, and transparent platform for investors to access institutional-grade assets and services on-chain. They achieve this through their tokenized financial products, the innovative Flux lending protocol, and a strong emphasis on building a robust and trustworthy ecosystem.

What Is Ondo Coin?

The Ondo token is at the heart of the Ondo ecosystem, acting as the governance token for both the Ondo DAO and the Flux Finance protocol. Here's a breakdown of its significance:

Governance Powerhouse:

- Ondo DAO: Token holders actively shape the future of the Ondo ecosystem by voting on proposals related to its development and operation.

- Flux Finance: Ondo token holders directly influence the evolution of Flux Finance, Ondo's decentralized lending protocol, by voting on updates and changes.

- Voting Power: Your voting influence is directly proportional to the number of Ondo tokens you hold. You can also delegate your voting power to other wallets.

Token Distribution and Market Performance:

- Early Community Distribution: The Ondo Foundation, a non-profit dedicated to advancing real-world asset tokenization (RWA), initially distributed Ondo tokens to early community members in 2022.

- Successful Public Launch: The token's public debut took place in January 2024 at a price of $0.11 USD. It has since experienced significant appreciation, reaching a high of $1.48 USD in early June 2024.

- Market Capitalization and Token Supply: With a current market capitalization of around $1.3 billion USD, the Ondo token has garnered considerable market interest. While the total supply is capped at 10 billion tokens, a strategic lock-up mechanism ensures a controlled release schedule. Only 14% of the total supply was made available at launch, with the remaining tokens set to unlock in phases. This controlled approach has led to speculation about potential price fluctuations, particularly as the next token unlock approaches in early 2025.

👉 In summary, the Ondo token empowers its holders to participate in the governance of a rapidly growing ecosystem focused on bridging traditional finance with the innovative potential of blockchain technology.

Ondo Coin Price Prediction: Technical Analysis

Let’s take a look at Ondo’s price history and available tokenomics data for a brief analysis before we dive into a detailed price prediction both short and long term.

Price Action:

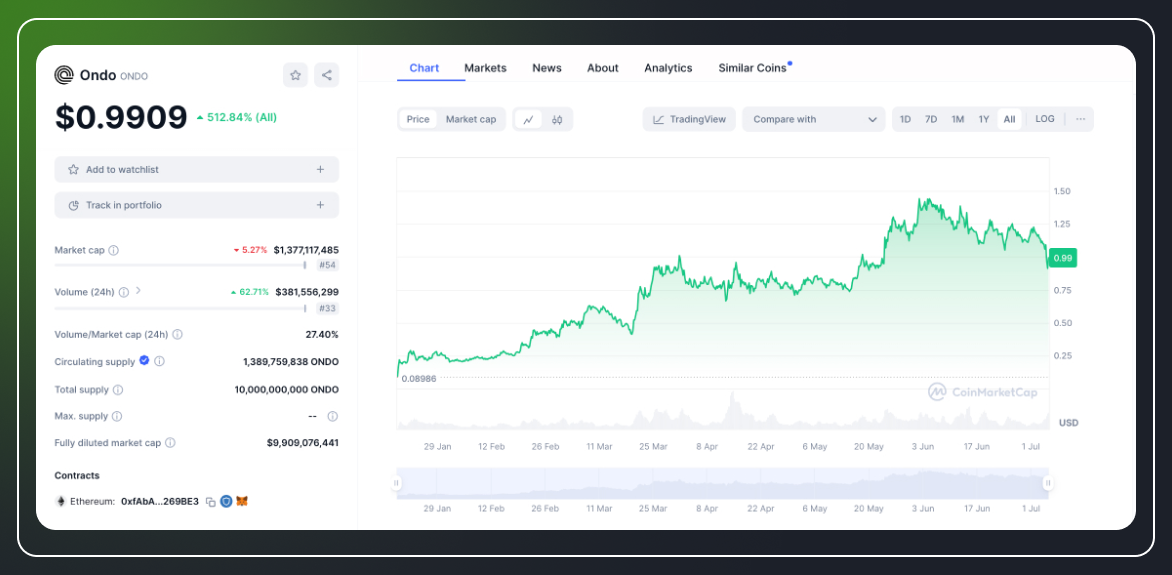

- Significant Growth: ONDO has experienced remarkable growth since its inception, boasting a 512.84% increase overall.

- Early 2024 Surge: The price chart reveals a significant upward trend starting in late January 2024, peaking around mid-March. This suggests a potential market event or positive news driving the price upwards.

- Volatility: Despite the overall upward trajectory, ONDO demonstrates price volatility. The chart shows periods of both sharp increases and corrections.

- Recent Performance: As of the image's snapshot, ONDO is priced at $0.9909. The green candle indicates a positive price movement within the captured timeframe.

Tokenomics:

- Circulating Supply: 1,389,759,838 ONDO

- Total Supply: 10,000,000,000 ONDO

- Market Cap: $1,377,117,485

- Fully Diluted Market Cap: $9,909,076,441

- 24h Trading Volume: $381,556,299

- Volume/Market Cap Ratio: 27.40%

Interpretation:

- High Volume: The high 24-hour trading volume suggests strong market activity and interest in ONDO.

- Potential for Growth: The circulating supply represents a relatively small percentage of the total supply. This implies a potential for future price appreciation if demand continues to outpace the token release.

- Market Cap Ranking: With a market cap ranking of #54, ONDO holds a respectable position within the broader cryptocurrency market.

- Volatility Consideration: While the historical price action and tokenomics suggest potential, investors should be aware of the inherent volatility within the cryptocurrency market.

Ondo Coin Prediction Short-Term and Long-Term

Now, let’s take a closer look at a couple of charts and analyze Ondo’s recent price movements in more detail.

Ondo Coin Price Short-Term

Let’s take a look at two charts first: 5 minutes and 30 minutes.

On the 5-min chart, the price is currently oscillating around the middle band of the Bollinger Bands, which is the 20-period moving average. It has recently touched the lower band, indicating potential support around the 0.98 level. The bands themselves are relatively narrow, suggesting that volatility has been low in the recent past.

In terms of the moving average, the price is hovering around the 9-period moving average, which suggests indecision in the market.

The Stochastic RSI is around 25, near the oversold territory. This could indicate a possible upward movement if the indicator reverses.

For the MACD, the MACD line is below the signal line, and the histogram is showing negative momentum. However, this negative momentum is starting to reduce, suggesting that bearish momentum might be weakening.

On the 30-min chart, the price recently touched the lower Bollinger Band and has started to move upward, indicating potential short-term support around the 0.96 level. The bands are expanding, which suggests increased volatility. The price is currently slightly below the 9-period moving average but is showing signs of recovery.

The Stochastic RSI is in the overbought territory, around 82, suggesting the price might face some resistance and could potentially reverse downward or enter a consolidation phase. Meanwhile, the MACD line is crossing above the signal line, and the histogram is turning positive. This crossover is a bullish signal, indicating potential upward momentum.

Based on the above analysis, here are both bullish and bearish short-term predictions:

- Bullish Signs: The 30-minute chart shows bullish signals with the MACD crossing above the signal line and the price moving up from the lower Bollinger Band. However, the Stochastic RSI being in the overbought territory suggests caution.

- Bearish Signs: The 5-minute chart shows the MACD is still below the signal line, indicating that bearish momentum might not be completely over. The Stochastic RSI is in the oversold territory, which could signal a potential upward move soon.

Ondo Coin Prediction Long-Term

On a 12-hour chart, the price has recently touched the lower Bollinger Band, indicating potential short-term support around the 0.96 level. The bands are expanding, suggesting increased volatility. Currently, the price is situated below the 9-period moving average, which signals a bearish trend in the shorter term.

The Stochastic RSI is deep in the oversold territory, around 1.38, suggesting that there might be potential for upward movement if the indicator starts to reverse. Meanwhile, the MACD line is below the signal line, and the histogram is showing increasing negative momentum, indicating continued downward pressure.

On the daily chart, the price has also touched the lower Bollinger Band on the daily chart, suggesting potential support around the 1.03 level. The bands are widening, which indicates increased volatility. Currently, the price is below the 9-period moving average, confirming a bearish trend in the medium term.

The Stochastic RSI is in the oversold territory at around 26.06, suggesting a possible reversal or upward movement if the indicator starts to rise. Meanwhile, the MACD line is below the signal line, and the histogram is showing negative momentum, reflecting bearish sentiment.

Given the indicators and patterns observed in both the 12-hour and daily charts, here’s a long-term prediction for ONDO/USDT:

Bearish Scenario:

- The price is currently below the 9-period moving average on both the 12-hour and daily charts, confirming a bearish trend.

- The MACD on both charts indicates increasing negative momentum, suggesting that the bearish trend might continue in the short to medium term.

- Increased volatility, as indicated by the widening Bollinger Bands, could lead to further downward movement before finding a stable support level.

Bullish Scenario:

- The Stochastic RSI on both charts is in the oversold territory, suggesting that the selling pressure might be overextended. This can lead to a potential reversal or upward movement.

- If the price finds strong support around the current levels (0.96 on the 12-hour chart and 1.03 on the daily chart), we might see a consolidation phase followed by a potential upward trend.

Ondo Coin Price Prediction 2025

Looking ahead to 2025, various sources offer a wide range of price predictions for ONDO:

- Changelly.com: Expects ONDO to trade between $1.38 and $2.37, with an average price of $1.76.

- Bitscreener.com: Forecasts a narrower range of $4.14 to $4.51.

- Ambcrypto.com: Projects ONDO's price to fluctuate between $1.47 and $2.20.

- Coincodex.com: Provides the widest range, predicting ONDO could trade anywhere from $0.95 to $4.52.

Ondo Coin Price Prediction 2030

Here is another set of predictions for ONDO in 2030:

- Coindcx.com: Forecasts a potential peak of $1100 in the first half of 2030.

- Changelly.com: Predicts a trading range of $14.31 to $17.08, averaging around $14.72.

- Bitscreener.com: Anticipates a range of $9.84 to $16.80.

- Ambcrypto.com: Projects a significant surge, placing ONDO around $7.64.

Where to Buy Ondo Coin

Ready to invest in Ondo? You can find it on various popular cryptocurrency exchanges like Coinbase, Uniswap, Bybit, Kraken, and Gate.io.

Want to streamline your trading experience? Consider connecting your existing exchange accounts to Bitsgap. With Bitsgap, you can:

- Trade seamlessly: Access over 15 exchanges from a single, user-friendly interface. No more juggling between platforms!

- Discover the best opportunities: Easily compare prices and seize the most favorable trading opportunities across multiple exchanges.

- Unlock advanced tools: Leverage Bitsgap's smart trading terminal, complete with smart orders and automation features not typically found on standard exchanges.

Ready to experience the Bitsgap difference? Sign up now and enjoy a free trial for the first seven days!

Conclusion: Is Ondo Finance a Good Investment?

Ondo Finance presents a compelling opportunity at the crossroads of traditional finance and decentralized innovation. Their emphasis on institutional-grade products, particularly tokenized real-world assets, caters to the growing need for bridging these two realms.

Several factors contribute to Ondo Finance's potential attractiveness. Their strong partnerships with industry giants like Coinbase, BlackRock, and Morgan Stanley demonstrate significant industry confidence and adoption. The innovative products they offer, such as tokenized US Treasury bills and money market funds, provide investors with regulated asset exposure combined with the flexibility of blockchain technology. Additionally, the team, led by former Goldman Sachs professional Nathan Allman, brings deep financial expertise. Their expanding ecosystem across multiple blockchains and a high Total Value Locked (TVL) indicate strong growth and adoption.

However, there are also considerations to keep in mind. The regulatory landscape surrounding tokenized assets and DeFi is still evolving, which could impact Ondo Finance's future. Cryptocurrency markets are inherently volatile, and ONDO's price may be influenced by broader market sentiment. Moreover, understanding Ondo Finance's products and the complexities of DeFi could pose a barrier to entry for some investors.

Overall, Ondo Finance shows strong potential for investors seeking exposure to the burgeoning world of tokenized real-world assets. Nonetheless, due diligence, careful research, and an understanding of the associated risks are crucial before making any investment decisions. Assessing your own risk tolerance, investment goals, and comfort level with the complexities of DeFi is essential when considering Ondo Finance as part of your portfolio.

FAQs

Where Do I Find Ondo Coin News?

To stay updated on Ondo Coin (ONDO) news, you can rely on several reliable sources.

For official updates, you can check the Ondo Finance website, specifically their news section or blog for announcements and insights. Additionally, following their official Twitter account will provide real-time updates, announcements, and community engagement. Several cryptocurrency news aggregators also offer dedicated sections for ONDO. CoinMarketCap and CoinGecko both provide news feeds specifically for ONDO, aggregating articles from various sources. Cryptocurrency media outlets are another valuable resource. The Block provides in-depth coverage of the cryptocurrency and blockchain industry, including news and analysis related to DeFi protocols like Ondo Finance. The Defiant focuses on decentralized finance (DeFi) and frequently covers projects such as Ondo Finance. Cointelegraph, a well-established cryptocurrency news outlet, covers a wide range of topics, including DeFi and tokenized assets. Social media platforms can also be useful for staying informed.