How AI Can Help Crypto Traders Improve Trading Experience

Are you ready to transform your crypto trading game with the power of Artificial Intelligence? Dive in to discover how AI can turn the tables in your favor, offering a blend of lightning-fast efficiency, round-the-clock market vigilance, and emotion-free trading.

Imagine a world where your crypto trades are executed with lightning speed, precision, and without emotional bias. Welcome to the world of AI-enhanced crypto trading!

With increasing acceptance and a myriad of use cases, cryptocurrencies are drawing more and more individuals and institutions into their vibrant, dynamic ecosystem. The dream? Profit, of course — and in the crypto world, the rewards can be breathtakingly high!

Long-term crypto enthusiasts might not keep a constant eye on market ups and downs, but short-term traders are in the thick of it, actively leveraging the wild volatility of the cryptocurrency market to their advantage. Yet, despite the array of opportunities, the success rate of manual trading can often be underwhelming.

Enter the new era of cryptocurrency trading, where human limitations like the need for rest and challenges in multitasking are no longer obstacles. With the advent of artificial intelligence (AI) in crypto trading, the potential to harness market situations and opportunities has never been more efficient.

Are you ready to explore the world of AI in crypto trading?

Let's dive in, examine an array of bots, including those powered by Bitsgap, and weigh up the pros and cons of navigating the crypto seas with automated trading bots.

Artificial Intelligence in Cryptocurrency Trading

Artificial intelligence in the trading context refers to fully developed and rigorously tested automated trading robots. These savvy pieces of code can analyze, predict market price movements, and autonomously trade on behalf of the user. AI-powered crypto trading solutions are rapidly emerging as one of the most effective, uncomplicated, secure, and cost-efficient ways to trade not just fiat currencies or stocks, but also digital assets. They offer a level of precision and speed in trading that was simply unimaginable before. AI trading automations are not just tools executing trades on behalf of human investors, but intelligent systems that can read market data and adapt trading strategies in real-time, responding to the slightest price fluctuations.

While cryptocurrency trading is a realm filled with opportunities, it's also fraught with challenges, making AI trading a crucial player in this field. Complex issues such as price and trend prediction, volatility forecasting, portfolio construction, and fraud detection can be overwhelming for humans to analyze and learn from in real-time. Here's where AI trading techniques come to the rescue.

AI trading bots perform a series of actions to deliver the optimal results users need for profitable outcomes. They gather historical market data, compute indicators, simulate order placements, and implement strategies in line with the current market conditions.

Though they might perform similar functions, AI cryptocurrency trading bots are built with unique features. Some are designed to maximize profit through market and price volatility. Others leverage features available on crypto exchanges to churn out profits, while certain bots specialize in portfolio building and optimization.

Benefits of Automated AI Trading

Excellently engineered AI crypto trading bots can supercharge profits while mitigating risks such as unexpected price drops or trend reversals. But that's not all! They offer a treasure trove of other benefits, including:

- Lower entry barrier

Diving into the cryptocurrency ecosystem and profiting from trading can be a daunting and time-consuming endeavor. New and aspiring traders need to undertake extensive research to grasp the intricacies of the industry. Even after diligent planning and analysis, long-term success isn't guaranteed. A trading bot might not promise success, but it certainly boosts the odds!

Crypto trading bots serve as helpful guides for novice traders, enabling them to mirror the strategies of successful traders in the industry. By automating crypto trading and leveraging some intuitive features, users can smoothly navigate their way into the sector. AI trading bots streamline the trading process and minimize the risk associated with crypto trading.

- Time-saving factor

Trading cryptocurrency demands a significant investment of time. Keeping pace with the latest industry developments while making savvy trading decisions requires constant vigilance of market trends and insights. Seasoned traders understand this, leading to the surge in AI bot adoption.

In this era of intuitive trading, traders can minimize the time spent glued to market fluctuations. An AI crypto bot automates the trading process and seizes opportunities as they arise, saving precious time.

- Round-the-clock trading

The crypto ecosystem hums with activity 24/7. But traders need to rest and tend to other life necessities. AI bots, on the other hand, never sleep, never rest, and are never distracted. Once activated, they work tirelessly in the background, allowing traders to enjoy life without fretting over missed opportunities.

- Increased efficiency and productivity

Human capacity to make calculated decisions and maintain focus is limited. Any seasoned crypto trader will agree that trading cryptocurrency can be time-consuming and draining.

It requires a wealth of experience, knowledge, and quick thinking to make accurate calculations and trade at opportune moments. But what if you could delegate this task? With a crypto trading bot, you can reduce the time spent staring at your computer screen and let it handle the heavy lifting.

Bots are highly efficient, capable of performing lightning-fast mathematical calculations that can make or break a trade. It's no wonder that bots account for a significant majority of all transactions.

Pros and Cons of Using AI Trading Bots

Trading bots have become the ultimate tool for executing automated trading. With the current advanced bots being highly customizable, they can process a wealth of data, including trading volume, price fluctuations over certain time frames, and a currency's trading history. These bots never take their eyes off the price movements of selected crypto assets, reacting according to pre-set rules.

AI crypto trading bots bring several exciting advantages to the table for their users:

- Emotion-free trading: As humans, investors can sometimes let emotions cloud their judgment. One of the standout benefits of crypto trading bots is their total lack of emotional involvement — a machine-led process that steers clear of costly emotional decisions.

- High trading efficiency: Crypto trading bots have taken trading efficiency to new heights, thanks to their multitasking prowess. They provide investors with a wealth of opportunities and data analyses, essential for making informed decisions at critical junctures.

- Simplified investing: The cryptocurrency market can be a complex maze for new investors and traders. Understanding intricate charts, analyzing data and price action, and grasping other key facets can be quite challenging. Crypto trading bots, through their automation capabilities, can transform a complex investment process into a straightforward one, marking one of the most significant benefits of using these bots.

However, it's not all sunshine and rainbows with trading bots, and they do have certain drawbacks that traders need to be aware of to fully leverage AI trading bots.

- Unexpected decisions: Sure, crypto trading bots operate autonomously round the clock. But their ability to make unforeseen decisions that can result in minor gains or losses is a potential pitfall. A bot's reliability is only as good as the trading strategies it's programmed with, and while they can lead to handsome returns, they can also be flawed and cause market losses.

- Time-consuming process: While automation can save considerable time, the process of developing or setting up crypto trading bots can be quite lengthy, especially when learning to handle the tools efficiently and without errors. Traders need to create the bots and backtest them to achieve optimal output, which can be time-consuming.

- Relatively expensive: The cost of accessing top-tier AI trading bots can be a significant deterrent. Although prices are dropping due to increased competition and the growing availability of open-source software, the price has been a prohibitive factor for many years, with top-end systems costing upwards of $10,000. Luckily, Bitsgap offers a wide selection of trading bots at a mere fraction of the price. Many exchanges also provide their own native trading bots and bot marketplaces. Plus, you can even craft your own bot, eliminating the need to purchase any third-party software.

A swift internet search will unveil a treasure trove of cryptocurrency trading bot options. But, how do you make the perfect choice? Well, don’t fret, we've compiled a handful of resources for you to dive in whenever you're ready to quench your thirst for knowledge and find answers to all those pressing questions:

- How to Choose the Best Automated Trading Software

- How Does a Cryptocurrency Trading Bot Work?

- Is It Safe to Use a Trading Bot for Cryptocurrency?

Important Things to Know When Choosing a Crypto Trading Bot

When choosing an automated trading bot for cryptocurrency trading, you get to weigh in on several factors, including cost, complexity, and user-friendliness. The ideal trading bot is like a well-oiled machine — it seamlessly integrates with multiple crypto exchanges, opening up a world of profit opportunities and leveraging AI machine learning algorithms for next-level automation capabilities.

First up, let's talk about intuitiveness. When you're sizing up an automated trading bot, you want to know just how approachable it is. Whether you're deploying a ready-made bot or coding your own, navigating the platform should be a breeze. And for those coding whizzes out there, even you'll appreciate a straightforward, user-friendly configuration wizard and a welcoming dashboard that gives you an at-a-glance view of all your trading activities.

For those new to the crypto trading scene, imagine having a crypto trading bot that does all the heavy lifting. You can sit back, relax, and watch a fully passive income stream roll in. Or, you might prefer a bot that's all about saving you time, providing the tools needed to automate your existing crypto market strategies.

In this context, don't shy away from asking the big questions:

- How reliable is the AI software company? Are there any positive/negative reviews about it online?

- What types of bot the company offers? What strategies do these bots employ?

- What features do the bots offer?

- Can bots tap into a comprehensive set of technical analysis tools, like the ever-reliable Bollinger Bands, the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD)?

- Can you set stop losses, take profits, enable trailing features?

Thirdly, when on the hunt for your automated trading software, look out for the ones that have features allowing for backtesting of your crypto strategies. Better yet, find ones that let you piggyback on the top-performing strategies of other traders. And let's not forget to consider whether the price tag is competitive and whether there are any sneaky trading fees.

Finally, let's talk about accessibility. It's 2023, and you should be able to access your trading account anytime, anywhere! So, consider whether the bot is cloud-based and if it supports all device types. Your crypto trading journey should be as convenient and exciting as possible!

Efficient Crypto Trading Bot Strategies to Consider

Before diving in, you might want to enhance your knowledge about trading strategies. Here's how to do it:

- Start with the suggestions provided below and gradually build your knowledge from there.

- Scroll through trading forums and channels to glean wisdom from fellow traders.

- Explore strategies on exchanges that other traders offer for sale — you can either copy these or buy them to test their effectiveness. See what works best for you!

Once you've got the basics down, everything else will fall into place more effortlessly. Many of these strategies are interconnected and echo each other in their core concepts.

Without further ado, let's dive into the most commonly used strategies:

- Crypto trading arbitrage

This approach lets users gain from the intense volatility of the digital currency markets, all while reaping the benefits of lower-risk arbitrage trading. Given that decentralized digital currency markets are relatively fresh players in the online financial sphere, considerable price inefficiencies still linger across various crypto exchanges, despite the gap gradually closing.

A crypto bot arbitrage strategy curtails exposure by enabling the trader to capitalize on considerable price disparities. This is achieved by buying a cryptocurrency at the lowest possible price on one exchange and promptly selling it at a higher price on another exchange, thus profiting from the spread.

This is where an intra-exchange cryptocurrency arbitrage bot comes into its own. It can execute this process far more swiftly and efficiently than a human, and with a much broader scope. Monitoring several currencies across multiple exchanges and reacting to market opportunities before prices shift would challenge even the most seasoned investor. This is the domain where AI bots truly excel.

- Scalping

One of the standout benefits of an automated system is its unmatched speed. It operates at a velocity that's beyond human capabilities. High-frequency trading, or scalping, leverages this capability of an automated system to execute potentially hundreds of thousands of trades in mere microseconds.

However, scalping has its share of critics. The primary objection is that it gives an undue advantage to large-scale traders who can make enormous block trades using algorithms. While this form of trading infuses liquidity into the market, many view it as a downside since this liquidity evaporates within seconds — too fleeting for non-sclaper to tap into.

On the bright side, scalping helps eliminate small bid-ask spreads. By increasing this gap, scalpers can often game the system and rake in larger profits.

- Trend-focused

This strategy is arguably one of the simplest in trading, as it entails tracking market trends. A bot mimics the actions of the majority. If the price escalates, the trading bot responds by initiating a long position, buying with the expectation that the asset's value will continue to rise.

When the market hits a slump, the algorithm shorts an asset, banking on the price to plummet. In essence, a bot offloads an asset (when prices are high) with the intention to repurchase it later at a reduced price. The difference translates into profit. Bots execute this strategy remarkably well, leveraging vast amounts of historical data to assess the market and predict with precision whether the trend will recur or reverse.

- Dollar-cost-averaging strategy

In this approach, an investor consistently purchases smaller quantities of an asset over a set timeframe, regardless of its price. It can be a savvy strategy to acquire crypto without the notorious challenge of market timing or the hazard of unknowingly investing all your funds at a peak.

The secret lies in selecting an affordable amount and investing consistently. This approach can potentially "average" out the cost of purchases over time, thereby diminishing the overall impact of an abrupt price drop on any individual purchase. If prices do take a tumble, DCA investors can persist in buying as planned, with the potential to reap returns as prices bounce back.

- GRID trading strategy

GRID trading is a methodical trading strategy where a trader positions incremental orders both below and above a predetermined price level. This algorithmic trading technique aims to capitalize on the roller-coaster ride of the crypto market's volatility.

In this setup, the GRID bots autonomously place orders within pre-set price boundaries. This forms a grid of trading orders that span a spectrum of possible market shifts. Essentially, traders define the ranges on the premise that the asset's price will oscillate within those bounds, and then harvest profits from the price's ebb and flow.

Bitsgap: An Excellent Choice for AI Trading

Bitsgap is a phenomenal, all-encompassing trading platform that gives users the power to merge their cryptocurrency exchange accounts and manage trades from one dynamic interface. Seamlessly integrated with over 17 of the world's top cryptocurrency exchanges — including heavy-hitters like Binance, Kraken, Bitfinex, Poloniex, and Coinbase Advanced Trade — Bitsgap delivers consistent service coverage across the board.

👉 Bitsgap is a smorgasbord of services, offering everything from smart trading and automated bots to portfolio management, paper trading, and backtesting.

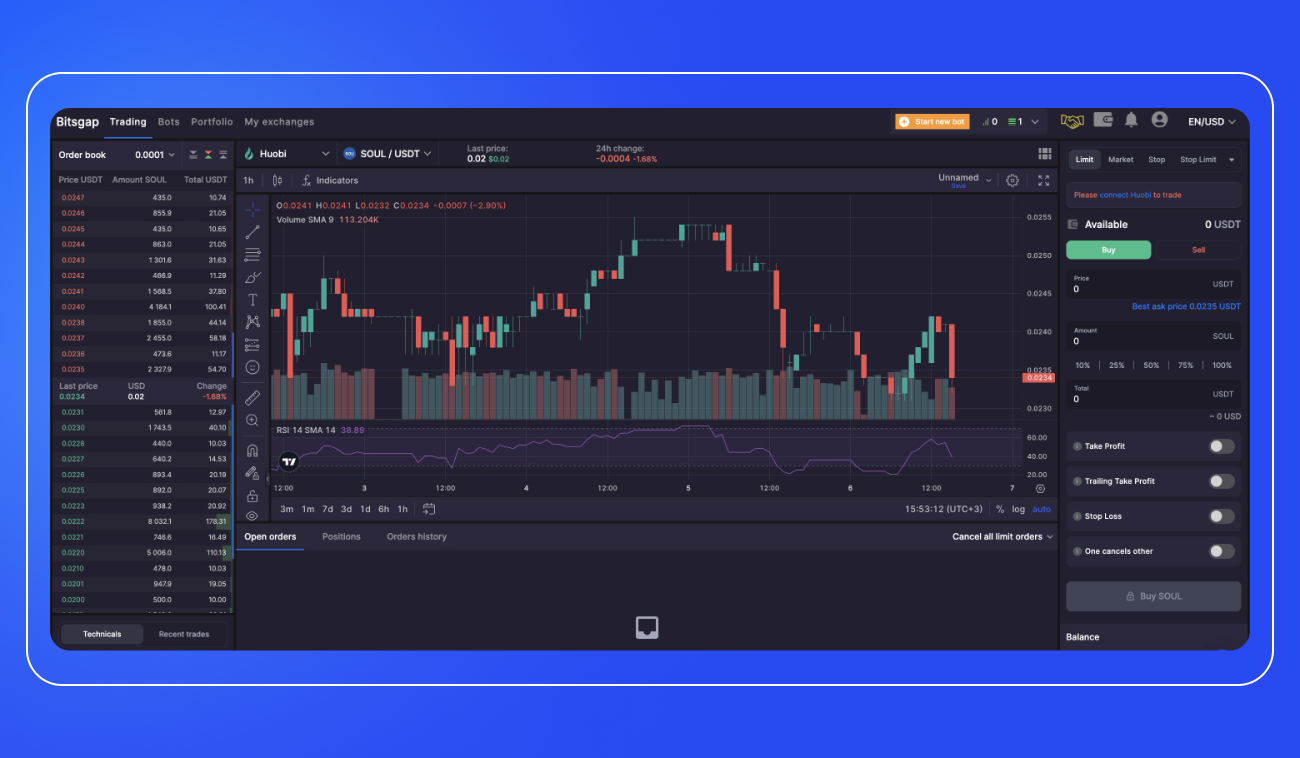

The Bitsgap platform boasts a user-friendly trading interface that simplifies order placement, portfolio handling, and performance monitoring. It's brimming with an array of features and tools designed for traders of all experience levels. With an intuitive and optimized interface that includes all the necessary trading instruments, Bitsgap presents the most comprehensive trading data at your fingertips.

But that's not all! Bitsgap also provides exclusive, proprietary AI trading bots that have been rigorously backtested to ensure top-notch efficiency. You can pick, tailor, and unleash these bots to generate a consistent stream of profits.

Now, let’s explore the bots on offer.

Bitsgap AI Crypto Trading Bots

Users can select from the available trading bots on Bitsgap depending on their trading objectives.

👉To fire up any bot, just click on the [Start new bot] button sitting pretty at the top of the interface, toggle between [Spot] and [Futures] to choose the market, then pick the bot that sets your heart racing!

Available options are:

GRID Bot

Bitsgap's GRID operates with deferred limit buy and sell orders set at specific price intervals. The price range you set is segmented into multiple levels, forming a grid teeming with orders. All grids are interchangeable; for every executed buy order, the bot generates a new sell order at a higher price, and vice versa.

The GRID strategy works very well in the sideways market when the coin's price fluctuates, selling when the price peaks and buying when it dips. Instead of investing hours dissecting charts to capitalize on market movements, GRID bots handle the job of buying low and selling high for you. They churn out steady profits by simply working off the grid parameters that you set for them.

BTD Bot

Buying the dip simply means snapping up a coin after its value has taken a hit. As the price plummets, it sets the stage for traders to buy more of that coin, boosting their future rewards when the price rebounds. Accumulating more of the base currency during these price dips is seen as one of the most effective strategies for trading in a downtrend. If you're looking to grow the amount of base currency for a chosen pair when the price is on a downward spiral, the Buy the Dip bot is your go-to tool.

DCA Bot

The DCA bot breaks down your investment into periodic buy or sell trades, aiming for an optimal average entry price. By doing this, it softens the blow of market volatility and price changes on your overall position.

Turn to the DCA Bot when you're looking to revamp your trading with robust technical signals and fail-safe risk management tools, offering you a chance to fully automate your daily trading routine.

Opting for Long? Watch as the bot embarks on a thrilling mission to stack up profits in a quote currency. Following the initial purchase of the base currency, the bot cleverly arranges the DCA (buy) orders and positions the Take Profit (sell) order above. As the price scales new heights, your bot swiftly sells all the purchased base currency at the Take Profit level, raking in a handsome profit. The end of one cycle isn't a finish line — it's a launching pad! The bot eagerly initiates a new cycle with the initial investment amount.

Alternatively, in a Short scenario, the bot becomes a profit-accumulating machine in the base currency. After the initial sale of the base currency, it meticulously places the DCA (sell) orders and the Take Profit (buy) order below. If the price takes an upward turn, the bot isn't phased—it sells more base currency and secures the quote currency at the DCA levels. When the price takes a dip, your bot seizes the opportunity to buy back the base currency with the Take Profit. The end of a cycle? No pause here—the bot fires up a new cycle with the initial base currency investment.

DCA Futures Bot

Bitsgap’s DCA Futures Bot is a powerhouse tool that packs the punch of the DCA strategy for futures trading, setting the stage for you to potentially reap substantial returns in a relatively brief timeframe, all thanks to the leverage.

Now, let's see what it brings to the table:

- Position averaging: The bot masterfully buys or sells an asset across various price levels, tweaking its entry price and buffering the blow of market swings. Should the price veer off in an unfavorable direction, averaging swoops in to soften the losses, recalibrate the average position price, and snatch profits more effectively when the price makes a U-turn.

- Cycle operation: Unlike the COMBO Bot, the DCA Futures Bot operates in cycles. Each cycle springs into action with the bot opening a position, followed by position averaging if the price strays from the initial position. The cycle wraps up with the bot sealing the position using a Take Profit or a Stop Loss order. Once done, the bot reopens positions and launches into a new cycle. This cyclical approach gifts you greater flexibility when mapping out your trading strategy.

COMBO Bot

The Bitsgap COMBO bot harnesses the power of GRID and DCA algorithms to trade futures contracts like a pro. It fully embraces GRID technology, orchestrating trades with every market twist and turn. Meanwhile, the DCA stands as the ultimate tool, harnessing the dollar-cost-averaging effect to nail the perfect entry price.

Designed to thrive in both soaring and plummeting markets, the COMBO bot's a high-roller, capable of generating returns that skyrocket up to a staggering 1,000%, thanks to leverage.

👉 But remember, with great potential comes great risk! The chance for high returns brings along the possibility of significant losses, given the volatility and unpredictable swings of the cryptocurrency market.

Bottom Line

When discussing the pros and cons of crypto trading bots, one must acknowledge the vast array of options available in today's market, catering to every kind of trader. There's a spectrum of choices, from simple software designed to execute basic strategies to advanced AI-based systems capable of processing a wealth of intricate data and simultaneously conducting multiple trades across various markets.

The choice of bot will influence the cost, which can range from free, open-source software to professional-grade systems costing thousands of dollars. There's no denying that trading bots can come with a hefty price tag, and their efficacy is essentially tied to the market strategies they're programmed with. However, when utilised intelligently and with human supervision, they can become an invaluable tool for swiftly and efficiently capitalising on market opportunities to optimise your profits.

Lucky for you, Bitsgap offers a diverse range of bots, each tailored for various market conditions and all available at a fraction of the cost. This means you can dive headfirst into the exciting world of crypto markets, armed with your ultimate crypto ally. Add to that the ability to backtest and experiment with different strategies in the paper trading mode with no risk to your capital, and you're set up for the ultimate winning streak!

FAQs

What Crypto Trading AI Tools Can You Recommend?

There's a range of AI tools for cryptocurrency trading that have earned a solid reputation and are well-regarded in the community: Bitsgap, 3Commas, Cryptohopper, CryptoTrader, Shrimpy, and TradeSanta are all excellent contenders. However, it's crucial to remember that diving into these tools should always be accompanied by thorough research and a clear understanding of the potential advantages and risks involved.

What Are Some of the AI Crypto Trading Benefits?

Artificial Intelligence (AI) isn't just influencing the future; it's revolutionizing the present, especially in the realm of cryptocurrency trading. These are its standout benefits:

- Lightning-fast efficiency: Bots are built to sift through mountains of data and spring into action, executing trades in the blink of an eye.

- Non-stop market monitoring: Cryptocurrency markets never sleep, and neither do AI trading bots!

- Emotion-free trading: AI trading bots aren't swayed by the emotional rollercoaster of the trading world. They stick to the script—predefined algorithms—and steer clear of emotional decision-making.

- Sophisticated data analysis: AI algorithms are pros at dissecting complex market data and sniffing out patterns that could easily elude human traders.

- Robust risk management: AI trading bots can be programmed with risk management rules, including stop-loss and take-profit parameters. This integrated safeguard can help shield your investment and pump up your profit potential.

- Backtesting: AI opens the door to backtesting. This means you can put your trading strategies through their paces using historical data, giving you a sneak peek into how they might have performed.

What AI Crypto Trading Platforms Are There?

A number of AI crypto trading platforms have earned their stripes in popularity and widespread use. Some leading lights in this arena include Bitsgap, 3Commas, Cryptohopper, TradeSanta, Shrimpy, HaasOnline, and AlgoTrader. But that's not all! Many exchanges are now stepping up their game by rolling out their own proprietary automated trading tools and copy trading features. These tools can be a real game-changer, catapulting your trading experience to exciting new AI-powered heights!