Crypto Trading Bots: 20-day profit challenge

Bitsgap challenged 3Commas and Bituniverse to find which platform can bring the biggest profit during the 20-day trading bot challenge.

Discover what makes the Bitsgap automated Grid Trading Robot different compared from trading bots like 3Commas and Bituniverse. Which bot will bring the most profit during the 20-day trading challenge?

Introduction

We decided to stress test Bitsgap's bot and compare it with other platform that offer automated trading bots on the cryptocurrency market. We did not know what the outcome is gonna be. The aim was to prove which platform has the best tools for risk management and profit maximization. Neither did we predict in which direction the price of Bitcoin is gonna move.

To compare the Bitsgap, 3Commas and Bituniverse with one another we focused on the GRID automated algorithm. All 3 platforms offer GRID bots. In this strategy the bot places buy and sell orders at certain regular intervals above and below a predefined base price within a selected trading range:

Grid trading bot algorithm

We used the SBot bot as an ultimate strategy. It is designed to minimize the loss if the market falls, and will generate returns on a rising and sideways trend.

A big race was planned, so we simultaneously launched 3 Grid trading bots with identical parameters. To make the comparative analysis we had to be very transparent, honest and objective. We took advantage of as many risk management and profit maximization instruments as each of the platforms could offer.

Bitsgap bot configuration

Investment: $399.81 ($400 planned)

Strategy: SBot (perfect for the sideways market)

Grids: 31

Stop-loss: ✔️

Trailing Up: ✔️

On Bitsgap there are 2 GRID strategies available. SBot is optimal for the sideways market, and Classic bot is for the rising market. Stop-loss was set at the price of $28,000 to limit the risk. Trailing Up is an ultimate mode to enable the robot to follow the market rally in case if the price breaks the Upper limit and hence goes even higher. Nobody wants to miss Bitcoin making new higher-highs, right? - Trailing Up is the solution.

Bituniverse bot configuration

Investment: $373.87 ($400 planned)

Strategy: Manual

Grids: 31

Stop-loss: ✔️

Trailing Up: ❌

On Bituniverse there are 2 GRID strategies available: A.I and Manual. A.I configuration was not optimal as the trading range was too wide. In Manual mode we set the same parameters as on Bitsgap. Bituniverse has no Trailing Up.

3Commas bot configuration

Investment: $399.97 ($400 planned)

Strategy: Manual

Grids: 31

Stop-loss: ❌

Trailing Up: ❌

On 3Commas there are 2 Grid strategies available: A.I and Manual. Proposed A.I configuration did not comply with planned settings, so we had to stick with the Manual mode. Trailing UP and Stop-loss are both unavailable.

20-day trading bot challenge results

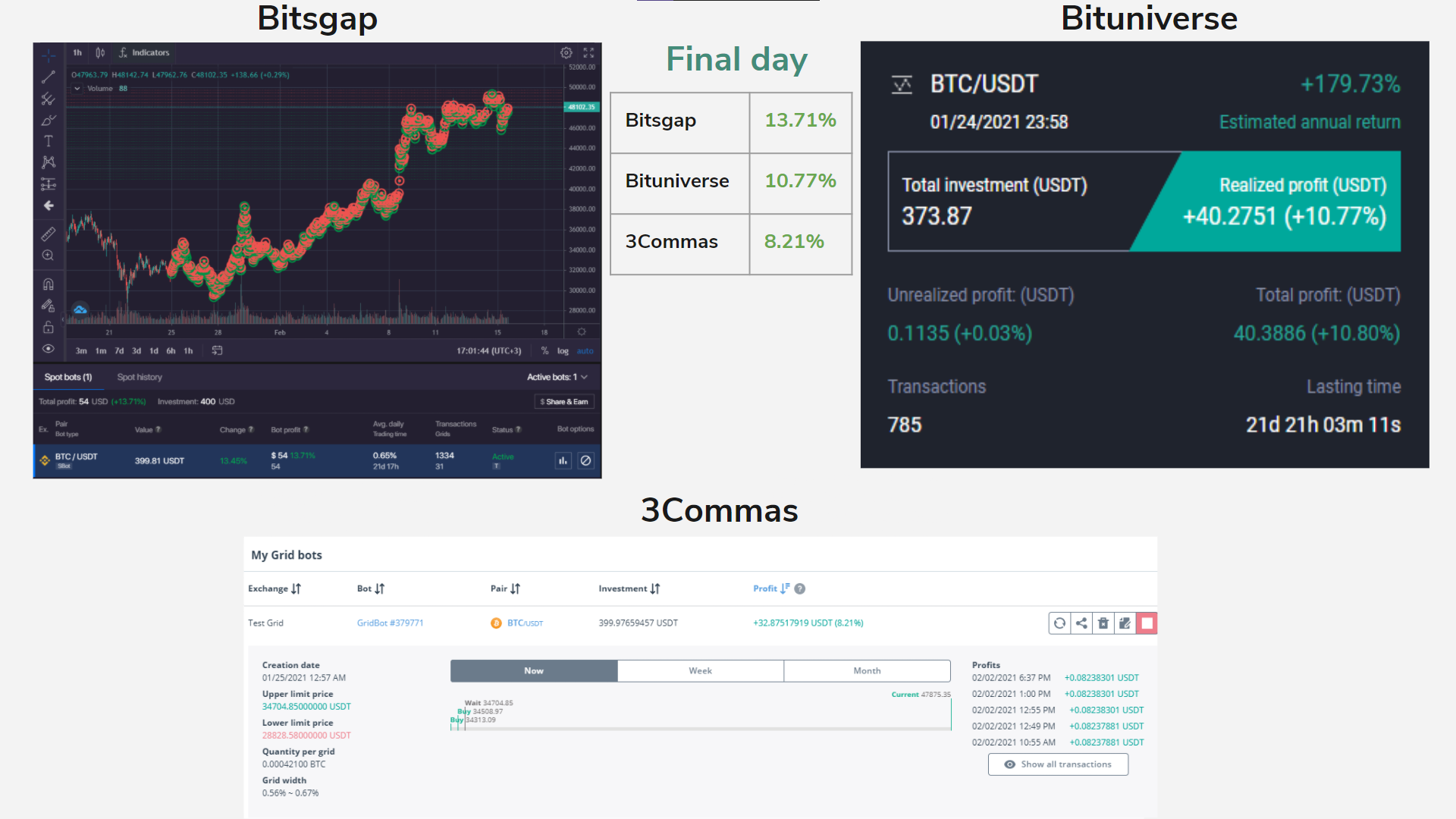

Bitsgap VS Bituniverse VS 3Commas: Grid trading bot 20-day results

Crypto Bot profit results in 22 days:

Bitsgap: 13.71%

Bituniverse: 10.77%

3Commas: 8.21%.

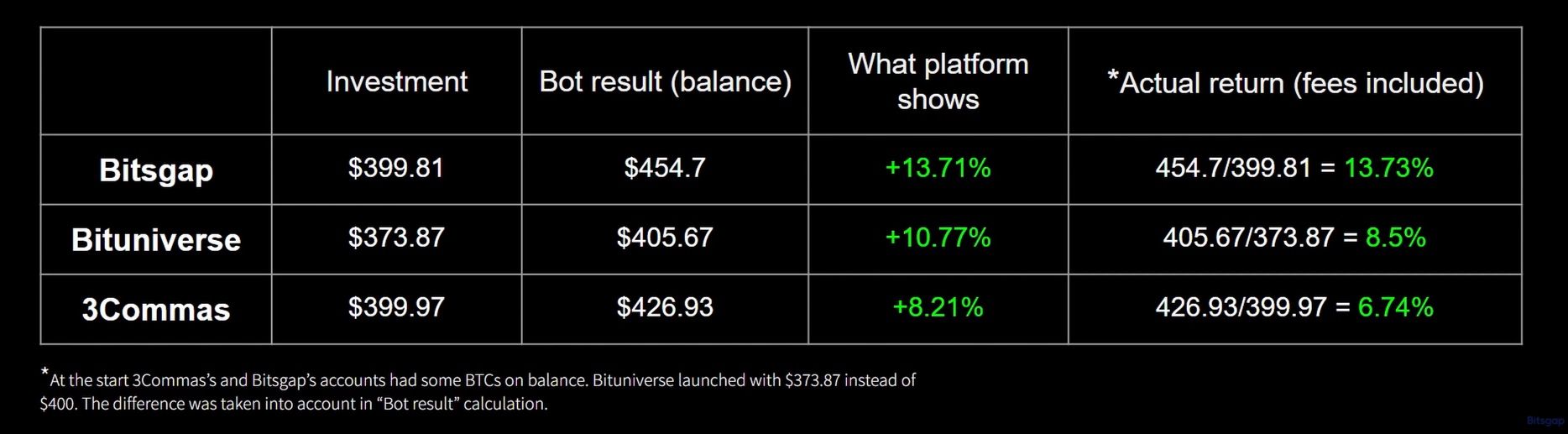

Below is the table of final results. The first column represents the investment value we allocated to each of the robot. The "Bot result" column depicts the final investment value by the time we closed all trading bots.

Returns displayed on each of the platform are in the "What platform shows" column. The last column, "Actual return" is the most interesting one, which shows the calculation of the exact return with fees taken into account.

Notice that since Bitsgap deducts fees with each bot's transaction, the actual return is the same as what platform indicates.

However, at Bituniverse and 3Commas fees are automatically excluded, so the actual return is less than the one displayed on platform.

Grid trading bot results

Here is another snapshot we made to demonstrate the trading path. What you can clearly spot is the initial trading range that we set from $28,800 up to $34,700. The starting price of $31,659.

3Commas and Bituniverse could trade only within the selected trading range, whereas Bitsgap is the only platform that has the Trailing Up mode, which takes advantage of the growing market and hence the robot could go above the Upper limit ($34,700).

Grid trading bot profit maximization

Top 3 takeaways from the trading bot race

To increase your odds of success on the cryptocurrency market the risk management and flexibility are the key elements. Adequate risk management and realistic return targets is the golden formula. Use all the tools at your disposal that can minimize the risk and maximize the returns.

Stop-loss is a must. With a Trailing Up enabled you can sleep well, because the robot monitors the market on your behalf and if Bitcoin goes higher the robot will follow it 24/7.

Do your due diligence. Analyze your winners and losers. Make sure to take the best out of your the most profitable strategies and avoid making biggest mistakes that led to huge losses.

Analyze the data, but at first make sure it is valid and transparent:

- Check if the balance displayed on a platform is the same as on your cryptocurrency exchange account.

- The displayed return generated by the Grid bot can be exaggerated if fees are excluded in calculation.

- Make sure the platform provides you with all essential metrics and parameters like: Investment change, Bot profit, Filled orders, Open orders.