Crypto Market Outlook & Cryptocurrency Trends 2025

The crypto industry's dramatic journey from FTX's collapse to Bitcoin breaking $100,000 tells a story of resilience and reinvention. As Trump returns to office with a surprising pro-crypto agenda, 2025 is shaping up to be the year digital assets go mainstream.

The cryptocurrency world reeled from the FTX implosion in late 2022. The exchange's collapse, leaving $8 billion in customer funds missing, and the subsequent 25-year prison sentence for co-founder Sam Bankman-Fried in March 2024, severely damaged the industry's credibility. Crypto's future seemed uncertain, relegated to a niche market.

However, the narrative shifted dramatically with Donald Trump's surprise victory in the 2024 US presidential election. His perceived pro-crypto stance, including plans for deregulation and increased institutional participation, revitalized the market. The nomination of Paul Atkins, a former SEC commissioner known for his crypto-friendly views, further boosted confidence, propelling Bitcoin beyond $100,000. Experts like Geoffrey Kendrick of Standard Chartered anticipate 2025 will usher in a new era of proactive, growth-oriented regulation.

This potential shift marks a stark contrast to Trump's previous skepticism towards crypto, having once labeled Bitcoin a "scam." Should he fulfill his ambition to make the US the global crypto hub, 2025 could witness a remarkable industry transformation. From the implications of Trump's inauguration to other key trends, this analysis will explore the forces poised to reshape the cryptocurrency landscape in the coming year.

Crypto Predictions for 2025

Every year, someone declares that crypto is finally going mainstream. But 2025 feels different, and here's why: the pieces are finally falling into place. We're not just seeing the usual price speculation and token launches. Instead, we're watching the convergence of policy shifts, technological breakthroughs, and institutional adoption that could genuinely transform how the world thinks about digital assets.

Now, let's break down how these forces are converging to write the next chapter in finance.

The Trump Effect

The crypto world has seen its share of watershed moments, but this might be the biggest yet: a former president promising to make America "the crypto capital of the planet." Love him or hate him, Trump's embrace of crypto is reshaping the landscape in ways that nobody saw coming.

The biggest shift? It's all about who's running the show. Trump's plan to put Paul Atkins at the helm of the SEC is like replacing a strict high school principal with the cool teacher who lets you eat in class. Atkins is known for his crypto-friendly stance, and his potential appointment has the industry buzzing.

This isn't just about relaxing rules—it's about rewriting them. The administration's approach to stablecoin regulation looks more like a welcome mat than a stop sign. For an industry that's been playing regulatory dodgeball for years, this is music to their ears.

The suits are finally joining the party too. BlackRock, the world's largest asset manager, isn't just dipping its toes in anymore—they're diving into crypto derivatives. When the company that manages more money than most countries' GDPs makes a move like this, people notice.

One of the most fascinating developments, however, is the discussion around using Bitcoin as a tool for US debt repayment.

It sounds like science fiction, but this once-fringe idea, introduced during Trump's campaign, is gaining serious traction and turning heads on the global stage. Trump himself has entertained the notion of a Strategic Bitcoin Reserve, mirroring the Federal Reserve's gold reserves, effectively legitimizing Bitcoin as a reserve asset. Such a move could offer a novel approach to tackling sovereign debt challenges and signal Bitcoin's growing influence on geopolitics.

The ongoing U.S. debt crisis, fueled by record borrowing and persistent fiscal imbalances, has policymakers scrambling for solutions. Proponents of a Bitcoin reserve argue it could act as a hedge against inflation and diversify the nation's financial toolkit, allowing for debt repayment without weakening the dollar. This bold move could position the U.S. as a leader in embracing digital assets while addressing long-standing economic woes.

The trend isn't limited to the U.S. Inspired by El Salvador's groundbreaking adoption of Bitcoin as legal tender, nations like Tonga, Paraguay, and Panama are exploring similar paths. They see Bitcoin as a catalyst for modernizing their financial systems, streamlining remittances, and attracting foreign investment, ultimately boosting economic opportunities and financial inclusion.

Even China, with its often-unpredictable crypto policies, might be considering a Bitcoin reserve. Binance founder Changpeng Zhao predicts that China will eventually follow suit if other nations continue to build their own reserves, driven by a desire to remain competitive in global finance.

Meanwhile, corporate giants like Amazon and Microsoft are facing increasing pressure from shareholders to consider holding Bitcoin. While a recent Microsoft shareholder vote rejected adding Bitcoin to the balance sheet, the fact that such discussions are taking place signifies a shift in corporate attitudes. This growing interest among major corporations could pave the way for widespread Bitcoin adoption in the near future.

But this isn't just an American story. The G20 countries are falling over themselves to create crypto-friendly rules. The European Union got out ahead with their MiCA regulations—basically a rulebook for how crypto companies can operate in Europe. The UK, Japan, and others are following suit. But the real action is in places like Singapore, Hong Kong, and the UAE.

If you're wondering why all this regulatory stuff matters, then it's about making crypto safe enough for the big money to come in. We're talking pension funds, insurance companies, and those massive institutional investors who've been sitting on the sidelines.

These aren't the type of investors who YOLO their money into the latest memecoin. They need rules. They need certainty. And now they're starting to get it.

👉 Did you know that Trump recently launched his own crypto token, and it’s already worth billions? Even his wife, Melania, has joined the trend with a token of her own! With Bitsgap, you can trade both tokens and amplify your returns. Simply connect your favorite exchange where the tokens are listed, set up your bot on the pair, and let the bot work its magic. What better way to support your favorite president than by earning some extra cash along the way? 💸

ETFs/ETPs and Altcoins

The ETF train isn't stopping with Bitcoin and Ethereum. 2025 is poised to be a landmark year for other cryptocurrencies like Solana (SOL) and XRP, as the possibility of their own ETFs gains momentum. While the US SEC has previously turned down Solana ETF applications, the fact that they're currently reviewing over 10 filings speaks volumes about the persistent demand for diversified crypto investment products.

This regulatory scrutiny, while rigorous, is a sign of progress. As the crypto market matures and regulations become clearer, the path to approval for these ETFs looks increasingly promising. Such approvals would be a game-changer, injecting a surge of liquidity into the market, attracting institutional investors, and further solidifying crypto's legitimacy as a bona fide asset class.

Tokenization of Real-World Assets (RWA)

Remember when owning a piece of prime Manhattan real estate or a chunk of a private equity fund was strictly billionaire territory? Those days are fading fast, thanks to something called tokenization. It's not the sexiest term in finance, but it's changing the game in ways that would've seemed impossible just a few years ago.

👉 At its core, tokenization is pretty straightforward: take something valuable—could be a building, a painting, or even a corporate bond—and split it into digital tokens that people can buy and sell. And it's all happening on blockchain too, which means these tokens are traceable, tradeable, and transparent.

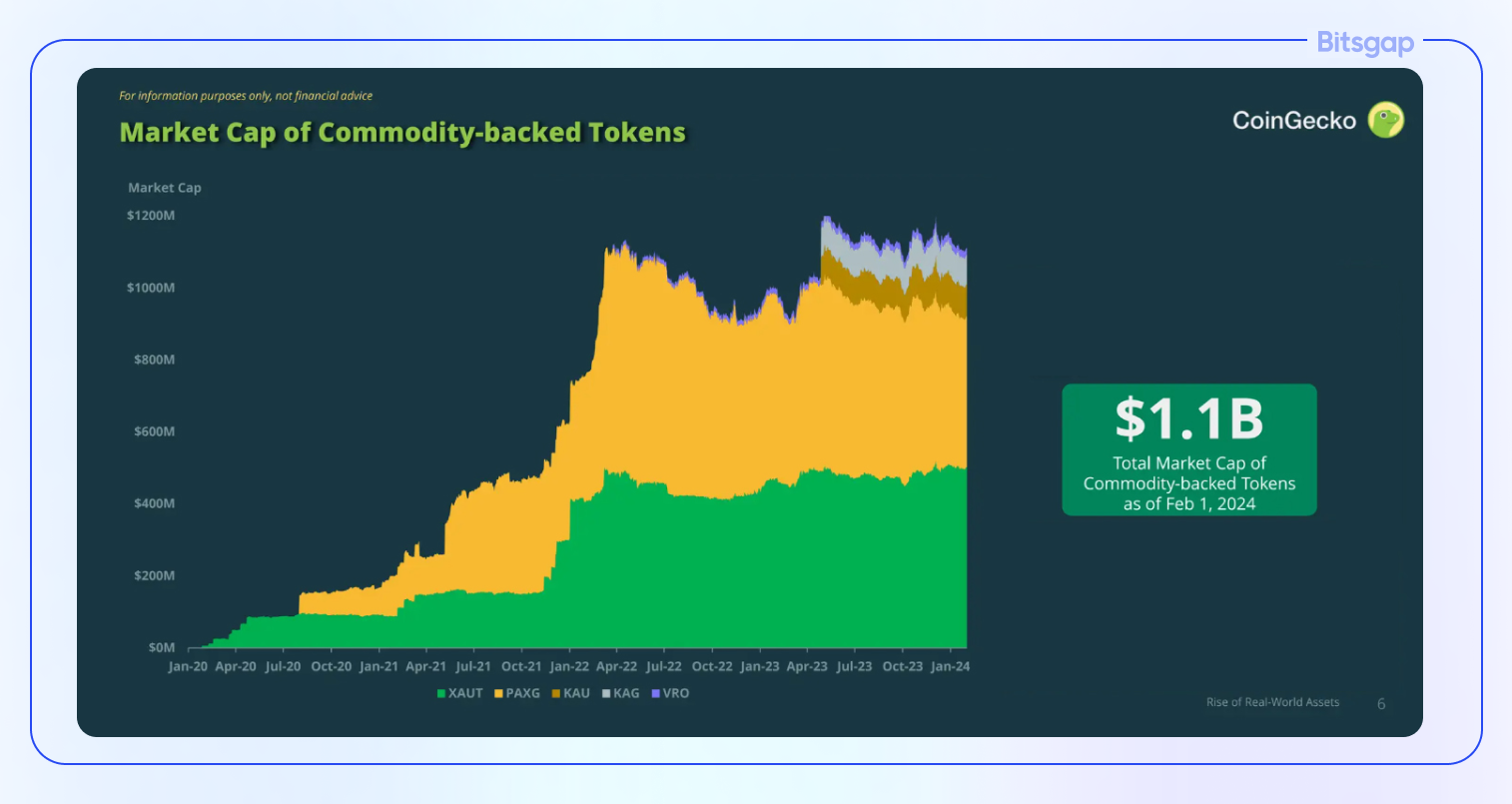

The numbers tell the story. In 2024, we've seen tokenized assets shoot up 60% to hit $13.5 billion. That's impressive, but most people in finance think we're just scratching the surface.

Let's cut through the hype and look at what tokenization really brings to the table:

- First off, it's making expensive stuff accessible. That luxury hotel you couldn't afford? Now you might be able to own a piece of it. The same goes for high-end art, rare wines, or even those corporate bonds that usually require millions just to get in the game.

- But it's not just about making things cheaper to buy in. The real magic happens in how easily you can trade these tokens. Want to sell your share in a building? No more endless paperwork and months of waiting—you can do it as easily as selling a stock.

Two projects are showing how this works in the real world:

- Paxos Gold (PAXG) took something as old school as gold and gave it a digital makeover. Each token represents actual gold sitting in a vault somewhere, but you can trade it as easily as sending an email. No more worrying about storing gold bars in your basement.

- Then there's AspenCoin, which might sound like just another crypto token, but it's actually partial ownership in the St. Regis Aspen Resort. Think about that—you can own a slice of a luxury hotel without being a hotel magnate.

The really exciting developments are happening in areas that might sound boring but could shake up finance in a big way. Private credit markets, which have traditionally been a playground for the ultra-wealthy, are starting to open up. Corporate bonds, which move about as fast as molasses in traditional markets, are getting the tokenization treatment too.

Here's what it all means: we're watching the democratization of finance happen in real time. Assets that were once locked away in the vaults of the wealthy are becoming accessible to regular investors. The barriers are coming down, piece by piece.

DeFi’s Resurgence

If you haven't checked in on DeFi since the last bull run, you might not recognize it. Sure, you can still do the basics like lending and trading, but that's just the tip of the iceberg now. The space has grown up, sobered up, and started solving real problems beyond just chasing yield.

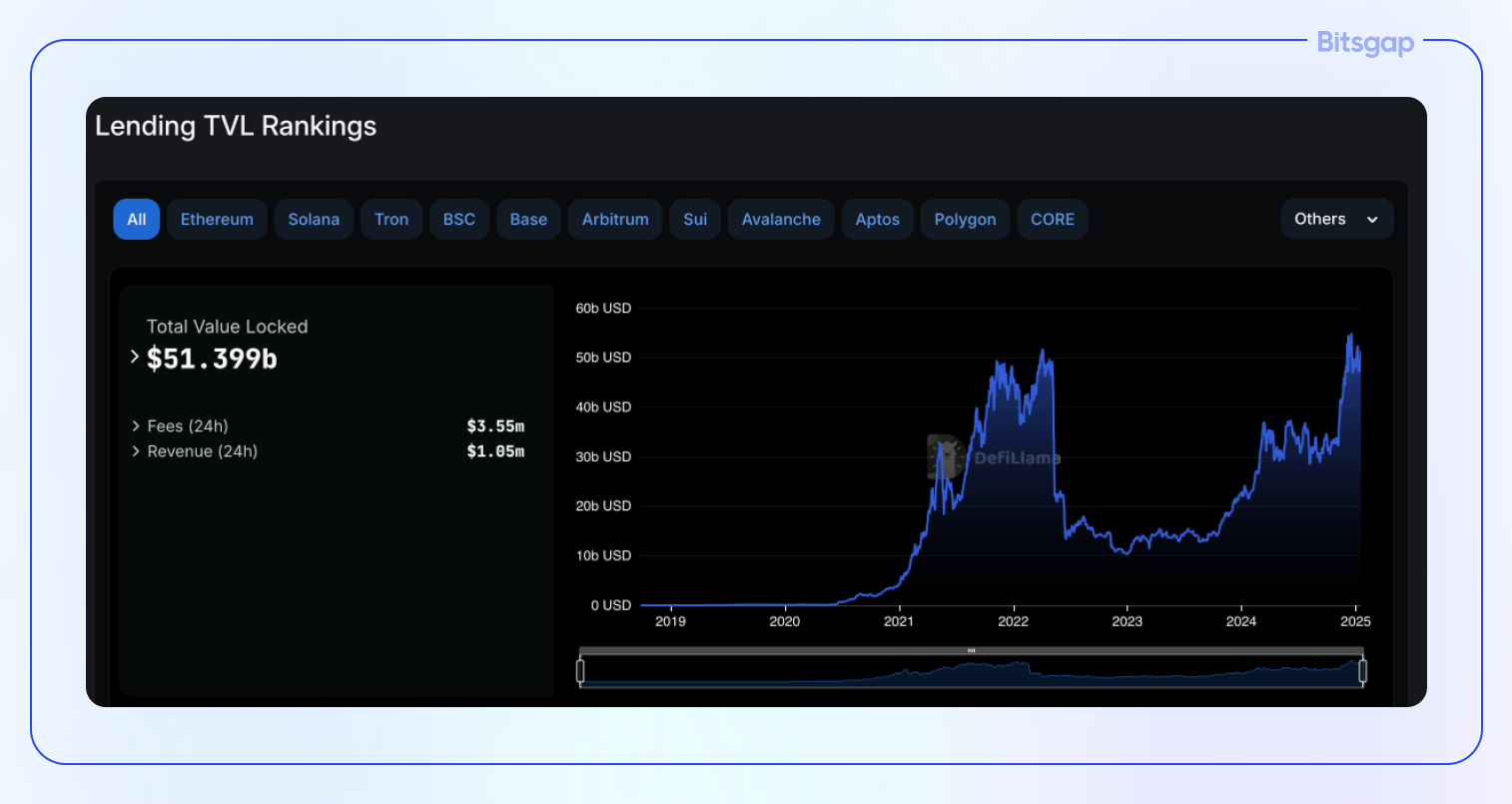

The numbers are there. According to Coinbase's research, lending protocols are hitting all-time highs in total value locked (TVL). And before you dismiss this as just another crypto metric, consider this: these platforms are processing real loans and generating real yields, often better than what you'd get at your local bank.

Decentralized exchanges like Uniswap and Curve aren't just matching orders anymore—they're becoming legitimate alternatives to traditional trading venues. Some days, they're even giving Binance and Coinbase a run for their money in terms of trading volume. And they're doing it without the need for a middleman taking a cut of every trade.

And DeFi isn't content just being a decentralized version of traditional finance anymore, it’s branching out into areas that would have seemed like science fiction a few years ago.

Take DePIN (Decentralized Physical Infrastructure Networks) for example. Projects like Helium are using DeFi principles to build and maintain actual wireless networks. Think about that for a second—people are using blockchain technology to run real-world infrastructure.

Prediction markets are another fascinating development. Platforms like Polymarket are letting people bet on everything from election outcomes to sports games, but all the odds and payouts are handled automatically by smart contracts. No bookies, no settlement delays, just pure market dynamics at work.

Maybe the biggest shift in DeFi is who's getting involved. Traditional financial institutions, the ones that used to dismiss crypto as a fad, are starting to dip their toes in the water. Why the change of heart? For one, regulation is finally catching up. Clear guidelines are emerging about what's allowed and what isn't. Plus, these institutions are realizing that blockchain's transparency might actually be a feature, not a bug. Every transaction is traceable, every position is verifiable—it's an auditor's dream. Some asset managers are even experimenting with yield farming and decentralized lending. Not because they've suddenly become crypto converts, but because they're seeing genuine opportunities to generate returns for their clients.

But let's be real—challenges remain. The technology still needs to scale better. User interfaces could be more intuitive. And yes, there's still work to be done on the security front.

Yet the trajectory is clear: DeFi is evolving from a crypto experiment into a legitimate alternative to traditional financial services. It's not about replacing the entire financial system—it's about building something better.

Layer-2 Solutions

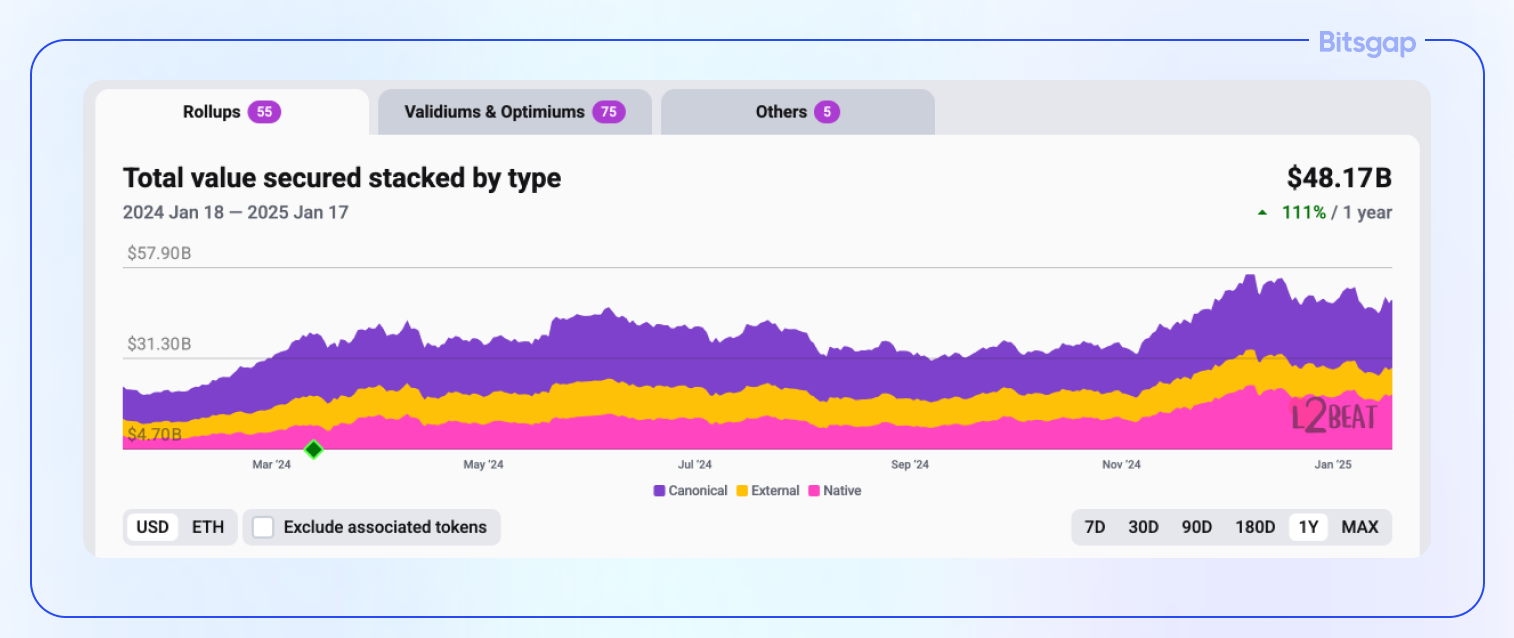

Remember when using Ethereum felt like paying premium airline prices for a bus ride? Those $50+ fees for simple transactions weren't just painful—they were a clear sign that something needed to change. Enter Layer-2 solutions, the tech that's quietly fixing blockchain's biggest headaches in 2025.

👉 Think of Layer-2 solutions as express lanes built on top of existing blockchain highways (Layer-1). They're designed to boost scalability and slash transaction costs. Unlike Layer-1 blockchains, which validate and record every transaction, Layer-2 protocols process transactions off-chain and then report back to the main blockchain.

Layer-2 solutions come in various forms, including state channels, rollups, and sidechains, all designed to reduce congestion and speed things up:

- Optimistic Rollups: Bundle transactions together like a well-organized courier service before settling them on the Layer-1 chain, increasing throughput.

- ZK-Rollups: Use cryptographic magic (zero-knowledge proofs) to compress massive amounts of data into a single transaction, enhancing scalability and security.

- State Channels: Enable private, off-chain transactions that are later settled on-chain – perfect for microtransactions and frequent interactions.

The implications here go way beyond just saving a few bucks on fees. When blockchain becomes faster and cheaper to use, entirely new applications become possible. Imagine being able to make microtransactions that cost less than a penny, or running complex DeFi operations without breaking the bank on gas fees.

This isn't just theoretical—we're seeing real adoption happening. Developers who once abandoned Ethereum due to high costs are coming back. Users who were priced out of DeFi are getting another shot at participating.

Moreover, the rise of these technologies has spawned new business models and exciting opportunities in the blockchain and crypto space. Several Layer-2 projects are already attracting significant investment, promising to boost blockchain adoption by making decentralized platforms more scalable and user-friendly.

So, 2025 is shaping up to be the year Layer-2 finally takes center stage. With major protocols maturing, user numbers soaring, and traditional finance starting to take notice, we're hitting that sweet spot where infrastructure meets adoption.

Infrastructure Investments and Technology Advancements

While everyone's talking about the latest AI chatbot or crypto token, there's a less sexy but far more crucial revolution happening behind the scenes. It's infrastructure—the nuts and bolts that make crypto and AI possible. And trust us, without these developments, all those flashy applications would be nothing but fancy PowerPoint slides.

Let's talk about chips. Not the kind you eat, but the kind that's causing tech executives to lose sleep. Nvidia's upcoming Blackwell chips are looking like they might be the backbone of both crypto and AI for years to come.

Think about it this way: running a blockchain network or training an AI model is like trying to solve millions of puzzles simultaneously. The better your chips, the faster you can solve these puzzles. And with Blackwell, we're talking about a quantum leap in what's possible.

👉 Remember when people used to talk about mining Bitcoin from their garage? Those days are long gone. Today's crypto and AI operations run out of massive datacenters—think football field-sized buildings packed with enough computing power to simulate entire virtual worlds.

And these aren't your grandfather's datacenters. The new ones are being built specifically to handle the unique demands of crypto and AI. They need to be:

- Fast enough to process thousands of transactions per second

- Efficient enough not to rack up energy bills bigger than a small country's GDP

- Reliable enough to run 24/7 without breaking a sweat

But with success comes challenges. As crypto and AI applications grow in popularity, the strain on infrastructure intensifies, demanding constant upgrades and innovation.

The good news? Solutions are emerging. Layer-2 networks like Arbitrum and Optimism are easing congestion on main blockchain networks by processing transactions off-chain. But even these solutions need immense computational power to function effectively, which is where cutting-edge chips and advanced datacenters come into play.

What’s interesting is that we're starting to see crypto and AI technologies feeding off each other. Projects like SingularityNET are using blockchain to create decentralized AI marketplaces. Meanwhile, AI is being used to make blockchain networks more efficient.

Of course, all this computational power comes at a cost—energy. However, this challenge is driving innovation in green technology. Datacenters are increasingly powered by renewable energy, and chip manufacturers are obsessed with making their processors more energy-efficient.

Why? Because wasting energy isn't just bad for the planet—it's bad for business. When your electricity bill could buy a small island, you tend to care about efficiency.

The infrastructure buildout we're seeing isn't just about supporting current applications—it's about enabling things we haven't even thought of yet. When Nvidia announces a new chip or Google builds a new datacenter, they're not just solving today's problems—they're laying the groundwork for tomorrow's innovations.

The real question isn't whether we'll have enough infrastructure to support crypto and AI—it's what wild new applications developers will dream up once they have all this power at their fingertips.

Conclusion

As we look at the landscape of 2025, it's clear we're witnessing more than just another crypto cycle. The convergence of institutional money, technological advancement, and regulatory clarity is creating something we haven't seen before: a mature, integrated digital asset ecosystem.

Let's put the pieces together:

- Institutional Embrace: From BlackRock's foray into crypto derivatives to the increasing pressure on corporate giants like Amazon and Microsoft to consider holding Bitcoin, institutional interest is solidifying crypto's place in the financial world. The potential for Bitcoin ETFs and ETPs for other cryptocurrencies like Solana and XRP further fuels this momentum.

- Tokenization's Rise: Tokenization is democratizing access to traditionally exclusive assets, unlocking liquidity in everything from real estate to private equity. Projects like Paxos Gold and AspenCoin are showcasing the real-world applications of this transformative technology.

- Ethereum's Evolution: Layer-2 solutions are finally addressing Ethereum's scalability challenges, paving the way for faster, cheaper transactions and unlocking new possibilities for decentralized applications.

- DeFi's Renaissance: DeFi is evolving beyond its experimental phase, offering robust alternatives to traditional finance. The growing involvement of institutional players signals a shift towards mainstream acceptance.

- Infrastructure Boom: Advancements in chip technology and the development of specialized data centers are laying the foundation for the next wave of crypto and AI innovation.

- The Regulatory Landscape: From the potential impact of a pro-crypto stance in the US to the G20's push for crypto-friendly regulations, the regulatory environment is becoming increasingly conducive to growth and investment. The EU's MiCA regulations and similar initiatives in other jurisdictions are providing much-needed clarity and attracting institutional capital.

These converging trends paint a picture of a maturing crypto ecosystem, one that is increasingly integrated with traditional financial systems. The stage is set for long-term growth and wider adoption as crypto moves from the fringes to the mainstream.

Want to jump on the crypto bandwagon? Consider Bitsgap, a crypto trading platform and aggregator connecting to 15 centralized exchanges. Bitsgap offers a suite of tools including automations, smart orders, AI assistance, and more to help amplify your returns.