Crypto-Asset Reporting Framework (CARF): What Investors Should Know

The crypto industry faces a watershed moment as the OECD's Crypto-Asset Reporting Framework (CARF) introduces comprehensive global tax reporting standards. Starting 2026, crypto platforms must report detailed transaction data, marking a new era of transparency.

In May 2023, the EU made a significant move to bring cryptocurrency into its tax system. The EU finance ministers approved new rules (called DAC8) that require crypto companies to report their clients' transactions to tax authorities.

These rules align with an international framework (CARF) that the G20 approved in 2022. The goal? To prevent cryptocurrency from becoming a tool for tax avoidance. Both crypto exchanges and wallet providers will need to follow these regulations.

What does this mean in practice? Starting in 2026, crypto businesses must:

- Verify their customers' identities

- Track transactions and transfers

- Share this information with tax authorities

The first reports under these new rules will be due by January 31, 2027. Investors and crypto businesses should start preparing now to meet these new requirements.

These changes affect not just the EU but all countries working with the OECD (Organisation for Economic Co-operation and Development). The rules cover various financial activities, including crypto trading and certain cross-border transactions.

In this article, we'll explore:

- What is the OECD Crypto-Asset Reporting Framework (CARF) and why does it matter?

- What is DAC8 and how does it affect crypto businesses?

- How do CASPs register under the new requirements?

- What steps has the EU taken to implement CARF?

- What information will CASPs need to report?

- What are the key components of CARF?

- Who's responsible for collecting and reporting CARF information?

- How is the US participating in the Common Reporting Standard?

CARF Overview: What Is the OECD Crypto-Asset Reporting Framework (CARF) and Why Should You Care?

Think of CARF as the new global 'rule book' for crypto tax reporting. Created by the OECD (Organisation for Economic Co-operation and Development), this framework represents the first coordinated international effort to bring order to crypto taxation. Just as banks must report your savings interest or investment gains, crypto platforms will now have similar obligations.

So, the key features of CARF include:

- Global Reach: Unlike previous regulations that varied by country, CARF creates a standardized approach across multiple nations

- Automatic Information Exchange: Countries will share crypto tax data automatically, making it harder to hide assets across borders

- Standardized Reporting: Creates uniform requirements for what information needs to be collected and how it should be reported

Why Was CARF Created?

The crypto world has been like the Wild West of finance—digital money flowing across borders with little oversight. Tax authorities found it challenging to track who owes what. CARF changes this by requiring crypto businesses to report their customers' activities, much like banks do with regular money.

What Does CARF Cover?

The framework casts a wide net, including:

- Popular cryptocurrencies like Bitcoin

- Stablecoins

- Certain NFTs

- Crypto derivatives

- Large payments over $50,000

- Both crypto-to-crypto and crypto-to-cash transactions

Who Needs To Follow These Rules?

If you run a crypto business—whether it's an exchange, a wallet service, or another crypto platform—you'll need to collect and share specific information about your users and their transactions. Think of it as similar to how banks report significant transactions to authorities.

This marks a significant shift in how the crypto industry operates, bringing it closer to traditional financial regulations while maintaining its innovative nature.

We’ll address all of the above in more detail in later sections.

Now, What Is DAC8, and How Does it Relate to CARF?

The Directive on Administrative Cooperation 8 (DAC8) is the latest update to the EU’s framework for tax transparency, specifically designed to address the challenges posed by crypto-assets. Adopted by the Council of the European Union on October 17, 2023, DAC8 aligns with the OECD’s CARF and introduces comprehensive reporting requirements for Crypto-Asset Service Providers (CASPs).

Here’s what makes DAC8 important:

- It's Bigger in Scope: DAC8 broadens the existing tax reporting framework under earlier directives to include crypto-assets, e-money products, and Central Bank Digital Currencies (CBDCs).

- It Plays Well with Others:

- It works hand in hand with CARF, making sure crypto reporting is consistent across different countries

- It uses the same language as MiCA (the EU's main crypto regulation) to keep everything clear and consistent

- It establishes mandatory reporting of crypto-to-fiat exchanges, crypto-to-crypto trades, retail payments exceeding $50,000, and transfers of crypto-assets.

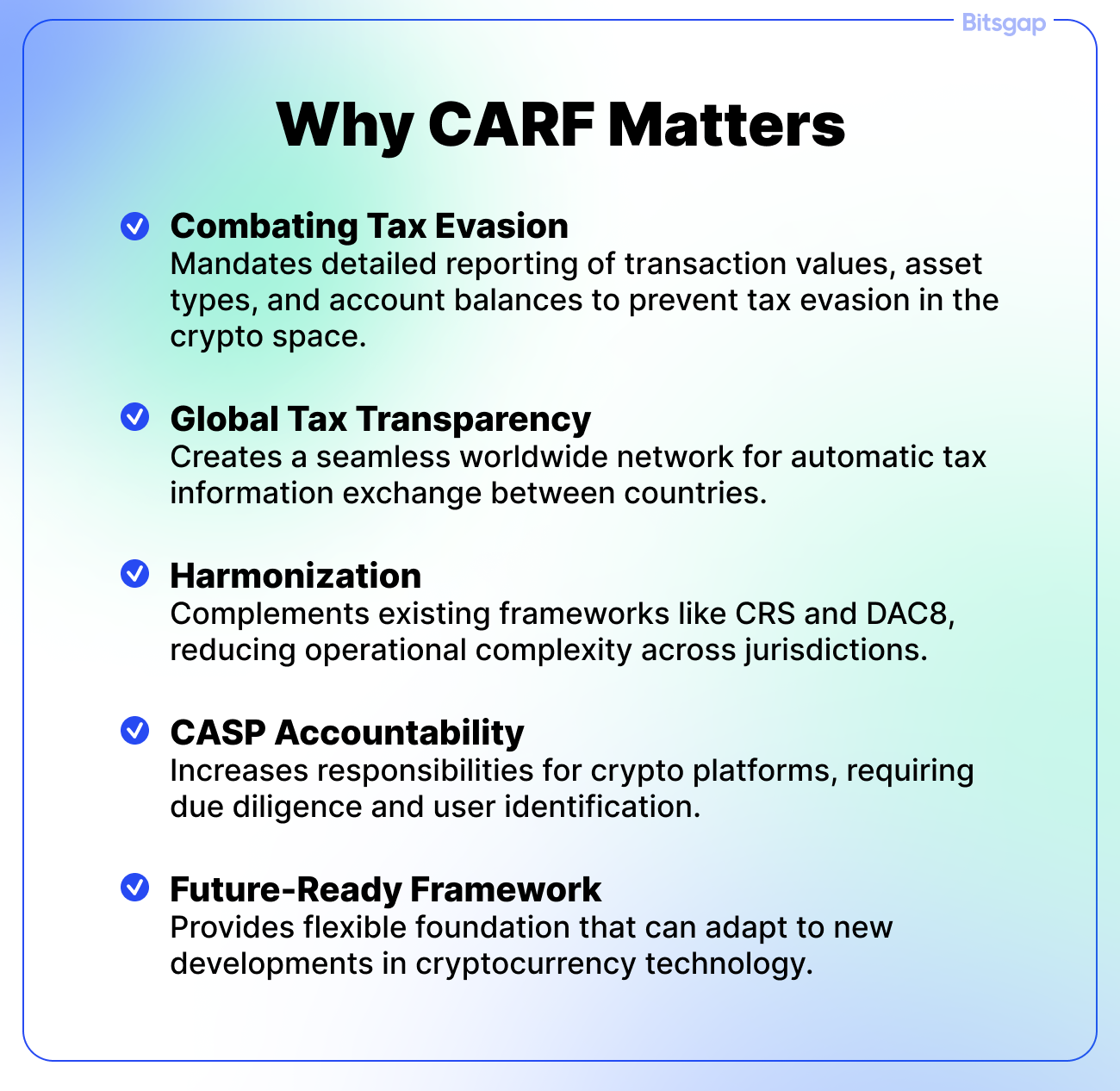

Why Should You Care About CARF?

CARF is more than just another regulation; it's a critical piece of the puzzle for the future of crypto. Here's why it matters:

- Combating Tax Evasion: Crypto's decentralized and often anonymous nature presents opportunities for tax evasion. CARF addresses this by mandating detailed reporting of transaction values, asset types, and account balances.

- Global Tax Transparency: Gone are the days of disconnected crypto tax systems. CARF creates a seamless worldwide network where tax information flows automatically between countries. This means if you're trading crypto in one country, tax authorities in your home country will know about it. It's like creating a global financial radar system, but for cryptocurrency.

- Harmonization with Existing Frameworks: CARF complements existing regulatory frameworks, such as the OECD's Common Reporting Standard (CRS) and the EU's DAC8. For international businesses, this harmonization reduces the complexity of operating across multiple jurisdictions.

- Enhanced Accountability for CASPs: CARF increases the responsibilities of CASPs, requiring them to perform due diligence, identify users' tax residencies, and share transaction data. Non-compliance isn't an option—platforms risk severe penalties or even being blacklisted by major financial authorities like the European Securities and Markets Authority (ESMA).

- Proactive Approach to Future Regulation: Perhaps most importantly, CARF lays the groundwork for future regulation. As cryptocurrency continues to evolve, this framework provides a flexible foundation that can adapt to new developments. It gives businesses and investors clear guidelines while ensuring tax systems can keep pace with rapid technological change.

👉 So, how does this all work in practice? Well, the process is relatively straightforward: CASPs gather key info about their users—think tax residency, what transactions they've made, and how much is in their accounts. They report all this to their local tax authorities. From there, the info gets shared internationally with other countries that are part of the agreement, using secure channels set up through what's called an MCAA (Multilateral Competent Authority Agreement). To keep everything running smoothly, everyone uses the same digital format (an XML schema) to share data, which helps make the whole process of international cooperation and tax transparency in crypto much more efficient.

How Do CASPs Register Under the New Requirements?

Under the OECD-agreed Crypto Asset Reporting Framework and aligned regulations such as the EU’s DAC8, CASPs face new registration and reporting obligations. Here's a breakdown of how CASPs register and comply under the new framework:

Who Needs to Register?

If you're running a crypto business serving EU clients, whether you're based in the EU or not, you'll need to register. This applies if you're:

- Running a centralized exchange or brokerage

- Operating an NFT marketplace

- Providing wallet services

- Managing a DeFi platform with transaction control

The European Securities and Markets Authority (ESMA) keeps track of all registered providers in a public database. Not registering? That could lead to penalties or even being blocked from operating in the EU.

The Registration Process

- Pick Your EU Home Base: Choose one EU country where you'll register and report to, even if you operate in multiple EU countries. This is your primary point of contact for tax reporting.

- Collect Customer Info: You'll need to gather self-certification forms from your users to verify their tax residency. For business customers, you'll also need details about who controls the company.

- Do Your Due Diligence: This means:

- Checking that tax residency information is accurate

- Collecting tax IDs, addresses, and other essential details

- Keeping all this information up to date (in fact, as frequently as every 36 months or when there are changes in user circumstances)

What About Non-EU Providers?

If you're based outside the EU but serve EU customers, you'll still need to register with an EU country. You'll have to report all significant transactions involving EU residents, whether they're trading crypto-to-crypto or crypto-to-fiat.

👉 Important dates to remember: First, EU countries must add these rules to their laws by December 31, 2025. Then, the first major reporting deadline hits on January 31, 2027, when platforms must report all crypto transactions from 2026. If you're involved in crypto, start preparing now to meet these requirements.

Registration helps tax authorities track crypto transactions across borders, making the crypto space more transparent and compliant. It's part of a bigger push for automatic information sharing (AEOI) between countries.

How Is the EU Putting CARF into Action?

The European Union (EU) has taken several steps to implement the CARF, primarily through the adoption of the DAC8. Here’s what they are doing:

- Making It Official:The EU has wrapped CARF into their laws through DAC8, updating their existing rules about how tax authorities work together. Every EU country needs to add these rules to their own laws by the end of 2025.

- Keeping Everything in Sync: They're making sure DAC8 works smoothly with other EU crypto rules like the Markets in Crypto-Assets Regulation (MiCA) and the Transfer of Funds Regulation (TFR). This helps create one clear set of rules for reporting crypto and keeping taxes transparent.

- Setting Up Clear Rules for CASPs: As mentioned, CARF requires all CASPs serving EU customers—whether EU-based or international—to register with one EU country, verify customer identities, and submit annual transaction reports by January 31. Tax authorities then automatically share this data between countries.

CAFR in Detail: What and How to Report and Who’s Responsible.

While we’ve gone through the basics above, let’s break down the key parts of CARF and look at who's involved in making it all work.

What Information Will CASPs Need To Report?

As discussed—if you're running a crypto service, CARF and DAC8 require you to collect and share specific details about your users and their transactions. Here's what you need to track:

- User Information:

- Full name and address

- Tax Identification Numbers (TINs)

- Jurisdiction(s) of tax residence

- Date and place of birth (for individuals)

- Controlling persons for entities (e.g., beneficial owners)

- Transactional Data:

- Crypto-to-Fiat Exchanges: Transactions where crypto-assets are exchanged for fiat currency (e.g., USD, EUR).

- Crypto-to-Crypto Exchanges: Transactions involving the exchange of one crypto-asset for another (e.g., Bitcoin to Ethereum).

- Reportable Retail Payment Transactions: Payments made using crypto-assets exceeding $50,000 in value for goods or services.

- Transfers of Crypto-Assets: Movement of crypto-assets between wallets or exchanges, including off-platform transfers.

- Transaction Details:

- Name of the crypto-asset

- Fair Market Value (FMV) of the transaction

- Number of units involved

- Transaction fees (deducted from the FMV)

- Type of transfer (e.g., airdrops, staking income, collateralized loans)

- External Wallet Reporting: If your users send crypto to outside wallets (ones not linked to another reporting service), you might need to report this too—but only if the user's country asks for this information.

- Currency Conversion: All values must be reported in a single fiat currency, with consistent application of conversion rates at the time of the transaction.

Breaking Down CARF: The Main Parts

The CARF framework is built around four primary components:

- Scope of Crypto-Assets: CARF applies to a broad range of crypto-assets, including:

- Cryptocurrencies (e.g., Bitcoin, Ethereum)

- Stablecoins

- Derivatives issued in the form of crypto-assets

- Certain non-fungible tokens (NFTs) that represent value and can be traded or exchanged.

- Exclusions: Central Bank Digital Currencies (CBDCs) and closed-loop crypto-assets (e.g., loyalty points or vouchers) are excluded from CARF.

- Intermediaries and Service Providers in Scope: CASPs are considered Reporting Crypto-Asset Service Providers under CARF if they facilitate exchange transactions, including:

- Centralized Exchanges: Platforms enabling the buying, selling, and trading of crypto-assets.

- Decentralized Protocol Operators: Entities with control or influence over DeFi platforms.

- Wallet Providers: Custodial wallet services managing crypto-assets on behalf of users.

- NFT Marketplaces: Platforms facilitating the trade of NFTs.

- Crypto-Asset Brokers and Dealers: Entities acting as intermediaries for crypto-asset transactions.

- Reporting Requirements: CARF mandates:

- Collection of self-certification forms to identify users and their tax residency.

- Reporting of all relevant transactions, including crypto-to-fiat exchanges, crypto-to-crypto trades, and transfers.

- Annual reporting of aggregated data, categorized by transaction type and asset.

- Due Diligence Procedures: CASPs must follow due diligence procedures to:

- Verify the identity and tax residency of users (both individuals and entities).

- Collect and validate the required information using self-certifications.

- Align these procedures with existing AML/KYC obligations and CRS standards.

- Update self-certifications every 36 months or when there are changes in user circumstances.

How Is the US Participating in the Common Reporting Standard?

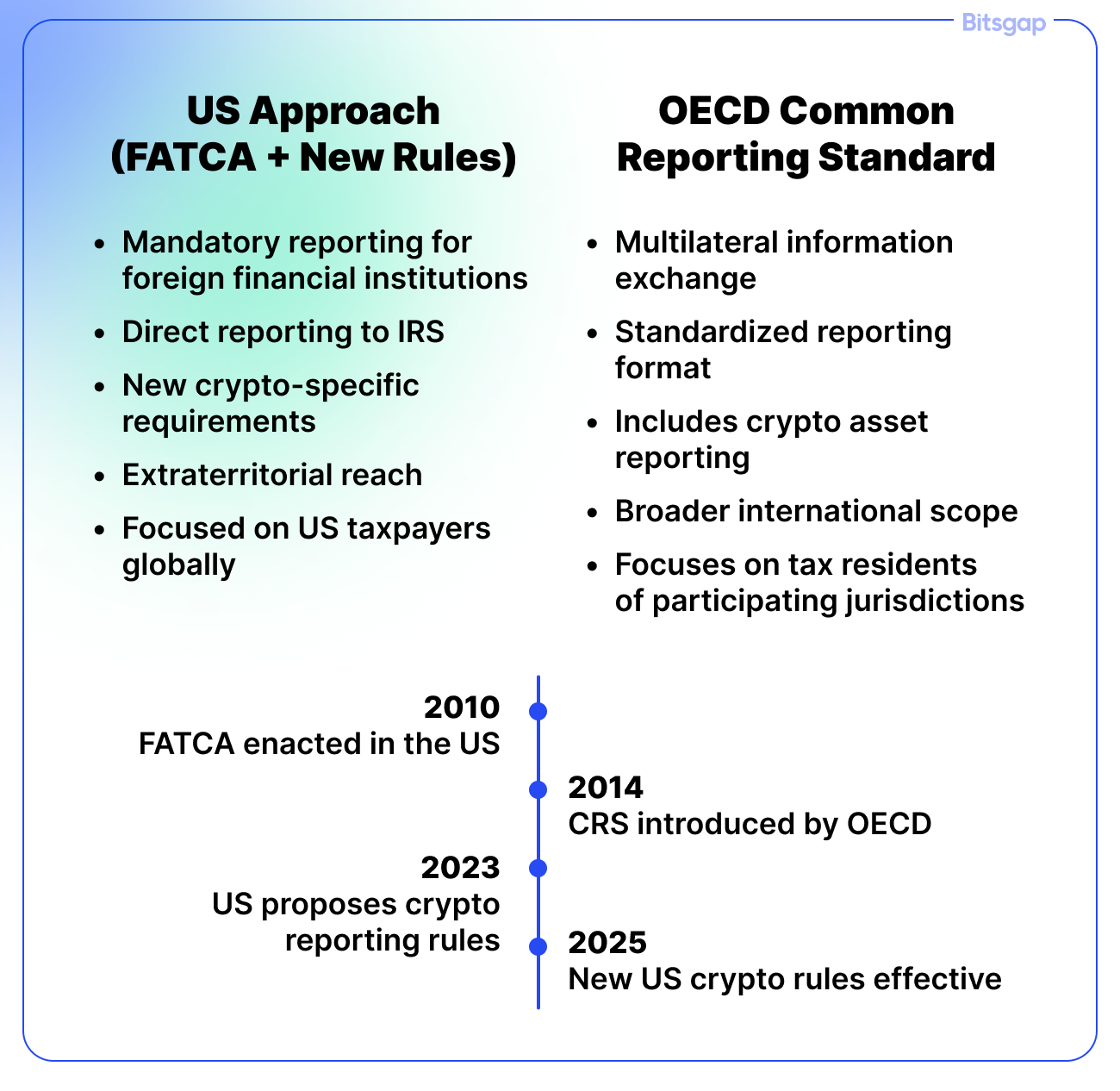

The United States has historically not participated in the OECD’s CRS, opting instead to rely on its own tax information sharing mechanism, the Foreign Account Tax Compliance Act (FATCA). However, recent developments suggest that the US is taking steps to align its reporting framework with global standards for crypto-asset transparency.

Below are a few key aspects of the US approach:

- FATCA as the Existing Framework:

- FATCA has served as the US's primary tool for international tax reporting, requiring foreign financial institutions to report US taxpayer information to the IRS. However, this system, while robust for traditional banking, wasn't designed with cryptocurrency in mind.

- Proposed Crypto Reporting Rules:

- In August 2023, the US Treasury and IRS proposed new rules for cryptocurrency tax reporting.

- These rules, effective January 1, 2025, would require crypto exchanges and brokers to report detailed information on digital asset transactions, including:

- Gross proceeds from sales.

- Transfers and exchanges involving US taxpayers.

- Alignment with CRS Principles:

- While the US hasn't formally joined the CRS, these new regulations effectively align with global standards. The combination of FATCA's reach and the new crypto reporting framework ensures that non-US exchanges serving American clients must meet similar transparency requirements.

- Practical Implications:

- This evolution in US policy demonstrates a practical approach to global tax transparency. While maintaining its independent framework, the US is effectively participating in the international effort to standardize crypto reporting. The result? A more cohesive global system for monitoring digital asset transactions, even without formal CRS participation.

Conclusion

As we've explored, CARF represents a significant shift in how the crypto industry operates globally. This framework, along with complementary regulations like DAC8 and evolving US policies, signals crypto's maturation from an alternative financial system to a regulated, transparent asset class.

Key Takeaways:

- Implementation begins in 2026, with first reports due January 31, 2027

- Global standardization of crypto reporting is becoming reality

- CASPs must prepare now for enhanced reporting requirements

- Tax transparency is no longer optional in the crypto space

For traders and investors, this evolving regulatory landscape makes platform choice more critical than ever. At Bitsgap, we are committed to supporting a transparent and compliant crypto ecosystem. As a fully compliant crypto trading aggregator and trading platform, Bitsgap connects to more than 15 exchanges without holding your data or funds. Using encrypted API keys, we ensure secure operations while maintaining a spotless record of zero security breaches. With smart trading terminal, cool automations, and a 7-day free trial on the PRO plan, Bitsgap empowers traders to navigate the crypto landscape with confidence.

So why wait? Come and trade with Bitsgap—your secure and innovative partner in the evolving world of crypto.