Do You Really Need to Use Arbitrage to Profit From Crypto?

Some traders are successful in arbitrage, but there are still too many uncertainties for it to be a truly practical method of making money. Let's explain why.

Some crypto traders find arbitrage trading attractive, seeing it as a low-risk way to profit from price differences. Indeed, crypto arbitrage—buying a cryptocurrency on one exchange and quickly selling it on another for more—can yield guaranteed profits in theory.

However, for most retail traders, arbitrage in crypto is not the golden ticket it might appear to be. While some individuals have made money with cryptocurrency arbitrage, there are many practical challenges and uncertainties that make arbitrage trading cryptocurrency assets far from easy. In this article, we’ll explain why that is and explore smarter alternatives for crypto trading.

What Is Crypto Arbitrage?

Arbitrage is not a new concept—it has long been a staple strategy in traditional financial markets.

Simply put, cryptocurrency arbitrage is a trading strategy where a trader simultaneously buys and sells the same asset on different markets to profit from a price discrepancy.

Market inefficiencies (like demand or liquidity differences between exchanges) create these price gaps for savvy traders to exploit.

Crypto markets, being notoriously volatile and operating 24/7, tend to attract arbitrageurs because price differences can arise and close at any time of day.

👉 For example, suppose on Exchange A (say Binance) one Bitcoin is priced at $19,526, while at the same moment on Exchange B (say Gemini) it’s $19,630. Sensing an arbitrage crypto opportunity, a trader could buy 1 BTC on the cheaper Exchange A and immediately sell it on the pricier Exchange B to pocket roughly $104 profit (ignoring fees). This kind of bitcoin arbitrage works only if you’re quick enough to execute before prices change.

In theory, arbitrage is considered “risk-free” profit because you’re locking in a price difference. In reality, there are other variables—transaction fees, transfer times, liquidity constraints—that can eat into or even erase that profit margin.

How Does Crypto Arbitrage Work?

To profit from price discrepancies, you need to spot differences in an asset’s price across two or more markets and then execute a series of transactions to capitalize on it. In practice, arbitrage means monitoring multiple exchanges (or trading pairs) and acting fast when a mismatch arises. Let’s break down some common types of arbitrage strategies in the crypto world and how they work:

Cross-Exchange Arbitrage

Cross-exchange arbitrage is the classic form of crypto arbitrage trading. It involves buying an asset on one exchange where the price is lower and then selling it on another exchange where the price is higher, profiting from the difference.

👉Our Bitcoin example above is a typical cross-exchange arbitrage scenario.

Essentially, you are taking advantage of inefficient pricing for the same coin on two platforms. While conceptually simple, successful cross-exchange arbitrage requires accounts funded on both exchanges and swift execution to be profitable.

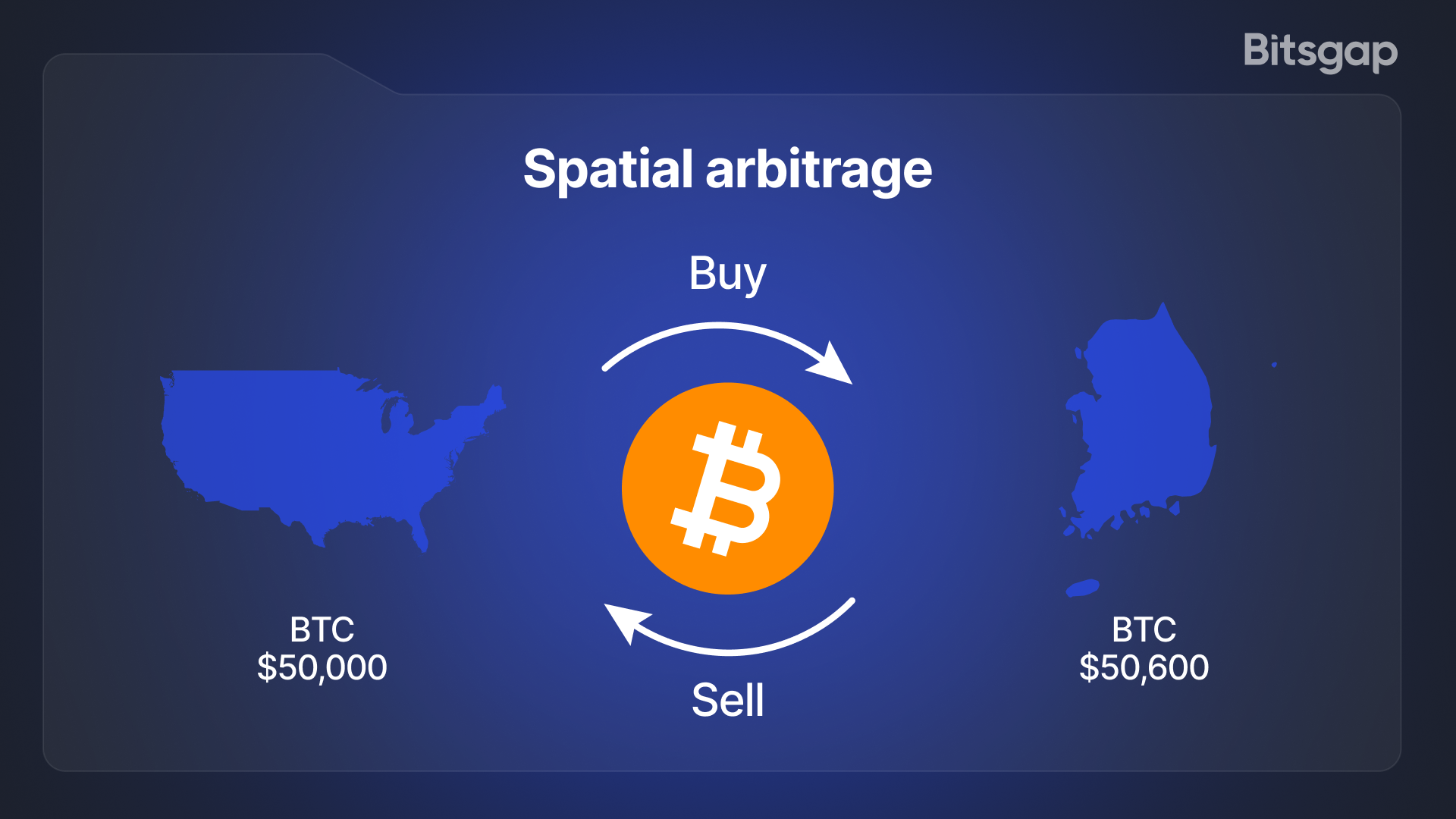

Spatial Arbitrage

Spatial arbitrage is a specific case of cross-exchange arbitrage where the two (or more) exchanges are in different regions or countries.

Due to local demand, regulations, or market isolation, a cryptocurrency might consistently trade at a premium in one country compared to another.

👉 For instance, traders have observed the so-called "kimchi premium" in the past—Bitcoin prices in South Korea at one point ran significantly higher (even 15–40% more) than on U.S. exchanges. In theory, a spatial arbitrageur could buy BTC cheaply abroad and sell it at the higher Korean price. However, capital controls and transfer frictions often make such arbitrage trading crypto across borders difficult to execute in practice.

Spatial arbitrage opportunities exist when regional markets diverge, but exploiting them requires navigating currency conversion, withdrawal limits, and sometimes legal restrictions.

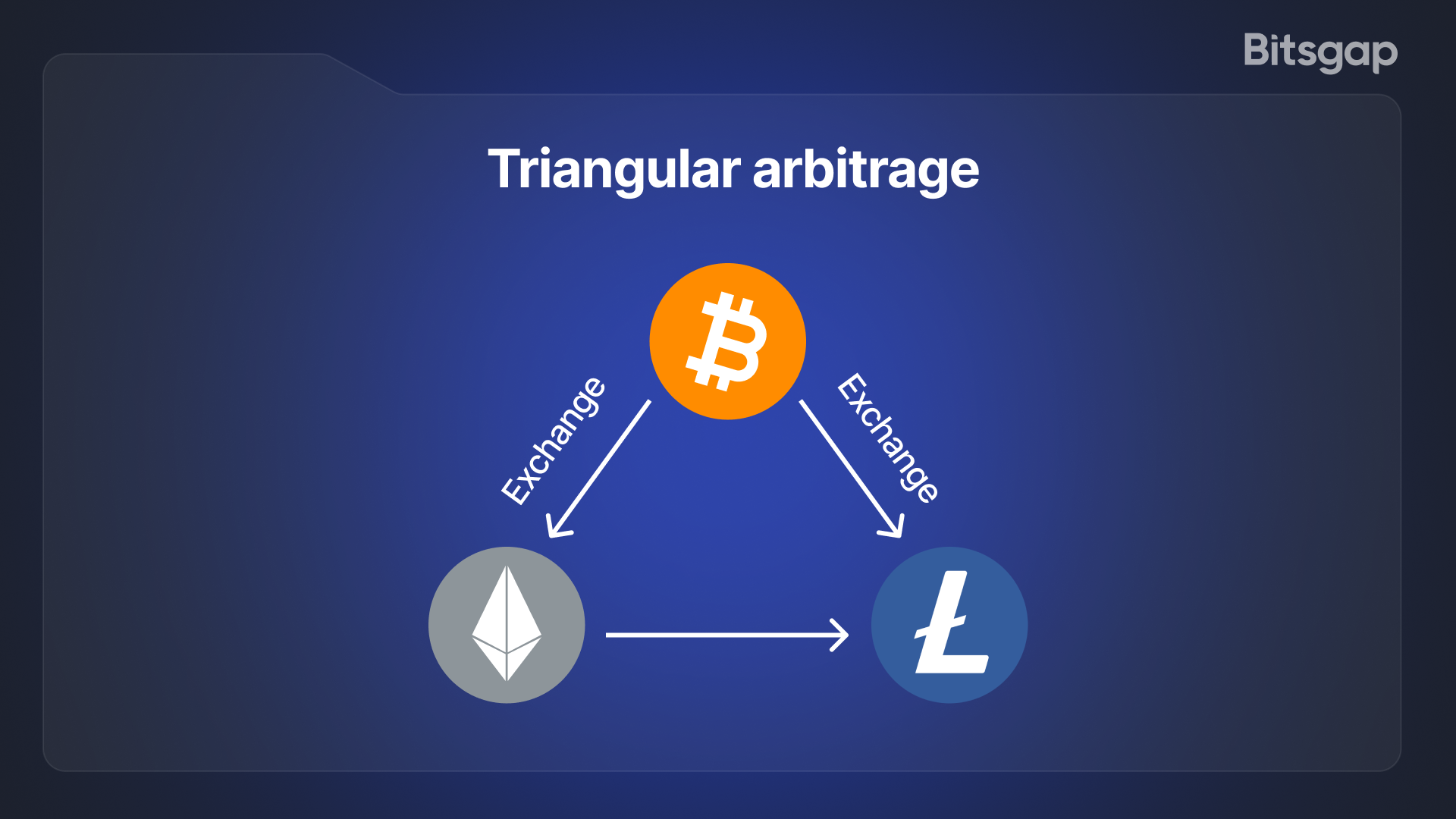

Triangular Arbitrage

Triangular arbitrage involves three assets (or currency pairs) and typically takes place on a single exchange. The idea is to cycle through a loop of trades to exploit price inconsistencies between three trading pairs.

For example, imagine a triangular route with UNI, ETH, and USDT on one exchange. If there’s a mispricing, you might:

- Use USDT to buy UNI.

- Trade that UNI for ETH.

- Sell the ETH back to USDT at a rate that nets more USDT than you started with.

👉As a concrete illustration, suppose 1 UNI costs 6.5 USDT. You buy 20 UNI for 130 USDT. Then you trade those UNI for ETH at a rate of 1 UNI = 0.005 ETH, yielding 0.1 ETH. Finally, you sell 0.1 ETH for USDT at an exchange rate of 1 ETH = 1,350 USDT, getting 135 USDT. Your round-trip ends with 135 USDT, meaning a profit of 5 USDT on your initial 130 USDT—about a 3.8% gain, risk-free on paper. This profit exists only because the UNI/ETH/USDT exchange rates were out of alignment momentarily.

Triangular arbitrage requires fast, concurrent execution of all three trades. It’s complex to do manually, but bots can scan and execute these multi-leg opportunities within milliseconds. (In fact, triangular arbitrage is common in both crypto and forex, and exchanges’ prices usually realign very quickly once traders capitalize on the discrepancy.)

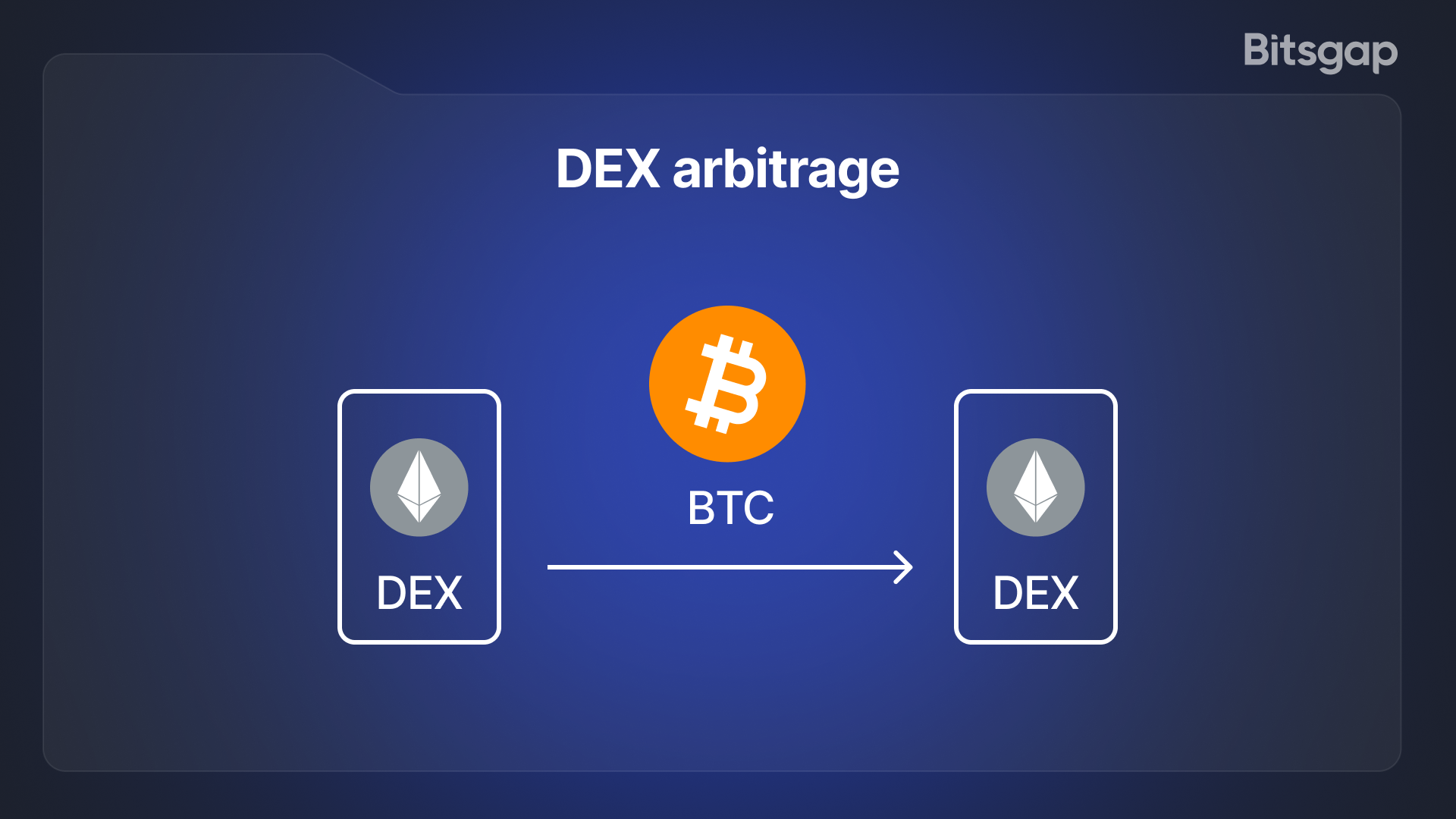

Decentralized Exchange (DEX) Arbitrage

With the rise of decentralized exchanges and DeFi, arbitrage has expanded into the DEX vs CEX realm.

Decentralized exchanges like Uniswap, SushiSwap, or Curve may list certain tokens that also trade on centralized exchanges (CEX) like Binance or Coinbase.

Price disparities can occur between a DEX and a CEX for the same asset.

Decentralized arbitrage means buying from the cheaper venue and selling on the more expensive one.

👉 For example, if a token’s price is lower on Uniswap than on Binance, an arbitrageur can buy on Uniswap (perhaps using a flash loan to avoid upfront capital) and then immediately sell on Binance for profit, all in one quick sequence. Conversely, if the DEX price is higher (perhaps due to a temporary liquidity imbalance in an AMM pool), one could sell on the DEX and buy on the CEX to profit.

DEX arbitrage often involves Ethereum gas fees and sometimes advanced techniques like flash loans, but it’s a crucial mechanism that actually helps keep prices aligned across the crypto ecosystem. Many DeFi arbitrage crypto trading strategies are executed by bots that monitor DEX liquidity pools and centralized order books simultaneously.

Statistical Arbitrage

Statistical arbitrage (or stat arb) isn’t about a single discrete price gap, but rather a data-driven approach to trading mispricings.

In crypto, statistical arbitrage usually involves algorithmic strategies and high-frequency trading to exploit patterns or correlations among assets.

Instead of directly buying on Exchange A and selling on Exchange B, stat arb traders use mathematical models to identify when one asset is statistically mispriced relative to another or to a group of others.

👉 For instance, a stat arb crypto strategy might monitor a basket of DeFi tokens that usually move in sync. If one lags behind, the algorithm might buy that token and short another temporarily, betting that they will converge again.

These strategies generate razor-thin margins on many trades and rely on automation and speed.

Statistical arbitrage is complex and typically employed by specialized funds or trading firms using bots—it’s not something a casual trader can easily do manually. It falls under arbitrage because it aims to exploit pricing inefficiencies (often across many assets), but it requires significant computational power, lots of data, and carefully managed risk.

Fig. 1. Comparison table with the key characteristics of different types of arbitrage trading in crypto.

Real-World Crypto Arbitrage: Opportunities and Why They Vanish Quickly

Arbitrage opportunities in the crypto market truly do exist, but they are extremely short-lived.

In the early days of crypto, one could occasionally find large price differences (for example, a coin trading for $100 on one exchange and $105 on another) and manually profit from them.

Today, however, such obvious gaps are rare, and when they appear, they’re usually gone in seconds.

Here’s why crypto arbitrage opportunities are so fleeting:

- Competition from Traders and Bots: The moment a price inefficiency appears, arbitrageurs around the world jump on it. With modern technology, any inefficient pricing is typically acted on almost immediately, and the opportunity is eliminated often in a matter of seconds. In fact, most arbitrage trading on cryptocurrency exchanges is done by automated programs. Asset arbitrage is usually done with bots that simultaneously buy and sell across exchanges, eliminating human reaction delays. Because many publicly available arbitrage bots exist (and anyone can use them), the playing field is very competitive. Only those with the fastest connections or proprietary algorithms might gain an edge.

- Market Dynamics Correct the Disparity: When arbitrageurs start buying an asset on the cheaper exchange, that buying pushes the price up on that venue. Meanwhile, selling on the expensive exchange pushes the price down there. Very quickly, the prices converge. In our earlier example, as people buy BTC on Binance (raising the price) and sell on Gemini (lowering the price), the $104 gap will shrink to zero. Thus, arbitrage in crypto markets is self-correcting—it’s one of the mechanisms that keeps prices fairly consistent globally.

- Transfer and Execution Delays: In cross-exchange arbitrage, you often need to transfer the asset (or a stablecoin) from one exchange to another to complete the trade. These transfers rely on blockchain confirmations or internal processing, which take time. If it takes 10 minutes to move your Bitcoin, its price could easily move beyond your arbitrage window. The time it takes to validate transactions on-chain can derail an arbitrage trade, as the market may move against you before you’re done. Even within one exchange (like with a triangular arbitrage), executing multiple trades sequentially carries the risk that by the time you place the second or third trade, the price has changed. In fast-moving crypto markets, traders must respond quickly to capitalize on arbitrage opportunities—any hesitation or delay can turn a winning trade into a breakeven or losing one.

- Exchange Limits and Frictions: Practical issues can ruin an arbitrage attempt. Exchanges have withdrawal and deposit limits; if you hit a daily limit, you might not move the funds needed in time. KYC/AML procedures or security holds can delay access to funds. There’s also the risk of exchange outages or wallet maintenance preventing transfers at the critical moment. In the worst case, an exchange might freeze trading or get hacked while you’re mid-arbitrage, leaving you unable to complete the cycle. These operational risks mean arbitrage trading crypto isn’t as risk-free as it sounds.

👉 In summary, crypto arbitrage trading is profitable only for those who can act with lightning speed and precision. The vast majority of straightforward arbitrage gaps are hoovered up by sophisticated traders or bots long before the average person can even notice them.

This arms race for speed and efficiency is why many retail traders find arbitrage too daunting—by the time you spot a price difference on your screen, it’s likely already gone. Modern markets are highly efficient, and any free lunch gets eaten very quickly.

Pros and Cons of Crypto Arbitrage

Like any trading strategy, arbitrage has its advantages and drawbacks. It’s important to weigh these before diving in:

Potential Benefits of Arbitrage Trading Cryptocurrency:

- Low (Directional) Risk: Arbitrage doesn’t require betting on market direction. You’re simultaneously buying and selling, so you’re not exposed to the asset’s price going up or down for long. If executed perfectly, arbitrage can be considered market-neutral and theoretically risk-free profit. You’re simply capitalizing on mispricing, not on the asset’s inherent value changes.

- Quick Realization of Profit: Unlike long-term investing, arbitrage deals are closed quickly—often within minutes or even seconds. You don’t have to wait days or weeks to see if a trade pans out. If a crypto arbitrage trade is successful, the profit is realized almost immediately once the transactions settle. This rapid turnover can be attractive if you’re trying to compound small gains frequently.

- Opportunities in All Market Conditions: Arbitrage opportunities aren’t limited to bull or bear markets. They can occur anytime there’s a pricing discrepancy. This means even if the overall market is flat or choppy, an arbitrageur could still find ways to make profits. For example, during market crashes, sometimes certain exchanges lag in price updates, opening short-lived gaps. In euphoric rallies, some coins might temporarily trade higher on exchanges that are slower to onboard new sellers. The strategy is about market inefficiency, not market direction.

Limitations and Risks of Arbitrage Crypto Trading:

- Small Margins (Need Large Capital): Arbitrage typically yields very slim profit margins per trade—often fractions of a percent. After accounting for fees, you might be looking at gains of 0.1%–2% on a trade, if that. To make meaningful money, you have to trade large volumes. This means tying up a lot of capital for relatively small returns, or repeating the process many times. As one Investopedia article notes, arbitrage usually involves trading substantial amounts of money, and often it’s done by large financial players. If you only have a small bankroll, the absolute profits from arbitrage might not justify the effort and risk.

- Exchange Fees and Costs: “Free” profit can quickly turn into a loss once you factor in transaction costs. Trading fees, withdrawal fees, deposit fees, and even network fees (like Ethereum gas) all eat into arbitrage margins. Continuing our earlier UNI/ETH example, if total fees for the cycle amounted to 1.5%, that would reduce a 3.8% profit to about 2.3%. In many cases, by the time you pay two trading fees and a withdrawal fee, a 1% price discrepancy could net out to zero gain or a negative. Successful arbitrageurs meticulously account for all fees before attempting a trade. Often, an arbitrage gap isn’t truly profitable unless it’s significantly larger than the total cost of executing the transactions.

- Execution Risk: In theory, arbitrage is risk-free; in practice, execution risk is very real. Prices can move while your trades or transfers are in progress, turning an expected profit into a loss. There’s also the possibility of slippage – the act of placing large orders might move the price, especially on lower-liquidity exchanges, reducing your profit. If one leg of the trade fails (e.g., your sell order doesn’t fill at the expected price), you could end up holding an asset that’s now worth less than you paid on the other exchange. Effective arbitrage demands flawless trade execution under pressure.

- Technical and Operational Risks: Arbitrage trading requires juggling multiple accounts, wallets, and transactions. Technical issues can and do happen: an API glitch, an exchange going into maintenance, a blockchain congestion spike, or even just your internet dropping at the wrong moment can blow up a carefully planned arbitrage. Additionally, keeping funds on many exchanges introduces counterparty risk – the risk that an exchange could freeze withdrawals or suffer a hack while you have assets there. Arbitrageurs have to distribute capital across platforms, which increases exposure to any single platform’s failure. This is why many arbitrageurs are actually teams or firms with robust systems and safeguards, rather than individual retail traders.

- Intense Competition & Need for Speed: As highlighted earlier, you’ll likely be competing against professional outfits that use co-located servers and algorithmic bots to sniff out and execute on price differences in milliseconds. Arbitrage has essentially become a high-frequency trading game. Without sophisticated software and infrastructure, a retail trader is at a significant disadvantage. Even with a good bot, if it’s a generic one many others use, the edge is minimal. In arbitrage trading, speed is king – and most individuals simply cannot react fast enough to beat the bots.

👉 The bottom line is that crypto arbitrage tends to offer low reward for the effort and capital required, especially for everyday traders. It’s not impossible to profit, but the easy pickings of years past have largely disappeared.

Arbitrage still plays an important role in the market (ensuring prices don’t drift too far apart), but it’s mostly the realm of specialized traders and automated systems now. Fortunately, there are other ways to profit from crypto’s price movements that don’t rely on finding these tiny needle-in-haystack opportunities.

Bitsgap’s Automated Trading Bots—Smart Alternatives to Arbitrage

You might be wondering: if arbitrage is so challenging, how else can one profit from the crypto market’s price swings?

This is where automated trading bots come in.

Bitsgap happens to specialize in trading automation, offering a suite of bots that help users capitalize on crypto volatility without having to hunt for arbitrage gaps.

In fact, Bitsgap previously offered a crypto arbitrage tool in its platform (and may do so again in the future), but as the market evolved, Bitsgap shifted focus to other high-performing trading strategies.

Instead of chasing fleeting arbitrage trades, Bitsgap users can deploy bots that generate profits in trending or sideways markets, with much less stress.

Bitsgap currently offers several types of trading bots—each with a distinct strategy. Here’s an overview of the key bots and how they present a powerful alternative to manual arbitrage strategies:

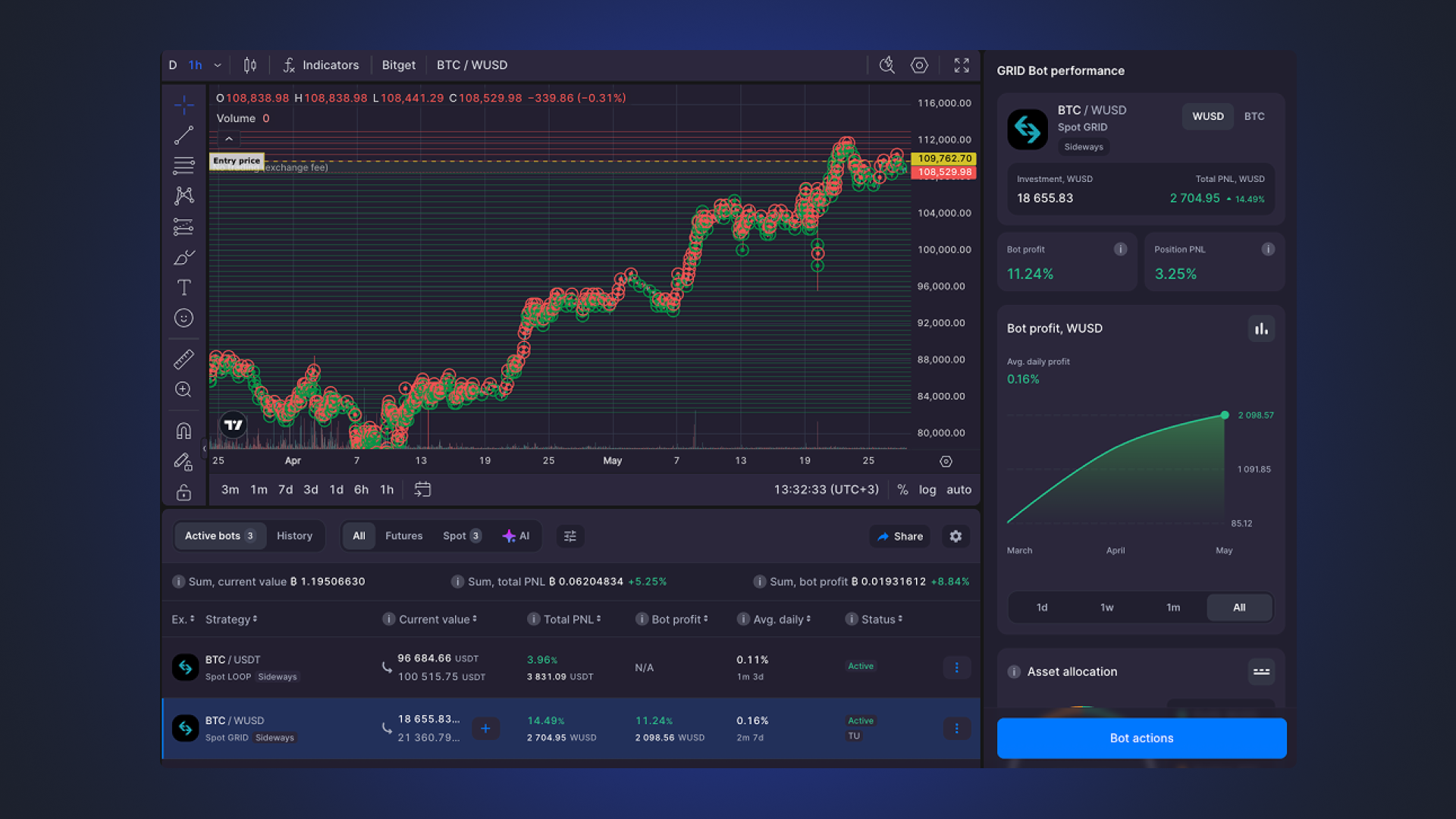

GRID Bot

The GRID bot is designed to profit from ranging or sideways markets by placing a series of buy and sell orders (a grid of orders) around a specified price range. Essentially, the bot buys low and sells high over and over, pocketing small profits on each oscillation.

👉 If you expect a coin to fluctuate between, say, $0.90 and $1.10 for a while, a GRID bot can repeatedly buy dips and sell rallies within that band.

Bitsgap’s GRID trading strategy has proven effective for capturing these micro-scale gains that many other traders would miss.

In fact, Bitsgap offers multiple preset grid bot modes as well as a custom mode where you can fine-tune the grid settings to your liking. All these modes follow the same core principle of a grid: they automate the age-old adage of “buy low, sell high.”

By running a GRID bot, you turn small market wiggles into cumulative profit, which can be a great alternative to arbitrage because it doesn’t require a price discrepancy between different exchanges—it just requires price movement.

👉 Learn more about the GRID Bot

DCA Bot

Bitsgap’s DCA Bot employs the Dollar-Cost Averaging strategy in an automated fashion. Dollar-cost averaging involves splitting your buying (or selling) into multiple smaller orders at regular intervals or predetermined price levels, rather than one lump sum. The idea is to average out your entry price and reduce the impact of volatility.

The DCA bot allows you to enter a position gradually and even average down if the price moves against you initially.

👉 For example, instead of buying 1 ETH all at once at $1,800, you might instruct the DCA bot to buy 0.2 ETH every time the price drops by another $50. If ETH dips to $1,700, you’ve bought at several points and your average cost is lower than it would have been buying everything at $1,800.

The Bitsgap DCA bot is quite powerful—it can place up to 100 safety orders, lets you customize the spacing or timing of these orders, and even integrates technical indicators to signal optimal moments to start buying or selling.

With built-in risk management features like take-profit and stop-loss, the DCA bot essentially automates a prudent trading plan so you don’t have to manually watch the market 24/7.

It’s a fantastic tool for executing swing trading strategies or accumulating coins over time. Instead of betting on a perfect entry, you let the DCA bot smooth out the ride.

Many traders find that using the DCA bot to handle volatile markets is far less stressful and more effective than trying to time arbitrage trades. It’s a great way to automate your trading routine and ensure you buying or selling systematically.

👉 Learn more about the DCA Bot

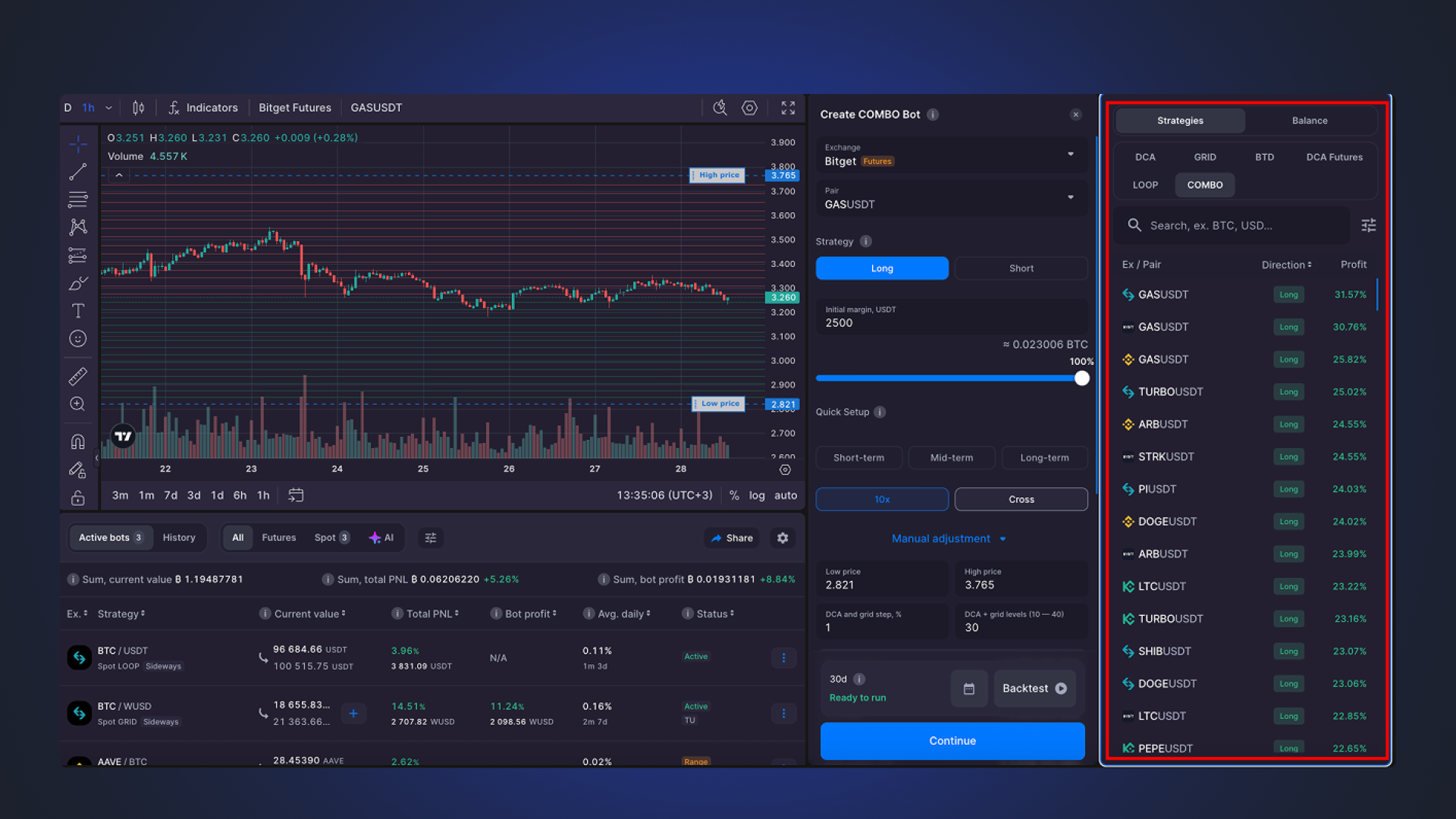

COMBO Bot

The COMBO bot is Bitsgap’s advanced automation for futures trading. It’s named “COMBO” because it combines strategies—specifically, it merges the grid approach with the DCA approach, tuned for the futures market.

Crypto futures allow you to trade with leverage (borrowed funds) and to profit from both rising and falling prices (long and short positions).

The COMBO bot takes advantage of this by using a hybrid strategy: it uses a DCA-like technique to optimize your entry and a GRID-like technique to take incremental profits.

👉 For instance, if you expect Bitcoin’s price to eventually rise but with lots of bumps on the way, the COMBO bot can open a long position in a way that if BTC first dips, it will average down (adding to the long position at better prices), and as BTC rises, it will scale out by taking profits at multiple levels (like a grid of sell orders). This way, the bot profits from every swing in the market, not just the final outcome.

COMBO is particularly useful in futures because it also handles the nuances of margin and liquidation—the bot manages your take-profit and stop-loss, and you can set it to only use a certain margin so it doesn’t overextend.

It’s a higher risk, higher reward bot (as futures usually are), but it’s far more systematic and disciplined than manual leveraged trading.

By capturing both small oscillations and the larger trend, the COMBO bot strives to squeeze more profit out of a futures trade than a simple one-shot trade would. This kind of approach can yield much larger returns than typical arbitrage (since you might use 5x or 10x leverage), though of course with higher risk.

Essentially, Bitsgap’s COMBO Bot lets you trade futures 24/7 with a predefined plan, so you’re not glued to the screen—the bot adjusts orders on the fly.

If arbitrage is about pennies of guaranteed profit, the COMBO bot is about intelligently riding the market’s waves for significantly bigger gains.

👉 Learn more about the COMBO Bot

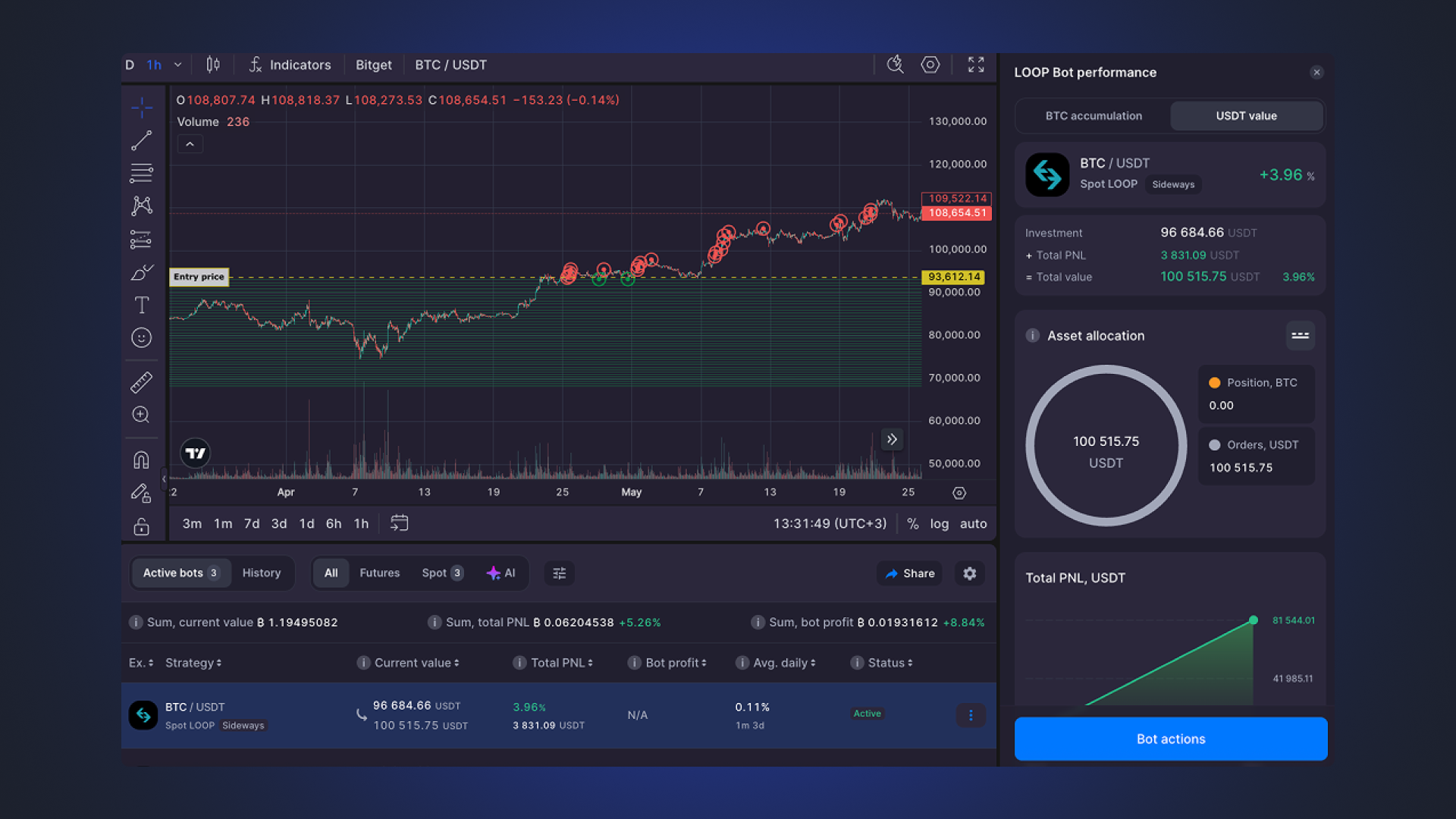

LOOP Bot

The LOOP bot is one of Bitsgap’s newest and most innovative offerings. This bot is an advanced position trading tool designed for the spot market (non-leveraged trading) with a long-term, compounding approach.

At its core, the LOOP bot operates within a price range—it places a dynamic grid of buy and sell orders and continuously buys low, sells high as the price oscillates.

What makes LOOP special is that it automatically reinvests the profits from each completed buy-sell cycle back into your trading capital. In other words, it “loops” your profits back into the position, growing the position size over time. This compounding effect can accelerate the growth of your portfolio versus a standard grid bot that might leave profits sitting idle after each cycle.

The LOOP bot thrives in sideways or moderately volatile markets where price moves up and down within a range over an extended period.

It has a dynamic order adjustment system that can move the grid or skip certain orders to avoid bad trades if the market starts trending one way too strongly.

Another neat aspect is that the LOOP Bot tracks profits in two currencies—both the base asset and the quote asset.

👉 For example, if you run a LOOP bot on the BTC/USDT pair, it can secure profits in BTC when price drops (increasing your BTC holdings) and secure profits in USDT when price rises (increasing your USD balance). This dual-currency accumulation means you have flexibility: you can stop the bot and exit entirely into USD if you want, or into BTC, whichever suits your goal.

The LOOP bot essentially automates a “buy low, sell high, and grow my stack over time” strategy with minimal oversight needed. It’s perfect for hands-off investors who want to gradually enlarge their position in a coin.

Compared to chasing arbitrage deals, deploying a LOOP bot on a coin you believe in for the long run can be far more rewarding, as it continuously works to increase your holdings through small cycles. It’s like putting your assets on autopilot to earn more of themselves.

👉 Learn more about the LOOP Bot

BTD Bot (Buy the Dip Bot)

The BTD Bot, short for “Buy The Dip,” is a specialized bot strategy offered by Bitsgap that does exactly what its name implies—it jumps on sudden price drops to buy low.

This bot is essentially an automation of the classic advice “buy the dip,” which means when a coin’s price sharply falls (but the fundamentals haven’t changed), that drop could be a great buying opportunity.

Manually catching dips is tough; it requires timing, discipline, and often emotion gets in the way (it’s scary to buy when a coin is plunging!). The BTD bot removes the emotion and executes your plan for you. It continuously monitors the market and when it detects a significant dip for the coin you’re targeting, it will execute a buy order for you.

The idea is that the BTD bot gets you in at a great price point automatically. This is especially useful in crypto because sudden flash crashes or wicks happen quite often—and they’re often followed by a bounce.

BTD bot ensures you seize the opportunity to buy low when many others are panic-selling. It’s a tool for bulls who have conviction that an asset will recover after a dip.

By using the BTD bot, you avoid missing out on those quick drop-and-rebound scenarios. As a result, you can accumulate coins at bargain prices and maximize profit when the price corrects back up.

The BTD bot can complement other strategies (for instance, feeding into a DCA plan).

Overall, it’s another example of automation making a job easier—instead of watching the chart 24/7 or setting dozens of alerts, you let the bot watch for your predefined dip conditions and handle the trade instantly.

For traders who are long-term optimistic on a coin, this is a fantastic way to grow your position. It plays into the strength of crypto volatility by treating sharp drops not as scares, but as chances to buy.

And again, it’s a more approachable strategy for most people than chasing arbitrage, because you’re focusing on a coin you want to hold and letting the bot improve your entry cost.

👉 Learn more about the BTD Bot

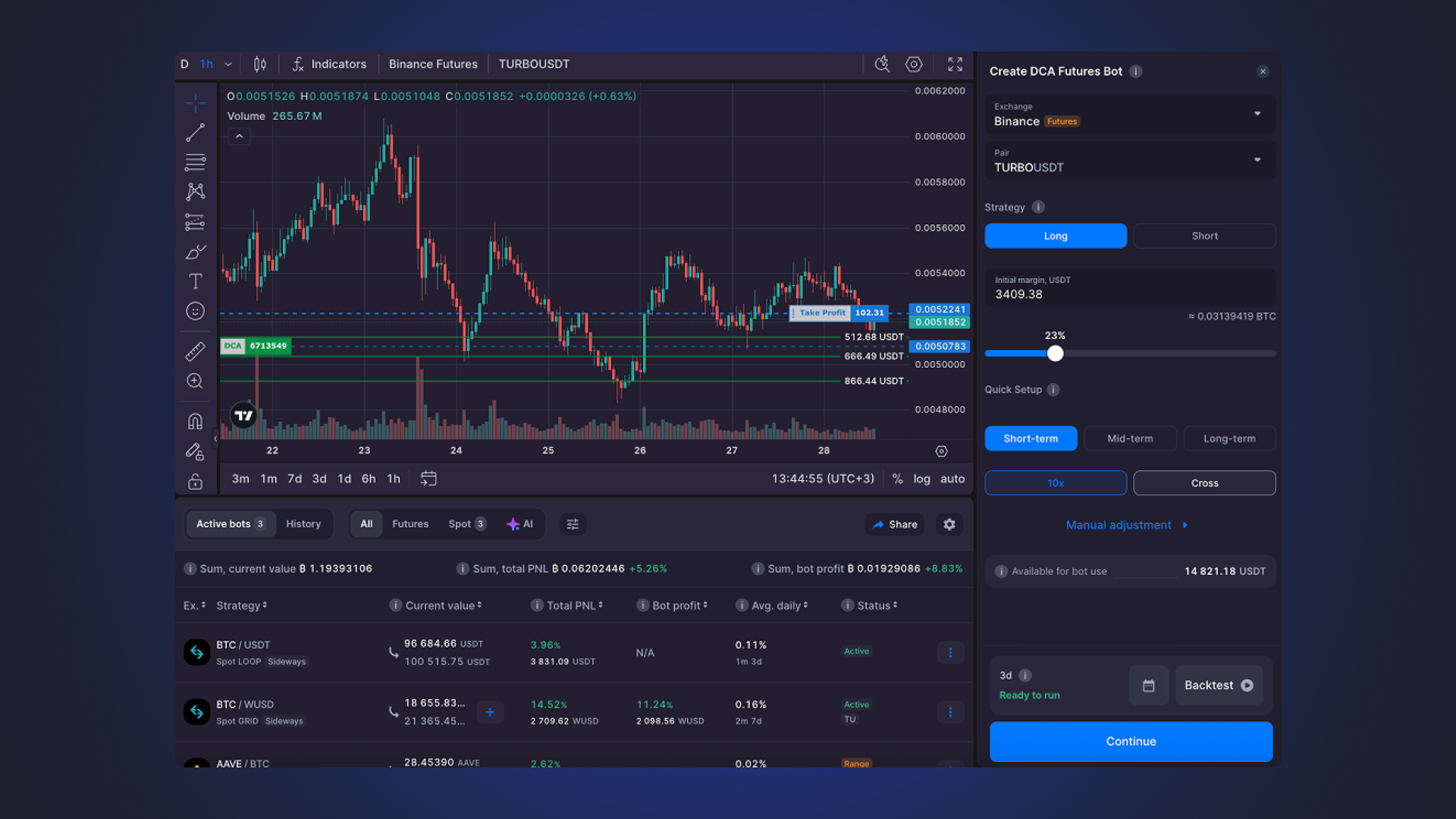

DCA Futures Bot

The DCA Futures Bot is Bitsgap’s solution for those who want to apply the proven dollar-cost averaging method to the high-stakes world of crypto futures.

Trading futures (perpetual swaps, etc.) allows one to go long or short with leverage, but it can be very volatile and risky to time the market.

The DCA Futures bot helps mitigate that risk by building a position gradually, just like the regular DCA bot, but in a futures context.

Suppose you want to enter a leveraged long position on Ethereum, but you’re worried the price might drop after you enter—the DCA Futures bot could start the long with a portion of your funds and set several additional buy orders at lower price intervals. If ETH’s price dips further, the bot adds to your position at those better prices (averaging down your entry), and if/when the price rises, you can take profit on the entire position at a target, potentially with a much nicer average entry price than if you had aped in all at once.

Likewise, the bot can work for shorting: it will short a bit, then if the price spikes upward (against your short), it will short more at higher levels, improving your average entry for an eventual drop.

The DCA Futures bot effectively brings structured, disciplined trading to futures, which are otherwise a realm where traders often get wrecked by impulsive decisions.

Bitsgap’s DCA Futures bot also layers on important risk management—you can set stop-loss and take-profit levels, and the bot will handle those, so you’re not caught off guard by sudden moves. It even suggests not to max out leverage; while you can use up to 10× leverage with the bot, it’s usually wise to keep some cushion.

By automating entries, the DCA Futures bot helps you navigate futures with precision. Instead of one all-or-nothing bet, you have a plan that adapts.

For traders who enjoy futures for their higher profit potential, the DCA Futures bot offers a way to engage those markets more safely and systematically. It’s particularly useful in choppy or unpredictable markets—times when even experienced traders might struggle to pick a perfect entry.

Rather than fighting for small arbitrage gains, a trader using the DCA Futures bot might capture a much larger move with a well-averaged position.

And because it’s automated, you avoid the emotional rollercoaster of watching every tick; the bot executes the strategy calmly according to the rules you set.

👉 Learn more about the DCA Futures Bot

Fig. 3. Bitsgap automated trading bots vs. arbitrage

As you can see, Bitsgap’s trading bots cover a spectrum of strategies for different market conditions—ranging from low-risk incremental gains (GRID, DCA) to more aggressive leveraged plays (COMBO, Futures) and innovative compounding methods (LOOP, BTD).

What they all have in common is that they leverage automation to take the heavy lifting and emotion out of trading. Instead of manually executing complex strategies or racing against other arbitrageurs, you can deploy a bot, configure it in a few clicks, and let it run. The bot will tirelessly follow the strategy logic, something human traders would find exhausting or impossible to do 24/7.

This is why many see algorithmic trading bots as a superior alternative to manual arbitrage—you’re still profiting from market inefficiencies or patterns, but in a way that’s sustainable and accessible.

Choosing the Best Arbitrage Trading Platform (and Considering Alternatives)

If you’re still intrigued by arbitrage, you might wonder how to choose the best arbitrage trading platform or tools to assist you. Here are a few tips on what to look for in an arbitrage platform or service:

- Multi-Exchange Connectivity: A good arbitrage platform should connect to many major exchanges (via API) and allow you to execute trades on all of them quickly. The more exchanges covered, the more opportunities can be found. It should also update price feeds in real-time. Essentially, you want a single interface that can scan numerous markets and let you trade on each without logging into them individually – speed is crucial in arbitrage.

- Automation and Alerts: Given how fast arbitrage opportunities evaporate, manual execution is nearly impractical. Look for platforms that support automated arbitrage trading or at least instant alerts when a price spread appears. Some platforms historically offered one-click arbitrage, where the system calculates the spread after fees and you just confirm the trade. If you plan to attempt arbitrage seriously, an automation feature (or a custom bot) is almost a must-have. Manual arbitrage trading (trying to do it all by yourself) often can’t keep up with the market’s pace.

- Low Fees and Minimal Transfer Times: Arbitrage profits are razor thin, so high fees can turn a winning trade into a loser. The best arbitrage trading platforms will either have low internal fees or recommend exchanges that have low fees. Some platforms might even facilitate internal transfers or use techniques to reduce the need to move funds across chains. Keep an eye on withdrawal fees especially – if you have to constantly move money between exchanges, those fees add up. A platform that can find arbitrage paths not requiring on-chain transfers (e.g. triangular arbitrage within one exchange, or using proxy tokens) can save you time and money.

- Reliability and Security: You’ll likely need to trust the platform with API keys to your exchange accounts. Make sure it’s reputable, secure, and ideally has a track record (community reviews, etc.). Also consider the stability – if the platform goes down or lags often, you could be stuck in the middle of a trade. In arbitrage, a small glitch can cause a big loss. So a reliable, well-supported service is important.

- Global Accessibility: If you’re looking at spatial arbitrage (across regions), some platforms might help by having infrastructure in different countries or by highlighting price differences inclusive of currency conversion. Also, ensure the platform itself is available in your jurisdiction and complies with any regulations.

Now, it’s worth noting that for a while, Bitsgap itself provided an arbitrage tool that showed price differences across exchanges and allowed users to execute those trades. Many users enjoyed it, but over time the feature was phased out as direct arbitrage became less profitable. The reason is simple: as we’ve detailed, pure arbitrage is now a tough game for retail traders. Bitsgap determined that users can often get better results by employing strategies like GRID or DCA, which don’t require transfer delays and can thrive in the crypto market’s natural volatility.

Alternatives to Manual Arbitrage: If your goal is to earn relatively low-risk profit in crypto, you don’t necessarily need to chase arbitrage. Consider some alternative approaches that can be more practical:

- Using Trading Bots (like Bitsgap’s): Rather than scanning dozens of exchanges for a $50 imbalance, you could deploy a automated strategy on one exchange that earns you small gains continuously. For example, a GRID bot might net you 0.5% a day by market making in a range–that’s akin to capturing an arbitrage-sized profit daily, without moving funds around. Over time, these strategies can compound nicely. And as we described, Bitsgap’s bots can be configured to suit your risk appetite and market outlook.

- Yield Farming and Staking: Another alternative “low-risk” strategy is to earn yield on your crypto through DeFi platforms or exchange programs. While not arbitrage, yield farming sometimes involves moving assets where they earn the most (which is conceptually similar to moving them where the price is highest). For example, if USDC yields 4% on Exchange A and 8% on Platform B, moving funds is a kind of arbitrage of interest rates. Just be cautious, because higher yields can imply higher risks. Staking major coins or providing liquidity can generate returns that, while not risk-free, are relatively steady compared to active trading.

- Swing Trading with Signals: Instead of fast in-and-out arbitrage, some traders use signals or algorithms to swing trade on one exchange–buying oversold dips and selling overbought bounces. This requires some analysis or good bots, but it’s more forgiving time-wise than arbitrage. You might have hours or days to act on a signal, versus seconds in arbitrage. Bitsgap’s platform, for instance, provides tools like TradingView charts and technical indicators which can assist in such strategies, and you can use the Smart Trading terminal to set up automated buys and sells with stop-loss/take-profit.

- Copy Trading or Social Trading: If you’re not keen to devise strategies yourself, you could follow experienced traders through copy-trading platforms. Again, this is nothing like arbitrage, but it’s a way to have your funds move in and out of the market based on someone else’s (hopefully expert) strategy. Some of those trades could indirectly capture arbitrage-like opportunities if the traders are doing quant strategies. Just ensure you understand the risks and the track record of any trader you copy.

In the end, if you are determined to pursue arbitrage, do so with realistic expectations. It’s highly competitive and often requires some trial and error (and probably some coding) to get right. You might find a niche opportunity in lesser-known altcoins or on newer exchanges with inefficiencies. But always calculate your net profit after all costs, and start small to test the waters.

Most importantly, don’t fall for any services that guarantee arbitrage profits or ask you to send funds for “arbitrage investments.” The allure of arbitrage has been used in scams (“we do arbitrage for you, guaranteed 1% daily!”—which is usually a Ponzi scheme). Real arbitrage is hard work and yields small margins – nobody is going to consistently give you huge returns from it risk-free.

Given all of this, many retail investors conclude that their time and capital are better spent on more accessible trading strategies. And that’s where platforms like Bitsgap shine: providing tools to automate those strategies in a user-friendly way. Rather than trying to outgun HFT firms at the arbitrage game, you can deploy a Bitsgap bot to steadily grow your portfolio with much less stress.

Conclusion: Smarter Trading Over Arbitrage—Try Automation with Bitsgap

As the crypto market has matured, competition has grown and price discrepancies have shrunk, making pure arbitrage trading less viable for the average person. This isn’t to say arbitrage opportunities never exist—they do, but as we’ve learned, capturing them consistently requires speed, sophistication, and resources that most retail traders simply don’t have. Arbitrage trading in cryptocurrency served its purpose in earlier days, but it’s no longer the easy profit hack it might sound like.

The good news is that you don’t really need to use arbitrage to profit from crypto. There are alternative strategies and tools that can harness crypto volatility in your favor without you having to scour for tiny price gaps. Bitsgap offers a suite of smart trading automation—from the GRID bot to the DCA, COMBO, LOOP, BTD, and more—that effectively allow you to make money off market movements with a fraction of the effort and anxiety of manual arbitrage. These bots encapsulate proven trading strategies and run them for you 24/7, which for most retail traders is a far superior approach. After all, why chase a 0.2% arbitrage spread (risking network fees and timing issues) when, for example, a well-tuned GRID bot could be earning that kind of return daily by simply trading within a range?

Bitsgap’s smart trading platform is built on the idea of leveling the playing field for everyday traders. You get access to powerful algorithmic strategies without needing to be a coding wizard or a hedge fund. Whether the market is going up, down, or sideways, there’s a Bitsgap bot that can be working to grow your assets. It’s automation that plays to the strengths of crypto (volatility and 24/7 markets) while mitigating many of the pitfalls (emotional trading, lack of sleep, missed opportunities).

So, if you’re looking to profit from crypto, ask yourself: do you want to stay up all night watching for a fleeting arbitrage window? Or would you rather set up a bot in a few minutes and let it do the heavy lifting? For most of us, the answer is clear. Bitsgap’s trading bots provide a hassle-free, effective alternative to arbitrage—one that is accessible to regular traders and doesn’t require crawling through exchange order books by hand.

Give it a try and experience the difference that smart automation can make. Bitsgap offers a free trial for new users, so you can test out these bots in demo mode or with a small amount and see how they perform. Once you see your first automated profits rolling in, you might not miss the idea of arbitrage at all!

Don’t waste another moment—join Bitsgap and let automated trading bots work for you. The crypto markets aren’t waiting, and neither should you.