Behind the Scenes: How Crypto Market Makers Move Markets

Behind the scenes, a mysterious league of traders called market makers are the wizards commanding the ebb and flow of digital asset prices. Read on to uncover how crypto markets really work.

Market makers are vital in the world of cryptocurrencies. They make it easier for traders to buy and sell by ensuring there's always enough money moving around. Let's explore what they do and how they keep things running smoothly.

Market making is essential for maintaining the robustness of financial markets. It bolsters liquidity, narrows the gap between buy and sell prices, and promotes fairness in market operations, all of which are crucial for the smooth functioning of global economies that use digital tokens.

This article demystifies the complex nature of market making by offering a detailed look at the duties of market makers and how they fit into the fast-paced world of digital assets.

What Are Market Makers?

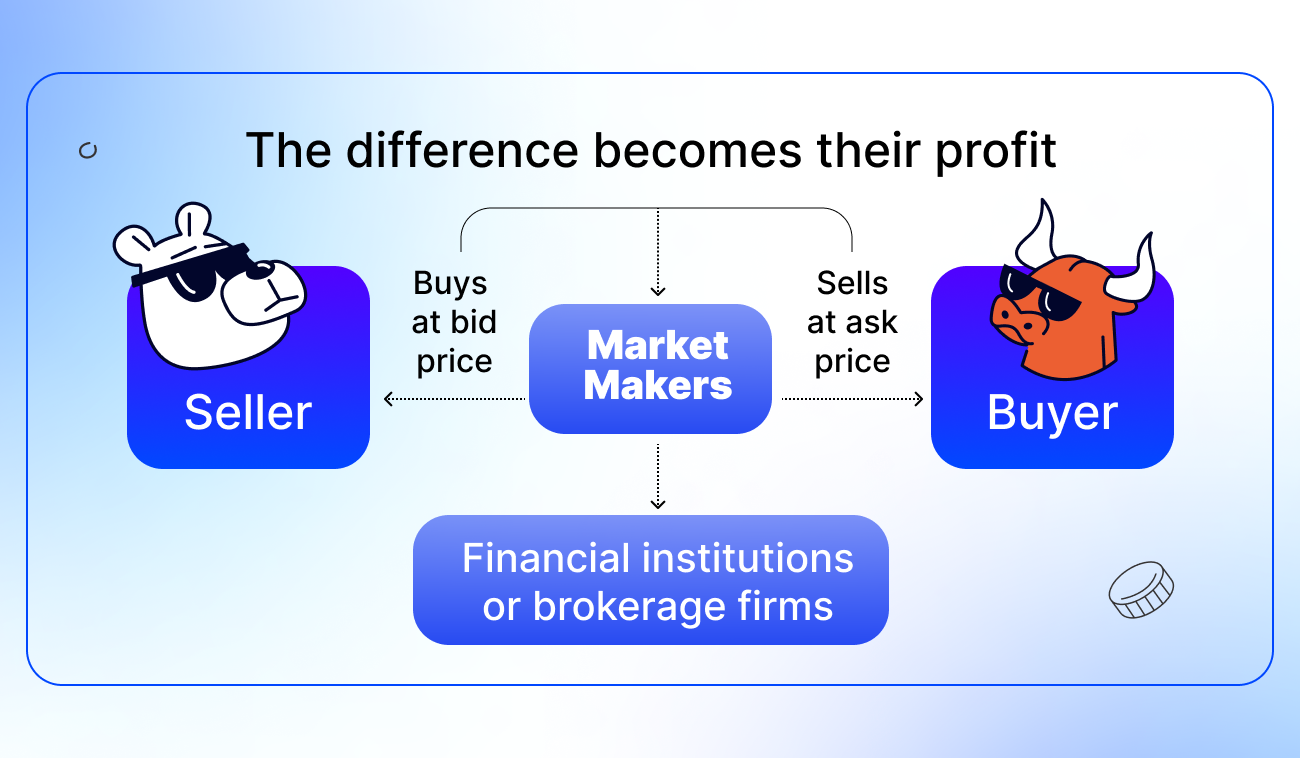

In a traditional sense, a market maker is a person or company that helps keep the stock market running smoothly by always being ready to buy or sell shares at publicly quoted prices. They make money from the small difference between the buying price and the selling price, known as the spread. Market makers include big brokerage firms that work on behalf of investors, as well as individual traders known as "locals." They're particularly important because they handle large quantities of trades, ensuring that there's always a market for securities when investors want to buy or sell.

Here's how it works: Market makers quote two prices for a security: the price they're willing to buy it for (bid) and the price they're willing to sell it for (ask). They must have a set number of shares available to trade at these prices and must maintain these quotes, no matter how choppy the market gets.

When a market maker gets an order from someone who wants to buy a share, they quickly sell from their stockpile, making the transaction fast and smooth. This is their way of adding "liquidity" to the market, which just means making it easier for people to trade.

Because holding shares comes with the risk that their value might drop, market makers get compensated through the spread. For example, if you're trading online, you might see a stock with a bid price of $50 and an ask price of $50.05. The market maker buys the stock at $50 and sells it to you for $50.05. These tiny amounts can add up to a lot when they're part of many trades.

Market makers have to play by the rules of the stock exchanges they trade on, which are enforced by financial regulators like the SEC in the U.S. The exact nature of a market maker's job can vary depending on the exchange and the kind of securities they deal with, like stocks or options. Some exchanges have a bunch of market makers competing with each other, while places like the New York Stock Exchange assign one market maker to handle trades for certain stocks, ensuring order and fair pricing in the market.

What Is Crypto Market Making?

In essence, market makers in the cryptocurrency world do something very similar to their counterparts in traditional finance, but they also have to keep coming up with new services to stay ahead in the fast-evolving digital asset market. To understand how they provide liquidity, consider the following example.

Imagine a new cryptocurrency called $FUTURE has just been launched and is now available for trading. Initially, there's uncertainty about its value, which means there aren't many people ready to buy or sell it yet. This is where market makers step in to help.

Consider two traders, Emma and Liam, who are interested in $FUTURE. Emma wants to sell her $FUTURE tokens, but she's not finding any buyers. Liam wants to buy $FUTURE tokens, but can't find sellers. The market for $FUTURE is illiquid because there's a disconnect between Emma's selling price and Liam's buying price.

Now, let's introduce a market maker named Noah. Noah's job is to provide liquidity, which he does by placing orders to buy from sellers like Emma and sell to buyers like Liam. Noah quotes a buying price that Emma is comfortable selling at, and he also sets a selling price that Liam finds reasonable to buy at, effectively bridging the price gap between Emma and Liam. This is called "tightening the spread."

Thanks to Noah's role as a market maker, he not only makes it possible for Emma and Liam to execute their trades smoothly but also enhances the overall liquidity of $FUTURE in the market. As a result, any trader can now buy or sell $FUTURE tokens with greater ease, without having to wait for a matching buyer or seller. This fluidity is crucial for the health and efficiency of the trading environment, whether in the traditional financial markets or in the dynamic crypto space.

Who Are Cryptocurrency Market Makers?

Market makers play a crucial role in the cryptocurrency trading ecosystem by injecting liquidity into the market, which ensures that there's always enough activity in the order books for trades to occur without delay. They effectively bridge the gap between those looking to sell tokens and those looking to buy, facilitating the quick and smooth transfer of positions between traders.

Typically, market makers are big financial institutions with the capacity to handle large trading volumes, which is necessary to ensure market fluidity. Nevertheless, it's also possible for individual traders to take on this role, provided they can meet the high standards required. This task is often left to specialized firms that focus on market making as their main business.

Below is an outline of a few key players who might be market makers:

- Individuals: Regular people who trade by setting limit orders on exchanges, looking to make a profit from the price differences between buying and selling.

- Market-making firms: These specialized companies focus on creating markets for a range of financial products, including cryptos. They use complex programs and tech to automate their trading.

- Exchanges: Some crypto exchanges step in to make markets themselves. They match up buyers and sellers and sometimes use their own money to make sure trades go through smoothly.

- High-frequency Traders (HFTs): These firms use powerful algorithms and super-fast trades to place lots of orders almost instantly. They often make markets to capitalize on tiny, quick price changes.

- Arbitrageurs: These traders look for price gaps across different exchanges or trading pairs to buy low and sell high, which helps even out prices between markets.

- Algorithmic traders: Both individuals and firms use complex algorithms that constantly tweak their buy and sell prices based on what's happening in the market and order book activity.

- Token creators: In the decentralized finance sector, some token creators also get involved in making markets for their tokens. They add liquidity to decentralized exchanges to keep trading active for their tokens.

- Institutional players: Big financial institutions like hedge funds and trading firms might also act as market makers, adding a lot of liquidity to the crypto market.

- Crypto funds: Funds that focus on cryptocurrencies might make markets as part of their strategy, using their resources and know-how to keep the market moving.

Also worth mentioning are market maker brokers, who act as middlemen between individual traders and the liquidity that market makers provide. These brokers are like connectors, linking traders with the active trading environment that market makers support.

Market maker brokers are pivotal in making sure traders can always buy and sell, particularly in the fast-moving crypto world. They provide the platforms and the variety of digital assets that traders need to carry out their trading plans.

For traders in the crypto market, it's important to check that there's a clear separation between the exchange hosting the trading and the entities providing market making services. This helps prevent any potential conflicts of interest and promotes a fair trading environment.

How Market Makers Work on Crypto Exchanges?

Market makers are the behind-the-scenes heroes who make sure that when you want to trade crypto, you can do it without a lot of waiting or uncertainty about the price.

Here’s what they do:

- Keep the store stocked: Market makers place buy and sell orders for cryptocurrencies all the time. This is like making sure the shelves are always stocked so customers can buy what they want.

- Set fair prices: They help set the price for cryptocurrencies by deciding how much they're willing to buy and sell them for. This gap between buying and selling price is where they make their money—it's like a convenience fee for making sure the trade happens immediately.

- Trade super fast: Many market makers use computer programs to buy and sell very quickly — much faster than a human could. This helps them adjust to new prices and keep the market moving smoothly.

- Balance their books: They try not to have too much or too little of any cryptocurrency. This way, they don't get caught off guard by sudden price changes.

- Get a discount: Sometimes, exchanges give market makers a little discount on trading fees because they help keep the market running well.

- Stay safe: Since they use a lot of technology, they have to make sure their systems are secure and running properly so there are no hiccups in trading.

What Are the Benefits of Crypto Market Making for Crypto Exchanges?

Market makers are a boon to cryptocurrency exchanges, playing a vital role in boosting the efficiency of trading.

Here's how they help:

- Keep things moving: Market makers are always ready to buy or sell. This means that there's always action on the exchange, and you don't have to wait long to trade your crypto.

- Attract more people: Because market makers keep trades moving smoothly, more traders are likely to use the exchange. This means more people to trade with and more activity overall.

- Steady prices: Market makers help prevent wild swings in prices by setting buying and selling prices close to each other. This makes trading less risky and more comfortable for traders.

- Confidence boost: When traders see that they can buy and sell easily and that prices aren't bouncing around too much, they feel more confident about trading.

- Helping the underdogs: Some cryptocurrencies aren't traded a lot, which can make them hard to buy or sell. Market makers step in and make these "quieter" coins easier to trade, which gets them more attention and makes them more attractive to investors.

What Are the Strategies Employed by Market Makers?

Market makers use sophisticated computer programs to refine how they do business. These programs crunch market numbers, spot chances to trade, and rely on tech and smart trading moves to keep the market full of buying and selling opportunities while adapting quickly to any market shifts.

Market makers don't just help keep the market flowing — they can also influence it because they really get how the market works. They know things like where orders are waiting, how trades are spread out, and the typical spots where traders set their stop-losses and targets to cash out.

Let's say the price of Solana is on an upswing, and a market maker spots a bunch of stop-loss orders piling up around $90, but there aren't many people looking to buy at that price.

Seeing this, the market maker might jump in and start buying big between $80 and $85, snapping up orders from sellers. This move can push the price down to $90 for a moment, setting off those stop-loss orders. Then, if things go as the market maker planned, Solana's price shoots up — let's say to $95 — and that's when they'll sell off what they bought.

Bottom Line

Market making is like the glue that holds the financial market together, keeping things steady and preventing the kind of wild price swings that can lead to big losses. Market makers are the behind-the-scenes heroes who make sure there's always enough activity in the market so that you can buy and sell without huge delays or price differences.

Now, it's true that some folks might give market makers the side-eye, thinking they sometimes play the system to tweak market prices. Remember, though, that's not the whole picture. Not all market makers are into these shady moves, and most are actually all about keeping the market running smoothly and efficiently.

Even with a bit of side drama, the good that market makers do for the crypto market's health far outweighs any mischief. They bring a lot of energy and stability to the table, making sure the crypto world keeps spinning in a good way.

Looking for a Reliable Trading Ally to Trade Across Multiple Platforms?

Searching for a seamless crypto trading experience across various exchanges? Bitsgap has got you covered. It's your one-stop crypto trading powerhouse, amalgamating up to 15 exchanges in a single, sleek interface. But that's not all — Bitsgap comes loaded with an array of impressive extras. From sturdy portfolio and risk management resources to automated trading bots that work around the clock, and from savvy trading features like trailing stops and hedging tools to top-tier charting instruments. Plus, with the Technicals Widget, you get a comprehensive digest of numerous trading signals all in one potent gauge. Dive into Bitsgap, where convenience meets functionality. First 7 day free!

FAQs

What Is the Cryptocurrency Market?

The cryptocurrency market is a digital environment where people buy, sell, and trade digital currencies. Cryptocurrencies like bitcoin are encrypted digital money that use blockchain technology to enable secure peer-to-peer transactions without third party intermediaries. In this virtual landscape, participants can invest in cryptos as speculative assets with the aim of generating returns. The crypto market enables the exchange of decentralized digital tokens and coins that are governed by cryptography and operate independently of central banks.

How Is the Crypto Market Doing?

The crypto market is known for its rapid and significant fluctuations, and currently, it's experiencing quite a positive phase. The long-awaited approval of a Bitcoin spot ETF has been met with a mix of volatility and enthusiasm, causing Bitcoin's price to swing sharply. With the greed index climbing, there's a surge of investor enthusiasm, and the prevailing mood in the market is predominantly optimistic.

What Is a Crypto Currency Market Maker?

A crypto market maker is like a matchmaker for buyers and sellers in the cryptocurrency world. They help people trade smoothly by always being ready to buy or sell crypto at set prices.