How Do You Trade & Store Altcoins Comparing to BTC?

In this article. Bitsgap covers altcoins and everything you need to know to get started trading and investing in them in the current market.

Almost everyone has heard of Bitcoin by now, but it’s not the only cryptocurrency. In fact, anything that’s not Bitcoin is called an ‘altcoin.’ And these are plenty! Many altcoins have even more tricks up their sleeve and offer more functionality to cryptocurrency holders than Bitcoin ever could.

What are they, though? How many altcoins are there? How to buy them? In this article, we’ll cover altcoins and everything you always wanted to know about but were afraid to ask!

As a cherry on top, we’ll go over the top 10 altcoins for 2023 and explain why use Bitsgap for trading altcoins.

What Are Alt Coins and Their Difference from Tokens?

Crypto talk can be a bit dizzying, especially when some terms are used interchangeably. That’s okay. Even crypto pros don’t always get it right. However, it’s worth knowing the difference between various crypto terms and definitions. Let’s start with coins vs. tokens before moving on to altcoins.

A coin is a cryptocurrency that comes with its own dedicated blockchain. For example, Ethereum’s coin is Ether. A token, on the other hand, is a crypto asset that runs on another cryptocurrency’s blockchain. For example, although USDC is called the USD Coin, it is, in fact, a token that runs on the Ethereum blockchain.

👉 Every cryptocurrency that’s not Bitcoin is considered an alternative coin or altcoin for short.

Some argue that Ether has to be included in the definition as it was the second original cryptocurrency and, therefore, could not be called just any other alternative coin. According to those crypto enthusiasts, an altcoin refers to any crypto that’s neither Bitcoin nor Ether.

The Altcoins Purpose: a Bitcoin Alternative

The whole purpose of altcoins is to provide a viable alternative to Bitcoin. As mentioned, the first such breakthrough alternative to Bitcoin was Ethereum, which Vitalik Buterin and Dr. Gavin Wood developed. Ethereum is a blockchain and distributed platform that allows anyone to create anything on its blockchain.

Many projects and tokens have been built on Ethereum since its inception, enabling the ICO craze of 2017-18. Ether, on the other hand, is a cryptocurrency used to pay for on-chain Ethereum transactions but also can be used for payment, investment, and trading on exchanges.

👉 Altcoins are designed by engineers who have a different vision for the development, use, and future of cryptocurrencies. Some altcoins use different consensus mechanisms to validate transactions or provide new additional functionality, better speed, or lower transaction fees.

Some of the altcoins are forks. A fork happens when a blockchain splits from its original chain (such as Bitcoin or Ethereum). There are typically many reasons for forks to occur. The most common, though, is when developers leave a project for personal or philosophical reasons, such as different visions for the project’s development, and start making coins on their own.

Bitcoin Cash, for example, was the result of such differences. In 2017, a group of Bitcoin activists disagreed with developers over the running of nodes and block sizes and created a spin-off from Bitcoin — Bitcoin Cash, a product of the hard fork.

Types of Altcoins

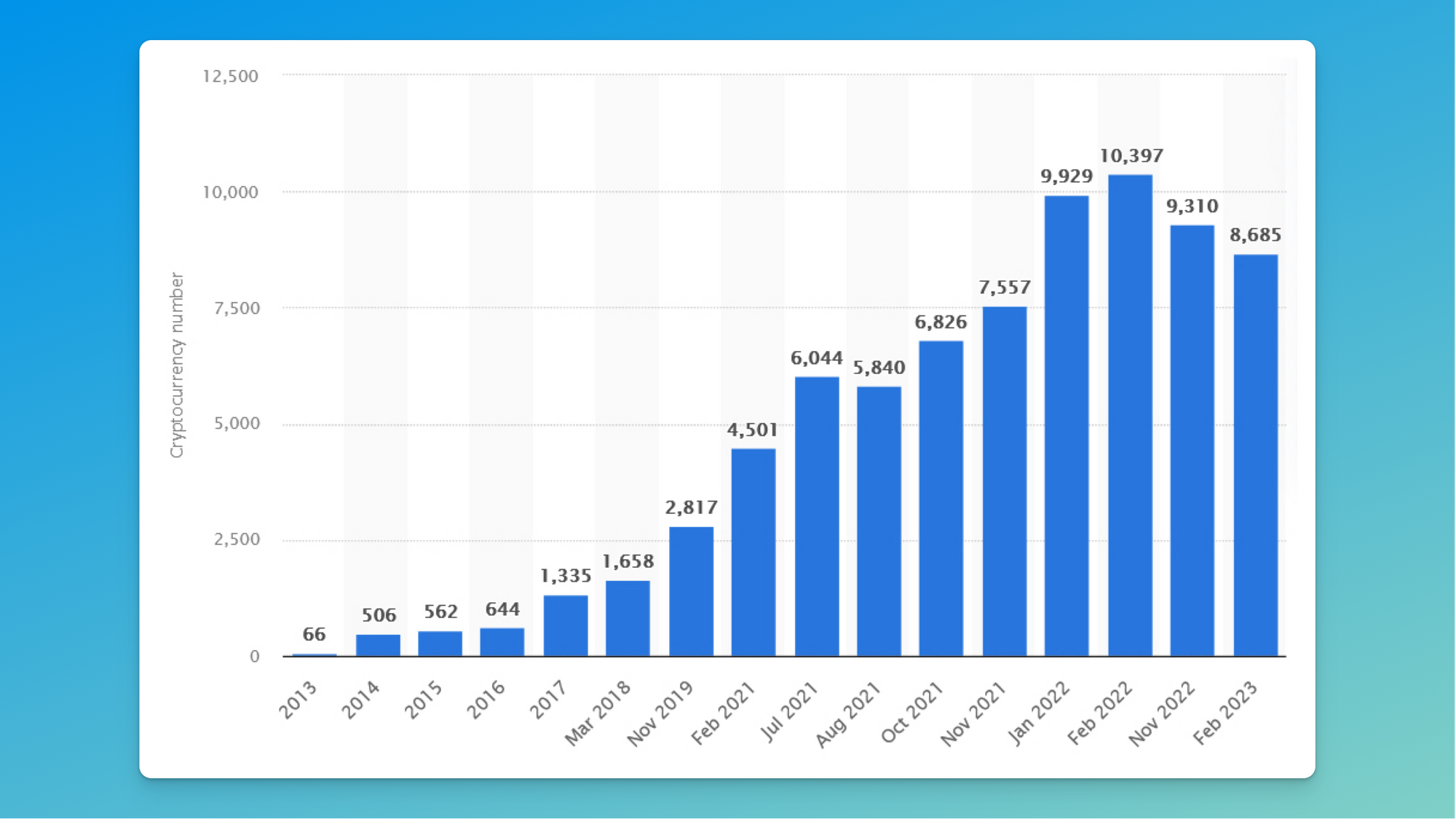

As of February 2023, there are 8,685 cryptocurrencies in circulation. The number is significantly less than an all-time high a year previously — 10,937 — but still much more than in 2013, when there were just 66 altcoins.

There are different types of altcoins. Let’s talk a bit about each:

- Payment tokens are designed for use as currency, such as Bitcoin.

- Stablecoins are coins that are pegged to fiat currencies, precious metals, or other cryptocurrencies that act as a reserve to redeem holders if crypto faces problems. Examples include USDT (Tether) and USDC (USD Coin).

- Security tokens are tokenized assets offered on stock markets and designed to act as securities. Any asset can be tokenized as long as it’s held and secured. Tokenization, in turn, is a transfer of value from an asset to a token. In 2021, Exodus converted $75M shares of common stock to tokens on the Algorand blockchain, completing a qualified Reg A+ token offering – a historic occasion.

- Utility tokens are tokens created to provide services within a network. Such tokens can be used to pay for network fees, redeem rewards, or purchase other services. BAT, or The Basic Attention Token, is an example of a utility token of the Brave ecosystem that can be used to tip content creators within the Brave browser or any other app integrated with the BAT wallet.

- Governance tokens are utility tokens that allow their holders to exercise certain rights within a blockchain. For example, MKR, or Maker, is a governance token that allows its holders to vote on decisions related to the DeFi protocol of the decentralized stablecoin DAI.

- Meme coins are tokens created as a joke and traded for pure speculation and short-term gains. Notable examples include Dogecoin and Shiba Inu.

Altcoin Examples: Top 10 Altcoins to Watch in 2023

There are many awesome altcoins to buy in 2023, but we’ll concentrate on just the best few. It’s safe to say that everyone knows about Ethereum, so we’ll omit it from the list; but, of course, it goes without saying that Ether is worth watching, 2023 or not. Also, we have decided not to include stablecoins, such as Tether and USD Coin, but instead – focused on other altcoins with very promising projects behind them.

Cardano (ADA)

Market cap: $ 12.67B

Cardano is an ecosystem that, like Ethereum, allows developers to create tokens, decentralized applications (dApps), and other use cases for the scalable blockchain network.

Cardano was an early adopter of the proof-of-stake (PoS) consensus mechanism, which allows people to mine it without using expensive or energy-intensive computers. To earn rewards in ADA, Cardano’s utility token, miners must hold a stake in the Cardano blockchain and validate blocks.

Cardano transactions are relatively fast and can be verified in less than a minute. Compare that with some of the Bitcoin transactions that can take up to an hour to verify.

Although Cardano’s solution has fulfilled some of its promises to early investors, like lower fees and higher levels of security, some say there’s yet a lot to deliver. When the final stage of development is complete, the Cardano team will release the blockchain and network to the community as it will be fully decentralized.

Uniswap (UNI)

Market cap: $ 4.74B

Uniswap is a decentralized exchange (DEX) ecosystem built on the Ethereum blockchain. It’s also open source, meaning anyone can copy and use the project’s code to create their own DEX.

Uniswap pioneered Automated Market Maker (AMM) Model that relies on smart contracts to execute trades and set token prices, eliminating the need for intermediaries.

Unlike traditional finance, where market makers are brokerage houses, anyone can be a market maker on Uniswap — just deposit your assets in a pool and earn fees based on trading activity. Moreover, anyone can list their coins for free too.

UNI is a Uniswap governance token that gives its holders the right to vote on new developments on the platform, including changes in fee structures or distribution of the minted tokens to the community.

Polkadot (DOT)

Market cap: $7.06B

Polkadot is an open-source sharded multichain protocol of Web3 Foundation designed by its president and Ethereum’s co-founder, Dr. Gavin Wood. The protocol connects and secures a network of specialized blockchains, facilitating the cross-chain transfer of any data, thereby allowing blockchains to be interoperable.

Polkadot was designed as a foundation for the decentralized internet of blockchains, known as Web3, a term that’s also attributed to Wood. Since it’s a sharded multichain network, Polkadot can process many transactions on several chains in parallel, greatly improving its scalability.

DOT is a Polkadot’s governance and utility token that fulfills two purposes – voting for the future of the protocol and staking, which is how Polkadot verifies transactions and issues new DOT.

Solana (SOL)

Market cap: $7.79B

Solana is a highly scalable blockchain solution that runs on hybrid proof-of-stake (PoS) and proof-of-history (PoH) mechanisms, which allows it to process as many as 50K transactions per second (compared to 15 for Ethereum).

Because of its speed, Solana’s fees and congestion remain low, which makes Solana’s developers hope and believe that in the future, Solana will be capable of competing with centralized payment processors like Visa.

SOL is Solana’s native token that allows its holders the right to vote in future upgrades and can be used to pay transaction fees and for staking.

Telcoin (TEL)

Market cap: $163.4M

What is Telcoin? Telcoin is a decentralized financial platform managed by Telcoin users, GSMA mobile network providers, and instant finance companies. The company’s goal is to build dApps and distribute them to mobile phone users with the help of telecom providers. Further, Telcoin aims to reduce the average cost of transferring payments from 7% to 2%.

The platform combines blockchain technology, decentralization, a multi-signature security system, smart contracts, and a mobile financial structure that allows it to transfer funds instantly worldwide.

TEL is the native utility token of the Telcoin platform that acts as its primary medium of exchange, reserve, and protocol asset. The token is issued based on the transaction volume and level of integration with the platform. Telcoin price is currently $0.0025. Pretty cheap, eh?

TRON (TRX)

Market cap: $6.21B

TRON is a decentralized blockchain-based operating system that was built to create a decentralized internet. It allows developers to build dApps on the TRON network, create content, and receive digital assets as compensation for their work.

The project’s main goal is to provide content creators with the possibility to create content with full ownership rights and share it openly without considering transaction fees (as all data hosted on the TRON network is free).

TRX is TRON’s utility token which connects the whole ecosystem with application scenarios, such as credit card payment or voting rights.

Polygon (MATIC)

Market cap: $10.8B

The Polygon Network is a scaling solution for Ethereum that aims to provide faster and cheaper transactions using Layer 2 sidechains. Polygon is also a framework for building and connecting Ethereum-compatible blockchain networks.

In using Polygon, developers can bridge some of the cryptos there and interact with a wide range of popular crypto applications which were once exclusive to the Ethereum network.

MATIC is Polygon’s utility token that is used for payment and settlement between participants within the network.

Cosmos (ATOM)

Market cap: $3.8B

The Cosmos network bills itself as an ecosystem of blockchains that can scale and interoperate. The project’s goal is to create an Internet of Blockchains where blockchains retain sovereignty, interact with other blockchains within the ecosystem, and process transactions quickly.

Other plans include making blockchain technology more accessible for developers and communication between blockchain networks less complex. The economic center of the Cosmos platform is the Cosmos Hub, which provides interchain token exchange, security, token custodianship, and bridges to ETH and BTC.

ATOM is the Cosmos Hub’s primary token that secures its interchain services and has three use cases – payment of fees, staking, and government.

Algorand (ALGO)

Market cap: $1.8B

Algrorand is a decentralized, blockchain-based network that was built to speed up transactions, improve efficiency, lower transaction fees, and eliminate mining. No mining is possible thanks to a permissionless pure proof-of-stake (PoS) blockchain protocol.

Unfortunately, Algorand has struggled to attract liquidity to its ecosystem despite lower transaction fees and higher scalability. To rectify this, in Feb 2022, the Algorand foundation announced a grant worth $10M for developing the London Bridge that would bring Ethereum compatibility to the Algorand blockchain. The money went to Applied Blockchain, which is still working on the Bridge.

ALGO is the native utility token of the Algorand network and is used to secure the consensus for building each block and pay for the transactions.

PancakeSwap (CAKE)

Market cap: $658.2M

PancakeSwap is an automated market maker (AMM) and a DeFi blockchain app that allows users to swap BEP20 tokens on Binance Smart Chain and trade against a liquidity pool.

These pools are filled by users’ deposited funds who receive liquidity provider tokens, known as LP or FLIP, in return. The tokens can be used to reclaim a share in the pool and a portion of the trading fees.

CAKE is an additional token that users can farm by depositing LP tokens and receiving CAKE in return. Users can also stake CAKE to earn more or stake CAKE to earn tokens of other projects.

FAQs

How to Store Altcoins?

To store altcoins, you’ll need to have an appropriate wallet. The exact wallet you need will depend on the coin or token in question. The best way to find this out is on a project’s official website, where you may find a list of accepted and reputable wallets.

Multi-asset hot or hardware wallets typically support many popular coins and tokens. While it’s tempting to leave altcoins on an exchange, choosing a safer place is best.

Where to Trade Altcoins?

Because not all exchanges carry the same tokens, your choice of exchange will depend on which altcoins coins you wish to trade.

However, most popular exchanges like Coinbase or Binance provide a wide variety of tokens, so you don’t have to look elsewhere. With that said, different exchanges have different liquidity pools, trading fees, and requirements, so it’s always good to have several accounts at different exchanges.

👉 Thankfully, Bitsgap allows you to connect to and trade on 15+ exchanges in one user-friendly interface without switching around — and use additional tools that most of those exchanges lack.

But Bitsgap is more than just a trading terminal. It also has the best crypto trading bots, algorithmic orders, portfolio management, a free seven-day trial, and a demo mode all in one place.

How to Buy Alt Coins?

You can buy altcoins on both centralized and decentralized exchanges. For new investors, it’s best to stick to a few reputable centralized exchanges such as Binance, KuCoin, or Coinbase.

Before signing up, shop around and see what’s allowed in your jurisdiction, what altcoins are available for purchase, and so on. Buying altcoins may differ slightly for different exchanges, but the general steps are similar.

👉 Most exchanges do not support fiat purchases, so you’ll be required to purchase supported cryptocurrencies (like stablecoins) and then swap them for altcoins on the exchange.

After you buy supported cryptocurrencies and have them in your exchange wallet, you can connect your exchange account to Bitsgap and continue trading through the Bitsgap interface.

To connect your exchange to Bitsgap, go to the [My exchanges] tab in the terminal, click on [+Add new exchange], and follow the prompts.

Is Trading Altcoins Secure?

Bitsgap is one of the most secure online trading platforms that takes the protection of your trading, personal information, and funds very seriously.

You connect to your exchange with an encrypted API key that gives Bitsgap only limited access to your exchange account without the possibility of withdrawing funds.

To learn more about Bitsgap’s different layers of protection and security measures, please read this article on the blog.

Why Do Altcoins Depend on Bitcoin?

If you take a moment to look at past price movements, you likely see a pattern. When the price of Bitcoin goes up or down, altcoins tend to follow it. The underlying reason is that altcoin prices are typically measured in Bitcoin (which still commands more than 50% of the cryptocurrency market cap).

Plus, the cryptocurrency market is still comparatively small and tightly knit — so when the price of Bitcoin falls, altcoins follow suit and often fall even more.

Are Altcoins Better Than Bitcoin?

While projects behind altcoins seem more promising and provide even greater functionality than Bitcoin, Bitcoin has been here much longer and is considered more SAFU than any altcoin.

👉 However, altcoins are less expensive than Bitcoin and are believed to have an even brighter future.

We recommend watching the altcoin market closely and picking up several interesting projects you trust and believe in.

Can Altcoins Survive Without Bitcoin?

At this point, it seems unlikely – after all, altcoins are tied too closely to Bitcoin. However, in the future, there’s a possibility that altcoins will become more independent of Bitcoin. Whether they conflate into one single currency is debatable. What’s more likely is the market coalescing around a few altcoins that offer the strongest utility.

Will Altcoins Overtake Bitcoin?

Several cryptocurrencies have been quickly creeping up in market cap. Solana and Ethereum are innovating at a much faster pace and offer far greater utility. But overtaking Bitcoin is no easy task as it still has the widest adoption of any cryptocurrency.

How to Determine the Potential of an Altcoin?

When attempting to determine the potential of an altcoin, it’s important to consider several factors. First, look at the use case. There are a lot of altcoins that don’t provide any value or solve any problems. But they are still many more that do. Then, research the project and team behind the altcoin and determine if there’s demand and community behind it. If there’s potential, invest!

The Bottom Line

Altcoins are a great way to diversify your portfolio. Thankfully, the majority of reputable exchanges carry a wide variety of tokens, so you won’t have problems buying them.

By connecting Bitsgap to your exchanges, you can greatly simplify the process of investing and trading, as you’ll be able to manage multiple exchange accounts within one single interface.

👉 Before investing in any specific altcoin, we recommend researching the project, its use case, and the utility that the altcoin offers.

Ready to start trading altcoins? Head to Bitsgap and connect your exchanges today!