A Token by Any Other Name: Digital Tokens Explained

Embarking on the crypto trading journey? Hold tight! We're unpacking the secrets to success in our comprehensive guide, from clever stop losses and take profits to the art of diversification with automated strategies. Dive into the full article for invaluable tips and expert advice!

Here’s your daily dose of five uncomplicated tips that will enhance your odds of succeeding in cryptocurrency trading.

Since 2017, the roller coaster that is the cryptocurrency market has given us quite the thrill ride with its peaks and troughs. Yet, in the most delightful twist, it has massively grown up over time, becoming somewhat more predictable, while the cost of admission still stays on the cheaper side.

This piece is our attempt at shepherding bright-eyed investors through their initial strides into this intriguing, never-static market.

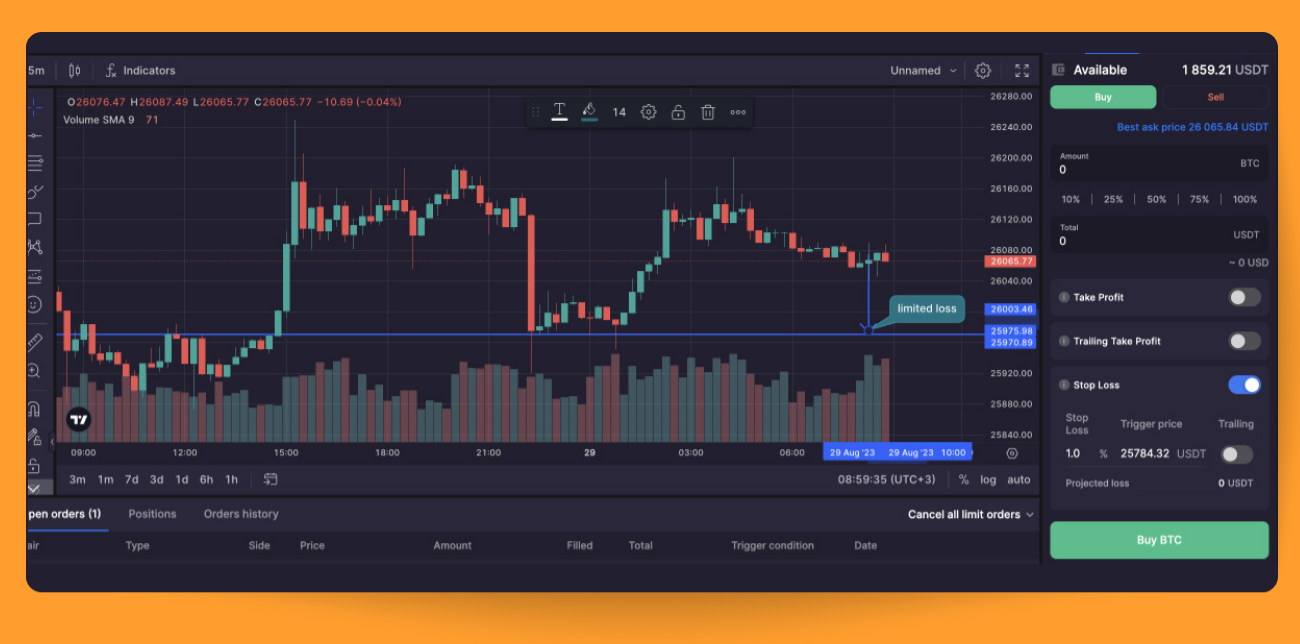

Don’t Ignore Stop Loss

It's really simple — if you're forgetful enough to not place a stop loss order, you're effectively inviting a full 100% risk exposure to your party. To paint the picture, let's say you invest $500 in a shiny coin, and ten days later, it loses 70% of its sparkle. Well, that's a painful $350 punched out of your trade.

To sidestep unnecessary risks and avoidable losses, you could consider becoming best friends with a host of online technical analysis tools. They're designed to help you figure out that sweet spot for your stop loss price.

Support and resistance lines are like the wallflowers and social butterflies of the party. They show the crucial price points where you can expect the most drama. The price usually bounces off the shy support line, but if it gets brave and crosses the line, it can take a deep dive. On the contrary, the price can shy away from the outgoing resistance line, but if it finds courage, it can soar even higher (which is a nightmare if you're short-selling futures).

👉 Pro tip: If you're banking on the price going up (long position), set your stop loss just below the support line. If you're betting on the price falling (short position), place your stop loss just above the resistance line.

👉 Another pro tip: Don't cling onto a losing trade hoping for the price to change its mind. Jump back in the game at a better price, once the market has had its breather.

Never Put All Eggs in One Basket

Diversification is more than just a buzzword tossed around by hedge fund moguls. It's not limited to juggling different coins in your portfolio to balance risk. It also involves strategically timing your purchases or sales, even if it means focusing on a single coin, so you're not dumping all your funds at once, but rather distributing them over time or in phases.

You've achieved the ultimate diversification level when you juggle multiple strategies and crypto investment products simultaneously.

👉 For instance, in our previous article, we discussed using a mix of strategies, spreading your portfolio across smart trading, automated trading, and some long-term holdings. But wait, there's more! In automated trading, you can command an army of different trading bots, each following their own battle plans, like buying the dip or dollar-cost averaging. And the best part? It's a breeze with Bitsgap.

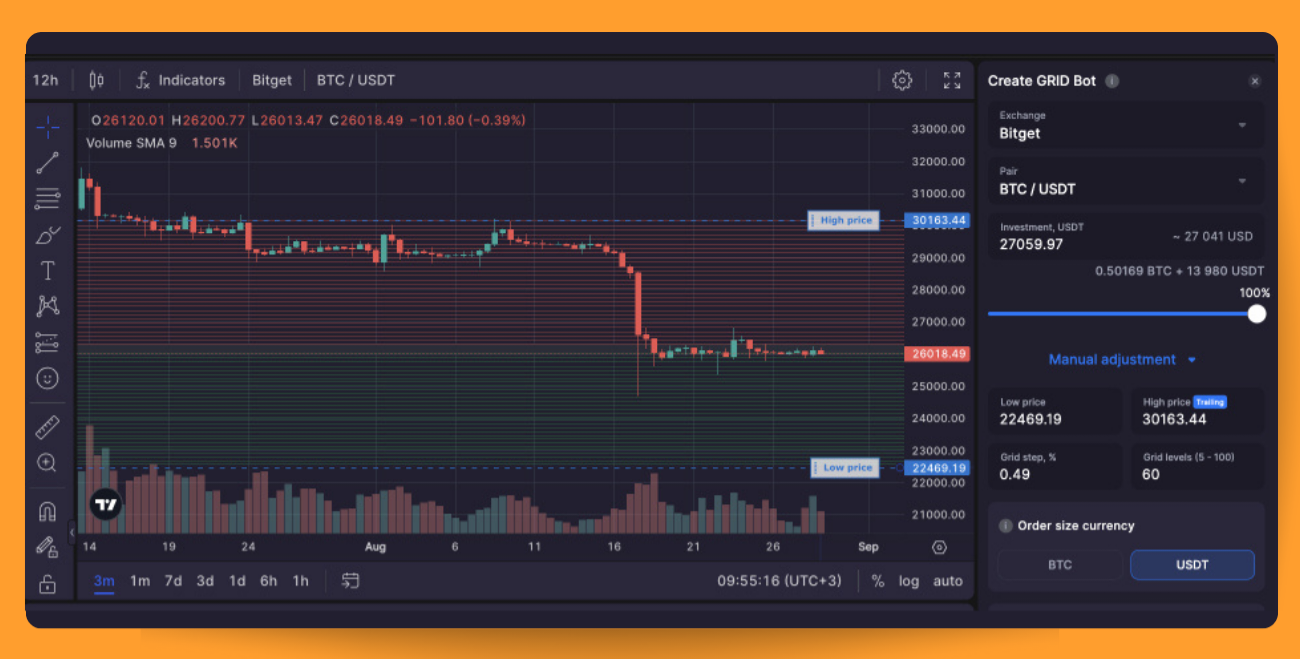

Bitsgap's automated trading offers a complete and comprehensive toolkit to shrink your risk exposure. Like tireless treasure hunters, robots are always on the lookout for profitable opportunities, distributing your investment according to predefined algorithmic trading strategies — DCA, BTD, or GRID, each doing its thing.

For instance, the GRID bot operates with delayed limit buy and sell orders at set price intervals (Pic. 2). The price range you select is split into several levels, forming a grid teeming with orders. What's fun is that all grids are swappable; for every completed buy order, the bot will conjure a new sell order above the executed price, and vice versa. So instead of squinting at charts for hours to profit from market shifts, let the GRID bots do the legwork. They churn out steady profits without any complex algorithms, simply operating on the grid parameters that you set.

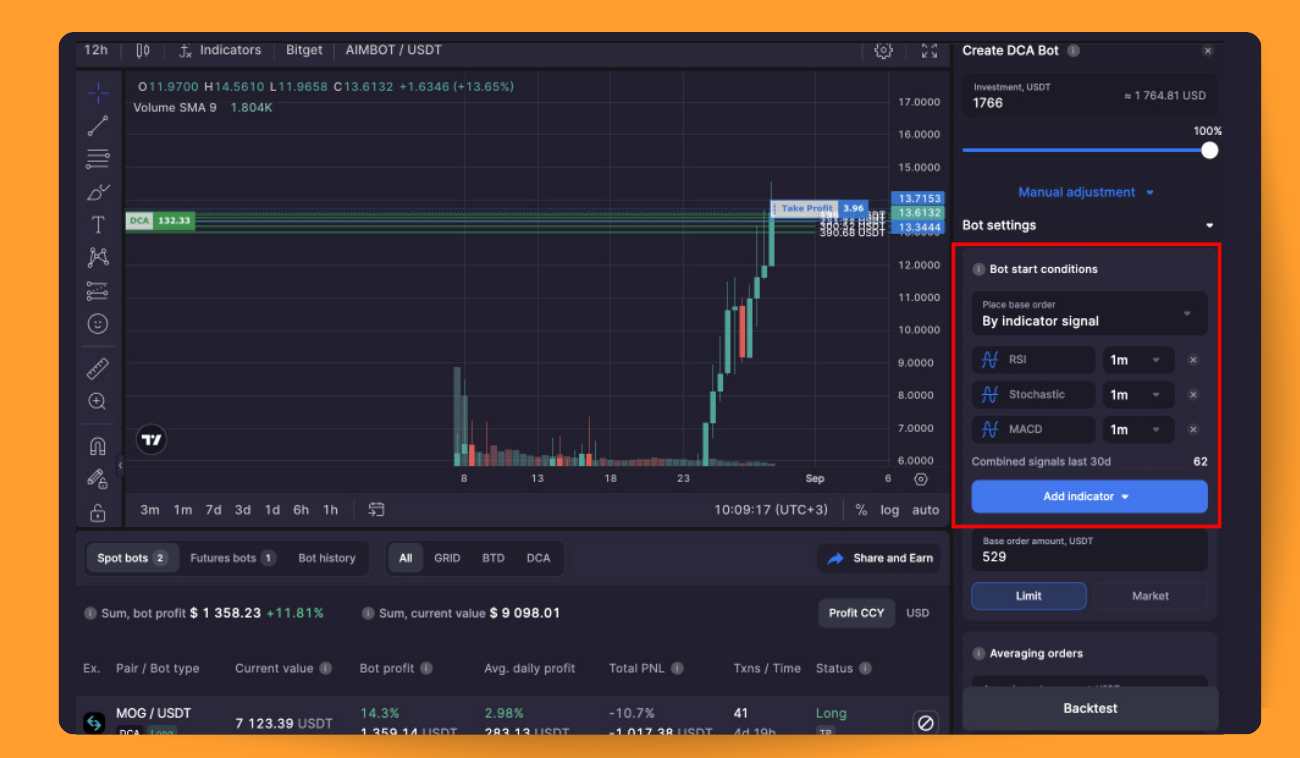

Now, let's look at the DCA bot. It cleverly disperses your investment across periodic buy or sell trades to secure a better average entry price, reducing volatility and price change impacts on your overall position. The DCA bot is like a precision instrument, finding the perfect moment to step in and out of a trade based on one or more technical indicators that you can select in the bot's [Manual adjustment] settings (Pic. 3). It builds a DCA orders grid for each cycle to improve your average entry price, scales back the trade size when safety calls for it, and limits your risks and drawdowns while letting your profits bloom.

The cherry on top is that this bot works in both spot and futures markets, letting you reap the benefits of DCA with derivative products, venturing into the thrilling realm of the futures market, and further diversifying your investment risk with leveraged products using automated tools.

Just sign up for a week-long trial today on the PRO plan and take these tools for a spin. If you're not quite ready to invest, you can always hone your trading skills in demo mode before diving in. Sounds great, right? Well, give it a whirl!

Lock In Profits

Securing your profits is a pivotal part of the trading process. The money you've raked in, or your realized return, can be put to work by opening new trades. But let's not forget about the rollercoaster ride of market volatility. One day, your unrealized return from an open position might hit a high of $500, only to plummet to a measly $200 the next day.

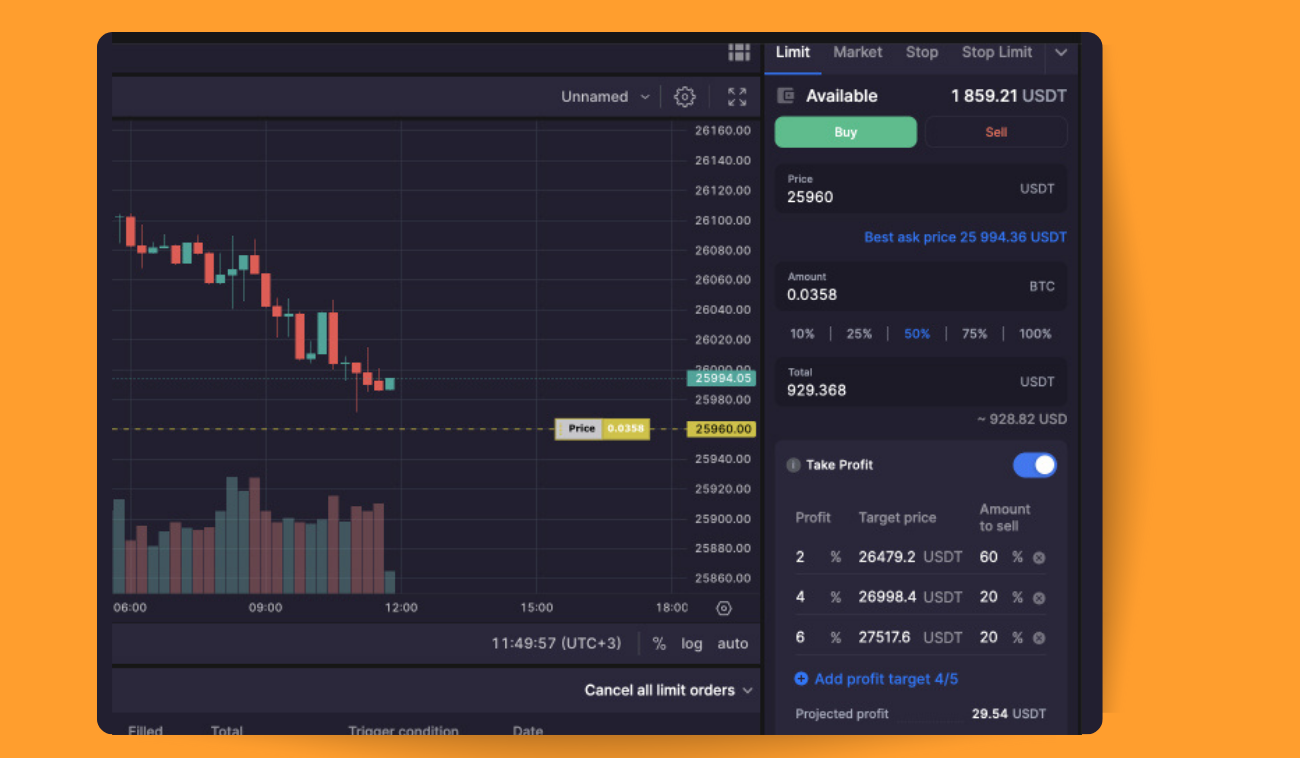

Don't forget to set up 'take profit' orders to ensure some of your gains are safely pocketed. There's no need to sell off your entire position at once. You can set multiple 'take profit' points to mitigate risk and boost returns. It's as easy as pie, just like in the sample scenario below (Pic. 4):

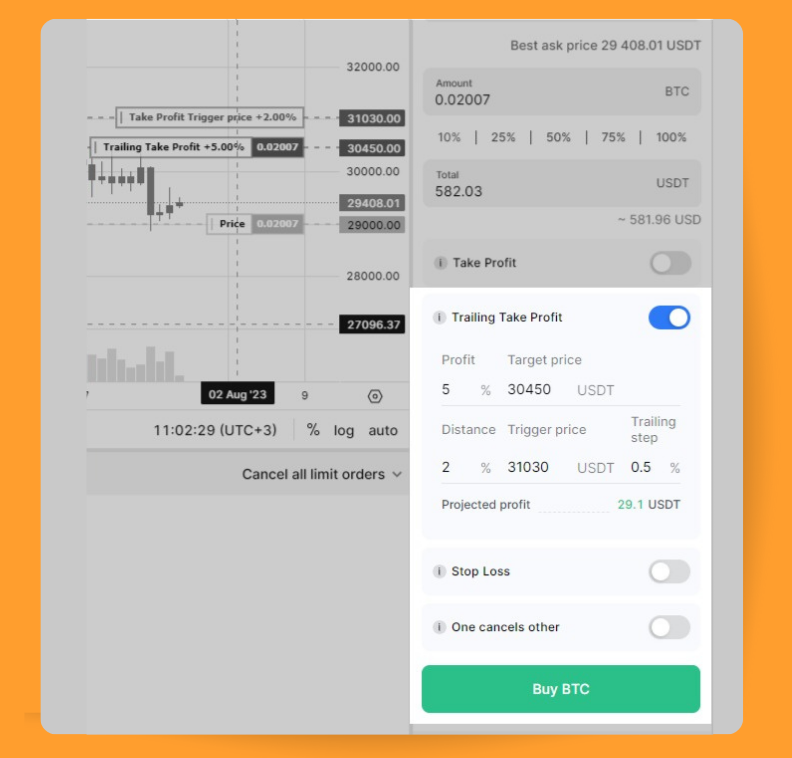

Now, at Bitsgap, there's also a unique feature known as Trailing Take Profit (TTP). This is a dynamic order designed to ride the wave and extract as much profit as possible. TTP aims to enhance your earnings by keeping a trade open for as long as the price is moving in your favor. The moment the price hits the 'trailing profit' level, voila, your order is executed!

The TTP feature is available for spot trading and can be found lounging on the Trading page. To place an order with TTP, select your order type (Limit, Market, or Stop), enable Trailing Profit, and set your preferred Target and Trigger Prices, along with a Trailing Step (Pic. 5).

Your Target price is where your TTP first sets up camp. It's the price point that, once hit, triggers your TTP order. The Trigger price is the magic number that sets your TTP into action. Once the price hits this level, your TTP is placed at the Target price. The Trailing Step? That's how often your TTP hops up and down, following the price. For example, a trailing step of 0.5% means your TTP will move each time the price shifts by 0.5%. If you're the kind who hates to miss out on a good thing, set the Trailing Step to a minimum of 0.2% — this puts your TTP on fast forward!

Now, when should you call upon your TTP? Well, it's always a good idea to bring TTP to the party along with a regular take profit order. It's like having a great DJ and a fantastic caterer at your event — one will keep the party going, and the other will ensure nobody goes hungry. This strategy sells your position in bite-sized pieces, divides the amount between your Take Profit orders, and saves some coins for your TTP to play with. TTP sells your coins at the best possible price by keeping a close eye on the price direction. The Take Profit orders dish out a fixed number of coins at specific prices, leaving the rest for TTP to scoop up more profit as the price keeps climbing. This approach lets you squeeze out the maximum potential profit by allowing the trailing to shift your Trailing Take Profit and then execute it when the price retracts.

Practice & Try New Things

Think of the Bitsgap demo mode as your personal trading playground — it's where you can make trades without fearing any hits to your wallet. It's the perfect space to hone those trading skills and carve out winning strategies. Consider it your lab for conducting all sorts of investment experiments. Here, you can cut your teeth on risk management and profit maximization without the fear of losing actual funds.

The market is a shapeshifter, always evolving and discovering ways to outsmart even the savviest of trading moves. If your strategy starts to feel like it's tripping over its own feet, it might be time to lock in those profits and take a breather in the safety of the demo mode. Here, you can recalibrate and adapt to the market's new dance moves. Once you've got the new rhythm down, you can jump back onto the trading dance floor and show the market who's boss!

Bottom Line: Stay CALM, Always DYOR, and Merge Strategies

Feeling emotional and tossing risk management principles out the window can turn into your worst enemy, leading to a severe case of FOMO (the "Fear of Missing Out").

Jumping into the crypto market without setting take profit and stop-loss orders, especially when it's overbought, is like dancing on a volcano – it significantly ups the chances of taking a nasty financial tumble.

👉 Pro tip: Don't let the market's mood swings sway you. Use the tools of technical and fundamental analysis to pinpoint the ideal moments to enter and exit the market.

Following these straightforward steps can not only shield you from potential losses but also serve as a golden ticket to greater profits. Avoid being a 'greedy guts' and stick to your game plan. Make tweaks as necessary based on the market's mood swings. Keep an eye out for fresh investment opportunities to spread the risk and up your chances of hitting the jackpot.

FAQs

What Is Crypto Trading Psychology?

Crypto trading psychology is the secret sauce, the magic potion, the Jedi mind trick you need to conquer the untamed beast of cryptocurrency trading. It's your mental and emotional compass, guiding you through the wild, roller-coaster ride of crypto markets. What's in this compass, you ask? At its core, crypto trading psychology is all about staying as cool and clear-headed as a Zen master and making decisions as rational as a supercomputer, no matter how much the market gyrates or how many curveballs life throws at you.

Are There Any Crypto Trading Rules I Should Follow?

Absolutely. A few golden rules to follow include always planning ahead, investing only what you can lose, spreading thy coins to minimize holes should you sink, sprinkling a tad bit of healthy logic into the decision-making process, sticking to strategy, and trusting only secure and noble trading platforms (the likes of Bitsgap, for instance).

What Are Beginner Crypto Trading Mistakes?

Being a newbie in crypto is a bit like wandering into a lion's den wearing a suit made of steak. We’ve all been there. Well, beyond the ever-present scamminess lurking about, BEGINNERS BEWARE: impulsiveness, poor risk management, lax security, and going all in on one coin like it's avocado on artisan sourdough. So heed this advice, lest you make a cereal error — DYOR and tread with care in these treacherous waters. Arm yourself with knowledge (perhaps start by perusing wise blogs like this one?). Oh, and practice trading imaginary coins in demo mode before investing your real dough.

Crypto Trading vs. Investing: What’s the Difference?

While people often use the terms 'trading' and 'investing' as if they're synonymous, some prefer to differentiate. Some liken crypto trading to the thrill of speed dating: swift, intense, and momentary. Traders capitalize on fleeting price changes and generally employ technical analysis to guide their maneuvers. Their holding time for a cryptocurrency can range from a mere blink of an eye to, say, a few months. Meanwhile, crypto investing is more of a committed, long-term relationship. This strategy involves clutching onto a cryptocurrency for an extended stretch: months, years, or perhaps even a decade. It's a journey that demands patience, dedication, and unwavering faith in what lies ahead. In crypto parlance, these loyalists are often referred to as the HODLers.

What Are Crypto Trading Research Tips?

Before trading cryptocurrency, make sure to learn about blockchain technology, transactions, wallets, and exchanges. The crypto market is highly volatile, so keep up with news and market trends. Research any coin you plan to trade –- understand its technology, team, and roadmap. Reading the whitepaper is a good start. Technical analysis involves studying past price and volume data to forecast future movements. Learning chart patterns, indicators, and trading volumes can identify opportunities. Trading has risks, so set a budget, define acceptable losses, and use stop losses. The crypto space evolves quickly, so keep learning and stay updated on new tools, strategies, and regulations. Be cautious of scams — double check information and avoid "too good to be true" offers.