Locking in Crypto Profits with Bitsgap: Strategies & Tools

Without a solid strategy, gains can quickly evaporate, and losses can spiral out of control. In this article, we'll explore various strategies for making profits in the crypto market, with a particular focus on trading & Bitsgap’s powerful TP toolkit.

Realizing returns remains one of crypto’s greatest challenges — as volatile spikes can rapidly revert to losses without proper risk controls. Thus locking in profits in a disciplined fashion serves as the cornerstone to accumulation and growth.

In this guide, we explore the art and science behind consistently securing gains to systematically build tokens and wealth over market cycles. By covering core concepts around take profit and stop losses alongside hands-on execution, traders of all skill levels can expand their toolkit.

We specifically highlight how Bitsgap enables both automated and manual techniques through an intuitive platform balancing simplicity and power. With bots executing around the clock alongside analytical tools informing strategy, traders accelerate while still maintaining control. Without further ado, let’s get started.

What Is Crypto Profit?

Crypto profit refers to the financial gain realized from buying and selling cryptocurrencies. It is calculated as the difference between the selling price and the purchase price of a cryptocurrency, considering any additional costs such as transaction fees.

For instance, if you buy a cryptocurrency for $1,000 and later sell it for $1,500, your crypto profit would be $500, assuming there are no significant fees involved.

Crypto profit can be achieved through various strategies, including trading, investing, staking, mining, and participating in DeFi (Decentralized Finance) activities. While this article will primarily focus on taking profits in trading, we will briefly touch on other strategies later on.

TP/SL Basics

Effective trading requires balancing profit potential with downside protection. Take profit and stop loss orders underpin these risk management efforts. In this section, we will define both and explain how basic protections open the door to profitability.

What Is Take Profit?

Take profit is a trading strategy used to lock in gains by setting a predetermined price level at which a position will be automatically closed. When the market price reaches this level, the trade is executed, and the profit is secured. This helps traders manage risk and ensure they capitalize on favorable market movements without having to monitor their trades constantly.

Let's say you purchase 1 Bitcoin (BTC) at $40,000, expecting its price to rise. To secure your gains, you set a take profit order at $45,000. This means that when the price of Bitcoin reaches $45,000, your position will automatically be closed, and you will realize the profit.

Here’s how it works:

- Entry Point: Buy 1 BTC at $40,000.

- Take Profit Level: Set a take profit order at $45,000.

- Market Movement: The price of BTC rises and hits $45,000.

- Execution: Your take profit order is triggered, and your position is sold at $45,000.

- Profit: You secure a profit of $5,000 (excluding any transaction fees).

By using a take profit order, you ensure that your gains are locked in once the price reaches your target, without the need to monitor the market constantly.

What Is Stop Loss?

Stop loss is a risk management tool used in trading to limit potential losses on a position. It involves setting a specific price level at which a trade will be automatically closed if the market moves against the trader. When the price hits the stop loss level, the trade is executed, thereby preventing further losses. This helps traders protect their capital and manage risk without needing to monitor the market continuously.

Let's say you purchase 1 Ethereum (ETH) at $2,000, anticipating its price will increase. To protect yourself from significant losses if the market moves against you, you set a stop loss order at $1,800. This means that if the price of Ethereum drops to $1,800, your position will automatically be closed, limiting your loss.

Here’s how it works:

- Entry Point: Buy 1 ETH at $2,000.

- Stop Loss Level: Set a stop loss order at $1,800.

- Market Movement: The price of ETH drops to $1,800.

- Execution: Your stop loss order is triggered, and your position is sold at $1,800.

- Loss: You incur a loss of $200 (excluding any transaction fees).

By using a stop loss order, you limit your potential losses and protect your capital if the market moves unfavorably, without needing to monitor the market continuously.

What Taking Profits Strategies Are There?

As mentioned above, crypto profit can be achieved through various strategies:

- Trading: Trading involves buying and selling cryptocurrencies to profit from price fluctuations. There are several trading strategies, including:

- Day Trading: Buying and selling cryptocurrencies within a single trading day to capitalize on short-term price movements.

- Swing Trading: Holding positions for several days or weeks to take advantage of expected price swings.

- Scalping: Making multiple trades in a single day to profit from small price changes.

- Arbitrage: Exploiting price differences of the same cryptocurrency on different exchanges.

- Investing: Investing in cryptocurrencies involves buying and holding assets for the long term, with the expectation that their value will increase over time. This strategy is based on fundamental analysis of the cryptocurrency’s potential, including factors like technology, team, market demand, and use cases.

- Staking: Staking is the process of participating in a proof-of-stake (PoS) blockchain network by locking up a certain amount of cryptocurrency to support network operations, such as validating transactions. In return, stakers earn rewards in the form of additional coins. Staking can provide a steady income stream while holding onto the cryptocurrency.

- Mining: Mining involves using computational power to solve complex mathematical problems and validate transactions on a proof-of-work (PoW) blockchain network. Miners are rewarded with newly created coins and transaction fees. While mining can be profitable, it requires significant investment in hardware and electricity.

- Participating in DeFi (Decentralized Finance) Activities: DeFi encompasses a wide range of financial services built on blockchain technology, allowing users to earn profits in various ways:

- Yield Farming: Providing liquidity to DeFi protocols in exchange for interest or additional tokens. Yield farmers move their funds between different protocols to maximize returns.

- Liquidity Mining: Earning rewards by providing liquidity to decentralized exchanges (DEXs) like Uniswap or SushiSwap.

- Lending and Borrowing: Lending cryptocurrencies to earn interest or borrowing against your crypto holdings to leverage your position or access funds without selling your assets.

- Synthetic Assets: Investing in tokenized versions of real-world assets or other cryptocurrencies, allowing for diverse investment opportunities.

- Insurance: Providing coverage in DeFi insurance protocols in exchange for premiums, earning a profit from the insurance fees.

Each of these strategies has its own risk and reward profile, and the choice of strategy depends on your risk tolerance, investment goals, and market knowledge. Rather than choose one school of thought, many traders diversify across strategies. Blending passive holdings with tailored active positions allows customizing a portfolio to one's preferences for risk, rewards, involvement, and knowledge. This flexibility proves key in turbulent markets.

Taking Profits Strategy in Trading

Now, let’s delve deeper into taking crypto profits in trading, as there are various strategies worth exploring in greater detail here as well. Here are some of the most common ones:

- Fixed Percentage Strategy: Set a predetermined percentage gain at which you will take profits. For example, you might decide to sell 50% of your holdings once the price increases by 20%.

- Trailing Stop Loss: Use a trailing stop loss to lock in profits as the price moves in your favor. This order adjusts with the market price, maintaining a specific percentage or dollar amount below the current price.

- Target Price Strategy: Set specific price targets at which you will sell a portion or all of your holdings. For example, sell 25% when the price reaches $50,000, another 25% at $55,000, and so on.

- Time-Based Strategy: Take profits based on a specific time frame. For example, you might decide to sell a portion of your holdings every month or quarter, regardless of the price.

- Laddering Out: Gradually sell your position in increments as the price rises. This can help you capture gains at multiple levels and reduce the risk of selling too early or too late.

- Portfolio Rebalancing: Periodically rebalance your portfolio by selling some of your crypto assets to maintain a desired allocation. This can help you lock in profits and manage risk.

- Fundamental Analysis: Take profits based on significant news, developments, or changes in the fundamentals of the cryptocurrency. For example, if a major partnership is announced or a crucial upgrade is implemented, you might decide to take profits.

- Technical Analysis: Use technical indicators and chart patterns to identify potential exit points. This might include selling when the price hits resistance levels, overbought conditions, or when certain technical indicators signal a reversal.

- Event-Driven Strategy: Take profits around specific events such as hard forks, regulatory announcements, or major market events that could impact the price of the cryptocurrency.

- Dollar-Cost Averaging Out (DCA): Similar to dollar-cost averaging in, this strategy involves selling a fixed dollar amount of your holdings at regular intervals, regardless of the price.

- Hedging with Derivatives: Use futures or options contracts to lock in profits or protect against downside risk. This can allow you to benefit from price movements while minimizing potential losses.

How to Take Profits on Bitsgap?

You can implement all of the above strategies on Bitsgap—set multiple target prices to sell at different levels, use automated DCA, hedge with derivatives, or utilize trailing orders to lock in profits and limit losses. Here are some primary tools you can use to achieve this:

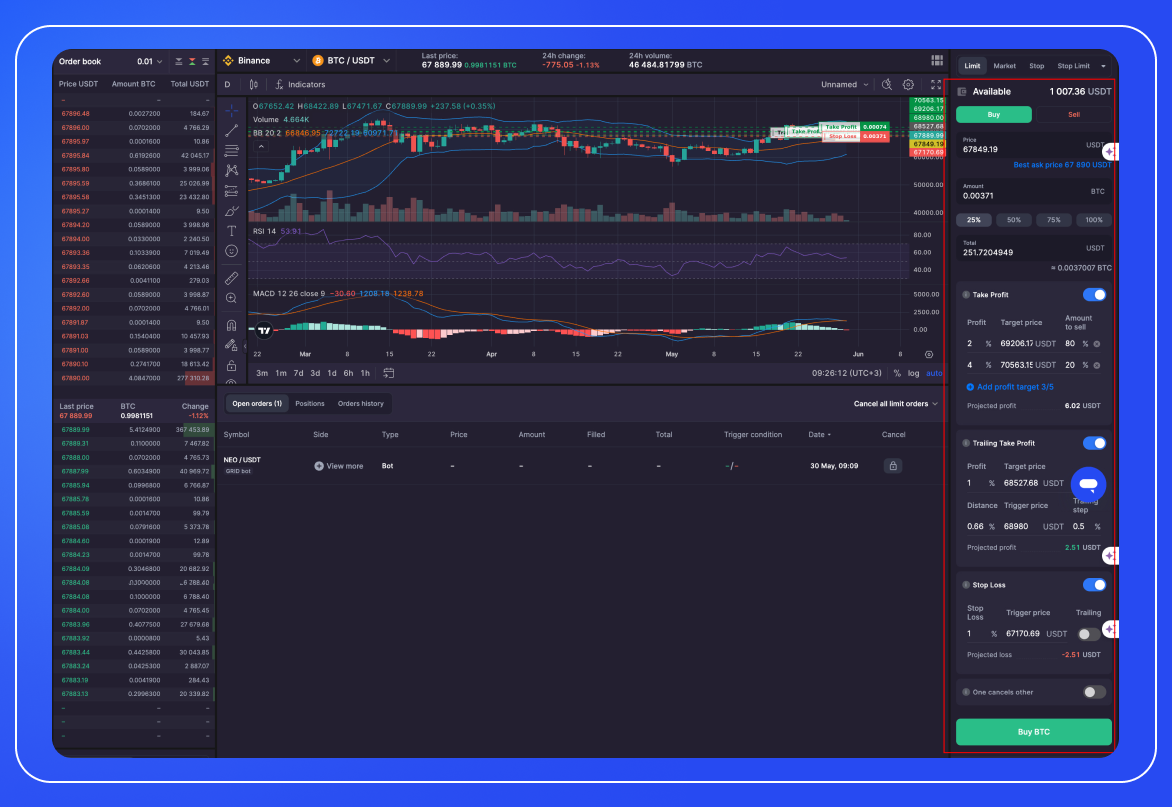

- Manual Trading with TP/SL & Trailing TP: Turning Every Order into a Smart One

Bitsgap’s smart trading terminal allows you to place any order and turn it into a smart one with additional tools like Take Profit, Stop Loss, Trailing Take Profit, One Cancels Other.

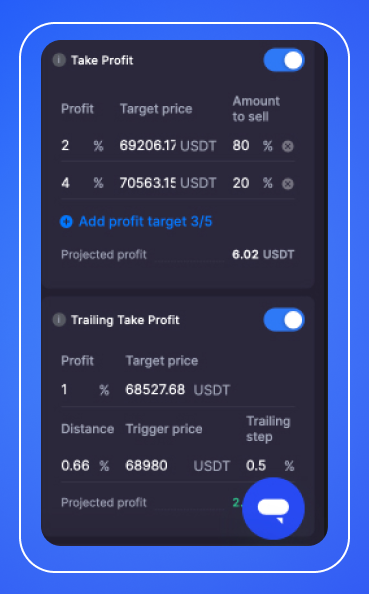

For take profit (TP) orders, you can specify not just a single target percentage but up to five different target profit percentages. This allows your order to close partially each time one of the specified percentages is reached.

Trailing Take Profit (TTP) is a dynamically adjusting order designed to maximize profit by capturing upward price movements. TTP aims to boost your gains by keeping a trade open as long as the price trends favorably. The order executes when the price reaches the trailing profit level.

In the TTP menu, you'll need to specify:

- Target Price: The initial level where the TTP is placed and will be executed if the price falls or rises to this point.

- Trigger Price: The price at which the TTP becomes active. When the price hits this level, the TTP is set at the Target price.

- Trailing Step: The percentage step (e.g., 0.5%) that determines how often the TTP adjusts to follow the price. For example, a trailing step of 0.5% means the TTP will move each time the price changes by 0.5%.

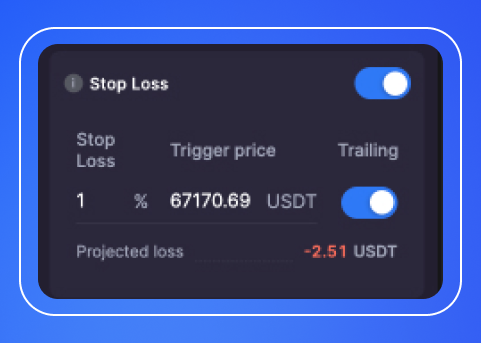

You can also activate Trailing when setting up Stop Loss. Unlike a fixed stop-loss order, which remains static, a trailing stop-loss "trails" the market price by a specified percentage or dollar amount. This allows traders to capitalize on favorable market movements while still protecting against significant losses if the market reverses.

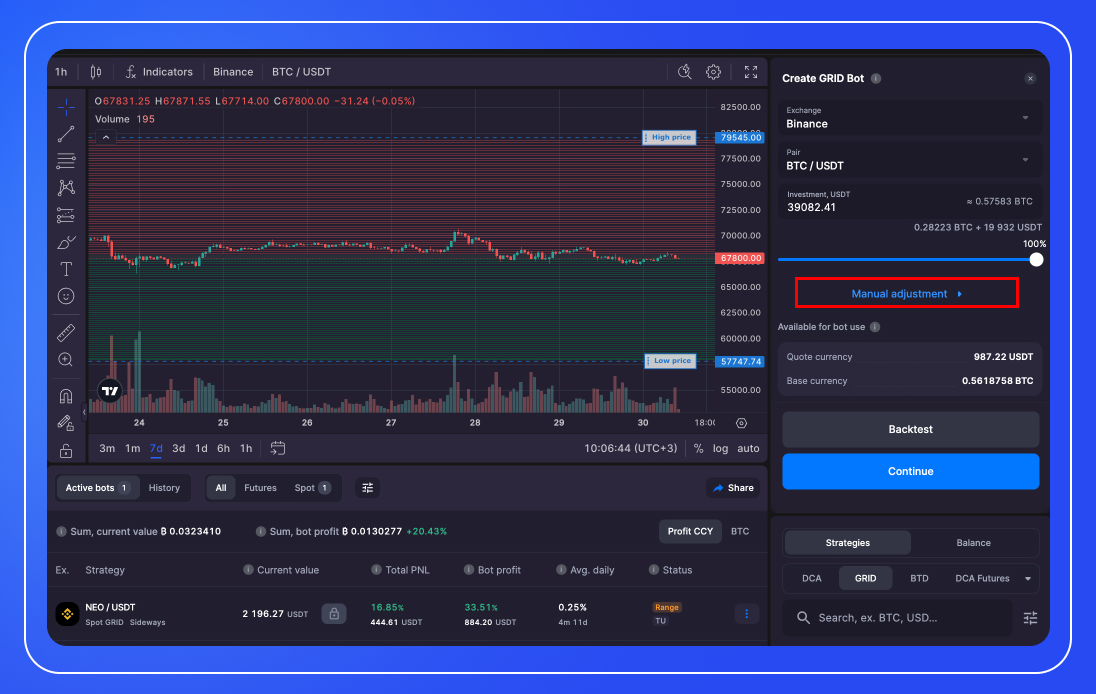

- Automated Trading with Customizable TP/SL/Trailing

You can also manage your risks by locking in profits and minimizing losses while trading with automated trading bots on Bitsgap. Designed for ease of use, Bitsgap's bots enable anyone to start trading crypto with minimal effort. Each bot can be launched quickly with pre-set default settings or fine-tuned to the smallest details, such as grid steps, levels, and targeted profit percentages. Adjusting the default settings is straightforward—simply click on [Manual adjustment] whenever you want to modify the existing settings before starting your bot.

While the adjustable settings for each bot may vary, take profit and stop loss orders are consistently available.

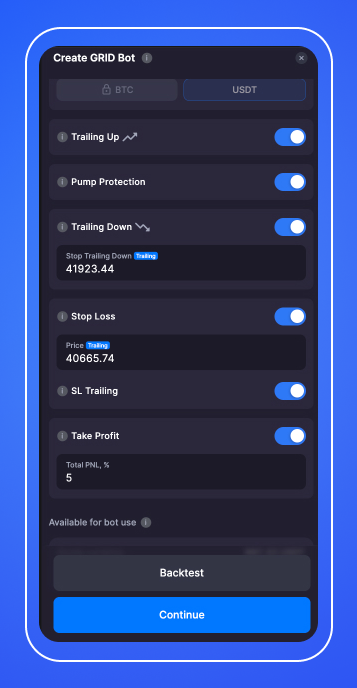

For instance, in the GRID bot, besides Take Profit and Stop Loss, you'll also find Trailing Up and Down features:

- Trailing Up: This feature allows the entire grid to move upwards if the price surpasses the highest grid level and continues rising. Trailing Up will cancel buy orders at the bottom of the grid and place new orders above the current upper grid level. This way, your grid follows the price, moving all buy orders from the bottom to the top, enabling your GRID bot to operate almost indefinitely.

- Trailing Down: This feature extends the bot's grid below the initial setup to continue trading during a downtrend. The bot will place market buy orders using the quote currency from your available balance and set new sell orders below the lower price border. This maintains the initial sell orders and adds more sell orders, extending the grid. The bot will continue placing new orders until it reaches the Stop Trailing Down Price or runs out of quote currency. Trailing Down does not move the grid but extends it, which means the bot will use more funds from the available balance beyond the initially set investment, increasing the amount of base currency used and potentially heightening the risks associated with a falling price.

- Take Profit and Stop Loss: The Stop Loss can be set at a specific price level, triggering when reached. The Take Profit is set as a percentage, reflecting the amount of return you want to secure from this bot. If Trailing Up is enabled, the Stop Loss becomes dynamic, following the low price at a fixed interval whenever the grid is moved.

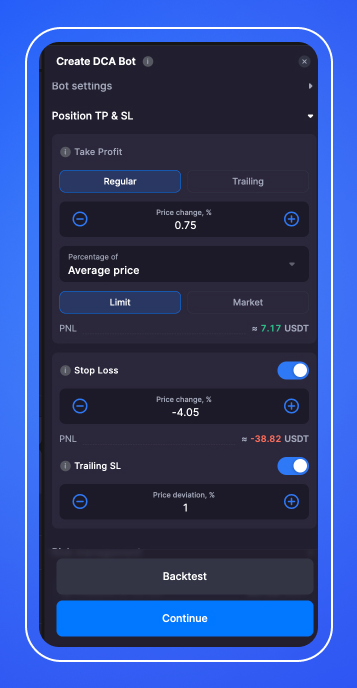

Similarly, the DCA bot would have ‘Position TP/SL’ with adjustable Take Profit, Stop Loss, and Trailing features:

- Take Profit: This order will be placed and executed at the chosen percentage change in price.

- Average Price: The Take Profit percentage is calculated from the maximum weighted average price of the position.

- Average Price + Indicators: The minimum profit level is calculated from the maximum weighted average price, and the cycle will close based on signals from selected indicators when the price is above the minimum profit.

- Base Order Price: The Take Profit percentage is calculated from the base order price.

- Base Order Price + Indicators: The minimum profit level is calculated from the base order price, and the cycle will close based on signals from selected indicators when the price is above the minimum profit.

You can choose the order type that will be placed when the Take Profit trigger is hit. The PNL metric reflects an approximate minimum profit based on the current Take Profit settings.

- Trailing Take Profit (TTP): This option allows the Take Profit to follow the current price at a specified distance. It helps maximize profits as the price moves favorably.

- Trailing TP Trigger, %: The level at which TTP is activated, calculated from the specified percentage value.

- Price Deviation, %: The bounce percentage from the maximum (for Long) or minimum (for Short) price reached after TTP activation.

- Percentage of: The reference point for the Trailing TP Trigger. If unsure about these options, check the Regular Take Profit section.

Once the price reaches the Trailing TP Trigger level, all DCA orders are canceled, and TTP is activated. From that point, the position will close at the Trailing TP level, which is set at the Price Deviation distance from the maximum/minimum price reached since TTP activation. If the price moves favorably, the Trailing TP level will follow, staying at the Price Deviation % from the maximum/minimum value. If the price reverses and reaches or exceeds the Price Deviation %, the Take Profit order is executed, and the position is closed.

- Stop Loss: This feature helps prevent further losses by closing the position when the price moves unfavorably.

- The Stop Loss level is calculated based on the maximum weighted average position price and closes the cycle by placing and executing a market buy/sell order, depending on the chosen strategy (Long/Short).

- Once you set the Stop Loss Price change percentage, the system calculates an approximate loss, considering all averaging orders.

- An additional Trailing option moves the Stop Loss following the price every time the price changes by a specified percentage (e.g., 1%).

These features provide flexibility and control over your trading strategy, helping to manage both profits and risks effectively.

You can adjust those parameters even further by setting up ‘Target total profit’ and ‘Allowed total loss’ in the ‘Risk management’ section. When these options are activated, you can specify the profit or loss percentage from the original investment in the "Investment change, %" field, at which point you want to finalize and close the bot. Once the Total PNL of your bot reaches the specified values, the system will close the bot by selling or purchasing the coins and move the bot to the "Bot History" tab.

As you can see, in Bitsgap, there are multiple ways to control your profits and losses, whether you trade manually or use automated trading tools.

Conclusion

Locking in profits is a crucial aspect of successful crypto trading. Utilizing Take Profit (TP) and Stop Loss (SL) orders allows traders to automate their strategies, ensuring they capture gains and limit losses without constant monitoring. TP orders help you secure profits at predetermined price levels, while SL orders protect your investment by capping potential losses.

Bitsgap offers robust tools to control your trading returns, whether through manual trading or automated bots like the DCA and GRID bots. With multiple features, including classic TP/SL, Trailing additions, and Allowed Total Profit/Loss, you can set precise conditions for closing your trades, optimizing your strategies for maximum efficiency and profitability.

See firsthand how Bitsgap elevates trading through an intuitive interface unlocking automation, insight, and management in one unified ecosystem. Sign up today to access a full-featured 7-day trial granting complete access with no limitations.