Beyond the Spread: Understanding Bid & Ask in Crypto

If you dive into the crypto trading fray without understanding bid and ask prices, your money can disappear as fast as a bitcoin flash crash. Know the spread between what buyers are bidding and what sellers are asking before you make your move!

It's time to bridge the gap between bid and ask and unlock the secrets of the market. Read on to learn everything you always wanted to know about the “spread.”

In the wild west of cryptocurrency trading, two terms get tossed around more than a gambler's poker chips: bid and ask. If these two terms seem as mysterious as Satoshi Nakamoto's true identity, fear not, because by the end of this primer, you’ll be wielding bids and asks like an expert.

So saddle up to discover the answers to your burning bid and ask questions and learn what’s really behind the spread.

What’s Bid and Ask in Crypto?

When it comes to trading, the term "bid and ask" (also known as "bid and offer") is a crucial concept to understand. Essentially, "bid price" and "ask price" refer to the best prices at which a buyer and seller are respectively willing to trade a coin at a particular time.

👉 The bid price is the maximum amount a buyer in the market is offering to pay for a coin. The ask price is the minimum amount a seller is willing to accept to sell that same coin.

When a buyer agrees to pay the ask price or a seller agrees to accept the bid price, a trade takes place.

The difference between the bid and ask price is known as the "spread." The spread provides an important indication of the liquidity of the coin, which refers to how quickly and easily it can be traded.

👉 Generally speaking, a narrower spread means higher liquidity because there is a smaller gap between the prices buyers and sellers will accept.

Watching the bid and ask prices, as well as the spread, gives you insight into the dynamics between buyers and sellers in the market for a particular coin. When the spread narrows over time, it signals that the two sides are getting closer to agreeing on a price. If the spread widens, the opposite may be true.

Tracking the bid-ask spread, along with factors like crypto trading volume, provides a window into market sentiment and helps you determine good entry or exit points for a coin. The interactive exchange between bids and asks is what enables markets to function, and understanding this give-and-take helps make you a smarter investor.

What Is Cryptocurrency Bid Price?

Unlike buying a can of soda at a relatively fixed price at the corner shop, trading cryptocurrencies plunges you into the thrills of the open market, where the value of crypto coins bobs and weaves based on the real-time whims of buyers and sellers.

When you place a bid for a cryptocurrency, you’re not just offering to buy — you’re voicing your optimism about its future prospects. Your bid broadcasts to the market how much potential you think still remains to be unlocked.

Similarly, other buyers’ bids and asks in the books provide a glimpse into the mood of the crowd. Cryptos that attract high bidding wars tend to be the darlings of the moment, indicating their stars are on the rise.

Of course, the asking prices tell the other side of the story. Cryptos with lofty asks suggest sellers believe there are still greater fools left who will pay a premium for the privilege of owning the coin. But when bids begin to chase the asks higher, the real fun starts as FOMO takes hold and the market enters into a speculative frenzy.

What Is Cryptocurrency Ask Price?

Ask prices are the flip side of the bidding coin, representing sellers' aspirations rather than buyers' optimism. When you set an ask price for your cryptocurrency holdings, you are signaling the minimum amount you will accept to part with your coins.

The ask prices streaming across the crypto order book provide a glimpse into how eager (or reluctant) sellers are feeling about a particular crypto's prospects. If the asks begin piling up and dwarfing the bids, it suggests sellers may know something buyers don't — or at least believe the end of the rally is nigh. A prevalence of sellers looking to offload their coins could indicate the value is poised to tumble.

👉 Of course, having more sellers than buyers is not always a bearish indicator. Sellers may simply have different risk appetites and time horizons than buyers. Or they may need funds for other opportunities. But all else being equal, an imbalance of asks signals the sellers currently have the upper hand over buyers in the never-ending tug-of-war between bulls and bears.

When asks dominate the order book, buyers beware. It means any bid you place may cross multiple asks before being filled, allowing sellers to dictate the price. The ball is in their court, and they can hold out for the highest bid to clinch a sale. Your bid will reveal how much you're willing to overpay for an asset sellers seem keen to offload.

Crypto Bid Ask Spread: Difference Between Bid and Ask Price

Bid and ask prices are the pillars that hold up the free market, representing the twin desires of buyers and sellers. Bids signify the maximum price purchasers are willing to shell out to own a coin. Asks denote the minimum price at which holders of that coin are willing to sell it off. The difference between the two is referred to as the bid-ask spread.

Bid and Ask Price Example

Jimmy was an opportunistic trader looking to buy crypto tokens on the cheap. Seeing asks of $1 per token, he believed that price overvalued the asset. Jimmy thought $0.90 better reflected fair value, so he bid 90 cents, hoping for a seller under duress.

For a while, Jimmy's bid languished as sellers held out for $1. But eventually a distressed seller flooded the market with supply, crushing the asks down to Jimmy's level. His 90-cent bid was filled, and the tokens were his — at the price he wanted.

Jimmy knew timing was everything in trading crypto. Monitoring the market all day, he watched as prices rose and fell with the fickle crowd. When asks once again hit $1, Jimmy decided to test the waters. He set an ask of $1 for the tokens he bought at 90 cents, hoping to sell into renewed optimism.

Overnight, Jimmy's asks were hit. He sold out at $1, earning a tidy 10-cent profit per token. By bidding at a discount and selling into strength, Jimmy exploited the volatile swings of crypto to make a quick profit.

👉 Of course, Jimmy's maneuver could have gone awry. If asks had kept sinking after he bought, his 90-cent bid might have left him with overpriced tokens. And if the market had not rebounded after he set his $1 asks, he may have sold too soon for a loss.

Bid vs Ask vs Market Price

As long as you have patience for the trade to fill, you call the shots. The "market price" of a coin is merely its current trading price, not some immutable value. If you opt to buy or sell at the market price, your order fills instantly, for better or worse. You take whatever leftovers remain in the order book. But limit bids and asks allow you to hold out for the price you actually want. You set the terms, not the market.

Place a bid beneath the fray, signaling you believe the asset overpriced, and see if sellers get shaken enough to hit your level. Or post an ask above it, conveying that the market has not yet fully recognized the coin's potential, as you await buyers awakening to that realization. Either way, you could gain an edge — if your patience and conviction hold.

👉 The trick in crypto is buying for less than you sell for later. Using bids and asks cleverly allows you to potentially buy at a discount or sell at a premium. You need not settle for the market price but can lie in wait for the opportunity you see. Your orders stand as a testimony to the value you perceive, for the market to validate — or not.

Smart Trading Tools on Bitsgap to Turn the Crypto Odds in Your Favor

Bitsgap offers a vast array of different tools that can smarten up your crypto trading and allow you to take the best possible advantage of the crypto market.

When you open up the Bitsgap terminal and click on the [Trading] tab, you’ll see the chart in the center, a crypto order book to your left, and smart order options on the right (Pic. 1):

From such a convenient, all-encompassing vantage point, you can observe the minute fluctuations of all the bids and asks on your left, choose your favorite trading indicators on the chart’s top, and decide how you’re willing to enter the trade by choosing an order type to your right.

Bitsgap has multiple options to turn your ordinary order into a smart one — just browse through the options on the smart order panel to see the many things available. These are a few things to do — place a Stop Limit, Stop Market, TWAP, or Scaled Order to seize the best trading opportunity, plus add (Trailing) Take Profit, Stop Loss, or One cancels other (OCO) to maximise gains and secure returns.

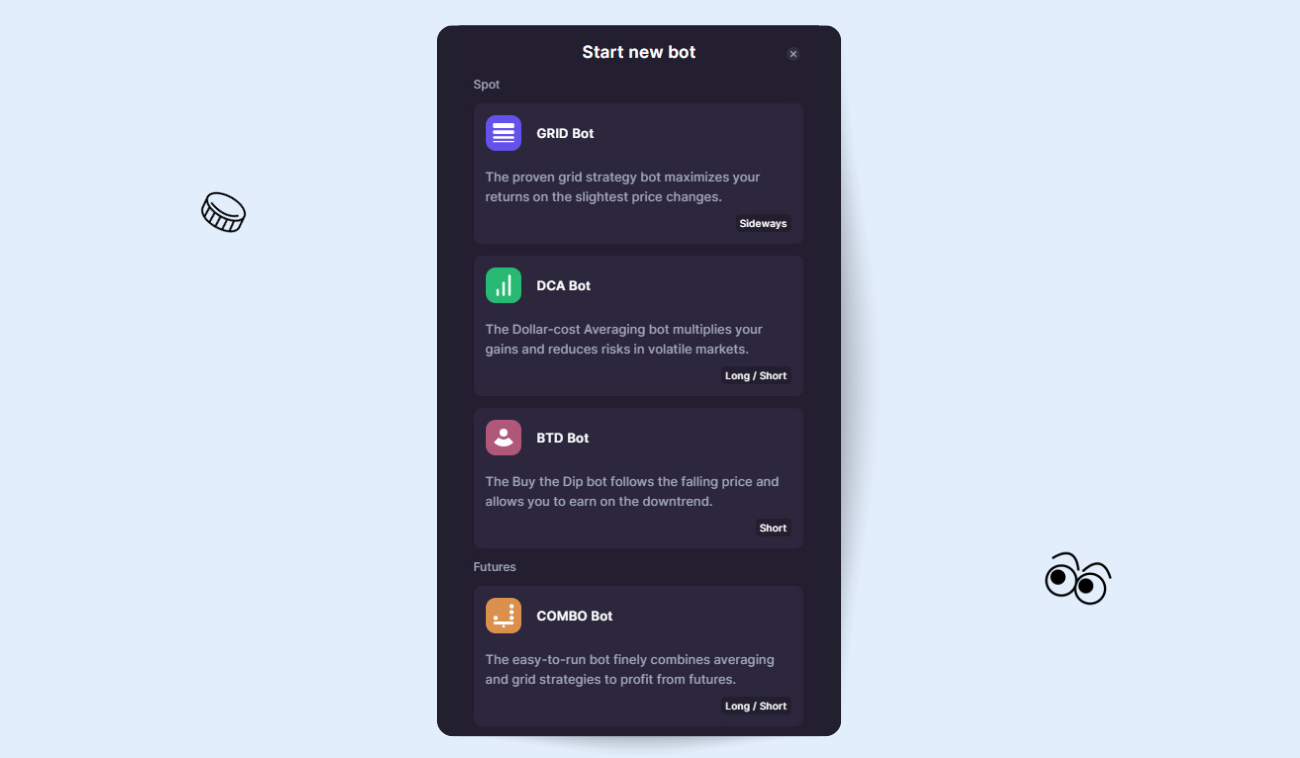

Wait, but that’s not all! Should you wish to let a crypto bot do all the hard work for you, click on the [Start new bot] button on top of the terminal to choose the best bot for your needs. And there are also different options (Pic. 2) available for different market conditions — GRID for the sideways market, BTD for the falling, COMBO for the futures, and DCA for all types of markets.

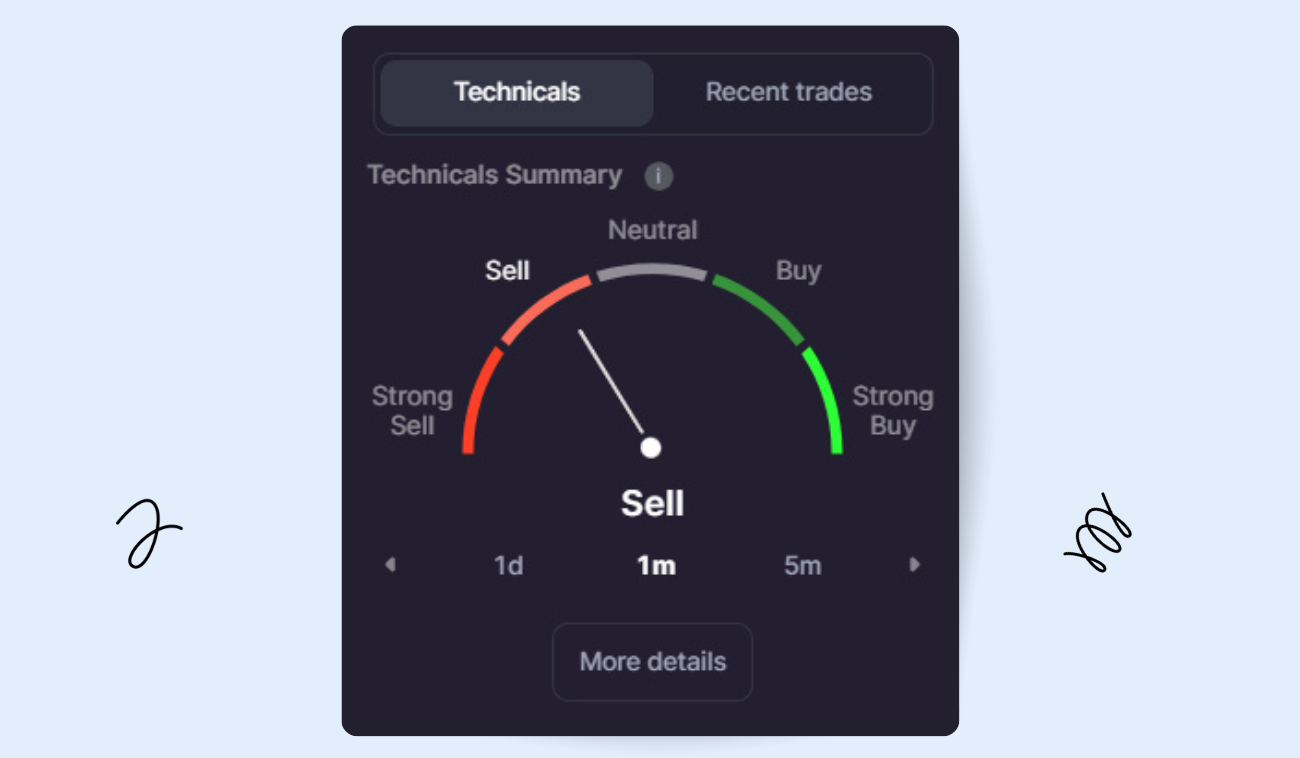

Also, Bitsgap has a powerfully robust yet simple and straightforward Technicals widget. The widget combines dozens of popular indicator signals into one intuitive gauge, so you can instantly see when markets align for your perfect trade. No more switching between different indicators and wasted hours seeking optimal signs for an upcoming move! In short, check it out and see for yourself (Pic. 3) — the Technicals is your single ticker tracker of multiple indicators and an at-a-glance visual of an overall market signal.

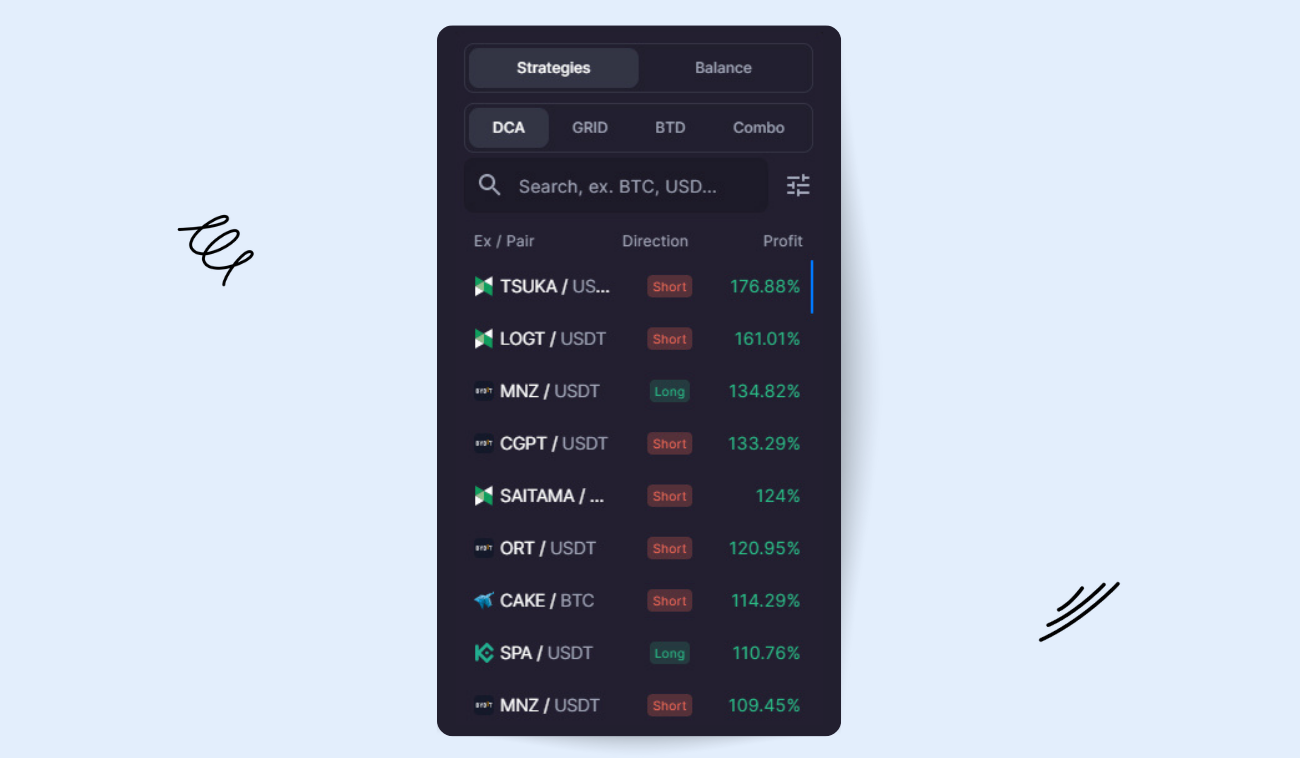

Finally, there’s the Strategies widget (Pic. 4) that instantly spots the best bot setups for you and takes the guesswork out of trading success. Whether you prefer aggressive or conservative, long or short, the Strategies widget delivers setups optimized for any trading mode or market condition. Intrigued? Here’s your brief guide to the lucrative setups.

Bottom Line: Ask for More & Bid for Less

Success hinges on discerning when trends may turn. Let bids and asks guide you, and move swiftly to capture the opportunity on the cusp. The spread represents the gulf between hope and fear that must narrow for trades to fill. How that gap closes shows who yielded first in the tug-of-war over an asset with value tied to the crowd's whims.

For better chances at acing your crypto trading game, use smart orders and automated crypto bots that watch the order books even during lulls. Bitsgap is your safest bet when it comes to supplementing your trading vigilance with powerful, smart trading tools. Ready to enter the crypto game now and test your bid and ask knowledge in the live trading waters? You’re welcome to start your seven-day free trial journey today!

Your Burning Bid and Ask FAQs

Why Is the Bid and Ask Price So Different?

A wide bid-ask spread usually means a lack of consensus around a coin’s fair value. For sophisticated traders, a large spread can present an opportunity to buy at the bid and sell at the ask for a quick profit if you're confident of the price direction. But for most investors, a wide spread is a signal of higher risk, uncertainty, and potential volatility.

Here are several factors that contribute to a wide spread between the bid and ask prices: low crypto liquidity, high volatility, excessive speculation, manipulation, and an impactful news item. All of those are signs to be wary and wait before entering the market.

What Happens When Bid Price Is Higher than Ask?

When bids leap above the existing asks, it signals buyers willing to pay a premium for immediate execution. The exchange automatically fills these "overbid" orders by scooping up asks already on the books, then seeks to buy more supply from the market to fulfill the order size.

These overbids act as a price magnet, pulling asks and the market price higher. They reflect demand outpacing available supply at the moment — so sellers raise their asks, and the market marks the new fair value higher. Traders react quickly, scrambling to adjust their bids and asks to this new revelation of buying power.

What Happens When Bid Price Is Lower than Ask?

A bid below the asking price implies the buyer believes the asset overvalued at current levels. They signal a willingness to own it - but only at a discount that validates their view. Sellers, on the other hand, ask a premium to part with the asset, conveying their perception of its inherent worth. The bid-ask spread represents the gulf between these outlooks that must be crossed.

In a deadlock, buyers and sellers wait for each other to budge. Traders may alter their bids or asks in response to shifting market forces or fresh information, hoping to inspire the other camp to meet them at a better price. The tension builds as both sides hold out for the most favorable outcome.