Three Cryptocurrency Trading Strategies That Work

Grab the crypto bull by the horns! Learn three battle-tested trading strategies to tame crypto and maximize profits.

Discover the secret blend of three tactics to steadily reap crypto gains. Unlock your unique success formula to hit the jackpot.

Welcome to the thrilling roller coaster ride of cryptocurrency trading, where we'll dive headfirst into the top three strategy hotspots. Each is armed with its own secret weapons of risk evasion and profit multiplication. You've got to pick the one that tickles your financial ambitions and risk appetite just right!

Now, let's get one thing straight about trading bitcoin and its digital cousins. It's not about batting a thousand with your price predictions — we're not trying to be the Nostradamus of crypto here! Instead, it's about the artful balance of risk and reward and the cool-headed logic of a seasoned chess player. Think of it this way: three golden goose trades can cover your back for the next five that lay rotten eggs.

👉 And here's a tidbit of wisdom (but don't tell everyone): To win at this game, your earnings per trade should ideally be about 2x-3x more than the risk you're brave enough to take. It's like saying, "For every punch you take, make sure to land two or three of your own!"

Smart Trading

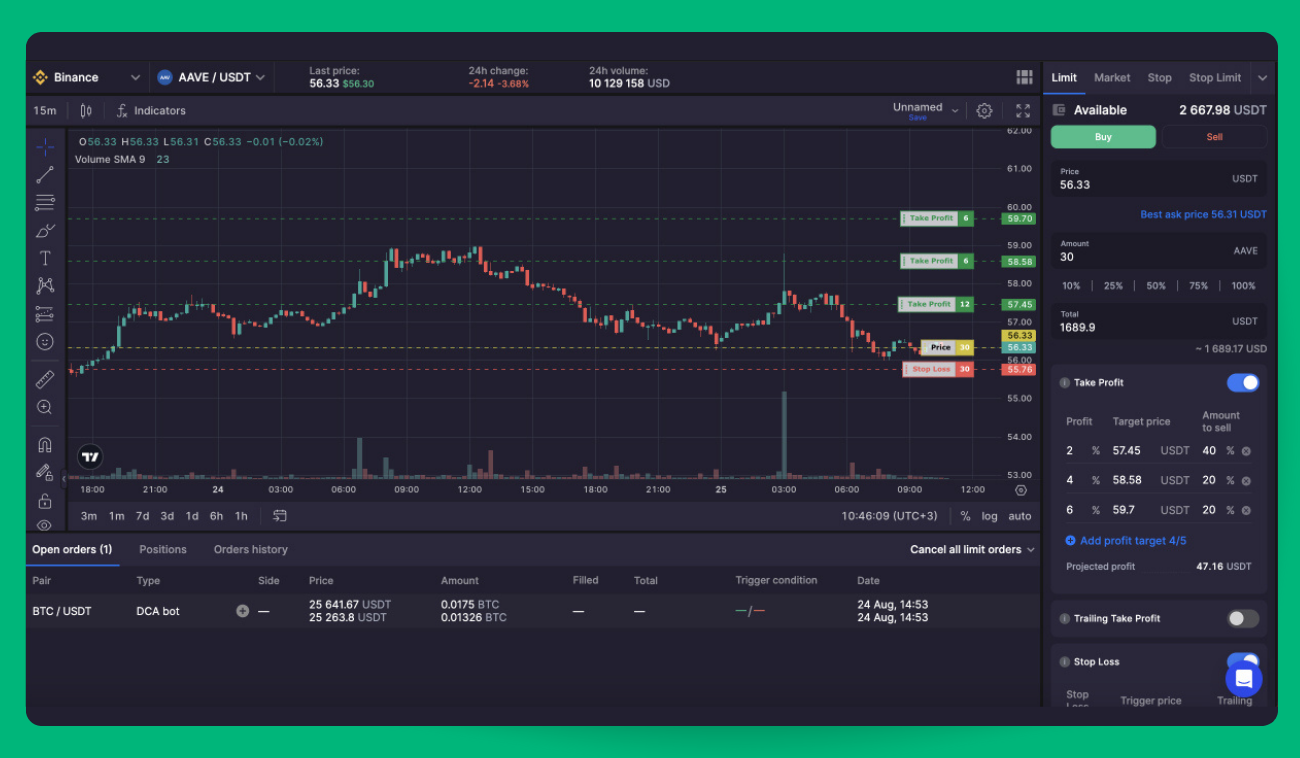

This approach involves the clever use of smart orders such as Stop Limit and Trailing Stop Loss when engaging in cryptocurrency spot or futures markets. With the Smart Trade mode, you can take the reins of risk and return management, forecasting your outcomes with ease. Feel like a master chef as you experiment with various mixtures using all the order types on offer at Bitsgap.

Here are a few trade combination recipes you might find handy:

Take profit + Stop Loss

This combo is as simple as a peanut butter and jelly sandwich, requiring only two orders. The Take Profit secures your gains when the price strikes gold in your target zone. On the flip side, the Stop Loss is your safety net, preventing significant losses if the market decides to play a cruel game of opposites.

👉 Pro tip: Aim for a TP 10-20% up, SL 5-10% down. It's like aiming for the moon but keeping a parachute handy, just in case!

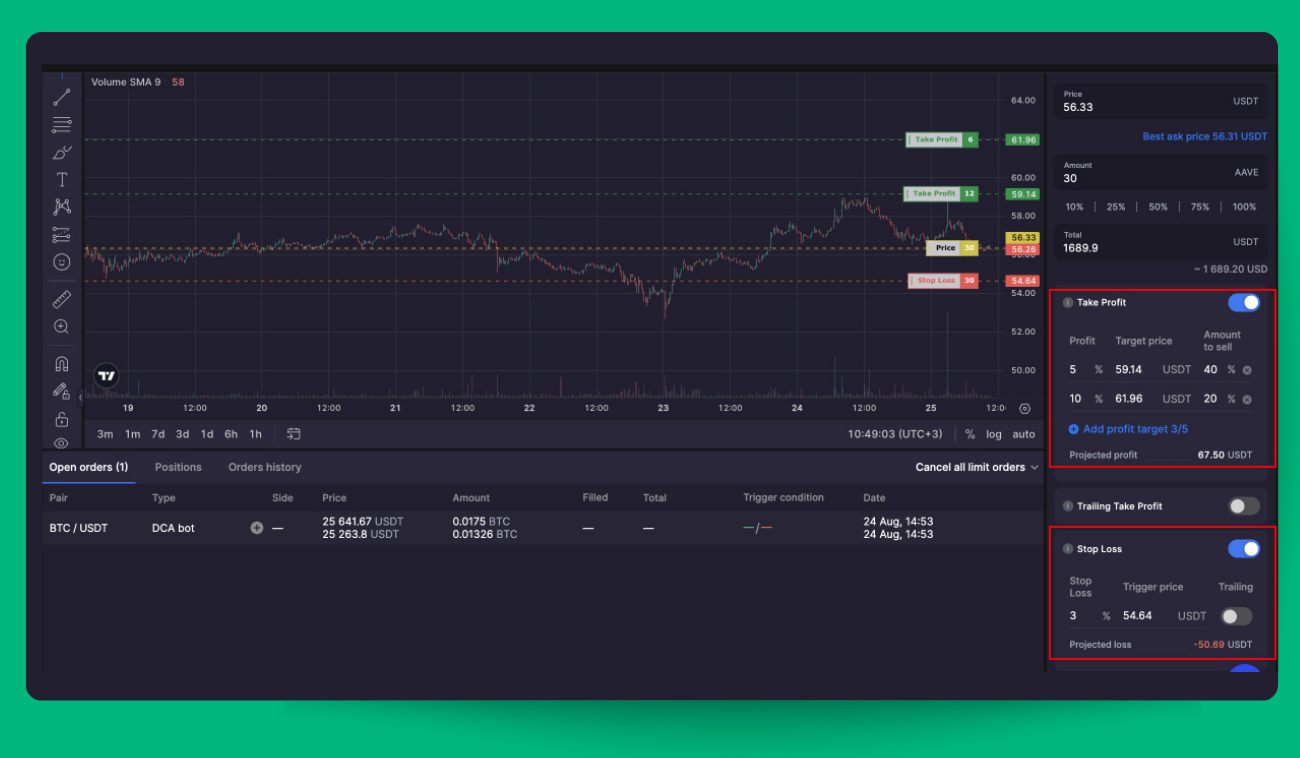

Multiple Take Profits + Stop Loss

The following combination is like graduating to the next level in the strategy game. By deploying multiple Take Profits, you're spreading your risk like butter on toast and cranking up the return. Imagine setting your first target 5% above your entry price and the next one at a 10% increase. As the price cozies up to your first target, you cash in 30% of your total position, saving the remaining 70% for the next target. The total return you pocket is a neat 8.5%.

But wait, don't turn a blind eye to the Stop Loss! Suppose you set it 3% below your entry price. Now you're armed with all the metrics you need to calculate your risk to return ratio. Take that 8.5% and divide it by 3%, and voila, you get 2.83. That's a sweet spot of a ratio, giving you a 2.83% return for every 1% of risk! It's like buying candy for a dime and selling it for a quarter!

👉 Pro tip: TP1 at 5-10% up, TP2 at 10-15% up, SL at 3-7% down

The golden goose in trading is the "Realized return" — this is the profit that nestles cosily in your balance. The "Unrealized return," on the other hand, is like a bird in the bush; it's a potential profit that's still at the mercy of the market's whims and fancies. An "Unrealized return" transforms into a "Realized" one when the Take Profit is hit.

The ideal way to discover your winning combination is like playing a video game in tutorial mode: trade in a risk-free demo setting. Once you've gained enough confidence and your success rate surpasses 70% (for example, you've pocketed $2000 in profit in 20 trades and lost $600 in 12 trades. Your net return is $1400, which when divided by your $2000 profit, gives a success rate of 70%), you're ready to play in the big leagues with real money.

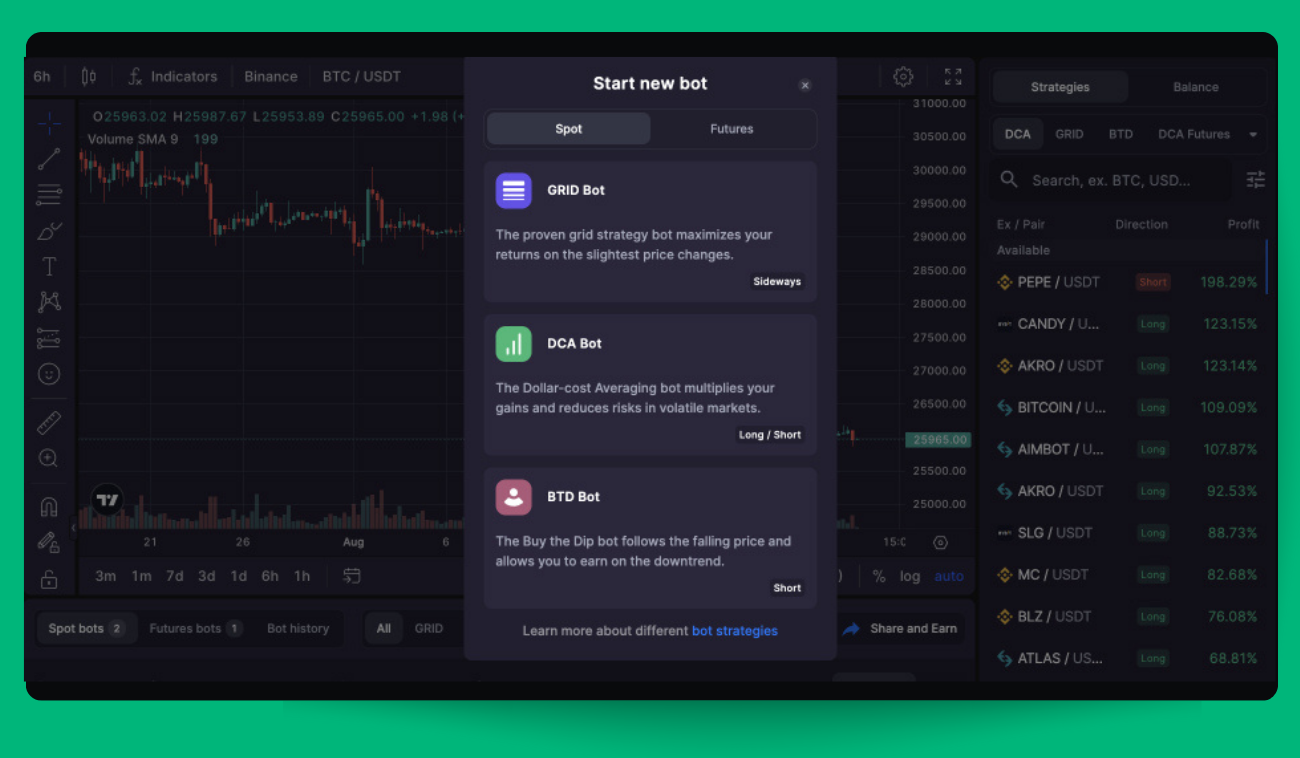

Automated Trading

Think of automated trading bots as the little elves in the shoemaker's story, working tirelessly to bring in consistent daily returns on any market, bullish or bearish. Over at Bitsgap, these bots (Pic. 3) are like the Energizer Bunny, they keep going no matter the trend's direction, 24/7. All you have to do is spend a few minutes tinkering with the bot's settings to squeeze the most juice out of the current market.

For example, the main objective of Bitsgap's GRID bots is to amass returns in either a quote or a base currency, depending on your settings, all while bracing itself against the volatility of the other currency in the pair. Say you've rigged the bot to trade on BTC/BNB in quote, the bot will cleverly churn out profit in BNB (it purchases BNB using BTC when the prices are down and sells BTC for BNB when the prices climb).

Let's imagine you're on a mission to hoard more BNB coins because you're betting on its value to increase in relation to the USD in the future. All you need to do is hunt down the cryptocurrency pair that trades BNB to generate more coins every day. Some examples include BTC/BNB, BTT/BNB, ADA/BNB. If you've got BTC, BTT, or ADA in your portfolio, you can put them to work with the GRID bot and generate more BNB.

👉 Conservative strategy: trading coins to stablecoins like USDT, BUSD, TUSD. High-yield strategy: trading crypto to crypto like BTC/BNB.

On the flip side, if you're playing fortune teller and foresee a certain cryptocurrency about to ascend, but only after it's had a good tumble and traded at a bargain for a while, you could unleash the BTD bot. This bot is a master impersonator of the Buy the Dip Strategy, snapping up more of the coin when its value is on a downward spiral. This approach to accumulating more of the base currency when the price is in the doldrums is considered to be a savant in downtrend trading.

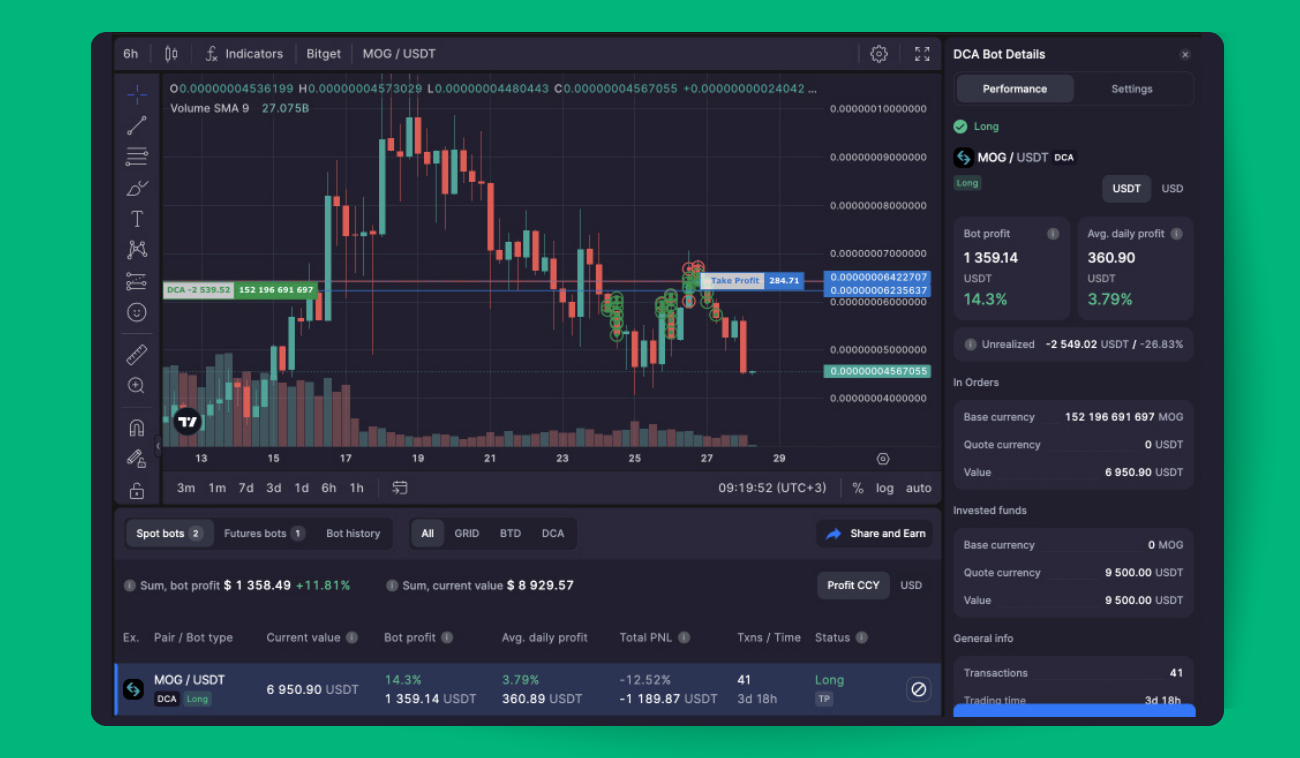

But wait, there's more. Bitsgap also offers the DCA trading bot, the embodiment of the Dollar Cost Averaging strategy. The DCA bot (Pic. 4) is all about frequent buying or selling of a coin in petite portions, minimizing price influence on your open position. Consider it your go-to when you want to put your trading on a merry-go-round of potent technical signals and effective risk management tools. Overall, the bot strives to minimize risks and drawdowns, while clearing the path for profits to steadily accumulate over time.

Ready to give these awesome bots a try?

HODL

HODLing is perhaps the most masochistic yet strangely satisfying strategy in the cryptoverse. It’s a thrilling yet torturous game where you're constantly dicing with bankruptcy but dangle the carrot of infinite returns before your eyes.

Take ADA, for instance. You snap it up, and voila, it's up 10% the next day. Two days later, it's 15% higher than your buy-in. But hold onto your seat, because 50 days on, ADA decides gravity is a thing after all and plummets 50% from your entry point. The question isn't "Can you stomach such risk?" It's "Do you have the emotional fortitude of a Zen monk?"

But then again, if the stars align and your coin-of-the-day starts a slow, steady ascent, you could be looking at a 100-500% profit in just a few months. Not bad for a game of digital Russian roulette.

HODLing, while hands-down the riskiest strategy, also requires a peculiar mindset: "Set it, forget it, and maybe panic a little bit." You're basically lighting a match under your investment, so only use money you wouldn't mind setting on fire.

Bottom Line: Combine ALL Three for a Golden Strategy

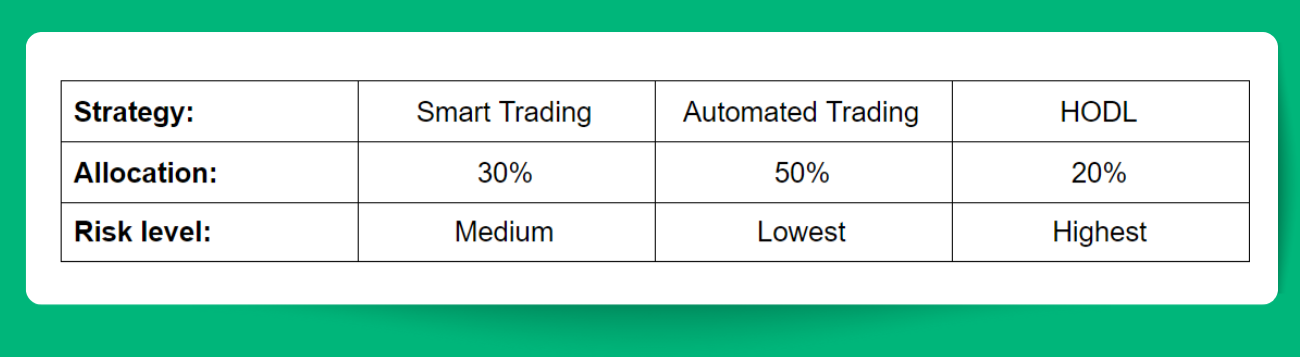

Once you've cut your teeth on each trading strategy, the ultimate game plan is to juggle all three. Think of it as a financial jambalaya; diversification is your secret seasoning. For instance, you could dish out 30% to "Smart Trading", 50% to "Automated Trading", and a mere 20% to the adrenaline rush that is "HODL".

Bitsgap robots are your knights in shining armor, dutifully churning out daily returns in rising, falling, and sideways markets.

For HODL, choose five cryptocurrencies to clutch like precious gems, and if one skyrockets by 100-500% in a few months, it's like hitting the jackpot with a single coin, making the overall risk worthwhile.

In the realm of "Smart Trading", you're the king or queen. The risk and return are your loyal subjects. Here's where you might find yourself clocking in the most hours, keeping a hawk's eye on the fickle market and making strategic maneuvers (like cranking up your Stop-loss, for example).

By the way, you can fine-tune your winning formula in Bitsgap's demo-mode, a veritable playground where mistakes are as harmless as a kitten's sneeze. No risk for your capital, but plenty of practice!

FAQs

What Is a Crypto Swing Strategy?

Swing trading is all about swooping into the market to seize gains over a few days to several weeks. Swing traders primarily rely on their trusty gadget, technical analysis, to decode patterns and trends in coin price movements and pick their stealthy entry and exit points.

The master plan? To 'swing' in and out of the market, capitalizing on price wobbles. For instance, if ether has been climbing the ladder for a few days, a swing trader might leap in, expecting to sell at a higher price in a few days or weeks. On the other hand, if the price is on a toboggan ride downhill, they might aim to short sell and buy back at a lower price.

This strategy doesn't demand the round-the-clock surveillance of day trading, but it does call for a keen understanding of market trends, price patterns, and indicators.

What Is a Crypocurrency Breakout Strategy?

The cryptocurrency breakout strategy is a trading tactic that’s used to spot when a cryptocurrency, which has been yawning and stretching in a price range for a while, is about to bolt either up the stairs or down the chute.

The term "breakout" paints a picture of the price throwing off its slippers, stepping out of its comfy trading range, and sprinting into new territory.

The anticipation is that once a breakout occurs, the price will continue to move in the breakout direction. Of course, it's not without its risks. False breakouts can occur where the price appears to break out but then retreats back into its previous range. Therefore, traders employ various different strategies to confirm if the breakout is genuine and then decide the best points to enter and exit trades.

What Is a Crypto Scalping Strategy?

Cryptocurrency scalping strategy is a trading method used by traders who prefer to snatch small, quick profits from minimal price changes in the volatile cryptocurrency market, rather than holding out for large price swings. Scalpers, as they are known, typically open and close trades within minutes or even seconds. Speed and frequency are the name of the game, with the belief that small gains accumulated over a large number of trades often lead to significant profits.

What Is a Crypto Range Trading Startegy?

Range trading is a trading approach employed when a cryptocurrency is oscillating between two price levels, or 'the range', bouncing off the resistance level (the wave's peak) and the support level (the wave's trough). Range traders aim to buy at the lower price (support) and sell at the higher price (resistance). They're not chasing the biggest waves or the deepest dives; they're content to frolic in the predictable middle ground. It's all about recognizing the pattern and exploiting the regular ebbs and flows.

What Is Crypto Position Trading Strategy?

The crypto position trading strategy is a trading method whereby traders prefer to hold onto their investments for a substantial period of time. Position traders don't let the tiny ripples of daily price changes sway them; instead, they concentrate on the larger market trends in an effort to profit from significant price changes. This requires a solid understanding of market fundamentals, a high tolerance for risk, and the patience of a saint. It might not be as thrilling as riding the daily market waves, but the potential for significant returns makes it an appealing strategy for those with a long-term vision.

What Is a Crypto Trend Trading Strategy?

A crypto trend trading strategy involves identifying the market's direction (upwards or downwards) and placing trades that align with that trend. In the world of trend trading, the mantra is "the trend is your friend". If the market is on an upward trajectory (bullish trend), trend traders will buy. If it's taking a downward plunge (bearish trend), they'll sell or short sell. It's all about going with the flow, not against it.

What Is a Crypto Leverage Trading Strategy?

A crypto leverage trading strategy is a trading tactic that involves the use of borrowed funds to amplify trading positions. A small initial deposit, known as margin, is leveraged to provide greater exposure to the market. For example, with 10:1 leverage, a $100 deposit could allow a trader to take a $1,000 position in the market. This strategy can certainly magnify profits, but it can also amplify losses if the market moves against your position. Leverage trading is best suited for experienced traders who can handle high levels of risk, have detailed knowledge of the market, and are able to make quick decisions when the market shifts.