Going for a Wild Ride: Your Ultimate Guide to Shorting Cryptocurrency

Let's talk about how you can make the most of crypto short positions, without losing your shirt in the process.

Short selling crypto is betting on the expectation that the coin price will fall. While not without its perils, crypto shorting can be tremendously profitable. With the right strategy, harnessing markets is possible.

While going long on crypto is like riding a wild bull, shorting is like wrestling that bull to the ground. The rewards of victory are sweet, but one wrong move and you'll get trampled. So, how do you avoid getting REKT while siding with bears?

In this guide, we'll explore the ins and outs of shorting crypto. You'll learn how to bet against the crowd, the tools and techniques the pros use, and the risks and rewards of shorting. The crypto market never sleeps, but with the right know-how you can stay one step ahead of the herd. Are you ready to outsmart the market? Then, read on.

What Does Cryptocurrency Short Position Mean?

Think of short selling as betting against the asset and rooting for its imminent decline. To put it in other words, when you short, you’re essentially doing the reverse of what traders typically do — buy low, sell high, and all that jazz — since you're selling high and buying low.

👉 It's like borrowing a friend's car for a joyride, but instead of returning it right away, you wait until it's on sale and scoop it up at a discount.

But hold up, don't get confused. Just because you're shorting doesn't mean you don't see potential in the asset. Sometimes, taking advantage of a temporary dip is the smart play.

How Does Crypto Shorting Work?

The basic idea of crypto shorting is to borrow an asset and sell it at the current price. Then, when the price drops, you buy it back and return it to the lender. Theoretically, you end up spending less money to buy the asset back than you received when you sold it, which means you make a profit.

Example of a Cryptocurrency Short Position

Let's break this down with a simple example. Say you borrow five ETH (worth $1,500 each) and sell them for $7,500. After a while, the price drops to $1,000 per ether, so you buy them back for $5,000 and return them to the lender. In this scenario, you've made a profit of $2,500 without even using your own assets. Not too shabby, right?

But wait, there's a catch. What if the price of ether goes up after you short? Or what if the entity you borrowed from demands that you buy back the assets before they drop to your desired price? This is where things can get tricky. When it comes to shorting, profits are limited, but losses are not. And with an asset as volatile as crypto, that's definitely something to keep in mind.

Let's go back to our example. What if the price of ether had instead increased to $2,000? In that case, you would have to buy back five ETH for $10,000, resulting in a loss of $2,500. Yikes.

So, there you have it. Shorting cryptocurrency can be profitable, but it's not without its risks.

Short versus Long in Crypto Trading

If you're entering into a long position, that means you believe the asset is going to keep climbing, so you can cash in on that sweet price appreciation. It’s like buying Van Gogh in the early 1900s and holding onto it until it's worth a fortune.

Shorting, on the other hand, means you believe the asset is not going to keep its pace up but instead will decline in the near future. So, by entering a shorting position, you borrow money from a broker to sell an asset, then buy it back at a discount, and cash in the difference. Now, it's like buying a designer handbag on sale and then reselling it for a profit.

👉 And here's where things get interesting. You can actually incorporate both long and short positions into your trading strategy, as long as you know what you’re doing.

How to Short Crypto

There are a variety of ways to bet against crypto, each with its own unique perks and risks. Here are some of the most popular options:

- Margin trading involves borrowing money from a broker (or an exchange like Binance) to make a trade. However, keep in mind that while using margin, you are using leverage, which may either magnify your gains or compound your losses.

- Futures trading means buying a futures contract if you think the price of an asset will rise or selling a futures contract if you predict a decline. Cryptocurrency futures trading is available on a variety of platforms, including popular exchanges like Kraken, Binance, or BitMEX and brokerages like eToro and TD Ameritrade.

- Binary options trading allows you to short crypto by executing a put order. Binary options are available through offshore exchanges, but beware of high costs and risks. One of the main differences and, as it happens, advantages of options over futures is that you can choose not to sell your put options, thereby limiting your losses.

- Using CFDs (or contracts for difference) means purchasing a CFD with a negative price target. The CFD settlement doesn’t require holding an asset and is based on the spread between its opening and closing prices.

- Manual short selling means you can sell off tokens at a price you're comfortable with now and wait for the price to drop to buy them again.

- Automated short selling means using automated trading bots that short crypto for you. For example, Bitsgap’s DCA shorting strategy allows you to sell crypto at a higher price to buy it back later at a discount. However, to start the DCA bot, you’ll need to have an asset you want to short on your balance, and you can’t borrow it from the platform.

Why Short Crypto

There are two main reasons to engage in short selling crypto: speculation and hedging.

Speculation is like betting on the outcome of a game. You're making a pure price bet that an asset will decline in the future. If you're right, you can make money. But if you're wrong, you'll have to buy those coins back at a higher price, resulting in some serious regret. And because of the extra risks involved in short selling (like using margin), it's usually done over a shorter time frame.

You may also use short selling to hedge your bets. If you have long positions, you might want to sell short against them to lock in your profits. Or, if you want to limit your losses without actually exiting a long position, you can sell short a similarly performing asset.

When to Open a Short Position

You should open a position when you anticipate that the asset will decrease in value. This anticipation can be based on various factors that you can try to identify, such as significant volume spikes over a short period, a surge in prices, or overly optimistic news. Shorting involves opening a position when you believe that an asset is trading above its actual worth.

When to Close a Short Position

Deciding when to close out a short position can be a tricky business, but there are a few key factors to consider.

First, keep an eye on interest charges, which can accumulate the longer you hold the short. You want to hold on to the short until the coin price drops, allowing you to buy back the borrowed asset at a lower price and make a profit. But make sure you factor in any interest charges when calculating your net profit.

Another important factor is your maximum loss threshold. Determine the maximum acceptable loss before initiating any investment. Short selling involves increased risk, so it's crucial to have an exit strategy in place. A buy stop order, for instance, can signal a buy when a security hits a strike price above the current spot price, limiting your potential losses.

Finally, consider hedging as a strategy to reduce risk in a trade by taking an offsetting position. If you're using a short position to hedge an existing long position, you may want to hold on to the short until the long position is no longer at risk.

Bitsgap’s Crypto Shorting Tools

Bitsgap has conjured up a stewpot of cash-churning tools that can not only do the dreary work of short selling for you but also spin straw into gold! Let's take a look at these awesome tools, shall we?

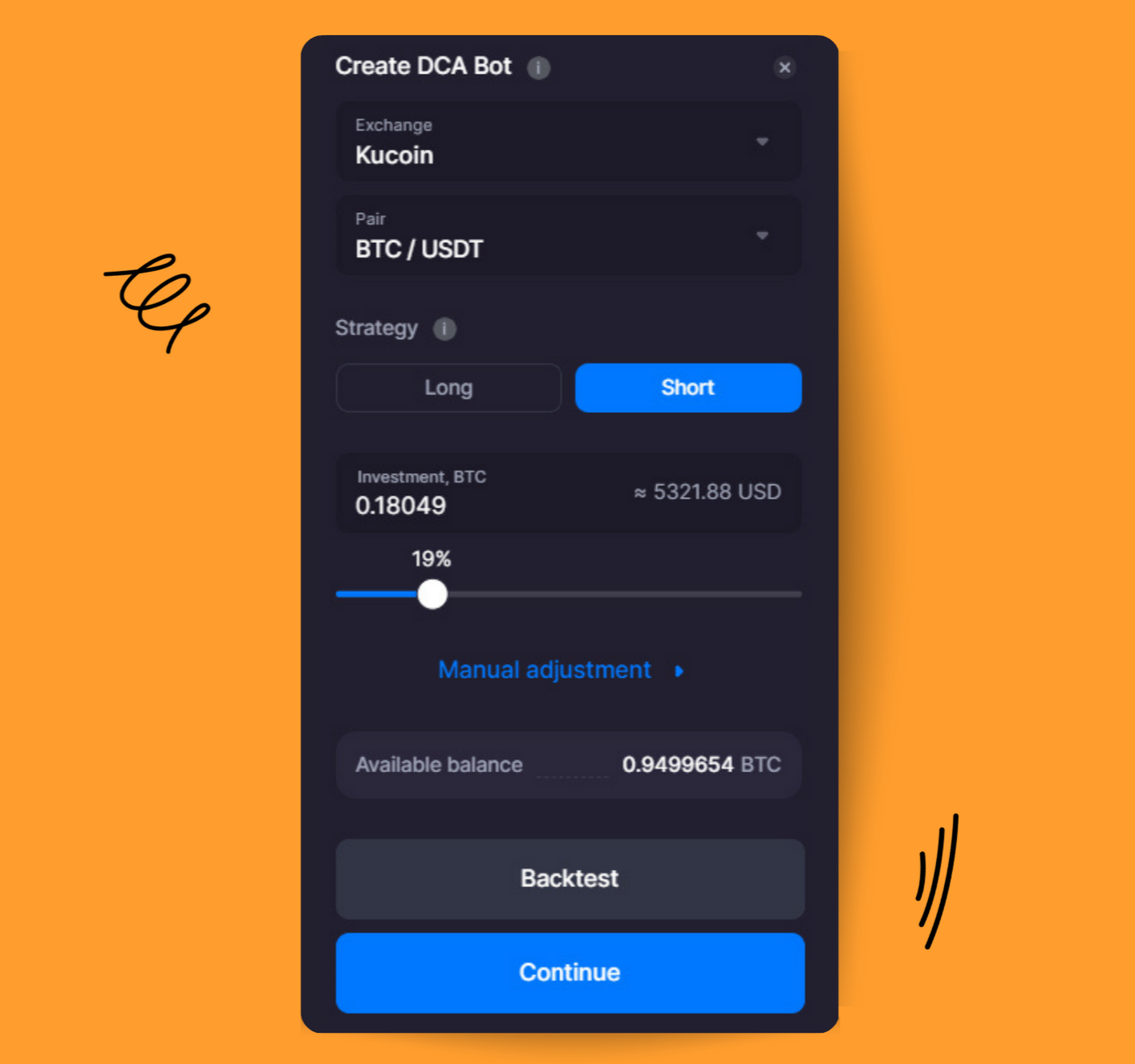

Dollar Cost Averaging (DCA) Bot

This bot uses the Dollar Cost Averaging trading strategy, tossing your investment into the market in regular installments to get the best bargain price. This approach minimizes the impact of volatility on your overall position and maximizes your returns.

You'll want to use this bot if you fancy cycling your trades, following the market’s indicator signals, or enhancing your short selling with risk management wizardry.

To open a short position with the DCA bot, you'll need the base currency to get started. If you don’t, you'll have to buy it manually, then return to the bot and begin your money magic!

Once you have enough base currency, click [Start new bot] and choose the DCA bot. Select an exchange, a trading pair, and click [Short] under [Strategy]. Click [Continue] and your bot will immediately start spinning using tried and true default settings. If you prefer to follow your own strategy, you can customize the settings to your heart's content under [Manual adjustment] (Pic. 1).

Learn more about DCA here and here.

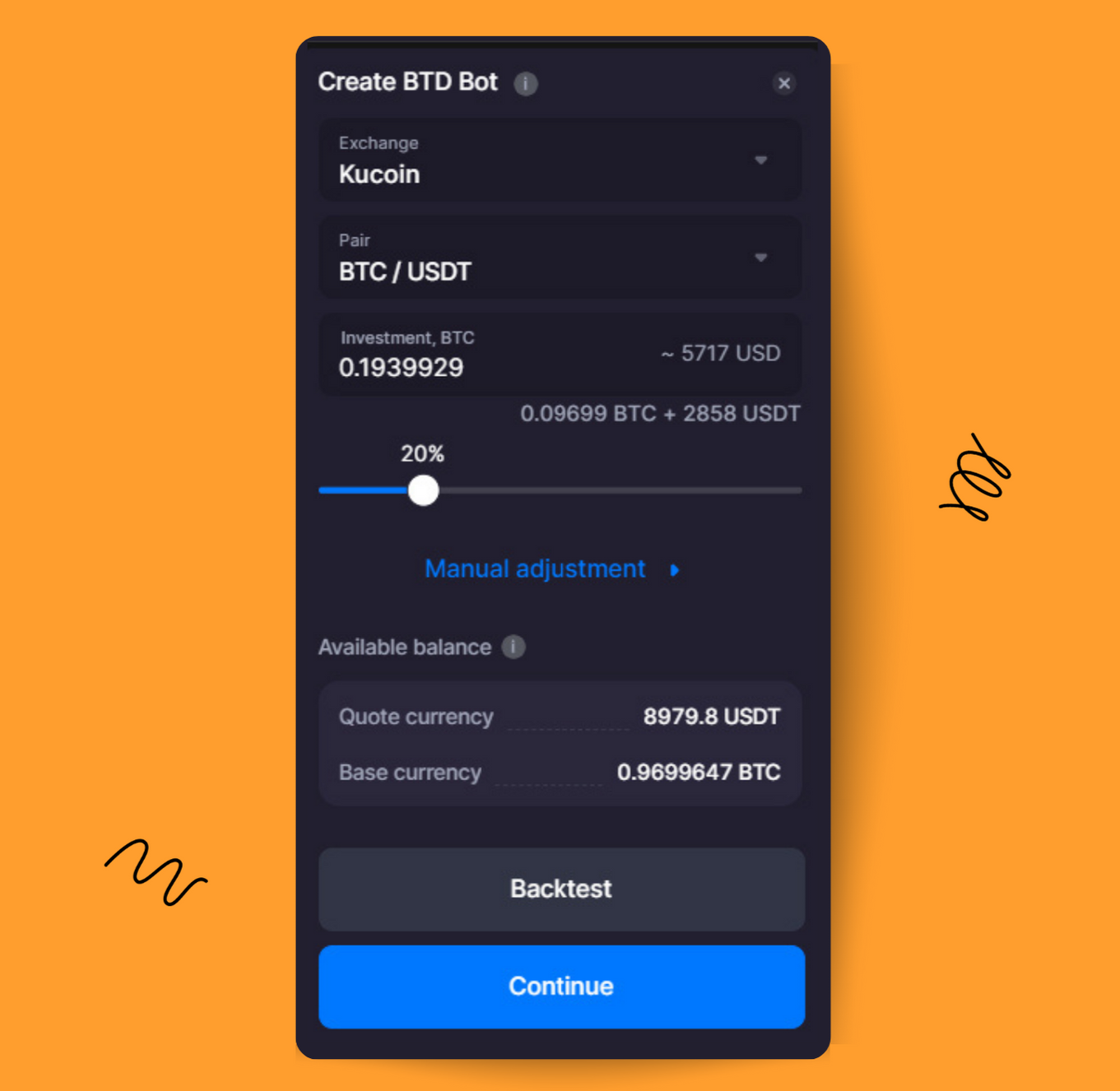

Buy the Dip (BTD) Bot

This bot purchases coins after they've fallen in price, buying into the dip. This averages the cost of owning your coin portfolio because the bot purchases coins in higher quantities as their price dips deeper.

To start BTD, click on [Start new bot] and choose BTD from the list. Select a trading pair, exchange, and investment. Then click [Continue] to begin trading with default settings or [Manual adjustment] to make changes to the bot's parameters (Pic. 2).

Learn more about BTD here and here.

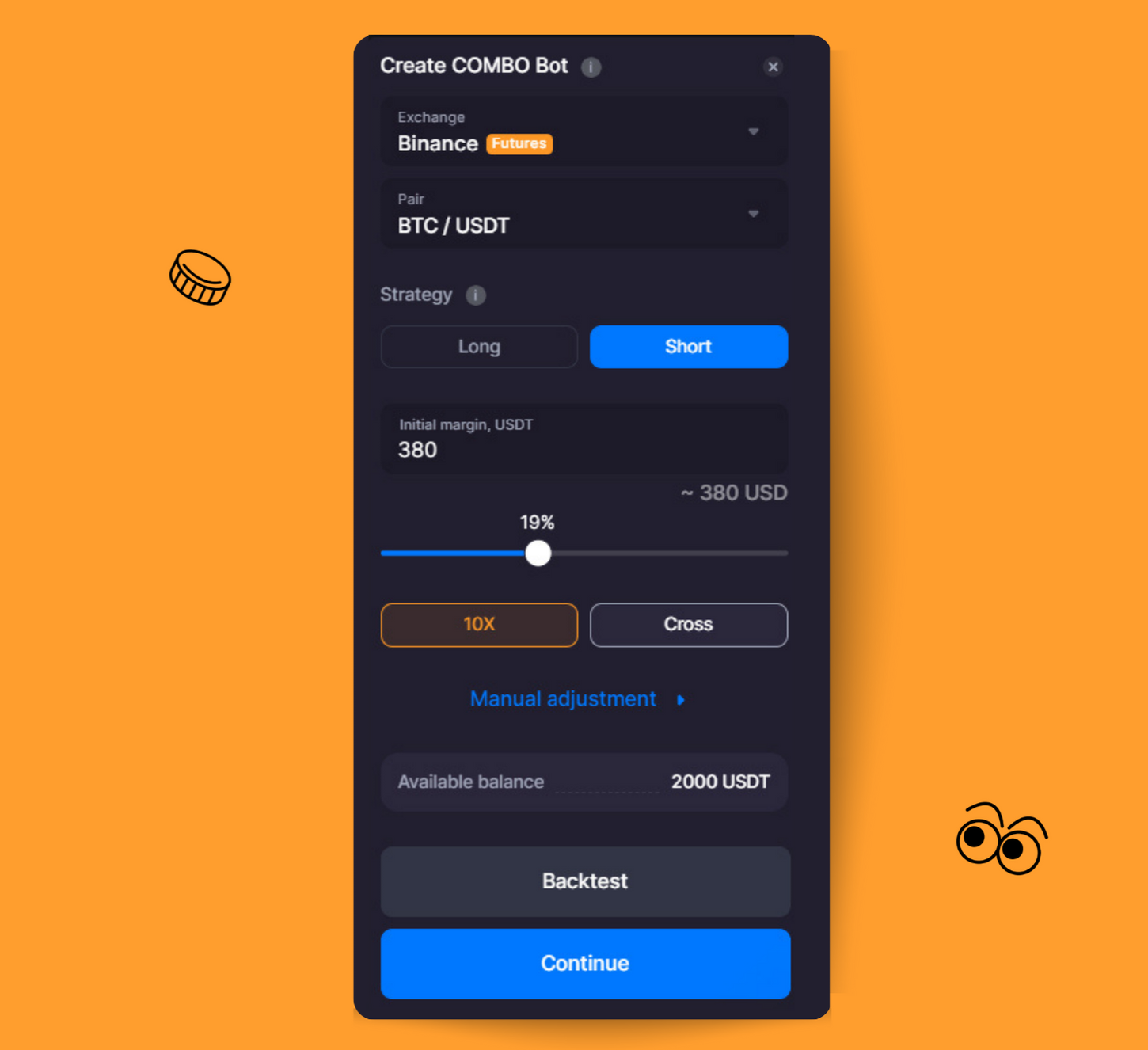

COMBO Bot for Futures

This futures bot combines DCA and GRID strategies to profit from both rising and falling markets. DCA optimises the average price of a position, while the GRID enables the bot to produce returns on every market fluctuation. The automated trailing of the Stop Loss stays in sync with the trend, protecting your profits.

To start the bot, click on [Start new bot] and choose COMBO from the drop-down menu. After selecting an exchange, trading pair, initial margin, and leverage, click [Short] under [Strategy]. By selecting [Manual adjustment], you may modify the COMBO bot's defaults (Pic. 3).

Learn more about COMBO here and here.

Crypto Shorting Strategy Advantages and Disadvantages

When you sell short, you're essentially betting that an asset's price will go down. But if you guess wrong, you could be in for a world of hurt. A trader who has shorted stock can lose more than 100% of their original investment because there's no ceiling for a coin’s price. Plus, you might have to fund the margin account, which can add up in costs.

Closing a short position can also be tricky. If other traders are shorting or if it's thinly traded, you might have trouble finding enough coins to buy. On the flip side, sellers can get caught in a short squeeze loop if the market or a particular coin starts to skyrocket.

But don't worry, there's a bright side! If you predict the price movement correctly, you could make a tidy return on investment. Short selling can be a cost-effective way to hedge and provide a counterbalance to other portfolio holdings. Just make sure to do your homework and get some trading experience under your belt before diving in.

Bottom Line: Big Risks, Big Rewards

While some say that short selling crypto might not be for the faint of heart, others buckle up and ride the bear while it runs. So, get out there and start strategizing like a pro. Who knows, you might just become the next Wolf of Wall Street (minus the illegal stuff). In any case, beware of the risks and use crypto trading bots where you may. Bitsgap is your best bet. Try now and see for yourself!

FAQs

What Is Crypto Shorting Meaning?

Short selling cryptocurrency is an advanced trading strategy that involves speculating on a decline in the asset's price. When taking a short position, traders sell a coin at a high price and buy it back later at a lower price. Investors often short for speculative reasons or as a hedge against the loss of a long position in the same or similar coin. However, shorting can be risky due to its speculative nature and the use of borrowed funds in most cases, which can expose investors to unforeseen losses. So, it's essential to proceed with caution and have a sound understanding of the risks involved when short selling cryptocurrency.

Is a Short Position in Crypto Trading Good or Bad?

Shorting can be a profitable trading strategy, but it's also a challenging game to play. This is especially true if you plan to trade with borrowed funds. If you're new to short selling, it's not recommended at all. You could end up in debt to your broker for a significant amount of money with no way to pay it back. The best approach is to save short selling for when you're more experienced. Learning to short properly can help ease the pain of bear markets if you can identify when they're coming. So take your time, learn the ropes, and be smart about your short selling strategy.

What Are the Risks of Cryptocurrency Short Trading?

Trading your own cryptocurrency is less risky than trading borrowed crypto. However, you're also limiting your profit potential. Trading on margin from a brokerage amplifies the risk. If you don't know what you're doing, you could end up in debt. Remember that shorting technically offers a limited reward compared to an unlimited risk. This "unlimited risk" is based on the fact that if you're wrong, you could potentially incur unlimited losses since the price of crypto could theoretically keep going up. It's up to you to decide if short trading is worth the risks involved.