Optimal Scenarios to Trade Leveraged Tokens VS Futures Contracts

Ever found yourself at a crossroads between trading leveraged tokens and futures contracts on Binance? Well, buckle up! Join us in this article to discover the optimal scenarios for each, and learn how to turn market volatility into your playground.

Cryptocurrency leveraged tokens adjust your exposure to the crypto rollercoaster based on the whims and fancies of the market. Feeling a bit pessimistic? Use DOWN tokens to short-sell the market. Feeling like a high-roller? UP tokens let you long the market.

The main goal of all crypto derivative products — and leveraged tokens aren't the wallflower at this party — is to speculate on markets playing seesaw. The twist lies in the potential returns, the thrill of risk exposure, and the valuation of the contract price.

In this delightful read, we'll unpack the optimal times to clutch onto your leveraged UP and DOWN tokens instead of your run-of-the-mill perpetual futures position. All the wisdom we're about to drop is based on the school of hard knocks, also known as practical experience.

NB: Yes, the article does take a 'blast from the past' approach with data from 2020-2021. But don't roll your eyes just yet! These scenarios haven't aged a bit. They are as relevant today as ever — much like that vintage band T-shirt you refuse to throw away.

What Are Leveraged Tokens?

Alright, let's get down to brass tacks. First up on the docket: defining leveraged tokens. For the sake of our examples, we're using Binance's leveraged tokens as our guinea pigs, so all contract specifications and jargon are borrowed from Binance's knowledge base and FAQ:

👉 Binance Leveraged Tokens (BLVT), as per the Binance Academy, are 'tradable assets in the Binance spot market that give you leveraged exposure to the underlying asset without the risk of liquidation. Each leveraged token represents a basket of perpetual contract positions. The price of the tokens tracks the change in notional amount of the perpetual contract positions in the basket and changes in the multiples of leverage level.’

So, in plain English? The perpetual contract of a token serves as the foundation for any leveraged token. So, if we're talking about BTCUP and BTCDOWN leveraged tokens, their backbone is the BTC/USDT perpetual contract in Binance Futures. That means BTCUP and BTCDOWN are essentially betting machines built to predict the ups and downs of the BTC/USDT perpetual contract.

In the grand scheme of things, BTCUP and BTCDOWN are just perpetual futures contracts playing dress-up. The only difference is they automatically keep a steady target leverage range, anywhere from 1.25x to 4x.

How Leveraged Tokens Generate Returns?

Alright, here's the lowdown. When the market's feeling like a rocket ship, the built-in rebalancing of these tokens cranks up the leverage to amplify your returns. It's like putting your profits on steroids, all the way up to a heady 4x. But when the market decides to take a nosedive, the system pulls back the reins on the leverage to keep your risks in check. It's like a self-regulating safety net, toning down the leverage to a cozy minimum of 1.25x.

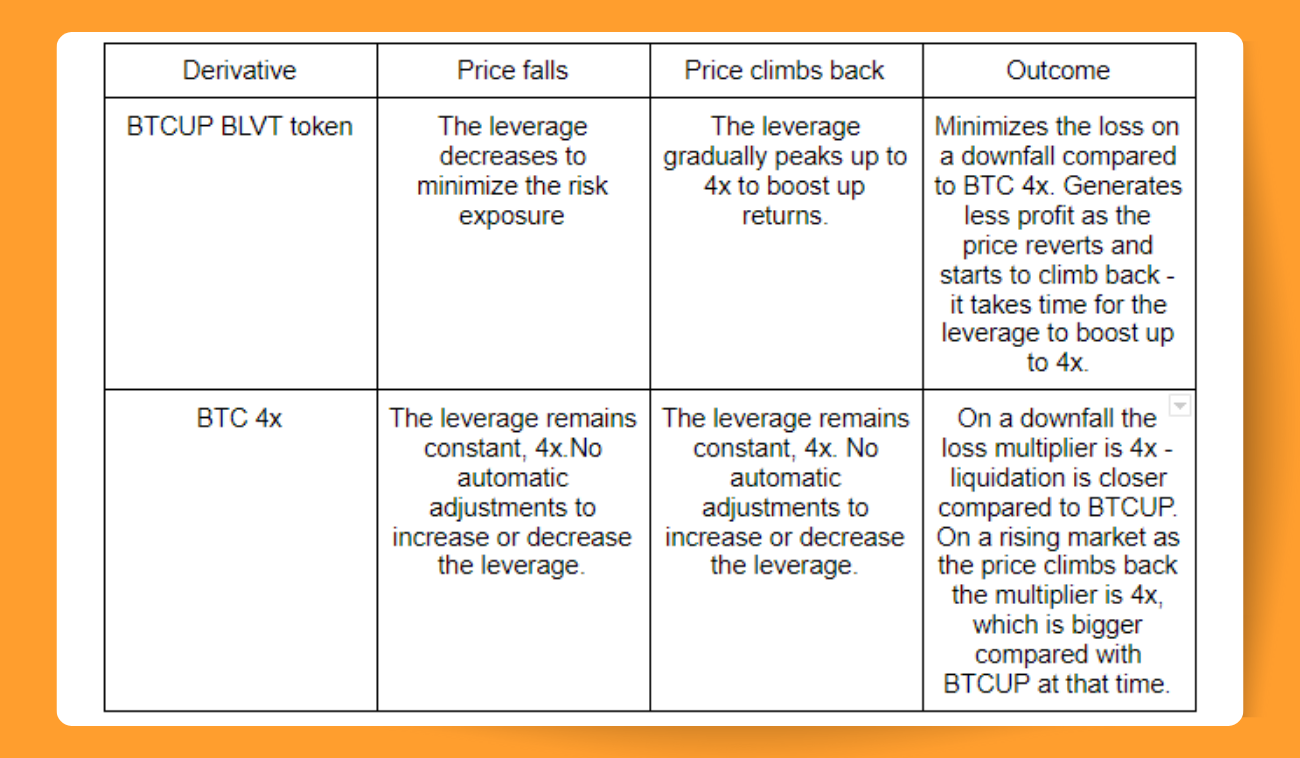

Now, let's roll up our sleeves and dive deeper into this data pool. To truly get a handle on the potential of these leveraged tokens, we're going to tackle a few scenarios where BLVT either shines or sinks in comparison to your garden-variety 4x leveraged futures position.

BTCUP Performance in the Sideways Market

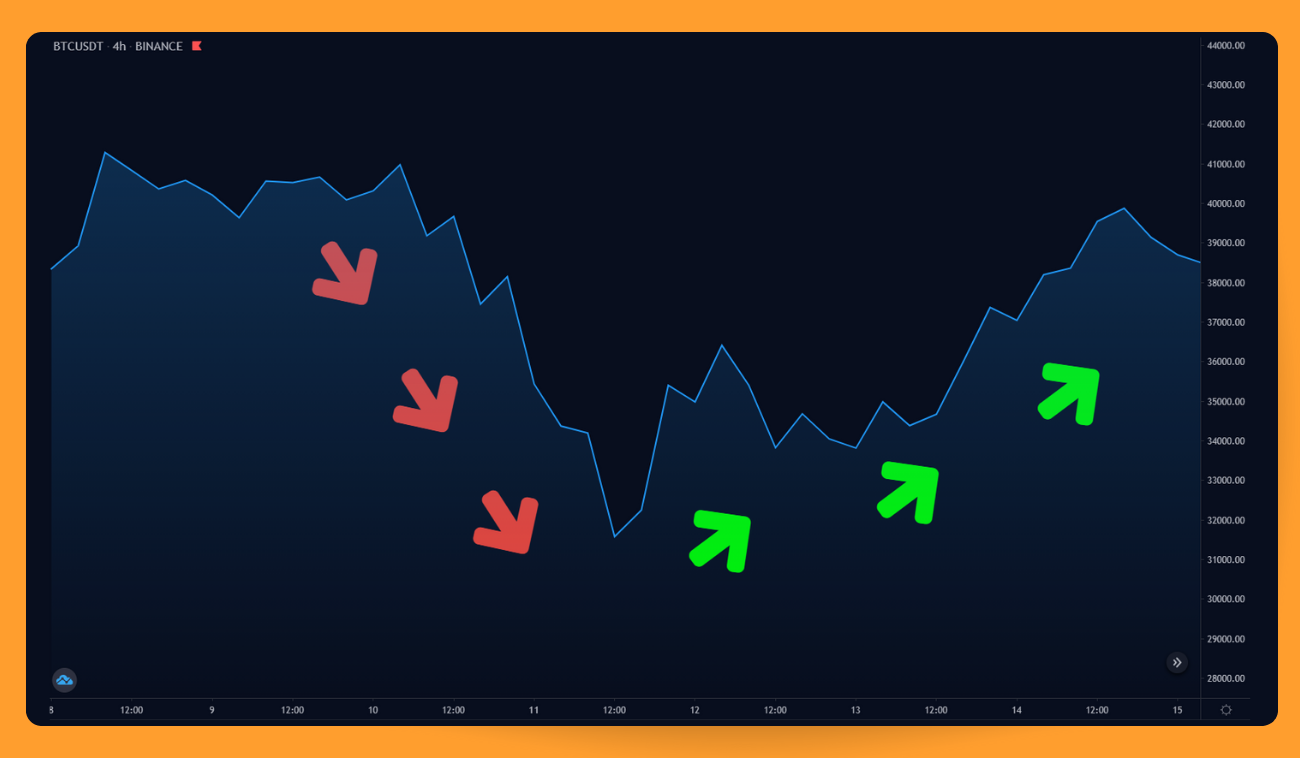

Picture this: a trader steps into the market, only to have the price take a nosedive almost immediately. But wait, there's a plot twist — the price starts to climb back up after a while. In this script, BTCUP's built-in mechanism is working overtime, recalibrating on an 'only-when-needed' basis. As the market stumbles and falls, the leverage scales back. But the moment the price decides to play nice and start climbing again, BTCUP hits the gas, cranking the leverage up to a daredevil 4x.

Verdict: Keep a tight grip on that BTCUP position if you've got a hunch the market's about to throw a rally party. If you notice the price taking a bit of a tumble but chalk it up to a brief 'catching-its-breath' phase before the big rally, then it's time to put your BTCUP position under the microscope. In this scenario, BTCUP pulls ahead of the BTC 4x futures position in the performance race (Fig. 1).

Warning: If the price decides to rebel and spin off in the wrong direction, and your leverage is already scraping the bottom at 1.25x—meaning the system's out of tricks to reduce risk — then you might want to consider waving the white flag and closing your position to sidestep further risk.

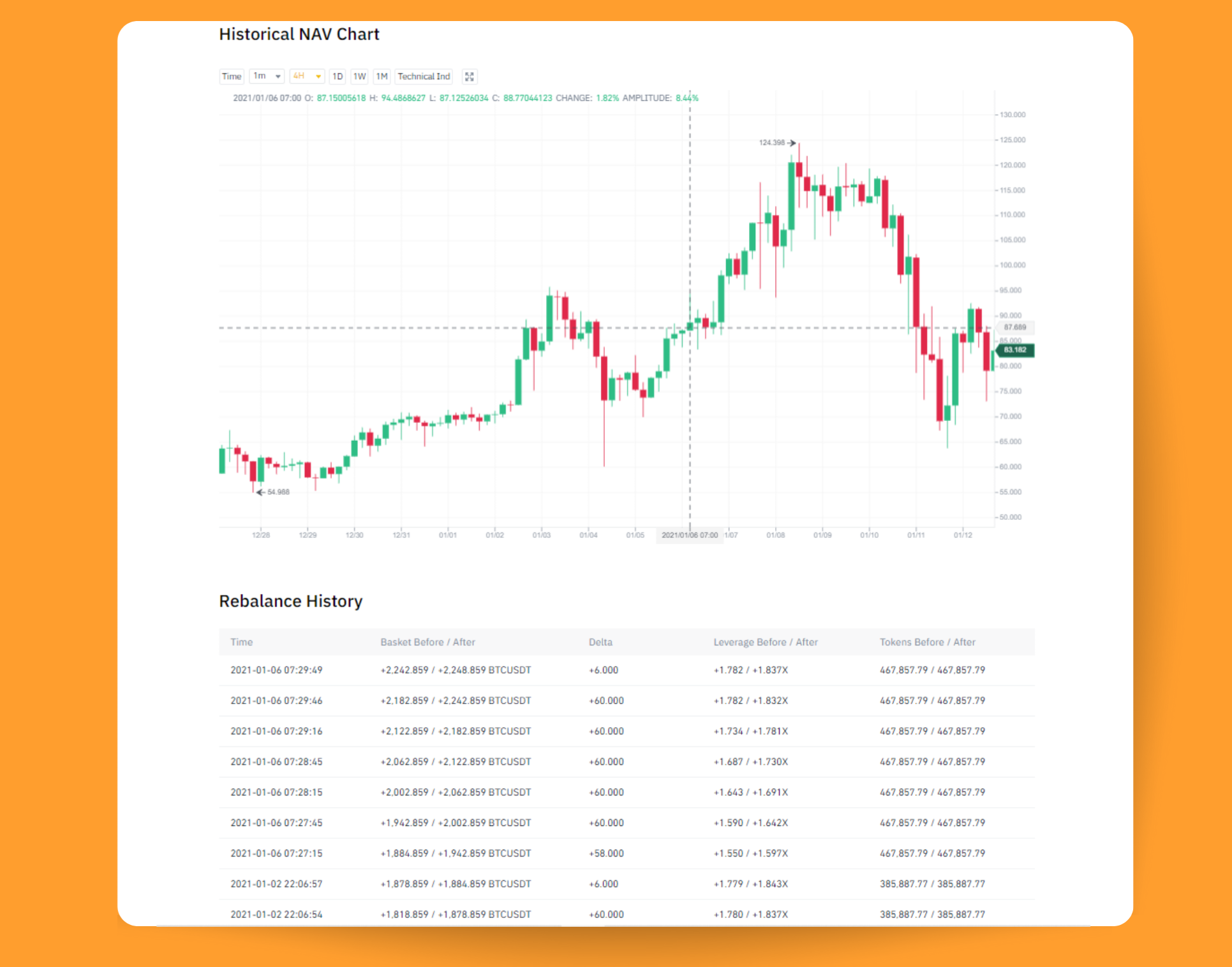

Now, let's take a gander at this historical NAV chart of BTCUP leveraged tokens (Pic. 3). The 'Leverage before / After' column is the star of the show here, spotlighting the ever-changing dance of the BTCUP leverage. As the BTC/USDT perpetual contract price scales the heights, the BTCUP leverage follows suit to squeeze out maximum returns. And when the price decides to take a slide, the leverage follows it down to keep the risks on a tight leash.

According to the gospel of Binance Academy, the primary aim here is to slam the door on front-running. If these tokens decided to rebalance on a fixed schedule, it'd be like leaving a window open for other traders to capitalize on this predictable event. Since the target leverage is as steady as a seesaw, the tokens don't feel the need to rebalance unless the market conditions send out an SOS.

Sounds like a pretty even playing field, right? Well, here's the catch: we're left in the dark about who gets to play judge on when 'market conditions deem it necessary'. Some traders and investors might see this as a handy-dandy tool for Binance to pull the strings on the price whenever it suits their fancy.

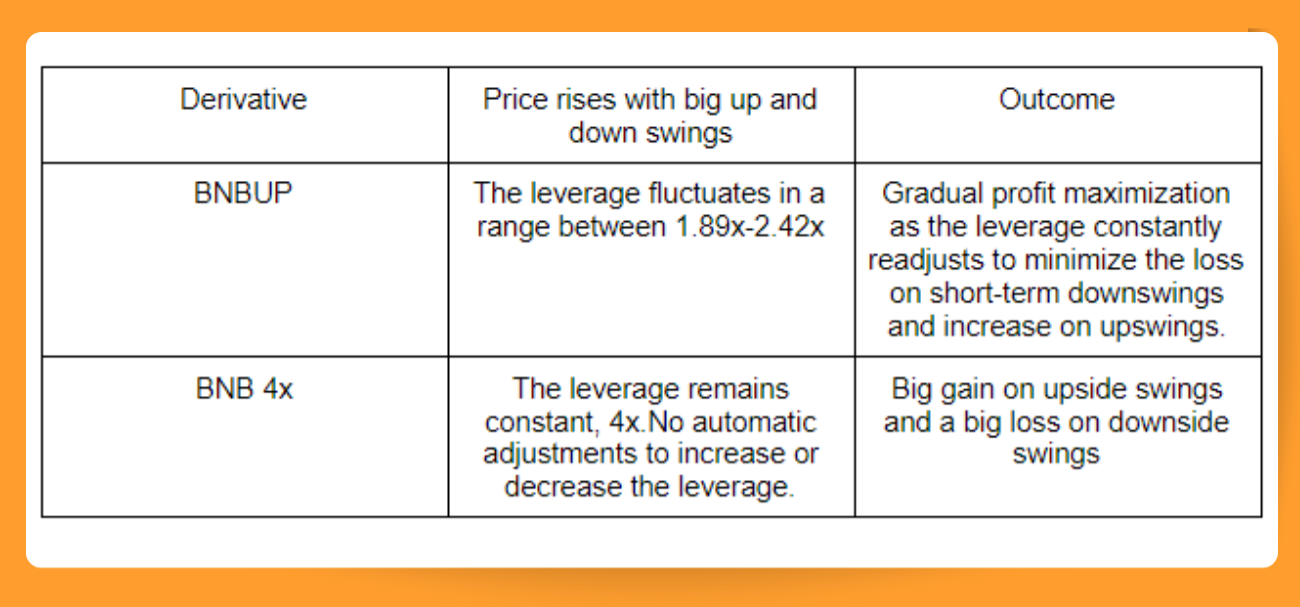

BNBUP Performance on a Highly Volatile Uptrend

The overall trend is on an uptick, but the price is dancing like it's got ants in its pants (Pic. 4). Thanks to the wild ride of extreme volatility, the BNBUP leverage is swinging within a certain range.

Final Verdict: In a market that's rocketing upwards, you'd think BNBUP would be having a field day, right? Well, think again. The culprit: volatility. Take BNB/USDT, for example — wild intraday swings of 15-20% were the proverbial banana peel on the road to riches, messing with the leverage rebalancing. So, despite the market heading north, BNBUP couldn't crank the leverage up to 4x, thanks to these tumultuous tremors on its way to a shiny new all-time high (ATH). Talk about a bumpy ride!

DOWN Tokens

DOWN leveraged tokens march to the same drumbeat of leverage rebalancing as their UP counterparts. They're crafted to rake in returns when the market's taking a tumble. So if you're putting your money on the price falling, the DOWN token is your ace in the hole. On the flip side, if you're betting on the price soaring, the UP token is your go-to.

As the market dips, DOWN tokens amp up the leverage to a hard-hitting maximum of 4x, but the moment the price starts to scale the heights, they dial down the leverage to keep risk exposure in check. Here's an example of when the stars align to trade the DOWN token (Pic. 6):

What Are Futures vs Leveraged Tokens Pros Cons?

Well, both futures and leveraged tokens come with their own bag of tricks and treats. Here's a quick overview.

Pros of leveraged tokens:

- Walk in the park: Getting started with leveraged tokens is as easy as pie. Buy, hold, and voila — you've got a 3x leveraged position. Want out? Just sell them. No fancy footwork needed.

- Big rewards for right guesses: If you've got the gift of prophecy and can predict which way the market winds will blow, these tokens can bring home much more bacon than their non-leveraged cousins.

- No collateral, no problem: Leveraged tokens don't need you to pledge your firstborn or keep topping up collateral. Thanks to their rebalancing act, they keep the risk of liquidation at bay.

- Safe from liquidation: No matter how low a leveraged token's price drops, it won't change the quantity you hold. Only in a blue moon, the price might approach zero.

- Auto-pilot profits and position reductions: In a bull market, leveraged tokens use their profits to buy more tokens, multiplying your gains. If a bear comes calling, they reduce positions instead of stopping losses.

Cons of leveraged tokens:

- High-stakes game: Leveraged tokens might keep liquidation risk low, but they're still high-risk players. The leverage amplifies both your potential profits and possible losses.

- Not a long haul buddy: These tokens are more of a fling than a long-term relationship. They're rebalanced daily, making them a poor choice for hodling. The longer you hold, the higher the risk and costs.

- Management fee: Unlike perpetual contracts, leveraged tokens charge a daily management fee of 0.01%. It's like their version of a tip jar.

- Volatility decay: Leveraged tokens love to amplify everything, including volatility. So, even minor price swings can cause volatility decay to gnaw at your investments.

So, there you have it. Now, let’s gander at the exciting world of crypto futures trading, where everything's made simpler, yet ironically, more complex.

Perks of crypto futures:

- Easy peasy: Crypto futures trading is like a shortcut to profit from price fluctuations without the fuss of babysitting the actual crypto.

- Leverage, baby!: This is where the magic happens. With a little capital, you can control a giant contract value (up to 125x on Binance, for instance). Leverage is the secret sauce that lets traders squeeze more profits from their limited capital.

- Safety net: Crypto futures markets have position and price limits, acting as your financial seatbelt. It minimizes your crash risk, even when you're driving in the fast lane.

- Flexible friend: Want to short an asset? Crypto futures are game. They're your all-weather friends, ready for any trading strategy you throw at them.

- Spot-on pricing: Unlike traditional futures, perpetual crypto futures trade close to actual spot prices. It's like getting the best seat in the house, minus the premium.

- Hedge your bets: Crypto futures can act as your financial umbrella, shielding your investments from short-term downturns.

Cons of crypto futures:

- Leverage, again: However, leverage can turn from friend to foe in a blink. Over-leverage can sweep your capital off its feet, and not in a romantic way.

- No ownership perks: While trading crypto futures, you miss out on the fun parts of owning cryptos like staking and voting rights.

Where to Trade Leveraged Tokens?

You can trade leverage tokens at exchanges that offer such a service, including, of course, Binance, which we’ve covered extensively in this article. Binance's daily management fee for leveraged tokens is a mere 0.01%, and the redemption fee is only 0.1%. Here's the cherry on top — unlike futures trading, you'll be relieved to find there's no funding fee.

Now, by integrating Binance (or any of the other 17 remarkable exchanges) with Bitsgap, you're in for a real treat! Not only will you be trading your tokens through the top-notch Bitsgap interface, but you'll also have the power to utilize a variety of advanced trading tools! Smart orders, trailing and hedging features, and the cream of the crop, automated trading bots, are all at your disposal.

Bitsgap's bots are a marvel! Choose the one that best suits your trading strategy. You have options galore — DCA for both spot and futures, BTD, GRID, COMBO for futures.

Eager to take the Bitsgap platform for a spin? Subscribe today and enjoy a week-long trial on the PRO plan! You can easily extend your trial or switch to any other plan that aligns best with your goals.

And here's a bonus! Bitsgap offers a paper trading mode, where you can trade without risking a single penny of your capital. Are you pumped and ready to dive in? Then let's get started!

Time to Sum Up

BLVT is the perfect fit for those looking to dip their toes into the world of leveraged exposure to a selection of cryptocurrency prices without the headache of managing a leveraged position. Its built-in rebalancing act automatically cranks up the leverage when the price sways towards the profit zone, and tones it down when the price veers towards the loss territory.

FAQs

What Is Leverage Tokens vs Futures Difference?

Think of leverage tokens as your automated butler for trading — they keep your exposure to a digital asset just right and make sure you don't get knocked out by liquidation. They're like a seesaw, always balancing between 1.25x and 4x leverage. So, when the market gets moody, these tokens step up their game, minimizing your risk and maximizing your potential returns. The poster boys for these tokens are the likes of BTCUP and BTCDOWN on Binance.

Futures are your classic buy or sell commitment at a future date with a set price (unless futures are perpetual). Imagine agreeing to buy a chocolate bar next year at today's price. Fun, right? Until the price of chocolate skyrockets. That's the risk you take with Futures. They're like a double-edged sword — high returns if you're lucky, high risks if you're not.

So the difference between leverage tokens and futures comes down to management, risk, liquidation, and rebalancing:

- Management: With Futures, you're on your own — monitoring margins, managing positions, and praying you don't get liquidated. Leveraged tokens, however, are the laid-back cousin — they do all the work for you.

- Risk: Futures can leave you with empty pockets if you're not careful. Leveraged tokens, being the gentler of the two, only risk what you put in.

- Liquidation: Futures can kick you out of the game if the market turns against you. Leveraged tokens, on the other hand, play nice — no liquidation, thanks to their rebalancing act.

- Rebalancing: Leveraged tokens love their balance. They constantly adjust their leverage, which, funnily enough, can make them act a bit wonky and deviate from what you'd expect. Futures, being the straightforward guys they are, don't bother with this balancing act.

So, there you have it — leveraged tokens and futures, two sides of the same coin, each with their own quirks and features.

Futures Contracts vs Leverage Tokens: What’s Better?

So, you're standing at the crossroads of futures contracts vs leveraged tokens, huh? Well, the path you choose will hinge on your appetite for risk, your understanding of the markets, and how much you love (or loathe) managing your positions.

Futures Contracts? They're for the adrenaline junkies of the trading world. Those who get a thrill from navigating the choppy waters of high-risk, high-reward trading. They come with the promise of high leverage and potentially juicy returns. But beware, if the market takes a nosedive, so does your position, and you might find yourself waving goodbye to your capital.

Now, if you're more of a 'set it and forget it' trader, leverage tokens could be your ticket. They're like having a personal assistant who handles your leveraged exposure for you, maintaining a target leverage range that dials down the risk when the market goes south and ups the potential returns when it's all sunshine and rainbows. But remember, it's not all smooth sailing. The auto-rebalance feature can lead to path dependency and compounding effects, causing unexpected deviations from the returns you were eyeing.

The final call between futures and leveraged tokens? It's a personal one, influenced by your trading strategy, how much risk you're willing to stomach, and your grasp of these financial instruments.

What Could Be Binance Leveraged Tokens Strategy?

Binance Leveraged Tokens (BLVTs) are like the Swiss Army knife of the trading world. They've got a little something for everyone, and here's how you might wield them in your trading strategy:

- If the idea of high leverage excites you, but the thought of managing positions makes you want to take a long nap, BLVTs are your ticket to the party. These tokens do all the dirty work, adjusting leverage as Mr. Market throws his tantrums, leaving you free to binge-watch the latest season of your favorite show.

- If you foresee a storm brewing for a particular crypto, 'DOWN' tokens (like ETHDOWN for a cloudy Ethereum forecast) could be your perfect hedge. They're like raincoats for your portfolio, keeping it dry while others get drenched.

- Love the adrenaline rush of market volatility? BLVTs adjust their leverage in tune with market swings, promising a thrill ride, no matter how bumpy the track gets.

- Unlike the precarious tightrope walk of futures, BLVTs are a safety net. You only stand to lose what you put in, so you can sample the leverage pie without the fear of falling off the financial cliff.

Finally, BLVTs are a great way to add some zing to your crypto portfolio. A mix of 'UP' and 'DOWN' tokens could let you profit from market movements in either direction.

How to Manage Risks with Leverage Tokens?

Leveraged tokens might sound like a magical potion that does all the work for you, but remember, there's no such thing as free lunch. They come with their own quirks like frequent rebalancing and path dependency. Make sure you've read the fine print and understand how they function. Decide beforehand how much you're willing to risk. This should be an amount you're comfortable with losing, because, let's face it, in trading, losses are part of the game.

Sure, leveraged tokens might sound exciting, but putting all your money into them is as wise as bringing a knife to a gunfight. Diversification is key. Mix up your portfolio with different types of investments.