The Battle of Currencies: Fiat Money vs Cryptocurrency

As crypto gains momentum, potentially heralding the future of finance, this article is your must-read guide to understanding the key differences between fiat and crypto and why they matter.

Throughout human history, communities have used various forms of money, from livestock to precious metals to paper bills. The emergence of cryptocurrencies and blockchain technology in the last decade represents another seismic shift in how we store and exchange value. But how is crypto different from the currency most of us know and own — fiat? Let’s find out.

Every time the crypto market surges with bullish fervor, the decade-old debate on whether cryptocurrencies will eventually dethrone government-backed fiat currencies comes to the fore. Yet, as soon as the crypto landscape shifts and bears take over, confidence in digital currencies seems to evaporate just as swiftly. However, many still believe that fiat is a ticking time bomb — destined to be replaced by crypto sooner or later. So, what sets fiat and crypto apart, and what makes many lose trust in fiat?

In this article, we will explain each in more detail and the roles they play in a new global economy.

What Is Fiat Money

Fiat money gets its name from the fact that it is established as money by government authority, or "fiat." This authority is ultimately what gives fiat money its value, even though it is not tied to any physical commodity. Governments control fiat money and declare it to be legal tender — an official medium of payment that must be accepted.

The U.S. dollar, for example, became fiat money when the U.S. abandoned the gold standard in 1971. The dollar was no longer convertible into gold but was still used as the main currency for trade and finance. The government had established its value by fiat.

Fiat Money Characteristics

- It is established as money by government decree.

- Its value comes from the government that issues it, not from a commodity.

- It’s centralized: The central bank controls its supply and the value can fluctuate based on the bank's policies.

- It is legally mandated as an official medium of exchange (legal tender).

- It’s restricted by borders — each country tends to have its own fiat currency.

- Examples include the U.S. dollar, Euro, Yen, Yuan, etc.

How Was Fiat Currency Created

Fiat currencies were created to facilitate trade and enable the storage of value. Initially, physical gold served as the backing for currencies like the U.S. dollar. In other words, the dollar was redeemable for its face value in gold. But then, governments severed this relationship to gain more control over the economy.

The U.S. transitioned to a fiat system in 1971, removing the link between the dollar and gold. Now, the dollar's value stems from the reputation and policies of the U.S. government and Federal Reserve.

While fiat systems aim to enable a balanced, reliable economy, a fiat currency's value still fluctuates. In fact, foreign exchange (forex) markets allow people to profit from changes in value between fiat currencies.

Fiat Money Example

We’ve already talked about the U.S. dollar as the primary example of a fiat currency. Another well-known example is the British pound.

For most of its history, the pound's value was pegged to gold, and its supply was limited by Britain's gold reserves.

In 1931, Britain abandoned the gold standard during the Great Depression, but foreign governments could still convert pounds to gold, which limited the pound’s flexibility.

After WWII, the Bretton Woods system pegged the pound to the U.S. dollar, which was convertible to gold. This continued until the early 1970s, when the U.S. abandoned its gold standard, leading to the collapse of the Bretton Woods system and many countries following suit by adopting fiat currencies. Britain followed in 1972, letting the pound float freely but controlling its supply based on economic conditions. Unfortunately, it was not much of a success, as economic troubles and eroding confidence caused the pound's value to plummet in 1976 and made the government take an IMF loan to stabilize the economy.

In the 1980s, Britain adopted monetarism to curb inflation, limiting money supply growth. Confidence in the pound grew, and its value rose.

In the 90s, Britain stayed with the pound without going full-blown euro, despite continuing debates about whether the country would be best served by alternatives.

Regardless of mild (and at times, major) perturbations, the British pound remains a strong, independent currency.

How Fiat Currency Is Backed

Fiat currency is not backed by a physical commodity, such as gold or silver, but rather by the government that issues it. Therefore, its value is based entirely on the trust and confidence that people have in the government and its ability to maintain the stability of the currency.

Let’s take a step back and think about what it means.

So, no precious metal or tangible resource backs fiat, and its worth stems from faith in political institutions and policies usually beyond our scrutiny. As we can’t control or influence those public agencies’ decisions, how can we be sure that governments will run their printing presses with prudence rather than reckless abandon and don’t suffer fiscal crises that fracture our economy? There’s no guarantee. So, the worth of fiat money, in other words, relies not on reality but on a shared myth — until the promised prosperity proves empty after all. If the above holds true, why not come up with our own people’s money that will rest its worth not in centralized government but in the most reliable foundation of all — mathematics? Sounds familiar? Yes, we’re talking crypto.

Fiat Pros and Cons

Fiat Money Advantages

Still, fiat has many advantages, so it doesn’t seem to be going away any time soon. Among those are:

- Regulation: Fiat money is regulated by governments, ensuring compliance with laws and policy. For businesses, this means accepting fiat payments is low risk and unlikely to cause legal issues.

- Wide acceptance and stability: Fiat currencies like the dollar are the most widely used payment methods globally. This makes it easy for companies to find customers and suppliers that accept fiat money. Fiat currency is also relatively stable in value, allowing for business planning and forecasting.

Fiat Money Disadvantages

However, as mentioned, fiat comes with many cons. Among those are:

- Slow payments: Processing fiat payments through banks can take days to complete, slowing down transactions. This can hamper businesses that need to move money quickly.

- Inflation risk: The value of fiat money can be eroded over time through inflation. For companies holding a lot of cash, this could significantly reduce the value of assets and make planning difficult in inflationary times.

- Government control: Governments control the fiat money supply and policies. They could potentially limit businesses' access to funds or ability to accept customer payments. This dependence on political institutions creates uncertainty.

While fiat money remains dominant, its disadvantages fuel interest in alternative payment methods, like cryptocurrency, that are decentralized, digital, and borderless. Let’s talk about crypto, then, finally.

Fiat Money versus Cryptocurrency

For a long time, fiat currencies have held sway over the global economy; however, cryptocurrencies are swiftly making headway, posing a significant challenge to the very core of our financial systems.

Fueled by the innovative blockchain technology, digital currencies operate outside of government control, heralding a more efficient, transparent, and inclusive worldwide monetary system.

Though fiat money continues to be the predominant means of global exchange, the momentum is shifting as increasing numbers of people recognize the unrivaled promise of crypto. Numerous nations have begun exploring the potential of issuing central bank digital currencies, and some, like El Salvador, have even embraced bitcoin as legal tender. This development is immensely encouraging and signals that cryptocurrencies are on track to surpass fiat currencies, barring any major, unforeseen circumstances.

Cryptocurrencies derive their value from various sources. For example, the value of cryptocurrencies such as bitcoin relies on their limited supply and market demand. While some view volatility as a significant drawback, others capitalize on it to amass wealth rapidly—much faster than what would have been achievable with fiat currency. Moreover, stablecoins offer price stability through reserves, providing options for a range of risk appetites.

In essence, when contrasting traditional and digital currencies, the differences are striking. Indeed, many experts strongly argue that comparing crypto and fiat is like comparing apples and oranges, as they serve entirely distinct functions. Crypto is decentralized, unregulated, and highly adaptable, whereas fiat currency is centralized, heavily regulated, and primarily used for payments. Both monetary systems rely on widespread acceptance, but crypto is quickly gaining ground in this area. As more individuals harness the power of cryptocurrencies, their influence will only continue to expand. Whether they ultimately surpass fiat or become intricately intertwined and interconnected, only time will tell!

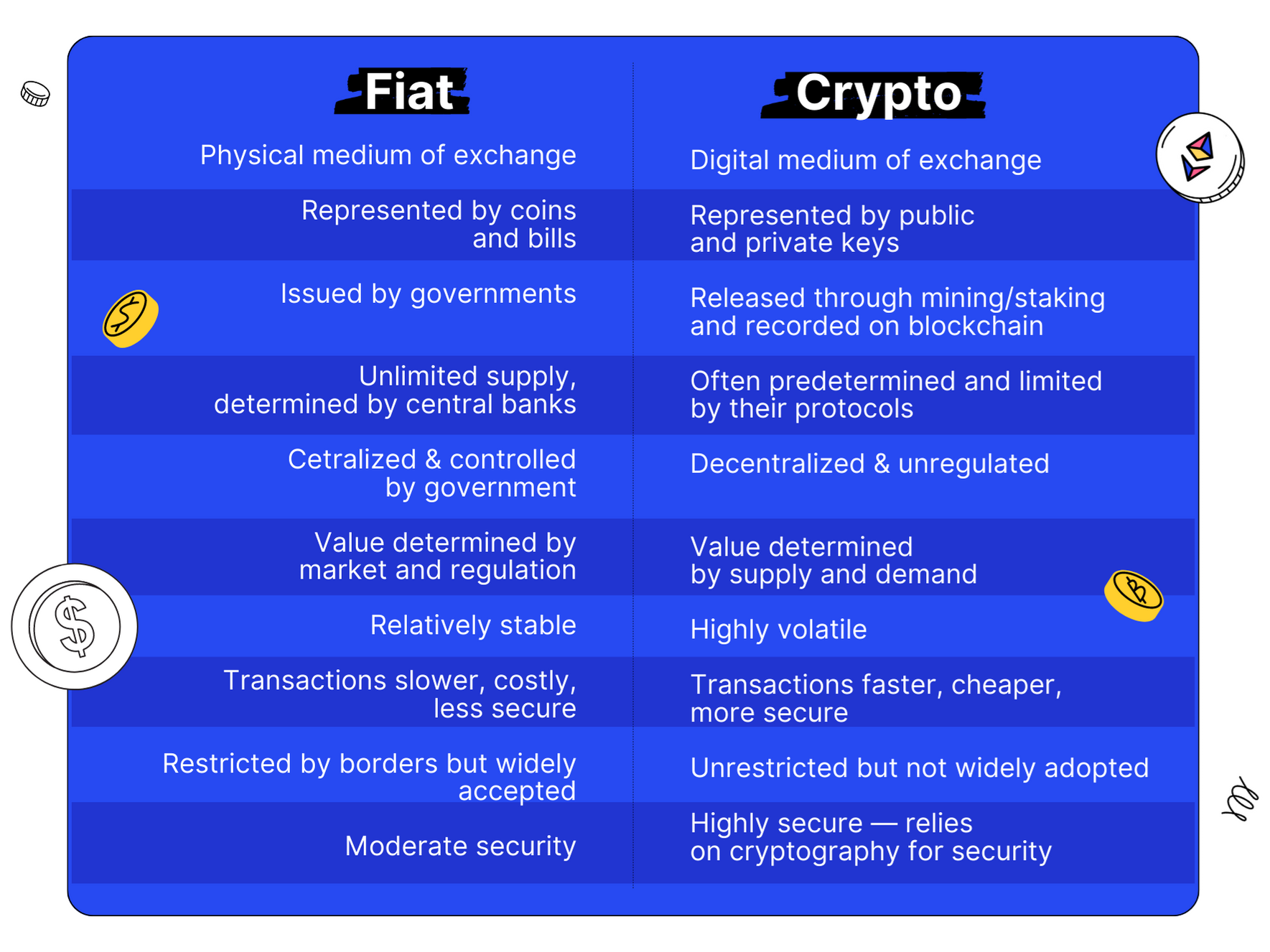

Fiat Currency and Crypto Comparison

👉 Thinking of trading your crypto? Think no more — Bitsgap aggregates the leading crypto exchanges so you can trade your crypto on more than 15 exchanges within a single interface! Among the offerings are smart trading tools and four highly-rated trading bots that have delivered stellar returns — DCA, GRID, BTD, and COMBO! Wait, but that’s not all! The integrated TradingView charts make crypto trading fun and easy on Bitsgap. With stunning visuals and an intuitive interface, you have a full playground of tools at your fingertips. Chartists will love the advanced indicators and an array of drawing tools to chart the uncharted crypto terrain and uncover valuable insights. The Technicals widget bundles signals from dozens of indicators into one powerful tool, so you can spot the best opportunities instantly and take your analysis to the next level. Whether you're a beginner or a pro, the customizable charts and trading dashboard make crypto accessible and exciting.

Can Cryptocurrency Replace Fiat Money

Cryptocurrencies absolutely have the potential to replace fiat currencies. Several governments are already exploring issuing their own digital currencies, which shows that cryptocurrencies might be our future “fiat.” However, to truly replace the old money, crypto needs to establish itself as a stable and reliable alternative. A pegged cryptocurrency that performs similar functions as the U.S. dollar while providing the benefits of cryptocurrencies is most likely to be the first-choice alternative.

Fiat Currency and Inflation

Fiat worth rests on supply-demand poise; however, fiat volume is unbounded. Officials typically steer supply and demand in the right directions, but even the most prudent and cautious can mismanage funds. Inordinate printing spurs hyperinflation, leading to the economy’s eventual downfall. Devoid of any commodity underpinning or provision curb, matters hastily deteriorate (just think about the U.S. debt ceiling for a second). Cryptocurrencies seek to redress this dilemma. Will they, however, prevail?

Future of Fiat Currency

Tangible legal tender will conceivably become extinct, but fiat tenets will persist as administrations covet utter mastery. Self-governing crypto will likely persist and coexist with officially-backed crypto. The implications for global trade and business from a new system with government digital currencies and traditional cryptocurrencies are yet to be witnessed. The future of finance is digital, but governments are unlikely to relinquish control over money. We have to wait and watch how this shift unfolds and impacts the world.

Bottom Line: Paper or Code? You Decide.

The debate over the superiority of fiat or cryptocurrencies is a hot topic, with both systems offering unique advantages and disadvantages. However, as the world becomes increasingly interconnected and digital, the undeniable potential of cryptocurrencies is poised to usher in a new era of financial freedom, prosperity, and innovation. That doesn’t mean that governments are ready to relinquish all control, however. We’re likely to see more regulation, more government-backed crypto, and all the rest of it. So hold your horses; the future might be shiny, but not as bright as we’d like it to be!

FAQs

What Is Fiat Money Definition?

Fiat money is a type of currency that is not backed by a physical commodity, such as gold or silver, but is declared legal tender by a government. Its value comes primarily from the trust and belief that people have in the stability of the issuing authority.

What Are Differences between Fiat and Crypto?

Fiat money is government-issued currency that is not backed by a physical commodity but is declared legal tender, while cryptocurrency is a digital or virtual currency that relies on cryptography for security and operates on decentralized platforms, like blockchain.

Fiat money is centralized, regulated by governments and financial institutions, whereas cryptocurrencies are decentralized, with no single authority controlling them.

Transactions with cryptocurrencies are typically faster, cheaper, and more secure compared to fiat transactions, which often require intermediaries.

The supply of fiat money is determined by central banks, while the supply of cryptocurrencies is often predetermined and limited by their protocols.

Lastly, fiat currencies are typically more stable in value, while cryptocurrencies can exhibit high price volatility.

What Is Best Fiat Crypto Exchange?

The ideal choice of a fiat-to-crypto exchange depends on many factors, such as trading fees, available currencies, security, and user experience. However, some popular exchanges include: Coinbase, Binance, Kraken, Gemini.

How Does Cryptocurrency Work?

Cryptocurrency is digital money that is secured through encryption techniques. It is decentralized, meaning it is not issued by any central authority like a government. Cryptocurrency transactions are recorded on the blockchain, a public digital ledger that is distributed across many computers. New coins are released through a process called mining, which involves using computers to discover virtual coins.