How AI Makes Cryptocurrencies Trading Faster and Smarter

Imagine having the power to analyze millions of market signals in milliseconds and execute perfect trades while you sleep—that's the reality AI is bringing to cryptocurrency trading today.

The convergence of artificial intelligence and cryptocurrency trading marks a pivotal evolution in digital finance. As cryptocurrency markets operate 24/7 with high volatility and vast data streams, traditional trading approaches often struggle to keep pace. AI-powered solutions are emerging as game-changers, enabling traders to process market signals more efficiently and execute trades with unprecedented speed and precision.

The timing couldn't be more relevant. With cryptocurrency markets maturing and institutional adoption growing, the demand for sophisticated trading tools has soared. The integration of AI technologies is transforming how traders analyze market sentiment, identify patterns, and manage risk in an increasingly complex crypto ecosystem.

This article explores the revolutionary impact of AI on cryptocurrency trading, covering:

- The fundamentals of AI in crypto trading and its core components

- Key distinctions between AI trading and traditional algorithmic trading strategies

- Practical applications of AI across different aspects of crypto trading

- Major advantages AI brings to crypto traders and investors

- Current limitations and potential risks to consider

- Leading AI tools and platforms reshaping the crypto trading landscape

Through this comprehensive overview, readers will gain insights into how AI is revolutionizing cryptocurrency trading and what this means for the future of digital asset markets.

What Is AI Crypto Trading?

Artificial Intelligence crypto trading is a sophisticated approach to digital asset trading that uses machine learning models and neural networks to analyze market data, identify patterns, and execute trades automatically. Unlike simple automated systems, AI trading platforms can learn from historical data, adapt to changing market conditions, and improve their performance over time.

At its core, AI crypto trading systems process multiple data sources simultaneously, including:

- Historical price movements and trading volumes

- Social media sentiment and news articles

- On-chain metrics like wallet activities and transaction flows

- Market order books and liquidity data

- Macroeconomic indicators

These systems employ various AI techniques, from deep learning to natural language processing, to extract meaningful insights from this vast sea of data. The AI models can recognize complex patterns that human traders might miss and make predictions about future market movements with increasing accuracy as they process more data.

Cryptocurrency AI Trading vs Algorithmic Trading Bots: What’s the Difference?

While both AI trading and algorithmic trading bots automate cryptocurrency trading, they differ fundamentally in their capabilities and approach. Traditional algorithmic trading bots operate on pre-defined rules and parameters set by human traders. These rules might be as simple as "buy when price drops 5%" or as complex as sophisticated technical analysis indicators, but they remain static unless manually updated.

AI trading systems, in contrast, can:

- Dynamically adjust their strategies based on market conditions

- Learn from their successes and failures to improve performance

- Identify new trading patterns without explicit programming

- Process unstructured data like news articles and social media

- Adapt to regime changes in market behavior

Think of algorithmic trading bots as sophisticated calculators that execute precise but inflexible instructions, while AI trading systems are more like adaptive decision-makers that can evolve their strategies. For example, an algorithmic bot following a trend-following strategy will continue to do so even if market conditions shift to favor mean reversion. An AI system, however, can recognize this shift and adjust its approach accordingly.

The distinction becomes particularly important in cryptocurrency markets, where conditions can change rapidly and traditional technical analysis patterns may break down. While algorithmic bots might struggle during unexpected market events, AI systems can potentially identify new patterns and adapt their trading strategies to maintain performance.

However, this increased sophistication comes with its own challenges. AI systems require significantly more computational resources, high-quality training data, and expertise to develop and maintain. They also tend to be less transparent in their decision-making process compared to algorithmic bots with clearly defined rules.

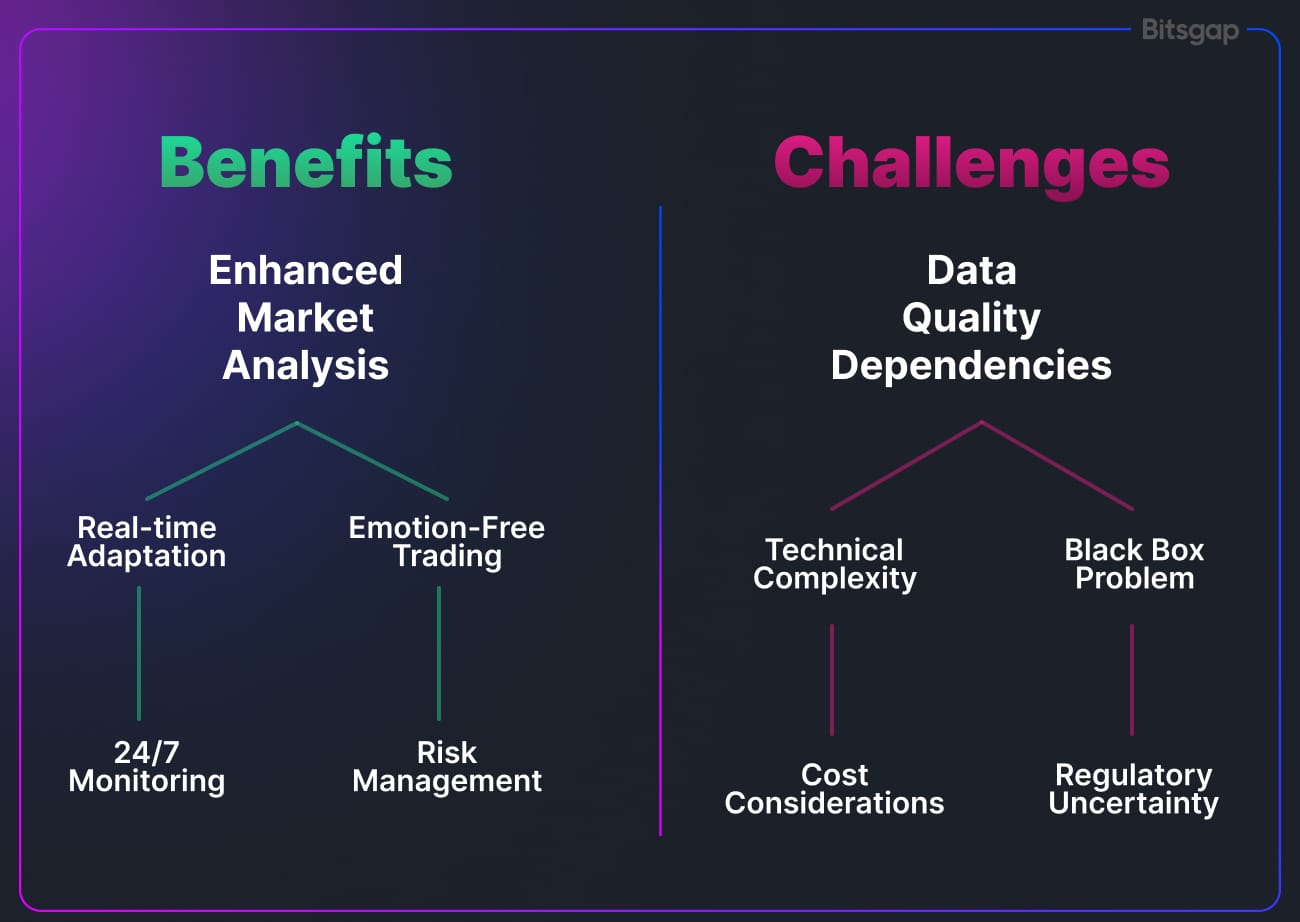

AI and Crypto: Key Benefits & Challenges

As artificial intelligence continues to reshape cryptocurrency trading, it's crucial to understand both the advantages and limitations of this transformative technology. While AI offers powerful capabilities that can significantly enhance trading performance, it also presents unique challenges that traders and institutions must carefully navigate. Let's examine the key benefits that make AI an attractive tool for crypto trading, as well as the challenges that need to be considered before implementation.

Key Benefits

Enhanced Market Analysis

AI systems excel at processing vast amounts of market data simultaneously, identifying subtle correlations and patterns that human traders might miss. These systems can analyze everything from price movements and trading volumes to social media sentiment and blockchain metrics, providing a more comprehensive view of market conditions.

Real-time Adaptation

Unlike traditional trading systems, AI can adapt to changing market conditions in real-time. When market dynamics shift, AI trading systems can quickly recognize these changes and adjust their strategies accordingly, helping traders stay ahead of market movements.

Emotion-Free Trading

One of the biggest advantages of AI trading is its ability to execute trades without emotional bias. While human traders might panic during market downturns or get caught up in FOMO (Fear Of Missing Out), AI systems stick to their trained strategies, maintaining disciplined trading even in volatile conditions.

24/7 Market Monitoring

Cryptocurrency markets never sleep, and neither do AI trading systems. They can continuously monitor markets, identify opportunities, and execute trades at any hour, ensuring no profitable trading opportunity is missed due to human limitations.

Risk Management

Advanced AI systems can implement sophisticated risk management strategies, monitoring multiple risk factors simultaneously and adjusting positions accordingly. They can quickly identify potential threats and take protective measures before significant losses occur.

Challenges

Data Quality Dependencies

AI systems are only as good as the data they're trained on. In the cryptocurrency market, where data quality can be inconsistent and historical data limited, this presents a significant challenge. Market manipulation and fake volume reports can also lead to AI systems learning from unreliable data.

Technical Complexity

Developing and maintaining effective AI trading systems requires substantial technical expertise in both machine learning and cryptocurrency markets. This high barrier to entry can make it difficult for smaller traders to implement sophisticated AI trading strategies.

Black Box Problem

Many AI systems, particularly deep learning models, operate as "black boxes" where the reasoning behind specific trading decisions isn't always clear. This lack of transparency can make it difficult to trust the system's decisions and comply with regulatory requirements.

Market Adaptation

As more traders adopt similar AI strategies, the market itself may adapt, potentially reducing the effectiveness of certain AI trading approaches. This creates a constant need to innovate and develop new strategies to maintain competitive advantage.

Cost Considerations

The infrastructure required to run sophisticated AI trading systems can be expensive. High-performance computing resources, quality data feeds, and ongoing system maintenance all contribute to significant operational costs.

Regulatory Uncertainty

The regulatory landscape for both AI and cryptocurrency trading continues to evolve. Changes in regulations could impact how AI trading systems can operate in different jurisdictions, creating compliance challenges for traders and developers.

Technical Failures

Like any technology, AI systems can experience technical failures or bugs that might lead to significant losses if not properly monitored. This requires robust testing, fail-safes, and human oversight to manage potential technical risks.

Despite these challenges, the benefits of AI in cryptocurrency trading often outweigh the drawbacks for many traders and institutions. The key lies in understanding both the potential and limitations of AI trading systems, implementing appropriate risk management strategies, and maintaining proper oversight of automated trading operations.

AI for Trading Crypto: How Can You Leverage AI for Trading Crypto?

Modern AI technologies offer multiple ways to enhance cryptocurrency trading strategies. Here's a comprehensive exploration of how traders can effectively leverage AI across different aspects of their trading operations.

Market Analysis and Prediction

AI excels at analyzing vast amounts of market data to forecast potential price movements. Traders can leverage AI for:

- Pattern recognition in price charts using deep learning models that identify complex technical patterns beyond traditional indicators

- Sentiment analysis of social media, news articles, and market discussions to gauge market mood and anticipate potential price impacts

- On-chain analysis to identify significant wallet movements and transaction patterns that might influence market direction

Portfolio Management

AI systems can optimize cryptocurrency portfolios by:

- Dynamically adjusting asset allocations based on market conditions and risk parameters

- Monitoring and rebalancing portfolios to maintain desired risk levels

- Identifying diversification opportunities across different cryptocurrencies and trading pairs

Trading Execution

AI can enhance trade execution through:

- Smart order routing that finds the best prices across multiple exchanges

- Transaction timing optimization to minimize slippage and maximize execution efficiency

- Dynamic position sizing based on market volatility and risk metrics

- Arbitrage detection and execution across different exchanges and trading pairs

Risk Management

Sophisticated AI systems help manage trading risks by:

- Monitoring multiple risk factors simultaneously and adjusting positions accordingly

- Detecting unusual market behavior that might indicate potential risks

- Implementing automated stop-loss and position-sizing strategies based on market conditions

- Identifying and avoiding potential scams or manipulated markets

Strategy Development and Backtesting

AI can assist in developing and testing trading strategies through:

- Automated strategy generation and optimization

- Advanced backtesting that accounts for realistic market conditions

- Strategy adaptation based on changing market conditions

- Performance analysis and strategy refinement

Integration Approaches

Traders can integrate AI into their crypto trading in several ways:

- Using existing AI-powered trading platforms and tools

- Developing custom AI solutions tailored to specific trading needs

- Combining AI insights with human decision-making in a hybrid approach

- Implementing multiple AI models for different aspects of the trading process

The key to successfully leveraging AI in crypto trading lies in choosing the right combination of tools and approaches that align with your trading goals, technical expertise, and resource constraints. Starting with simpler applications and gradually expanding to more sophisticated uses as you gain experience can help ensure successful implementation.

Using AI to Trade Crypto: Tools, Techniques, and Software

The landscape of AI-powered crypto trading tools is rapidly evolving, offering traders a variety of options to enhance their trading strategies. Here's a comprehensive overview of specific tools and platforms currently available in the market.

Trading Platforms with AI Integration

Professional Trading Platforms

- TradingView with AI-powered technical analysis tools and pattern recognition capabilities

- Bitsgap has an AI-powered trading assistant that suggests optimized strategies based on users’ risk preferences, balance, and preferred exchange

AI-Specific Trading Platforms

- Tickeron providing AI-driven trading signals and pattern detection

- Capitalise.ai offering natural language processing for strategy creation

Data Analysis Tools

The cryptocurrency market generates massive amounts of data across multiple dimensions, from on-chain transactions to social media sentiment. Modern data analysis tools leverage AI and machine learning to process this information, providing traders with actionable insights. Let's explore the leading platforms that help traders make informed decisions through sophisticated data analysis.

Market Intelligence

- Glassnode using AI for on-chain analytics. The platform excels at tracking network fundamentals, analyzing wallet behaviors, and identifying significant market trends through blockchain activity. Its sophisticated metrics, such as realized value and MVRV ratio, help traders understand market cycles and investor behavior patterns at a deeper level.

- Santiment providing AI-powered market sentiment analysis. The platform processes vast amounts of social media data, development activity, and on-chain information to create unique market insights. Its advanced algorithms detect emerging trends and market narratives before they become widely recognized. Particularly valuable is its ability to track developer activity and social volume metrics, which often serve as leading indicators for price movements.

- LunarCrush analyzing social media sentiment with machine learning. The platform measures social engagement, tracks influencer impact, and quantifies market sentiment across multiple social platforms. Its unique metrics, such as Galaxy Score and Alt Rank, combine social metrics with market data to provide comprehensive asset rankings. The platform's real-time analysis helps traders identify shifting market narratives and sentiment trends.

- IntoTheBlock offering machine learning-based market signals. The platform's sophisticated algorithms analyze large volumes of data to identify market patterns and generate actionable trading signals. Its holistic approach includes ownership concentration analysis, trading volume profiling, and price correlation metrics, helping traders understand market dynamics from multiple angles.

Technical Analysis

- AutoChartist for automated pattern recognition. The platform excels at identifying chart patterns, support and resistance levels, and potential breakout opportunities across multiple timeframes. Its pattern quality indicators help traders focus on the most reliable trading opportunities, while real-time alerts ensure they never miss significant technical developments.

- Bookmap providing AI-enhanced order flow analysis. The platform visualizes order book depth and liquidity flows in real-time, helping traders understand market dynamics at a granular level. Its advanced algorithms detect potential large orders and unusual trading patterns, providing valuable insights for both short-term traders and long-term investors. The platform's unique heat map visualization makes complex order flow data easily interpretable.

- TrendSpider using machine learning for technical analysis automation. The platform automatically identifies support and resistance levels, tracks multiple timeframe analyses, and detects complex chart patterns. Its unique Raindrop Charts and automated trendline analysis help traders identify high-probability trading opportunities with greater accuracy. The platform's ability to automate complex technical analysis tasks allows traders to focus on strategy development and execution.

Development Frameworks and Libraries

For traders and developers looking to build custom AI solutions for cryptocurrency trading, several powerful frameworks and libraries are available. These tools provide the foundation for developing sophisticated trading systems, from data collection and analysis to model development and trade execution. Let's explore the key frameworks and libraries that can help you build professional-grade AI trading solutions.

For Custom AI Solutions

- TensorFlow and PyTorch for building deep learning models:

- TensorFlow: Google's open-source framework stands out as a leading platform for creating neural networks in the crypto trading space. It excels at developing price prediction models through time series analysis and is particularly effective for sentiment analysis using natural language processing. Traders commonly use TensorFlow to build LSTM models that predict price movements by analyzing historical data alongside multiple features such as trading volume, social sentiment metrics, and on-chain data.

- PyTorch: Facebook's framework has become increasingly popular among researchers and developers for its dynamic computational graphs and intuitive design. It's particularly well-suited for rapid prototyping of trading models and provides robust support for reinforcement learning applications. Trading developers frequently use PyTorch to create deep reinforcement learning agents that can adapt their strategies through direct market interaction.

- Scikit-learn for implementing machine learning algorithms

- Scikit-learn serves as a cornerstone for implementing classical machine learning algorithms in crypto trading. It provides essential tools for feature selection and data preprocessing, along with robust capabilities for cross-validation and model evaluation. Traders often use Scikit-learn to create ensemble models that combine multiple technical indicators for market trend prediction.

- Pandas TA for technical analysis in Python

- Building on the popular data analysis library pandas, Pandas TA offers comprehensive technical analysis capabilities essential for crypto trading. Its extensive collection of over 130 indicators and utility functions streamlines the process of analyzing cryptocurrency market data. The library's efficient handling of time-series data makes it invaluable for processing large datasets and calculating multiple technical indicators simultaneously, which can then serve as features for machine learning models.

- CCXT for cryptocurrency exchange integration

- The CCXT library addresses one of the most challenging aspects of crypto trading: exchange integration. By providing a unified API for accessing multiple cryptocurrency exchanges, it simplifies the process of data collection and trade execution across different platforms. The library's robust support for real-time market data retrieval and order execution makes it particularly valuable for implementing multi-exchange trading strategies, such as arbitrage systems that capitalize on price discrepancies.

Specialized Crypto AI Libraries

- Freqtrade for automated trading bot development

- Freqtrade represents a comprehensive approach to automated trading bot development. This framework combines traditional algorithmic approaches with machine learning capabilities, offering extensive tools for strategy optimization and backtesting. Its integrated hyperparameter optimization tools allow traders to fine-tune their strategies effectively. The framework's modular design enables developers to implement custom strategies that combine technical indicators with machine learning predictions.

- TensorTrade for building trading bots with reinforcement learning

- Built with deep learning frameworks like TensorFlow and PyTorch at its core, TensorTrade provides a flexible environment for training AI models that can handle complex market scenarios. The framework's modular design allows traders to experiment with different reward functions and action spaces, making it particularly valuable for developing sophisticated trading strategies that can evolve over time.

- CryptoSignal for signal generation for crypto trading

- The platform integrates multiple technical analysis indicators and employs machine learning to generate trading signals across various timeframes. Its modular architecture allows traders to customize signal generation parameters and implement their own analytical models. The platform's ability to monitor multiple exchanges simultaneously makes it particularly valuable for traders seeking arbitrage opportunities or broad market insights.

- PyAlgoTrade as a backtesting and live trading library

- As a mature Python library for backtesting and live trading, PyAlgoTrade provides a robust foundation for developing trading strategies. The library's event-driven architecture makes it particularly well-suited for implementing complex trading logic, while its extensive backtesting capabilities help traders validate their strategies before deploying real capital. The platform's integration with various data sources and its support for multiple asset types make it a versatile tool for strategy development.

- Backtrader for backtesting and strategy development

- Backtrader has established itself as a powerful platform for backtesting and strategy development. The framework's intuitive design and comprehensive feature set make it accessible to both beginners and advanced traders. Its support for custom indicators, sophisticated position sizing, and multiple data feeds enables traders to develop and test complex strategies effectively. The platform's visualization tools provide valuable insights into strategy performance and risk metrics.

- AI4Finance as a deep reinforcement learning library for financial markets

- The library offers implementations of various reinforcement learning algorithms specifically optimized for trading applications. Its focus on financial markets makes it particularly valuable for traders looking to implement sophisticated AI strategies that can adapt to changing market conditions. The platform's research-driven approach ensures access to the latest developments in AI trading technology.

Technical Implementation Techniques

The implementation of AI in cryptocurrency trading involves sophisticated technical approaches that leverage various machine learning models and data processing methods. These techniques form the backbone of modern AI trading systems, each serving specific purposes in the complex task of market analysis and prediction.

Machine Learning Models

- Long Short-Term Memory (LSTM) networks for price prediction

- LSTM networks excel in cryptocurrency price prediction due to their ability to remember important patterns over extended periods. These neural networks can identify complex relationships in time-series data, making them particularly effective at capturing both short-term price fluctuations and longer-term market trends. Traders implement LSTM models to process multiple data streams simultaneously, from price action to trading volume patterns, helping predict future price movements with greater accuracy.

- Convolutional Neural Networks (CNN) for pattern recognition

- CNNs have revolutionized pattern recognition in crypto trading charts. Originally designed for image processing, these networks excel at identifying visual patterns in price charts and technical indicators. Traders use CNNs to automatically detect complex chart patterns like head and shoulders, double tops, or more subtle formations that might escape human observation. The network's ability to recognize patterns across different timeframes makes it particularly valuable for multi-scale analysis.

- Random Forests for market regime classification

- In market regime classification, Random Forests provide robust and interpretable results. These models excel at categorizing market conditions into different states – such as trending, ranging, or volatile periods. Their ensemble nature makes them particularly resistant to overfitting, while their ability to handle non-linear relationships helps traders adapt their strategies to changing market conditions.

- Support Vector Machines (SVM) for trend prediction

- SVMs prove especially valuable in trend prediction by excelling at binary classification problems. These models can effectively separate different market states and identify trend reversals. Their ability to handle high-dimensional data makes them particularly useful when analyzing multiple technical indicators simultaneously, helping traders make more informed decisions about market direction.

Data Processing Methods

- Natural Language Processing (NLP) for news sentiment analysis

- NLP techniques have become crucial for analyzing market sentiment through news and social media. Modern NLP models can process vast amounts of textual data from news articles, social media posts, and forum discussions, quantifying market sentiment in real-time. This capability helps traders gauge market mood and anticipate potential price movements based on public sentiment.

- Time series analysis using statistical AI methods

- Statistical AI methods for time series analysis form the foundation of many trading strategies. These techniques combine traditional statistical approaches with modern machine learning capabilities to identify trends, seasonal patterns, and cycles in cryptocurrency markets. Advanced methods like ARIMA-GARCH hybrids with neural networks help traders model both price trends and volatility patterns.

- Deep reinforcement learning for trading strategy optimization

- Trading strategy optimization has reached new levels of sophistication through deep reinforcement learning. These systems learn optimal trading behaviors by interacting with market environments, gradually improving their decision-making through trial and error. The ability to adapt to changing market conditions makes reinforcement learning particularly valuable for developing dynamic trading strategies.

- Ensemble methods combining multiple AI models

- The combination of multiple AI models through ensemble methods has proven particularly effective in crypto trading. These approaches leverage the strengths of different models while minimizing their individual weaknesses. Traders might combine predictions from LSTM networks, Random Forests, and SVMs, weighting their inputs based on historical performance under different market conditions. This diversification of AI models helps create more robust trading systems that can perform well across various market scenarios.

Risk Management Tools

The following sophisticated platforms leverage AI and advanced analytics to provide comprehensive insights into portfolio performance and potential risks. Let's explore the leading tools that help traders navigate the complexities of crypto markets safely and effectively.

Portfolio Analytics

- Messari for AI-driven crypto asset analysis. The platform aggregates and analyzes vast amounts of data to provide professional-grade insights into crypto assets. Its advanced screening tools help traders evaluate projects based on fundamental metrics, while its real-time analytics enable quick identification of market opportunities and risks.

- CryptoQuant for institutional-grade on-chain analytics. The platform's AI-powered systems analyze blockchain data to identify significant wallet movements, miner behavior, and exchange flows. These insights prove particularly valuable for understanding potential market impacts before they materialize in price action.

- Coinmetrics for advanced market metrics. Their suite of tools offers detailed analysis of network health, market structure, and asset behavior. The platform's sophisticated data science approaches help traders understand market liquidity, identify potential risks, and evaluate trading opportunities across different exchanges. Their real-time analytics serve as an early warning system for market anomalies and potential risks.

Risk Assessment

- Chainalysis for transaction monitoring and risk assessment. Their platform combines sophisticated blockchain analysis with machine learning to help traders understand the origin and flow of funds. This proves particularly valuable for institutional traders who need to ensure compliance with regulatory requirements while managing their trading operations. The platform's real-time monitoring capabilities help identify and avoid high-risk transactions and counterparties.

- Crystal Intelligence for blockchain analytics and risk management. Their platform excels at visualizing and analyzing complex transaction patterns across multiple blockchain networks. The system's AI-powered risk assessment tools help traders evaluate the safety of different addresses and transactions, while their monitoring capabilities provide ongoing oversight of portfolio risks. Their detailed reporting features are particularly valuable for institutional traders who need to maintain comprehensive risk management documentation.

Best Practices for Tool Selection

The selection and implementation of AI trading tools represent critical decisions that can significantly impact trading success. Understanding how to evaluate and integrate these tools requires a systematic approach based on clear criteria and careful consideration of various factors.

When choosing AI trading tools, consider:

- Integration capabilities with your preferred exchanges

Exchange compatibility stands as a fundamental consideration when selecting AI trading tools. Tools must seamlessly integrate with your preferred trading venues, supporting all required trading pairs and order types. Consider both current and future needs – a tool that works with multiple major exchanges offers greater flexibility as your trading strategy evolves.

- Historical performance and reliability

Historical performance and system reliability form the backbone of any trading tool's value proposition. Evaluate uptime statistics, system latency, and historical accuracy of signals or predictions. Consider how the tool performs during high-volatility periods and whether it maintains reliability during market stress events. Documentation of past performance should be transparent and verifiable.

- Cost structure and subscription models

Understanding the complete cost structure proves essential for maintaining profitable trading operations. Beyond basic subscription fees, consider additional costs such as API access, data feeds, and potential volume-based charges. Compare pricing models across similar tools and evaluate the return on investment based on your trading volume and strategy.

- Level of technical expertise required

The technical expertise required to effectively utilize a tool should align with your current capabilities or learning path. Some platforms offer intuitive interfaces suitable for beginners, while others demand extensive programming knowledge. Consider the learning curve and time investment required to master each tool.

- Quality and breadth of data sources

The quality and breadth of data sources directly impact trading results. Evaluate the comprehensiveness of market data coverage, the frequency of updates, and the reliability of data providers. Consider whether the tool offers access to alternative data sources that could provide competitive advantages.

Getting Started

For traders new to AI-powered trading, a methodical approach to implementation proves most effective:

- Begin with User-Friendly Platforms

Start your journey with accessible platforms that offer comprehensive educational resources and intuitive interfaces. TradingView and Bitsgap provide excellent entry points, allowing you to understand basic concepts while minimizing complexity.

- Demo Trading Period

Utilize demo accounts extensively before committing real capital. This phase allows you to:

- Understand platform functionality without financial risk

- Test different strategies and settings

- Identify potential issues or limitations

- Build confidence in your trading approach

- Gradual Tool Integration

As your experience grows, systematically incorporate more sophisticated tools into your trading strategy:

- Start with basic technical analysis and signal generation

- Progress to automated trading with simple strategies

- Gradually introduce more complex AI-driven features

- Maintain careful documentation of results at each stage

- Risk Management Integration

Regardless of the tools employed, maintaining robust risk management remains paramount:

- Set clear position size limits

- Implement stop-loss orders consistently

- Monitor overall portfolio exposure

- Regular review and adjustment of risk parameters

Remember that AI trading tools serve as enablers rather than complete solutions. Their effective use requires a comprehensive understanding of both trading principles and tool capabilities. Success comes from integrating these tools into a well-designed trading strategy while maintaining disciplined risk management practices.

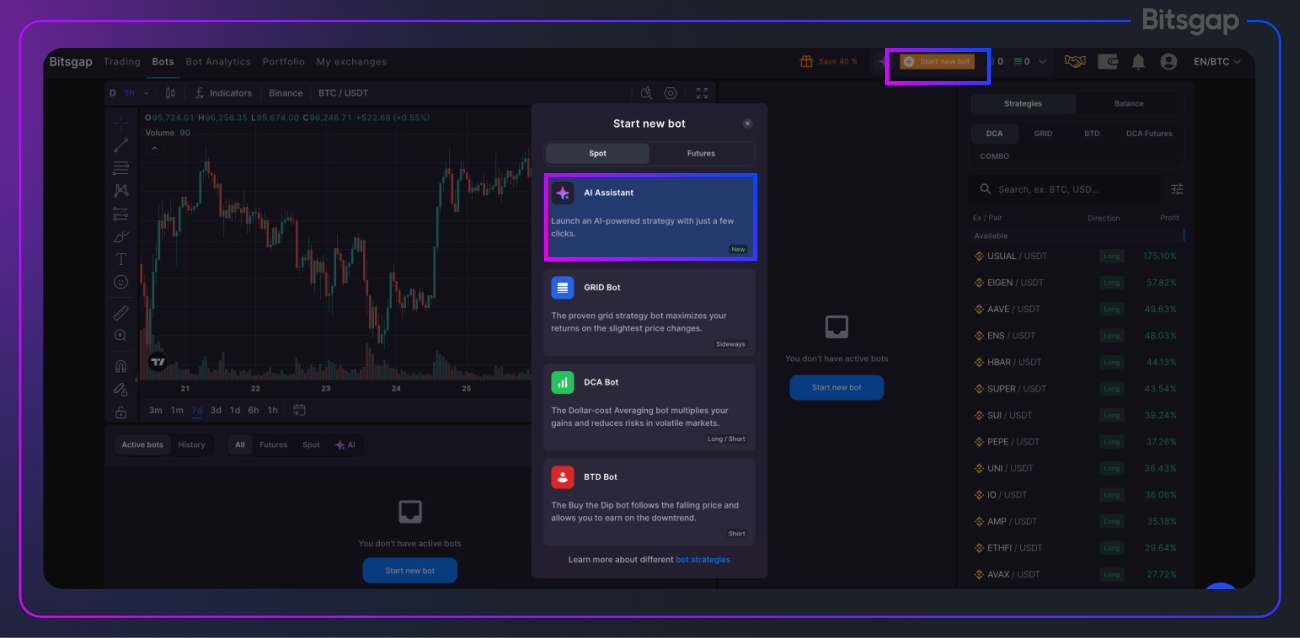

Bitsgap AI Assistant as Your Ultimate Trading Companion

After discussing the key AI tools currently accessible to crypto traders, we've also introduced the Bitsgap AI Assistant, which is invaluable for both newcomers to the crypto space who are unsure of how to get started and for seasoned traders looking to enhance their returns or receive smart strategy recommendations. Here's an explanation of how the Bitsgap AI Assistant functions and its location within the platform.

What Does Bitsgap AI Assistant Do?

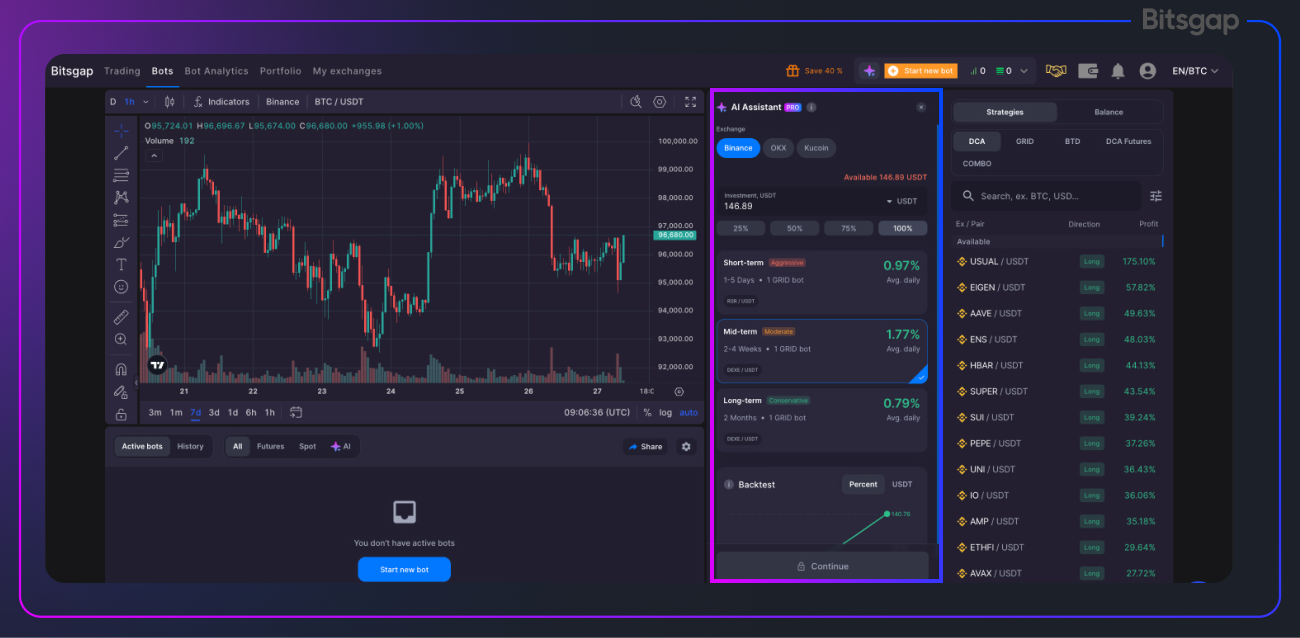

Bitsgap’s AI Assistant is a user-friendly solution that enables you to create a portfolio of GRID Bots in just a few clicks. The unique Bitsgap algorithm analyzes your available balance and generates a list of customized strategy recommendations.

Strategies are selected exclusively from USDT, USDC, EUR, USD, TRY, BTC, and ETH pairs. By following the AI Assistant's recommendations, you can diversify your portfolio with bots across different trading pairs, helping to mitigate risks and maximize earnings in varying market conditions.

How to Use AI Assistant

To start using AI Assistant, follow the steps below:

- Select AI Assistant: Click the [Start new bot] button in the top menu of the Bots page. In the pop-up window, select [AI Assistant].

- Customize Your Strategy: On the right side of the screen, you’ll find options to configure your AI-generated GRID Bot portfolio. Here, you can select the exchange, investment amount, and duration.Begin by choosing an exchange for your bots, which will be highlighted in blue. Enter your desired investment amount or specify a percentage based on your available balance. Choose your portfolio strategy based on your investment goals:

- Short-term (Aggressive): Operate bots for 1-5 days to maximize short-term profits.

- Mid-term (Moderate): Run bots for 2-4 weeks to capitalize on market volatility.

- Long-term (Conservative): Launch bots for up to 2 months to gradually grow your portfolio.

The suggested investment duration is a recommendation; bots will continue to operate until manually closed or until they hit the Take Profit target. Use the Backtest chart to evaluate your trading strategy's potential efficiency based on historical data. If you’re ready, click the [Continue] button.

- Review and Confirm Settings: Before launching your bots, take a moment to review your selected settings, including:

- Exchange

- Investment

- Number of bots

- Profit currency

- Trading pairs

- For Pro plan users, you can enter a Total PNL % value for automatic bot closure upon reaching the Take Profit target. By default, bots started with the AI Assistant will have Trailing Up and Pump Protection enabled, which can be adjusted at any time.

- Click the [Start bots] button to launch your bots.

After launching, bots will appear in the “Active bots” tab with an AI icon. You can modify and close them at any time.

Portfolio for AI Bots

The Portfolio mode allows you to combine selected active bots into a single unit. Once activated, all AI bots will work together as one, sharing a common Take Profit level and individual statuses. After enabling Portfolio mode, individual bot edits will not be possible.

To activate Portfolio mode:

- Choose your exchange.

- Select your desired duration and click [Continue].

- In the “Active bots” panel, switch to the “AI” tab.

- Enable Portfolio mode by toggling the switch. You can name your portfolio or keep the default name.

If Portfolio mode is activated, total profit will be calculated across all AI bots. You can choose between “Portfolio Total PNL” or “Portfolio Bot Profit” for the Take Profit feature.

Intrigued by the functionality and power of the Bitsgap’s AI? Why not give a try today?

Conclusion

As we’ve discussed, the cryptocurrency trading landscape has seen significant changes in recent years, with AI evolving from a competitive edge to a vital tool for traders navigating the round-the-clock digital asset markets. However, integrating AI comes with its challenges. Issues like data quality, technical complexity, and high costs can be intimidating. This is where user-friendly solutions like Messari and Bitsgap’s AI Assistant play a critical role. Instead of grappling with countless news sources, complex algorithms, or costly infrastructure, you can access expert analyses on the go or quickly build a diversified portfolio of bots based on intelligent recommendations. Remember, the future of crypto trading isn’t about choosing between human intuition and artificial intelligence—it’s about leveraging both.