Crypto Dollar Cost Averaging Strategy & DCA Trading Bot

Learn how the Dollar-cost (DCA) crypto strategy can help you invest and maximize returns over the long term.

The DCA crypto strategy means investing equal amounts at regular intervals, no matter the market. If you stick to the plan, you’ll maximize returns over the long term. Learn how it works.

Cryptocurrency investing can be extremely challenging. Even seasoned traders who try to time the market can miss the most opportune moments to buy or sell. Thankfully, the Dollar Cost Averaging strategy makes it easier to invest regularly, mitigate the risks, and build positions over time, whatever the market.

In this article, we’ll explain how the DCA strategy works and how you can use the Bitsgap DCA bot to fully automate your trading routine.

What Is DCA crypto?

Dollar Cost Averaging, or DCA, is a trading strategy that involves investing the same amount of money in a particular crypto, regardless of price, at regular intervals over a predetermined length of time.

👉 By employing DCA in crypto, you can lower your average cost per coin and make your investments less “sensitive” to market changes.

Effectively, DCA eliminates the need for market timing. You no longer have to watch the market for the best time to buy or sell; you just invest regularly, regardless of market conditions.

How Crypto Dollar Cost Averaging Works

By consistently buying or selling, you can finally take emotion out of investing. What that means is that you buy more when prices are down and less when prices are up. To better understand how crypto dollar cost averaging works, consider the following example.

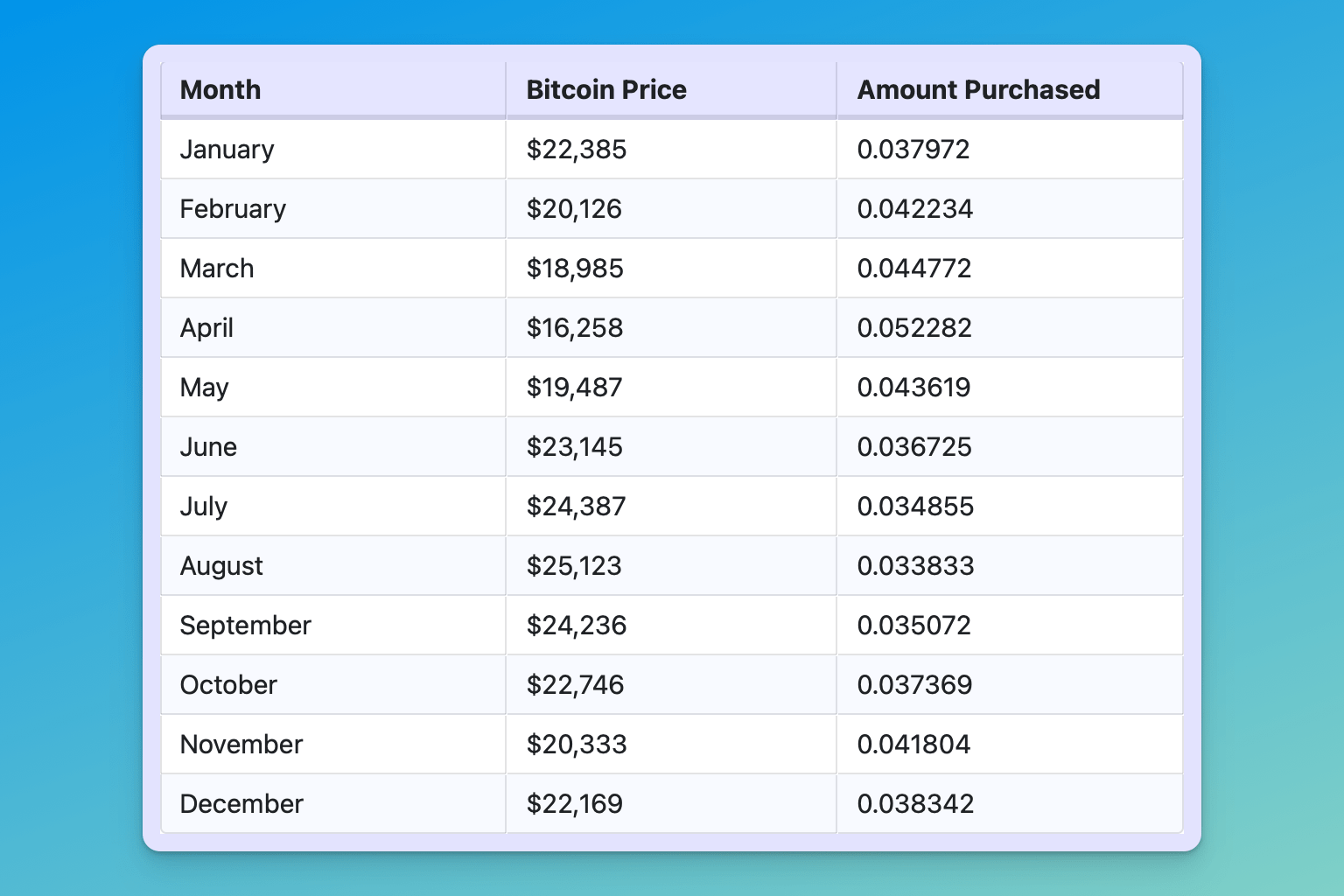

Let’s say you want to invest $10,200 this year in bitcoin. You have two options: either spend the entire sum now and purchase bitcoin at $ 22,385 or invest $ 850 each month.

Although at first, it might not seem like much of a difference if you stretch your purchase over 12 months, in reality, you might end up with more bitcoin than you would if you invested the whole sum at once. Take a look at this potential outcome (Fig. 1):

By following DCA, at the end of the year, you’d have 0.478879 bitcoins. However, if you’d invested the whole $ 10,200, you’d have had 0.455662, which is 0.023217 bitcoins less. Arguably, that’s not much of a difference; however, imagine if, by the end of the year, Bitcoin was 40k or, conversely, 15k. If that were the case, the difference might have been significant.

Dollar Cost Averaging Crypto Pros and Cons

Let’s see if there are any benefits and downsides to employing DCA in crypto.

Pros

- DCA can lower the average amount you spend on crypto. Consider the example above one more time. Instead of buying bitcoin at $ 22,385, you paid for it on average $ 21,615 or $ 770 less.

- DCA allows you to start off with a modest investment. For example, you might not have much to invest at once. DCA allows you to routinely invest small amounts of money rather than wait until you save up a bigger sum.

- DCA reinforces the habit of investing regularly while eliminating concerns about timing. It prevents you from potentially reducing your portfolio’s returns by taking sentiment out of your strategy.

- DCA ensures you invest even when the market is down. For some traders, it can be extremely difficult to keep up with investing during a downturn. However, according to a study conducted by Charles Schwab, those who keep investing in down markets typically see higher returns on average than those who withdraw and try to time the market recovery to return.

Cons

- Unfortunately, DCA doesn’t always play out well. For example, it may not work if you see prices steadily moving in just one direction. If prices are consistently increasing, you’ll end up buying fewer coins. If prices are falling, there is always a chance that you should not be investing at all. So you need to make sure you consider your outlook for this particular investment as well as the wider market. To avoid endangering your portfolio, use DCA for less risky coins.

- Also, repetitive investment over time can result in larger transaction costs. So, sometimes, DCA might not be worth it.

- Then, there’s data (from the Financial Planning Association and Vanguard) that over the very long term, DCA underperforms lump investments. That means if you do have a large sum of money, you’d better go all in. We’re a bit skeptical about taking this research at face value for a few good reasons.

👉 Firstly, one might not have a large sum to invest. Secondly, it’s a bit daunting to invest a lot of money at once. And finally, DCA helps your portfolio grow. Just launch the Bitsgap DCA bot and see for yourself.

DCA Trading Bot

DCA becomes a hell of a lot easier when you automate the strategy and let the bot do all the hard work for you.

Thankfully, Bitsgap has the DCA trading bot that you can use to fully automate your trading routine.

What Is the Bitsgap DCA Trading Bot?

The crypto DCA bot from Bitsgap follows the Dollar Cost Averaging strategy and divides your investment into periodic purchases or sales, depending on your position — either long or short. Such recurrent buy or sell trades allow you to get a better average price and lessen the effect of volatility on your overall position.

How Does the Crypto DCA Trading Bot Works?

As mentioned, the DCA bot regularly purchases or sells small amounts of coins at predetermined price levels. But it is also much more than that, as the Bitsgap DCA bot can also follow technical indicators and limit your risks with powerful hedging tools.

How to Get Started with Bitsgap DCA Bot?

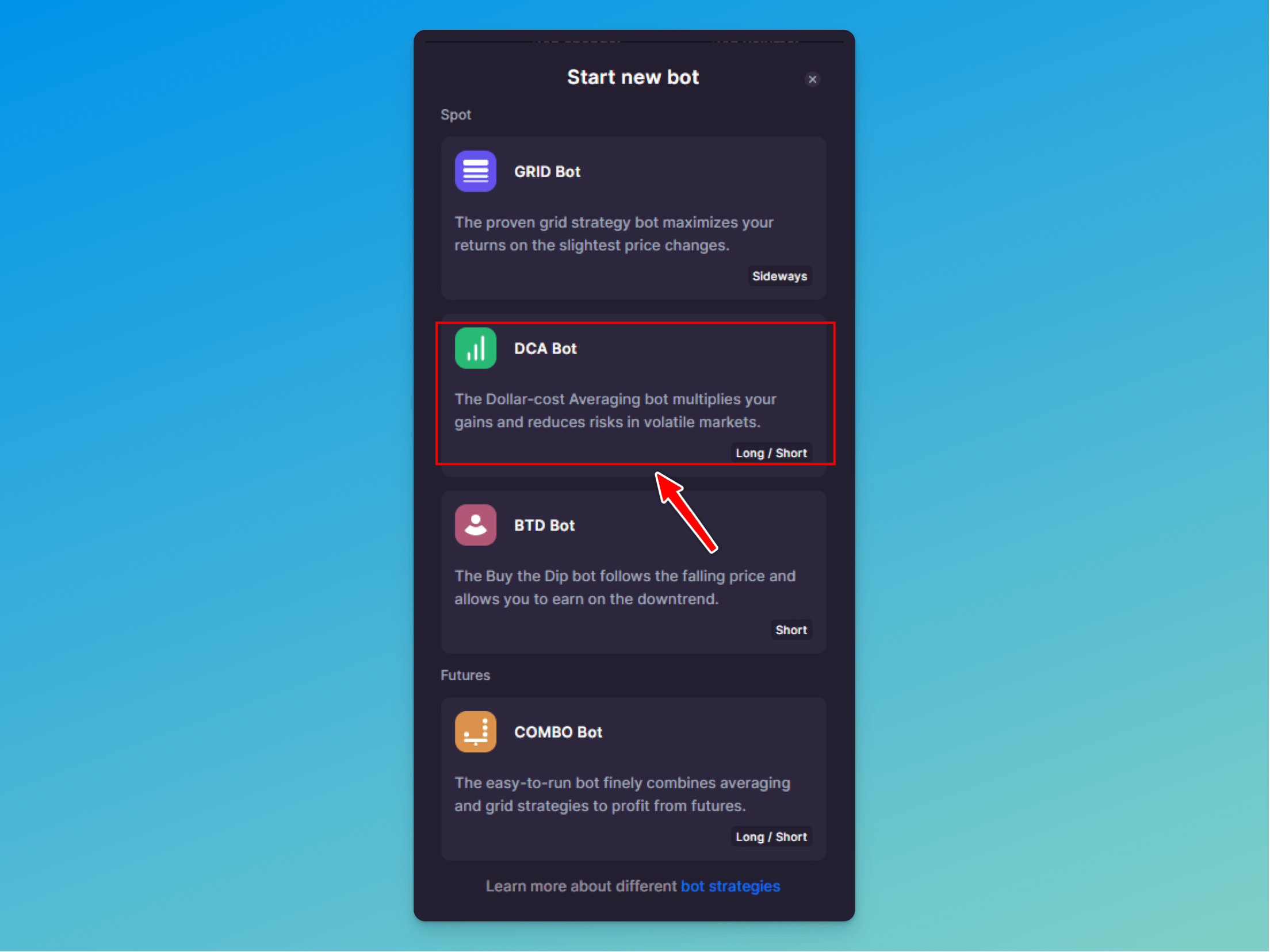

To launch your crypto DCA bot, click on the [Start new bot] button on top of the Bitsgap interface and select DCA from the list (Pic. 1):

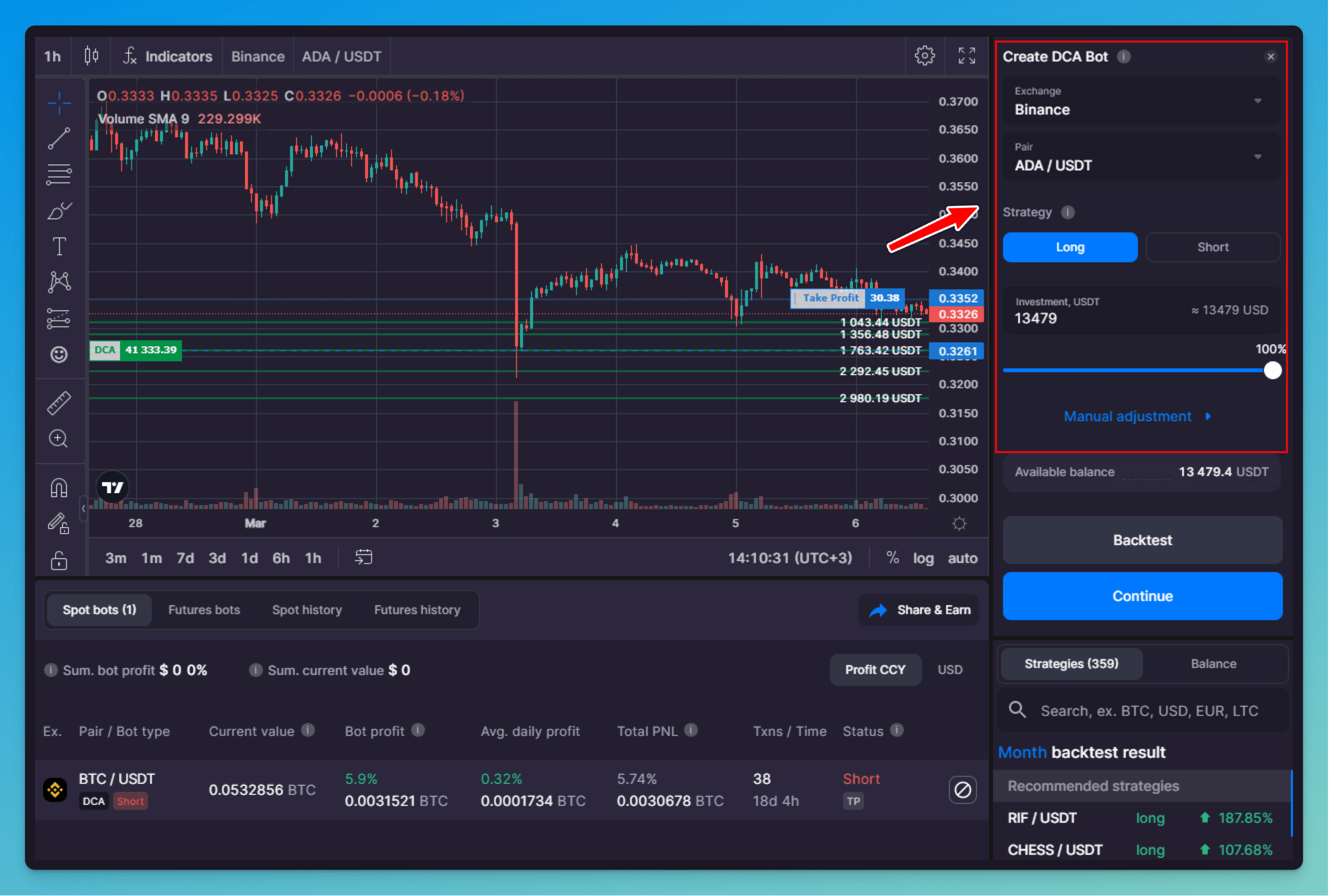

After you’ve selected the DCA bot, you can adjust its settings in the window that appears on the right-hand side of your screen (Pic. 2):

There, select an exchange, a trading pair, an investment, and a strategy — long or short.

If you click [Continue], your bot will start with a profitable default configuration, which you can see on the chart to the left. If you want to check and adjust your bot’s settings, click on [Manual adjustment].

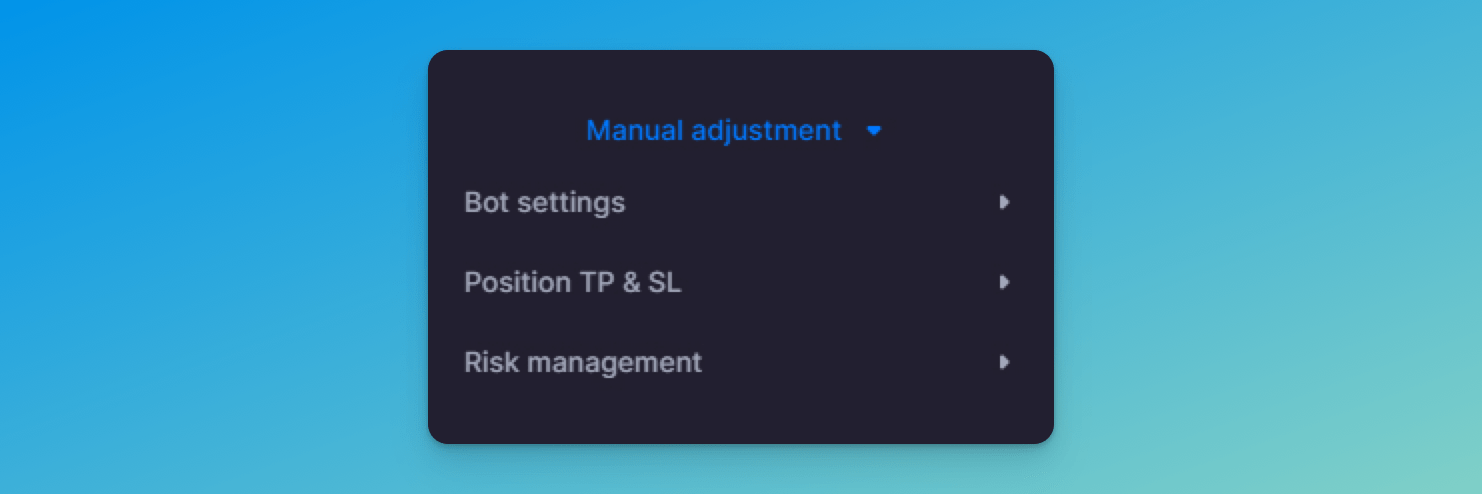

[Manual adjustment] comprises three distinct sections: [Bot settings], [Position TP&SL], and [Risk Management] (Pic. 3):

In the [Bot settings] section, you can specify conditions for starting your bot, including the base and averaging order amounts, indicator signals, and amount & step multipliers.

In [Position TP&SL], you can specify conditions for closing your position. This way, you may determine at what percentage of a price change your bot should close and fix the profit and how such a percentage is calculated. You can also set a [Stop Loss] to prevent unexpected losses and close the position if the price moves in an unfavorable direction.

In [Risk management], you can add more conditions for closing your DCA bot and use hedging tools like [Target total profit] and [Allowed total loss] to protect your trading.

Conclusion

So you see that by using the DCA strategy, investors can mitigate risks and build positions over time while maximizing returns in the long term. It eliminates the need for market timing and can be fully automated using tools such as the Bitsgap DCA bot.

To learn more about the DCA bot and its customization, please refer to this and this article in our Help Center. Ready to roll up your sleeves and start earning?

FAQ

What Is DCA Meaning Crypto?

DCA in crypto is the practice of buying or selling small amounts of cryptocurrency regularly in the same small amounts over time.

Is the Crypto DCA Strategy a Good Idea?

DCA might be a good idea if you are starting with limited funds, are not interested in timing the market, and are pretty confident that prices will likely fluctuate rather than fall. DCA might not be a good idea if you have a large sum to invest, enjoy timing the market, and are investing short-term.

Who Should Use DCA Crypto?

DCA should be used by any investor who’s looking for the benefits of the method, meaning — lower average cost, investing at regular intervals, and not stressing over trading under pressure. Dollar-cost averaging can be especially helpful for people who are just starting out and don't have enough knowledge or experience to know the best times to buy. It may also be a sound strategy for long-term buyers who are dedicated to making regular investments but lack the time or desire to monitor the market.