Bitsgap vs Gainium: Which Trading Platform Comes Out on Top?

Wondering which crypto trading platform truly delivers—Bitsgap or Gainium? We break it all down so you can pick the powerhouse that fits your strategy.

Welcome to another installment in our Bitsgap Comparison series, where we dive deep into side-by-side comparisons between Bitsgap and other leading crypto trading platforms. Our goal? To explore how Bitsgap stacks up, spotlighting its standout features and advantages—while ultimately leaving the final verdict up to you, the trader.

In this article, we’re turning our attention to Gainium, another player in the crypto trading arena. Both Bitsgap and Gainium offer powerful tools designed to help traders automate strategies, optimize trades, and manage their portfolios with confidence. While Bitsgap has earned a reputation for its user-friendly interface, advanced trading bots, and robust security, Gainium brings its own flavor of innovation to crypto.

We’ll take a closer look at the features that matter most—automation, smart trading tools, pricing models, platform security, and more—to help you make an informed decision on which solution best fits your trading style and goals.

Let’s get into it.

Key Platform Features: Bitsgap vs Gainium

Bitsgap and Gainium are both web-based crypto trading platforms that offer a comprehensive suite of tools for automated trading. Each provides an all-in-one interface to manage trades across multiple exchanges, incorporating features like trading bots, advanced order types, and portfolio tracking.

Bitsgap, established in 2017, has become a leader with a large user base (over 650,000 traders) and supports 15+ major exchanges through one unified dashboard. It’s an all-in-one solution that includes the best crypto trading bots, algorithmic orders, portfolio management, and a free demo mode for practice.

Gainium is a newer entrant (based in Singapore) focused on automation and strategy optimization. It similarly integrates with popular exchanges and offers a full suite of tools for researching, deploying, and analyzing crypto trades without any coding required.

👉 In essence, both platforms let traders monitor portfolios and execute strategies on multiple markets from a single web interface, aiming to simplify and streamline the trading experience.

Core Tools and Services

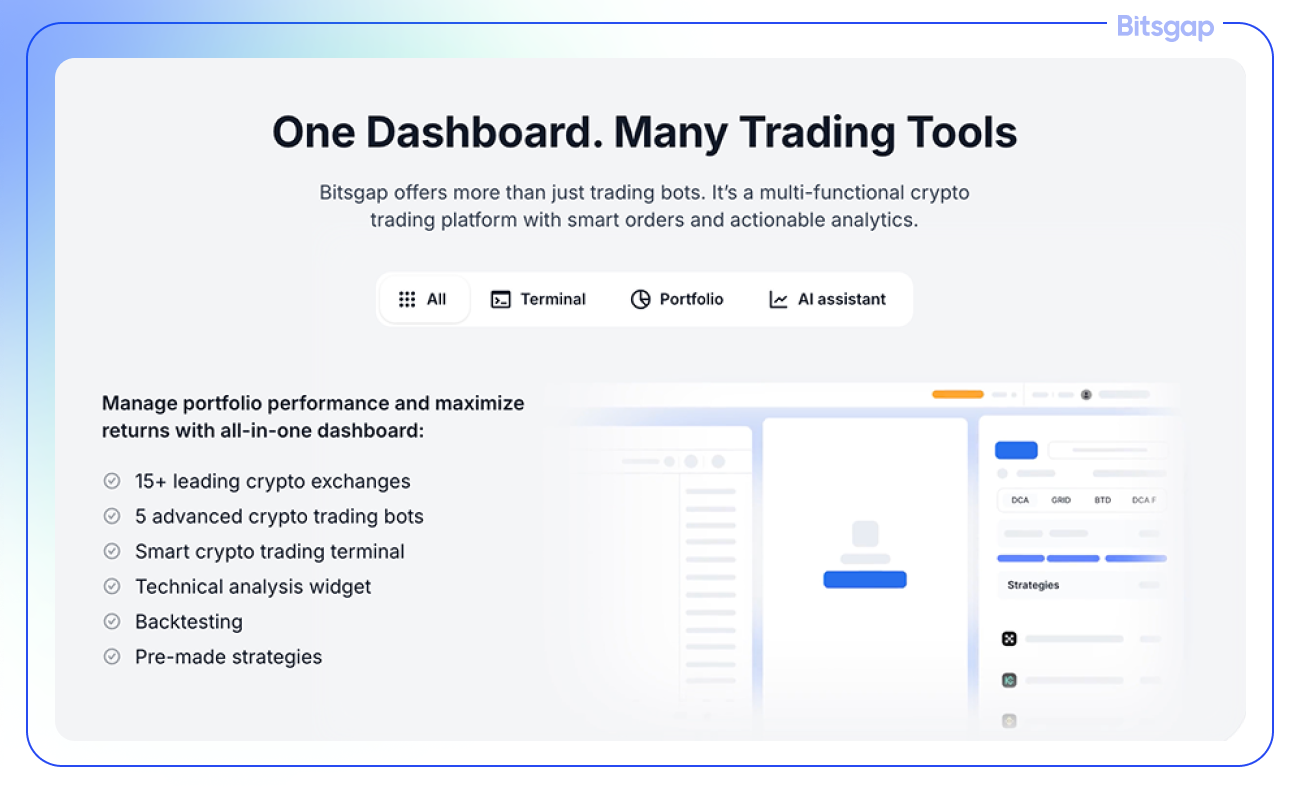

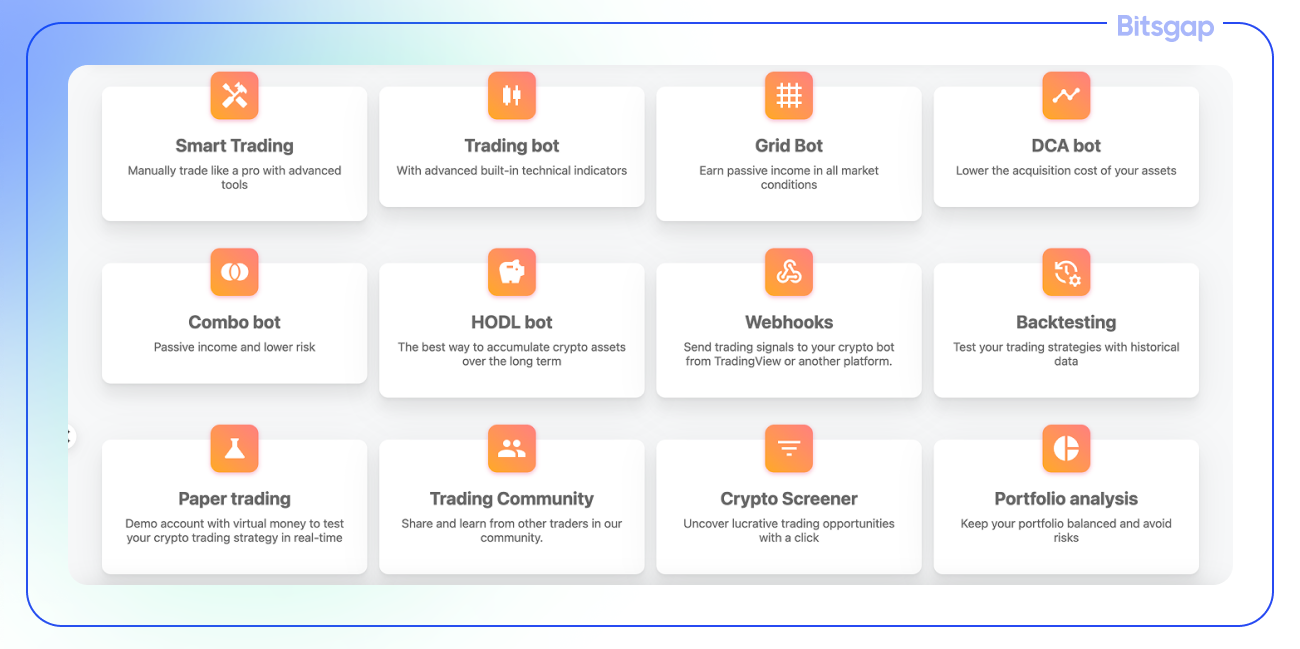

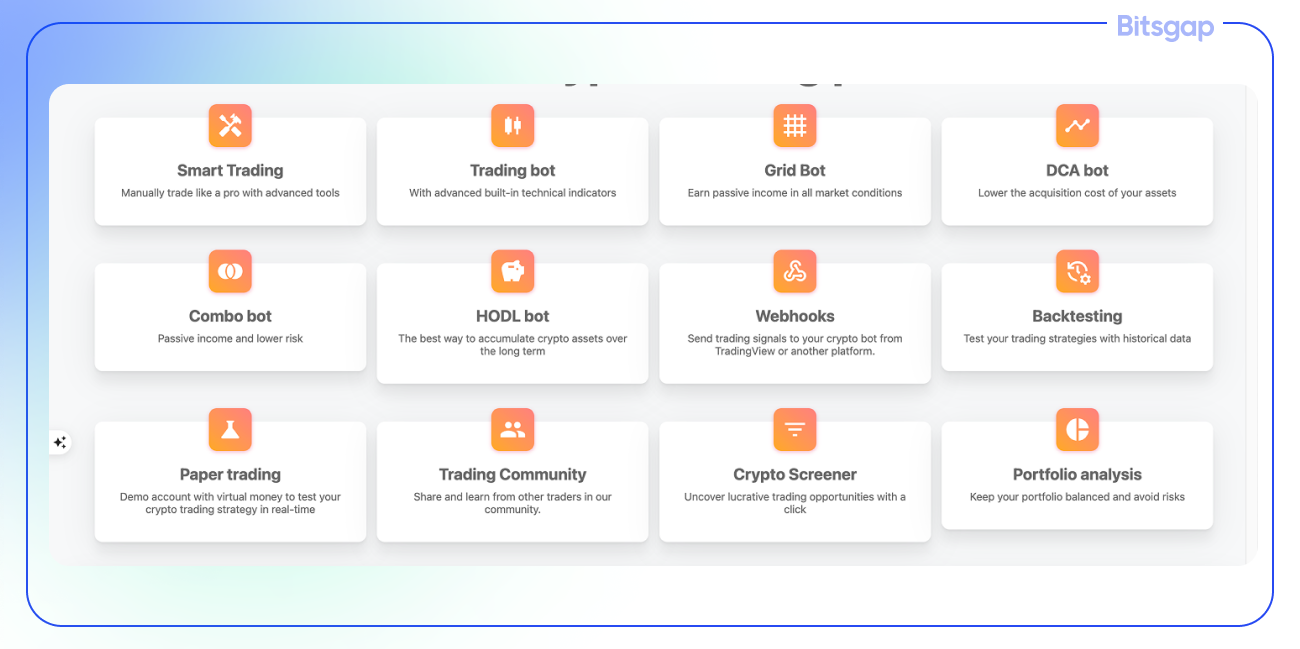

Bitsgap’s Toolset: Bitsgap’s platform offers a broad range of features under one roof. Its core offerings include a suite of automated trading bots (for both spot and futures markets), an advanced smart trading terminal for manual orders, real-time portfolio management, and AI assistance. Notably, Bitsgap was among the first services to popularize crypto trading bots, and over time it has layered on rich functionality like technical charting widgets and detailed analytics. Overall, Bitsgap’s core service is to be a “one-stop” trading hub that centralizes everything from automation to manual trading tools in a secure, easy-to-use interface.

Gainium’s Toolset: Gainium, launched more recently, also provides an extensive feature set geared toward strategy automation and testing. Its platform centers on automated bots and includes robust tools for strategy research and development. Traders on Gainium can perform backtesting on historical data and paper trading (forward-testing) to fine-tune their strategies before going live. Like Bitsgap, it offers a unified web terminal for placing trades on connected exchanges, along with portfolio analysis dashboards to track holdings and performance across accounts. Gainium places a strong emphasis on being beginner-friendly while still powerful for pros – for example, it provides a strategy library where users can save and compare different trading strategies, and a crypto screener to spot market opportunities.

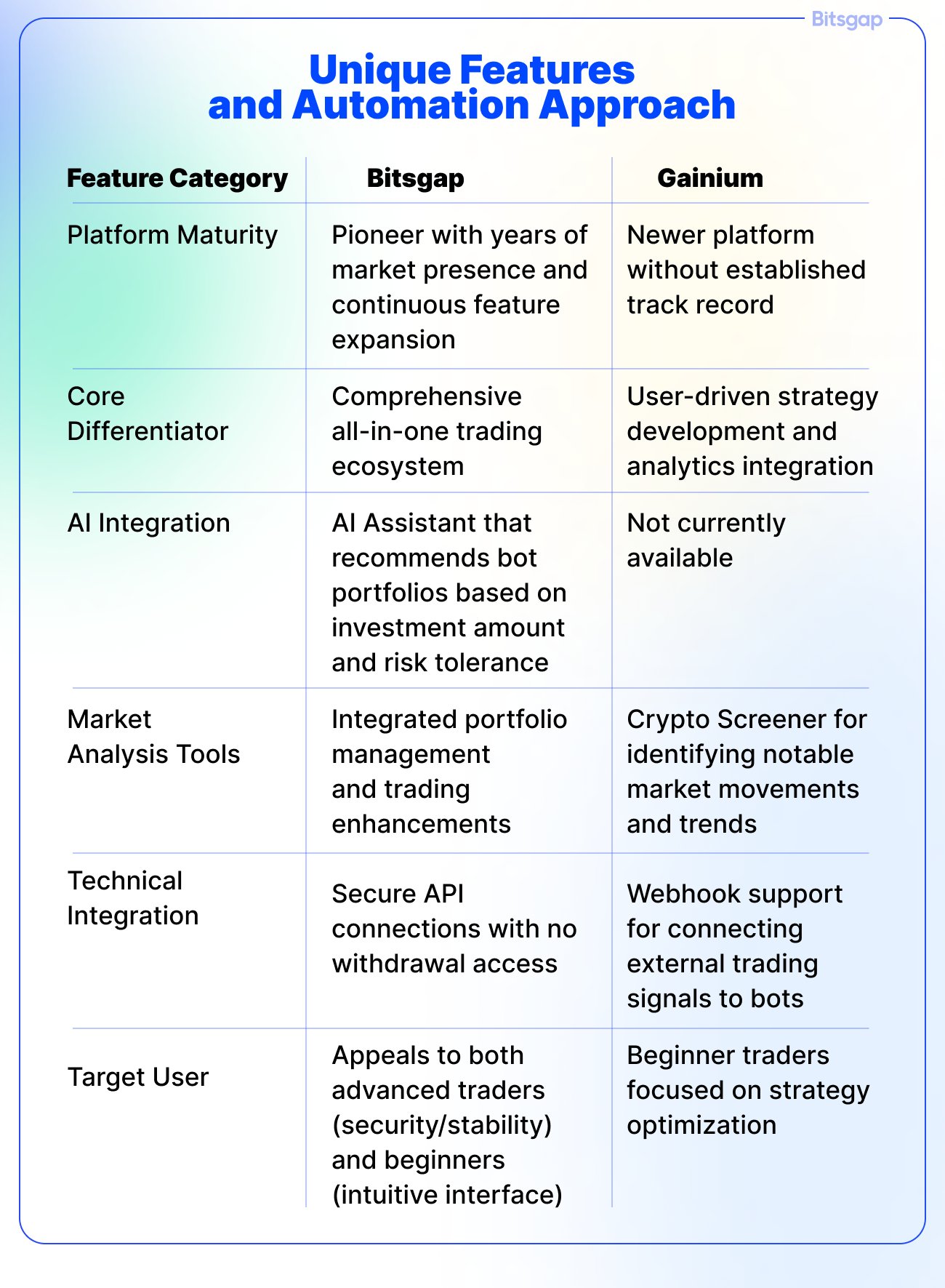

Unique Features and Automation Approach

While there is substantial overlap in what Bitsgap and Gainium offer, each platform brings some unique features and approaches to crypto trading automation that set it apart:

Bitsgap’s Unique Strengths

The key differentiator for Bitsgap is its maturity and breadth as a platform. Having been a pioneer in automated crypto trading, Bitsgap has continuously expanded its feature set. One standout is Bitsgap’s integration of an AI Assistant that helps users discover and deploy bot strategies. This AI feature can recommend a portfolio of bots tailored to the user’s investment amount and risk preference, essentially simplifying bot selection for those unsure where to start.

Additionally, Bitsgap provides curated strategy templates through its proprietary Strategies widget that users can follow, which is helpful for beginners looking for guidance. All of these extras come on top of Bitsgap’s core bots and smart orders.

Finally, Bitsgap's latest innovation—the LOOP bot—stands unmatched by competitors. This unique position trading bot simultaneously generates profits in both trading currencies, automatically reinvests earnings, and dynamically adjusts levels to maximize returns.

👉 In essence, Bitsgap stands out by being a very comprehensive, battle-tested platform: it combines automated bots, manual trading enhancements, portfolio management, and even niche tools like LOOP bot and AI Asistance in one package.

This makes it extremely versatile—a trader can use Bitsgap for virtually every aspect of their crypto trading workflow. Its reputation for security and stability (funds remain on exchanges via API, with no withdrawal access by Bitsgap) also adds to why advanced traders trust it, while its intuitive interface appeals to newer traders. This balanced, all-in-one approach is a big reason Bitsgap often stands out in the broader context of crypto trading platforms.

Gainium’s Unique Strengths

Gainium differentiates itself with an emphasis on user-driven strategy development and flexibility. As a newer platform, it brings fresh ideas particularly in how traders can design and automate their strategies.

One unique aspect is Gainium’s seamless loop of “Research → Deploy → Analyze” built into the platform. It encourages users to continuously refine their approach: you can backtest a strategy, launch it with a bot, then review detailed performance statistics and even export trade data for further analysis. This tight integration of analytics makes Gainium attractive for systematic traders who are always optimizing.

Gainium also provides a Crypto Screener tool that scans the market for coins with notable movements or trend patterns. This is useful for idea generation—for example, spotting potential pairs to deploy a bot on.

Another standout feature is the earlier mentioned webhook support in Gainium’s bots. This means experienced users can plug in external trading signals (say from TradingView alerts or custom algorithms) to trigger their Gainium bots, effectively allowing custom strategy automation beyond the built-in options.

👉 Because it’s an up-and-coming platform, it may not have the same breadth of integrations or userbase as Bitsgap yet, but it is evolving. The focus is clearly on making advanced trading automation accessible and providing rich tools to support that.

Automated trading: Bitsgap vs Gainium Bot Review

Both Bitsgap and Gainium are perhaps best known for their automated trading bots, which execute strategies algorithmically on behalf of the trader. These bots allow users to capitalize on market movements 24/7 without constant manual intervention.

Each platform offers several types of bots to suit different market conditions and trading styles:

Bitsgap Bots

Bitsgap provides a variety of pre-built trading bots that cater to different scenarios. Key examples include the GRID Trading Bot, which places a grid of buy and sell orders to profit from small price oscillations in range-bound (sideways) markets, and the DCA Bot (Dollar-Cost Averaging) for gradually buying or selling assets over time to reduce risk in volatile markets.

It also features a “BTD” bot (Buy The Dip) designed to accumulate assets during price dips and sell on rebounds, and a LOOP Bot, the most recent addition, built for long-term wealth building in two currencies simultaneously.

For futures trading, Bitsgap offers the DCA Futures Bot, which follows the DCA strategy for futures, and COMBO Bot, a high-risk, high-reward strategy that combines grid and DCA techniques.

All of these automated strategies come with ready-made templates and can be customized by users.

Bitsgap has continually expanded its bot arsenal and reports that over 4.7 million bots have been launched on its platform to date—underscoring its experience in algorithmic trading.

👉 All of Bitsgap’s bots (except LOOP) can be backtested on historical data and run in demo mode, so traders can optimize parameters before deploying real funds.

Gainium’s Bots

Gainium likewise offers a rich selection of trading bots, covering similar ground with its own twist. Grid Bots for range-bound markets, DCA Bots for systematic investing, and a Combo Bot that merges both strategies to adapt to changing market conditions. This hybrid approach allows traders to secure frequent small gains while building positions during trend development. For long-term investors, the platform's HODL Bot implements a traditional dollar-cost averaging strategy, automatically purchasing at set intervals to build positions gradually regardless of market volatility. All these bots are highly configurable with advanced settings.

Additionally, Gainium bots support webhook integrations, meaning traders can connect external signals or custom triggers to start/stop bots based on specific market alerts. This flexibility indicates Gainium’s focus on algorithmic strategy customization.

👉 Like Bitsgap, Gainium provides built-in backtesting for its bots and lets users paper-trade strategies to ensure they are profitable before committing real capital.

In summary, both platforms clearly provide trading bots and algorithmic strategy automation as a core service. Bitsgap’s bot suite is polished and diversified, benefiting from years of user feedback, while Gainium offers a similar lineup plus webhook integration, which Bitsgap lacks. Both are suitable for beginners (with ready-made bot presets) and advanced traders (with fine-tunable parameters) looking to automate their trading plans.

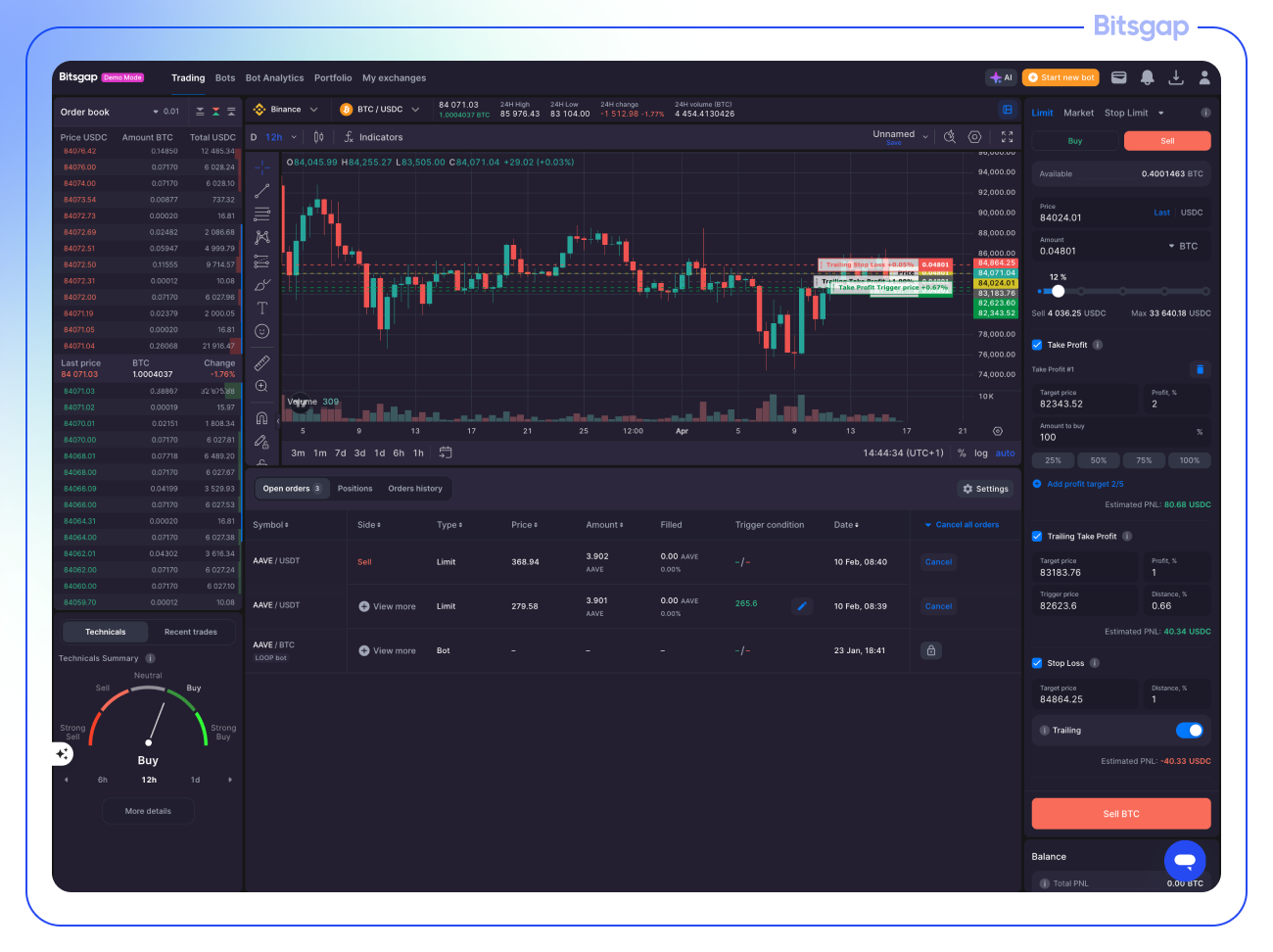

Smart Order Types and Trading Tools: Bitsgap vs Gainium

Beyond fully automated bots, Bitsgap and Gainium also equip traders with smart trading tools—advanced order types and management features for manual or semi-automated trading. These tools help users execute complex trading strategies and manage risk more effectively, all from the platforms’ web interfaces.

Bitsgap’s Smart Orders

Bitsgap offers a powerful trading terminal that supports a range of algorithmic order types to give traders precision and control in their manual trades.

Users can set up simultaneous stop-loss and take-profit orders to protect against downside and secure profits, something not always possible directly on exchanges.

Bitsgap’s terminal also enables setting OCO (One-Cancels-Other) orders, where placing a take-profit and stop-loss together ensures that when one executes, the other is automatically canceled.

Advanced order types like TWAP (Time-Weighted Average Price) orders—useful for executing large trades incrementally to avoid slippage—and Scaled (ladder) orders are available as well.

Additionally, Bitsgap provides trailing orders (trailing stop-loss and trailing take-profit) that adjust automatically with market movements to lock in gains or reduce losses. All these “smart orders” allow traders to implement algorithmic strategies manually, such as breakout trades or range trades, with a high degree of flexibility.

Importantly, Bitsgap’s smart trading features work across its integrated exchanges, so a user can deploy, for example, an OCO order on any exchange account via the Bitsgap interface.

👉 This comprehensive set of order types is a big part of Bitsgap’s appeal for active traders who want more than basic buy/sell functionality.

Gainium’s Smart Trading

Gainium also includes a Smart Trading interface that aims to enhance manual trading with advanced order capabilities.

Traders can similarly place combined orders like concurrent stop-loss and take-profit, use trailing stop-losses to follow favorable price trends, and set conditional orders to execute when certain criteria are met.

Gainium’s documentation and reviews indicate support for features such as OCO orders and OSO (One-Sends-Other) sequences, allowing complex order chaining. The presence of a dedicated “Smart Orders” feature implies that Gainium, like Bitsgap, lets users slice large orders or reserve funds by only partially filling an order (to maintain liquidity while orders execute). In practice, this means a Gainium user can execute sophisticated trades – e.g. set a limit sell with a stop-loss and trailing stop attached—all in one step.

Both platforms also incorporate real-time charting and technical analysis tools (via TradingView widgets) within their terminals, so traders can analyze market trends and place orders in the same window.

👉 Overall, when it comes to smart order types, Bitsgap and Gainium both empower traders with professional-grade tools normally found on advanced exchanges or through separate trading terminals. This includes everything from basic stop/limit orders up to complex multi-leg orders, which can be crucial for effective risk management and automation of trading strategies.

Exchange support: Bitsgap vs Gainium Review

Both Bitsgap and Gainium let users connect multiple exchanges via API and run trading bots or algorithms. This comparison will detail their current live exchange integrations as of 2025.

Bitsgap Supported Exchanges

Bitsgap offers integrations with 15+ major cryptocurrency exchanges, all of which are centralized exchanges (CEX), covering virtually all of the top-tier CEX markets for spot trading. These include Binance, Binance US, Coinbase (Advanced Trade API), Kraken, KuCoin, OKX, Bitfinex, Crypto.com, Gate.io, Gemini, Huobi (HTX), Poloniex, Bitget, BitMart, WhiteBIT, and Bybit. In other words, if a major exchange is popular for crypto trading, there’s a good chance Bitsgap already supports it. Importantly, Bitsgap’s integrations cover spot trading on all these exchanges, and in many cases also allow futurestrading on exchanges that offer those markets (e.g. Binance Futures, OKX perpetual swaps, etc.). However, Bitsgap does not currently support decentralized exchanges (DEXs) or on-chain wallets – its focus remains on exchange APIs for centralized platforms.

Gainium Supported Exchanges:

Gainium, being a newer platform, supports a smaller set of exchanges in comparison. As of early 2025, Gainium offers live integration with five major exchanges for spot trading: Binance, Binance.US, KuCoin, OKX, and Bybit. These cover a broad range of popular trading venues (including both global and U.S. platforms).

For futures trading, Gainium currently supports only Binance (futures) and OKX (futures) out of its lineup. (Other exchanges on Gainium, like KuCoin or Bybit, can be used for spot trading but do not yet have futures enabled via Gainium’s interface.)

👉 Like Bitsgap, Gainium’s integrations are all with centralized exchanges using API keys, and no DEX integrations are live at this time.

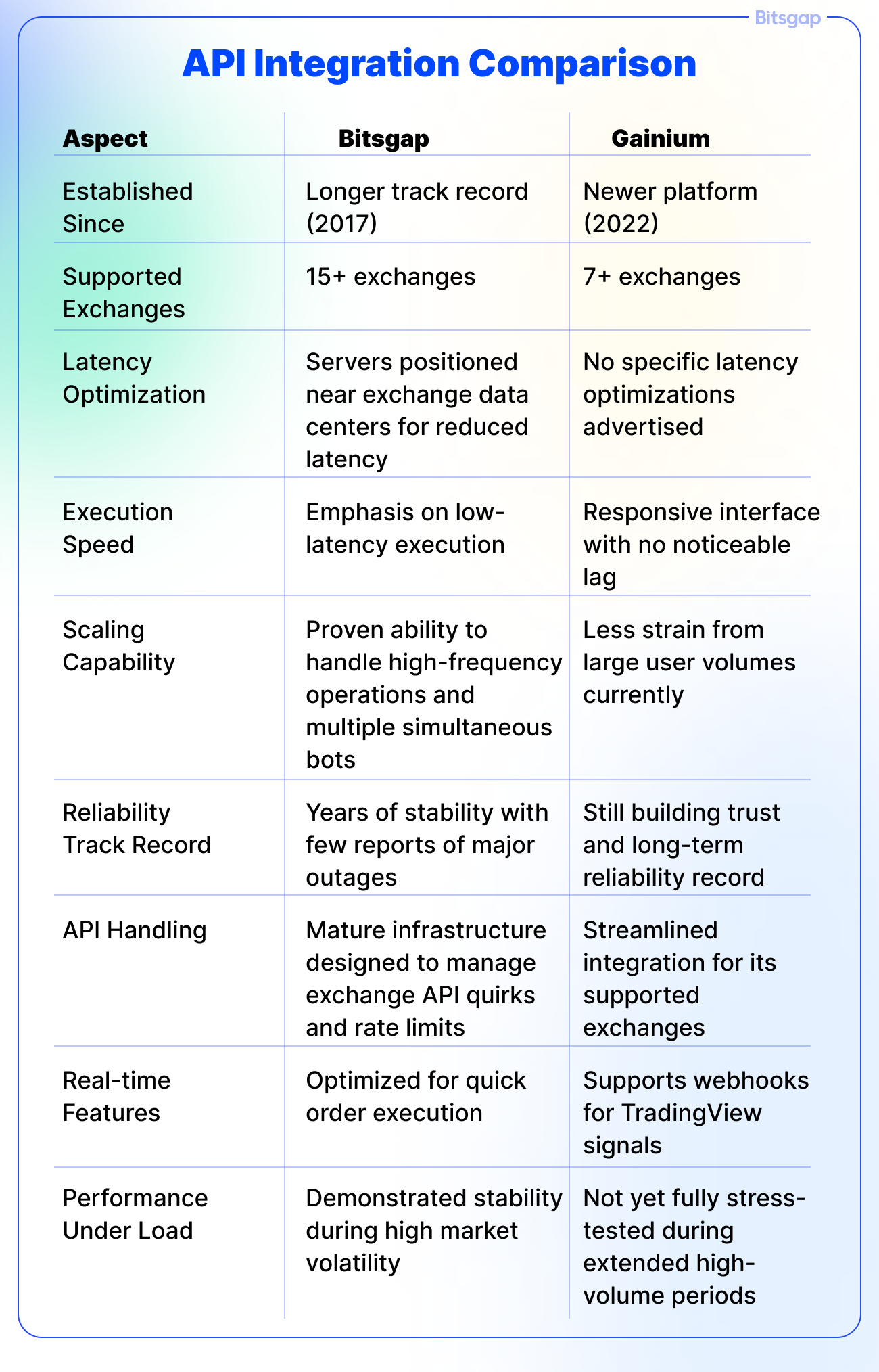

API Integration, Order Execution Speed & Stability

Both Bitsgap and Gainium are non-custodial services that connect to exchanges via API keys, meaning your trades are executed on the exchange itself through these APIs. In practice, this setup requires robust API integration to ensure orders are executed quickly and reliably across different exchanges.

Bitsgap’s API Integration:

With a longer track record, Bitsgap has had time to optimize its API connections for speed and stability across all supported exchanges. The platform emphasizes low-latency execution—for example, Bitsgap runs its trading servers in locations close to the servers of popular exchanges to reduce latency and ensure fast order execution. This means when your Bitsgap trading bot or smart trade issues an order, it reaches the exchange and fills as fast as possible, with minimal delay.

Users generally report that Bitsgap’s interface and trading engine handle high-frequency operations smoothly, even when running many bots simultaneously. Stability-wise, Bitsgap’s mature integration means it can handle the quirks of each exchange API (rate limits, downtime, etc.) with minimal disruption.

👉 In essence, Bitsgap provides a stable, high-speed trading experience on the 15+ exchanges it supports—an important factor for advanced traders who demand quick execution. Over the years, Bitsgap has built a reputation for stable API connectivity, and there are few reports of major outages beyond occasional maintenance.

Gainium’s API Integration:

Gainium is newer (founded 2022) and has fewer exchanges to connect, which has likely helped it maintain solid performance as well. Although the platform doesn’t boast specific latency optimizations on its homepage, user reviews note that Gainium’s interface is responsive and executes commands without noticeable lag.

In tests, creating or adjusting a bot on Gainium and sending orders (like starting/stopping bots or placing trades) feels snappy, indicating the API calls are handled efficiently.

Gainium’s smaller scale means less strain from large user volumes, and so far it has delivered stable trade execution on the exchanges it supports. It also offers features like webhooks for TradingView signals, suggesting the backend can handle real-time triggers reliably. That said, as a relatively new platform with a limited track record, Gainium is still proving its reliability over time. It hasn’t faced the same long-term stress tests as Bitsgap. In practice, this means most Gainium users have not reported major issues with order execution or API disconnects, but the platform is still in the process of building trust.

On the positive side, Gainium’s focus on a few key exchanges likely means their integration for each is streamlined and tested, which can translate to stability.

👉 In summary, Gainium appears to offer stable and reasonably fast API performance for its current exchange integrations, though it doesn’t explicitly market ultra-low latency features.

Advanced traders will find both platforms sufficient for most use cases, but those needing the absolute fastest execution might give Bitsgap an edge due to its infrastructure and longer optimization effort.

Terminal, Interface and Ease of Use: Bitsgap vs Gainium

Now, let’s take a look at both platforms’ interfaces, user-friendliness for beginners vs. professionals, and accessibility (including mobile use).

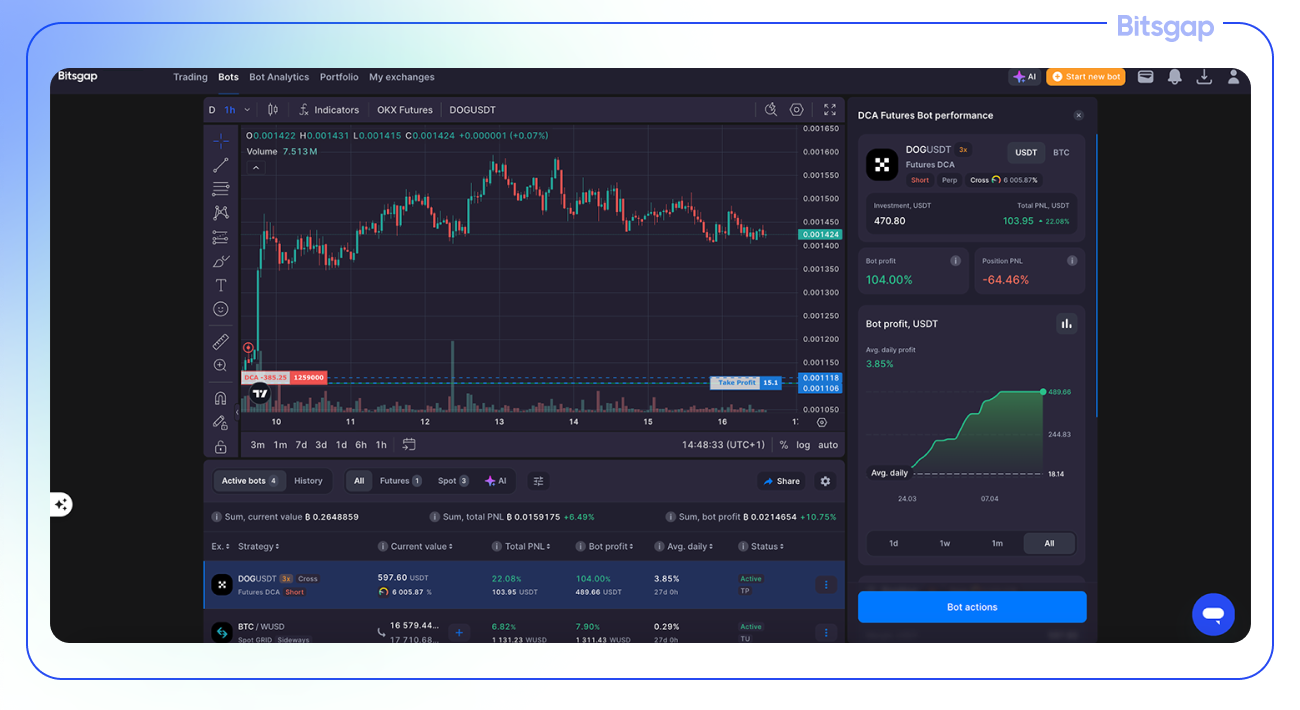

Bitsgap Terminal and Interface Design

Bitsgap’s trading terminal emphasizes a clean, minimalist design that highlights essential trading information. The interface integrates a TradingView-powered chart (with 100+ technical indicators and drawing tools) alongside an order book and recent trades panel for market depth. Advanced order controls (limit, market, stop-limit, OCO, etc.) and smart trading features (like trailing stop-loss/take-profit) are clearly available on the right-hand panel. Navigation is straightforward—a top menu lets users switch between the Trading terminal, Bots, Bot Analytics, Portfolio, and Exchanges in one click. Overall, Bitsgap’s layout is uncluttered and intuitive, aiming to provide detailed tools without overwhelming the user

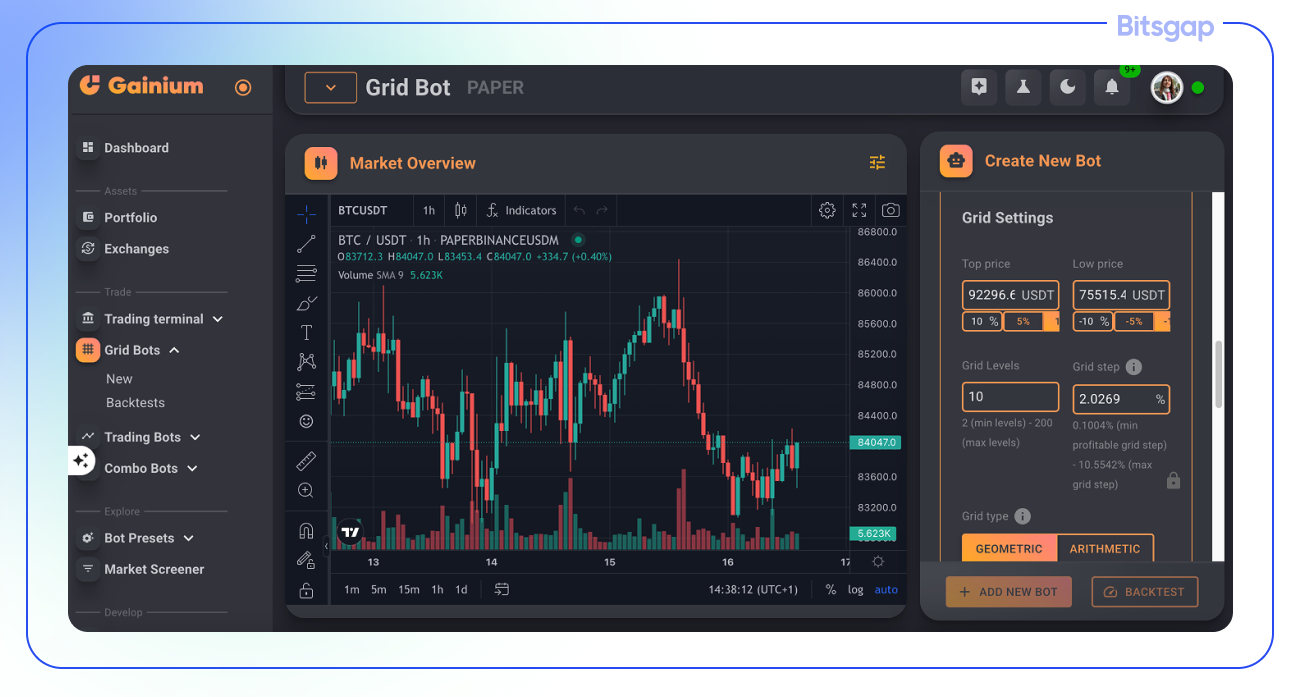

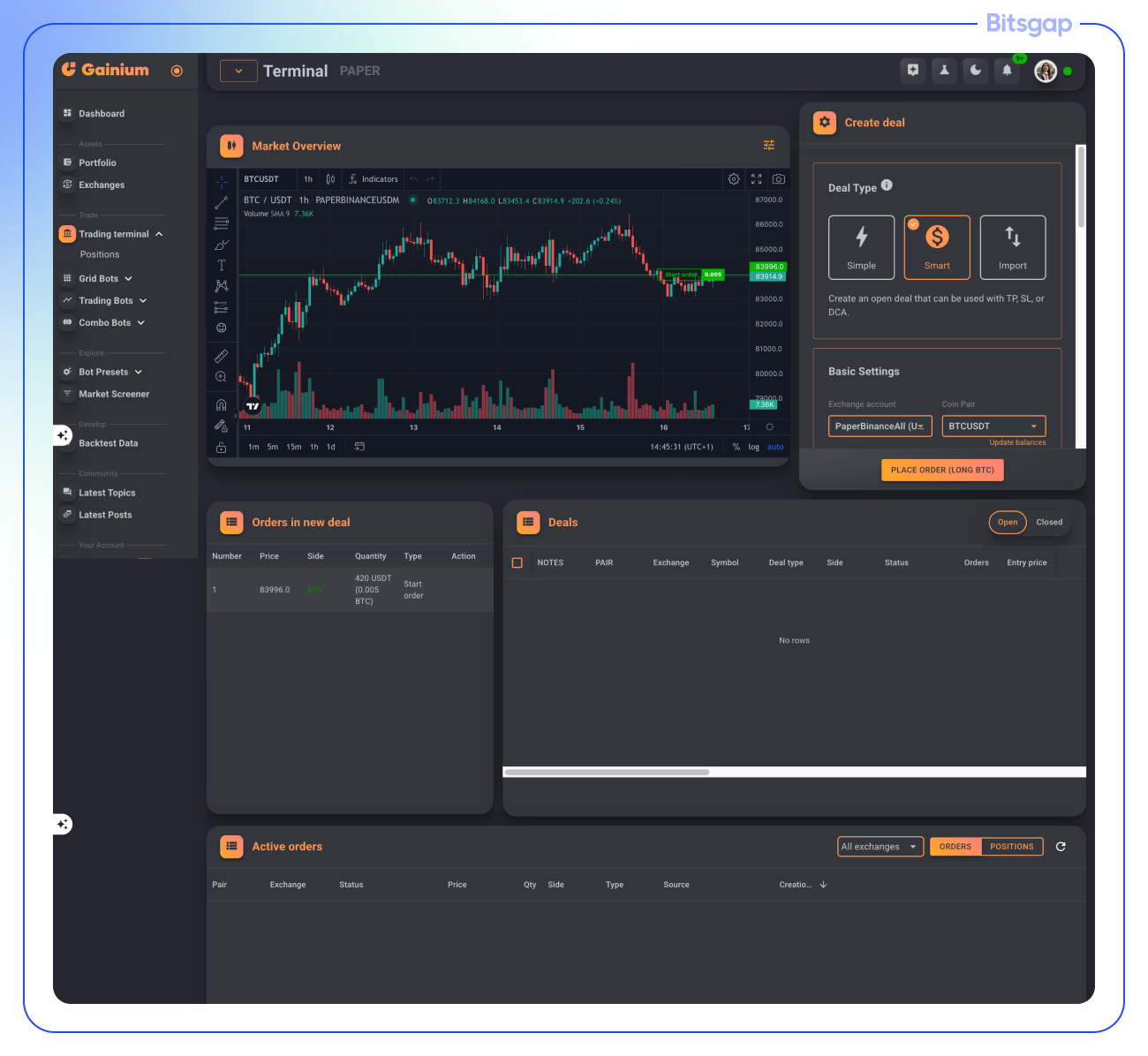

Gainium Terminal and Interface Design

Gainium’s platform interface is designed to be sleek and user-friendly, presenting information in a visually clear dashboard format. Upon login, users are greeted with an overview dashboard that displays portfolio value and profit analytics at a glance. A left sidebar menu provides easy navigation to different sections (such as bots, strategies, or the smart trading terminal). The layout is intuitive even for non-tech-savvy users, with smooth navigation and well-organized panels. For example, the main dashboard shows portfolio performance charts and summaries of active trading bots (their status, profit/loss) in a clean, graphical format. When using Gainium’s trading terminal or bot pages, the interface continues to prioritize clarity—charts and bot settings are presented with straightforward controls, though with fewer on-screen technical widgets than Bitsgap.

Users have noted that Gainium’s UI is modern and easy to get started with, though it may lack some of the advanced layout customization found in other platforms (e.g. panels are fixed in size, which one review noted can make the interface feel space-consuming on large screens).

User Suitability for Beginners and Professionals

Both platforms claim to serve both novice and experienced traders, but they approach this in different ways:

Bitsgap (Beginner-Friendly):

Bitsgap incorporates several onboarding and ease-of-use features to help newcomers. It offers a free Demo Mode where users can simulate trades and bots without risking real funds. The platform also provides pre-defined bot strategies and templates (e.g. “3-click” bot launch categorized by market conditions) to simplify setup. Bitsgap deliberately uses a “no fiddly settings” approach for its basic bot setup —meaning new users can launch a grid or DCA bot with default parameters if they aren’t comfortable tweaking everything. In addition, an AI trading assistant can automatically suggest a balanced portfolio of bots, which lowers the entry barrier for beginners.

👉 These features, combined with an easy sign-up and exchange API connection flow, make Bitsgap’s interface approachable for beginners, allowing them to get started with minimal configuration while still learning the ropes.

Gainium (Beginner-Friendly):

Gainium supports unlimited paper trading bots and extensive backtesting, so novices can practice strategies risk-free as long as they need. The platform’s onboarding is supported by helpful guides and tutorials embedded in the interface, which walk users through setting up their first bots or smart trades. The interface often uses tooltips and explanations for technical settings, aiming to educate users as they navigate. Thanks to its clean layout and guided approach, one reviewer noted that Gainium’s learning curve is gentle—users can get started quickly with basic features, and only a gradual learning curve as they explore more advanced tools

Bitsgap (Advanced Traders):

For experienced traders, Bitsgap offers a suite of advanced tools that can all be accessed in one unified platform. Its trading terminal supports complex order types (like TWAP, scaled orders, OCO orders) and allows simultaneous multi-exchange management, which is valuable for professionals arbitraging or managing large portfolios.

Bitsgap also provides rich real-time analytics for bots—including performance metrics and visualizations – so that advanced users can optimize their strategies on the fly. The platform’s bots (GRID, DCA, COMBO, etc.) have numerous settings for those who want fine-tuned control, and users can customize parameters or set trailing up/down features as needed. Crucially, Bitsgap includes robust backtesting on historical data and a portfolio tracker across exchanges.

These features cater to professional traders by allowing deep strategy customization and monitoring. Despite the depth, Bitsgap keeps the workflow relatively smooth—for instance, a trader can quickly switch from manual trading to bot management in a couple of clicks, and the interface consistency means there’s no need to learn separate systems for each feature.

Gainium (Advanced Traders):

Gainium, while newer, also targets advanced users through specific features. It offers backtesting capabilities so that traders can optimize complex strategies before deploying. Gainium’s Combo Bots allow experienced traders to combine Grid and DCA strategies with fine control—users can expand grid levels with DCA and even trigger actions based on technical indicators or external webhooks. This opens the door for technically adept traders to integrate custom signals or connect Gainium with other trading tools via API. The platform’s support for multiple exchanges (Binance, KuCoin, Bybit, etc.) means professionals can run strategies on different markets from the same interface. While Gainium’s UI is simple, advanced users can dive into the settings: for example, they can tweak indicator-based entry/exit conditions, or analyze detailed bot logs and performance stats.

Accessibility and Mobile Use

Both Bitsgap and Gainium are primarily web-based platforms. Each can be accessed through a browser on desktop, and both provide a responsive web interface for use on different screen sizes. Bitsgap’s web interface is optimized for desktop and adapts reasonably well to mobile browsers as well.

Gainium’s platform can likewise be opened on a mobile browser, but users have reported that it isn’t fully optimized for smaller screens—some interface elements can be hard to use on phones (e.g. panels don’t resize gracefully. On a tablet or desktop, however, Gainium works smoothly. Neither platform requires any software installation on PC; all features (from trading terminal to bot management) run via the cloud and browser, with bots continuing to run even if you log off.

One key difference is mobile app availability. Bitsgap offers a native mobile app for iOS and Android (introduced in 2024). The mobile app mirrors much of Bitsgap’s desktop functionality—it retains the familiar interface style and lets users manage their exchange accounts, run trading bots, use demo mode, and view portfolio performance on the go. In contrast, Gainium does not yet have a native mobile app Users of Gainium who wish to check their bots or portfolio on a phone must use the web app in a mobile browser. This means a slightly less streamlined mobile experience—for example, there are no push notifications or native gestures, and some UI elements might require zooming or horizontal scrolling on a small screen.

Security and Data Protection: Bitsgap vs Gainium

With API keys, exchange access, and sensitive account data on the line, platforms like Bitsgap and Gainium must offer robust protections to ensure traders' peace of mind. In this section, we compare how each platform handles user security, including API key protection, encryption standards, two-factor authentication, and the general level of trust traders can place in them.

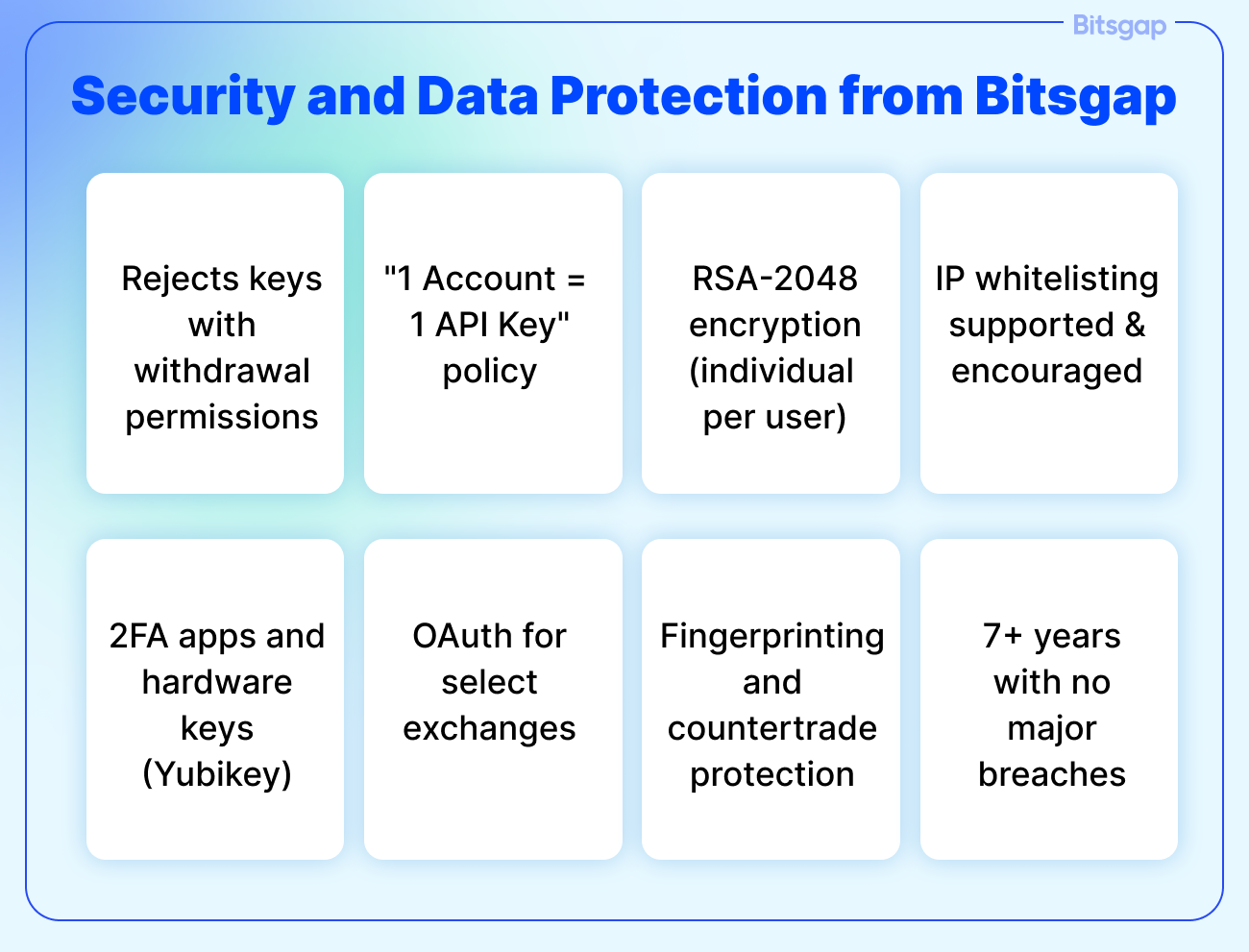

API Key Protection and Data Handling

Bitsgap takes a rigorous approach to API security, emphasizing that it never has access to user funds. API keys added to Bitsgap must have no withdrawal permissions, and any key with those rights is instantly rejected by the system. The platform follows a “1 Account = 1 API Key” policy, ensuring compromised keys cannot be reused across accounts. Additionally, API keys are encrypted and stored with individual RSA-2048 encryption per user, one of the strongest encryption standards available today. Bitsgap also implements fingerprinting and countertrade protection, blocking malicious trading patterns even if a key were somehow exposed. IP whitelisting is supported, allowing users to lock API key access to only Bitsgap’s servers, which adds a powerful extra barrier.

Gainium similarly encourages strong API key practices and openly educates users on threats like “contra trading”, a form of market manipulation using exposed keys. The platform supports API key IP whitelisting, guiding users to whitelist only Gainium’s server IPs. While Gainium doesn’t provide as in-depth a breakdown of encryption standards as Bitsgap, it does recommend token symbol whitelisting to limit trades to specific pairs—helpful in preventing abuse through obscure assets. Gainium also emphasizes user responsibility and shares best practices publicly, like activating 2FA on both the exchange and the Gainium platform.

Encryption, 2FA, and Security Features

Bitsgap stands out with an impressive range of layered security mechanisms:

- 2048-bit RSA encryption for all user data and API keys, making brute-force attacks virtually impossible.

- OAuth integration for Binance, OKX, and KuCoin—allowing for secure, password-free API connections.

- Two-factor authentication (2FA) with support for apps and hardware keys (e.g. Yubikey), adding a robust second layer of protection.

- IP whitelisting, API key fingerprinting, and countertrade detection all combine to block unauthorized or suspicious usage patterns.

Gainium, while newer and slightly less comprehensive in its documentation, covers the key essentials:

- 2FA across the board (on exchange and platform login).

- IP whitelisting at the exchange level to limit API usage only to Gainium’s servers.

- Symbol whitelisting to prevent use of keys on illiquid or risk-prone pairs. These are all solid practices and show that Gainium is proactive about trader security, though it currently lacks features like OAuth and fingerprinting.

Trust and Track Record

Bitsgap has established a solid reputation over seven years of operation. With zero major breaches reported, a community of 600,000+ traders, and a transparent approach to platform safety, Bitsgap is widely trusted by both novice and professional users. Its longevity and advanced infrastructure, including continuous platform updates and public security transparency, make it a reassuring choice for cautious traders.

Gainium, while younger, has been transparent about security education and publishes clear guidance for users on how to secure their API keys and accounts. It has not reported any security incidents as of 2025, and its open community and leadership presence help build a sense of accountability and trust. That said, as a newer platform, it still has to prove its resilience over the long term.

Prices and Tariff Plans: Bitsgap vs Gainium Platfrom Review

Pricing plays a critical role in selecting the right crypto trading platform—especially when you’re weighing advanced features, bot limits, and exchange support against what you’re actually paying for. Both Bitsgap and Gainium offer multiple pricing tiers tailored to different levels of trader—from casual beginners to automation-heavy professionals. In this section, we’ll compare subscription costs, what’s included in free vs. paid plans, and where users are likely to get the best value for their money.

Subscription Cost Comparison

Bitsgap starts at $26/month for its Basic plan, scaling up to $135/month for the Pro tier. Gainium is slightly more affordable across the board, starting at $20/month for Basic and topping out at $80/month for Pro. Both platforms offer a 20% discount on annual subscriptions, which can translate to substantial savings over the year.

What’s Included: Free and Paid Plans

Bitsgap’s Free Plan:

- No live bots, but allows 20 demo bots.

- Includes unlimited manual trading, smart orders, and access to the trading terminal.

- A 7-day free trial of the PRO plan is also available without requiring a credit card.

Gainium’s Free Plan:

- Supports 1 live bot (Grid, DCA, or Combo).

- Up to 3 paper trading bots.

- Access to smart trading, backtesting, portfolio analytics, and crypto screener tools.

- Limited to Bybit, OKX, KuCoin, and Bitget exchanges on the free tier.

When it comes to entry-level plans, here’s what users get:

- Bitsgap Basic ($26/month) includes:

- 3 active Grid bots, 10 DCA bots.

- AI Assistant and unlimited smart/manual trading.

- Access to all 15+ supported exchanges.

- Gainium Basic ($20/month) includes:

- 3 Grid/Combo bots and 10 DCA bots.

- Unlimited smart trades and backtesting.

- Multi-coin bot support (up to 500 pairs).

- Full exchange support (all currently integrated exchanges).

At the top tier:

- Bitsgap Pro ($135/month):

- 50 Grid bots and 250 DCA bots.

- All smart trading features (TWAP, trailing SL/TP, scaled orders).

- Access to AI Portfolio Mode and advanced bot tools like take-profit for Grid and AI bots.

- Futures bots included.

- Gainium Pro ($80/month):

- 100 Grid/Combo bots and 300 DCA bots.

- Unlimited paper trading bots.

- Includes all core features (backtesting, strategy automation, smart trading).

- Suited for high-volume users or those running complex setups across multiple exchanges.

Best Balance of Price and Functionality

- For beginners, Gainium offers more hands-on value in its free plan—providing live bot access and integrated tools like paper trading and strategy testing. Bitsgap’s free plan is more of a sandbox for manual or demo usage, with no live bot deployment unless you’re on a paid tier.

- For intermediate users, Gainium’s $20–$40 range provides automation and analytics capabilities at a lower price point. It’s especially appealing if you don’t need futures bots or support for dozens of exchanges.

- For professionals and power users, Bitsgap’s PRO plan is more robust, justifying its higher price with advanced tools like AI-powered bot creation, futures support, and comprehensive exchange coverage (15+ CEXs). If your trading strategy involves scaling across multiple accounts, bots, or exchanges, Bitsgap delivers more operational firepower.

Bottom line:

- Gainium is slightly more affordable, making it ideal for traders starting out or looking for a lower-cost automation platform.

- Bitsgap offers a premium experience with deeper functionality, more bot variety, and a refined AI-assisted ecosystem—perfect for traders ready to scale up.

Conclusions and Recommendations

After closely examining the features, pricing, security, and overall usability of both platforms, it’s clear that while Gainium is a promising and capable solution—particularly for those just getting started—Bitsgap stands out as the more complete, professional-grade trading platform.

Bitsgap’s edge lies in its maturity, stability, and depth. It offers a wider range of supported exchanges, a more advanced suite of smart trading and automation tools, and a multi-layered security infrastructure that has earned it the trust of over 600,000 traders worldwide. Its platform is built to scale with you, whether you're a beginner learning the ropes or an experienced trader managing multiple bots and complex strategies. Features like AI-powered bot recommendations, futures trading support, and seamless mobile access make it a true all-in-one solution for modern crypto trading.

That said, the best way to understand the value of a platform is to try it yourself. Bitsgap offers a 7-day free trial of its Pro plan, giving you full access to every feature—no credit card required. If you're serious about leveling up your trading game or simply want to explore what's possible with automation and smart trading, there’s no better time to dive in and experience why Bitsgap continues to lead the field.

Ready to test it out? Sign up for your free trial today and see what Bitsgap can do for your trading.