What Is Asset Tokenization and Which Assets Can Be Tokenized in 2024?

Imagine a world where any asset, from real estate to artwork, is as easily traded as stocks on Wall Street. Asset tokenization is turning this vision into reality, potentially unlocking a $10 trillion market by digitizing assets into tradable tokens.

The ascendance of cryptocurrencies and blockchain signals a monumental shift for finance as institutions embrace the disruptive potential within these technologies. Among the most transformative applications is asset tokenization – the process of converting real-world assets into digital tokens.

Digital Asset Manager 21.co forecasts this nascent market could swell to $10 trillion in an optimistic scenario. As asset tokenization gains momentum, it prompts an urgent question: How will this innovation reshape finance to unlock new opportunities?

The answer lies in the profound implications of asset tokenization. By rendering previously illiquid assets tradable 24/7 and revolutionizing ownership records, tokenization promises to democratize access, streamline processes, and redefine asset holding in the digital age.

This article explores what asset tokenization entails, the mechanisms involved, what assets can be tokenized, and the broader ramifications for global finance.

What Is Tokenization?

Tokenization is the process of converting rights to an asset into a digital token on a blockchain. Essentially, this means representing a real-world asset or the ownership of any type of right in the form of a digital token that can be managed, traded, or recorded on a blockchain system. These tokens can represent anything from shares in a company, ownership of a piece of art, to real estate rights, and more.

The primary appeal of tokenization is that it leverages blockchain technology to ensure immutability, security, and transparency of records, while also potentially increasing liquidity and enabling finer granularity in asset ownership.

The terms "tokenization" and "asset tokenization" are often used interchangeably, but there can be a subtle distinction:

- Tokenization in a broader sense can refer to the digital representation of various types of rights or data. This can include the transformation of sensitive data into unique identifiers (tokens) in financial services to protect credit card numbers, personal data, or other sensitive information. Essentially, it's a process used to safeguard data by replacing it with an equivalent, non-sensitive placeholder called a token.

- Asset tokenization, on the other hand, specifically refers to the process of converting rights to a tangible or intangible asset into tokens that can be managed on a blockchain. It focuses on the conversion of real-world assets into digital tokens, ensuring each token represents a specific stake, value, or ownership in the asset. This form of tokenization is particularly transformative for industries like real estate, art, and commodities, as it democratizes access to these markets and enhances liquidity.

Types of Tokenized Assets

- Real world assets like securities, commodities and property can transform into blockchain-based digital representations conveying identical ownership rights. Just as paper deeds or trading cards bestow holders legal claims to physical assets, these tokenized proxies enable frictionless 24/7 trading, collateralization and more — only embedded in tamper-proof blockchain infrastructure.

- Digital-native items from domain names to social media profiles to metaverse value can directly transition into crypto tokens manifesting outright asset ownership rather than derivative claims. These expand Web3 capacities, whether representing DAO governance rights, cross-chain assets or virtual world prized possessions like character “skins” or currencies.

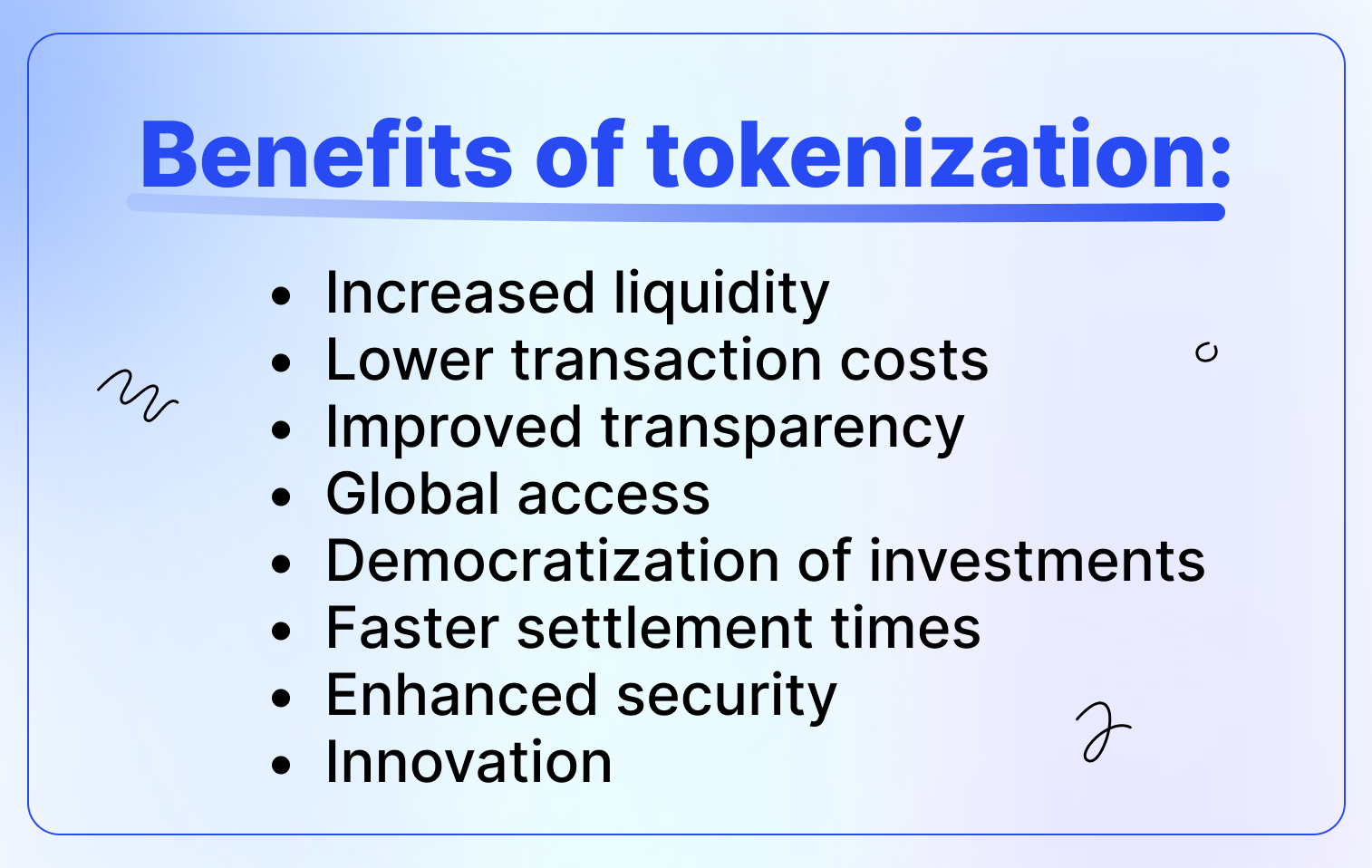

What Are the Benefits of Asset Tokenization?

Tokenization unlocks assets once deemed illiquid or inaccessible, transforming them into digitally tradeable units available 24/7. Fractional ownership opens profitable markets like private equity or real estate to everyday investors historically sidelined by high barriers to entry. And underpinning it all, blockchain furnishes transparent, tamper-proof ownership records while embedding security in transactions — establishing trust in pioneering terrain.

In essence, asset tokenization promises enhanced liquidity, financial inclusion and integrity. By porting the benefits of cryptocurrency exchanges onto real-world assets, it dismantles notions of exclusivity and opacity shrouding lucrative deals. Democratization allows participation transcending wealth or status, while embedded safeguards provide accountability across stakeholders.

How Does Tokenization Work?

Tokenization works by converting rights or ownership of an asset into a digital token on a blockchain. The process involves several steps, each crucial for ensuring the security, legitimacy, and functionality of the tokenized asset. Here’s an outline of how tokenization typically works, especially in the context of asset tokenization:

- Asset Selection and Verification

- Identify the Asset: The first step is to identify the asset which you want to tokenize. This could be a physical asset like real estate, a piece of art, or intangible assets like intellectual property or equity in a company.

- Legal and Compliance Checks: Ensure that tokenizing the asset complies with relevant laws and regulations. This may involve legal counsel to address issues related to ownership rights, regulatory compliance, and potential liabilities.

- Asset Valuation: Accurately valuing the asset is crucial, especially if the tokens represent investment stakes. Professional appraisals or audits might be necessary to establish the asset's market value.

- Creation of the Digital Token

- Define Token Parameters: Decide on the type of blockchain (e.g., Ethereum, Binance Smart Chain) and the token standard (e.g., ERC-20 for fungible tokens, ERC-721 for non-fungible tokens). Define other token parameters such as total supply, divisibility, and rights attached to the tokens (voting rights, dividend distribution, etc.).

- Smart Contract Development: Develop a smart contract that will govern the tokens' behavior. This contract encodes rules regarding the issuance, transfer, and other interactions with the tokens.

- Issuance of Tokens

- Token Minting: Tokens are minted through the smart contract. Minting is the process of creating new tokens and assigning them to owners, based on their investment or ownership share.

- Distribute Tokens: Tokens are distributed to investors or owners, often through a digital wallet that supports the blockchain on which the tokens are issued.

- Trading and Management

- Secondary Trading: If compliant with regulatory frameworks, these tokens can often be traded on secondary markets or exchanges, enhancing liquidity and providing holders with a platform to buy or sell tokens.

- Asset Management and Operations: Token holders can interact with the asset through the blockchain, exercising rights such as voting or receiving dividends. The smart contract automates many aspects of these interactions.

- Regulatory and Ongoing Compliance

- Monitor and Comply: Continually monitor for compliance with legal and regulatory requirements, which might involve reporting transactions or altering token functionalities to adhere to new regulations.

Challenges with Asset Tokenization

Asset tokenization, while offering numerous benefits like increased liquidity, democratization of ownership, and enhanced transparency, also faces several significant challenges. These challenges stem from regulatory, technical, operational, and market-related complexities. Here's a detailed look at some of the main challenges associated with asset tokenization:

- Regulatory and Legal Challenges

- Unclear Regulations: The regulatory landscape for blockchain and tokenized assets is still evolving. Different jurisdictions may have conflicting or undeveloped regulations concerning tokenization, leading to uncertainty and potential legal risks for issuers and investors.

- Compliance Costs: Complying with existing financial regulations (e.g., anti-money laundering (AML), know your customer (KYC), securities laws) can be costly and complex, especially when tokenized assets cross international borders.

- Asset Ownership Rights: Establishing and enforcing ownership rights in a tokenized form can be legally complex, especially if the underlying asset is in a jurisdiction with different laws from where the token is issued.

- Technical Challenges

- Blockchain Scalability: High transaction volumes can lead to network congestion, slow transaction times, and higher costs, particularly on blockchains not yet fully scalable.

- Interoperability: Different blockchain platforms may not be inherently compatible with one another, complicating the process of managing and trading tokenized assets across multiple blockchains.

- Security Risks: While blockchain technology is generally secure, smart contracts (which govern tokenized assets) can contain vulnerabilities or bugs. This can expose tokenized assets to risks of hacks or fraudulent activities.

- Market Adoption Challenges

- Market Acceptance: Traditional investors and institutions may be hesitant to invest in tokenized assets due to lack of understanding, distrust of the technology, or perceived risks.

- Liquidity Expectations: While tokenization is supposed to increase market liquidity, actual liquidity depends on having a sufficient number of buyers and sellers, which may not be immediately available for more niche or newly tokenized assets.

- Valuation Issues: Properly valuing tokenized assets can be challenging, especially for unique or non-standard assets like art or real estate. This can lead to volatility or pricing inefficiencies.

- Weak Backing: Tokens often represent assets indirectly. For instance, a token might indicate partial ownership in real estate, not the actual property deed. This lack of direct ownership can erode trust in the token's value, especially if legal protections are weak, risking the credibility of tokenization projects by offering no genuine ownership or economic rights.

- Operational Challenges

- Management and Governance: Managing a tokenized asset requires new governance structures to handle investor relations, compliance, and other operational aspects. This can be particularly complex if the asset involves numerous stakeholders.

- Education and Training: There is a steep learning curve associated with blockchain and tokenization. Adequate training and educational resources are necessary to ensure that all parties understand the mechanics and risks of tokenized assets.

- Custody and Security

- Custodial Services: Safely storing and managing the private keys for wallets holding tokenized assets is critical. Loss or theft of these keys can result in irreversible losses.

- Data Privacy: While blockchains offer transparency, excessive transparency can lead to privacy concerns, especially for participants who require discretion in their transactions.

- Fraud: Crypto assets are frequently linked to fraud and illegal activities. Even with regulatory improvements like KYC protocols, vulnerabilities like phishing remain on public chains. Effective processes and regulations are essential to mitigate these risks without compromising the advantages of tokenization.

When it comes to technological hurdles, the oracle problem is particularly well acknowledged and understood, highlighting the security risks and complications that arise when blockchain apps need to interact with the external world. Asset tokenization, which inherently depends on off-chain information, is similarly affected. Secure oracles are essential for the success of asset tokenization, as they provide reliable information crucial for various processes such as minting, trading, and managing assets.

One tool addressing this need is the Chainlink Proof of Reserve (PoR), a decentralized verification service that relays off-chain information to the blockchain. This service provides exceptional transparency concerning off-chain collateral, thereby improving the security and verifiability of tokenized assets.

Through the decentralized verification mechanism of Chainlink PoR, tokenization projects can achieve a new standard of transparency and security. Depending on the asset, different oracle network structures and functionalities are required. Chainlink oracles can provide direct asset valuations or serve as benchmarks for decision-making. They can source data from various providers such as professional data services (e.g., Kelly Blue Book for cars), independent experts, exchanges, or customized aggregations of data sources. This data can be retrieved by decentralized networks of independent Chainlink nodes or directly by data providers running Chainlink oracles themselves. To maintain the integrity and quality of the network data, unique crypto-economic incentives such as staking-backed service agreements and immutable reputation systems are used. These systems track and incentivize accurate valuations by financially penalizing dishonest valuations and lowering the reputation scores of those involved, which affects their future earning potential as data providers. This framework also supports the entry of niche and esoteric assets into the tokenized market, ensuring robust crypto-economic guarantees for valuation data.

Furthermore, the Cross-Chain Interoperability Protocol (CCIP) aids tokenized assets in achieving interoperability across different computing environments. This expands their liquidity pool and user base across various platforms and ecosystems, eliminating the need for developers to write custom code for each chain-specific integration and facilitating the creation of native cross-chain tokenized assets. In summary, robust and secure oracles like Chainlink are essential for enabling asset tokenization to take off and gain momentum.

Which Assets Can Be Tokenized in 2024?

As of 2024, the scope of assets that can be tokenized is broad and continues to expand as technology and regulatory frameworks develop. Tokenization is the process of converting rights to an asset into a digital token on a blockchain. This can include a wide range of asset types, from traditional financial assets to physical goods and even intangible assets. Here are some key categories of assets that can be tokenized:

- Financial Assets

- Stocks and Bonds: Tokenization can make trading stocks and bonds more efficient by enabling fractional ownership and reducing the need for intermediaries.

- Funds: Investment funds, including mutual funds and hedge funds, can be tokenized to provide better liquidity and accessibility.

- Debts: Various forms of debt, including loans and mortgages, can be tokenized to streamline processes and improve transparency in lending markets.

- Real Estate

- Commercial and Residential Properties: Tokenizing real estate assets allows for fractional ownership, making real estate investment more accessible to a broader audience and enhancing liquidity in the real estate market.

- Land Ownership: Tokenization can simplify land registry and ownership transfer processes, reducing fraud and increasing efficiency.

- Commodities

- Precious Metals: Gold, silver, and other precious metals can be tokenized to facilitate easier trading and ownership tracking.

- Energy Commodities: Tokenization of oil, gas, and renewable energy credits can lead to more transparent and efficient markets.

- Art and Collectibles

- Artworks: Tokenizing art can democratize ownership and investment in artworks, potentially increasing the market size.

- Collectibles: Items like rare wines, vintage cars, and sports memorabilia can be tokenized to allow for fractional ownership and trading.

- Intellectual Property

- Patents and Trademarks: Tokenizing intellectual property rights can help creators gain funding and manage royalties more efficiently.

- Music and Media Rights: Artists can tokenize their music or films to manage royalties and offer fans a chance to own a share of the revenues.

- Digital Assets

- Domain Names: Digital real estate such as domain names can be tokenized for trading or investment purposes.

- Gaming Items and Virtual Assets: In-game items, characters, or other virtual goods can be tokenized, allowing players to own and trade these assets outside the gaming platforms.

- Cryptocurrencies and Utility Tokens

- Existing Cryptocurrencies: Bitcoin, Ethereum, and other cryptocurrencies are inherently tokenized assets.

- Utility Tokens: Tokens that provide users with access to a specific product or service offered by the issuing platform.

- Identity and Personal Data

- Personal Identity Information: Tokenizing personal data and credentials can improve privacy and security in identity verification processes.

Financial service providers have already begun the process of tokenizing cash. Currently, there is approximately $120 billion worth of tokenized cash in circulation, primarily in the form of fully reserved stablecoins. And while tokenization has not yet reached a scale that could be considered a tipping point, there are several reasons why it might take off. Firstly, the heightened interest rates of the current economic cycle, although a subject of discontent for many, are enhancing the economics for certain use cases of tokenization, particularly those related to short-term liquidity. (In an environment of high interest rates, even a one-hour time difference in a transaction can result in significant savings.)

Furthermore, in the five years since tokenization was introduced, financial-service companies have significantly expanded their digital-asset teams and capabilities. These teams are engaging in more experimentation and continuously expanding their skillsets. As these digital-asset teams mature, we can anticipate a greater utilization of tokenization in financial transactions.

Recent trends also indicate that asset tokenization is enhancing the liquidity and accessibility of investments across various industries. Platforms like RealT are offering digital tokens for fractional ownership of properties, while Maecenas and OpenSea facilitate fractional investments in high-value artworks. Tokenization has also reached the commodities market, with products like Paxos Gold (PAXG) and Tether Gold (XAUT) offering investors token-based ownership of physical gold. In the financial sector, JPMorgan has utilized tokenization to improve the efficiency and security of short-term financing in the repo market.

Additionally, the issuance of digital bonds on the Ethereum blockchain by the European Investment Bank demonstrates the increasing adoption of blockchain technology for debt instruments. Sustainability initiatives like Nori and Moss.Earth are advancing the trading of tokenized carbon credits.

Major financial players, including Goldman Sachs, Citigroup, and JPMorgan, are integrating blockchain technology to streamline their operations and spearhead the adoption of tokenization in finance. Larry Fink from BlackRock has suggested that tokenization will shape the future of markets and securities. Aligning with this perspective, BlackRock has introduced the BUIDL token-backed BlackRock USD Institutional Digital Liquidity Fund, designed to distribute daily yield payouts to token holders through blockchain technology.

Conclusion

Asset tokenization stands ready to revolutionize investment by expanding access to new asset classes while upholding fairness and security. Yet legal and technological complexities loom as hurdles.

Still, these barriers are not insurmountable. As the technology matures, purpose-built tokenization frameworks and accompanying regulatory guidance will crystallize. Just as securities laws evolved to accommodate new financial innovations, so too will legislation adapt to govern digitized asset ownership.

👉 The journey to mastering the ebbs and flows of cryptocurrency markets might seem daunting, Bitsgap is here to simplify your ride to success. The platform is your gateway to harnessing the power of algorithmic trading, managing your portfolio like a pro, and employing a suite of advanced tools that provide unparalleled control over multiple exchanges. For those eager to jump on board today, Bitsgap gives a week-long trial on the PRO plan at no cost. So why not try it?

FAQs

What Is Blockchain Tokenization?

Blockchain tokenization is the process of converting rights to an asset into a digital token on a blockchain. This process allows for assets to be bought, sold, and traded more efficiently and securely. Tokenization divides ownership into digital tokens, which can then be managed on a blockchain system, facilitating transparency and reducing fraud.

Tokenized Meaning?

"Tokenized" refers to the conversion of ownership rights of any asset into a digital token that exists on a blockchain. These tokens represent a share or ownership of the underlying asset, which can be traded, stored, or used in transactions digitally.

What Are Tokenization Payments?

Tokenization in payments is a security process where sensitive payment data, like credit card numbers, are replaced with a unique digital token. These tokens are used in transactions to protect real financial data from theft or unauthorized access. The actual payment data is stored securely, while the token is the only thing transmitted during transactions, enhancing security.

What Is Tokenized Blockchain?

A tokenized blockchain refers to a blockchain system where assets or rights are represented as digital tokens. These tokens can encapsulate various forms of value and are traded, tracked, and managed entirely on the blockchain, providing a secure and transparent method to handle digital assets. This system leverages blockchain's inherent security and decentralization to facilitate transactions and ownership transfers.