Understanding and Using Sentiment Analytics in Crypto Trading

This guide explores the art and science of gauging crowd sentiment, manual tracking techniques, and how automation tools now parse digital tea leaves.

Cryptocurrency values fluctuate with asset market dynamics like any tradable commodity. Myriad factors sway such collective psychology — news cycles, social media chatter, public opinion shifts.

Savvy traders supplement technical and fundamental analysis by monitoring emotive market sentiment for insights on asset trajectory. Understanding crowd emotions offers another analytical lens anticipating coming price moves.

This guide explores sentiment analysis fundamentals, manual tracking techniques, and tools to automate this crypto trading approach.

What Is a Crypto Market Sentiment?

Crypto market sentiment refers to the overall attitude of investors and market participants towards the cryptocurrency market. It is an aggregate of the emotions and attitudes which influence collective behavior, shaping the market's movements and trends. Bitcoin sentiment, for instance, captures the prevailing emotions and attitudes investors have toward Bitcoin itself, often seen as a leading indicator for the broader crypto market due to its dominance and popularity.

Crypto sentiment can be bullish or bearish; a bullish sentiment indicates that investors feel confident and positive about the future value of cryptocurrencies, leading to increased buying pressure. Conversely, a bearish sentiment reflects negativity or skepticism about the market's future, potentially leading to a sell-off.

What Is Crypto Sentiment Analysis

Crypto sentiment analysis is a subset of market sentiment analysis that specifically measures the mood of cryptocurrency markets. It involves collecting and examining large volumes of data from various sources, such as social media, news articles, forums, and market indicators, to assess the prevailing mood and opinions.

The goal of crypto sentiment analysis is to understand market sentiment and leverage that understanding to make predictions about market behavior. By analyzing changes in sentiment, be it positive (bullish) or negative (bearish), investors and traders can gain insights into potential market movements and make better-informed decisions.

What Is a Sentiment Trading Strategy?

A sentiment trading strategy is an investment approach that involves gauging the overall mood of the market and making trading decisions based on the collective attitudes of investors and traders. This strategy doesn't solely rely on traditional technical and fundamental analysis; instead, it takes into account the prevailing sentiment to predict market movements.

Here's how it works:

- Data Collection: Sentiment traders aggregate data from various sources, such as news headlines, social media platforms, investor forums, and market commentary to glean insights about the market's mood. They often use specialized tools and software that employ natural language processing (NLP) and machine learning to process and interpret this information quantitatively.

- Analysis: Once data is collected, traders analyze it to assess whether the market sentiment is predominantly bullish (positive) or bearish (negative). They look for signs of extreme sentiment, as these can be indicative of market overreactions and potential turning points.

- Strategy Formulation: Based on this sentiment analysis, traders formulate their strategy. If the sentiment is overly bullish, it may signal that the market is becoming overbought, and a correction or downturn could follow. Conversely, if the sentiment is exceedingly bearish, the market might be oversold, and a rebound or uptick might be imminent.

- Execution: Sentiment traders execute trades in anticipation of these market corrections. For instance, in a market that's overly optimistic, a sentiment trader might take a short position, expecting prices to fall, while in a pessimistic market, they might go long, anticipating a rise in prices.

It's important to note, however, that sentiment trading strategies can be risky. Market sentiment can be fickle and influenced by unforeseen events, leading to abrupt changes in direction that defy sentiment-based predictions. For this reason, many sentiment traders also incorporate traditional analysis techniques to validate their sentiment-based insights.

How to Perform Cryptocurrency Sentiment Analysis Manually?

Performing cryptocurrency sentiment analysis manually is a multi-step process that involves collecting and analyzing qualitative data to gauge the collective mood of the market. Although it's time-consuming and less precise than automated methods, it can still provide valuable insights. Here are the steps to perform a manual cryptocurrency sentiment analysis:

Identify Sources of Sentiment:

- Social Media: Keep track of what is being said on platforms like Twitter, Reddit, and Telegram. Pay attention to influential figures within the crypto community and the general discourse around specific coins and the market at large.

- News and Publications: Follow cryptocurrency news websites, official press releases, and financial news to monitor for positive or negative trends that could affect sentiment.

- Blogs and Forums: Read blogs from thought leaders and participate in forums like BitcoinTalk and the cryptocurrency sections of Reddit to understand the grassroots sentiment.

- Comments and Reviews: Examine comment sections of cryptocurrency videos, articles, and podcasts for the community's reactions and opinions.

Collect Data:

- Document mentions of specific coins, ICOs, exchanges, or the market as a whole.

- Keep track of the frequency and the intensity of the discussions regarding the sentiment.

Analyze the Data:

- Volume of Discussion: A sudden increase in discussion volume can indicate growing interest or concern about a cryptocurrency.

- Tone of Discussion: Sort the data into positive, neutral, and negative sentiments.

- Context: Understand the context in which a cryptocurrency is mentioned. Are people discussing it because of a recent price surge, technological development, partnership announcement, or regulatory news?

- Consensus: Determine if there is a consensus among various sources or if opinions are divided.

Track Price Correlations:

- Compare your sentiment analysis with actual price movements over time to identify any correlations that may exist.

- Look for patterns where changes in sentiment preempted price increases or decreases.

Document and Adjust:

- Keep a log of your observations and analyze how accurate your manual sentiment determinations are relative to market actions.

- Refine your process by focusing more on the sources that proved to be more reliable indicators in the past.

Combine with Technical Analysis: To reinforce your findings, correlate your sentiment analysis with technical indicators. See if bullish sentiment aligns with bullish price patterns and vice versa for bearish sentiment.

Take Action With Caution: If you decide to trade based on your sentiment analysis, remember to do so with caution, understanding that sentiment is just one of many factors that can influence the volatile cryptocurrency market.

Remember, manual analysis lacks the depth and breadth of data processing found in automated methods. However, it can still offer unique insights, especially when incorporating nuances and subtleties that may be overlooked by automation. Always use sentiment analysis as one part of a diversified approach to market analysis.

Crypto Market Sentiment Analysis Tools

Crypto market sentiment analysis tools are specialized software that monitor and analyze the emotions and opinions of investors and traders pertaining to the cryptocurrency market. These tools scrape data from various sources to provide a sentiment score or insight. They typically fall into several categories based on their primary data sources or analytical methods:

Social Media Monitoring Tools: These tools focus on gathering and analyzing data from social media platforms, where much of the crypto conversation takes place.

👉 Example: LunarCRUSH collects data from various social media channels to produce insights into user emotions and opinions. CryptoMood analyzes data from social media, news, and blogs to evaluate the sentiment of the market.

News Aggregators and Analysis Tools: This category includes tools that scrutinize news articles and press releases for keywords and sentiments that could suggest a bullish or bearish market trend.

👉 Example: The TIE is a sophisticated tool that uses proprietary algorithms to interpret the sentiment from news articles and tweets. NewsCrypto provides a ‘Market Sentiment’ analysis section that does a similar job of parsing through numerous news resources.

Forum and Community Sentiment Analyzers: These tools are designed to monitor sentiment in crypto-focused forums and discussion groups.

👉 Example: Solume.io tracks social data on cryptocurrencies from Twitter and Reddit and then provides statistics on how much a specific coin is being talked about.

Algorithmic Sentiment Tools: This category includes advanced tools that combine natural language processing, machine learning, and data analytics to measure the sentiment.

👉 Example: Sentiment.io and Augmento analyze vast amounts of social media and web content to provide sentiment and trend predictions.

Technical Analysis Tools with Sentiment Indicators: Some technical analysis software includes integrated sentiment indicators, combining traditional chart analysis with sentiment data.

👉 Example: TradingView integrates sentiment indicators through certain brokers, and users can access a variety of custom sentiment-related indicators created by the community.

Market Data Sentiment Tools: These analyze trading volume, price fluctuations, and order book dynamics to infer the sentiment.

👉 Example: Santiment provides a suite of metrics, including social sentiment, to give insight into the emotional state of the market.

It's important to note that the effectiveness of these tools can be dependent on market conditions, and they should be used in conjunction with other methods of analysis. As with all trading tools and indicators, sentiment analysis tools should not be used in isolation to make trading decisions.

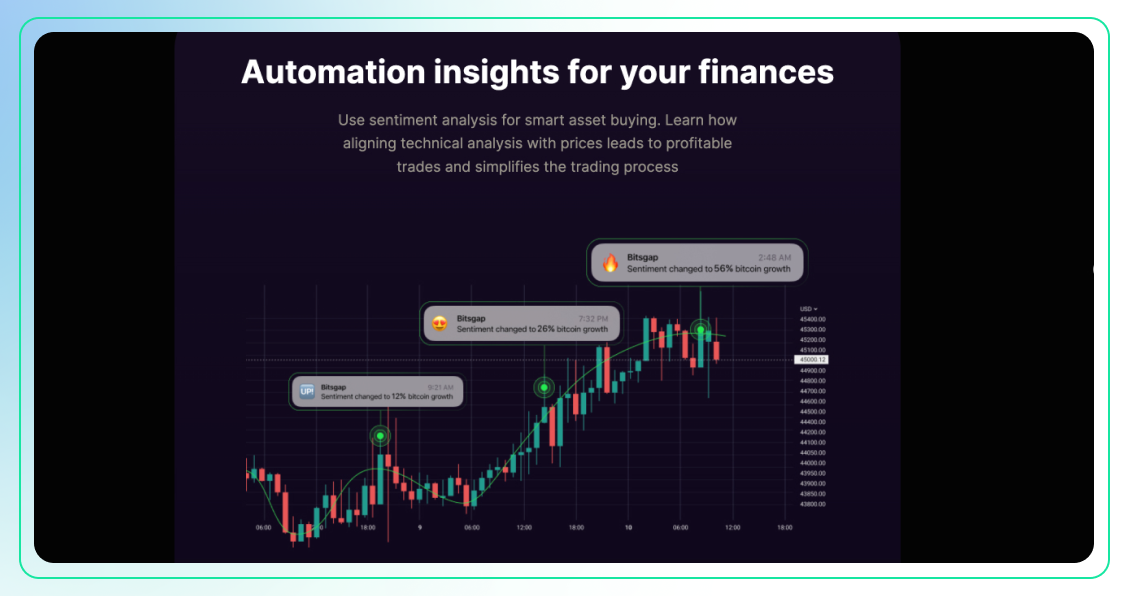

Introducing AI Social Media Analysis for Trading from Bitsgap

Bitsgap is also rolling out its own proprietary sentiment analysis trading tool, AI social media analysis, that leverages neural network technology to parse enormous social media datasets. By tapping public opinion flows, the tool delivers actionable insights and market intelligence to help you make better, more informed trading decisions.

Beyond raw sentiment readings, Bitsgap's offerings target users of all types — from individuals to institutions. Tiered subscription plans cater to unique needs — blending sentiment signals with trading suggestions, analytical dashboards, and more.

Now in limited beta before full launch, early access spots remain for 500 testers of this innovative social listening/analytics hybrid. The 14-day free trial period allows first-hand experience before opting for the package matching one's requirements post-release.

So for traders seeking an edge from sentiment's subtle cues, Bitsgap's new solution promises robust capabilities. The chance to influence the tool's evolution also awaits beta testers now. Join now — as algorithms and collective emotion converge to augment profits.

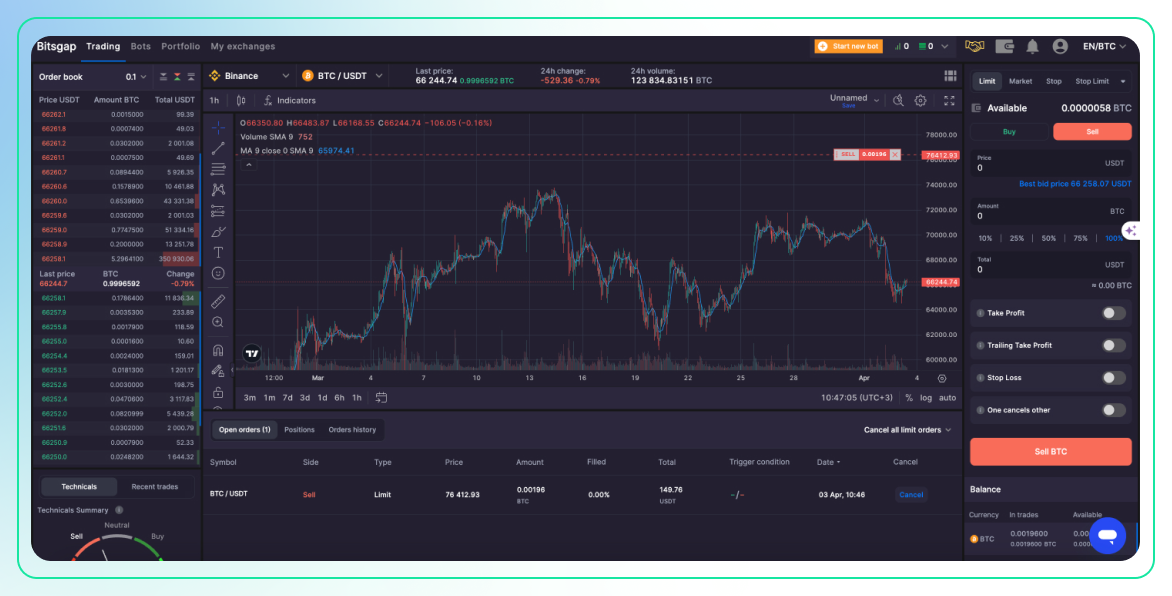

If, however, you prefer old-school technical analysis, while manually tracking sentiment across social platforms, consider trading on Bitsgap. Our platform provides advanced charting tools for pattern recognition, as well as customizable algorithmic bots — like the DCA bot — that track a wide range of indicators.

The proprietary Technicals widget condenses multiple signals into an aggregated gauge akin to fear/greed. And demo access enables indefinite test drives, with paid tiers starting after the full 7 free days. So whether preferring manual or automated approaches, Bitsgap provides versatile hybrid solutions for traders of all stripes. Why not give our cutting-edge toolkit a spin?

Conclusion

In essence, sentiment analysis reveals crypto's underlying investor psychology. By monitoring attitude shifts, traders discern clues pointing to imminent swings. Thus, sentiment strategies bet on how emotional currents may steer markets.

Manually tracking sentiment proves laborious, even if social platforms offer raw insight. The automated power of tools like LunarCRUSH and The TIE streamline gathering and deciphering vast data flows through machine learning.

Yet no indicator acts as a crystal ball. Sentiment metrics simply provide another lens — one still requiring correlation with fundamental and technical factors for trading confidence.

The key is judiciously balancing sentiment inputs with traditional signals with informed discretion. By incorporating crypto's emotional dimension rather than relying on it wholesale, traders can anticipate turns the market itself is about to make.