What is the DCA strategy? Can it be automated?

The cryptocurrency market clearly demonstrates cyclical and volatile nature. These are the main grounds why the DCA strategy can be helpful for cryptocurrency traders.

The DCA origins

This trading strategy was developed in the USA, so the authors assumed that transactions would be carried out in US dollars. Therefore, this strategy is called dollar-cost averaging.

The authors of the idea were looking for a method to reduce the impact of volatility in order to lower the final price for total asset purchases. Modern technology made it possible to built a DCA trading bot upon those brilliant ideas.

The idea behind Dollar-Cost Averaging.

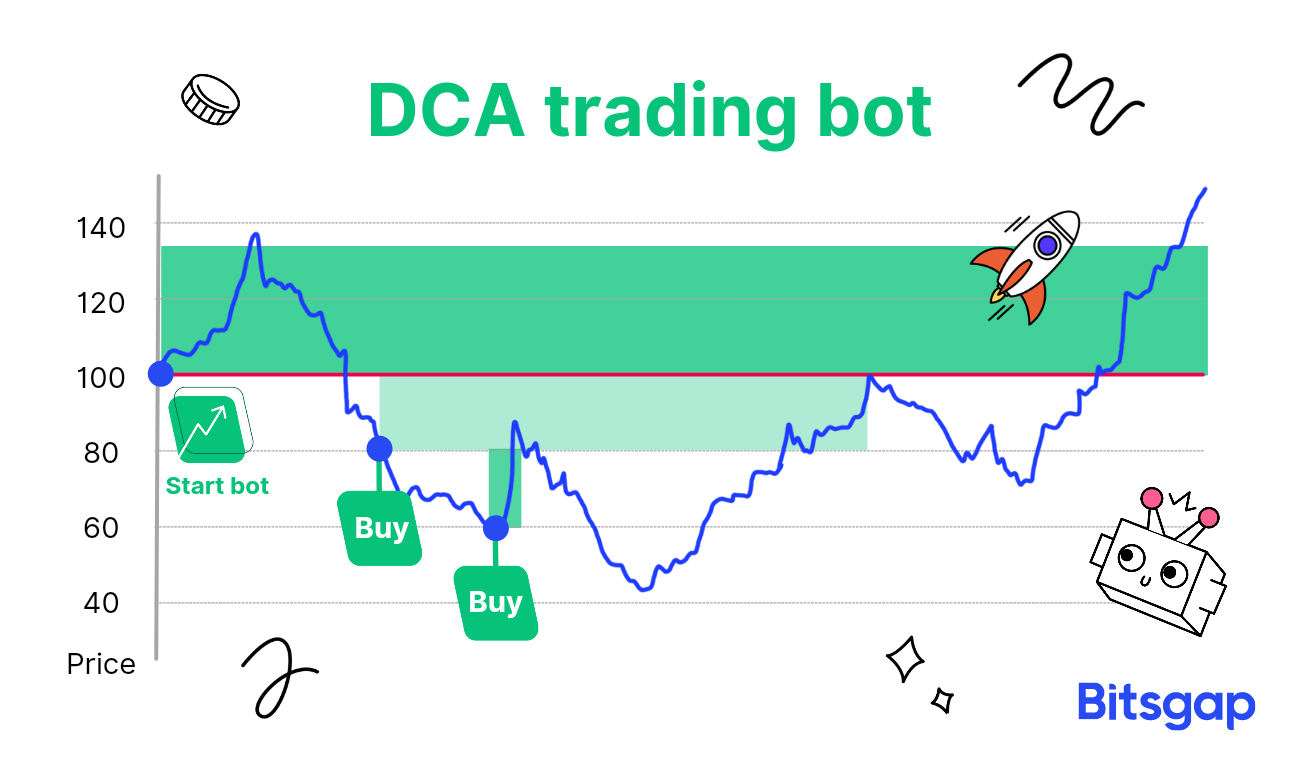

To keep it simple, this is an investment strategy with the idea of buying a specific type of asset, for example, BTC, not with one shot but by distributing funds among different, lower price levels to get a better average entry point.

In other words, you should not consider the current value of the asset as the best entry price since it can be relatively low or high. Only time will show!

We can assume that there is always a chance that a better price can come later and we must be prepared to buy more of the desired coin at a better price.

If the market gives us a“discount” why not take it?

Therefore, DCA helps lower the average buying price and smooth out the effect of volatility by splitting the buying of the necessary amount of coin into several orders and setting them at current and lower price levels.

On the other hand, If the market moves up without pullbacks and does not give us the opportunity to buy more coins at lower levels the total profit will be less since there are only a fraction of funds invested.

However, profit is profit, and from the trading point of view, it is a positive outcome anyway.

There is always a second side of a coin with any trading strategy.

If we consider the worst-case scenario, the market can go down further than we expect and dive deeper than our lower price level of purchase.

However, even in this case, our loss will be less than if we would buy the total amount of coin at the initial price level since DCA lowered the average entry point and smoothed the negative trading outcome.

Why does the Dollar Cost Averaging technique work?

Let’s calculate a simple example case.

We want to buy 1 BTС using the DCA approach and the current price is 45000 USDT.

- We buy 0.2 BTC at the current price and invest 9000 USDT.

- We place the DCA limit orders to buy 0.2 BTC at the lower price levels: 40000, 35000, 30000, and 25000 respectively.

If the market goes up and does not trigger our lower limit orders we just enjoy the ride, however to a lesser extent as if we would buy the whole amount. The outcome is positive.

If the market goes down and triggers for example all our pending limit orders our average price for 1 BTC would be:

(45000 X 0.2+ 40000 X 0.2 +35000 X 0.2 + 30000 X 0.2 + 25000 X 0.2) / (0.2+0.2+0.2+0.2+0.2) = 35000 USDT.

In other words with the DCA, we saved 10K USDT while having the same BTC volume purchased as we planned.

Alternatively, we can think about these calculations as reducing our trading risks by 10K USDT in comparison to buying 1 BTC at the initial price of 45000.

However, It is important to understand that DCA does not remove the risk.

If the price continues to fall, then, in any case, the investor will remain a loser with this strategy.

Any market price above 35000 means profit for us and below this handle, we suffer a loss.

The meaning of dollar-cost averaging is that the average buying price is constantly approaching the current price of a financial instrument but only if we succeeded to buy more of the asset at the lower price levels and the general market direction didn’t change.

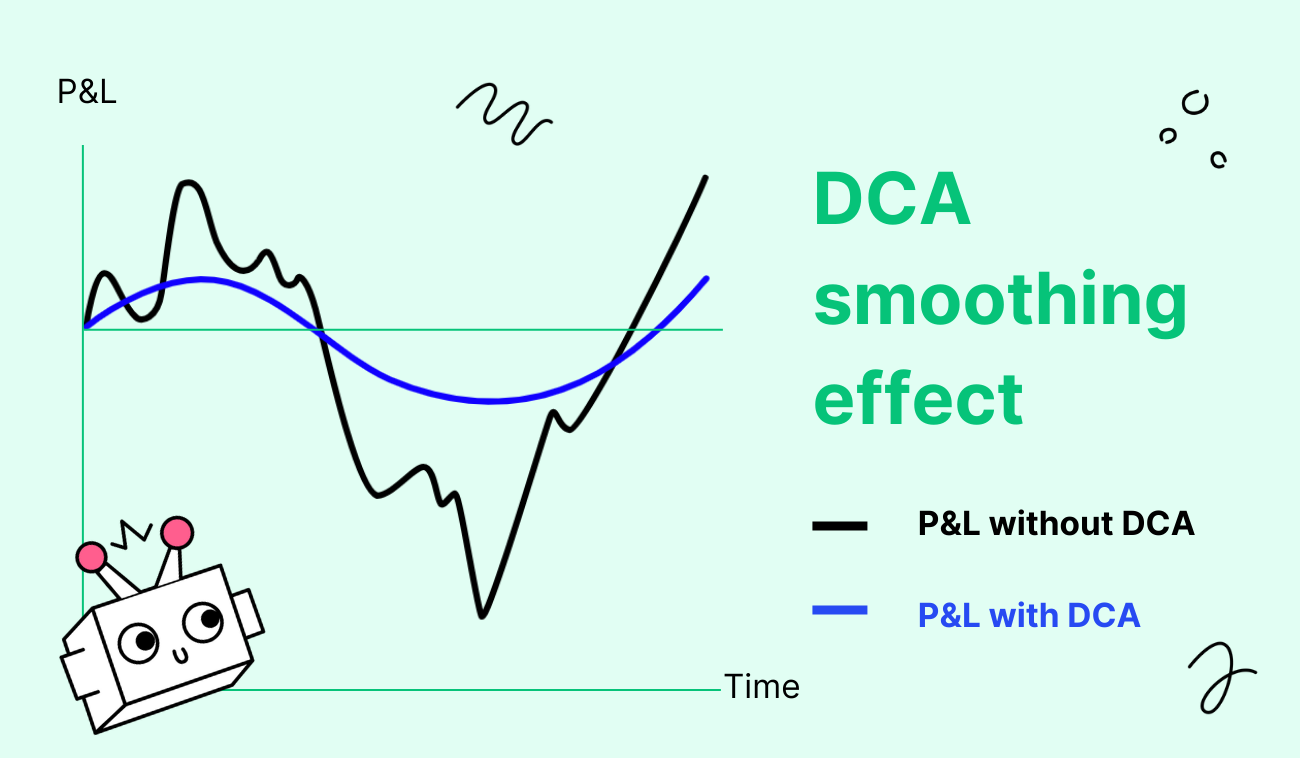

The first implication that comes to the head is that DCA allows the investor to reduce risk, but at the same time reduces profits to a lesser extent.

Surprisingly but this assumption is wrong.

In a long run, neither risks nor profits will be reduced, however, the PNL curve will become smoother and more balanced.

The cryptocurrency market clearly demonstrates cyclical and volatile nature. These are the main grounds why the DCA strategy can be helpful for cryptocurrency traders.

Additional DCA benefits

By taking this approach, investors avoid the risk of making counterproductive decisions out of greed or fear. Let’s see how it works.

Experienced traders know that it is quite difficult in practice to catch such a market entry point that was not followed by at least a small pullback. It is rather a luck than routine.

This is why investing the whole amount in a single order may cause much stress during such pullbacks.

Typically, traders in such a situation can not bear the stress and close the position fixing a relatively small loss in order not to get a bigger loss in the hope to catch later a better entry point. This is just fear.

Therefore, they start to get involved in a game of guessing the best entry point instead of following the global market trend.

What happens next?

Eventually market moves up and we all know how rapid and explosive this shift can be. However, there is no guarantee that our “hero” will be on the market at this time. Maybe he will be in between his attempts to catch “the best point of entry” with “minimal risks”, as usual.

Most probably, either he will miss this chance or jump into the market at a much worse price when the main upshot is maybe over, just to catch at least some piece of escaping cake. This is greed.

And if there will be another pullback after the big move… This can be an endless story.

To sum up dollar-cost averaging reduces the impact of investor psychology and market conditions on their portfolio.

Can it be automated?

DCA is, in its purest form, a mathematical approach to buy a particular asset in volatile market conditions.

Therefore, it is not «rocket science» to write a trading algorithm if all the variables are well-known, the logic of their relationship is clear, and the result to strive for is obvious.

The Bitsgap team created the totally automated DCA bot to eliminate the human psychological factors on decisions when to enter and exit trades while trading the volatile crypto assets.

DCA trading bot by Bitsgap sets a grid of up to 100 orders that helps split investments and average the price as much as possible.

It is almost impossible to achieve such averaging manually.

Above all, there is an aggregation of risk management tools that timely cut unprofitable positions and allow profitable trades to flourish.

DCA trading bot outperforms the buy & hold strategy both in the short and long run and can be utilized not only during uptrends but also on flat and declining markets.

In our next article, we will talk about a unique aggregate of technical indicators that will determine when the Bitsgap DCA bot decides to buy or sell cryptocurrency.

Stay tuned!