Going Long in Crypto for Ultimate Gains

Unleash the potential of long positions in cryptocurrency trading and learn how to buy low, hold strong, and watch your investments soar to new heights.

Any trader worth their salt knows that "going long" means buying an asset to profit from price gains over time, even if only for a day. But is there anything else you should know before getting started?

“Going long” and “going short” are essential components of the market dialect. While going short means betting the price of crypto will depreciate, “going long” is the polar opposite. In fact, it’s an act of faith — the belief that an asset will soar in value. You need not cling to your investment for eternity; even day traders can dabble in the art of "going long."

Join us as we embark on unraveling the “longing” mysteries — read on to learn strategies for timing long position entries and exists and advanced tools to use to become a long-term crypto success story.

What Does Long Position Mean in Crypto?

The term "going long" signifies the bold act of acquiring a crypto asset. Be mindful, however, that "long" is a shape-shifter, changing its meaning based on the context.

👉 For instance, if someone asks you if you're going long on bitcoin, the inquirer is essentially interested in knowing if you intend to purchase the coveted digital currency. Similarly, when someone claims, "I am long on bitcoin," they reveal their proud ownership of the prized asset.

To put it simply, “going long” means acquiring and holding cryptos for as long as your heart desires. With no intricate trading strategies to master, adopting a long position signals your optimism that the crypto’s value will rise.

Short vs Long Position Crypto

A long position represents your hope for price growth. When you "go long," you buy the cryptocurrency, embracing the potential for riches. Conversely, a short position signifies your anticipation of a price drop. By "going short," you sell the cryptocurrency in the quest for profits amidst the decline.

You might wonder if it’s possible to long or short crypto without actually owning it, and indeed, it is. By trading derivatives (such as futures, options, and contracts for differences), you gain exposure to cryptocurrencies without the need for tangible ownership.

Long positions are inherently prevalent during bullish rallies, where traders eagerly seek to profit from rising prices. On the other hand, bearish markets often see short positions exceeding long ones. However, the professional traders weave both strategies by buying the dips and selling the rips. This means they open long positions as prices retreat from recent peaks and sell their cryptocurrencies when prices test resistance levels.

Long vs HODL

“Going long” in crypto trading doesn't always entail a lifelong commitment. Depending on your intentions, you may “go long” as long as you want. In contrast, the “HODL” mentality embraces a more relentless approach. By HOLDing crypto, you commit to hold it long-term, withstanding the tumultuous ebbs and flows of the market and never wavering in your resolve.

Many HODLers envision years-long partnerships with their crypto, while some even pledge a lifetime alliance. However, eternal loyalty might come at a cost. Without ever selling, profits remain an elusive dream. Furthermore, an unwavering devotion to a specific crypto project can cloud judgment, potentially steering HODLers towards ill-fated investment choices.

Example of a Cryptocurrency Long Position

Jimmy senses that a beloved crypto token has reached rock bottom. After thorough research and observing the growing chart volume, he is optimistic. He decides to embark on a long position, placing an order at a tantalizing price and securing his desired quantity of tokens. Weeks pass, and it appears his instincts were spot-on as the token's value begins to soar. Sensing a potential downturn, Jimmy sells his tokens, reaping the rewards. Feeling encouraged, he contemplates trading on margin next time, which will enable him to leverage a more substantial position backed by a loan from the exchange.

What Is the Duration of Crypto Long Positions?

In long positions, time knows no bounds! Hold your position as long as your heart desires. Even day traders “go long," using the term interchangeably with buying.

As an active trader, you may choose to “go long” for weeks or months, capitalizing on news, market trends, or data that hint at a potential price increase for your chosen asset.

Margin traders, however, should beware of interest on borrowed money and other fees that can accumulate as long as they hold their coins. Carefully consider your holding period when calculating potential profits.

For cash buyers, the only peril lies in having their capital tied up for extended periods. Yet patience has its rewards! Long positions of a year or more may offer reduced tax rates, providing substantial savings for those planning a lengthy hold.

When to Open a Long Position

Open a long position when you sense the cryptocurrency market has plunged to its deepest depths. Pinpointing this moment is no easy feat; however, traders can search for glimmers of hope amidst the market's turmoil. Keep an eye out for uplifting news in the media or seek out burgeoning trading volumes that could signal an imminent rise in support levels. Seize the opportunity to open a long position when the time is ripe, and ride the wave of recovery to new heights!

How to Open a Long Position

Opening a long position is easy — just buy your crypto, whether on cash or margin. But beware, that margin trading demands a higher degree of confidence. While leverage can empower you to seize lucrative opportunities, it also harbors significantly increased risks.

Did you know that you can connect as many as 15 exchanges to Bitsgap and open long positions on all of them while trading from one single interface? That sounds convenient, doesn’t it? Say goodbye to frantic tab switching and embrace the ease of streamlined trading! All you need to do is connect your exchanges to the Bitsgap platform via encrypted API keys and go long to your heart’s content!

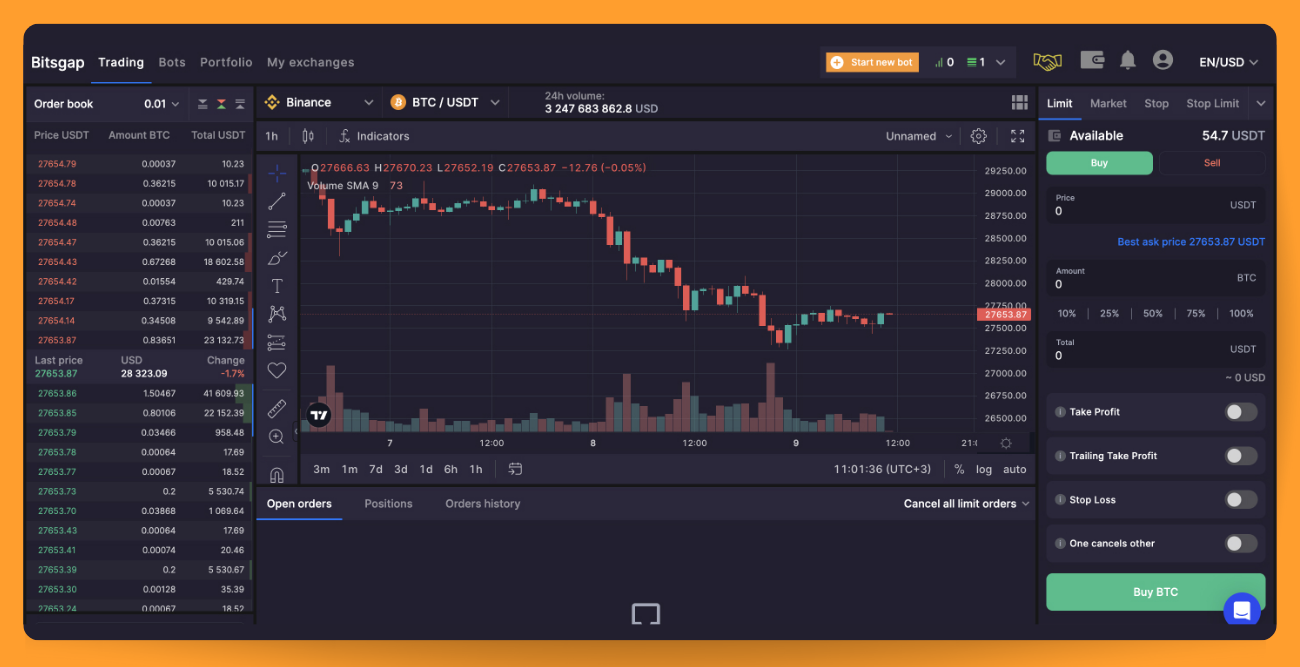

Here’s how to open a long position on Bitsgap:

Go to the [Trading] tab in the terminal and choose your exchange and trading pair on top of the chart’s interface. Then click on any type of order you’d like to place (Market/Limit, Scaled, TWAP, or Stop Market/Limit), choose your desired price for some orders like Limit, quantity, and any other features if you want to turn your ordinary order into a smart one, and click [Buy] (Pic. 1). Easy, isn’t it?

If you click on the [Bots] tab, you’ll enter a very different realm — the universe of automated trading, the whole brave new world. Bitsgap offers a variety of bots that work marvelously well in any market, so all you have to do is explore and choose the one you like best. Of course, some bots work better than others depending on the market situation, so you should research before starting.

👉 For example, the GRID bot is designed to reap gains in the swing market where prices go up and down within a horizontal range, BTD works best in the falling market, DCA for both rising and falling, and COMBO for the futures. Both DCA and COMBO can go long and short, so you can open your coveted long positions with those two should you choose to do so.

When to Close a Long Position

It's crucial to close your long positions once you feel they've reached their peak potential. Many traders establish predetermined goals to avoid falling prey to greed and jeopardizing profits.

Knowing when to harvest your gains and feel content with your trades is essential. Lingering too long may lead to substantial losses as the market self-adjusts and prices tumble. While this error proves expensive for cash traders, the consequences are even more severe for those trading on margin. Make your move at the right moment and relish your well-earned rewards!

Are There Any Risks Involved in Cryptocurrency Long Trading?

Every cryptocurrency trade carries its share of risks, and long positions are no stranger to them. One of the biggest dangers you'll face is buying in at the wrong time, which could cause your investment to plummet in value.

And if you're trading with borrowed funds, the stakes are even higher. Timing the market's lowest point becomes critical to avoid potential losses. But don't worry, there are less risky options available, such as cash trading. With cash trading, you don't have to worry about the looming threat of a margin call. Plus, you have the flexibility to wait patiently for prices to bounce back before making a move.

FAQ

When to Trade Long and Short?

When it comes to trading cryptocurrencies, your outlook on their future price can determine your strategy. If you're feeling optimistic, then opening a long position could be the way to go. On the other hand, if you're feeling pessimistic, shorting a position may be more suitable.

Both of these trading strategies have their place, and it's important to know when to use each one. In fact, you may even find yourself holding both long and short positions simultaneously, using them as part of a balanced trading approach. So, whether you're bullish or bearish on crypto assets, there's a strategy that can work for you.