How Does Crypto Pump and Dump Work?

Learn how not to fall victim to pump-and-dump schemes in crypto. Equip yourself with Bitsgap's Pump & Dump Protection to secure your investments.

One of the biggest dangers for new crypto investors is pump and dump. Suffice it to say, it’s one of the most successful scams that many investors fall for repeatedly. In this article, we’ll explain what exactly a crypto pump and dump are and how to avoid them.

Being an unregulated frontier, crypto naturally attracts its fair share of criminals. Fortunately, most illegal crypto schemes resemble those of traditional markets and, therefore, can be duly identified and avoided. It might probably take time and a few mistakes along the way, but eventually, you’ll learn to separate the wheat from the chaff.

In this article, we’ll look at one of the most notorious crypto scams, commonly referred to as a “pump and dump.” Keep reading to find out what a crypto pump and dump is and how to spot and avoid it.

What Are Pump and Dump?

Pump and dump is a scam in which a group of investors colludes to run up the price of an asset. In most cases, bad actors will dupe inexperienced traders into going along with their scam with the promise of huge returns. Unfortunately, those who bought into the hype find out too late that their investments are little more than worthless.

In a traditional pump-and-dump scheme, swindlers spread false or deceptive information to spark a purchasing spree, thereby pumping the price of a stock. After the price has sufficiently gone up, the fraudsters dump the stock by selling their overvalued shares. Once they stop the hype, the stock’s price typically freefalls, and investors lose money.

👉 The pump and dump scheme occurs most frequently with "microcaps," or very small companies, and small-cap cryptocurrencies.

If previously, scammers relied on cold calls and direct mail to reach a large number of unsuspecting investors, now the Internet offers a much cheaper and easier way to do that. Spam email, social media, online ads, and chat rooms are just a few channels they use to spread “fake news.”

What Is Pump and Dump Crypto?

Crypto pump and dump is a type of scam that falls under the category of "rug pull" crypto fraud. It happens when disingenuous speculators spread deceptive information about a specific cryptocurrency to inflate its price and then sell it after enough investors have bought into the scam.

Unfortunately, due to technical complexity and lack of oversight, the cryptocurrency market is particularly susceptible to pump and dump. A research paper from 2018, which observed two messaging platforms popular among bitcoin investors over the course of six months, discovered more than 3,400 pump-and-dump scams.

In March 2021, the U.S. Commodity Futures Trading Commission (CFTC) issued a warning to investors to watch out for pump-and-dump schemes in thinly traded or new cryptocurrencies. In case you might be interested, the CFTC also announced that anyone to report a pump-and-dump scheme worth at least $1 million in fines would receive a financial reward of 10% to 30%. That means that whistleblowing can get you up to $300,000. Not bad.

👉 Despite the nascent regulation and nudging whistleblower programs, investor groups often get away with illegal activity much easier than they would in traditional financial markets. The crypto niche is filled with small market-cap coins that can be easily manipulated by a relatively sophisticated group of speculators.

Often, scammers operate on social media sites like Discord, Twitter, and Telegram, scouring legitimate crypto project channels for potential victims. That’s not to say that large projects are immune to manipulation; scams are just much easier in smaller markets where controlling supply is cheap.

How Does Cryptocurrency Pump and Dump Work?

Crypto pump-and-dump schemes often start by convincing inexperienced investors that there’s an exclusive opportunity to get rich quickly — a coin that’s about to take off. Since FOMO is such a powerful thing, some investors don’t even have to be persuaded, as they often convince themselves the investment is legit.

👉 The asset typically has an extremely small market cap because that makes it easier to control and manipulate. When trading volume is low, it only takes a small amount of buying power to inflate the price beyond reasonable levels.

Unbeknownst to the victims, the bad actors might have been slowly acquiring the coins over the course of several weeks while the prices were low. If promoters pumping the coin are successful, more unwitting investors will buy into the asset and stimulate trading activity.

The coin’s price will steadily rise until a certain point when fraudsters start to dispose of their bags quickly. So, when the asset is dumped, investors lose money that they can't get back because the asset will usually never recover.

Types and Variations of a Pump and Dump Scam

Currently, there are two types of pump and dump that are most common. One is when fraudsters promote a coin while simultaneously covertly selling it slowly. The other rallies community members to buy a specific coin, thus triggering algorithms and bots that start buying it too.

Whoever doesn’t sell last is left holding useless tokens. While the first type can happen with any coin, the second typically targets less popular tokens.

A “short and distort” scam works in a reverse way. Instead of buying a coin and raising its price before selling it, scammers short-sell the stock, lower its price, and then buy it back at a discount. Similarly, swindlers criticize the project, spread negative predictions, or do anything else that will drive the price down until the desired result is reached.

Another, more recent variation of the scam is known as a "pump-and-dump hack." In this scam, a hacker gets unauthorized access to victims’ exchange or brokerage accounts and uses them to purchase a small-cap or illiquid coin to pump up its price. After a sufficient price increase, he or she cashes out at a premium.

Pump and Dump Example

To illustrate, let’s look at a hypothetical example.

Jimmy heard a rumor that a certain crypto coin is about to go to the moon from a supposedly knowledgeable chap on Twitter or Discord, common hunting grounds for pump-and-dump groups. He sees that the price is continuously increasing and can’t help joining in. Jimmy’s virtual friends seem to be doing the same, so he feels relieved and encouraged.

As the price has increased fourfold, the scammers decide it’s time to dump their bags. They all quickly close their positions, and once they are clear, the market crashes. The asset's value plummets and Jimmy loses a lot of money that he can never recoup. The crypto pump-and-dump group takes its profit and moves on to the next coin.

Now, let’s look at the cases that actually happened. The best way to do so in terms of stocks is to take the infamous Enron example.

Prior to the company’s demise, Enron executives ran complex pump-and-dump schemes in addition to other unethical activities that managed to deceive even the most seasoned Wall Street analysts.

After Enron lied about earnings, which made the stock price go up, they tried to hide the real numbers by using questionable bookkeeping methods. Before the business went bankrupt, 29 Enron execs sold overpriced shares for more than a billion dollars.

👉 Since crypto pumps and dumps mostly happen to smaller coins, they can go largely unnoticed. For example, back in 2021, a relatively unknown coin PNT was pumped from 0.5 USDT to 6.40 USDT within one minute, which is a 1,180% jump in 60 seconds (Pic. 1). It’s now worth a little more than 0.2 USDT.

How to Recognize and Avoid Pump and Dump

Contrary to other types of fraud, pump and dump don’t require a victim to contact the scammer to claim the “winnings” or transfer money to the perpetrator’s bank account. All of it makes pump and dump very difficult to track and prosecute. So, it’s important to be vigilant and know how to spot and avoid such scams. Below are a few tips:

- Be suspicious of unsolicited investment offers

Bad actors can send you unsolicited messages about a supposedly excellent “investment opportunity” through a variety of communication channels, such as an email, a social media page, a direct message, a call, or a voicemail, to name a few. Avoid responding to such messages. Acting upon promises of fantastic returns can result in significant losses.

- Watch out for red flags

Ask yourself a few questions: Does the investment sound too good to be true? Does it promise huge guaranteed profits? Do you feel under pressure to purchase now, before the price soars? If you answered yes, then drop the idea of investing immediately.

- Beware of affinity fraud

Affinity fraud targets members of specific organizations and communities. You might get convinced of the credibility of an investment because someone from the group you’re affiliated with approaches you. The problem is that your friend might have been unknowingly duped into believing that an investment is legitimate. Exercise extreme caution when dealing with any type of investment, even if it’s being touted by someone you know.

- DYOR = Do Your Own Research

Before subscribing to any “scheme,” conduct your own research and due diligence. Fortunately, it’s fairly easy to find information about companies and projects, including their financial records and management. The absence of such data can frequently be a warning sign.

Bitsgap’s Protection Against Pump and Dumps

Although pump-and-dump scammers typically target small-cap coins, larger coins can also experience unexpected price surges and drops that can be detrimental to your trading. The best protection against such sudden price movements is automation.

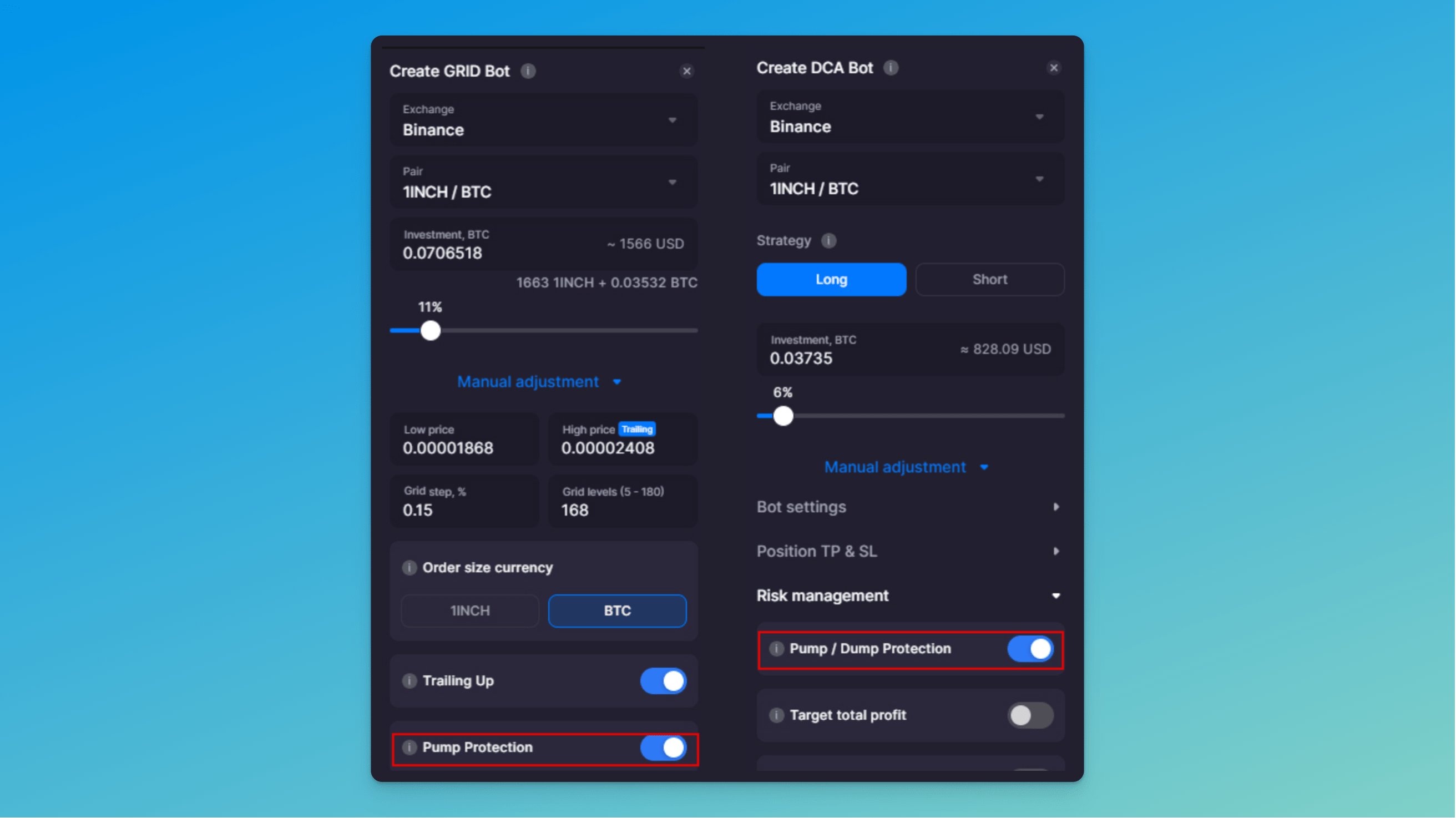

👉 Bitsgap has a specific feature called “Pump and Dump Protection” (P&D) that prevents your trading bot from buying too high (in case of a pump) or extending your trading range (in case of a slump).

The P&D feature is available in the bot’s settings and is enabled by default once you activate Trailing (Pic. 2):

When the feature is active, the bot will detect sudden price changes and prevent unfavorable trades from happening. This way, when you activate Trailing Up, the bot won’t move the grids higher if it suspects a pump. The reverse is true for Trailing Down. And, even though we don’t recommend it, you can disable the P&D feature by toggling it off (Pic. 2).

Bottom Line: Avoid at All Costs

You’ve just learned that a crypto pump and dump happens when a bunch of people cooperates to shoot up the coin’s price before selling it and cashing out. It’s always best to watch out and avoid such schemes.

Use your discretion, technical and fundamental analyses, and Bitsgap tools to protect yourself from becoming yet another unwitting victim of a scam. Stay with Bitsgap — stay safe!

FAQ

Why Is Pump and Dump Illegal

In traditional financial markets, this type of activity is heavily regulated. Insider trading is a serious offense because it makes markets unfair for those who are not privy to the “special” information that might affect asset prices.

In the United States, trading activity such as this can carry hefty prison sentences and fines if insiders are caught. The regulations were put in place to protect casual investors, who are often the ones affected by these scams.

Can You Make Money from Crypto Pumps and Dumps

It is possible but also very dangerous. Theoretically, if you see an asset quickly increasing in volume and price, you could try to take advantage of the opportunity. However, it’s easy to get greedy and find yourself holding the bag. If you’re planning to try chasing these pumps, then do so using only a small portion of your portfolio, or you’re likely to have a very bad day (if not a year).

Want to get in with an “investor group” in order to profit off cryptocurrency pump-and-dump schemes? Then it’s very likely that the only thing you will get out of it is becoming another victim. Not to mention the fact that you open yourself up to some serious legal consequences if anyone finds out about these activities.