Combo Bot: Complete Automated Solution for Futures Trading

Bitsgap has worked diligently over the past months, to bring you an automated futures trading solution. Let’s take a closer look at risk management and trading configuration essentials for the Combo bot.

Bitsgap has worked diligently over the past months, to bring you an automated Binance futures trading solution. Now it’s live, and you can start benefiting from using the spot market bots, SBot and Classic, and the futures bot dubbed the Combo bot, that will allow you to diversify your trading strategies.

Let’s take a closer look at risk management and trading configuration essentials for the Combo bot. We’ll detail two pre-established strategies: one for a rising market and the other one for a falling market.

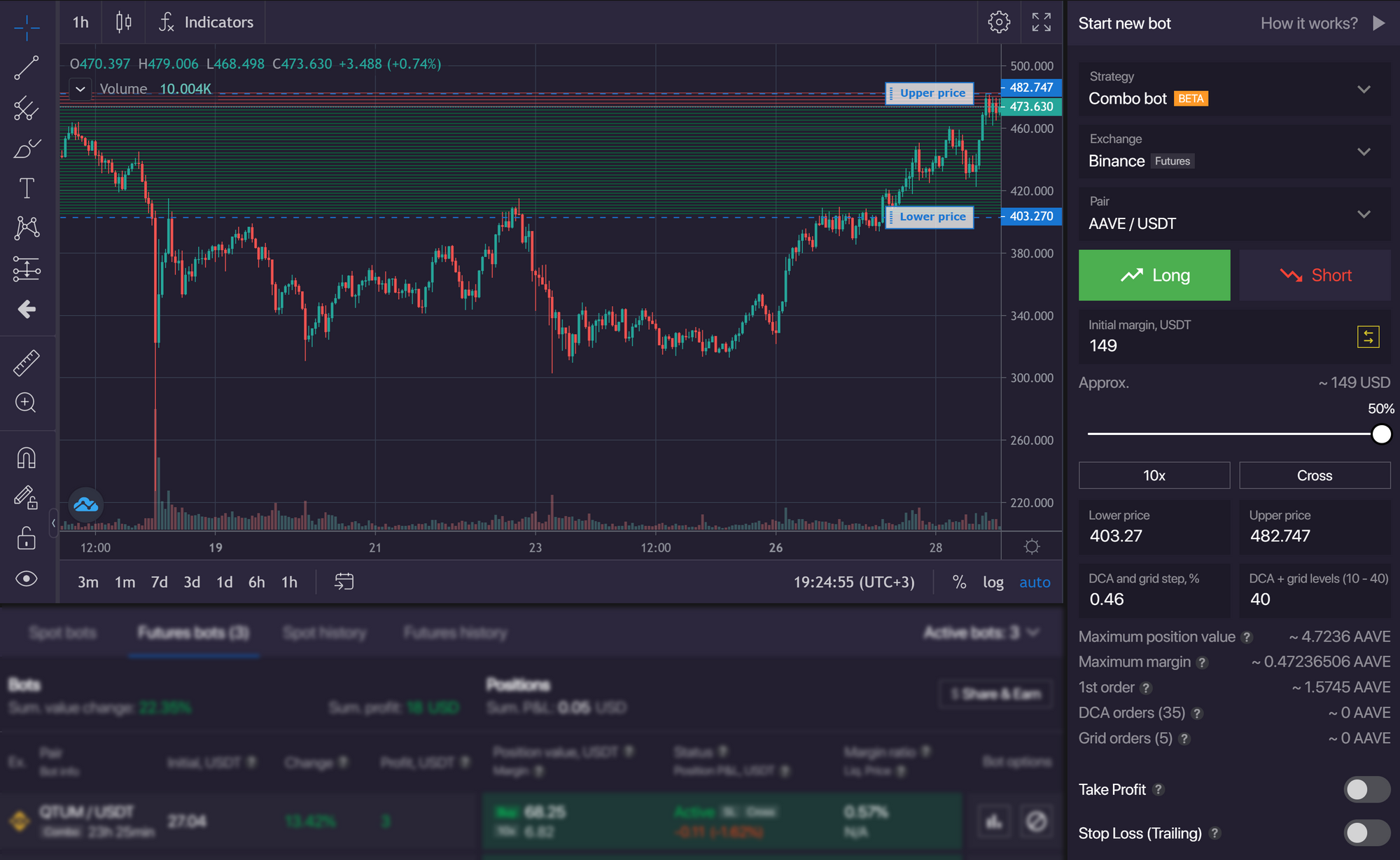

Combo bot specifications

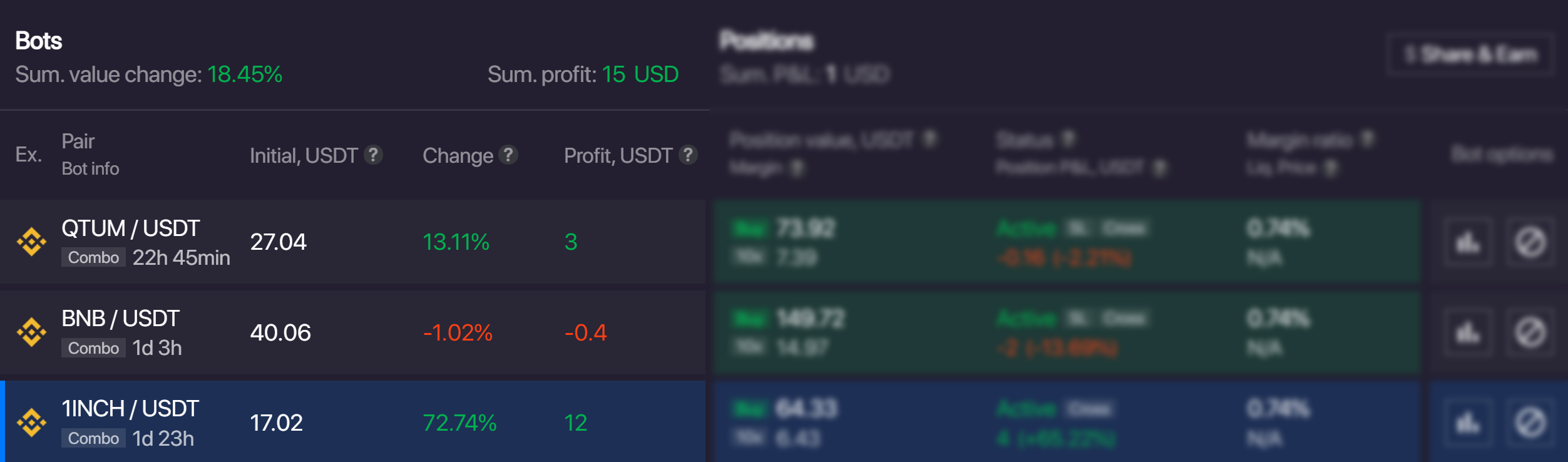

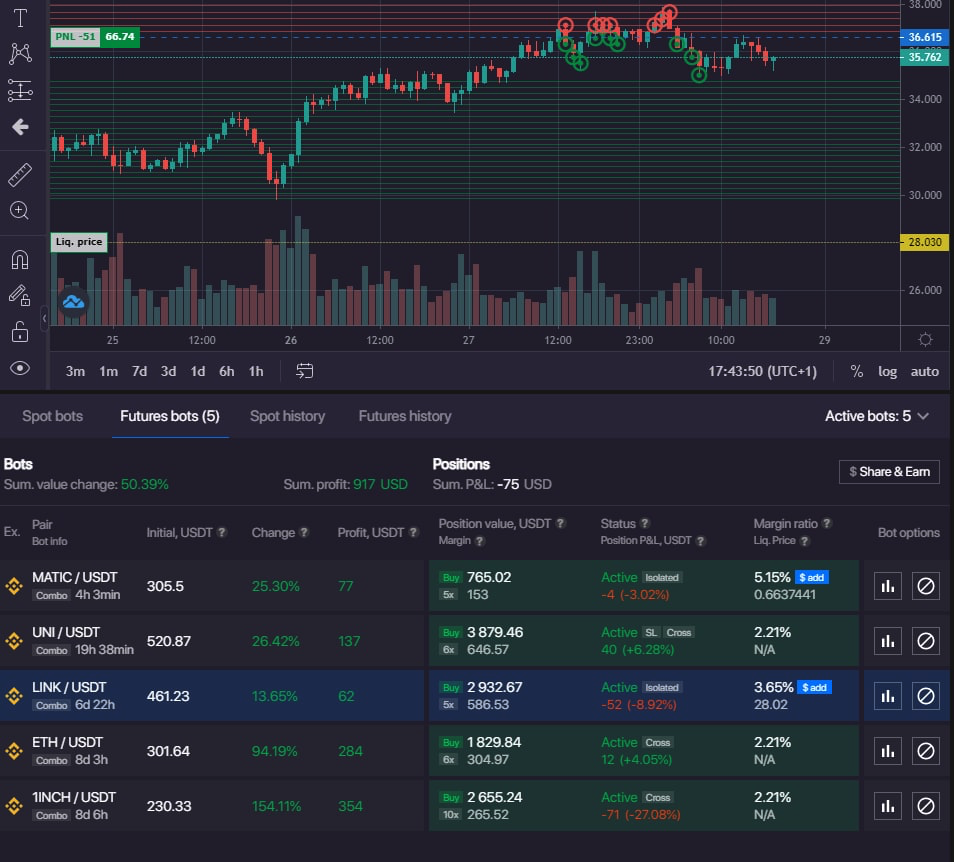

1.There are two return columns:

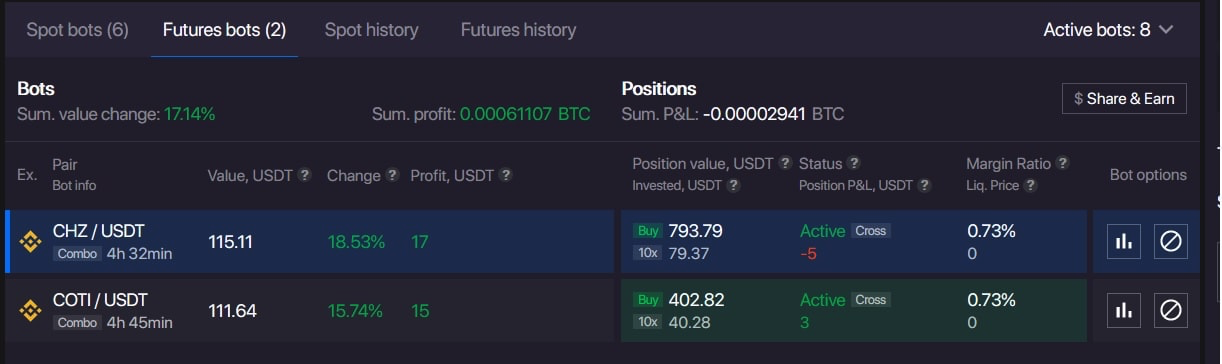

Bitsgap's Combo bots' return

In the Combo bot, we designed two distinctive, but related, columns that depict the actual profit generated by all active bots. On the left side, we have "Bots" return, which calculates the realized return + open P&L. For example, in QTUM/USDT, the total profit is 3, meaning that if you close the bot you will get exactly 3 USDT.

All profit added up together is 15 USDT = 12$ (1INCH) -0.4$ (BNB) + 3$ (QTUM). Don't get confused! The only key metric that does matter is "Sum profit," which shows whether you are in an overall profit or loss.

On the right side, we have "Positions," which shows current P&L on open futures contracts. As the bot constantly opens new long and short contracts to increase or decrease the exposure depending on the market's price action, the "Position value" remains dynamic.

For example, when trading futures contracts for QTUM/USDT, we have an open long position with a total position value of 73.92 USDT (7.39 USDT of your margin multiplied by 10x leverage) and the current P&L of QTUM is -0.44 USDT (-6.07% equity).

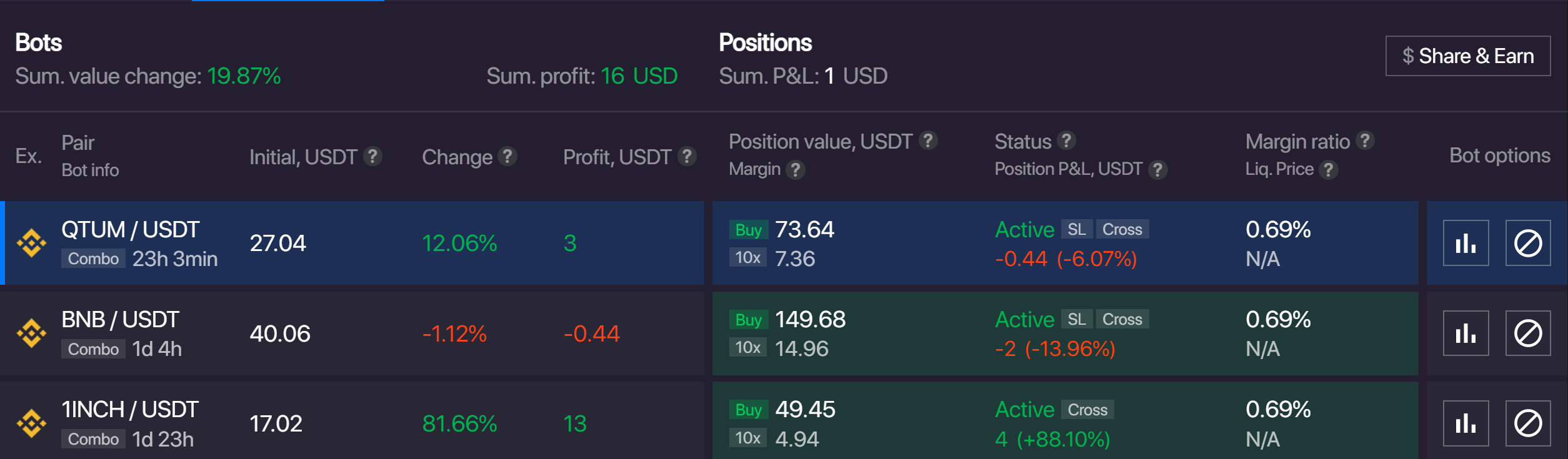

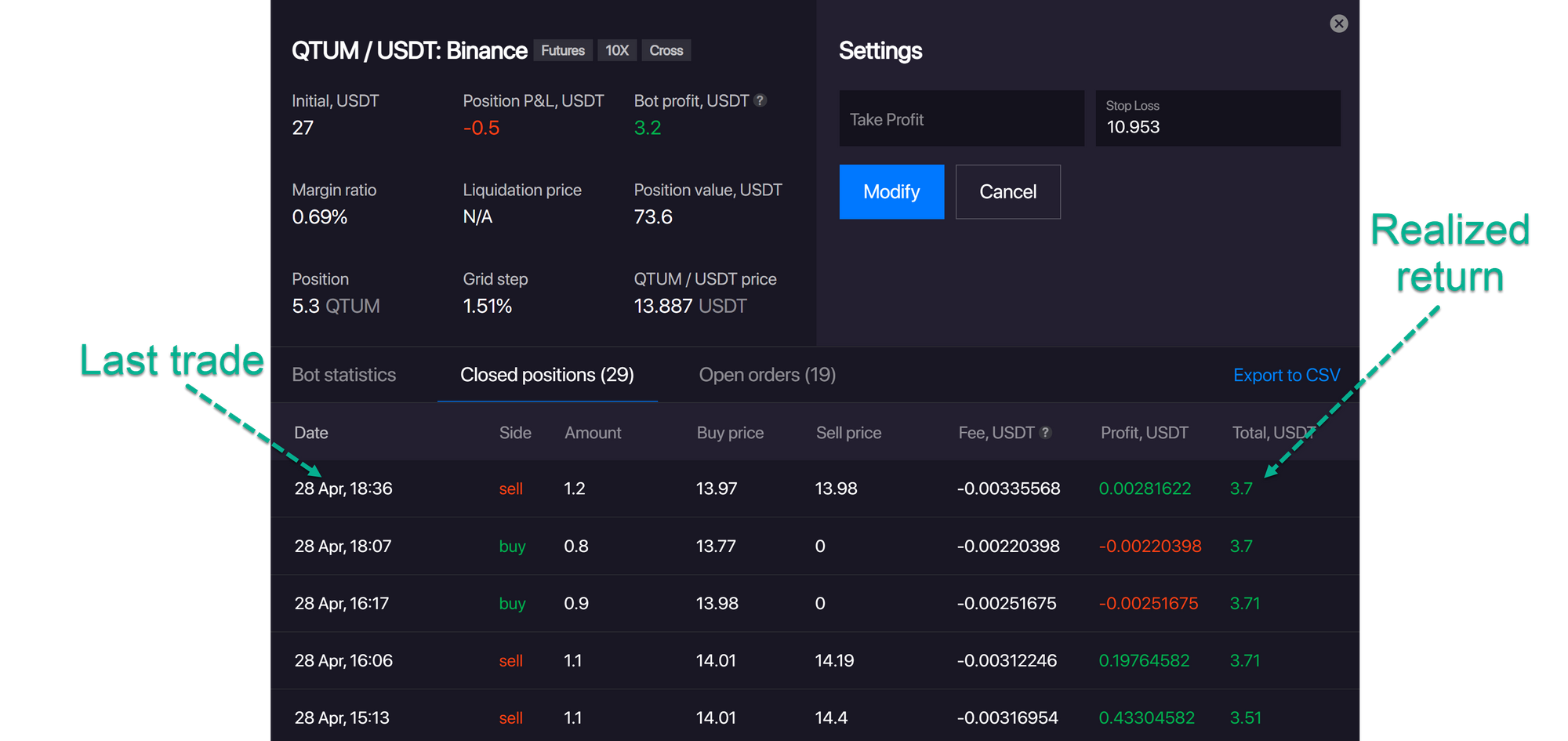

So far not bad, even though the P&L of QTUM is negative, the overall return is 3 USDT. Look at the chart below that demonstrates a total realized return in QTUM, that offsets the negative P&L with past returns. We made 3.7 USDT, but since P&L is -0,44, the net return is around 3 USDT:

Detailed Combo bot's return on QTUM

2. There are 2 strategies: Short and Long

With the Combo bot, you can choose the "Long" strategy if you anticipate the price of a coin to rise. Conversely, if you conduct thorough research and indicators point at a bearish momentum, then the "Short" strategy can bring you returns on a downfall.

LONG: The bot places DCA orders (limit buys) below the entry price to increase the total position value as the price declines. GRID orders are above the entry price, acting as take profit orders.

SHORT: The bot places DCA orders (limit short-sells) above the entry price to increase the total position value as the price climbs. GRID orders are below the entry price, acting as take profit orders.

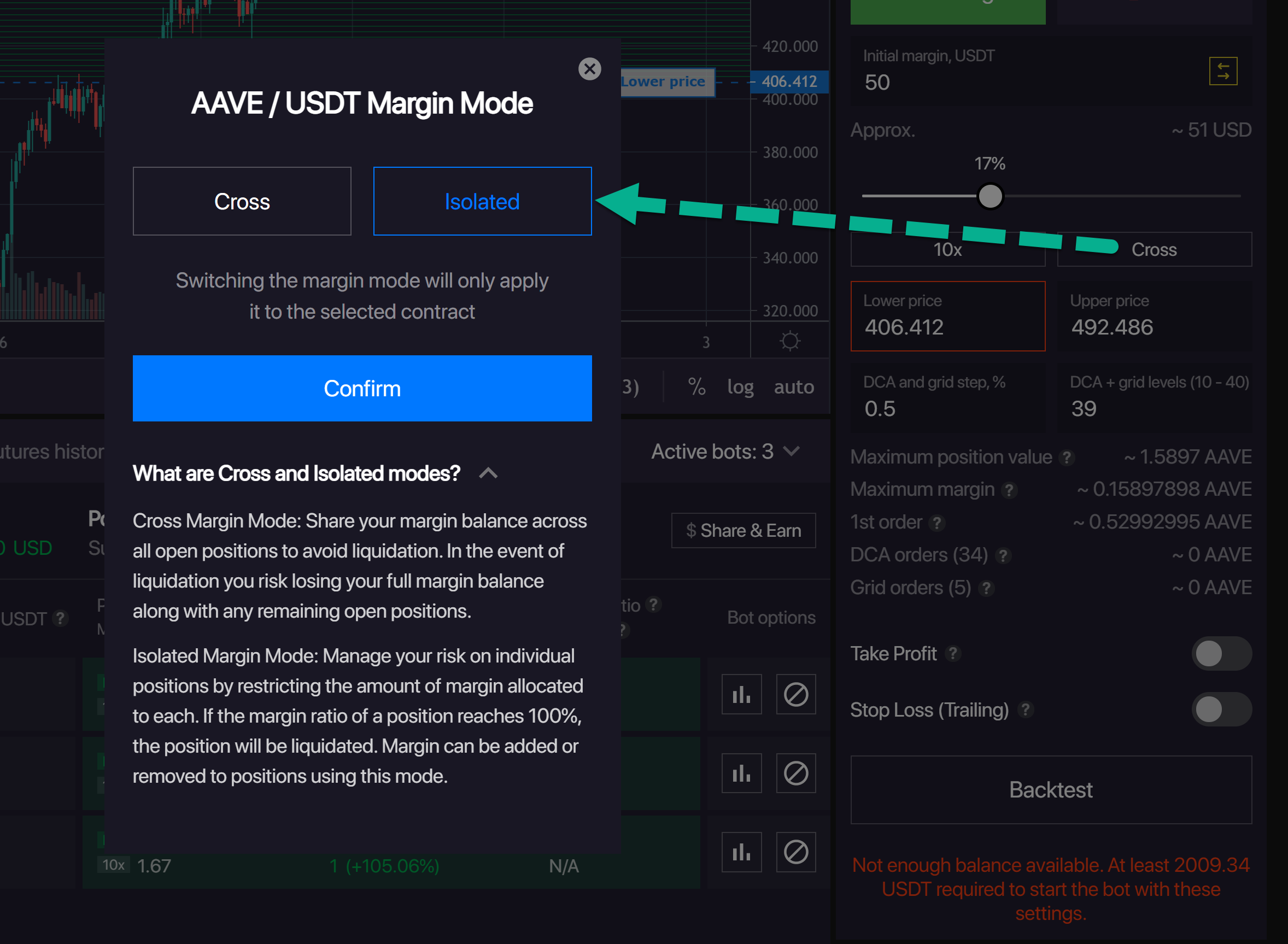

3. Different margin modes

Cross and isolated margin modes

In futures trading, there are two margin modes available: cross and isolated. Depending on your risk appetite and available margin balance, you can stick to either of two. But before you proceed, make sure you fully understand the nature of leveraged trading.

Cross margin mode: Share your margin balance across all open positions to avoid close liquidation. In the event of liquidation, you risk losing your full margin balance, along with any remaining open positions.

Use the cross mode only if you need to widen the gap between your entry price and liquidation. The more margin you put in a trade, the farther is the liquidation price. If you have more than one active bot, the overall risk becomes dreater!

Isolated margin mode: Manage your risk on individual positions by restricting the amount of margin allocated to each of them. If the margin ratio of a position reaches 100%, the position will be liquidated. Margin can be added or removed to positions using this mode.

The isolated mode reduces your risk exposure. However, in this mode, there is the higher chance for the bot to shut down pretty soon. Remember, that according to the Combo bot's algorithm, it is capable of nearly doubling your initial margin!

4. Stop-loss is automatically trailing

A trailing stop-loss follows the trend. As soon as your bot triggers the first profit order (sell order for the long bot, buy order for the short bot), the stop-loss price changes. Let's look at the example below.

This is a BNB/USDT perpetual active bot. As seen in the chart, when the BNB price started climbing, it triggered the sell orders. After executing several orders, the stop-loss began following the uptrend. The stop-loss was at 455 USDT, now it is at 475 USDT.

Stop-loss trailing

At some point of time if the trend sustains and continues to go higher, the stop-loss that was once your order to limit the loss, becomes a take profit after a series of successful trades on an uptrend. That is great, because you don't want to lose the entire profit generated by the bot! The stop-loss saves a big chunk of it if the trend suddenly reverts!

Cornerstone of your strategy

With the Combo bot, you can set automated trading on the futures market with a leverage of up to 10x. Leverage substantially increases your possible return if the trend goes in a predicted direction. However, your risk is also multiplied if the trend follows the opposite direction.

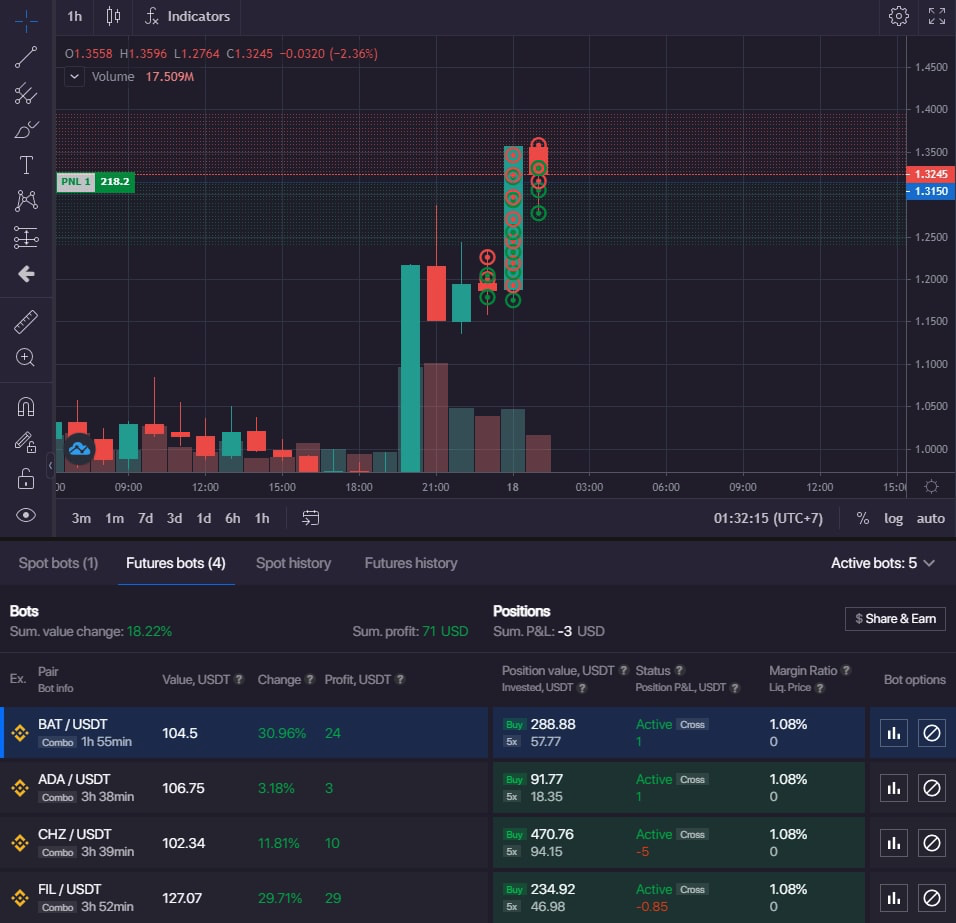

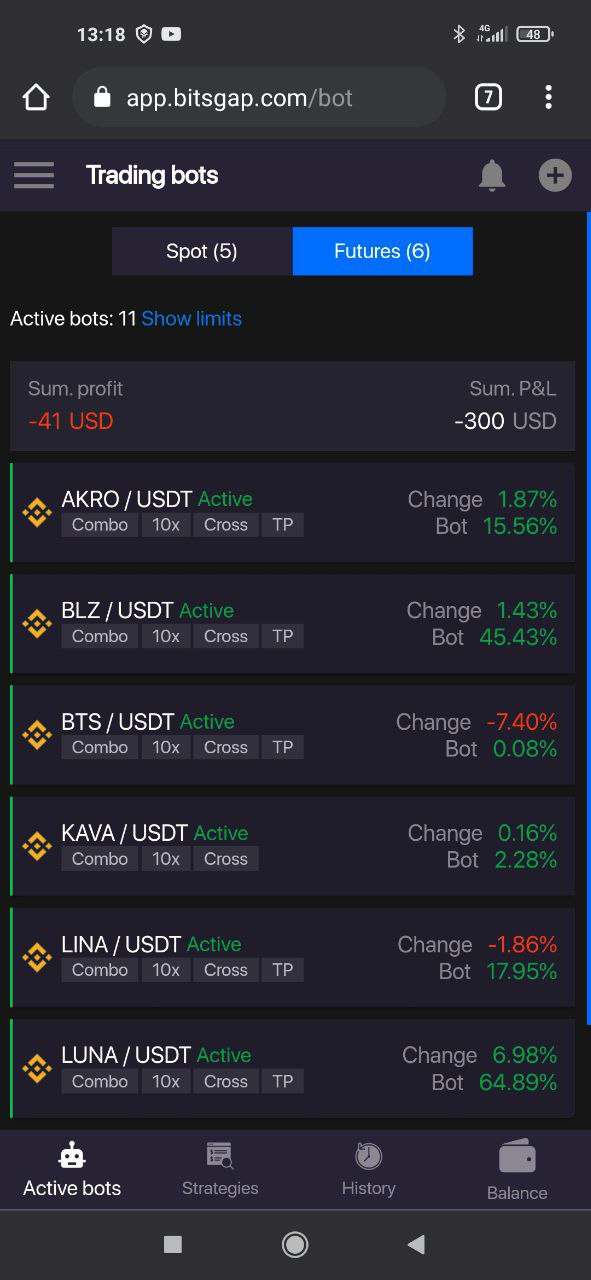

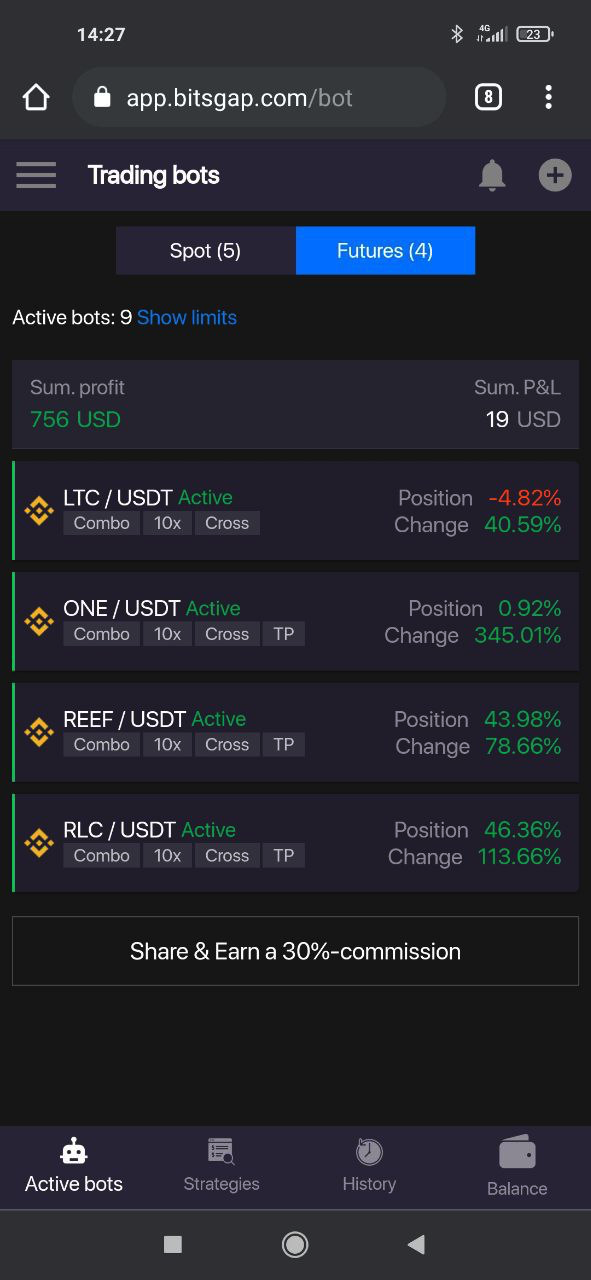

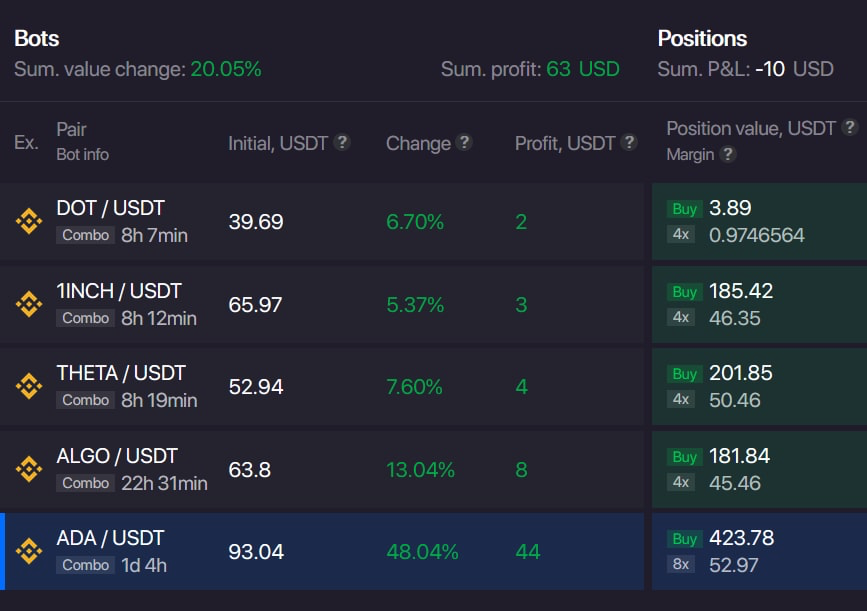

The cornerstone of your strategy is to maximize the return and minimize the loss. Make sure to use a stop-loss to limit your risk exposure. At some point, it becomes your take profit. Look at the images below and see examples of how Bitsgap community members use the Combo bot.

Сommunity members use the Combo bot

Before engaging into trading activity with Combo bot, make sure you have practiced enough on the spot market with SBot or Classic bot in a risk-free Bitsgap demo mode. SBot is a perfect robot to make decent returns on a sideways market. Classic bot is your ultimate solution on a rising trend.

Warning

Trading cryptocurrencies carries a high level of risk, and may not be suitable for all investors. The information provided on this website is distributed for informational and educational purposes only and does not constitute investment advice, financial advice, trading advice, or any other sort of advice.

You should not make any decision, financial, investment, trading or otherwise, based on any of the information presented on this website without undertaking independent due diligence and consultation with a professional broker or financial advisory.

Bitsgap expressly disclaims any liability or loss incurred by any person who acts on the information, ideas or strategies discussed herein.