Dogecoin (DOGE): Price, News, and Predictions

As the original meme coin, Dogecoin has cemented its place in cryptocurrency lore. But behind the rocket emojis lies a serious question — does DOGE have the real-world utility to validate its $22.72B market cap, or will the joke ultimately be on HODLers?

As the largest meme coin by market capitalization, Dogecoin (DOGE) has shown tremendous price volatility that echoes previous hype-driven rallies. This intermittent explosive growth leaves some speculating on another viral breakout ahead, despite recent pullbacks.

However, the asset's checkered history of booms and busts also raises reasonable doubts about its viability. Questions abound on whether Dogecoin is essentially "dead," or if any chance remains for a meaningful recovery following its steep declines.

In truth, complex factors underpin DOGE's outlook that defy simple verdicts. By reviewing technical and fundamental indicators around its utility, a more informed projection of future trajectories emerges. In this article, we’ll do just that — take a closer look at DOGE to develop a balanced perspective on growth potential ahead.

Dogecoin (DOGE): What Is It & How Did We Get Here?

Dogecoin (DOGE) is a unique cryptocurrency that has captured the interest of the digital currency community and beyond, mainly due to its origins and the culture that has developed around it.

Here’s a brief analysis of Dogecoin and its history:

What Is Dogecoin (DOGE)?

Dogecoin is a cryptocurrency that was created in 2013 partly as a tongue-in-cheek response to the flood of new digital currencies at the time. Unlike many cryptocurrencies designed to address specific technical or business problems, Dogecoin leaned into its own absurdity by using the Doge meme as its mascot. As an open-source, decentralized peer-to-peer payment system, it allows users to send and receive DOGE coins through a digital wallet. Despite its humorous origins and association with an internet joke, Dogecoin has developed an active community and seen significant valuation increases that indicate staying power as a cryptocurrency.

How Did Dogecoin Come About?

As mentioned, Dogecoin was created in 2013 by software engineers Billy Markus and Jackson Palmer as a lighthearted satire of the many dubious cryptocurrencies proliferating at the time.

Despite its comedic start, a dedicated community rallied around Dogecoin, using it for charitable tips and donations that embodied the meme’s friendly essence. This grassroots movement fueled early adoption and price surges, with the 2017-18 crypto frenzy pushing Dogecoin’s market capitalization above $1 billion.

Defying skeptics, Dogecoin has shown surprising longevity and mainstream reach. Its market cap now exceeds $22 billion as of April 2024. The currency is accepted by some retailers and continues to be used by a loyal community for transactions and contributions to various causes. What originated as a parody has morphed into a prominent cryptocurrency with significant valuation and adoption.

DOGE Utility & Tokenomics

Let’s kick off with the basics first:

- At its foundation, Dogecoin operates on a decentralized blockchain network like other cryptocurrencies. Instead of a central server, transactions are recorded on a public ledger maintained by nodes worldwide.

- Dogecoin was originally forked from Luckycoin, which itself was derived from Litecoin, inheriting the Scrypt proof-of-work algorithm. Scrypt mining is less computationally intensive than Bitcoin's SHA-256, making it more accessible for everyday computers.

- Contrasting Bitcoin's hard cap of 21 million coins, Dogecoin implemented a much higher supply ceiling. Additionally, in its early days block rewards were randomly allocated to miners. However, this approach shifted in March 2014 to a standardized reward per block discovered. This ensured consistent miner incentives and a predictable growth in circulating supply over time.

- Despite its lighthearted origins, dedicated development and communal efforts enable the continual evolution of Dogecoin’s functionality.

Behind Dogecoin lies an enthusiastic community known as the "Doge Army,” recognized for its lively social media activity and funding of collective goodwill initiatives. Their mantra “Do Only Good Everyday” encapsulates an ethos of positivity and philanthropy. Past community-led efforts include fundraising for the Jamaican Olympic team and Kenyan water projects, showcasing both the spirit and influence of the Dogecoin user base.

Thus, in response to criticisms about lack of utility, Dogecoin founders and the broader community highlight that the cryptocurrency's primary use case is as a currency and philanthropic vehicle:

- Low-Cost Transactions: Dogecoin stands out for its minimal fees compared to major cryptocurrencies, making micro-transactions and online tipping more feasible. Fast confirmation times (60 seconds), which are several times faster than Bitcoin's 10-minute block intervals, also enhance its usability as a casual, everyday spending currency.

- Tipping and Crowdfunding: Dogecoin has been eagerly adopted for tipping content creators and fundraising campaigns. The low-fee structure and supportive community are conducive to expressions of generosity on social media, crowdfunding endeavors, and mutual encouragement in online spaces.

- Purchasing and Charity: The expanding real-world utility of Dogecoin includes adoption by merchants and nonprofits. Online retailers are increasingly accepting Dogecoin for purchases through its simplicity and low processing costs. Charity initiatives also utilize Dogecoin for its efficiency in pooling grassroots donations from the dedicated Dogecoin community.

The adoption of Dogecoin for real-world transactions has been further boosted by third-party processors like BitPay and Coinbase integrating Dogecoin payments. This has ultimately bridged the gap between cryptocurrency and retail, expanding the utility of Dogecoin as a decentralized means of exchange.

DOGE Tokenomics

Dogecoin (DOGE) has a unique set of tokenomics, particularly in comparison to other major cryptos. Here’s an overview of its key economic features:

- As mentioned, the coin has no hard cap on the total supply, meaning that it can be mined indefinitely.

- The lack of a supply cap means that Dogecoin is inflationary. This is quite distinct in the crypto world where many coins are deflationary, designed to mimic digital gold. The inflationary nature of Dogecoin theoretically encourages spending and circulation rather than holding. The continuous addition of new coins can dilute the value of existing coins, which is a typical characteristic of an inflationary currency. However, the ongoing demand from the active community helps counterbalance this effect to some extent.

- Dogecoin miners currently receive 10,000 DOGE for each block they mine. This block reward does not halve like Bitcoin’s, which halves approximately every four years. The consistent reward continues to add a significant number of new Dogecoins to the system each year.

- The combination of low fees, fast transactions, and an inflationary supply encourages the use of Dogecoin as a transactional currency rather than a long-term investment store of value.

DOGE Hard-Won Numbers

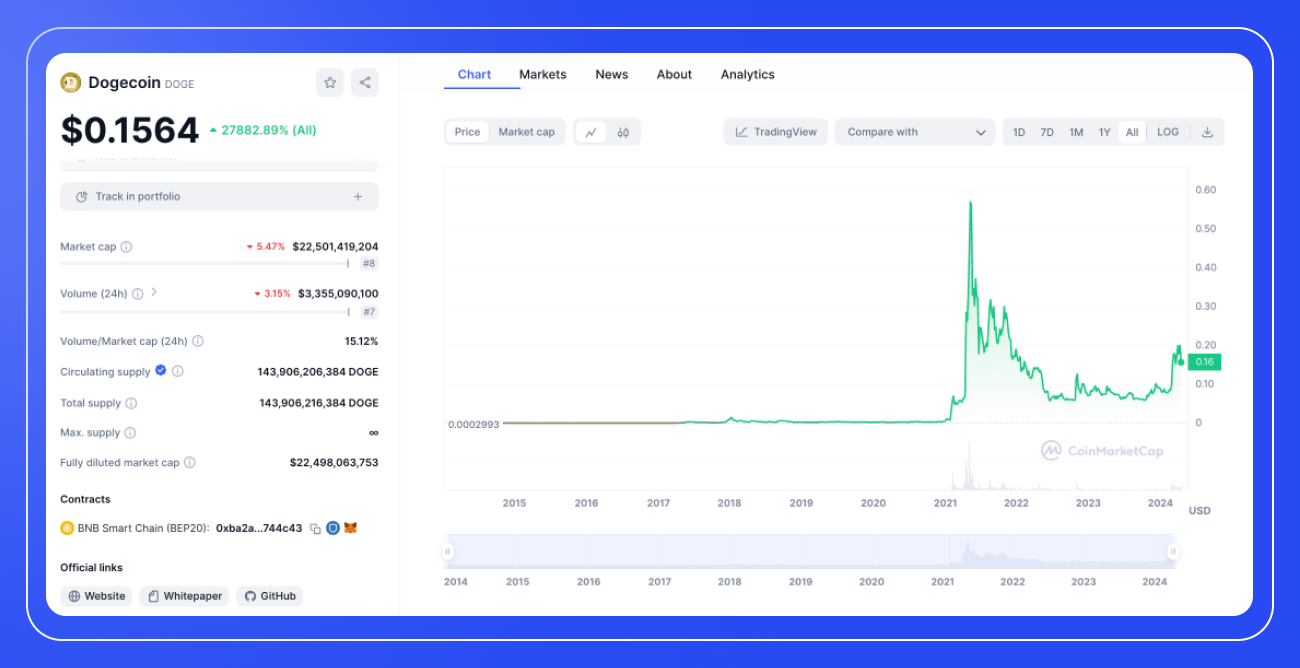

Here’s a snapshot of Dogecoin's market status at the time of writing, including its supply details and trading volume:

- Price: $0.1567

- Price Change: The price has increased by 27939.29% since its inception.

- Market Cap: $22,546,770,306, and it's ranked 8th by market cap in the cryptocurrency market.

- 24h Volume: $3,381,788,041, with the volume being down by 2.23% in the last 24 hours.

- Volume/Market Cap Ratio (24h): 15.12%

- Circulating Supply: 143,906,206,384 DOGE

- Total Supply: The total supply is the same as the circulating supply, at 143,906,216,384 DOGE.

- Max Supply: There is no maximum supply for Dogecoin, as it is an inflationary coin, which is represented by the symbol "∞" (infinity).

- Fully Diluted Market Cap: $22,547,040,034

Is Dogecoin a Good Investment?

Determining if Dogecoin (or any cryptocurrency for that matter) is a wise investment depends on your personal financial situation and risk tolerance. Key aspects to evaluate include:

- Market Drivers: Dogecoin prices have historically responded to social media hype, celebrity endorsements, and overall crypto sentiment shifts. The underlying fundamentals may not always support price moves.

- Uncapped Supply: With no maximum coin supply, Dogecoin differs from coins like Bitcoin. Continued mining could risk inflating the circulating supply and diluting per coin prices long-term.

- Evolving Utility: Now accepted for some commercial payments and used for tipping, Dogecoin has grown beyond its comedic beginnings. But further mainstream adoption is still uncertain.

- Investment Timeframe: Gains to date have largely benefited savvy traders who profit from DOGE momentum and speculation, rather than long-term investors believing in its utility.

- Portfolio Diversification: Like any asset, concentrating too heavily in one coin amplifies downside risks.

As a highly speculative digital asset, Dogecoin value has proven extremely volatile, swayed by social media hype and celebrity endorsements rather than fundamental value. Such unpredictability makes sound financial planning difficult. The fear of missing out has also fueled unsustainable bubbles around assets like Dogecoin in the past. Thus, financial experts typically caution buyers to make level-headed assessments of risk and resist getting swept up in frenzied rallies.

However, profiting short-term is more than a viability. While risky, some traders have found success turning quick profits on Dogecoin's volatility using defined strategies. Algorithmic approaches are commonly employed, like Bitsgap’s Dollar Cost Averaging (DCA) to smooth out price fluctuations when accumulating positions, GRID trading bots to systematically buy low and sell high on price swings, or strategies like BTD to capitalize on downtrends.

These programmed tactics allow traders to methodically execute specific game plans tailored to different Dogecoin market movements. By sticking to rules-based signals for entries and exits, seasoned crypto traders aim to profit from DOGE price action in the near-term.

Dogecoin News

Dogecoin and other leading memecoins have faced exceptional volatility recently amidst the impending Bitcoin halving. In fact, joke cryptocurrencies have been among the worst performing assets lately, indicating a tangible waning of earlier enthusiasm that impelled the sector earlier in March.

On the surface, the broad decline across Dogecoin and peers reflects pre-halving profit-taking across crypto markets. Traders appear to be securing gains ahead of historically turbulent halving events. For example, Dogecoin dropped 22.5% into Bitcoin's previous halving in 2020 — a trend seemingly repeating based on high correlation between the assets.

Moreover, memecoin trading volumes have recently plunged nearly 90% off their peak of $1 billion, signaling fading trader conviction. Yet many expect interest to resurge as the memorable halving approaches, with Dogecoin already regaining some lost ground on rumors of potential Elon Musk integrations.

Still, Dogecoin likely needs tangible utility catalysts to reclaim former highs sustainably. Absent real-world utility, DOGE remains vulnerable to the whims of hype-driven pumps and dumps. Some speculate newer memecoins may begin to divert attention, projects addressing limitations of incumbents. For example, Dogeverse (DOGEVERSE) markets itself as a multi-chain asset with staking rewards — potentially offering modest utility improvements over DOGE.

Current Price of Dogecoin & Dogecoin Price Prediction

Analyzing the all-time chart on Pic. 2, we can see that the price of Dogecoin (DOGE) has had a relatively flat performance from its inception in 2014 until early 2021, with prices hovering below $0.01. However, in 2021, there was a significant spike, with prices reaching an all-time high of around $0.73 in May. This spike was followed by a sharp correction and a series of lower peaks, with the price settling down to a range of $0.15 to $0.30 in the following months.

The second chart (Pic. 3) reflects a period of increased volatility. There was a steady increase in price beginning in November 2023, culminating in a peak in March 2024. After reaching this peak, the price experienced a decline and then a period of consolidation in the $0.12 to $0.16 range before another upward movement.

Let’s look at a doggy coin rate more closely by examining another set of charts: daily and hourly.

In the first chart (daily time frame), we observe that the price of DOGE has been in a downtrend since the end of March, with lower highs and lower lows. The moving averages (MA) are indicating a bearish sentiment, with the 9-period moving average below the 20-period Bollinger Band's middle line. The price recently touched the lower Bollinger Band, showing some signs of overselling. The Relative Strength Index (RSI) is currently below 50, which generally signals bearish momentum, though it's not in the oversold territory. The Moving Average Convergence Divergence (MACD) is below the signal line and the zero line, which is also indicative of bearish momentum.

In the second chart (1-hour time frame), price action shows a tighter consolidation within a range. The Bollinger Bands are squeezing, which might indicate a period of low volatility before a potential larger move. The RSI is hovering just below 40, again showing no clear sign of being oversold nor overbought. The MACD is closer to the signal line and the zero line, suggesting less bearish momentum in the shorter term than in the daily chart.

Based on the technical analysis of the above charts, we can conclude the following:

- Given the bearish trend in the daily chart, the price could continue to face downward pressure in the near term. The recent touch of the lower Bollinger Band may lead to a short-term bounce, but unless the price breaks above the moving averages with significant volume, the downtrend is likely to continue. Potential support levels could be found near previous lows, with one noticeable level around $0.13. A break below this could accelerate the bearish momentum.

- Conversely, for a bullish scenario to unfold, we would need to see the price climb above the moving averages and turn them into support, as well as a bullish crossover in the MACD and an RSI above 50. This could potentially lead to a retest of higher resistance levels around $0.20.

Expert Dogecoin Price Prediction

According to forecasts by market research firms, Dogecoin prices could continue fluctuating wildly in the coming years:

2024 Targets:

- Price between $0.078 and $0.32, averaging around $0.115 [Benzinga & Technopedia]

2025 Targets:

- New all-time high exceeding $1.12 [Cryptonews]

- Average price of $0.30 [Benzinga]

2030 Targets:

- Range of $0.34 to $0.52 [Tokenmetrics]

- Potential to reach $0.98 [Finder]

Of course, these predictions should be considered directional insights rather than precise point estimates. Expect DOGE prices to continue fluctuating dramatically through the decade based on shifting investor sentiment, underlying technology developments, real-world adoption, and other hard-to-predict variables.

Conclusions

So where does this leave Dogecoin in both the near and long-term? The truth is, unpredictable variables from hype-driven manias to protocol improvements ensure its outlook stays volatile. Yet for traders who fancy speculating on DOGE, platforms like Bitsgap offer sophisticated tools to execute strategies safely. Bitsgap's robust risk management features, including stops and trailing stops, and an array of sophisticated automations provide guardrails to maximize gains and minimize losses if investing directly in the meme coin or trading Dogecoin-based derivatives.